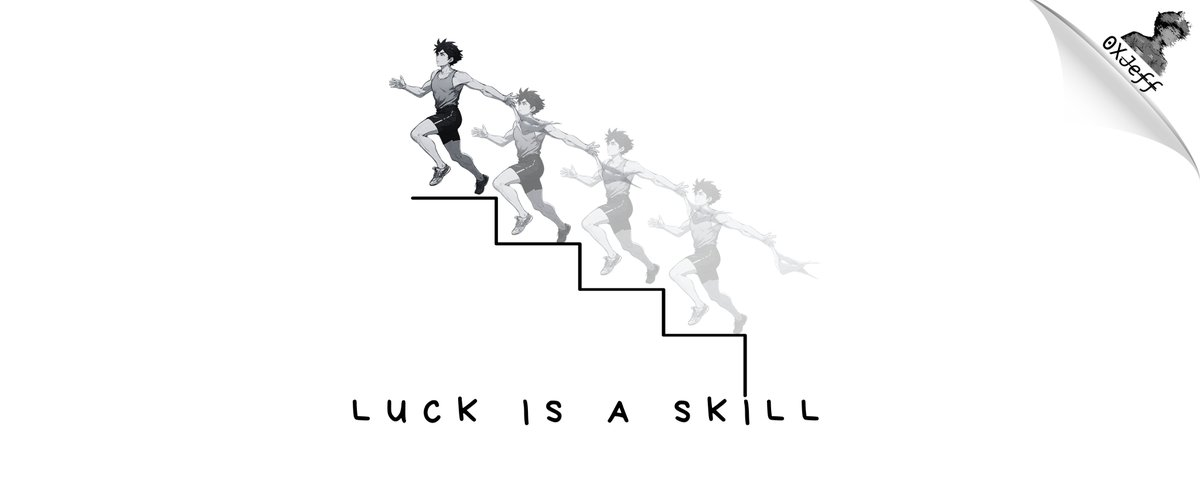

A Letter to You, Lost in Crypto: From Major Mistakes to Seizing Opportunities, Luck Is Preparedness in Disguise

TechFlow Selected TechFlow Selected

A Letter to You, Lost in Crypto: From Major Mistakes to Seizing Opportunities, Luck Is Preparedness in Disguise

Cryptocurrency is a marathon, not a sprint.

Author: 0xJeff

Translation: TechFlow

Fifteen years ago, when I was deeply into playing Dota, there was a YouTube series called *Luck is No Excuse*.

In these videos, top players consistently defeated their opponents with perfect positioning and execution under ideal circumstances. Their precise decisions left rivals powerless, securing effortless victories.

Back then, I tried to replicate those highlight moments—but always failed. Was it bad luck? Or had I simply not practiced enough?

In other words, I just needed to “get stronger.”

The same logic applies in crypto. You see people on your timeline achieving life-changing returns and wonder, “Why can’t I do that?” This mindset drives action—maybe buying $TRUMP, rushing into $VINE out of FOMO, hunting for the next beta, or chasing trending narratives.

Sure, if you deeply understand meme culture and master PvP (player-versus-player) dynamics, you might get lucky. But if not, you’ll likely end up worse off than when you started.

Take my own journey. I entered crypto at the end of 2021, right at the peak of the bull market. My first purchase was $CAKE, attracted by its auto-compounding pools promising 70–100% APR. The result? I lost 30% of my principal within a week as $CAKE crashed. At the time, I didn’t understand why—it just seemed like a bad asset.

Later, I discovered TIME Wonderland by @danielesesta. I was drawn in by its outrageous 50,000% APY and that infamous yield calculator: “Deposit $1,000, harness the power of staking and compounding, and turn it into $1 million in a year. If everyone stakes, we all win together via (3,3).”

Well… we all know how that ended.

I cut my losses and started over. That was my first real lesson in emissions mechanics within crypto projects. A few months later, I learned a similar lesson from Andre Cronje’s @AndreCronjeTech Solidly project, which taught me the importance of strong teams in any Web3 venture.

Eventually, I found my rhythm—scouting new projects on Pinksale Finance. I made some profits, reinvested them into Bybit Launchpad token trading, then moved into liquidity mining on Abracadabra @MIM_Spell at 140% APY. This strategy worked for three months—until I made one fatal mistake.

I locked most of my funds into projects within the Terra ecosystem using Lockdrop and LBA models (requiring UST deposits in exchange for project tokens). To maximize token allocation, I chose to lock UST for 12 months. Just one month later, UST depegged and the Terra-Luna collapse happened.

I lost everything.

In desperation, I tried shorting LUNA to recover, but emotional trading led to liquidation during a bounce. In the end, my portfolio dropped from nearly six figures to just $500.

Yet this experience opened the door to an opportunity at @TheSpartanGroup. I spent over a year there consulting for multiple projects. Then I made a bold move: launching this account to focus on writing about DeFi.

In early 2023, I discovered @CamelotDEX and other Arbitrum-based DeFi projects. After deep analysis, I shared insights with the community, rapidly growing my Twitter presence.

But from 2023 to 2024, I drifted—sometimes even losing motivation. DeFi innovation slowed, L1/L2/L3 ecosystems became increasingly fragmented, and personal life pressures piled up.

It wasn't until August 2024 that things began to shift.

A conversation with @vtes369 and the @ChasmNetwork team sparked my interest in AI. Despite having no formal AI background, I began self-studying consumer-facing AI companions and agents. Soon after, I discovered @virtuals_io.

During a call with @everythingempt0, he laid out Virtuals’ vision—tokenizing AI agents. Lightbulb moment. It reminded me of discovering @pendle_fi back in 2023.

Just as Pendle tokenized yield, Virtuals aims to tokenize AI agents—a potentially billion-dollar market. The team’s creativity impressed me deeply. Before launching @luna_virtuals, they released comics depicting @VitalikButerin discovering a self-aware AI idol. That bold, unique storytelling gave me full confidence in their vision.

When $VIRTUAL was valued at $30 million market cap, I invested. As the platform grew, my thesis proved valid. I dove deeper, wrote about AI agents, and built a supportive community.

This isn’t bragging—I know I still have a long way to go.

The point is: in crypto, you must learn from mistakes, adapt to change, and continuously improve. Resilience is the foundation of success. Whether markets rise, fall, or consolidate, people may chase memecoins, but you must persist—keep learning, keep supporting others.

If you stay in the game long enough, luck will eventually find you.

Lessons I’ve learned in crypto:

-

Do your own research (DYOR).

-

Develop your own views and investment framework.

-

Reflect on your mistakes.

-

Stay engaged with the market every single day.

My daily routine:

-

Check @cookiedotfun, @Decentralisedco, and @GoatIndexAI for market trends and updates.

-

Follow a curated AI-crypto Twitter feed for real-time insights.

-

Write one piece of content daily to solidify my thinking and share with others.

Those who turned $500 into millions via memes didn’t succeed purely by luck. They spent countless hours grinding through markets, learning from failures, and building success brick by brick through persistence and resilience.

Many look at these success stories and assume crypto investing is easy. But reality is far different.

The truth is: luck is a skill.

Luck is earned through thorough preparation, consistent effort, and the courage to keep moving forward despite adversity.

Crypto, like life, is a marathon—not a sprint. You may stumble, fall, or even hit rock bottom. But the only way to truly lose is to stop trying.

The market isn’t over. Alpha still exists, waiting to be uncovered. And the best time to spot—and invest in—these opportunities is precisely when the market is blood red and fear is everywhere. That’s when chances are ripe—yet only for those brave enough to seek them.

Success isn’t instant. It’s built slowly, over years, through relentless effort, reflection, and growth—one brick at a time. So keep going, keep learning, keep believing in yourself.

Your lucky break won’t come from nowhere—it’s being built right now, through every effort you make today.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News