Meme decline: Why should you pay attention to the countercyclical growth of the RWA sector?

TechFlow Selected TechFlow Selected

Meme decline: Why should you pay attention to the countercyclical growth of the RWA sector?

As regulatory frameworks gradually become clearer, this sector is expected to become one of the fastest-growing markets in the future.

Author: Cheeezzyyyy

Compiled by: TechFlow

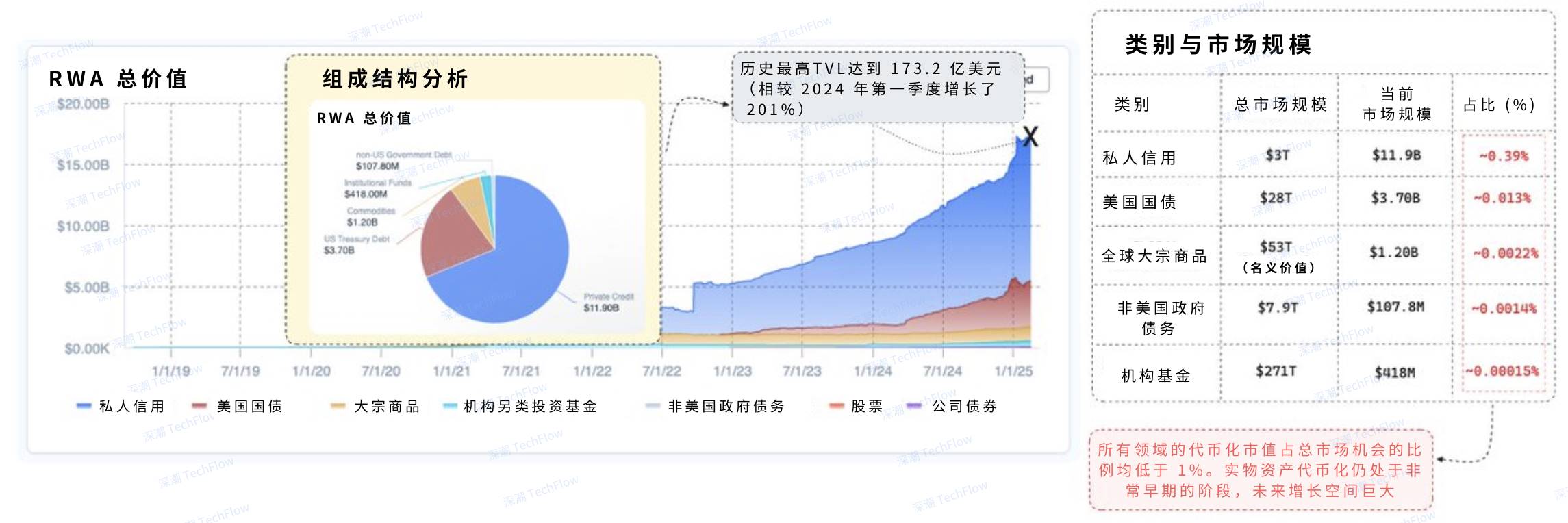

Despite market volatility, RWA continues to demonstrate strong growth momentum. Its TVL has reached a record high of $17.32 billion, doubling since 2024.

However, the market potential in this sector remains vast. Currently, less than 1% of global physical assets are tokenized, with private credit accounting for approximately 68% of the market share. This indicates significant room for future growth in RWA tokenization.

Below are some key insights worth noting.

(Original image from Cheeezzyyyy, compiled by TechFlow)

With rising institutional investor interest, the tokenized U.S. Treasury market has shown significant growth, reaching a total size of $3.6 billion. Below are performances of some key projects:

-

@Hashnote_Labs' $USYC ST-yield is currently the largest tokenized Treasury product by market cap, valued at approximately $1.1 billion.

-

@BlackRock's $BUIDL fund has reached $650 million in size, leveraging @OndoFinance's $OUSG to provide investors with convenient access to Treasury investments.

-

@FTI_Global's money market fund (FOBXX) currently manages $580 million, continuing to attract market attention.

The rapid growth of these tokenized Treasury products not only reflects institutional recognition of blockchain technology but also demonstrates the integration potential between traditional financial assets and decentralized finance (DeFi).

(Original image from Cheeezzyyyy, compiled by TechFlow)

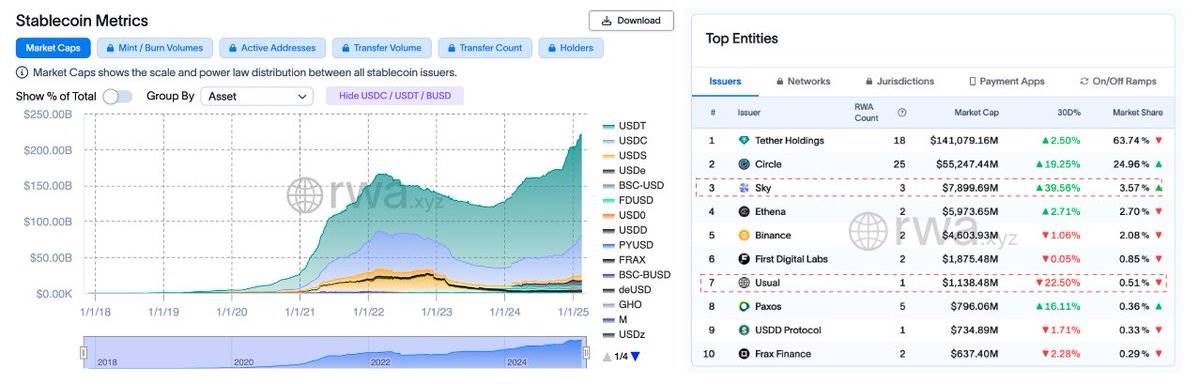

Tokenizing RWAs into yield-bearing stablecoins has become one of the most popular application forms today. Several well-known protocols are actively advancing in this space, including:

-

@SkyEcosystem's $USDS

-

@usualmoney's $USD0

Notably, many issuers are utilizing their own holdings of Treasury assets to generate stablecoins via tokenization, creating passive income for investors. This model not only introduces reliable yield sources for stablecoins but also further promotes deeper integration between traditional assets and blockchain technology.

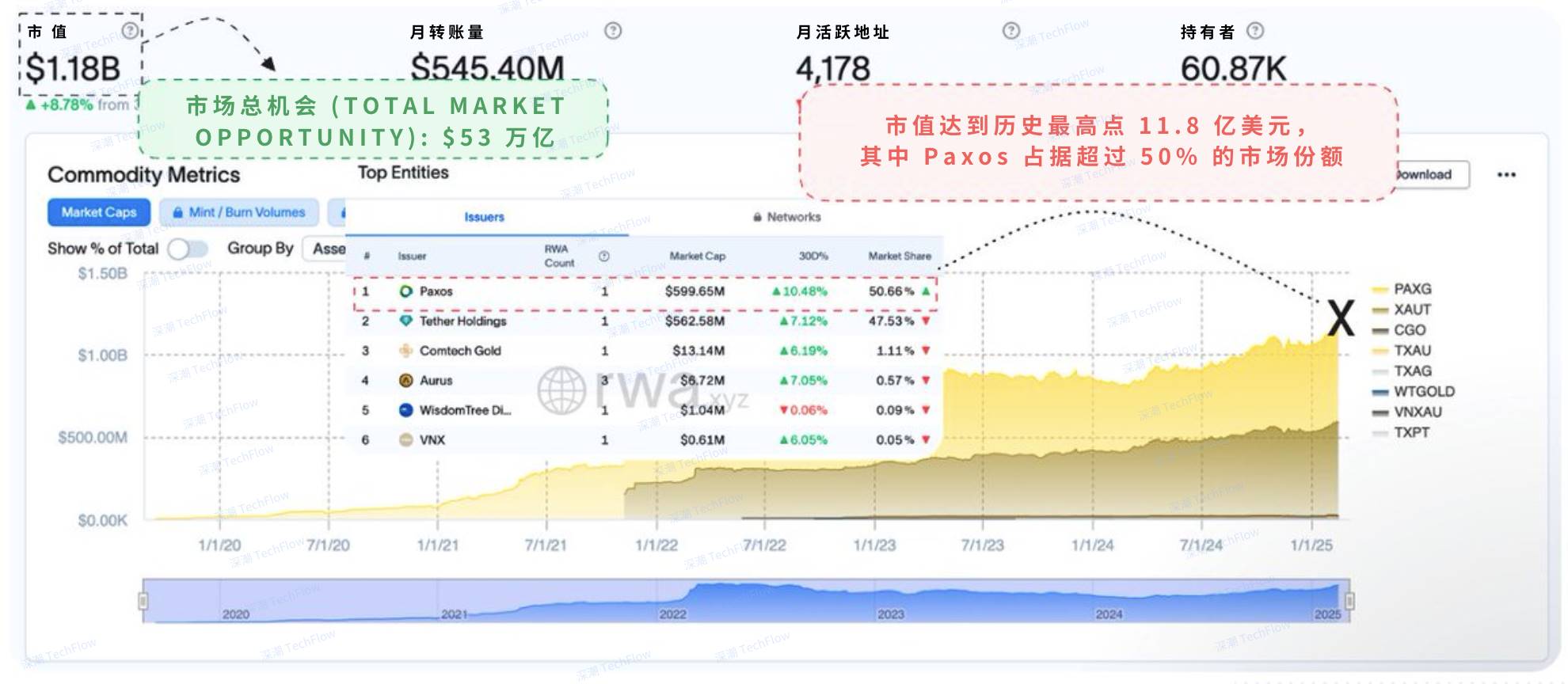

Among all markets, commodities represent one of the largest opportunities, with a total nominal value as high as $53 trillion. However, the current value of tokenized commodities stands at only about $1.18 billion, representing just 0.0022% of the total addressable market (TAM). In this sector, @Paxos leads the industry with approximately $600 million in tokenized assets, capturing 50.66% of the market share.

As technology matures and institutional interest grows, the tokenized commodities market is expected to experience exponential expansion in the coming years.

(Original image from Cheeezzyyyy, compiled by TechFlow)

For institutional investors, the total size of the global market portfolio reaches $271 trillion, while the historical high of tokenized assets is only $418 million, led by @Securitize. This highlights substantial potential for future capital inflows.

As regulatory frameworks gradually become clearer, this sector is poised to become one of the fastest-growing markets in the future, offering greater opportunities for investors and the industry.

(Original image from Cheeezzyyyy, compiled by TechFlow)

Although various sub-sectors within Real World Assets (RWA) remain in early stages of growth exploration, from a market potential perspective, this is undoubtedly a multi-trillion-dollar opportunity—and we are only just getting started.

Current tokenized market capitalization remains very limited, still at the level of hundreds of millions or low billions of dollars. This is merely the beginning of exponential growth.

(Original image from Cheeezzyyyy, compiled by TechFlow)

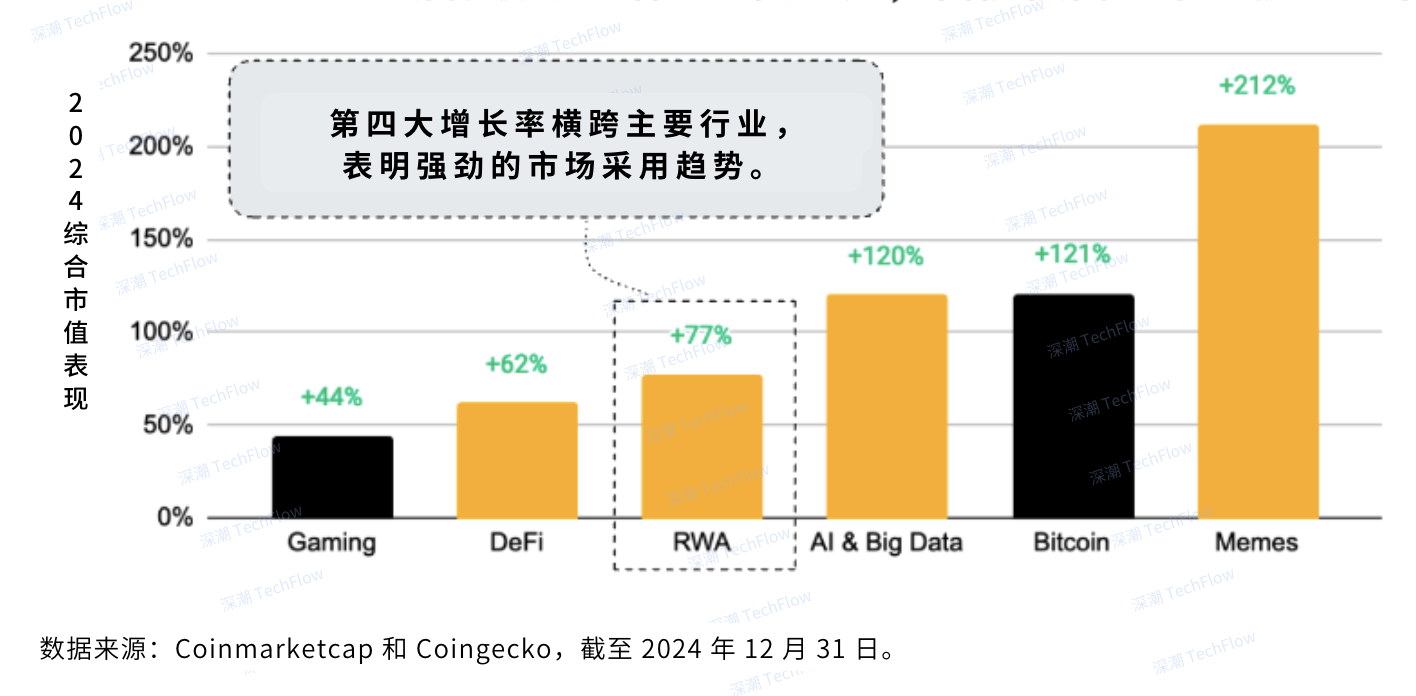

Therefore, the RWA market is poised for more robust growth, primarily driven by strong fundamentals and the increasingly important role of on-chain asset issuance models in the financial sector.

In 2024, the RWA sector ranked 4th among all sectors in terms of market cap growth, with an impressive increase of 77%.

I believe that by 2025, RWA will likely rank among the top three best-performing sectors.

(Original image from Cheeezzyyyy, compiled by TechFlow)

Looking ahead, as more countries and funds recognize the potential of this market, the value structure of tokenized RWA will undergo significant transformation.

Meanwhile, as regulatory frameworks gradually improve, many regions are showing greater acceptance toward blockchain-based financial infrastructure.

The future will bring exciting opportunities in this field!

(Original image from Cheeezzyyyy, compiled by TechFlow)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News