Discussing Hong Kong Court's "Crypto Wallet Injunction": Is De-anonymization an Inevitable Trend?

TechFlow Selected TechFlow Selected

Discussing Hong Kong Court's "Crypto Wallet Injunction": Is De-anonymization an Inevitable Trend?

Today, Sister Sa's team turns its attention from the mainland to Hong Kong, discussing a recent judicial precedent set by Hong Kong's High Court in the cryptocurrency field.

Trump's return to power inevitably signals a boom in the cryptocurrency market, but beneath this prosperity lies undercurrents of turmoil. A few days ago, Team Sah discussed recent significant judicial rulings from mainland China related to cryptocurrencies. Today, Team Sah shifts its focus from the mainland to Hong Kong, discussing a groundbreaking legal precedent recently set by the Hong Kong High Court in the field of cryptocurrencies.

01. Is the Hong Kong High Court using blockchain to issue injunctions directly to cryptocurrency wallets?

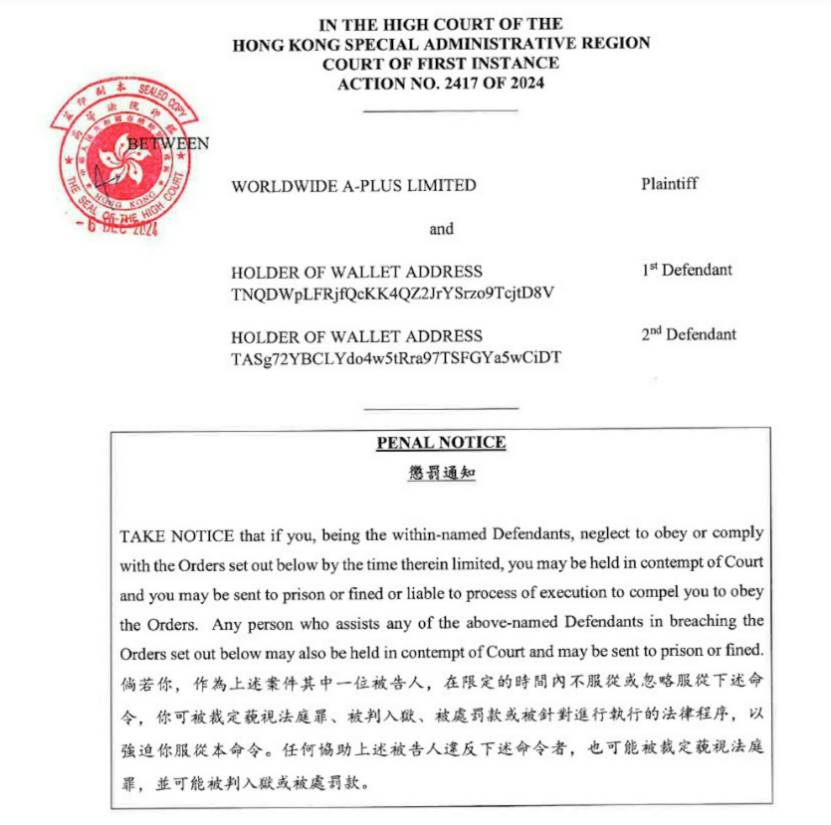

The injunction issued by the Hong Kong High Court at the end of last year was likely seen by many seasoned members of the crypto community.

The facts of this case are not complicated. The plaintiff, Company W, is a private limited company established in Hong Kong in March 2015, primarily engaged in marketing consulting. In December last year, it was defrauded via telecom scam of nearly 2.6 million USDT. After realizing the fraud, the company’s management immediately contacted the Hong Kong High Court through lawyers, requesting that injunctions be issued against the holders of two Tron wallet addresses holding the stolen funds, freezing the assets within those wallets.

Just days later, Deputy Judge Douglas Lam of the Hong Kong High Court issued the asset-freezing injunction shown above and delivered it to the two涉案 wallet addresses via a technology company named M. The process was seamless. Since all cryptocurrency transaction details are recorded on the blockchain, anyone transacting with these two涉案 wallets will see the injunction recorded on-chain. This approach can be viewed as a form of "inscription" technique—akin to engraving the words "stolen funds" directly into the涉案 cryptocurrency wallets.

Under Hong Kong law, violating an injunction constitutes contempt of court, punishable by imprisonment or fines. This injunction effectively freezes the liquidity of the cryptocurrencies in the two涉案 wallets, preventing further losses for the plaintiff.

02. Why is this development significant?

Due to the inherent anonymity of blockchain technology and cryptocurrencies, law enforcement agencies face extremely high costs when tracing real individuals behind cryptocurrency wallet addresses (although not impossible—authorities in countries like China and the U.S. do have such capabilities; however, the cost often outweighs the loss, so in minor cryptocurrency-related criminal cases, relevant technologies and manpower are typically not deployed).

In most civil disputes involving cryptocurrencies in Hong Kong, claimants often only know the opposing party’s wallet address and cannot identify their true identity, making lawsuits extremely difficult and legal remedies nearly unattainable. By approving the direct issuance of injunctions via blockchain technology to two wallet addresses, the Hong Kong High Court has directly addressed the common challenge in crypto disputes: "knowing the wallet but not the person." As seen in the injunction, the court listed the two wallet addresses directly under the "Defendant" field, effectively resolving litigation challenges posed by cryptocurrency anonymity.

03. Will cryptocurrencies no longer be "safe"?

In recent conversations with friends, Team Sah has heard sentiments like this: “I invest in cryptocurrencies not only because of their strong investment potential but also because ‘anonymous’ wallets make assets more ‘secure’—if I ever face legal proceedings, at least some wealth can remain ‘protected.’” Many investors share this view. If "security" is understood in this way—not as protection against theft or loss, but as insulation from legal scrutiny—then Team Sah can state clearly: yes, cryptocurrencies are no longer "secure."

The Hong Kong High Court’s decision to name cryptocurrency wallet addresses as defendants and deliver injunctions directly to them via technology companies sets a global precedent: even without cooperation from exchanges or stablecoin issuers, judicial authorities can directly issue legal orders to wallet addresses, broadcasting to all potential counterparties: any transaction with this wallet is illegal and will incur penalties.

From now on, Hong Kong’s judiciary can issue injunctions not only against identifiable individuals or entities in cryptocurrency disputes but also against anonymous wallets. It must be acknowledged that Hong Kong has taken a leading role in the technological issuance of tokenized legal notices. Foreign parties involved in cryptocurrency disputes may soon use Hong Kong-based tech firms and enforcement agencies to issue similar injunctions and recover losses. The ability to evade legal control and sanctions through cryptocurrency anonymity is rapidly diminishing.

04. Final Thoughts

Finally, let’s revisit key judicial developments in Hong Kong’s cryptocurrency space over the years, appreciating the steps taken by Hong Kong’s judiciary to support the city’s ambition of becoming a cryptocurrency hub.

Step One: Recognizing cryptocurrency as "property." The most important milestone in Hong Kong’s legal protection of cryptocurrencies was arguably the early-2023 Gatecoin case. In this ruling, the Court of First Instance declared for the first time that cryptocurrencies qualify as "property" under Hong Kong law, thus subject to laws protecting private property. The Gatecoin case provided legal certainty and demonstrated that Hong Kong courts align with other major common law jurisdictions—including the UK, British Virgin Islands, Singapore, Australia, New Zealand, Canada, and the US—in treating cryptocurrencies as "property." This stands as one of the brightest achievements in Hong Kong’s recent judicial advancements in the crypto space.

Step Two: Enactment of the Stablecoin Bill. Stablecoins serve as a bridge between traditional finance and blockchain technology. Hong Kong’s Stablecoin Bill establishes a comprehensive compliance framework and requirements for fiat-backed stablecoins, directly safeguarding financial security for stablecoin holders and institutions. This marks a crucial step in integrating Hong Kong’s traditional financial sector with its fintech innovations.

Step Three: Protecting cryptocurrency assets via blockchain technology. This refers to the case discussed in this article. Leveraging blockchain’s inherent characteristics, the court does not require plaintiffs to know the defendant’s real identity—so long as a wallet address exists, an injunction can be sent directly to it. This represents a critical advancement in judicial protection and a major shift in traditional legal frameworks adapting to fintech, directly overcoming the previous obstacle in Hong Kong where victims could not seek legal recourse without identifying the perpetrators of crypto fraud.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News