From HODL to Daily-Disposable Memes: How Do I Survive in a Highly Fragmented Market?

TechFlow Selected TechFlow Selected

From HODL to Daily-Disposable Memes: How Do I Survive in a Highly Fragmented Market?

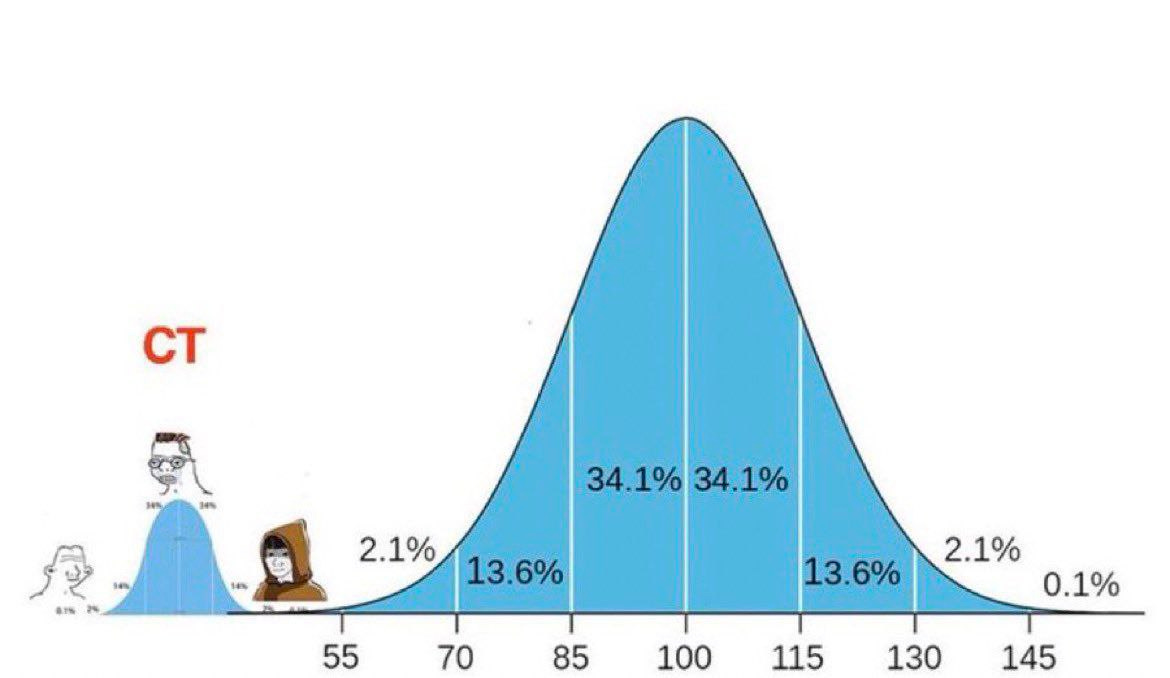

Funds are circulating more within the existing cryptocurrency space, showing a "net flat" state.

Author: Route 2 FI

Translation: TechFlow

Gm, friends.

The crypto market is undergoing a seismic shift, and we must adapt our strategies and tactics—because the approaches that once worked are no longer effective.

The traditional "buy and hold (HODL)" strategy is gradually losing its edge. As market volatility intensifies and new projects emerge constantly, the conviction behind long-term holding has become increasingly fragile.

Today, the survival rule of the market is agile trading, continuously adjusting positions, and seeking opportunities within a fragmented and uncertain environment.

Whether you succeed in adapting to this new reality will determine whether you survive or get left behind by the market.

Let’s dive deeper and explore whether there’s still a path forward in such a market.

Altcoin Casino: How to Survive in a Fragmented Cryptocurrency Market

For those who entered the crypto market within the past year to eighteen months, this market is undergoing a profound transformation.

The once-easy path to profits via centralized exchanges has grown increasingly complex. The market now operates more like a casino than a traditional financial market, requiring investors to possess unprecedented flexibility and sharpness.

The traditional “buy and hold” approach, while effective in earlier cycles, no longer applies. Holding periods are shrinking—from weeks down to just days (remember when seasoned traders told us to simply buy altcoins low and wait for them to peak?)

Behind this shift lies the constant influx of new coins and projects. Each new project competes fiercely for attention and capital, constantly challenging the dominance of existing ones.

Even events traditionally seen as positive can have unintended consequences. For example, Trump launching a highly anticipated Meme may attract many new users into crypto—but could simultaneously cause many altcoins to plummet. Typically, only Bitcoin (BTC), Solana (SOL), and related Meme coins benefit.

Many investors have learned this lesson the hard way—if your portfolio isn’t heavily weighted in BTC and SOL, you’re likely facing significant losses.

A similar situation occurred with the launch of Berachain, which drew massive attention and capital but dealt a blow to the Abstract ecosystem.

In such a dynamic and unpredictable environment, the wisest course is to accept volatility as the norm—and recognize that it may intensify further with the continuous emergence of new tokens, chains, and projects.

As a result, many investors are reshaping their strategies, increasing allocations to BTC and stablecoins while drastically reducing long-term altcoin positions. The market focus has shifted from “long-term investment” in altcoins to tactical, short-term trading.

The goal is to avoid becoming the “last believer” in failing projects, watching helplessly as their value drops to zero.

As this cycle nears its end, buying non-BTC assets based on long-term investment logic may offer an unattractive risk-reward profile. While altcoins may be near their lows, the likelihood of most coins, NFTs, or ecosystems reaching new highs simultaneously is diminishing.

With a flood of new tokens launching daily, market attention and capital are diluted, making it harder for existing projects to regain momentum.

The current cryptocurrency cycle presents unprecedented challenges, driven largely by a heightened sense of uncertainty. This stems from a key fact: even popular altcoins, after sharp declines, no longer inspire confidence that they’ll rebound.

Looking back at the 2017 and 2021 cycles, investors typically had strong conviction when buying the dip in altcoins—as long as the project's market cap wasn’t too small (usually below $100 million). The prevailing belief was that these tokens would recover during the cycle and wouldn't disappear entirely before its end. Early-movers often maintained relevance and market position until the cycle concluded.

But this cycle is different—yes, really. The market is flooded with narratives and sub-narratives, each vying for investor attention, yet all fleeting. Investors are now far more cautious about “buying the dip,” because a coin’s entire narrative can collapse overnight, rendering investments worthless.

Unlike previous cycles dominated by a single main narrative, today’s market features multiple smaller cycles driven by distinct narratives, each with its own peak and trough. Bitcoin (BTC) and Solana (SOL) are widely seen as relatively safe bets that may eventually recover in value—but for investors chasing high multiples, their potential returns may seem lackluster (after all, BTC is already up 6x from lows, and SOL up 20x). The question becomes whether to allocate funds to areas like AI cryptocurrencies. While these have recently drawn attention, they’ve also fallen sharply from all-time highs, with no clear sign of recovery.

Market fragmentation makes it extremely difficult for investors to accurately identify and capture emerging trends. Cryptocurrencies have always been speculative, though past cycles tried to legitimize the space through concepts like “peer-reviewed blockchain technology,” “solid fundamentals,” and “real-world applications.” Yet this cycle appears to have dropped the pretense, embracing a more honest truth: everything hinges on capturing and sustaining market attention. This trend has drastically shortened investor attention spans. Bull runs that once lasted one to two years are now compressed into mere months, weeks, or even days.

The current market seems to be experiencing—or perhaps has just exited—a Meme supercycle. However, even the most popular Memes have seen dramatic pullbacks from their peaks, casting doubt on the rationale for investing in them.

In today’s crypto market, the risk of being the “greater fool” is higher than ever. In past cycles, when tokens declined similarly, investors saw it as a buying opportunity—because a rebound was almost guaranteed. Today, the real question is whether these tokens can ever regain their former spotlight. The market now favors front-runners over laggards. Even projects with strong fundamentals struggle if they lack market heat.

Despite strong performance from Meme coins and AI projects, investors remain cautious, as shifts in market focus are rapid and unpredictable. This pervasive uncertainty arises from the overwhelming number of choices. Thousands of coins and projects compete for attention, making it hard to distinguish genuine potential from fleeting fads. With attention so scattered and short-lived, building lasting consensus around any single project is nearly impossible. A critical question emerges: Is this the new normal for crypto markets, or merely a temporary phase?

Typically, each market cycle begins with chaos and fragmented attention, then stabilizes as clear winners emerge. But it’s possible the market has fundamentally changed—investor attention spans have shortened so much that no single narrative can dominate for long. Meanwhile, macroeconomic factors are deeply shaping the current landscape. In the past, loose monetary policy made investing easier, as abundant liquidity fueled speculative bubbles. But under today’s high interest rates and tight liquidity, the market is far harsher.

Diminished confidence in “buying the dip” likely reflects broader economic realities. Amid uncertain economic outlooks, investor risk appetite has significantly declined. Debates about the traditional four-year cycle are growing, with some predicting elongation. Yet current market behavior suggests the four-year cycle still holds, albeit with notable differences. For instance, this cycle’s performance has been relatively weak: Bitcoin reached only about 1.5x its prior all-time high, while Ethereum hasn’t even set a new record. Much of this movement has been driven by specific catalysts—like Michael Saylor’s Bitcoin accumulation and the approval of Bitcoin ETFs—which attracted institutional interest. However, inflows outside the Bitcoin ecosystem remain weak, with speculative capital flowing instead into ultra-short-lived Meme coins.

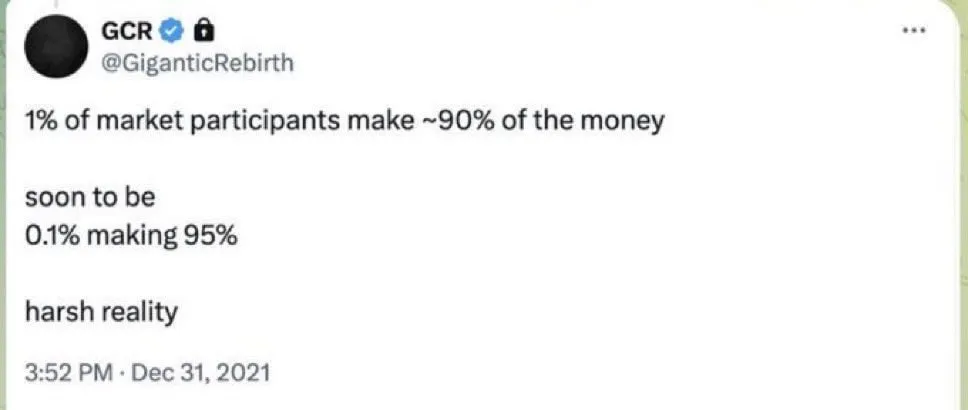

In today’s market, widespread speculative capital has virtually disappeared, leaving insufficient momentum to push the market to new all-time highs. Instead, capital circulates within existing crypto domains, resulting in a net flat state. Without major liquidity providers, these scattered热点 cannot drive broad capital flows or attract substantial new investor money.

This crypto cycle behaves very differently from previous bull runs, prompting deep reflection on the nature of market cycles. The absence of broad-based speculation, concentration of gains in Bitcoin, and internal recycling of capital suggest the market is adapting to a new operating model. Key drivers of past bull markets—loose monetary policy and retail enthusiasm—are far less evident today. And the long-awaited “alt season”—when nearly all altcoins surge rapidly—has yet to truly materialize.

Since the launch of Bitcoin ETFs, the gap between Bitcoin’s market cap and the total market cap of all other cryptocurrencies (i.e., the BTC-TOTAL2 metric) has continued to widen. During past alt seasons, massive speculative inflows lifted nearly every token indiscriminately. But today, Bitcoin stands apart—its price increasingly influenced by ETFs, MicroStrategy’s strategy, macro conditions, and political factors. In contrast, the altcoin market resembles a high-risk casino. Returns are possible only when there’s significant net inflow and you pick the right direction.

Yet in this casino, every winner comes at the expense of a loser. Compared to previous cycles, the 2025 crypto market is more complex and harder to navigate. Too many competing “investment themes” (i.e., different altcoins and niches) exist simultaneously, with new tokens launching daily, fighting for attention and capital. Excessive choice makes it hard to quickly identify truly promising projects—and increases the risk of backing losers. In such a fast-moving environment, success demands exceptional insight, acute market awareness, and adaptive agility.

Still, some remain confident that an alt season will come—and I sincerely hope their predictions prove true.

That’s all for today.

Have a great weekend, see you next week!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News