From Trump's $500 billion infrastructure plan to 90% of on-chain transactions becoming intelligent, Web3 is entering the AI revolution's inaugural year

TechFlow Selected TechFlow Selected

From Trump's $500 billion infrastructure plan to 90% of on-chain transactions becoming intelligent, Web3 is entering the AI revolution's inaugural year

Looking ahead to next week, markets will focus on key events including the Federal Reserve's FOMC meeting, the PCE price index, and tech earnings reports.

Author: Frontier Lab

Market Overview

Overall Market Conditions

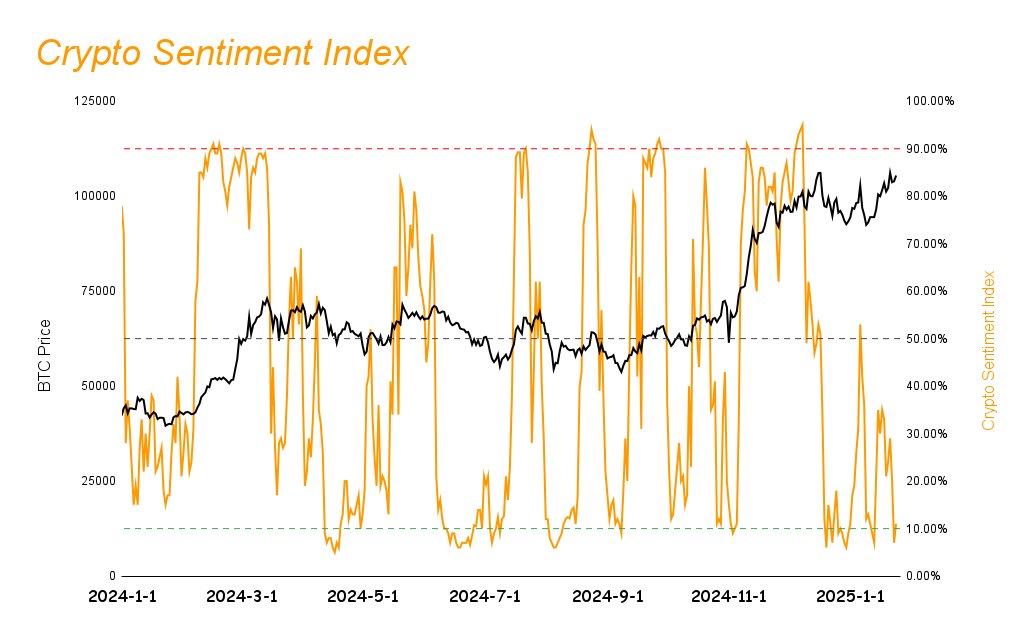

This week, the crypto market experienced wide-ranging volatility. The market sentiment index dropped from 35% last week to 10%, entering an "extreme fear" zone. Stablecoin market capitalization continued to grow (USDT reached $138.9 billion, USDC reached $519 billion), indicating ongoing institutional inflows. Poor market sentiment was primarily due to President Trump not immediately unveiling cryptocurrency-related policies after taking office. Although Trump signed a crypto-focused executive order and the SEC repealed SAB-121 on Thursday, these actions failed to significantly boost market confidence. As a result, most altcoins underperformed relative to the broader market, with the overall altcoin sector lagging behind benchmark indices.

DeFi Ecosystem Development

The DeFi sector performed strongly, with Total Value Locked (TVL) rising from $53.5 billion to $53.8 billion—a 0.56% increase—and marking two consecutive weeks of positive growth. This uptick was driven by rising underlying asset prices and project incentive programs, leading to higher on-chain APYs across platforms. Projects such as Sumer.money and Meteora stood out in terms of TVL growth, signaling renewed investor interest in foundational yield opportunities within DeFi.

AI Sector Developments

The AI sector's total market cap reached $41.9 billion following Trump’s announcement of a $500 billion AI infrastructure initiative, though it later pulled back amid broader market weakness. On the project front, Virtuals Protocol and Swarms continue advancing technological innovation, focusing on autonomous trading agents, multi-agent collaboration frameworks, and core infrastructure development. Emerging narratives such as TEE (Trusted Execution Environment) applications and agent-based economic models are gradually gaining traction.

Meme Coin Trends

This week, meme coin attention centered on TRUMP and MELANIA—the official tokens launched by Donald Trump and Melania on Solana—drawing significant capital and public focus toward these two assets. This concentration led to sharp declines in other meme coins, highlighting the highly speculative and herd-like nature of the meme coin market.

Layer 1 Performance Analysis

Among Layer 1 blockchains, Solana and Tron delivered the strongest performance. Solana benefited significantly from the launch of the TRUMP token, pushing its on-chain stablecoin supply to a record high of $10.138 billion. Meanwhile, emerging chains like Sonic, Core, and BSquared continue innovating in both DeFi and AI domains, demonstrating strong potential for ecosystem growth.

Outlook for the Coming Week

Looking ahead, key events to watch include the Federal Reserve's FOMC meeting, the PCE price index data release, and major tech earnings reports. The market is expected to remain volatile in the short term. However, investors generally anticipate improved conditions starting in February as crypto policy clarity emerges. Both DeFi and AI sectors are well-positioned to benefit from improving fundamentals and supportive regulatory developments, while competition among Layer 1 ecosystems is set to intensify.

Market Sentiment Index Analysis

The market sentiment index declined from 35% last week to 10%, falling into the "extreme fear" category.

Altcoins underperformed the broader market this week, with most tokens declining more than the main indices. This stems from investor anticipation surrounding new crypto legislation under the Trump administration. Despite the signing of a crypto executive order and the repeal of SAB-121 by the SEC on Thursday, market sentiment remained subdued. Investors are currently cautious, contributing to weak overall sentiment. Given the current market structure, altcoins are expected to move in line with benchmark indices in the near term.

Summary of Overall Market Trends

-

The cryptocurrency market experienced volatile movements this week, with sentiment entering the extreme fear zone.

-

DeFi-related projects outperformed other sectors, reflecting sustained investor interest in yield-generating opportunities.

-

AI-related projects attracted heightened media and community attention, suggesting investors are actively seeking the next breakout narrative.

Hot Sectors

AI Rising: From Trump’s $500B Infrastructure Plan to 90% Intelligent On-chain Transactions — Web3 Enters Its AI Revolution Year

This week, the AI sector rebounded following Trump’s announcement of a $500 billion investment in AI infrastructure over the next four years. However, gains were partially erased due to overall bearish market sentiment.

Despite macro volatility, innovation continued across AI projects. Virtuals Protocol updated its value accrual mechanism; Swarms established a $10 million token ecosystem fund and plans new feature rollouts; AI16Z expanded onto Near and Avalanche; Holoworld launched its Launchpool; and AIXBT remained at the top of Kaito’s attention leaderboard—indicating that teams are steadily advancing their roadmaps. Current market focus includes autonomous trading agents (e.g., Cod3x, Almanak), multi-agent coordination frameworks (Spectral Lux), and infrastructure development (Virtuals SDK). Newer themes such as TEE technology validation, agent-native economies, and cross-chain agent integration are also beginning to attract market attention.

According to Messari projections, by the end of 2025, approximately 90% of on-chain transactions will no longer be manually executed by humans but instead managed by AI agents. These intelligent agents can perform micro-payments based on real-time data, optimize liquidity pools, and allocate rewards efficiently—enabling smarter, faster, and more effective operations. The dawn of an AI-driven era in crypto appears imminent.

DeFi Sector

Top TVL Gainers

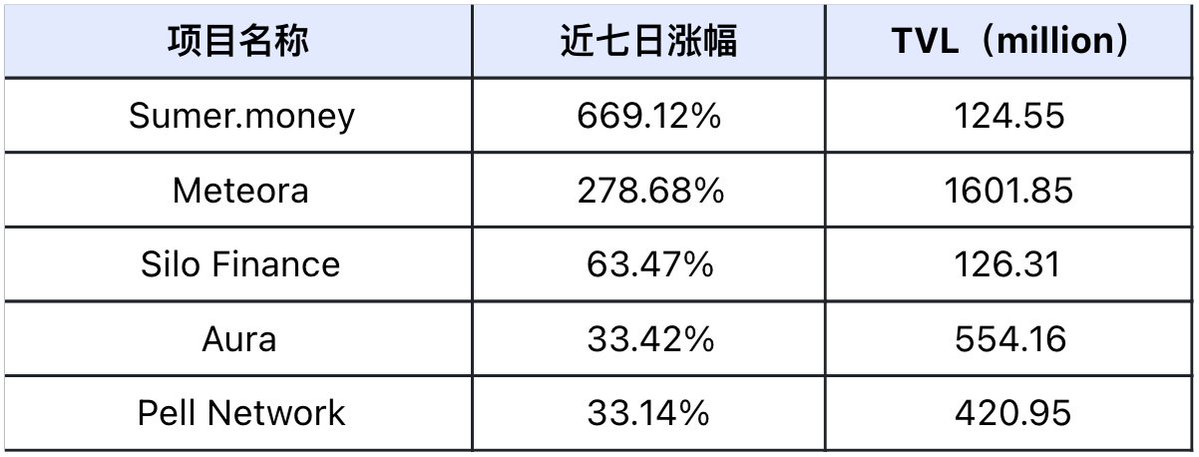

The top 5 projects by TVL growth over the past week (excluding smaller projects below $30 million TVL). Data source: DefiLlama

(No token yet): (Rating: ⭐️⭐️⭐️)

Launched NFT minting collaborations with multiple projects

-

Project Overview: Sumer.money is a cross-chain synthetic asset protocol featuring lending markets deployed across supported networks. It enables the creation of SuTokens (synthetic USD, ETH, and BTC), offering users a credit card-like financial experience.

-

Latest Updates: Sumer Money surpassed the $100M TVL milestone this week. The project expanded its ecosystem through NFT minting partnerships with BeraSkool, Bera Horses, and Kingdomly. Strategically, it joined Core DAO’s Core Ignition program. In team communications via AMA sessions, they revealed optimization strategies for Sumer Money Multipliers (suBTC) and are preparing new pool designs. Community engagement remains active through Twitter contests.

Meteora (No token yet): (Rating: ⭐️⭐️⭐️)

Enhanced user experience with the new "Liquidity Ratio Slider" feature

-

Project Overview: Meteora is a Solana-based DeFi platform focused on optimizing liquidity to improve capital efficiency and trading experiences. It offers decentralized liquidity management tools, including automated trading, fee analytics, and sniper-bot protection for token launches.

-

Latest Updates: Meteora introduced the innovative "Liquidity Ratio Slider," simplifying how users adjust their asset allocations. The LP Army community showed increasing diversity, attracting global participants across languages and regions, and partnered with Starseed. Through regular LP Army calls and Office Hours, the team continues strengthening user engagement—highlighting Meteora’s commitment to innovation and global expansion in DeFi.

Silo Finance (SILO): (Rating: ⭐️⭐️)

Launched S-ETH and S-USDC to enhance user yields

-

Project Overview: Silo Finance is a permissionless, decentralized lending protocol that addresses security flaws in shared liquidity pools by isolating each borrowing market, thereby enhancing safety and efficiency.

-

Latest Updates: Silo Finance launched two key markets—S-ETH and S-USDC—providing diverse options for users. The S-USDC market offers up to 5,425% APY, while stS/S silo delivers a stable 7.9% return. The project formed a strategic partnership with Solv Protocol and became the second-largest protocol on Sonic Labs, controlling 20% of Sonic’s USDC supply and 10% of stS. Leveraging Sonic’s points system and diversified yield strategies, Silo Finance successfully attracted user participation this week.

Aura (AURA): (Rating: ⭐️⭐️)

Launched StableSurge with innovative depeg protection; capital efficiency soars to 1:1.58

-

Project Overview: Aura Network is an NFT-centric Layer 1 blockchain aiming to accelerate global NFT adoption. It provides an open, interoperable system designed to integrate NFTs into metaverse infrastructure layers.

-

Latest Updates: Aura partnered with Balancer to launch the StableSurge Hook mechanism—an innovative solution using price-increase taxes to prevent depeg risks while boosting LP returns during volatility. The platform will soon introduce Balancer v3 Boosted Pools, enabling multi-dimensional rewards from trading, lending, and T-Bills. Additionally, Aura collaborated with GnosisChain, offering up to 5% cashback in GNO. Governance efficiency is notable: every $1 in incentives generates $1.58 in output. Over $300,000 in rewards were distributed to vlAURA voters in recent cycles—demonstrating strong operational execution and continuous innovation in DeFi.

Pell Network (PELL): (Rating: ⭐️⭐️⭐️)

Expanding full-chain BTC restaking infrastructure

-

Project Overview: Pell Network aims to build a decentralized tokenized security leasing platform for the Bitcoin ecosystem. By aggregating native BTC staking and LSD restaking services, it allows stakeholders to validate new software modules built on its ecosystem.

-

Latest Updates: Pell Network advanced its token utility and integrated EGLD restaking protocols this week. It launched an omnichain Bitcoin restaking network in collaboration with SovereignChains and entered an exclusive partnership with Hatom Protocol to provide algorithmic lending solutions for the MultiversX ecosystem. Strategic alliances with Atlas_Nodes and P2Pvalidator further strengthen Bitcoin restaking efforts. Pell Network is also preparing for an upcoming IDO on xLaunchpad.

In summary, the fastest-growing TVL projects this week were primarily concentrated in leveraged yield ("gunpool") protocols.

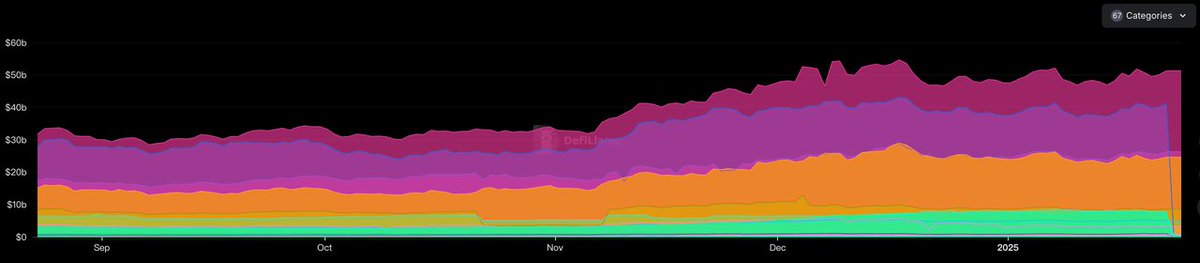

Sector-Wide Performance

-

Increasing Liquidity: APYs across DeFi protocols rose significantly due to appreciation in base assets and widespread point-incentive programs. For long-term believers in crypto, returning to DeFi presents a compelling opportunity.

-

Funding Trends: DeFi TVL increased from $53.5 billion last week to $53.8 billion—an uptick of 0.56%. This marks two consecutive weeks of positive growth across DeFi subsectors. Investor optimism around U.S. crypto policy developments in Q1 has driven capital inflows into DeFi. Higher APYs have further attracted on-chain activity, fueling TVL expansion.

Performance in Other Sectors

Layer 1 Blockchains

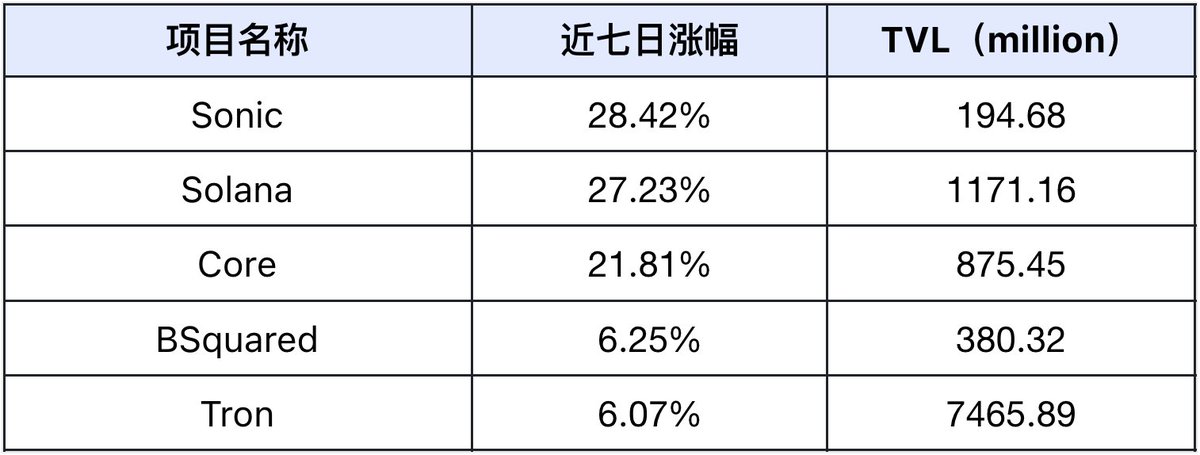

Top 5 Layer 1 blockchains by TVL growth over the past week (excluding smaller chains). Data source: DefiLlama

Sonic: Sonic’s dual exchange listing ignites ecosystem momentum—integrates Chainlink cross-chain capabilities, launches $250K DeFAI hackathon to boost AI agent development

This week, Sonic successfully integrated Chainlink’s cross-chain and data feed functionalities and partnered with Orderly Network to enhance cross-chain liquidity. Its native token $S began trading on OKX and Binance, bringing substantial visibility. Sonic also launched a $250,000 prize pool DeFAI hackathon to encourage developers to build AI agent applications. Further, Sonic collaborated with KuCoin, OKX, and TrustWallet to support token migration and maintained community engagement through AMAs and outreach initiatives.

Solana: Trump couple’s surprise entry sparks meme frenzy—on-chain stablecoin supply breaks $10B record

Solana focused heavily on expanding its stablecoin ecosystem this week, reaching a record $10.138 billion in on-chain stablecoin supply. Through a partnership with E Money Network, users can now spend Solana-based stablecoins and earn rewards at over 150 merchants globally. Multicoin Capital released a research report highlighting Solana’s technical advantages in capital markets—particularly low latency and tight spreads. In ecosystem growth, Solana added Indie.fun as a dedicated fundraising platform for gaming projects. Most notably, Donald and Melania Trump launched their official meme coins TRUMP and MELANIA on Solana, driving massive traffic and capital inflows.

Core: Core advances BTC consumer chain strategy—teams up with SumerMoney for lending, innovates rewards via Coretoshi NFTs

This week, Core pursued a three-pronged strategy: First, deepened its partnership with SumerMoney to strengthen lending capabilities. Second, enhanced the Sparks reward system through Coretoshi NFTs, continuing to attract BTC deposits and solidify its position as a BTC consumer chain. Third, boosted marketing outreach by planning a DAO Gallery event in Tokyo and launching the Core Ignition campaign to increase user participation and platform activity.

BSquared: B² Network collaborates with 0G_labs to build decentralized AI OS, advancing BTC-native AI agent ecosystem

B² Network focused on AI ecosystem development this week: partnering with 0G_labs and Gaianet_AI to co-develop a decentralized AI operating system; collaborating with ElizaOS_ai and ai16zdao to deepen integration between Bitcoin and AI agents; and launching the Lightning Genesis airdrop with utxostack—showcasing dynamic progress across AI infrastructure, application development, and community building.

Tron: After Justin Sun becomes Trump family crypto advisor, Tron makes high-profile appearances at Washington power events

Following Tron founder Justin Sun’s appointment as an advisor to the Trump family’s World Liberty Financial crypto project, Tron participated in several high-level events in Washington D.C. this week—including Crypto Ball, President's Reception, and Candlelight Dinner. These engagements enabled direct dialogue with policymakers and industry leaders, promoting compliant crypto adoption and broader blockchain integration.

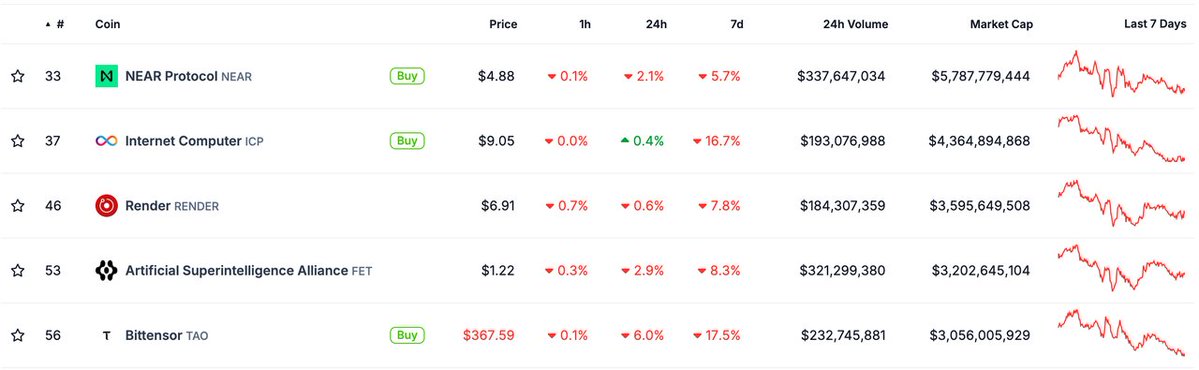

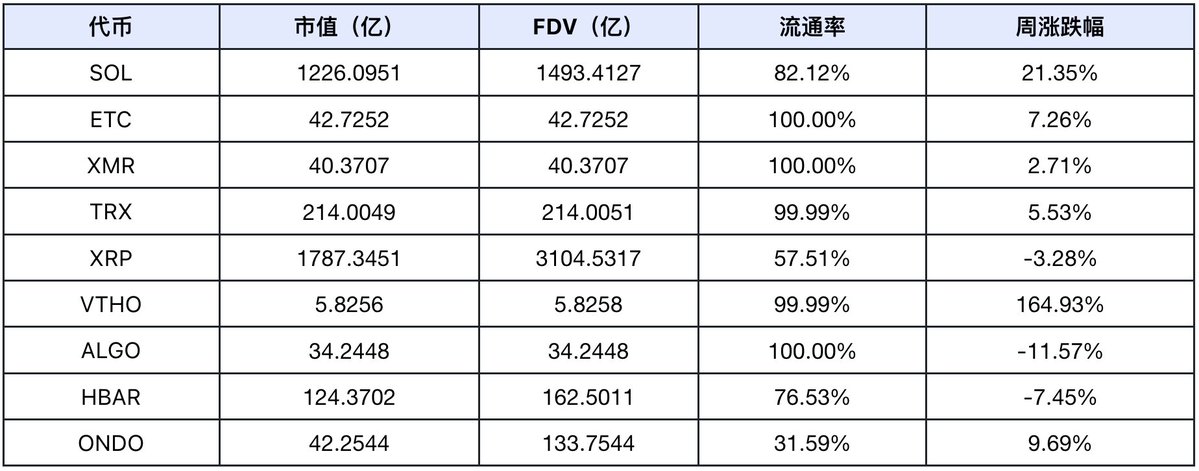

Top Gainers Overview

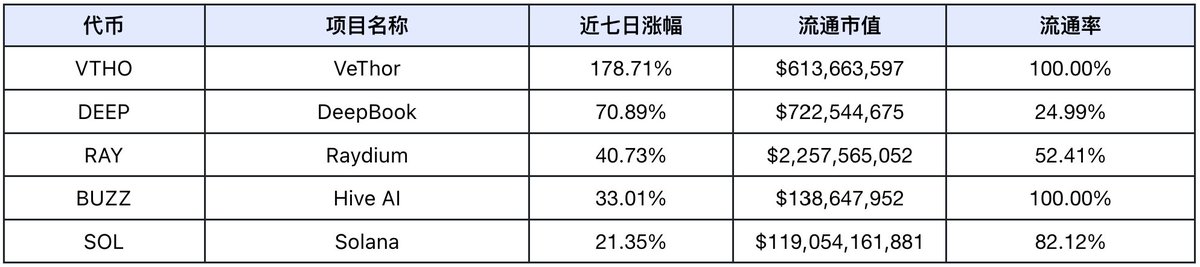

Top 5 performing tokens over the past week (excluding low-volume and meme coins). Data source: CoinMarketCap

VTHO: VeThor rolls out B3TR protocol upgrade for enhanced security; deepens UFC partnership to expand NFT ecosystem

This week, VeThor advanced critical protocol upgrades, introducing the B3TR feature to strengthen platform security and real-world utility. Through ongoing collaboration with UFC and support for innovative NFT projects, VeThor demonstrated strong ecosystem vitality. It also optimized staking and reward distribution mechanisms to improve user experience and actual yields. Furthermore, VeThor expanded its sustainability initiatives through a partnership with Mugshot—reflecting a balanced strategy between technological innovation and practical application.

DEEP: DeepBook V3 hits new daily volume record of $52.6M, low fees reinforce Sui DeFi infrastructure leadership

DeepBook achieved a milestone this week with $52.6 million in 24-hour trading volume post-V3 launch—validating its mature architecture and central role in DeFi. By emphasizing ultra-low fees and its brand message “I am the pulse of DeFi,” DeepBook further cemented its status as a core DeFi infrastructure component within the Sui ecosystem. With enhanced UX and reliable technical support, DeepBook is making tangible strides in decentralized trading.

RAY: Raydium capitalizes on Trump-meme trend with 10x leverage contracts, distributes $200K in USDS incentives

With the Solana ecosystem surging this week, Raydium—Solana’s leading DEX—received a major boost. It launched 10x leveraged perpetual contracts for $MELANIA and $TRUMP, expanding its Perps product line. The USDS rewards program was extended: weekly incentives include 50,000 USDS + 750 RAY for SOL-USDS Vault, 100 RAY for SOL-USDS 0.03% pool, and 150,000 USDS for USDS-USDC Vault. These measures effectively attracted users and boosted platform liquidity.

BUZZ: Hive AI upgrades Swarm architecture for multi-agent coordination; Market Agent intelligently tracks top traders

Hive AI implemented an innovative Swarm distributed architecture this week, enabling collaborative workflows among multiple agents and significantly improving system efficiency. The Token Analysis Agent upgraded charting tools and token data UI, and launched an experimental portfolio dashboard. Enhanced support for Raydium’s liquidity management and integration with additional protocols enable more comprehensive portfolio analysis and yield discovery. Notably, the Market Agent now provides intelligent tracking of top traders’ behavior—highlighting Hive AI’s unique edge in crypto data processing and smart analytics.

SOL: Trump couple’s Solana debut triggers meme boom—stablecoin supply exceeds $10B

Solana received a major tailwind this week from the launch of TRUMP and MELANIA—official meme coins issued by Donald and Melania Trump on Solana—driving substantial traffic and capital inflows. On-chain stablecoin supply hit a record $10.138 billion. Through collaboration with E Money Network, Solana stablecoins are now usable for payments and rewards at over 150 global merchants. Multicoin Capital published a research report underscoring Solana’s low-latency and tight-spread advantages in capital markets. Additionally, Solana welcomed Indie.fun as a dedicated community funding platform for gaming projects.

Meme Coin Top Gainers

Data source:

The market remained highly volatile this week. Following the launch of TRUMP and MELANIA on Solana, most capital and attention shifted toward these two tokens, causing sharp declines in many other cryptocurrencies—especially rival meme coins.

Social Media Hotspots

Data compiled from LunarCrush’s daily top 5 gainers and Scopechat’s AI score rankings for the week (Jan 18–24):

The most frequently mentioned theme was L1s. Listed tokens (excluding low-volume and meme coins) are shown below:

Data source: LunarCrush and Scopechat

TRUMP token triggered market volatility and capital分流; Layer 1 projects stabilized first thanks to high DeFi yields

Data shows Layer 1 projects dominated social media attention this week. The market saw broad volatility. Last weekend, Trump’s launch of the TRUMP token on Solana rapidly drained liquidity from other areas, pulling active funds onto Solana and triggering declines across sectors. On Monday, Trump’s inauguration did not mention crypto in his speeches or early executive orders. Though he signed a crypto executive order and the SEC repealed SAB-121 on Thursday, sentiment remained unimpressed. Consequently, most projects posted losses. However, after initial dips, Layer 1 projects recovered due to optimistic outlooks and rising DeFi APYs, which attracted renewed on-chain participation. Since most DeFi positions use native Layer 1 tokens, capital and attention flowed back into major blockchain ecosystems.

Sector-Wide Performance Overview

Data source: SoSoValue

By weekly return rate, the DeFi sector performed best, while GameFi ranked last.

-

DeFi Sector: The DeFi space hosts numerous projects. In SoSoValue’s sample, LINK, UNI, and AAVE accounted for 43.36%, 18.11%, and 13.07% respectively—totaling 74.54%. This week, LINK, UNI, and AAVE rose 11.42%, 2.13%, and 7.86% respectively, driving DeFi to lead all sectors in performance. Heightened price volatility created numerous arbitrage opportunities, contributing to DeFi’s strong showing.

-

GameFi Sector: GameFi has remained out of favor throughout this cycle, receiving little capital or traffic. Without the previous wealth-generation appeal, interest continues to wane. IMX, BEAM, GALA, SAND, and AXS collectively represent 71.99% of the sector but all posted significant declines this week, dragging down GameFi’s overall performance.

Upcoming Crypto Events Next Week

-

Thursday (Jan 30): Fed FOMC interest rate decision; U.S. weekly jobless claims (week ending Jan 25); Fed interest rate decision (upper bound); Plan B Forum El Salvador 2025; Ethereum Zurich 2025; Tesla Q4 and full-year 2024 earnings report

-

Friday (Jan 31): U.S. December core PCE price index YoY; OneKey Card announces full service shutdown

Next Week Outlook

-

Macro Analysis

Next week features several major financial events: the Fed FOMC meeting, the U.S. December core PCE inflation data, and the start of corporate earnings season. Markets have already priced in a hold on interest rates at the January meeting. However, the core PCE figure—one of the Fed’s key metrics—could influence expectations for future policy decisions. Additionally, earnings reports from major U.S. tech companies, especially the “Magnificent Seven,” may cause short-term market fluctuations. Overall, the market is likely to remain range-bound and volatile.

-

Sector Rotation Trends

Despite recent volatility and weak sentiment, investors broadly expect a broad market rally starting in February as crypto regulations become clearer. Most holders are reluctant to sell and instead seek higher yields through leveraged yield protocols (“gunpools”) to maximize returns on existing holdings.

AI Sector: While AI agent narratives haven’t sustained consistent momentum—market cap dipped to $15 billion, down ~5.66% this week—the sector rebounded temporarily on news of Trump’s proposed $500 billion AI infrastructure plan. However, the rally faded quickly, reflecting poor overall sentiment and investor caution amid uncertainty about upcoming crypto policies. Nevertheless, given strong government backing over the next four years, the AI sector retains significant long-term potential. Market research suggests that by end-2025, 90% of on-chain transactions will be executed by AI agents rather than humans. The transition into an AI-powered crypto era appears inevitable.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News