Hong Kong Web3 Revolution: Key Trends and Regulatory Policies Unveiled at Consensus 2025

TechFlow Selected TechFlow Selected

Hong Kong Web3 Revolution: Key Trends and Regulatory Policies Unveiled at Consensus 2025

This conference covered innovative regulatory policies, accelerated institutional capital entering the market, and the deep integration of AI and blockchain.

Key Takeaways

-

Clearer regulation: The Securities and Futures Commission (SFC) of Hong Kong has approved cryptocurrency derivatives and margin trading, offering more options for professional investors and further solidifying Hong Kong's position as a global crypto-financial hub.

-

Faster institutional adoption: Hong Kong has issued 9 digital asset exchange platform licenses, with more under review, indicating traditional financial institutions are accelerating their entry into the crypto market.

-

AI empowering blockchain: Artificial intelligence is enhancing the security and execution efficiency of smart contracts, driving Web3 ecosystem development and enabling more decentralized applications.

-

DePIN and asset tokenization reshaping finance: Decentralized Physical Infrastructure Networks (DePIN) and asset tokenization are transforming investment landscapes, enabling real-world assets to seamlessly enter blockchains and improving market liquidity.

In an era of rapid advancement in blockchain, Web3, and digital assets, Consensus Hong Kong 2025 set a historic record as CoinDesk’s flagship conference made its first expansion into Asia. Over 5,000 attendees from finance, technology, entrepreneurship, and public policy gathered in Hong Kong—the international financial center—to witness groundbreaking announcements, engage with industry experts, and explore future trends in decentralized technologies.

As the Hong Kong government actively promotes Web3 to become Asia's hub for cryptocurrencies and digital assets, this event covered innovative regulatory policies, accelerated institutional capital inflows, and the deep integration of AI and blockchain. Below, we break down this globally impactful industry summit by daily highlights.

Top Five Highlights

Regulatory Expansion

The Securities and Futures Commission (SFC) of Hong Kong approved cryptocurrency derivatives and margin lending, providing professional investors with more financial options and further strengthening Hong Kong's status as a global cryptocurrency hub.

Accelerated Institutional Adoption of Web3

Financial Secretary Paul Chan announced 9 digital asset exchange platform licenses have been issued, with more under review. Additionally, regulatory frameworks for DeFi and stablecoins continue to improve, advancing the institutionalization of the Web3 economy.

Meme Coins and Web3 Culture

Meme coins have evolved from internet jokes into community-driven digital economies, while platforms like Memeland integrate NFTs, social networks, and gamified interactions to drive innovation in Web3 culture.

AI and Blockchain Convergence

AI is enhancing blockchain security, optimizing smart contracts, and accelerating decentralized governance. This summit also sparked important discussions on risks related to AI automation and trust mechanisms.

DePIN and Asset Tokenization Reshaping Financial Markets: Decentralized Physical Infrastructure Networks (DePIN) are tightly connecting data, infrastructure, and real-world resources, while asset tokenization transforms traditional financial assets into highly liquid digital investment tools on blockchains.

Laying the Foundation: Why Asia? Why Now?

Hong Kong is aggressively promoting digital asset development at a time when traditional financial institutions and tech entrepreneurs show surging interest in the Web3 industry. With its strategic location, robust legal framework, and status as an international financial center, Hong Kong has rapidly emerged as a key hub for blockchain innovation.

This context made Consensus Hong Kong 2025 an unmissable annual event, attracting policymakers, corporate executives, venture capitalists, and developers from around the world to discuss the future direction of Web3.

-

"As the Web3 ecosystem continues to evolve, Hong Kong will maintain a stable, open, and vibrant digital asset market." — Paul Chan, Financial Secretary of Hong Kong

Day 1: Policy, Bitcoin, and the Future of Web3

Main Conference Highlights

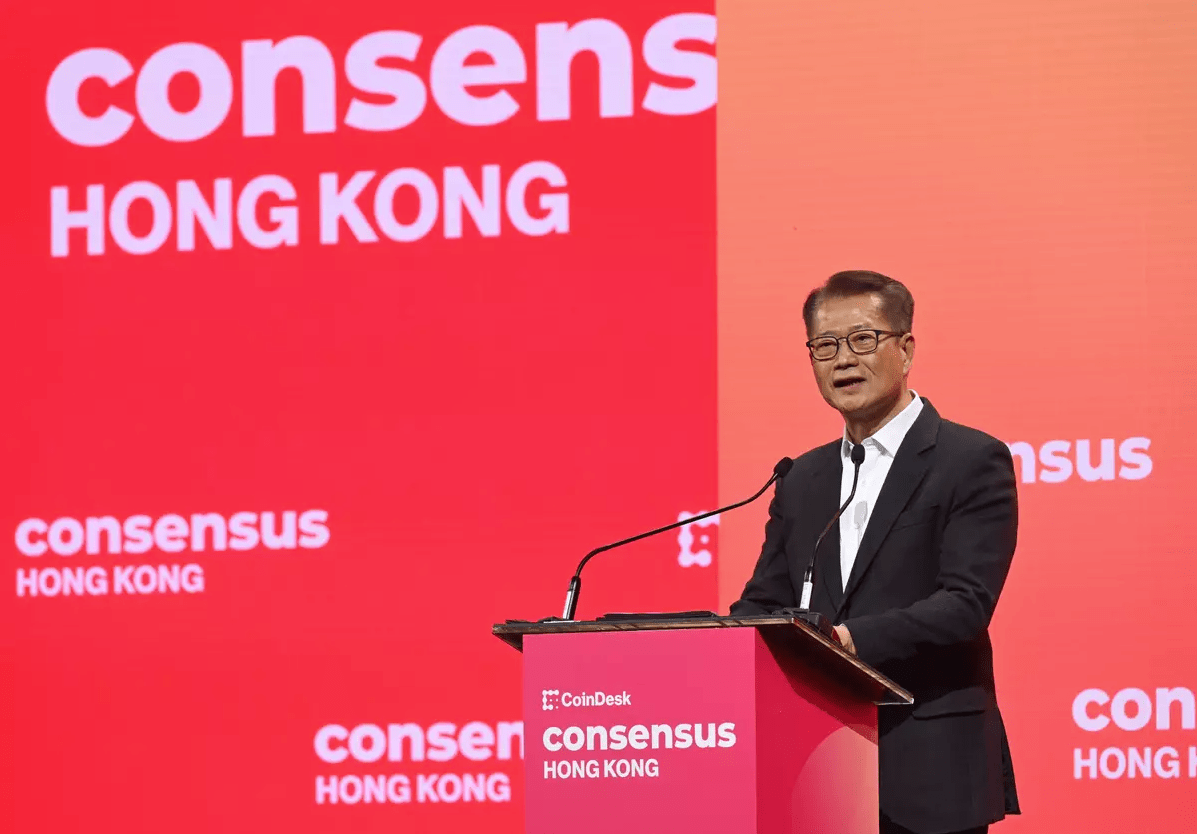

Opening Keynote by Financial Secretary Paul Chan

Paul Chan opened Consensus Hong Kong 2025 with an energetic speech, reaffirming Hong Kong’s goal to become a global leader in cryptocurrency and the Web3 industry. He emphasized that the government is actively streamlining licensing procedures for crypto businesses and expanding public funding for blockchain research and development.

-

"We are making significant investments in infrastructure and talent development." — Paul Chan, Financial Secretary of Hong Kong

Regulatory Progress

Julia Leung, Chief Executive Officer of the SFC, shared Hong Kong’s latest cryptocurrency regulatory developments. She stated that the SFC plans to approve trading of crypto derivatives and allow margin lending for specific investors, expanding financial tools available to professional investors.

-

"We are considering opening up derivatives trading for professional investors and allowing certain clients to use margin lending." — Julia Leung, CEO of SFC, Hong Kong

Bitcoin and the Global Financial System

A high-level panel featuring Blockstream CEO Adam Back, JAN3 CEO Samson Mow, and Babylon co-founder David Tse discussed Bitcoin’s potential as a global reserve asset and analyzed how institutional investors are adopting Bitcoin and developing Bitcoin-based decentralized finance (DeFi) solutions.

Image Credit: Bastille Post

Sidebar Events and Networking

Rolling Stone China-HK VIP Party Powered by XT.COM #BeyondTrade

What happens when music, culture, and blockchain collide? The Rolling Stone China-HK VIP Party held at The Iron Fairies offered participants a premium networking environment to enjoy live music performances, exchange insights on the latest Web3 application trends, and explore how blockchain is transforming the entertainment industry.

Performers:

-

– MC Jin (legendary Chinese-language rapper)

-

– SHUZO (emerging Japanese electronic music artist)

This event, sponsored by XT.COM, marked deeper blockchain applications in entertainment, particularly through NFTs, music rights, and fan economies.

OKX Web3 Night

OKX Web3 Night was a high-end networking event offering opportunities to interact closely with OKX executives, top traders, investors, and blockchain developers. In a relaxed setting, participants gained firsthand insights into OKX’s latest technological developments, upcoming partnerships, and the future direction of the Web3 ecosystem.

Key Highlights:

-

– Platform updates: OKX shared upcoming Web3 solutions.

-

– In-depth discussion on DeFi and NFTs: OKX executives analyzed how NFTs and DeFi are shaping the Web3 ecosystem.

-

– High-level networking: Face-to-face interaction with thought leaders, investors, and developers in the Web3 space.

Image Credit: OKX

Day 2: DePIN, Web3 Growth, and the Lightning Payment Revolution

Main Conference Highlights

Keynote Address by Binance CEO Richard Teng

In his keynote titled "Digital Assets: The Currency of the Future," Richard Teng praised the growing presence of institutional investors in the crypto market and emphasized how Hong Kong’s increasingly clear regulatory framework is attracting large-scale institutional capital.

Keynote Address by Hong Kong Financial Secretary Paul Chan

Paul Chan reiterated Hong Kong’s strong commitment to digital assets, announcing that 9 digital asset exchange platform licenses have been issued, with more applications under review—further boosting Hong Kong’s progress in the Web3 sector. He also revealed that Hong Kong is preparing to introduce a regulatory framework for stablecoins to support safer and more efficient digital payments globally.

-

"We recognize the potential of stablecoins in global transactions, and Hong Kong is committed to creating an environment conducive to such innovation." — Paul Chan, Financial Secretary of Hong Kong

Image Credit: Consensus Hong Kong 2025

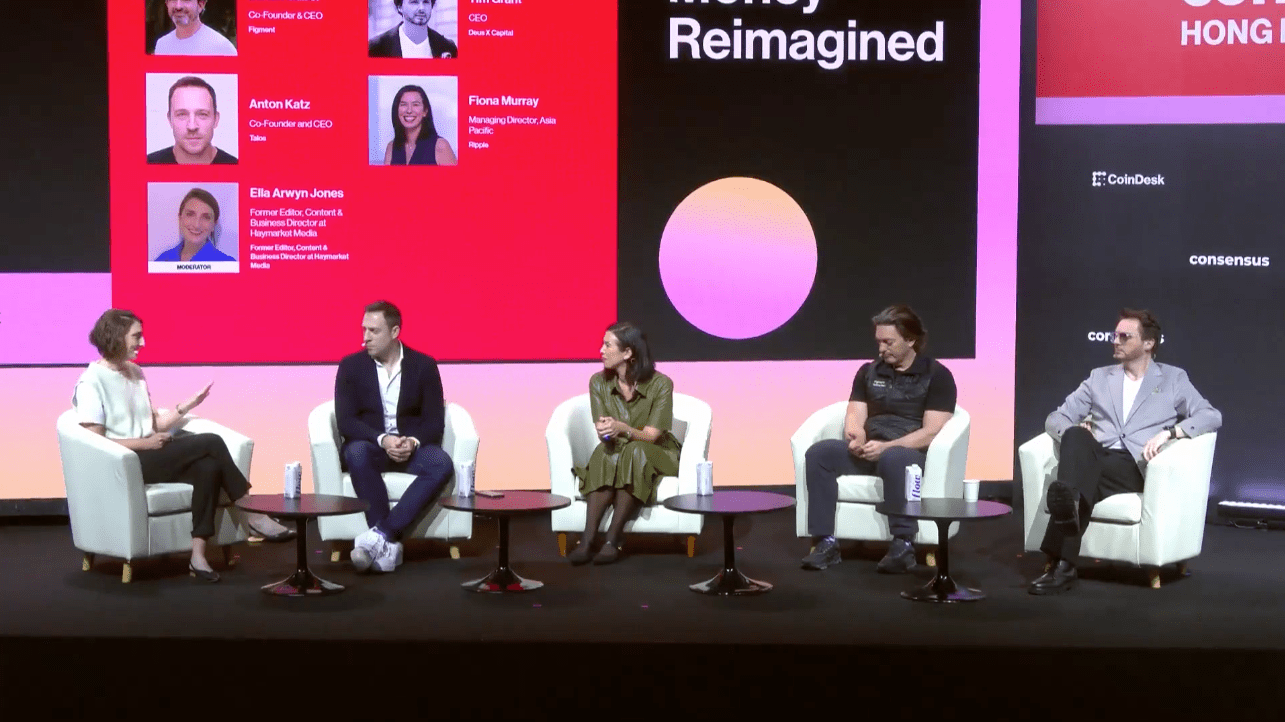

Money Reimagined Stage

Crypto Derivatives and Institutional Investors

Financial analysts discussed risk management strategies for crypto derivatives and examined how traditional financial institutions are entering this market amid clearer regulations.

Image Credit: Consensus Hong Kong 2025

Builders Stage

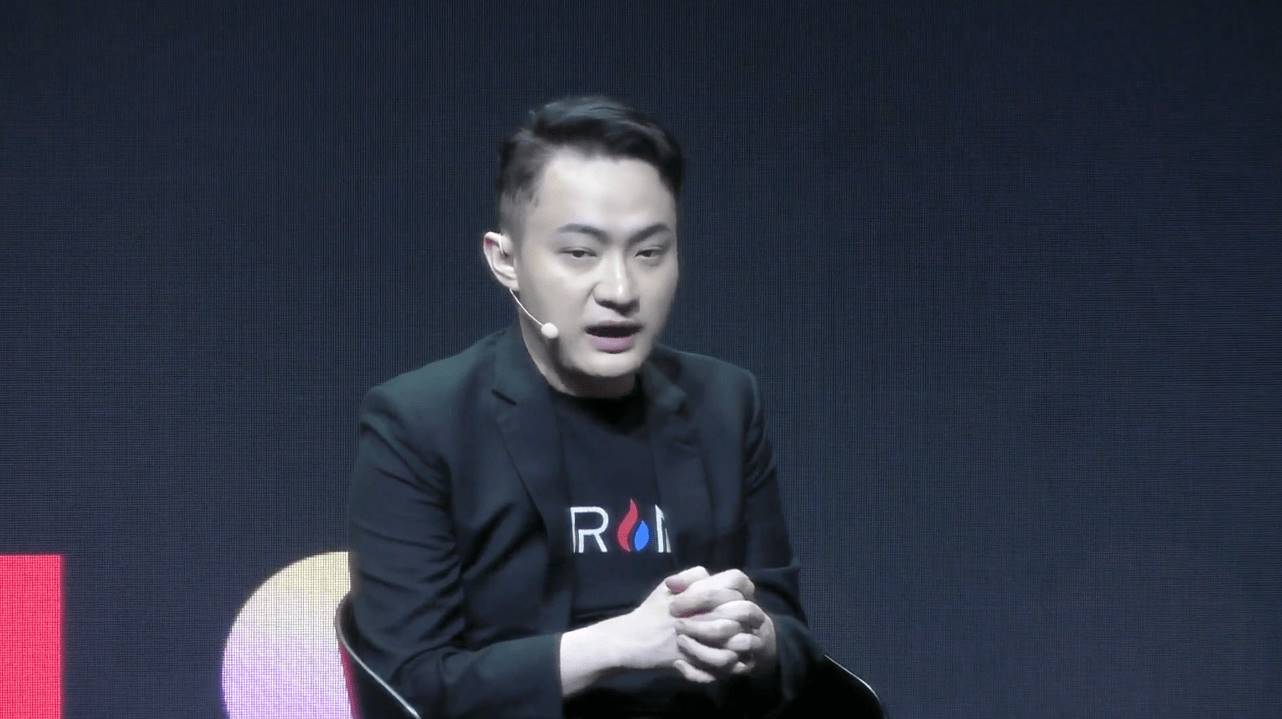

TRON and T3 FCU: Challenges of Global Adoption – Balancing Decentralization, Security, and Scalability

This technical session delved into TRON’s role in the global Web3 ecosystem and how T3 FCU (a blockchain-based financial credit union) achieves balance among decentralization, security, and scalability to drive global financial innovation.

Image Credit: Consensus Hong Kong 2025

Sidebar Events and Networking

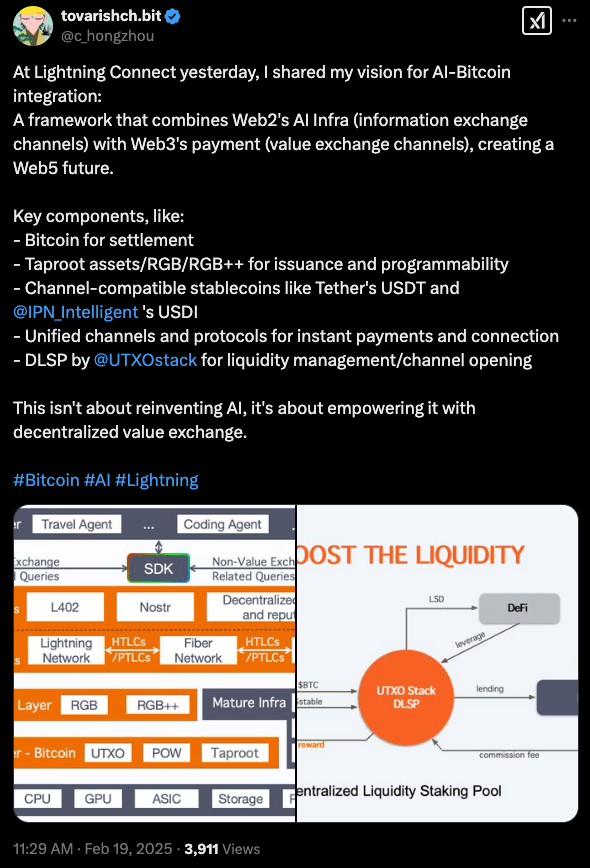

Lightning Connect: Transforming Global Payments

The Lightning Network is reshaping the global payment landscape. This dedicated event, co-hosted by CKB Eco Fund, Breez, and UTXO Stack, explored how the Lightning Network can enhance the speed and scalability of Bitcoin transactions, enabling instant, low-cost global payments.

Highlights:

-

– Lightning Network use cases: How businesses worldwide use Bitcoin for cross-border remittances, merchant payments, and micropayments.

-

– Technical integration: How developers can embed the Lightning Network into their applications for seamless payment experiences.

-

– Hands-on demos: Attendees experienced live demonstrations of Lightning Network applications and payment channels.

Image Credit: tovarishch.bit

Day 3: Meme Coins, AI, and the Tokenized Economy

Main Conference Highlights

How Meme Coins Evolved from Internet Jokes into 2024's Digital Economies

This session analyzed how meme coins (memecoins) have transformed from online humor into digital assets with real utility and cultural impact. Industry experts dissected how community dynamics, social media trends, and speculative trading shape the growth path of memecoins. Core topics:

-

– How memecoins evolved from speculative assets into blockchain projects with governance mechanisms, staking functions, and DeFi integrations.

-

– The critical role of community-driven movements and KOL marketing in memecoin success.

-

– How Layer-2 scaling solutions reduce transaction costs, making memecoins more sustainable.

"Memes Are More Than Memes": How Memeland Is Reinventing Web3 Community Culture

A panel hosted by the founding team of Memeland explored how NFTs, Web3 social platforms, and gamified experiences transform meme culture into a sustainable digital economy. Discussion points:

-

– How Memeland integrates content creation with blockchain reward systems to deliver new user experiences.

-

– The power of decentralized narratives: How memecoins build strong community consensus beyond mere speculation.

-

– The future of memecoins, NFTs, and brand collaborations—how Web3 culture attracts mainstream attention.

The DePIN Revolution: Bridging the Physical and Digital Worlds?

Decentralized Physical Infrastructure Networks (DePIN) are disrupting traditional industries by bringing blockchain technology into cloud computing, wireless networks, and supply chain management. This session featured leading DePIN project teams sharing trends in blockchain-powered infrastructure. Key topics:

-

– How blockchain infrastructure is transforming industries such as cloud computing, decentralized wireless (DeWi), and supply chain finance.

-

– How crypto-driven IoT solutions promote smart cities and decentralized logistics systems.

-

– The investment potential and scalability of DePIN within the Web3 space.

Image Credit: Consensus Hong Kong 2025

Emerging Tech Stage

"Can We Trust AI?" – Challenges and Opportunities in AI and Blockchain Integration

As artificial intelligence (AI) becomes increasingly integrated into blockchain and Web3, this session explored the balance between automation, transparency, and trust. Key discussion points:

-

– AI applications in blockchain security: Can it predict fraud and strengthen smart contract integrity?

-

– Challenges of decentralization vs. AI governance: How to prevent centralization of AI control and ensure fairness?

-

– The future of AI-generated assets: From on-chain content creation to AI-driven DAOs (decentralized autonomous organizations)—how this technology will reshape Web3?

Spotlight Stage

From Custody to Liquidity: How Is Asset Tokenization Changing Financial Markets?

Asset tokenization is redefining traditional financial markets by enabling illiquid assets—such as real estate, art, and private equity—to be traded more easily on blockchains. This session deeply analyzed the potential and regulatory challenges of asset tokenization. Core topics:

-

– How fractional ownership allows retail investors to access high-value asset markets?

-

– How financial institutions are embracing tokenization and using blockchain to improve market transparency and efficiency?

-

– Regulatory attitudes toward asset tokenization: How to balance compliance and innovation?

Major Announcements and Industry Impact

New Regulatory Developments

The approval by the Hong Kong Securities and Futures Commission (SFC) of cryptocurrency derivatives and margin lending further demonstrates Hong Kong’s acceleration toward becoming a global digital asset financial center. This policy shift not only attracts Asian capital but also encourages global institutional investors to enter the market, adding liquidity and stability to Hong Kong’s cryptocurrency ecosystem.

Stablecoin Regulatory Roadmap

Stablecoins have become a key focus for the Hong Kong government. Financial Secretary Paul Chan revealed during the summit that regulators are studying the legal framework for stablecoin issuance—a move expected to boost stablecoin usage in retail payments and enterprise settlements. Impact analysis:

-

– Likely to attract more international financial institutions and stablecoin issuers to establish operations in Hong Kong.

-

– May lead to the launch of compliant, fiat-backed stablecoins in Hong Kong, strengthening global confidence in its Web3 ecosystem.

-

– Businesses and consumers can use stablecoins more conveniently for payments, cross-border transactions, and financial management.

Accelerated Institutional Capital Inflows

With Hong Kong’s digital asset regulatory system maturing, institutional investor interest in the crypto market has reached new highs. Several banks and hedge funds have announced plans to establish crypto trading divisions in Hong Kong, which will further boost market liquidity and accelerate mainstream adoption of digital assets. Key developments:

-

– A Web3-friendly regulatory environment increases institutional confidence, encouraging greater capital and resource allocation into the market.

-

– Integration of traditional finance with DeFi (decentralized finance) helps build a more stable and transparent Web3 financial ecosystem.

-

– Significant growth in Hong Kong’s digital asset trading volume is expected within the next 12 months.

AI and Blockchain Integration

This summit highlighted how artificial intelligence (AI) enhances user experience in blockchain—from automating smart contracts to optimizing data analytics—expanding AI applications across Web3. Technology trends over the next 12–18 months:

-

– AI-powered trading and market prediction: More trading platforms will adopt AI-driven analytics and strategies to improve efficiency and risk management.

-

– Automated smart contracts: AI will be used for vulnerability detection and fraud identification, enhancing the security and stability of Web3 applications.

-

– AI-enhanced DeFi and DAOs (decentralized autonomous organizations), leveraging intelligent governance models to improve community decision-making and user experience.

Conclusion and Outlook

Consensus Hong Kong 2025 fully demonstrated Hong Kong’s influence in the global digital asset industry, successfully fostering collaboration and exchange between Eastern and Western blockchain, Web3, and financial innovations. With clearer regulations, active institutional participation, and transformative advancements in DePIN (decentralized physical infrastructure) and AI technologies, Hong Kong has firmly established itself as one of the global leaders in cryptocurrency and digital finance.

Future Trends: What’s Next for Hong Kong?

Regulatory Evolution

-

– Stablecoin regulations are expected to be further refined, providing a clearer legal framework for the market.

-

– Licensing for digital asset trading platforms will expand, attracting more international Web3 projects and institutional investors to the Hong Kong market.

Institutional Acceleration

-

– The issuance of nine exchange licenses is just the beginning; more banks, hedge funds, and fintech companies are expected to accelerate their Web3 business expansions.

-

– Hong Kong’s Web3 ecosystem will see more mature financial infrastructure, enabling more institutional investors to participate securely and compliantly in digital asset markets.

AI & DePIN Expansion

-

– AI-powered blockchain will make smart contracts safer, more efficient, and self-optimizing.

-

– DePIN (decentralized physical infrastructure) will continue evolving, bringing disruptive changes to finance, logistics, and data security.

Tokenization & DeFi Growth

-

– Asset tokenization will bring new liquidity to traditional financial markets, with more real-world assets (RWAs) expected to enter blockchain ecosystems.

-

– Integration between DeFi ecosystems and institutional investors will deepen, pushing decentralized finance toward greater maturity.

Driven collectively by financial institutions, major corporations, innovative startups, and regulators, Hong Kong is rapidly emerging as a global model for Web3 finance. The discussions and innovations at this summit not only shape Hong Kong’s future but also lay the foundation for global digital economic development. The impact of Consensus Hong Kong 2025 will continue to grow, accelerating global adoption of digital assets, regulatory refinement, and industry consolidation—ushering in a more interconnected digital economy era.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News