Trump took office, but MicroStrategy stopped buying?

TechFlow Selected TechFlow Selected

Trump took office, but MicroStrategy stopped buying?

Suspending purchases may be a financial risk control measure to better assess and manage future tax liabilities.

By Hedy Bi, OKG Research

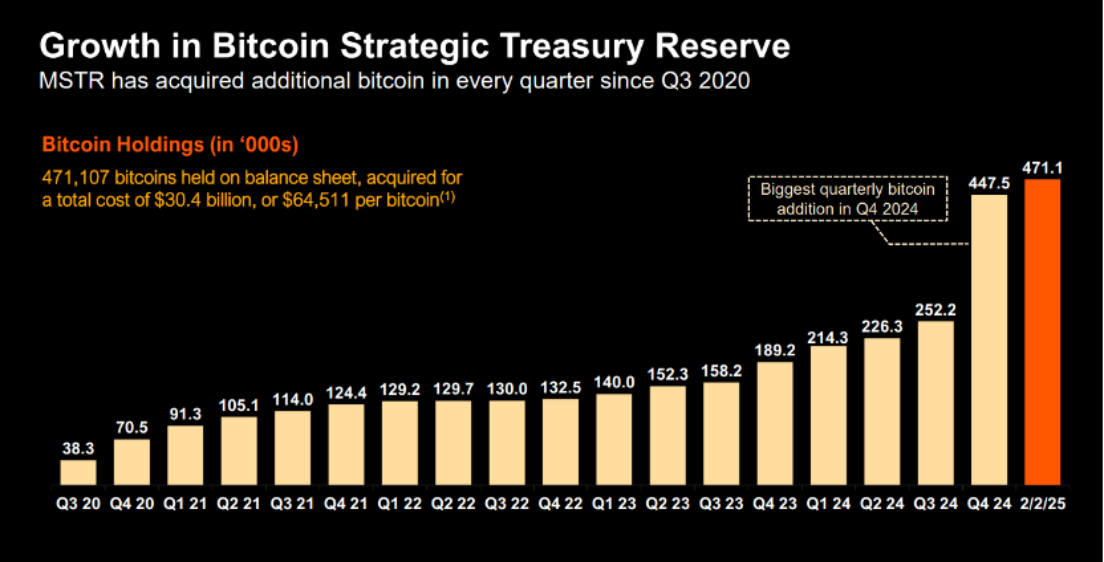

With Trump back in power, political winds and economic policies are reshaping the global capital landscape at an astonishing pace. Against this backdrop, Strategy (formerly MicroStrategy, referred to as "Strategy" throughout) — a publicly traded company renowned for aggressively acquiring Bitcoin — has suddenly announced a pause in new Bitcoin purchases. Yet, during last night's earnings call, Strategy set an annual 2025 target of $10 billion in "Bitcoin dollar gains." Assuming all funds used by Strategy to purchase Bitcoin come from financing, achieving this goal would require either doubling the Bitcoin price or, under the theoretical assumption that Bitcoin remains at current prices, adding an amount equal to its existing holdings at its current cost basis.

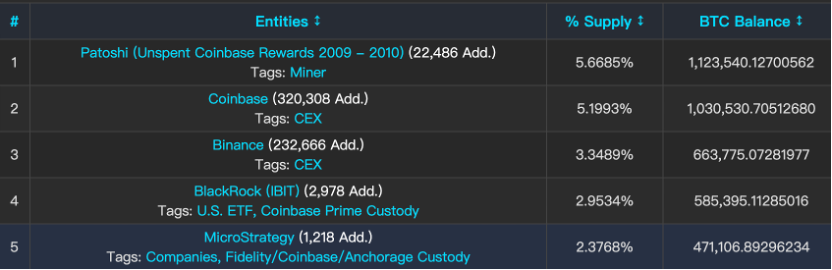

As the world’s largest corporate holder of Bitcoin, as of February 7, 2024, Strategy holds 450,000 Bitcoins at an average cost of approximately $62,000, ranking among the top five Bitcoin holders globally and accounting for about 2.38% of the total Bitcoin supply. This proportion is comparable to the U.S. official gold reserves—the largest national gold reserve according to the World Gold Council—highlighting Strategy’s leading position and strategic resolve in the crypto asset space. Because of this, Strategy’s transparency and clear investment strategy make its holding changes a key reference point for global investors watching cryptocurrencies.

For investors who have long viewed Strategy as a “digital gold treasury,” the company’s recent moves have undoubtedly sparked intense debate. How should such seemingly contradictory actions be interpreted? This article analyzes why Strategy changed its Bitcoin purchasing strategy and explores the implications for the Bitcoin market.

Why did Strategy choose to pause purchases after Trump took office? The answer is far more complex than it appears. One critical factor lies in the company’s recent pressures related to financial performance and accounting practices.

First, although Strategy doubled its Bitcoin holdings in Q4 2024, it reported a net loss of $3.03 per share, significantly exceeding analysts’ expectations of a $0.12 loss per share. This was primarily due to substantial impairment charges on its digital assets. Under previous accounting rules, when Bitcoin’s price falls below its acquisition cost, companies must reflect these losses in their financial statements. If the fair value of an asset drops below its book value, an impairment loss must be recognized.

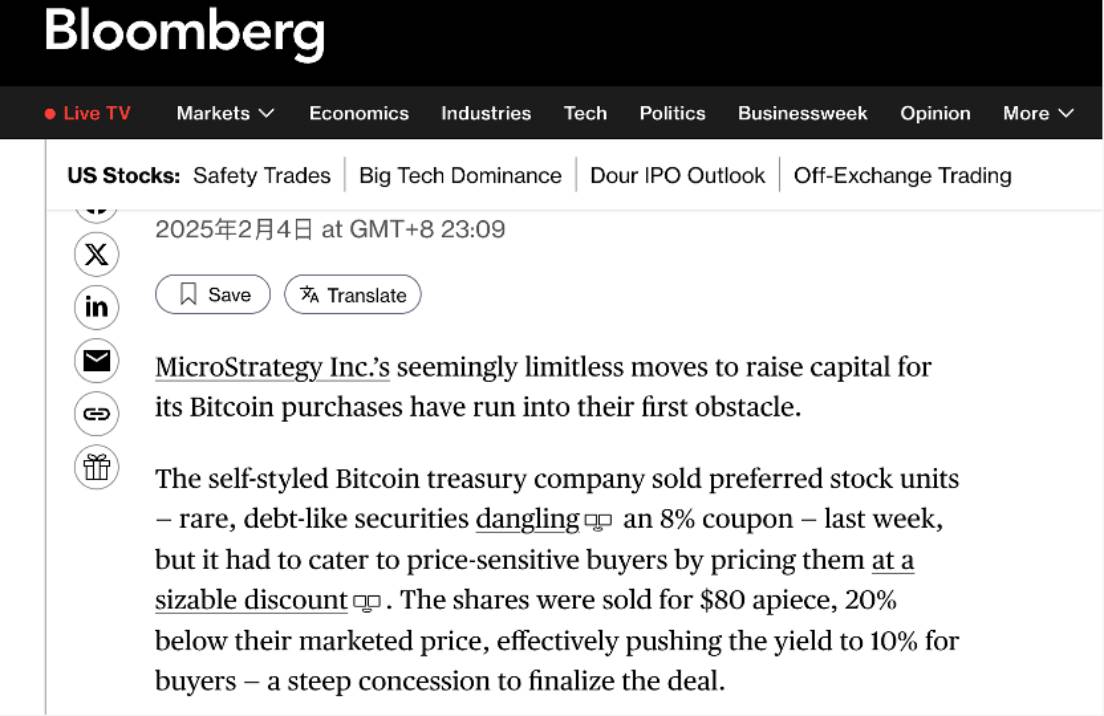

Such unexpectedly large losses can erode investor confidence, leading them to demand higher returns to compensate for risk, making it harder to attract buyers for preferred shares. This explains why, according to Bloomberg, Strategy issued new preferred shares at a 20% discount. However, for investors bullish on Strategy’s prospects, the discounted issuance effectively increases their yield.

Meanwhile, while the implementation of the new FASB (Financial Accounting Standards Board) standards allows Strategy to recognize unrealized gains on its Bitcoin holdings for the first time, it also complicates tax matters: under the new accounting rules, Strategy must measure its Bitcoin holdings at fair value and report unrealized gains on its financial statements. While this enhances balance sheet transparency, it also means the company may owe Corporate Alternative Minimum Tax (CAMT, approximately 15%) on these unrealized gains. Facing potentially massive tax bills, Strategy must engage in careful financial planning to manage future tax obligations. The purchase pause may be a financial risk control measure aimed at better assessing and managing future tax burdens.

Additionally, since being added to the Nasdaq-100 Index, Strategy has been required to comply with stricter disclosure and corporate governance standards, including tighter insider trading policies to prevent misconduct. One reason for pausing Bitcoin accumulation could relate to blackout period restrictions. Although the U.S. Securities and Exchange Commission (SEC) does not mandate blackout periods, many companies voluntarily impose them for compliance reasons, especially around earnings releases. For example, Strategy released its Q4 2024 earnings on February 5, meaning a blackout period likely began in January, restricting its ability to buy Bitcoin during that window.

In short, Strategy has not lost faith in Bitcoin’s outlook; the apparent inconsistency is less about external market forces and more about internal financial and compliance considerations.

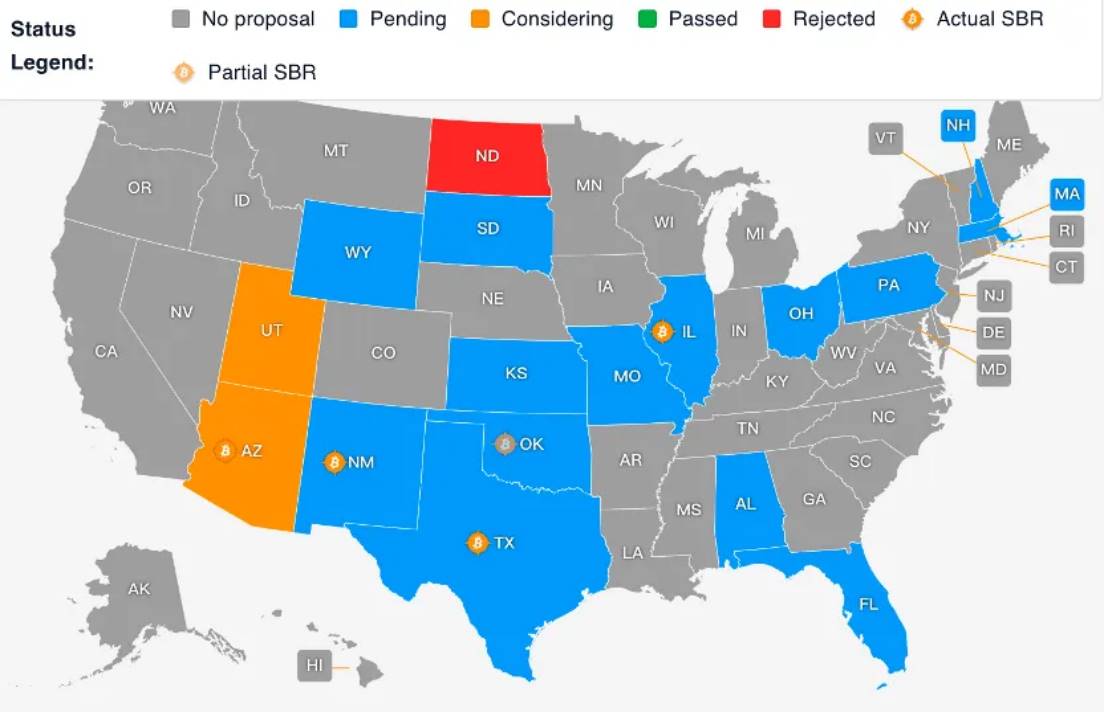

Other institutions in the market won’t follow Strategy’s lead simply because of its internal constraints. On the contrary, U.S. states are pushing bottom-up initiatives to adopt Bitcoin as a strategic asset. So far, 16 states have introduced relevant legislation, with two advancing faster than others. According to the chart below, approximately 28,312 Bitcoins are likely to be purchased for investment purposes. States currently labeled as “Pending” are not necessarily unsupportive of digital currencies like Bitcoin. Today (February 7), Kentucky State Representative TJ Roberts introduced House Bill 376, proposing to allocate 10% of state funds to invest in digital assets with a market cap exceeding $75 billion.

Based on Kentucky’s 2023 General Fund revenue, allocating 10% to Bitcoin investments would amount to roughly $1.51 billion. If all 16 states followed this model, over $24 billion could flow into the Bitcoin market. This sum represents nearly 1.25% of Bitcoin’s current market value (as of February 7) and equals about 3.24% of U.S. gold reserves. According to the World Gold Council, U.S. gold reserves are valued at approximately $740 billion. Notably, this scale of inflow isn't driven by any national reserve initiative but purely by state-level policy momentum. This indicates that beyond firms like Strategy, other institutions and governments are actively buying Bitcoin. Within less than a month of Trump officially returning to the White House, Bitcoin’s status within the global financial system is rising at an unprecedented speed and in non-traditional ways.

And this is merely a snapshot of the new policies emerging in the Trump era—full of uncertainty, yet brimming with possibilities.

This is the third installment in the "Trumponomics" series.

OKG Research presents a special series titled "Trumponomics," offering in-depth analysis of future trends and core dynamics in the crypto market as Trump’s second-term policies continue to unfold.

Other articles in this series:

"Trump’s Re-Election: Bitcoin, Oil, and Gold in the New Economic Era" focuses on Bitcoin’s impact on the international financial order.

"Trump Returns: Can Stablecoins or Bitcoin Solve America’s Debt Crisis?" dives into the $36 trillion U.S. Treasury market—the cornerstone of traditional finance—and examines how blockchain technology and crypto tools could further strengthen and extend the dollar’s dominance in the global financial system.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News