Grayscale's Bet on the IP Empire: Why Is Story Sparking a New IP Era?

TechFlow Selected TechFlow Selected

Grayscale's Bet on the IP Empire: Why Is Story Sparking a New IP Era?

Creators can quickly secure funding, while users are able to share in the returns and participate in cultural asset investments. This innovative model has drawn attention from institutions such as Grayscale.

Author: Luke, Mars Finance

In the past month, Story Protocol has made headlines nearly every day in the crypto market. As a Layer 1 blockchain project dedicated to intellectual property (IP) management, Story Protocol has sparked a wave of tokenization by bringing some of the world's most influential cultural assets—such as Justin Bieber’s “Peaches,” BTS’s “Like It’s Christmas,” and the film *Balisty x*—onto the blockchain through its core ecosystem protocols Aria and STR8FIRE. This has not only drawn attention from institutions like Grayscale but also ignited widespread discussion: How does the Story ecosystem operate? How does it generate revenue? And what returns can creators and ordinary users expect? This article will delve into its model, explore how Web3 is revolutionizing the IP industry, and examine its future potential.

1. Story Protocol’s Operating Model: From Technology to Ecosystem

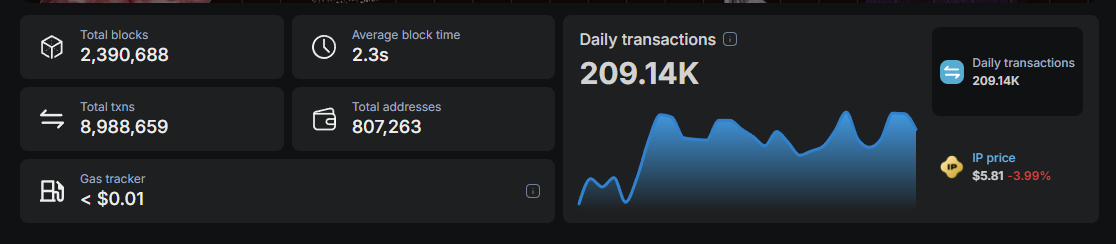

Story Protocol is a Layer 1 blockchain specifically built for IP management, aiming to transform real-world intellectual properties—such as music, films, and artworks—into tradable digital assets with liquidity. As of March 27, 2025, the Story mainnet has reached 2.39 million blocks, with an average block time of 2.35 seconds, daily transactions peaking at 209,000, total transactions nearing 9 million, and over 800,000 participating wallets—demonstrating strong technological and community momentum.

Founded in 2022 by Seung Yoon Lee and others, the project has raised multiple rounds of funding led by a16z, totaling over $134 million. With ambitions targeting the global $61 trillion IP market—even capturing just 1% would mean a $610 billion opportunity—Story aims to become the foundational digital infrastructure for future IP management. Its ecosystem comprises several sub-protocols, among which Aria and STR8FIRE focus on music and film industries respectively, jointly building a decentralized IP economy.

1. Core Logic: Programmable Intellectual Property

Story’s key innovation lies in enabling programmability of IP via smart contracts. In traditional IP management, rights holders rely on complex legal agreements, intermediaries, and lengthy settlement processes. Story moves these functions onto the blockchain. Smart contracts not only record ownership but also automatically execute licensing agreements, track usage, and distribute revenues. This decentralized design significantly reduces transaction costs while enhancing transparency and efficiency. The native token $IP serves as the lifeblood of the ecosystem, used for paying network fees, staking, and governance voting, powering the entire system.

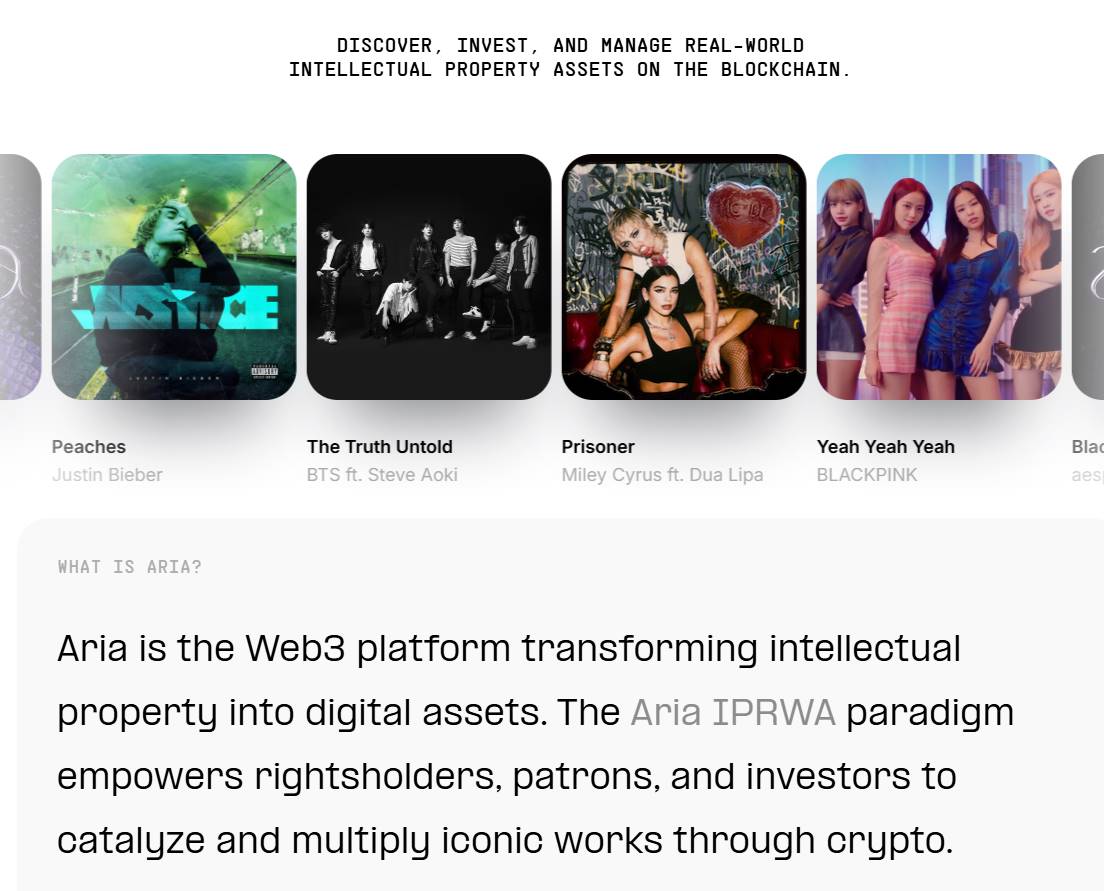

2. Aria: Pioneer of Music IP Tokenization

Aria is Story’s RWA (Real-World Asset) protocol focused on music IP, operating through a clear and efficient mechanism outlined below:

-

Asset Acquisition: Aria acquires music copyrights using community funds. For example, on February 18, 2025, Aria partnered with StakeStone to launch a deposit campaign that attracted 4,156 wallets to contribute a total of $10.95 million in stablecoins (e.g., USDC and USDT), used to purchase partial rights to popular tracks including Justin Bieber’s “Peaches” and BTS’s “Like It’s Christmas.” These funds are managed by smart contracts to ensure transparent allocation.

-

Tokenization: Acquired copyrights are split into RWIP (Real-World IP) tokens, each representing a share of a song’s revenue rights. These tokens are minted on the Story mainnet and freely tradable on decentralized exchanges (DEXs) such as Uniswap, granting unprecedented liquidity to IP assets.

-

Revenue Distribution: Streaming income generated by songs (e.g., from Spotify or Apple Music plays) is automatically distributed proportionally to RWIP holders via smart contracts. For instance, if “Peaches” earns $100 million annually, a holder owning 1% of the tokens receives $1 million—without any intermediary involvement.

-

Staking & Rewards: Users can stake their RWIP tokens or Aria Points earned during deposit campaigns on the Story mainnet to earn additional yields. The Aria Premiere Launch previously offered up to 30% annual percentage yield (APY), while certain IP RWA offerings provide steady returns around 7%, attracting significant investor participation.

Aria’s success stems not only from technical innovation but also from deep understanding of the music industry. By merging traditional royalty models with blockchain economics, it opens new possibilities for both creators and investors.

3. STR8FIRE: Exploration and Breakthrough in Film & TV IP

STR8FIRE is Story’s sub-protocol targeting film and television IP, following a similar operational framework to Aria but with distinct application focuses:

Asset Tokenization: On March 5, 2025, STR8FIRE announced the tokenization of partial rights to the movie *Balisty x*, issuing corresponding RWIP tokens. These represent shares in box office revenue, streaming subscription fees, or merchandise sales.

Participation Mechanism: Users participate by depositing stablecoins to acquire RWIP tokens and gain access to revenue sharing. For example, if *Balisty x* generates $500 million globally at the box office, a user holding 0.1% of the tokens could receive $500,000.

Ecosystem Expansion: STR8FIRE plans to expand into TV series, animation, and other forms of video content, creating diversified IP investment portfolios to meet varied user demands.

4. Revenue Model: Multi-Layered Income Streams

Story Protocol and its sub-protocols feature a sophisticated revenue model blending blockchain economics with traditional finance mechanisms:

-

Transaction Fees: A small fee (estimated between 0.1%–1%, exact rate not fully disclosed) is charged on the Story mainnet whenever RWIP tokens are traded on DEXs or transferred within the ecosystem. As transaction volume grows, this becomes a stable income stream.

-

Staking Yield Sharing: When users stake RWIP or Aria Points, the platform takes a cut from generated rewards. For example, if the staking APY is 10%, the platform may retain 1% as an operational fee.

-

Service Fees: Aria and STR8FIRE may charge rights holders service fees when acquiring and onboarding IP, or take a 5%–10% cut from revenue distributions to support ecosystem development.

-

Value-Added Services: In the future, Story plans to introduce premium features such as AI-powered copyright tracking tools and IP derivative creation platforms, charging users subscription or per-use fees to further diversify revenue sources.

This model resembles DeFi’s liquidity mining and fee structures but stands out by integrating real-world IP assets with blockchain, creating an economic system combining predictable cash flows with growth potential.

2. Who Shares the Gains: A Win-Win Ecosystem for Creators and Users

Story Protocol’s ecosystem enables both creators and everyday users to benefit, forming an open, collaborative cultural economy.

Creators: From Passive Royalties to Active Appreciation

For creators, Story offers a transformative opportunity. Take Justin Bieber: by tokenizing the rights to “Peaches” via Aria, he could sell 20% of future royalties to immediately raise millions in working capital—for new album production or personal investments—while retaining 80% for long-term earnings. This model is far more efficient than traditional royalty settlements, which often take months or even years. Similarly, every holiday season when BTS’s “Like It’s Christmas” streams surge, revenues flow directly to rights holders via smart contracts, eliminating cumbersome negotiations with record labels or streaming platforms.

More importantly, Story supports permissionless collaboration. Fans or third-party developers can remix, adapt, or create NFTs based on original works, with creators receiving automatic revenue shares. This expands income channels and fuels community creativity. For instance, an independent artist releasing a remix of “Peaches” might trigger a 10% royalty payment to Bieber through a smart contract. Blockchain’s transparency ensures creators avoid backroom dealings—the use and distribution of their work are fully visible and verifiable.

Users: From Consumers to Shareholders

For ordinary users, Story transforms them from passive cultural consumers into “shareholders” of IP. Take “Black Mamba,” which has 200 million Spotify streams and generates approximately $5 million annually. If a user invests $1,000 to buy RWIP tokens representing 0.2% of revenue rights, they could earn $10,000 per year—a yield ranging from 7% to 30%. These tokens can also be traded on DEXs; if the song gains popularity, token prices may double, offering additional capital gains.

Users can further boost returns by staking RWIP or Aria Points. For example, staking $1,000 worth of tokens might yield an extra $50–$300 annually in $IP token rewards. This financialization creates deeper emotional engagement with cultural assets—a Katy Perry fan investing in the “Daisies” RWIP doesn’t just earn money; they feel personally involved in their idol’s success. Such an experience is unattainable under traditional consumption models.

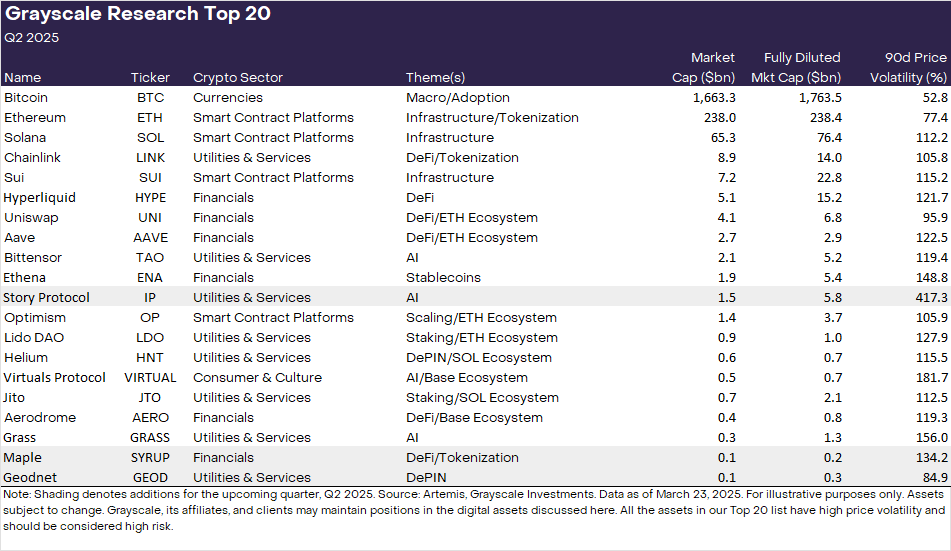

3. Why Grayscale Is Bullish: Signs of Mature, Non-Speculative Use Cases

Grayscale included Story Protocol’s IP tokens in the “Top 20” list in its latest report, *Grayscale Crypto Sectors*, signaling strong confidence in its potential. In Q1 2025, amid a broadly declining crypto market—with valuations down 18% on average—Grayscale shifted focus toward application-layer assets rather than pure infrastructure projects. Story Protocol fits perfectly into this trend. Its focus—non-speculative real-world applications such as RWA tokenization, decentralized physical infrastructure (DePIN), and IP management—is seen as a hallmark of crypto’s maturation. Notably impressive was Story’s rapid execution: shortly after launching its IP-focused blockchain and token in February 2025, it successfully brought heavyweight IPs like Justin Bieber and BTS on-chain, demonstrating capabilities that caught Grayscale’s attention.

Additionally, Grayscale recognizes the massive market opportunity behind Story. The global IP market is valued at $70 trillion, and in the AI era, the value of intellectual property is being redefined. For example, training AI models requires vast amounts of music and text data, and unauthorized use has already triggered lawsuits (e.g., *The New York Times* vs. OpenAI). By putting IP on-chain, Story allows rights holders to track and manage their assets while earning revenue through authorized usage. This model solves critical industry pain points and offers investors stable return channels. Grayscale believes such real-world-integrated applications represent the future direction of crypto assets.

Moreover, Story’s growth trajectory provides data-backed support for Grayscale’s optimism. Although full details remain undisclosed, Aria’s $10.95 million deposit event on February 18 attracted 4,156 wallets, reflecting strong community enthusiasm. According to Grayscale’s report, IP tokens have risen 84.9% in price over the past 90 days—not matching the explosive growth of some DeFi or AI-related tokens, but their low market cap and high potential make them a balanced risk-return investment. Clearly, Grayscale sees Story not as a short-lived hype, but as a force capable of reshaping the IP landscape in the long term.

4. Web3 Meets the IP Industry: A Quiet Revolution

The rise of Story Protocol reflects the convergence of Web3 and the IP industry. How is this transformation unfolding, and what new opportunities does it bring?

1. Tokenization and Liquidity: Breaking Down Barriers

Traditional IP markets suffer from illiquidity—a hit song’s copyright may be worth tens of millions, yet inaccessible to average individuals. Web3 breaks this barrier via tokenization: assets are fractionalized, allowing users to buy RWIP with stablecoins and trade them on DEXs. For example, with just $100, an Aria user can own a tiny slice of “Peaches” revenue rights—democratizing access to IP once reserved for elites.

2. Distributed Ownership and Collaboration: Redefining Creation

Story enables distributed ownership and permissionless collaboration. Fans can invest in the copyright of “Black Mamba” and then create remixes or NFTs based on it, with revenues automatically distributed via smart contracts. This mechanism allows creators and investors to co-participate in the appreciation of cultural assets.

3. Value Attribution in the AI Era: Technology Empowerment

AI proliferation complicates IP protection, but Story’s programmable IP offers solutions. Collaborating with Oxford University on research into AI agent negotiability, results of which will feed into the Agent TCP/IP framework, Story aims to enable its blockchain to use AI for automatically tracking IP usage and negotiating licenses in the future.

4. Diversified Returns: Financial Engineering

Users don’t just earn passively from holding RWIP—they can also stake to achieve APYs as high as 30%. This fusion of DeFi mechanics with IP enhances investment appeal.

Conclusion

Through Aria and STR8FIRE, Story Protocol brings IP onto the blockchain, empowering creators and enabling users to share in the rewards. Backed by Grayscale’s recognition, its non-speculative use cases signal maturity in the sector. Can this IP revolution reshape the cultural economy? The answer may lie in the next chart-topping track to go on-chain.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News