Goodbye to 4-year cycles: How to achieve sustainable profits in the new crypto landscape in 2025?

TechFlow Selected TechFlow Selected

Goodbye to 4-year cycles: How to achieve sustainable profits in the new crypto landscape in 2025?

Wealth accumulation through the compounding effect of time.

Author: Miles Deutscher

Compiled by: TechFlow

The 4-year cycle is over. We are entering a new paradigm in crypto—survival of the fittest, extinction of the unfit.

Below is my strategy for navigating market shifts in 2025 to continue accumulating wealth amid uncertainty.

Before sharing my strategy, let’s first examine why the 4-year cycle is now obsolete.

I believe there are two main reasons why the 4-year cycle no longer applies.

-

Halving impact is fading

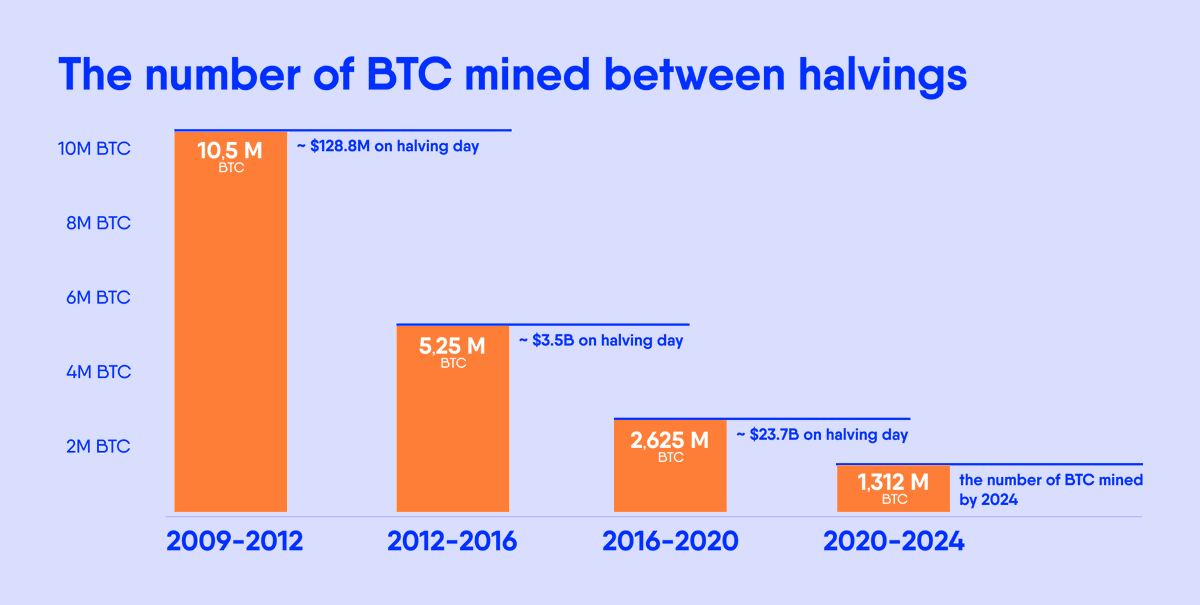

First, from the supply side, Bitcoin ($BTC) halving events are becoming less impactful.

With each halving, the reduction in newly issued Bitcoin diminishes in magnitude.

For example, the 2012 and 2016 halvings reduced issuance by 50% and 25%, respectively, significantly affecting market prices.

But by 2024, the issuance reduction from halving was only 6.25%. This means the price-driving power of halvings has greatly weakened.

-

ETFs have changed the game

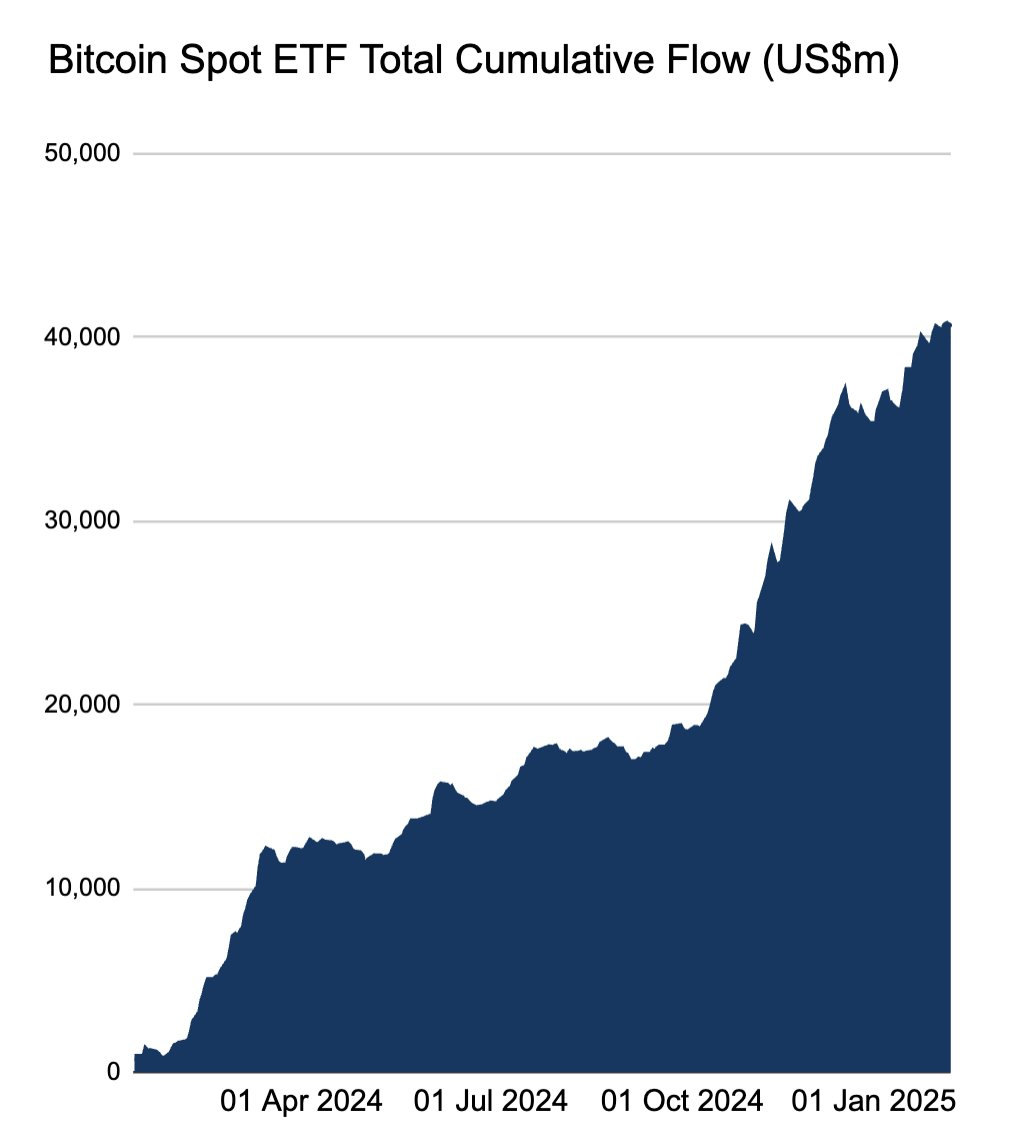

Second, from the demand side, the launch of Bitcoin ETFs introduced a major variable that permanently altered market dynamics.

Bitcoin ETFs are financial instruments allowing traditional market investors to gain indirect exposure to Bitcoin.

Since their launch, they’ve become the most successful ETF products in history, with demand far exceeding expectations.

This surge in demand has not only reshaped the overall crypto landscape but also broken many old market patterns (e.g., the 4-year cycle).

The biggest impact of ETFs is actually seen in the altcoin market. Let me explain.

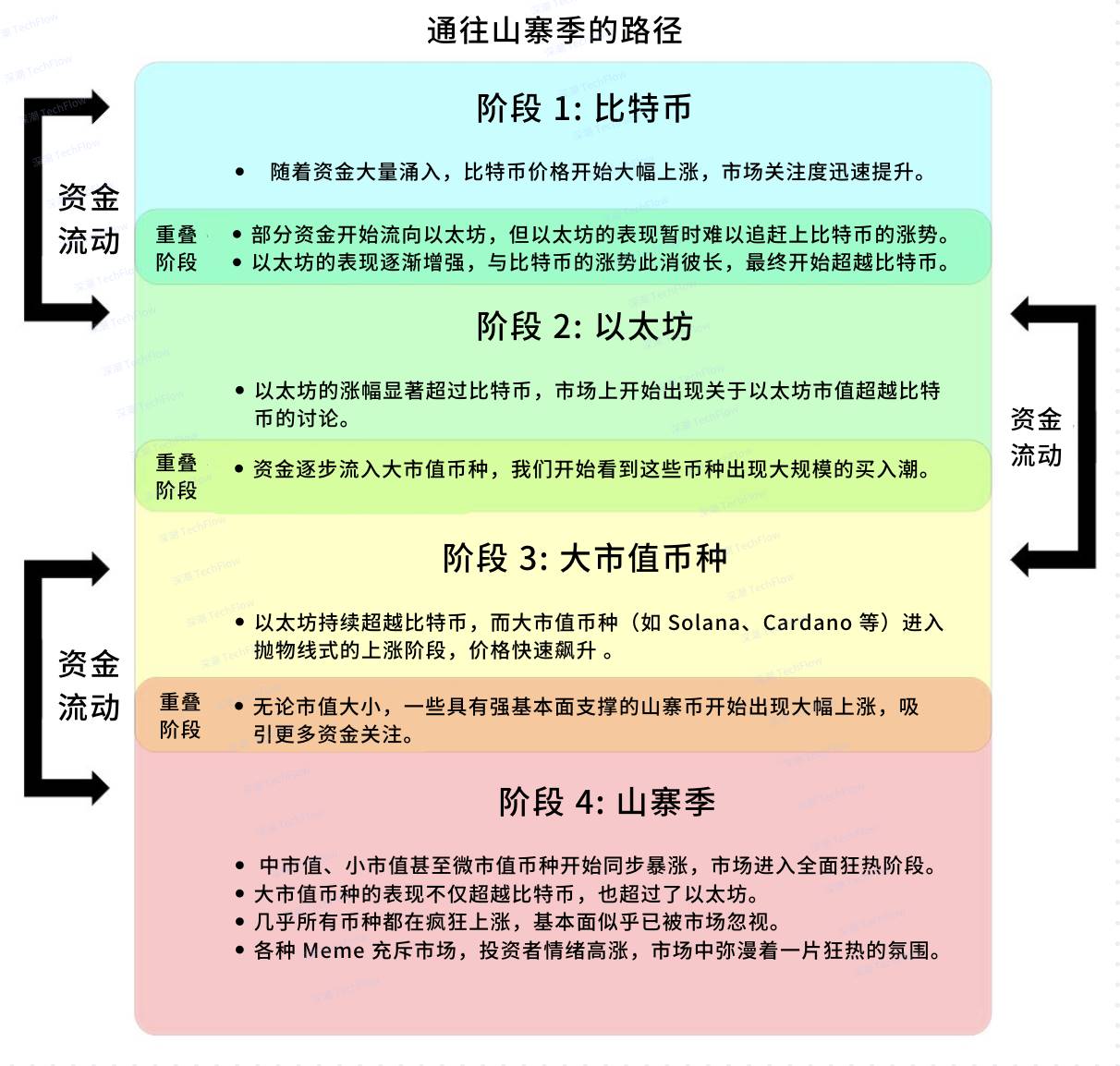

In the past, you might have often seen a chart illustrating the price rotation between Bitcoin and altcoins. This held true in 2021.

Now, this relationship has broken down.

(Original image by Miles Deutscher, compiled by TechFlow)

Bitcoin's wealth effect has disappeared

In 2017 and 2021, when Bitcoin rose in price, wealthy Bitcoin whales would often move profits into altcoins on centralized exchanges (CEX), fueling an altcoin boom.

Today, most new capital enters via Bitcoin ETFs—and this money does not flow into the altcoin market.

In other words, capital flows have fundamentally changed; altcoins no longer benefit from Bitcoin's wealth effect.

Retail investors skipped Stage 2 (ETH) and Stage 3 (major altcoins)

Retail investors went straight to high-risk speculative projects on-chain—what we call "on-chain casino games" (Pump Fun).

Compared to 2021, retail participation in this cycle is noticeably lower. This is largely due to macroeconomic pressures and heavy losses suffered during the last cycle from events like LUNA, FTX, BlockFi, and Voyager.

Yet, those retail investors who remain have skipped mainstream coins entirely, seeking opportunities directly on-chain.

You can read my detailed analysis of how this phenomenon affects markets here.

If I'm correct—that cyclical theories no longer apply—what does this mean for future markets?

I have some bad news and some good news.

The bad news: It's harder than ever to "sit back and earn." This is a natural sign of industry maturation.

In reality, there are more trading opportunities now than before—but if you stick to 2021-era strategies, such as holding a basket of altcoins and waiting passively for an "alt season," you may be disappointed or underperform.

The good news: Since the four-year cycle is gone, multi-year bear markets driven purely by crypto-specific factors may no longer occur. Of course, long-term bear markets are still possible from a macroeconomic perspective, as crypto is not isolated—the sector’s correlation with broader macro trends is stronger than ever.

Periods of "risk-on" and "risk-off" in the market will likely be driven more by macroeconomic shifts. These changes typically trigger short-lived mini echo-bubbles rather than sustained one-way rallies. An echo bubble refers to a brief market rebound caused by macro shifts—smaller in scale but structurally similar to past large bubbles.

Within these bubbles lie abundant profit opportunities.

For example, in 2024, we saw rotating themes: November brought meme mania, December focused on AI, January shifted to AI agents. Undoubtedly, new trends will follow.

If you're sharp enough, these are excellent profit windows—but they require a slightly different strategy than in past cycles.

This leads me to what I want to discuss next: my strategy.

A few days ago, I had dinner with @gametheorizing, who made a very insightful point.

Many people chase a single ultimate goal—whether it's multiplying their portfolio 5x, 10x, or 20x.

But a better approach is focusing on multiple small bets instead of going all-in. Over time, consistently stacking small wins may yield greater returns.

Rather than betting everything on an alt season to double your portfolio overnight, aim to build wealth steadily through compounding over time.

Specifically, you can adopt this strategy:

Small bet → Take profits → Reinvest → Take profits again → Repeat.

This is why many top crypto traders and thinkers (like Jordi) were former professional poker players. They learned from poker how to approach each trade probabilistically, evaluating potential outcomes rather than gambling blindly.

My current portfolio allocation looks like this:

50% in long-term, high-conviction assets; 50% in stablecoins and active trading. I use the latter portion to seek short-term opportunities, moving in and out flexibly.

Additionally, I use stablecoins as the benchmark for measuring trading success. Every time I exit a trade, I convert profits back to stablecoins, making gains clearly visible.

If your crypto portfolio is overly diversified and you're unsure how to adapt to current market changes, last week I shared a guide detailing how to optimize your portfolio in response to evolving market conditions.

In that post, I emphasized one key point: the importance of setting an "invalidation" criterion for every trade. Just as you need a clear reason to validate (VALIDATION) your decision when buying a cryptocurrency, “invalidation” refers to the predefined condition under which you exit a trade when market conditions no longer align with your thesis.

I’ve noticed many people enter trades without basic risk management or clear exit criteria. This often leads to avoidable losses.

If you’re looking for one actionable step that could significantly boost your future profitability, it’s this: Establish clear technical or fundamental “invalidation” criteria for every trade. This not only improves risk management but enhances overall trading efficiency.

Of course, your level of conviction in a trade and expected holding period may influence how you define invalidation triggers. But regardless, the necessity of planning ahead remains unchanged. Having a clear exit plan is one of the keys to trading success.

While the current market may not strictly follow historical cycles, I remain confident about the future. With the right mindset and strategy, 2025 still holds immense growth potential.

We are currently in a bear market phase, but market trends will eventually shift, bringing new opportunities. Until then, your primary goal is survival.

Rewards in crypto often go to those who endure extreme volatility. No matter how turbulent the market, patience and resilience are ultimately what lead to victory.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News