Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

TechFlow Selected TechFlow Selected

Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch

Enter the Monad Arena

Author: Noveleader, Francesco

Translation: LlamaC

After a long wait, Monad has finally arrived, with the mainnet launching on November 24.

The promise of a high-performance L1 is now being fulfilled with the MON TGE and the upcoming mainnet launch.

To welcome users receiving MON tokens, a well-developed ecosystem is already available, offering a wide range of activities to keep them engaged.

We make your life easier by covering the projects in the Monad ecosystem you're most interested in, so anyone can understand how to utilize their airdrop across the entire ecosystem. Since the broader crypto community is eligible for token airdrops, many users will be looking for available opportunities.

Even if you missed the airdrop (which isn't much of a loss for you), this can serve as a guide to understanding native protocols.

We've made this report quite practical: the first part briefly introduces Monad, then we focus on several projects, concluding with summary thoughts on the mainnet launch.

Ladies and gentlemen, enjoy the journey.

Introduction to Monad

To achieve its vision of building a high-performance blockchain, Monad decided to develop its tech stack from scratch. No matter how performant a blockchain is, relying on existing infrastructure inevitably leads to bottlenecks.

Without diving into details, Monad's tech stack stands out due to the inclusion of the following components:

-

MonadBFT: Monad created an optimized version of the BFT consensus model that helps the network achieve 10k TPS and sub-second finality, even with a large number of consensus nodes. Through this consensus model, Monad achieves speculative finality within one round and full finality within two rounds, with tail fork resistance. This means the leader of a new block cannot fork off its previous block, preventing potential malicious behavior.

-

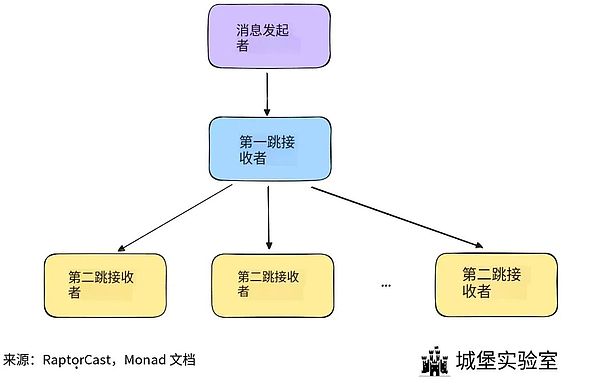

RaptorCast: Efficiently broadcasting block proposals to all validators in the network is crucial for a high-bandwidth network like Monad. RaptorCast, designed specifically for MonadBFT, solves this problem. It's a specialized messaging protocol that converts block proposals into erasure-coded chunks, a process executed by the leader. Each of these chunks is sent to all validators via a two-tier broadcast tree, where the first tier consists of a single non-leader node per group of chunks, proportionate to the validator’s stake weight. These first-tier nodes propagate the chunks to second-tier recipients (second hop). This method effectively reduces the latency for validators to receive block proposals and reach consensus on transaction ordering.

-

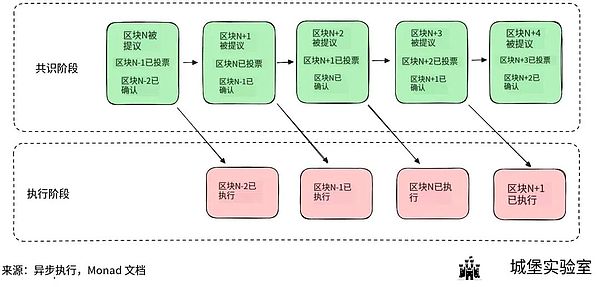

Asynchronous Execution: Monad decouples consensus from execution. Monad first reaches consensus on block ordering without executing transactions. Once a block is finalized, every node in the network can execute the transactions in that block to produce the latest state. This approach is better than the interleaved execution method of executing first and then reaching consensus.

-

Monad DB: It is a custom key-value database based on the Patricia Trie data structure, simplifying synchronization between readers (RPC requests) and writers (execution). It's important to understand that while writers update the database, many readers may need simultaneous access. MonadDB ensures this by adhering to an immutable Patricia Trie design: whenever data is updated, new versions of nodes on the branch are created, while the previous state remains persistent and accessible for reading.

-

Transaction Parallelization: Most blockchains adopt sequential transaction execution, which guarantees correctness but is slow in practice. To solve this, Monad employs an optimistic execution approach, where all transactions, whether conflicting or not, are executed in parallel. In cases of conflicting transactions—such as two transactions modifying the same account balance and potentially executing in conflicting orders—Monad re-executes these transactions by tracking the state changes during their initial execution, thereby resolving conflicts.

Besides being one of the pioneers of high-performance L1s, Monad is also among the earliest networks to emphasize community engagement.

Monad created Kaito, a Discord version for its community. Many have diligently contributed as part of this community for years, doing whatever they could, and in some cases even becoming team members. While many criticize this level of involvement, there's no doubt this focus helped build a highly loyal community.

Many networks face a similar issue at launch: not enough applications go live, or not enough unique applications exist for users to truly decide to stay after mainnet or token generation event (TGE) launches. To avoid this, different approaches exist on how to handle it. Some prefer curating and incubating projects within their own ecosystem, while others prefer to remain completely neutral.

Monad occupies a middle ground—allowing things to evolve naturally while also providing extensive support to ecosystem projects to help them succeed. However, its involvement is always limited to ecosystem coordination, not venture capital or incubation.

Monad has had ample time to launch with a vibrant ecosystem that has also undergone natural selection over time.

For anyone wondering what to do with their MON airdrop, here’s the answer.

Monad Ecosystem

As of now, there are over 300 projects in the ecosystem, with 78 being exclusive to Monad.

Due to time constraints, we'll only analyze a small fraction of these, categorized into several verticals:

-

DeFi

-

Gaming

-

Consumer Apps

-

AI

-

NFTs

DeFi

Perpl

(https://x.com/perpltrade)

Perpl is a CLOB-based perpetual contract exchange. Perpl aims to provide deep liquidity and efficient markets for seamless trading execution, with a strong focus on excellent user experience.

Perpl recently launched on testnet:

They follow the slogan "Trade Perps on Perpl" and plan to deploy multiple markets for trading on day one of mainnet launch. Additionally, they raised $9.25 million from DragonFly and Ergonia Trading.

Drake

(https://x.com/DrakeExchange)

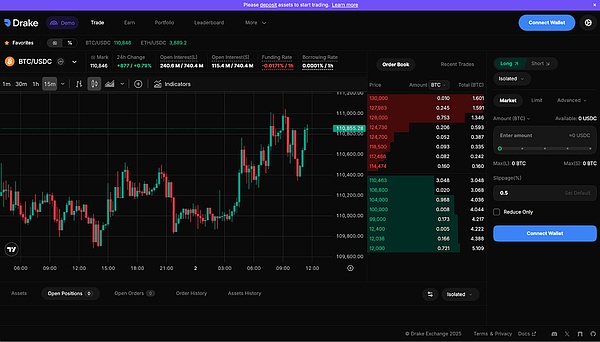

Drake is a hybrid perpetual decentralized exchange (DEX) that leverages both centralized limit order book (CLOB) and standard automated market maker (AMM) models to provide liquidity in specific markets.

Drake positions itself as “bringing CEX into Perp DEX,” a fair description considering its prioritization of optimal order execution through its hybrid model. In this model, CLOB liquidity is prioritized, with AMM liquidity serving as backup to complete orders. In some cases, the model splits orders to leverage both CLOB and AMM liquidity, securing the best possible price.

Another notable feature of Drake is its advanced margin system, supporting both cross-margin and isolated margin positions, equipped with a universal asset margin engine. This allows different types of collateral to be used across various positions, giving users greater flexibility in managing assets used as margin.

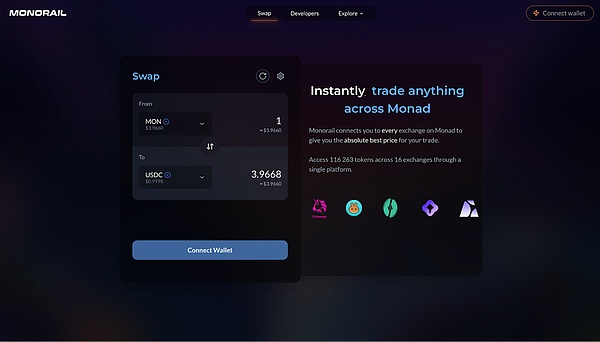

Monorail

(https://x.com/monorail_xyz)

Monorail is a spot aggregator on Monad that routes orders on-chain to secure the best possible prices for users. They currently connect 16 exchanges in their routing.

Monorail aims to unify AMMs and order books into a single liquidity framework called the synthetic order book. This liquidity aggregation framework optimally routes orders with lower gas costs, achieving minimal slippage and efficient execution.

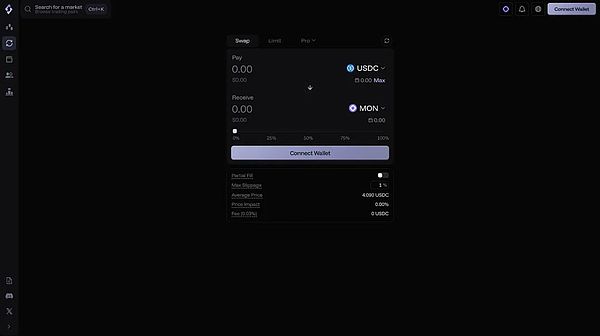

A quick look at their UI:

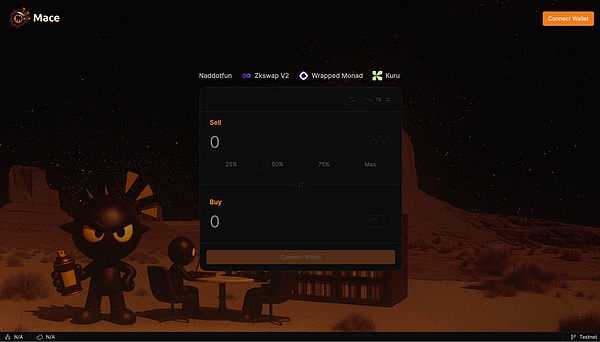

Mace

(https://x.com/mace_ag)

Mace is another DEX aggregator on Monad, aiming to connect liquidity across AMMs, order books, and CEX market makers via a request-for-quote (RFQ) system.

By routing liquidity through multiple paths, Mace aims to ensure optimal trade execution while reducing gas fees and accessing deeper liquidity.

Here’s their UI interface:

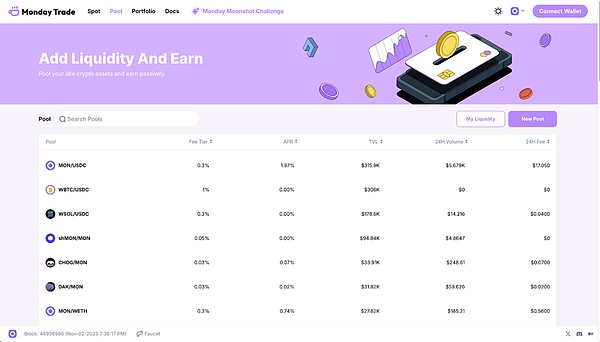

Monday Trade

(https://x.com/MondayTrade_)

Remember SynFutures, the perpetual DEX built on Base and Blast? Monday Trade is built on top of its tech stack.

Monday Trade is a hybrid spot DEX on Monad that combines AMM liquidity and on-chain order books on a single platform. This hybrid model, combined with high gas efficiency, makes Monday an ideal platform for smooth trading execution without high slippage.

Examples of pools available on Monday:

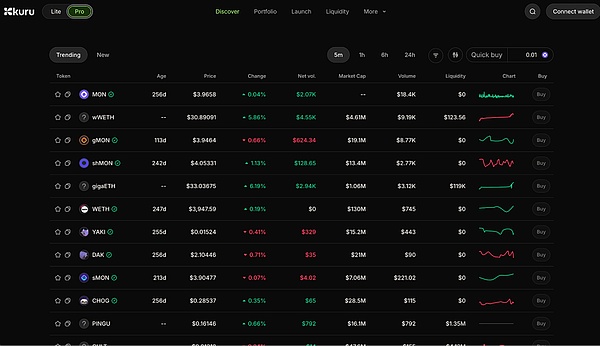

Kuru

(https://x.com/KuruExchange)

Kuru is a CLOB-based exchange enabling fast buying and selling of tokens. It also allows users to issue their own tokens, making it suitable for the “launchpad” category.

Users can also provide liquidity for various tokens on the trading platform across different fee tiers, similar to traditional AMMs. This is particularly important for new markets or tokens that initially lack market maker participation.

Kuru is well-funded, raising $11.6 million in a round led by Paradigm.

Capricorn

(https://x.com/CapricornDEX)

Capricorn is a market-maker AMM featuring high-frequency trading-level swap execution on Monad.

It offers CEX-level liquidity, minimized impermanent loss, toxic flow protection for LPs, tighter spreads, and guaranteed composability with the rest of the Monad DeFi ecosystem.

Crystal

(https://x.com/CrystalExch)

Crystal is a spot exchange based on an on-chain central limit order book (CLOB), delivering CEX-like performance on Monad. A key differentiator is Crystal’s use of the CLOB model to provide spot liquidity.

Here’s a quick preview of their interface:

Fastlane

(https://x.com/0xFastLane)

Fastlane is building Monad’s liquid staking token (LST)—“shMON”.

It aims to offer users the best staking rewards on Monad and higher yields for their Monad tokens. Fastlane will be the place to earn additional yield beyond staking, while also protecting the ecosystem.

They’ve also launched shMonad RPC, an RPC infrastructure service introducing a stake-weighted bandwidth allocation system powered by shMonad.

Townsquare

(https://x.com/TownSquarexyz)

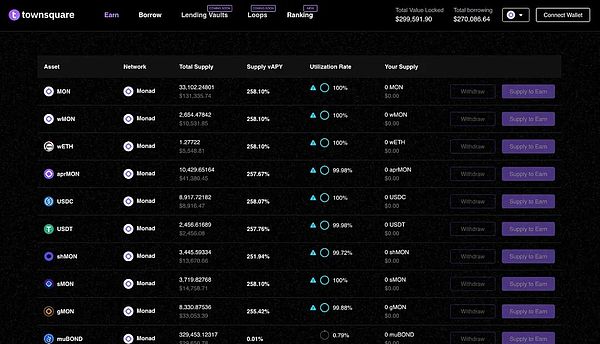

Townsquare is building a modular money market on Monad, aiming to enable cross-chain lending and borrowing, access to cross-chain yield markets, and create a complete lending and yield stack—all on one platform.

Here’s what the platform looks like, including simulated examples of supported assets:

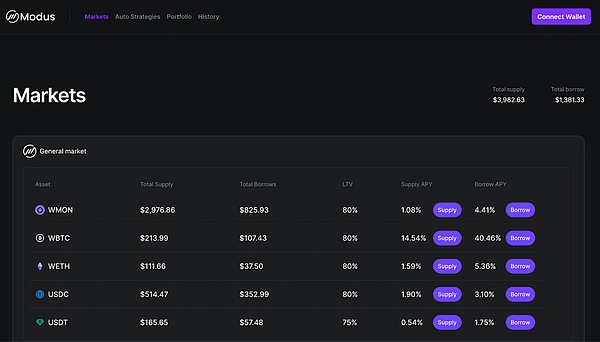

Modus

(https://x.com/modus_finance)

Modus is the native lending protocol on Monad. It features standard markets like any other lending protocol and offers auto-compounding strategies for LSTs to maximize yield. It also introduces a sealed-bid liquidation mechanism that keeps captured value within the protocol, preventing leakage to MEV bots.

New features on the platform include:

-

Arbiter: Executes liquidations via sealed-bid auctions within the platform and triggers vault strategies such as hedging, e.g., on perpetual exchanges.

-

Sigma Vault: A vault that hedges perpetual positions using Arbiter, capturing funding rates, lending rate spreads, and liquidation rebates. The counterparty to this hedged position consists of users’ idle deposits, such as ETH and BTC.

-

Dynamic Yield Allocator (DYA): If there are idle assets in the market, it redirects them to the highest-yielding source available in the Modus ecosystem—Sigma Vault.

-

Tokenised Stock Lending Infrastructure: Modus will support collateralizing on-chain counterparts of stocks to borrow assets against them.

A quick look at the platform interface:

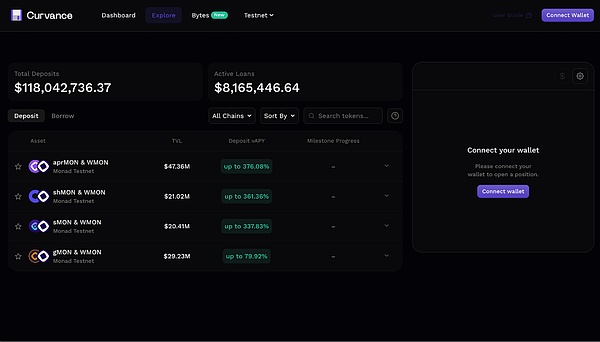

Curvance

(https://x.com/Curvance)

Curvance is a money market on Monad where users can lend, deposit into auto-compounding vaults and optimized DeFi strategies, gaining broader DeFi exposure all in one place.

The platform also provides individually tailored positions for each asset to enable portfolio investment under risk management. Additionally, each market on Curvance uses two oracles, eliminating single points of failure and protecting users when one oracle fails.

Another notable feature is its auction-based liquidation mechanism, allowing liquidators to bid on repaying debt, minimizing value loss from MEV. This also enables up to 97% LTV (loan-to-value ratio) on certain markets.

A quick look at the user interface:

Zona

(https://x.com/zona_io)

Zona is working to solve the composability problem of real-world assets (RWA) in DeFi. The platform aims to allow users to borrow stablecoins using their RWA assets as collateral.

Beyond that, Zona targets the $300 trillion real estate market. As part of its future vision, users will be able to use property as collateral for loans. They aim to achieve this through their proprietary real estate oracle that frequently prices properties.

As part of this vision, they’ve already partnered with Agora to bring AUSD to Monad.

Mu Digital

(https://x.com/MuDigitalHQ)

Mu Digital is an RWA protocol aiming to bring Asia’s best yields on-chain—yields currently restricted by national borders and high-net-worth individuals (HNWIs).

Asia offers an ideal yield environment, accompanied by high growth, high returns, good liquidity, security, and diversification. Mu Digital aims to capture yields from deals returning 8–20%. These yields will be sourced from Asian debt markets via large, reputable corporate borrowers, bringing previously inaccessible APAC market exposure on-chain.

Ammplify

(https://x.com/ammplify_xyz)

Ammplify focuses on capital efficiency, building a liquidity provider (LP) amplifier to double LP yields. In a standard Uni V3 pool, liquidity outside the price range simply sits idle, generating no returns.

Ammplify directs that idle liquidity to other yield-generating channels, improving capital efficiency and creating more earning opportunities for end users.

Their goal is to compete with private asset managers and curators while reducing risk and maintaining self-custody and transparency.

SEER

(https://x.com/seertrade)

Enhance your on-chain trading research with SEER. SEER Beta is now live, offering exclusive access to SEER Founder Pass holders.

At its core, SEER is a platform combining social interaction and on-chain intelligence to deliver the most informed trading experience.

Users can view curated feeds, chat, make voice calls, check on-chain metrics, and track trending topics—all in one place. It also allows users to create unlimited wallets and route private capital. Additionally, SEER recently raised $300,000 in a round of echo financing.

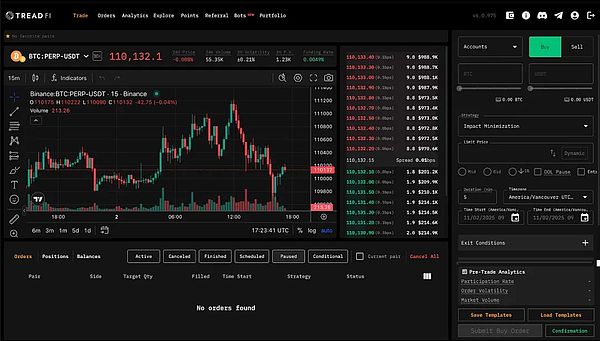

Tread Fi

(https://x.com/tread_fi)

Tread Fi is a trading terminal that executes or routes perpetual and spot trades across multiple decentralized exchanges (DEXs) and centralized exchanges (CEXs).

It enables users to conduct algorithmic trading using various algorithms and manage positions across multiple exchanges, including Binance, Bitget, Hyperliquid, and others.

While Tread Fi operates on multiple exchange platforms, it uses Monad to publish trading data on-chain to verify that trades actually occurred. This was initially a convenient feature for traders to prove profitability, with potential to evolve into more sophisticated products (e.g., lending, dark pools).

Accountable

(https://x.com/AccountableData)

Accountable aims to transform the way asset verification is done.

It leverages a Data Verification Network (DVN) to validate data “directly from the source” while preserving privacy.

Unlike static proof-of-reserves that typically lack complete information about “liabilities or real-time solvency,” Accountable provides a continuous, real-time way to verify assets.

Initially, the team plans to focus on stablecoins, on-chain treasuries, and institutional treasuries, with a long-term goal of creating a standard layer for verifying all assets, whether on-chain or off-chain.

Gaming

Lumiterra

(https://x.com/LumiterraGame)

Lumiterra is a multiplayer survival game set in an open world.

This game is particularly notable because the team envisions an AI-driven open world that evolves based on player choices. Through the game, users will be able to own AI agents that “develop alongside their playstyle and convert mastered skills into on-chain assets.”

From skills to agents to assets.

The game will be designed with its own economy, allowing anyone to trade these assets across markets.

Here’s a screenshot from their gameplay video:

LootGO

(https://x.com/lootgo_official)

While other games are still in beta or haven’t launched yet, you can already play LootGO on iOS and Android!

Similar to its famous “older brother” STEPN, LootGO lets you earn money just by walking:

Omnia

(https://x.com/ExploreOmnia)

Omnia is a game developed by the Sappy Seals NFT community.

The game focuses on adventure and pet battles.

The team conducted a trial run for the community a month ago. Those interested in learning more can find additional information here.

Breath of Estova

(https://x.com/BreathOfEstova)

Breath of Estova is a play-to-earn 2D MMORPG game on Monad. Here’s a screenshot of their gameplay:

To address the token dilution issues faced by earlier “play-to-earn” games, in-game $ESTOVA earnings are dynamically adjusted and “tied to progression and asset ownership, limiting massive token output and rewarding loyal players.” Additionally, they have a burn mechanism.

The game also includes a series of NFTs and gives token holders the ability to directly influence the game’s future development through governance.

NFT

Purple friends

(https://x.com/Purple_Frens)

Purple Friends is one of the most iconic NFT collections on Monad, well, because they’re purple.

The collection contains 1,111 unique NFTs, with a few rare 1/1 pieces.

Beyond deep community focus, they’re also building an internet capital market launchpad that will benefit NFT holders through staking rewards and 20% of generated revenue.

Chog

https://x.com/ChogNFT

Chog is one of the earliest meme/NFT projects in Monad.

The founder of Chog is also one of the largest recipients of the Monad airdrop. This might fuel speculation around the collection.

In particular, they recently announced the CHOG token, which will launch shortly after mainnet goes live.

Skrumpeys

(https://x.com/skrumpeys)

Skrumpeys is another OG NFT series on Monad, based on pixel art and minted on the first day of the Monad mainnet launch.

Their Discord is very active—a great place to get started.

Consumer Apps

LEVR

(https://x.com/levr_bet)

Levr is a leveraged sports betting app currently in testing. Inspired by perpetual contract trading, it allows users to bet on various sports events such as NBA, NFL, NCAAB, and MLB, while establishing leveraged positions on their bets.

The leveraged trading setup is where Levr stands out, as most prediction markets don’t offer this due to liquidity and risk management challenges. Levr uses an aggregated liquidity vault to support these markets. This vault supports multiple markets within the app, manages risk, and distributes rewards.

RareBetSports

(https://x.com/RareBetSports)

RareBetSports is another consumer-facing sports betting app on Monad.

With this app, users can bet on player performances in basketball and baseball games, either individually or in parlays.

Here’s a quick screenshot of their user interface:

Kizzy

(https://x.com/kizzymobile)

Kizzy is a social media betting app where users can bet on their favorite influencers and celebrities' performances across social media platforms. Users can bet on influencer performance across categories like culture, politics, sports, and more.

Kizzy combines prediction markets and sports betting, building a platform at their intersection where users can predict the performance of influencer content they consume daily.

Fluffle

(https://x.com/fluffleworld)

Even Monad has its own Fluffle—a gamified productivity platform that helps turn productivity into rewards.

Every focused session on the app contributes to earning rewards. By doing things like staying away from your phone, users can earn coins, hatch dragons, grow their island, and unlock rewards based on their behavior.

On Fluffle, effort turns into habits, and users get rewarded for it.

Rumi

(https://x.com/RumiLabs_io)

Rumi rewards users for watching content. It’s more of a “watch-to-earn” model. Rumi is a Chrome extension that rewards users simply by playing content.

Behind the scenes, Rumi is building an AI-driven media and advertising company. You can share data with Rumi in three modes:

-

Data Mode: Simply share what you’re watching to help them rank content.

-

Audio Mode: Allows Rumi to access the audio of your streamed content, enabling it to map moments to corresponding emotions.

-

Visual Mode: Also allows Rumi to watch content, identifying characters and moments in each clip.

As you might have guessed, among the three given modes, visual mode earns the highest rewards, followed by the others.

Kinetk

(https://x.com/KINETK_AI)

Kinetk brings AI-powered content protection for creators. The platform tracks IP across X, TikTok, and other social media platforms, alerting creators whenever their content appears on unofficial sources.

Fans3 AI

(https://x.com/Fans3_AI)

Fans3 is creating emotionally intelligent AI characters that can interact with fans anytime and generate income for themselves.

On the platform, users can subscribe to earn points, granting access to exclusive content from their chosen creators. This subscription also enables unlimited chatting with these AI characters, even voice chats.

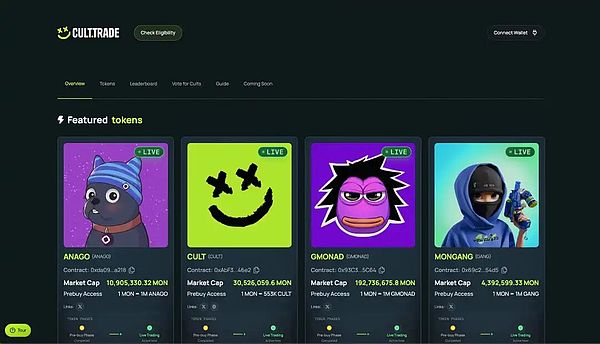

Cult

(https://x.com/cultdottrade)

Cult is building a launchpad where users participate and build reputation to earn rewards such as early access to future token airdrops.

This reputation can be built by frequently trading cult coins and holding them long-term. After establishing good on-chain activity reputation, Cult grants users “Diamond Hand Status,” giving them exclusive privileges as mentioned above.

Platform interface overview:

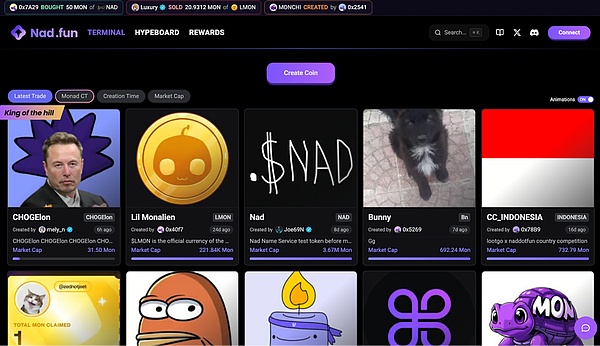

Nad.fun

(https://x.com/naddotfun)

Nad.fun is the pump.fun of Monad, where users can seamlessly launch meme coins based on current trending topics. It works similarly to pump platforms but places strong emphasis on revenue distribution among holders.

Just as Pump uses Meteora to deploy liquidity, Nad uses Uniswap V3 to migrate once the token market cap reaches 432 MON.

Here’s a preview of their UI:

AI

FortyTwo

(https://x.com/fortytwo)

FortyTwo is an AI development lab with over a decade of experience in AI research and development. Their vision is that collective intelligence can only truly be called collective when it emerges from many interconnected models rather than one massive centralized model.

As they mention in their paper, “centralized intelligence has produced specialized tools and ambitious ‘God models,’ each excelling in their domain. Yet, decentralized intelligence is opening new frontiers, most notably swarm-based systems that scale not by making individual models larger, but by enabling multiple models to work cohesively as a whole.”

The protocol can use swarm intelligence to generate datasets and has just released benchmarks showing its models are competitive compared to centralized ones.

Today, it has over 500 node operators, a GUI application, and a functioning web browser.

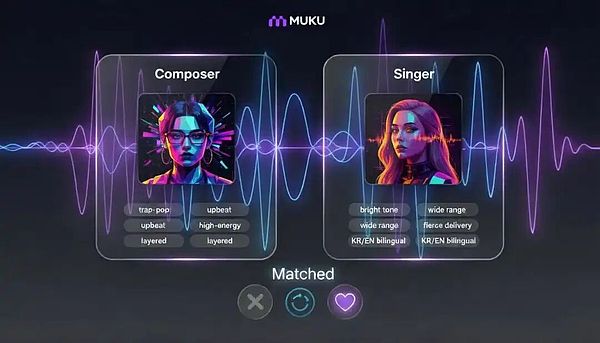

Muku AI

(https://x.com/Mukusongs)

Muku AI is an AI company focused on the audio domain. It provides a way for composers and singers to receive AI support.

Imagine competing with other users to become the official singer of a song created by AI (or other users). The image below shows their “song matching engine” user experience model.

We’ve seen several experiments in AI music, and although this niche hasn’t gained mainstream attention yet, it’s very interesting in terms of its distribution potential.

Kodeus AI

(https://x.com/TheKodeusLabs)

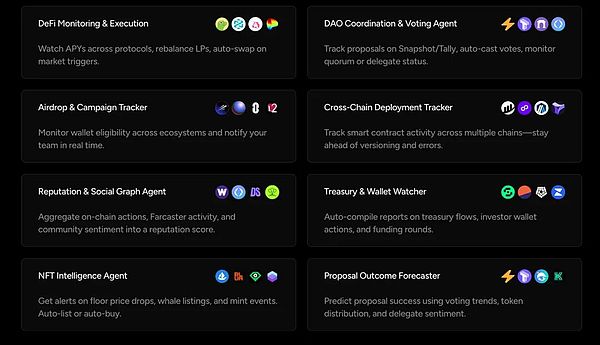

Kodeus provides a framework for creating AI agents across multiple use cases:

Agents can be developed through simple, natural language inputs and equipped with tools via MCP.

Notably, Kodeus agents can be embedded into third-party apps via Widget and Deep Link deployment.

Rayvo

(https://x.com/rayvo_xyz)

Rayvo is an AI protocol focused on POV data, helping robots understand and navigate the real world. This type of data is extremely difficult to obtain and provides valuable insights into what it means “to be human” for robotics and AI systems.

As part of this, Rayvo expects to release the first Web3 smart glasses, enabling you to power AI agents with your POV data and directly deploy a voice-first agent into the glasses.

Dfusion

(https://x.com/dFusionAI)

At the core of Dfusion is the “dFusion AI Social Truth Data Liquidity Pool (DLP),” a decentralized layer of human-generated social data.

Users can opt-in to authorize access to their Telegram chat history in exchange for incentives, generating authentic human conversations for training AI models and tools.

Data is loaded into your browser, encrypted, and pinned to IPFS; the encryption key is encrypted using DLP’s public key, allowing DLP to access it. The data is then analyzed and scored within a Trusted Execution Environment (TEE).

Beyond that, users can create their own subnets, set their own incentives, and attract specific types of data they’re interested in. This enables the creation of specialized models in very niche domains.

Conclusion

We hope this report gives you an overview of projects you can explore and enjoy! Monad will launch with a fairly mature ecosystem containing many native protocols.

We noticed many interesting DeFi and consumer applications.

Prediction markets are opening doors for consumer apps to go mainstream.

What else can we expect from Monad?

The gaming space too: strong community elements and gamification, combined with a performance-focused tech stack, make Monad fertile ground for testing new gaming applications.

After reading this report, you should be overwhelmed.

Another thing we’d like to highlight is the applications from the Monad Momentum program. These apps have confirmed rewards upon mainnet launch.

https://x.com/monad/status/1986795825066901633

Considering the MON supply reserved for ecosystem incentives, this might be something worth remembering (you know what we mean).

Clearly, due to time constraints, we may have missed some equally important and interesting projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News