Is spending 30 million HKD in crypto assets to buy a "Hong Kong identity" worth it?

TechFlow Selected TechFlow Selected

Is spending 30 million HKD in crypto assets to buy a "Hong Kong identity" worth it?

Hong Kong was never intended to capture market share from the crypto market, but rather to build a new decentralized financial system on top of traditional finance, aiming to fill the gap in virtual assets.

The market remains lukewarm, yet Hong Kong, long neglected, is now attracting fresh attention.

On February 8, Clementsiu, a practicing accountant in Hong Kong, disclosed on social media that the Hong Kong Investment Promotion Agency had approved an investment immigration application using Ethereum as proof of HK$30 million in assets. He also mentioned that back in October last year, he successfully handled Hong Kong's first-ever investment immigration case using Bitcoin as asset proof.

At first glance, this may seem unremarkable. However, for cryptocurrency holders—especially major Chinese holders—it significantly lowers the threshold for overseas immigration. After all, HK$30 million isn't an enormous sum within the affluent circles of crypto, and moving to Hong Kong represents a natural direction for many Chinese individuals seeking relocation.

But is investment immigration really that simple? And is Hong Kong truly a crypto utopia? Different people have different answers. In reality, regardless of whether cryptocurrencies are involved, this investment immigration policy falls under Hong Kong’s new Capital Investor Entrant Scheme (CIES), introduced by the government in 2023. This scheme targets qualified investors, aiming to strengthen Hong Kong’s status as an international asset and wealth management center by attracting external capital and investors.

Under the scheme, eligible investors who invest HK$30 million in permitted assets in Hong Kong can obtain a residency visa, with the possibility of applying for permanent residency after seven years of continuous residence. The plan itself is straightforward, but practical implementation involves numerous details worth noting.

First, applicants must hire a professional Hong Kong accountant at their own expense to verify they possess net assets of HK$30 million. There are no restrictions on where these assets are located or how they are composed. Applicants must prove they have absolutely and beneficially owned net assets or net worth of no less than HK$30 million throughout the six-month period immediately preceding the date of their net asset review application. Notably, this required holding period was originally two years but has since been optimized by the Hong Kong government to six months.

Having assets alone isn’t enough—the ultimate goal of the Hong Kong government is to channel these assets into the local economy. Within six months before submitting the application, or within six months after approval, applicants must invest no less than HK$30 million into designated permissible investment categories. The government has clearly defined acceptable investment vehicles: HK$27 million must be invested in financial assets (all priced and traded in HKD/RMB), including stocks listed on the Hong Kong Stock Exchange, debt securities, certificates of deposit, subordinated bonds; qualified collective investment schemes such as funds issued by firms holding SFC Type 9 licenses, real estate trusts, open-ended funds, and life insurance plans; private limited partnership funds registered in Hong Kong; and non-residential real estate for commercial or industrial use (including pre-sale properties but excluding land), though investments in this category are capped at HK$10 million.

The remaining HK$3 million constitutes a mandatory allocation, requiring investment into the "Capital Investor Entrant Scheme Portfolio" established by Hong Kong Investment Management Limited. This portfolio invests in companies or projects linked to Hong Kong, supporting innovation, technology, and other key industries crucial to Hong Kong’s long-term economic development. Practically, the HK$3 million is deposited into a designated account managed by financial intermediaries and overseen by four fund management firms—Betatron Venture Group, INNO Angel Fund, Concept Capital, and WiserFunder—and related service providers. Put simply, this HK$3 million effectively contributes to Hong Kong’s angel investment ecosystem. Any profits bring mutual benefit; any losses are borne solely by the investor.

After completing these investments, the Hong Kong Immigration Department issues a two-year residency visa. Subsequent renewals typically follow a 3+3 pattern. Each year, applicants must submit a new verification report from a professional accountant confirming that the total investment remains no less than HK$30 million, has not been transferred, and hasn’t been used for unauthorized purposes. Importantly, this requirement does not consider investment losses—even if the current value drops below HK$30 million, so long as the initial investment scale met the threshold at the time of application, no additional funding is required. Profits, interest, or returns generated from investments may be freely disposed of. After residing in Hong Kong for seven years, applicants become eligible for permanent residency, after which there are no further investment restrictions and full control over assets is restored.

The entire process is as outlined above. The role of cryptocurrency comes primarily during the initial asset verification stage—Bitcoin, Ethereum, and other digital currencies can now be recognized as qualifying assets. Crypto holdings can be stored in cold wallets or verified via top-tier exchanges like Binance. It should be noted, however, that while Bitcoin and Ethereum are currently accepted, the eligibility of other cryptocurrencies cannot be generalized. Based on current practice, only those with relatively stable valuations, high liquidity, and legal status in Hong Kong qualify.

Additionally, whether the subsequent HK$30 million investment can include virtual asset ETFs remains uncertain. According to萧耀和 (Siu Yiu Wo), Deputy Managing Partner at Grandway CPA Limited, the likelihood is low. However, one might attempt such purchases through setting up a limited partnership fund, though direct investment would require further validation.

In fact, from the perspective of asset verification, using cryptocurrencies as proof of wealth has precedents in places like the United States and Singapore. But for crypto holders, the greatest challenge has never been proving they have money—it’s proving where that money came from. When using cryptocurrency as asset proof, relevant institutions and accountants will require applicants to provide evidence of fund origins.

This typically involves disclosing the original source of funds used to purchase cryptocurrencies, along with transaction records showing when and where the assets were acquired. Given the volatile nature of crypto markets and the inherent anonymity associated with blockchain transactions, answering these questions is extremely difficult. This, in fact, is the real hurdle for crypto-based immigration. With heavy historical baggage, holders must ensure every transaction leaves a traceable record to meet compliance requirements.

Regardless, this first instance of cryptocurrency being used in Hong Kong’s investment immigration program not only reflects Hong Kong’s high degree of openness but also reaffirms the government’s inclusive stance toward digital assets. It continues to hold appeal for Chinese-speaking crypto communities. Moreover, expanding the use cases for cryptocurrencies could further elevate Hong Kong’s position in the global crypto landscape, potentially creating long-term agglomeration effects in talent and capital that drive the growth of Hong Kong’s Web3 industry.

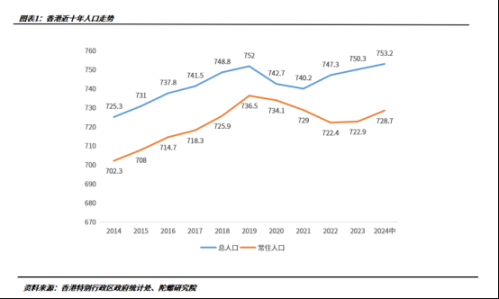

Looking at Hong Kong’s recent strategic moves, beyond the new capital investor scheme, since late 2022 the SAR government has rolled out multiple initiatives to attract overseas talent—including optimizing existing talent admission programs such as the Quality Migrant Admission Scheme and launching the new Top Talent Pass Scheme. These measures aim to diversify talent recruitment and enrich Hong Kong’s talent pool. The motivation is simple: too many people have left Hong Kong. Prior to 2022, Hong Kong’s resident population declined for five consecutive years, falling from 7.365 million in 2019 to 7.224 million in 2022. The outflow data is even more striking: between July 2020 and June 2023, 6.33 million Hong Kong residents departed via airport, with only 5.8 million returning. In other words, Hong Kong experienced a net outflow of 530,000 residents over three years—nearly 7% of its total population.

To date, the talent attraction programs have shown significant results. According to summaries from the Hong Kong Immigration Department, nearly 140,000 approvals were granted across various talent admission schemes in 2024—an increase of 4,000 compared to 2023. As of January 2, following the launch of the "New Capital Investor Entrant Scheme," Hong Kong has received over 750 applications, with projected total investments exceeding HK$22 billion. Unfortunately, only two applicants so far have utilized crypto assets. Meanwhile, amid broader economic contraction, Hong Kong’s local economy has taken a hit. According to reports from Economic Daily, retail sales in December last year amounted to HK$32.8 billion, down 9.7% year-on-year—the tenth consecutive month of decline. The report also notes that cryptocurrency’s popularity among younger demographics has made it one of the external pillars supporting Hong Kong’s consumer market.

Against this backdrop, Hong Kong’s focus on the Web3 sector has intensified rather than diminished. Over the past year alone, Hong Kong has increasingly emerged as a gateway—balancing regulation and inclusivity in virtual assets, demonstrating policy maturity and ecosystem support, with notable progress in product innovation, platform licensing, and regulatory expansion.

On the product front, in 2024, Hong Kong approved six spot virtual asset ETFs issued by China Asset Management (Hong Kong), Bosera International, and Harvest International. This greatly enhanced investor accessibility and advanced the compliance and productization of virtual assets. To date, the three Bitcoin spot ETFs collectively hold 4,330 BTC, with total net assets reaching US$425 million. The Ethereum spot ETF holds 2,083 ETH, with net assets totaling US$56 million.

Regarding exchanges, the new virtual asset regulations have been in effect for one and a half years. To date, nine virtual asset trading platforms have been approved in Hong Kong, over 31 brokers have upgraded to SFC Type 1 licenses, and more than 36 asset managers have obtained upgrades to SFC Type 9 licenses. In the highly watched PayFi space, the Hong Kong Monetary Authority has not only launched the Ensemble project to explore RWA and CBDC but is also continuously extending regulations from platforms to derivative institutions, refining oversight rules. Recently, Hong Kong’s Legislative Council’s relevant bill committee reviewed the Draft Stablecoin Regulation for the first time. Unless unforeseen, the bill is expected to take effect this year, successfully establishing a framework of “same business, same risk, same rules” for licensed stablecoin issuers, ensuring clear regulatory pathways. Last year, Hong Kong also launched a stablecoin issuer sandbox, continuously promoting integration between traditional finance and Web3 systems. Next steps in regulation will focus on OTC and custody services, with a second round of public consultation on virtual asset over-the-counter (OTC) trading supervision expected this year, alongside a consultation paper on licensing virtual asset custody service providers.

The environment conducive to Web3 development is solidifying. Yet from a market perspective, given its limited scale and high operating costs, Hong Kong ultimately struggles to become a global epicenter for Web3 innovation and exerts minimal influence on the global crypto market. This is evident when comparing virtual asset ETFs: against the U.S., where Bitcoin ETFs alone hold over US$111.78 billion in net assets, Hong Kong’s figures fall short by more than an order of magnitude. Even regarding the current immigration policy, some crypto professionals argue the price is too high and the cost-performance ratio poor: “Spending HK$30 million to move to Hong Kong isn’t as attractive as going to Singapore or Australia. Dubai’s golden visa costs only HK$4.24 million.”

Yet as previously stated, Hong Kong was never aiming to capture market share from the broader crypto world. Instead, it seeks to build a new decentralized financial system atop traditional finance, filling gaps in virtual asset infrastructure—reinforcing its role as a traditional financial hub while innovatively positioning itself for the future era of digital asset trading. This explains why Hong Kong, while standardizing virtual asset exchange platforms through licensing, simultaneously prioritizes areas like stablecoins and RWA. Once again, despite not being the most active region in crypto, Hong Kong’s model of “small government, big market” offers safety and stability—factors that, from the viewpoint of traditional capital, outweigh almost all others.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News