Monad Ecosystem Guide: Native Wallets and Launch Platforms

TechFlow Selected TechFlow Selected

Monad Ecosystem Guide: Native Wallets and Launch Platforms

This article will focus on three Monad-native projects: Mozi Wallet, Haha Wallet, and Nad.fun.

Author: Harvey C

Introduction

As the @Monad_xyz ecosystem continues to grow, a variety of projects are leveraging its high throughput, low gas fees, and parallel execution capabilities. Among them, wallets and launchpads stand out as particularly significant, often serving as key entry points for users entering the ecosystem and effectively driving community expansion. This article focuses on three native Monad projects—Mozi Wallet, Haha Wallet, and Nad.fun—all aiming to bridge the gap between DeFi and broader user bases. By examining their core features and testnet activation strategies, we can better understand how they utilize Monad's technical foundation to deliver novel user experiences.

These projects employ various innovative approaches in practice, from lowering initial barriers via Telegram integration to introducing gamification elements into token launches. Whether they will sustainably attract and retain users over time remains to be seen. However, one thing is certain: these initiatives bring fresh vitality to the Monad ecosystem and open up new possibilities for future development.

Mozi Wallet

@mozifinance is a native wallet built on the Monad ecosystem, designed as an easy-to-use, yield-focused solution that aims to establish a more direct connection between DeFi and everyday use cases.

Core Features

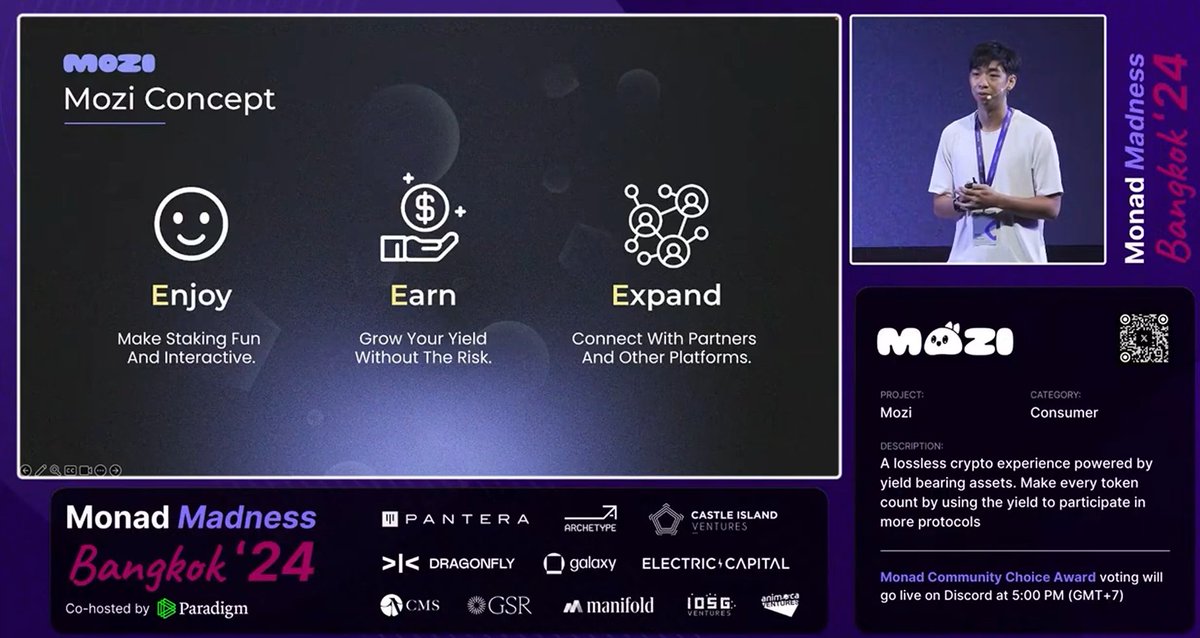

Gang demonstrating Mozi Wallet at the Monad Madness Bangkok event

1. Mozi Wallet (Telegram MiniApp)

One of Mozi’s standout features is its Telegram-based wallet functionality, which eliminates the need to install browser extensions like MetaMask. Users can perform transaction signing directly within Telegram:

Lower Entry Barrier: For new users accustomed to chat applications, the operating environment feels more familiar and intuitive.

Integrated Staking Management: Users can directly manage liquid staking tokens (LSTs) from multiple platforms such as Apriori, MagmaDAO, and Kintsu—all within the wallet interface.

In-Chat Notifications and Actions: Without leaving Telegram, users can monitor yields in real time, manage stakes, and participate in games or DeFi applications.

2. Staking and Yield Conversion

Mozi enables users to stake tokens directly on Monad (and potentially cross-chain environments), automatically converting earned yields into usable assets. In theory, this brings about:

Instantly Usable Yields: Rewards can be used immediately for subscriptions, in-game purchases, or other DeFi products.

Reduced Operational Complexity: No manual unstaking or cross-chain bridging steps are required.

3. Mozi Debit Card (Future Plan)

Mozi has also proposed launching a debit card, allowing users to spend staking-generated rewards just like with a regular payment card. This aligns with the project’s vision of integrating Web3 rewards with real-world economic spending.

4. Gamified Finance (PvPfi) and LST Integration

Mozi positions itself as a "PvPfi" platform, combining gaming mechanics with liquid staking tokens. Its Vault system differentiates between principal and earnings, offering the following functionalities:

Security: Official vaults will undergo regular audits; however, Yield Leverage Mechanism: Users may temporarily utilize their earnings (or even part of their principal) to boost in-game power or earn higher returns.

Risk Management: While earnings are used for gameplay, Mozi claims to implement “strict risk controls” to safeguard users’ main principal as much as possible.

How Monad Empowers Mozi’s Vision

Mozi won the Community Award at the Madness Bangkok event

1. High Performance for Real-World Use Cases

Thanks to Monad’s high throughput and strong scalability, Mozi can efficiently process frequent, small-value transactions. With reduced network latency and transaction costs, Monad supports Mozi in enabling high-frequency yield conversion and micropayments.

Low Gas Fees: Lower the cost barrier for Web2 and Web3 integration, making microtransactions viable.

Fast Execution: Ensures smoother gameplay and yield management experiences—critical for Mozi’s focus on “gamified DeFi.”

2. Security and Stability

As an emerging Layer 1 blockchain, Monad provides a secure foundation for Mozi’s staking and yield management operations. Mozi’s vaults will undergo subsequent audits, further boosting user confidence and complementing the increasingly robust security framework of the Monad ecosystem.

Mozi’s Testnet Activation Strategy

To attract user participation during the Monad public testnet launch, Mozi plans the following measures:

1. Seamless Onboarding via Telegram

Offering a smooth experience within a familiar app environment. For example: publishing tutorials on managing wallets and staking within the Telegram MiniApp.

Hosting AMAs (Ask Me Anything sessions) in Telegram groups to allow users to ask questions and receive immediate responses.

2. Enhancing Gamification Elements

Organizing competitions during the testnet phase to highlight the PvPfi mechanism and leverage yield features, allowing players early access to Mozi’s unique gameplay.

3. Collaboration with LST Providers

Partnering with LST platforms such as Apriori, MagmaDAO, and Kintsu to demonstrate the composability of Mozi’s vaults and launch joint campaigns to encourage users to explore diverse yield strategies.

4. Community Challenges and Incentives

Rewarding early adopters who test the product, provide feedback, and help identify issues—not only gathering valuable insights during testing but also solidifying a core user base.

Overall, supported by Monad, Mozi seeks to redefine how the crypto industry perceives and uses yield. It aims to make staking rewards easier to convert into daily usable value while enhancing engagement through gamified design. Mozi’s long-term success will depend not only on its testnet operational strategy but also on its continued innovation in integrating DeFi with real-world consumption scenarios.

Haha Wallet

@haha_app Wallet is another Monad-based wallet solution designed for deep integration with the Monad network, providing users with a more interactive, efficient, and secure DeFi experience. Below are its key features and synergies with Monad’s technology.

Core Features

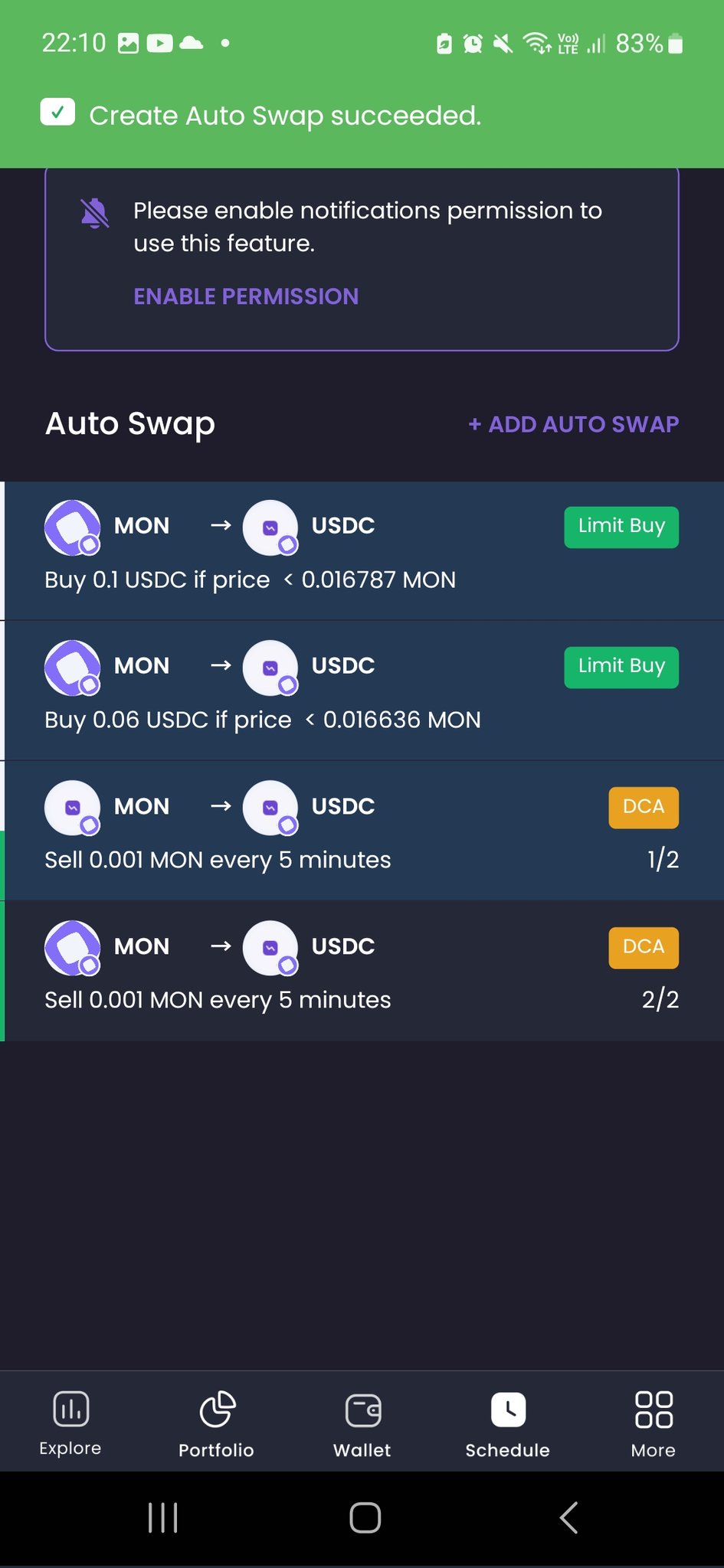

Haha Wallet user interface

1. Smart Wallet Capabilities

Haha Wallet offers several tools aimed at simplifying operations: Scheduled Transactions and Automation Strategies: Users can pre-schedule trades or set automated logic, potentially increasing flexibility and efficiency in asset management.

Multi-Signature Security: Supports multi-party signatures, enhancing transaction security by requiring consensus among multiple parties before execution.

2. Integration with DeFi Services

Through collaboration with Kintsu, Haha Wallet will offer liquid staking, allowing users to earn staking rewards while maintaining asset liquidity.

3. Community Interaction and Incentives

To attract and retain users, Haha Wallet has designed a series of incentive mechanisms: Quest Campaigns: Encourage users to deeply explore the Monad ecosystem and reward participation accordingly.

Karma Leaderboard: Tracks user activities on the platform, allowing them to redeem “Karma” points for various privileges or benefits.

Haha’s Testnet Activation Strategy

1. Quest Campaigns

Haha Wallet will roll out a series of quests involving both in-app actions and interactions on social platforms like Twitter and Discord. Users completing specific objectives will receive corresponding rewards.

2. Community Engagement Initiatives

To strengthen community cohesion, Haha Wallet plans to deploy the following measures: Karma Leaderboard: Continuously track user activity within the platform to accumulate Karma points, which can be redeemed for practical functions across the ecosystem.

Referral Rewards: Allow users to invite friends to join the Haha community via Discord, with both parties receiving Karma bonuses.

Time-Limited Flash Quests: Daily short-duration tasks offering instant rewards upon completion, aimed at boosting engagement and retention.

Leveraging Monad’s technological advantages, Haha Wallet aims to provide users with secure and convenient asset management tools, while fostering deeper interaction with DeFi through various community activities. Its goal is to build an efficient and inclusive ecosystem that fully capitalizes on the opportunities presented by Monad, both in performance and user experience.

Nad.fun

@naddotfun is another project built on Monad, branding itself as a “gamified launchpad” that combines token creation tools, gamification features, and community incentives to deliver a more diversified token issuance and trading experience.

Nad.fun's Unique Aspects

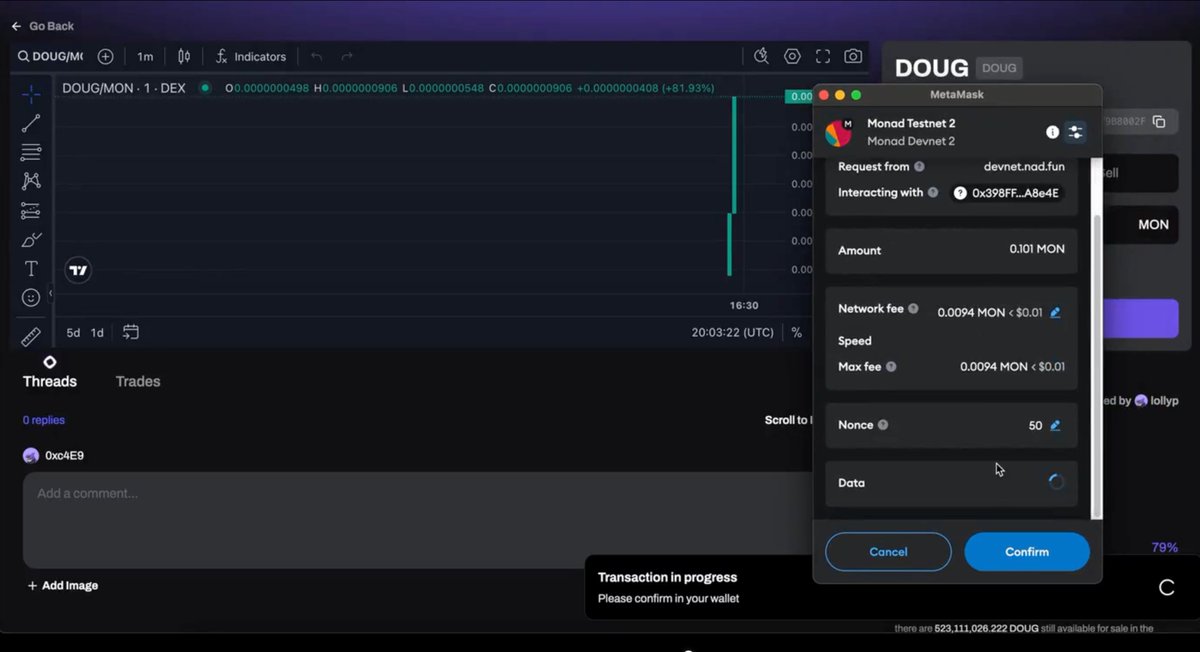

Nad.Fun has launched on DevNet

1. Integrated Issuance and Trading Model

Nad.fun strives to simplify the token issuance and trading process:

Bonding Curve Pricing: Uses bonding curves during initial issuance to balance supply and demand.

DEX Integration: Once the bonding curve reaches an 80% liquidity threshold, tokens can be listed on external decentralized exchanges to enhance liquidity.

Fee Structure: Charges a 1% fee on token trades, with proceeds directed into the platform treasury.

2. Mint Party: Collaborative Token Launch Inspired by the “party system” in RPG games, Nad.fun's Mint Party encourages collaboration among developers, influencers, and ordinary users:

Role Division: Developers handle technical aspects, while influencers and active community members lead promotion efforts, jointly completing token launches.

Shared Returns: After a token goes live, all participants benefit from the project’s growth on the platform.

3. Quest Pool Incentive Mechanism

When project teams want to incentivize user participation, they can choose to:

Task-Based Rewards: Developers allocate tokens to the Quest Pool; users earn additional rewards from the pool by staking or otherwise engaging with the token.

Optimized Tokenomics: Rewarding active community members helps extend the lifecycle of a token.

4. Gamified Dividend (Rake-Back) Structure

Nad.fun introduces gamification into its dividend model:

Voting-Based Reward Distribution: Users gain voting power based on trading volume and can predict trending categories (e.g., “Dog,” “Trump”)—earning extra rewards if predictions are correct.

Community Engagement: This feature makes revenue distribution more entertaining, allowing users to earn more by identifying market trends.

5. Expansion Toward Social-Fi

Nad.fun integrates social elements to enhance engagement during trading:

Achievement System: Awards badges for key actions such as creating tokens, holding small-cap assets, or completing profitable trades, helping users build reputation and trust within the community.

Trending and Follow Features: Users can follow specific wallets to track trading behavior or view which tokens are gaining popularity, aiding in filtering valuable opportunities amid information overload.

Nad.fun emphasizes combining token launches with gamified and socialized trading elements, aiming to deliver a smoother and more enjoyable experience for developers and users alike under Monad’s high scalability and low-cost advantages. Whether it can successfully integrate community dynamics with reward mechanisms remains to be tested, but it certainly presents a novel approach to token issuance and trading.

Conclusion

Projects like Mozi Wallet, Haha Wallet, and Nad.fun vividly demonstrate the efforts of the @monad_eco ecosystem in merging user-friendly interfaces with gamification. Mozi leverages Telegram-integrated wallets and yield mechanisms to make DeFi more accessible to mainstream users; Haha encourages deeper community involvement through quest campaigns and a Karma points system; while Nad.fun redefines traditional launchpad models by integrating token creation with gamified, interactive mechanics to attract broader participation.

These native projects showcase how Monad’s strengths in high performance and scalability support diverse innovative solutions, appealing not only to seasoned crypto enthusiasts but also helping newcomers better integrate into the Monad ecosystem. As each project refines itself through continuous testing and iteration, active community engagement and transparent development processes will be crucial in validating these concepts. Meanwhile, the growing diversity of projects within the Monad ecosystem creates favorable opportunities for more developers. Whether aiming to break new ground in wallet experiences, explore gamified DeFi, or innovate creative launchpad models, Monad offers a broad stage for experimentation, collaboration, and shared progress toward a thriving ecosystem.

Note: This long-form series aims to introduce native projects within the Monad ecosystem. Interested readers can explore different sections using the links below:

Monad Ecosystem Guide: Native DEX/Perp Preview

Monad Ecosystem Guide: Native Liquid Staking / Native DEX Part II

Monad Ecosystem Guide: Consumer dApp (Native Prediction Markets)

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News