Monad launches on mainnet tonight, here's what you need to know

TechFlow Selected TechFlow Selected

Monad launches on mainnet tonight, here's what you need to know

Based on the pre-market price of approximately $0.032–0.034 at the time of publication, the paper gains for public sale participants range between 28% and 36%.

Author: TechFlow

The crypto market, after last week's sharp decline, is gradually showing signs of recovery and adjustment.

As we enter a new week, all eyes are on Monad, which is set to launch its mainnet tonight at 10 PM.

As a star project that has raised over $430 million, Monad not only broke fundraising records in the L1 sector but also became the first public sale project on Coinbase’s Token Sales platform.

At a time when the market generally lacks new narratives and existing projects are struggling with momentum, how $MON will perform post-mainnet launch and which ecosystem projects can be accessed immediately bring fresh energy into an otherwise stagnant market.

Whether participating in early ecosystem development or observing the price discovery process of the MON token, these could both represent notable trading opportunities in the near term.

We’ve compiled information from across the current market—including funding background, token distribution, and ecosystem projects—to help you quickly understand Monad’s latest status.

Funding Recap: The VC Era’s Imprint

From May 2022 to November 2025, Monad’s fundraising journey spanned exactly three and a half years—coinciding perfectly with the full market cycle from bear market bottom to bull market peak and subsequent downturn.

This timeframe itself is quite telling.

The Pre-Seed round in May 2022 occurred during market turmoil triggered by the Luna collapse; in April 2024, Paradigm led a $225 million Series A—the largest crypto raise that year.

Data source: RootData + Surf.AI. Total fundraising: $431.5 million.

Private raises: ~$244 million; Public sale: $187.5 million (actual raised: $269 million)

During this period, skepticism grew around “high FDV, low circulation” projects, with some high-valuation chains recently mocked by the community as “clock-out chains,” delivering unsatisfactory results in both operations and actual chain usage.

Yet Monad, thanks to its strong community engagement—from early community building and founder support to the pre-launch Monad Card campaign—and most recently its dream-team collaboration with Solana, has consistently generated excitement.

Backed by top-tier institutions yet facing shifting market sentiment—will Monad be remembered as a gem left behind from the VC era, or the final shining proof of institutional value? The answer may come tonight.

Still, we can already find clues in recent public sale data.

The recently concluded Coinbase public sale raised $269 million—144% oversubscribed. Under the “bottom-fill” rule, users who maxed out their $100,000 allocation received approximately $57,000 worth of tokens.

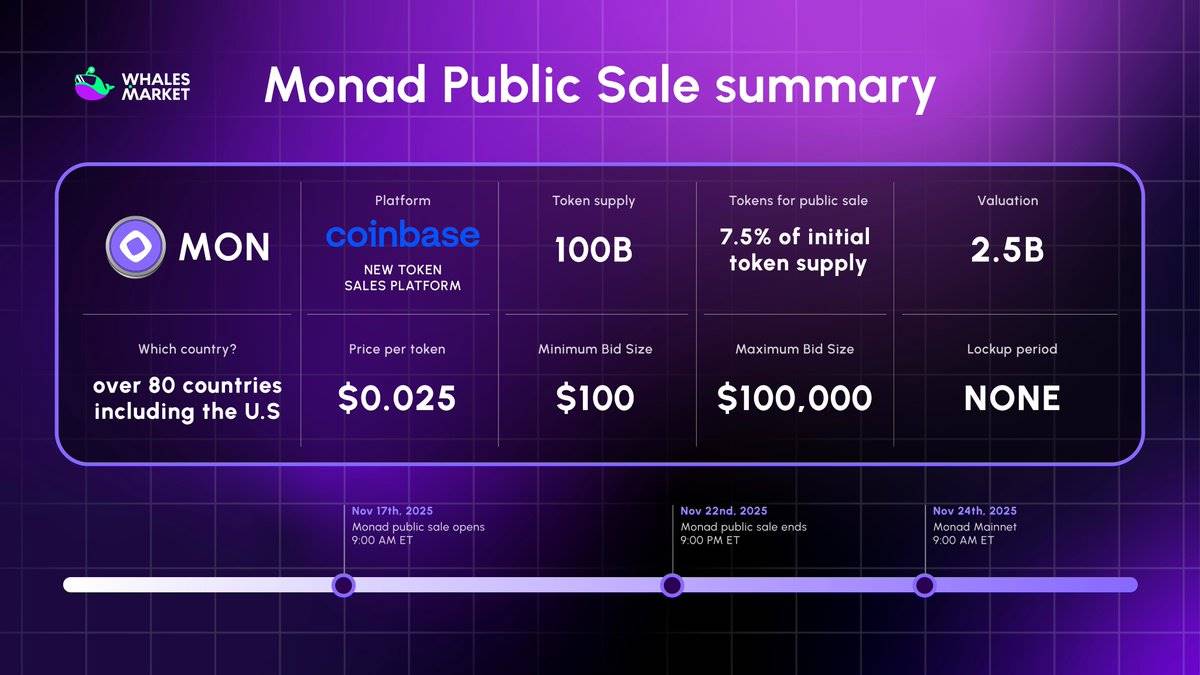

Image source: Whales Market

Based on the pre-market price of around $0.032–0.034 at time of writing, public sale participants are sitting on paper gains of 28–36%.

This return isn’t an outrageous windfall, but in the current market environment, it qualifies as a modest victory.

Pre-market $3B FDV: Too High?

When it comes to $MON’s valuation, market expectations are even more interesting.

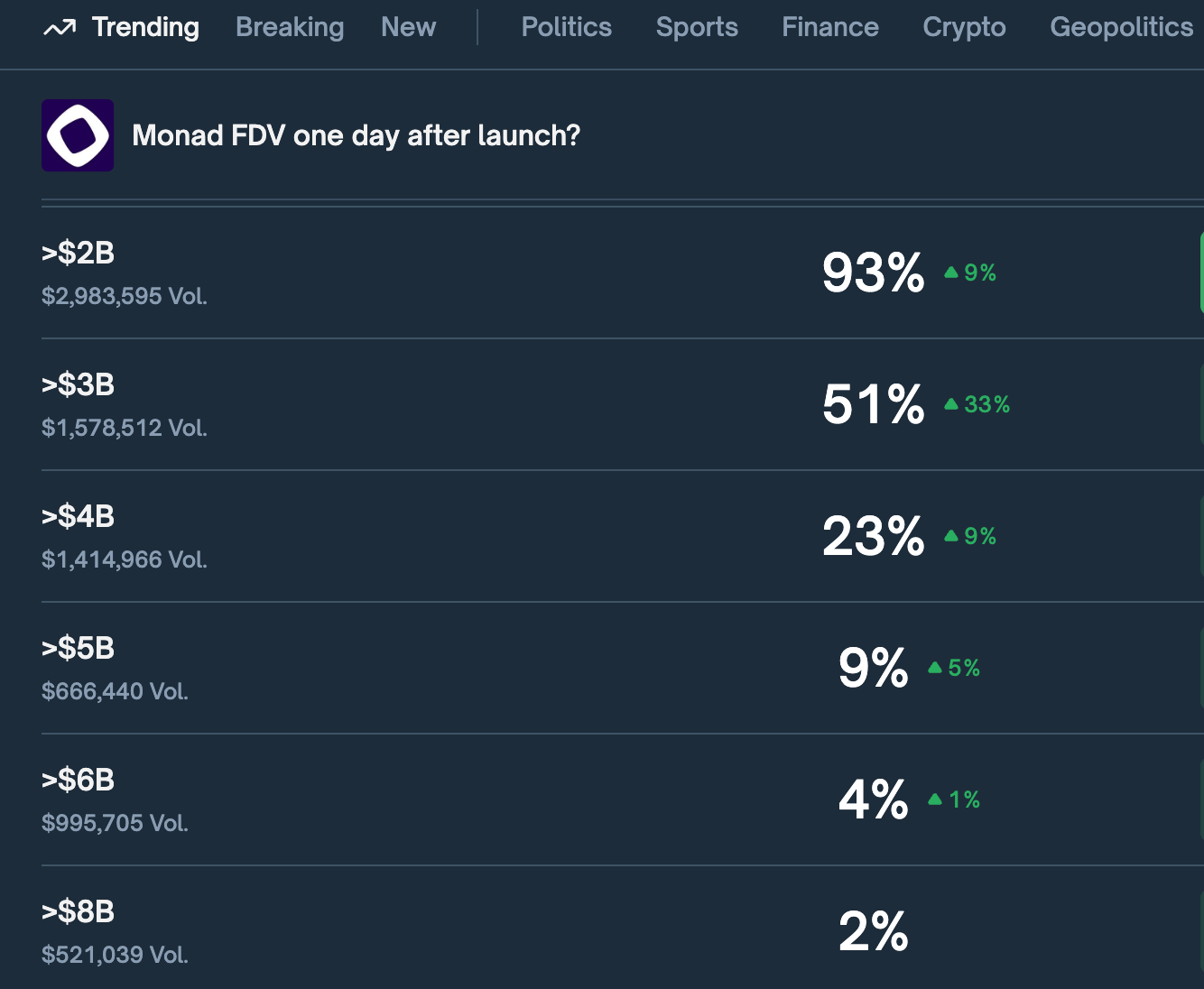

Prediction platforms show over 50% probability that $MON’s FDV will exceed $3 billion on its second day—slightly above the public sale’s $2.5 billion valuation.

At the current pre-market price of $0.032, $MON’s FDV stands at about $3.2 billion—right within the predicted range. The market is expressing a nuanced stance: recognition of the project, coupled with caution against excessive valuation.

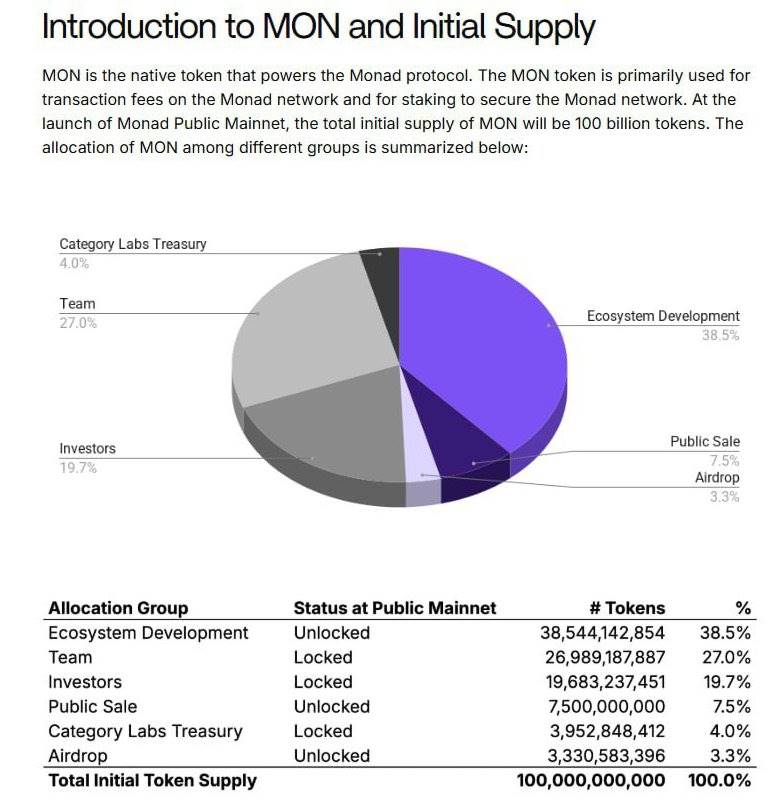

In terms of tokenomics, $MON has a total supply of 100 billion, with an initial circulating supply of 10.8 billion (10.8%). This includes 7.5% from the public sale and 3.3% allocated to promised airdrops.

Other portions allocated to team and early investors are subject to vesting schedules and currently remain non-circulating.

Notably, the largest variable in the token economy is the 38.5 billion tokens (38.5% of total supply) designated for ecosystem development, which are already unlocked.

On the positive side, ample ecosystem incentives can rapidly attract developers and users—Optimism and Arbitrum both used large-scale incentives to drive rapid TVL growth.

On the downside, improper use could create significant selling pressure. The key lies in how the foundation deploys this "ammunition"—whether through precise incentives for core projects or indiscriminate distribution—which will determine whether Monad can build real ecosystem moats and shape market confidence in the $MON token.

Compared to other L1s, Monad sits at a delicate valuation point.

Looking at the relationship between funding amount and valuation, differences among projects are stark. Monad raised $431 million against an estimated FDV of ~$3 billion—a multiple of about 8x. Interestingly, Aptos shows a similar ratio (350M funding vs 2.8B FDV), while Sui operates on another scale entirely—$400M funding supporting a $14.1B FDV, a 35x multiple.

Market valuations depend more on narrative strength, ecosystem progress, and timing than simple funding multiples.

Monad’s 8x valuation multiple appears relatively conservative—neither enjoying Sui’s premium nor signaling blind optimism. Instead, it reflects market hesitation, waiting for mainnet performance before assigning higher value.

When Solana Endorses Monad

In crypto, competition is everywhere—but scenes like this are rare:

Solana’s official account changed its profile picture to Monad’s purple logo and tweeted “MON mode activated.”

You might momentarily forget whether it’s Solana or Molana.

Even more surprising: Solana officially announced that MON will go live on Solana chain simultaneously with its mainnet launch, enabled via Wormhole Labs’ Sunrise DeFi, allowing direct trading without complex cross-chain steps.

As they put it:

“MON will be compatible with most Solana DeFi venues and trading platforms, including perpetuals and upcoming lending features.”

On the surface, Solana and Monad are both high-performance L1s—seemingly competitors. But looking deeper, they occupy different niches:

Solana has built its own non-EVM ecosystem, whereas Monad focuses on EVM compatibility. Rather than direct rivals, they represent distinct lanes within the high-performance blockchain space.

Solana’s move is essentially showcasing the openness and liquidity advantages of its ecosystem. Through native cross-chain solutions like Sunrise DeFi, Solana is positioning itself as a central hub for all assets—not just a closed loop within the SOL ecosystem. In their words, listing no longer belongs exclusively to centralized exchanges.

The author believes this co-opetition dynamic reflects a broader trend in crypto.

In a reality marked by fragmented liquidity, user fatigue around cross-chain complexity, and limited attractive asset opportunities, the winner will be whoever offers the best trading experience and deepest liquidity.

By embracing MON, Solana demonstrates confidence in its DeFi infrastructure and aims to capture more traffic during the listing phase. For MON holders, this means an additional, highly liquid on-chain trading venue beyond traditional CEXs.

Solana’s DeFi ecosystem ranks second only to Ethereum, with daily trading volumes consistently in the billions. MON’s immediate integration into this ecosystem provides strong support for price discovery and liquidity from day one.

Opportunities Available on Day 1

Monad’s mainnet launch isn’t a cold drop—over 300 projects are already active in its ecosystem, with 78 being exclusive to Monad.

For those receiving MON airdrops or seeking early participation, here are several key directions:

DeFi: Trading and Yield Opportunities

Perpetual exchanges are ready. Both Perpl and Drake will launch on day one—Perpl backed by DragonFly with $9.25 million, Drake featuring a hybrid CLOB+AMM model. Users seeking optimal execution should watch aggregators Monorail and Mace.

Lending markets offer variety. Modus uses sealed-bid liquidations to prevent MEV exploitation; Curvance offers up to 97% LTV; Townsquare focuses on cross-chain lending. Each protocol brings unique features and incentive programs.

Staking yield can be accessed via Fastlane’s shMON, Monad’s liquid staking token, allowing users to earn staking rewards while maintaining liquidity.

Space constraints limit us to brief highlights—see the full list here:

"Monad Ecosystem Guide: Everything You Can Do After Mainnet Launch"

Additionally, the official team released a Day 1 Consumer App Guide—apps available from launch day:

Gaming:

-

Lumiterra: Open-world MMORPG with AI companion system

-

LootGo: Pokémon GO-style walk-to-earn app (already on App Store)

-

Bro.fun: On-chain beer pong with betting and rewards

Prediction Markets:

-

RareBetSports: Predict individual player stats (points, assists, etc.)

-

LEVR.Bet: Leverage sports predictions up to 5x

Social Mining:

-

TeleMafia: Turn Telegram groups into mafia battlegrounds, fighting directly in chat

You can find more consumer apps at app.monad.xyz

Meme and NFT: The Purple Wave

Nad.fun is set to become Monad’s version of pump.fun, enabling meme coin launches upon mainnet go-live. On the NFT front, Purple Friends (1,111 pieces) and Chog are the OG collections, with the latter’s founder being one of the largest airdrop recipients.

Meme trading opportunities tied to MON will also appear on Solana via Sunrise DeFi, accessible directly.

Full guide here:

"Monad Day 1 Consumer App Guide"

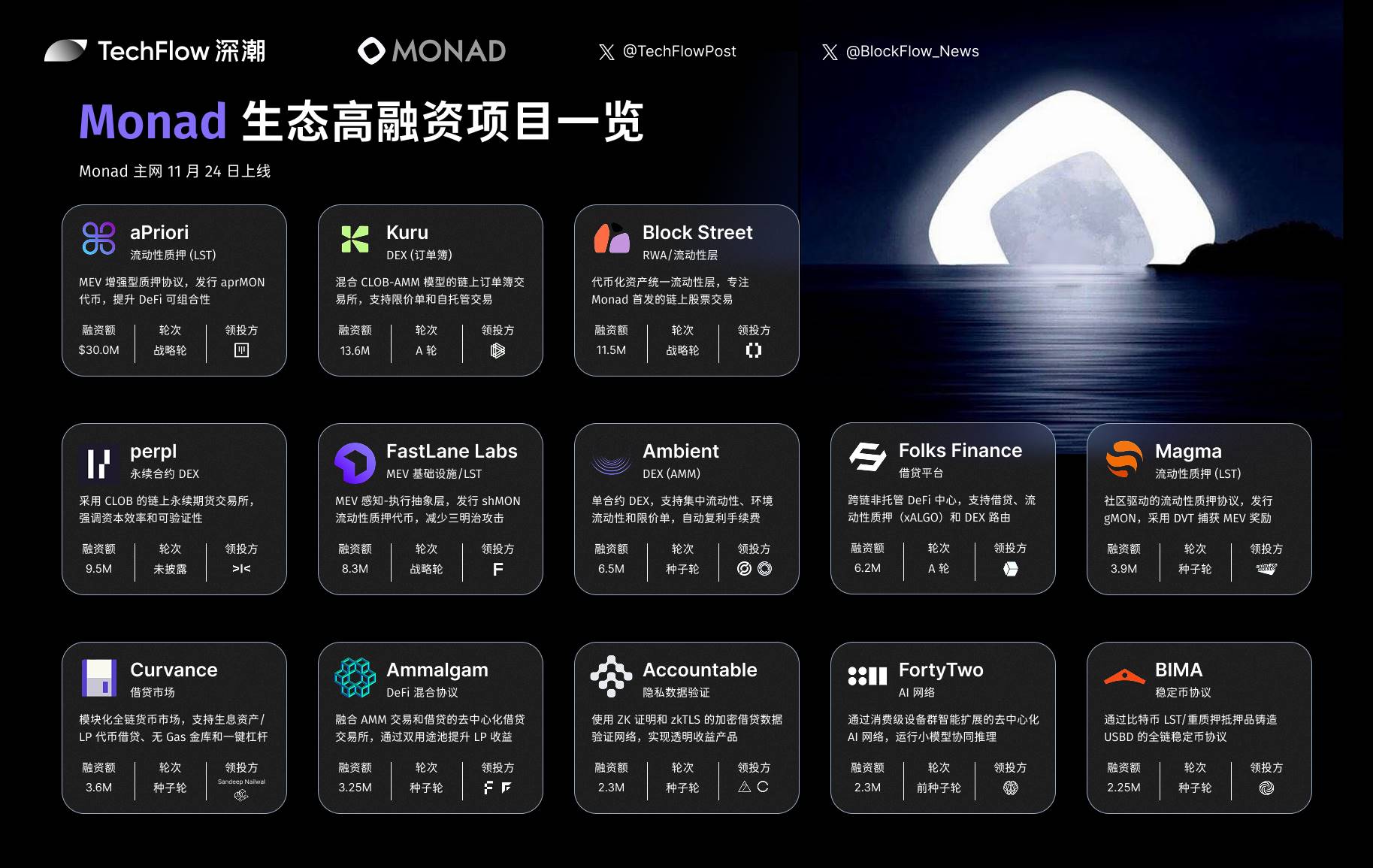

Beyond these, we previously summarized several high-funding projects within the Monad ecosystem—still relevant today. One-pager below:

The ecosystem is ready. Now it’s time to see how the mainnet performs tonight.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News