Story: The Trust Machine for Crypto Brands

TechFlow Selected TechFlow Selected

Story: The Trust Machine for Crypto Brands

In the future, crypto-native brands issuing through Story have the potential to play a central role in liquidity within the massive $61 trillion IP market.

Looking back at multiple cycles in the crypto market, the protocol layers leading each cycle have always possessed two core elements.

The first is narrative. A new protocol layer must be compelling enough for users to believe it enables innovations previously unattainable, generating strong anticipation. At the same time, it needs sufficient market appeal to drive token market development in order to achieve real success. The other core element is that the protocol layer must solve fundamental problems within the crypto ecosystem.

In two words, these are brand building and problem-solving capability. Taking successful crypto projects like Ethereum, Solana, and Uniswap as examples, while these two core elements may seem easy to describe in language, actually building a project that excels in even one of them is extremely challenging.

This article will explore how Story meets both core criteria in the 2025 crypto market and analyze its potential impact on future markets.

How to Fix the Flaws in Crypto Narratives?

Monetizing narratives indeed sounds like a dream for aspiring entrepreneurs. Even without a solid business foundation, constructing a sufficiently attractive story can still attract large-scale funding. Those who don't invest in cryptocurrencies might struggle to understand the value of meme coin narratives. Let's use gold—an asset familiar to everyone—as an example to illustrate this point.

Gold is also a classic example of an illusory asset shaped by narrative. Although many metals are rarer than gold, none have become widely recognized stores of value like gold. In fact, gold’s current status as an asset stems entirely from the long-standing narrative that “gold is precious.”

When introducing Bitcoin, we could describe it technically as an electronic cash system based on distributed ledgers and blockchain technology. However, those sensitive to narrative tend to simply call it “digital gold.” Bitcoin not only shares gold’s scarcity narrative but also offers superior user experience in ownership management, tracking, storage, and transactions compared to gold.

Users don’t need to deeply understand Bitcoin’s technical advantages; as long as the “digital gold” narrative spreads widely and strengthens over time, Bitcoin’s position as an asset could surpass that of gold. In fact, Bitcoin has grown into an asset class with brand value comparable to gold—a metal with 10,000 years of accumulated prestige—within just 16 years.

As the second-largest cryptocurrency by market cap, Ethereum’s narrative logic isn’t as intuitive as “digital gold,” but it remains relatively easy to grasp. Using smart contract technology, Ethereum allows anyone to create contracts via code and record information on-chain, forming a decentralized “world computer” that operates autonomously without intermediaries. Ethereum’s native token ETH serves as the fuel powering this world. Therefore, the more people use the Ethereum ecosystem, the higher ETH’s value naturally rises.

Around 2017, when cryptocurrencies officially surged, this narrative-driven economic model was exceptionally active. With a strong vision and carefully crafted storytelling, raising funds became effortless. However, participants in the crypto ecosystem soon realized serious flaws in narrative-dependent economic models. They found many individuals used persuasive language to fabricate seemingly plausible stories, raised funds from communities, then failed to deliver on promises.

In early crypto communities, users successfully assigned economic value to narratives through tokens. Yet they failed to invent a mechanism ensuring these narratives would persist and materialize. Tokenization of narratives succeeded, but tokenization of trust failed.

Over time, dump-and-runs in the crypto world grew increasingly rampant. Despite the rollout of spot Bitcoin ETFs and growing capital inflows from traditional finance into crypto markets, ironically, there has been almost no substantive progress in the realm of narratives. Thus, we arrive at 2025.

If we were to pick the breakout product of the 2024 crypto market, meme coins would undoubtedly take the crown. As long as liquidity is sufficient, meme coins can trade smoothly without requiring complex narrative support. If this trend continues, the market will keep spawning new meme coins, while users may gradually lose hope for innovative products in the crypto industry. Today, the market urgently needs a platform capable of tokenizing trust.

What Changes Could Come From Solving Both IP Protection and On-Chain Trust Issues Simultaneously?

Looking at past bull and bear markets, the tokenized narrative market in each cycle contains potential value exceeding $10 billion—an undoubtedly massive market. Historically, protocol-layer projects like Ethereum, Solana, and Uniswap successfully addressed core issues in the crypto industry such as capital efficiency, liquidity, and user experience (UX), thus consistently occupying the best positions in this market. Meanwhile, as iconic projects of their eras, they maintain long-term influence into subsequent cycles.

Each bull market spawns numerous new protocol-layer projects. Interestingly, their paths to success continue evolving. In the past, protocol layers built around generality received more market attention; today, strategies focused on solving core crypto market problems and driving expansion have become more important. Consequently, compared to the past, a new project’s problem-solving ability now holds greater value in the market.

Recently, Sui and HyperLiquid are representative protocol-layer projects that have successfully adopted this strategy.

-

Sui focuses on optimizing user experience instead of following the generic protocol-layer architecture of Ethereum’s official EVM ecosystem, which inherits Ethereum’s high user entry barriers and latency issues. By optimizing its underlying ecosystem to enhance low-latency performance and fast transaction processing, and combining zero-knowledge proofs (ZK Proof) to launch zk Login, Sui enables users to access wallets using just a Google account without understanding wallet mechanics. This innovation allows Sui users to easily engage with the crypto ecosystem much like in Web2 environments, making Sui a user-centric protocol layer.

-

HyperLiquid targets the on-chain market with strong demand for trading long-tail assets, offering robust liquidity and a user experience rivaling centralized exchanges (CEX). Compared to other perpetual contract platforms, HyperLiquid features lower trading fees and supports multiple long-tail asset pairs. Additionally, users can provide liquidity via Hyperliquidity Provider (HLP), enabling trades without liquidity risk. Moreover, rather than adopting generic protocol frameworks like Cosmos SDK or OP Stack, HyperLiquid built a customized parallel EVM L1 specifically designed for Perp and DeFi, further strengthening the PMF (Product-Market Fit) of its existing products.

The commonality between Sui and HyperLiquid lies in their precise identification of long-standing problems in the crypto market and their launch of protocol layers achieving PMF (Product-Market Fit). As a result, they’ve won widespread user recognition and attracted significant high-market-cap capital inflows.

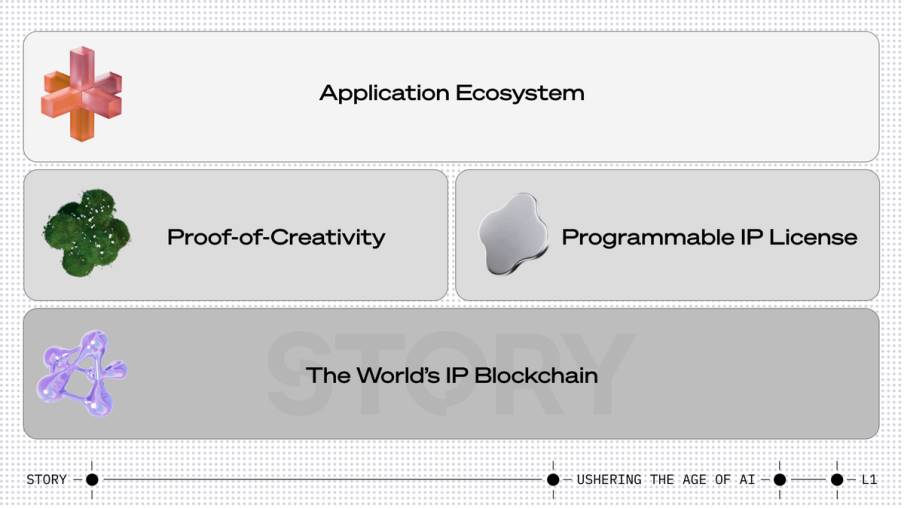

Story is a protocol layer whose core narrative centers on “tokenizing IP (intellectual property) on-chain.” Its greatest feature is not relying solely on smart contracts to establish trust, but building a protocol-level PoC (Proof of Creativity) mechanism to sustainably support the value of tokenized brands. Currently, Story’s PMF (Product-Market Fit) is not yet fully defined, but because it tackles unresolved core industry challenges, it commands exceptionally high market attention.

Story: The Trust Machine for Crypto Brands

We often hear phrases like “IP powerhouse” or “prestigious IP.” However, neither powerhouses nor prestigious names are formed overnight—they are built over long periods of accumulation. Giant IPs like Disney and Marvel were born after decades of reshaping narratives and investing astronomical sums into legal protection systems. Essentially, this process builds value-protection mechanisms atop IP networks, creating an environment of public trust.

Let’s dive deeper. Story primarily provides the following functions:

Tokenization of Brand Ownership

-

Full brand ownership is tokenized via IP accounts (based on ERC6551++).

-

This token functions as a wallet and can manage ownership across multiple IPs within the brand.

-

Ownership of the brand token can be programmatically controlled via individuals, Multi-sig, DAOs, and other methods.

IP Data Provenance Verification

-

Through PoC (Proof of Creativity), data can be tracked and updated in real-time starting from the IP creation stage, verifying whether data has been tampered with.

Programmable Brand IP

-

When brand creators issue tokens on Story, they can customize brand value protection mechanisms.

-

For example, programmable settings can restrict token purchases, IP leasing, derivative creation, and automatically distribute royalty revenues only to authorized users.

Protecting Asset Value Through Dispute Resolution

-

When disputes arise over brand IP, decentralized on-chain/off-chain oracles can be combined for arbitration.

-

Additionally, off-chain legal frameworks can help define standards for copyright infringement judgments.

By reinforcing ownership rights, revenue rights, and asset protection rights, Story safeguards brand value. When brands undergo tokenization, they can set granular permission configurations, effectively aligning stakeholders. This not only helps reduce IP transaction costs but also promotes derivative creations aligned with brand identity, providing infinite scalability for brand value growth.

Moreover, Story’s dispute resolution module prevents damage to brand value without requiring complex consensus processes. If someone maliciously forks a brand, the system executes a slashing mechanism based on arbitration results, ensuring brands cannot be forked at zero cost. Through this mechanism, all brands tokenized on Story inherently possess protocol-level consensus mechanisms without needing additional infrastructure.

$IP as an Accelerator for Crypto Brands

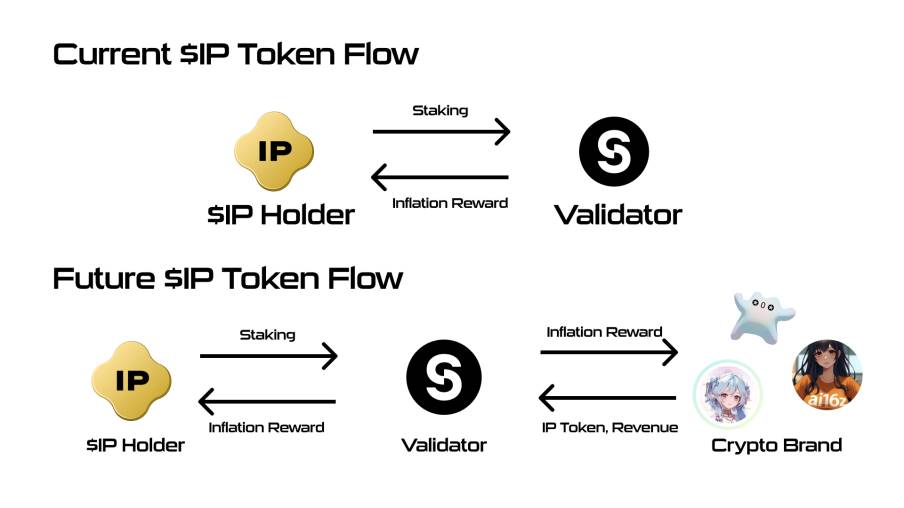

At the heart of Story’s structure lies $IP.

-

$IP essentially acts as a value storage and exchange medium between brands and users, serving as foundational currency within the brand value chain.

-

Furthermore, $IP uses a PoS mechanism with moderate inflation, part of which supports brand building, helping startups overcome cold-start challenges and achieve early bootstrap growth.

Early-stage crypto brands often propose grand narratives but struggle to attract stakeholders due to lack of trust. Tokens issued by unknown brands carry high risk, making network effects difficult to form. To address this, brands first communicate their narrative to $IP holders and obtain delegation before issuing their own tokens. Through delegation, brands earn partial staking rewards to fund early IP and token preparation, while users sacrifice these rewards in exchange for future IP token incentives and returns from the brand. This model allows $IP holders to establish long-term stakeholder relationships with brands at relatively low risk.

Additionally, if delegated $IP enters liquid markets, it can further participate in DeFi ecosystems to generate liquidity yields. The higher the liquidity of $IP tokens, the greater the value of the brand’s IP ecosystem becomes, driving brand value growth, enhancing Story protocol security, and further increasing $IP token value.

Moreover, brands build ecosystems not only through their own issued IP tokens but also gain support from delegated $IP holders, forming broad networks of stakeholders. If malicious forking occurs and attempts to issue new brand IP tokens, the system can initiate dispute resolution for arbitration. During this process, multiple stakeholders—including $IP holders, brand creators, and IP token holders—jointly participate to reach fair consensus and impose punitive slashing on attackers. As brand value is reinforced by $IP holders, attack costs rise accordingly, reducing the likelihood of malicious attacks.

Conclusion

As the crypto market grows to $3 trillion, each cycle spawns new infrastructure that enhances trust efficiency and creates new liquidity, enabling landmark growth. For example, Dogecoin, built on PoW, reached an $80 billion market cap within seven years, while Shiba Inu, relying solely on simple tokenization, hit $40 billion within one year. Clearly, the trend of improving trust efficiency through tokenization will accelerate further in the future.

Currently, crypto-native brands like memes and AI frequently face risks of value erosion. Since these brands are issued under specific token standards with structures allowing risk-free forking, they lead to PVP-style zero-sum competition, ultimately resulting in value loss.

From Story’s architecture perspective, it can somewhat support brands originating off-chain. However, due to misaligned interests between on-chain and off-chain domains, certain complexities remain. Therefore, Story is better suited as infrastructure for crypto-native brands built natively on-chain from inception.

As times evolve, Story continuously introduces new token standards, helping crypto-native brands attract broader stakeholders and providing the trust efficiency needed to build sustainable brands. In the future, crypto-native brands launched on Story have the potential to play a central liquidity role in the vast $61 trillion IP market.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News