Quick Overview of CAP: A New Stablecoin Protocol on MegaETH

TechFlow Selected TechFlow Selected

Quick Overview of CAP: A New Stablecoin Protocol on MegaETH

Each participant in CAP (minters, operators, and restakers) unlocks new revenue opportunities by contributing value.

Author: DeFi Dave

Translation: TechFlow

The rise of online platform economies has helped many small startups grow into today's tech giants, all based on a seemingly counterintuitive phenomenon: they do not own any assets required for their core operations. The classic examples are Uber, which owns no vehicles in its fleet, and Airbnb, which owns no rooms on its platform. These companies leverage market forces to precisely match service demanders with providers, whether for short urban trips or temporary accommodations. Unlike traditional businesses that must handle complex logistics such as vehicle maintenance and licensing, these platforms can focus on optimizing technology, improving user experience, and increasing efficiency—enabling unlimited business scalability.

A similar dynamic exists in the on-chain world. On one side are users seeking yield; on the other are protocols and participants offering yield through various strategies advertising high annual percentage yields (APY). However, whether using leveraged collateralized debt positions (CDPs), Treasury bill interest, or market strategies like basis trading, any single strategy will eventually hit bottlenecks when scaling up.

The Story of Two (Limited) Designs

Traditional projects typically rely on endogenous designs where revenue comes from platform usage demand. For example, lending markets and perpetual contracts depend on users' willingness to use leverage, while token flywheel effects require continuous purchases of governance tokens by new investors. However, if the platform lacks demand—whether for leverage or token buying—liquidity providers cannot earn returns. This design resembles Ouroboros, unable to sustainably evolve beyond itself.

For newer exogenous strategies, protocols often ask the wrong question: which strategy can scale the most? In reality, no strategy can scale infinitely. When alpha dries up, all strategies eventually become obsolete, forcing developers back to the drawing board.

So what questions should stablecoins be asking? As a central hub for capital formation, stablecoins must consider how to efficiently allocate capital and how to safeguard users' funds. To achieve true success, the blockchain ecosystem needs a flexible and secure stablecoin solution.

CAP Enters the Scene

CAP is the first stablecoin protocol that programmatically outsources yield generation while providing comprehensive protection.

Who Makes Up CAP?

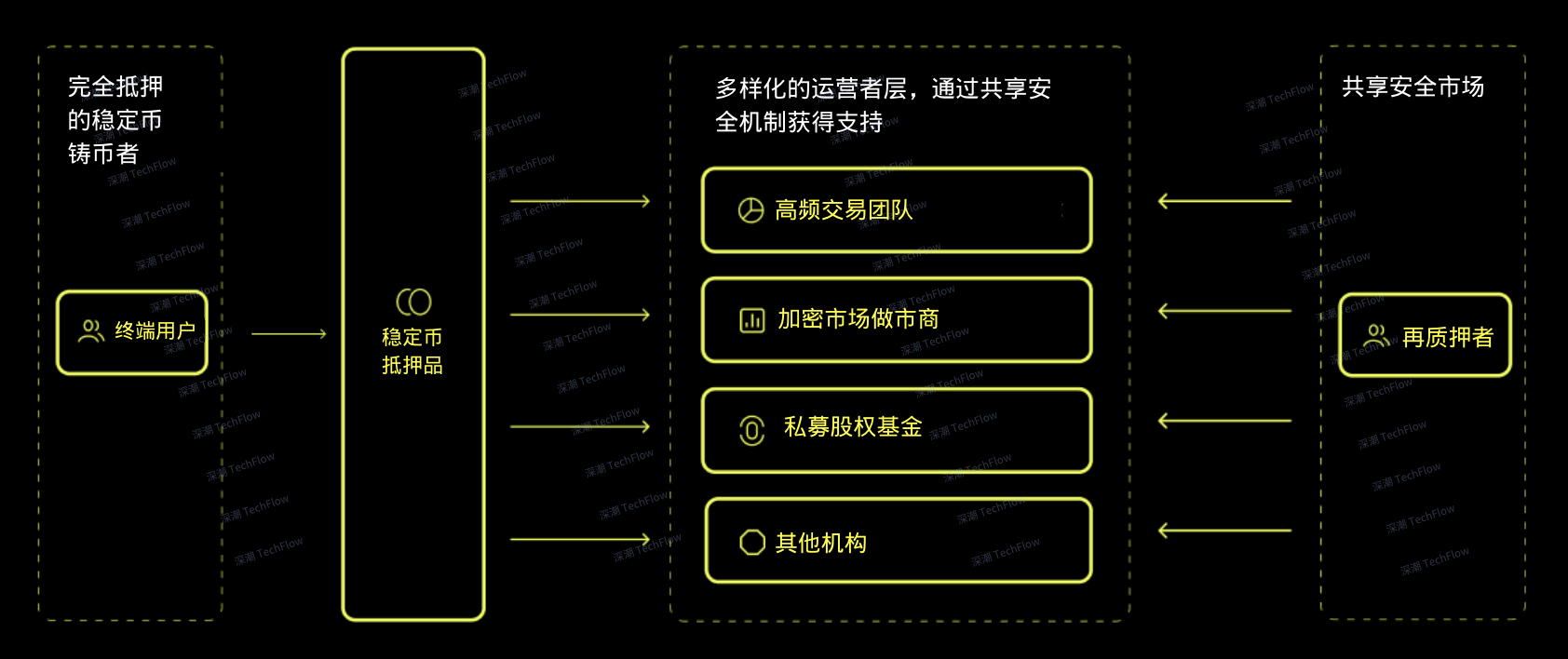

The core of the CAP system consists of three types of participants: Minters, Operators, and Restakers.

-

Minters: Minters are stablecoin users holding cUSD. cUSD can always be redeemed 1:1 for its underlying collateral assets USDC or USDT.

-

Operators: Operators are institutions capable of executing large-scale yield-generating strategies, including banks, high-frequency trading (HFT) firms, private equity firms, real-world asset protocols (RWA protocols), decentralized finance protocols (DeFi protocols), and liquidity funds.

-

Restakers: Restakers are capital pools that lock up funds to secure the activities of Operators, thereby protecting stablecoin users, and in return gain access to use restaked ETH.

(Original image by DeFi Dave, translated by TechFlow)

How CAP Works

CAP’s smart contracts clearly define operational rules for all participants, including fixed requirements, penalties, and incentives.

-

Stablecoin users deposit USDC or USDT to mint cUSD at a 1:1 ratio. Users may choose to stake cUSD to earn yield or use it directly as a dollar-pegged stablecoin. cUSD is always fully redeemable.

-

An institution (e.g., an HFT firm targeting a 40% return threshold) chooses to join CAP’s operator pool and plans to obtain loans via CAP for its yield strategy.

-

To become an Operator, the institution must first pass CAP’s whitelist review and convince restakers to delegate capital to them. The total amount delegated determines the capital ceiling available to the Operator. Once sufficient “coverage” is obtained through delegation, the institution can withdraw USDC from the collateral pool to execute its proprietary strategy.

-

At the end of the loan period, the institution distributes yield to stablecoin users based on CAP’s benchmark rate and pays a premium to restakers. For instance, if the benchmark yield is 13% and the premium is 2%, the institution keeps the remaining yield (in this case, 25%).

-

Users staking cUSD accumulate interest through Operator activities, which can be withdrawn at any time.

Motivations for Each Participant

To understand how CAP works, it's not enough to know what participants do—it's crucial to understand why they participate.

Stablecoin Holders

-

Stable yield without constant switching: Market-set rates allow users to earn yield continuously without frequently changing protocols—even as market conditions shift or individual strategies become outdated.

-

Security assurance: Compared to CeFi and DeFi applications promising high yields but resulting in user fund losses, CAP offers greater security. User principal is protected by the immutability of smart contracts and fully backed collateral—not by trust.

Operators

-

Zero-cost access to additional capital: Capital provided by CAP carries no cost basis, allowing yield market makers to achieve higher returns than under traditional LP models, boosting TVL for DeFi protocols, AUM for private credit funds, and creating more opportunities for cross-domain arbitrageurs.

Restakers

-

New utility for locked ETH: Since ETH is typically locked at the L1 layer with limited use cases, restaking allows users to delegate their ETH to Operators and participate in active validation services (AVS) like CAP.

-

Yield paid in blue-chip assets: CAP allows restakers to set their own premiums to compensate for risk exposure. These premiums are paid in blue-chip assets like ETH or USD—not inflationary governance tokens or off-chain point systems. Thus, restaker yields are not capped by project market caps and have unlimited growth potential.

Risks Involved

Every new opportunity comes with risks, so understanding CAP’s potential risks is essential:

-

Risks from shared security markets: CAP relies on shared security markets like EigenLayer and thus may be exposed to risks associated with those platforms.

-

Price volatility of underlying assets: If USDC or USDT depegs, users face price fluctuation risks. However, this risk exists even without CAP.

-

Risks from third-party cross-chain bridges: When users use cUSD on other chains via cross-chain bridges, they may face risks from third-party bridging solutions. However, CAP itself is not directly exposed to these risks.

-

Smart contract risks: CAP does not rely on custodians or human oversight but protects users through smart contract rules. Nevertheless, users bear potential risks from smart contract logic, even if audited.

Conclusion

Each participant in CAP—Minters, Operators, and Restakers—unlocks new yield opportunities by contributing value: depositors gain secured, stable returns, Operators access capital at zero cost, and Restakers earn high-quality asset yields through delegation.

For yield-bearing stablecoins to achieve mass adoption, we must rely on the power of efficient markets, not centralized teams. Just like markets in other industries, competitive mechanisms deliver optimal outcomes for all participants.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News