Don't Let Emotions Ruin Your Trading: A Psychological Guide from an Experienced Trader

TechFlow Selected TechFlow Selected

Don't Let Emotions Ruin Your Trading: A Psychological Guide from an Experienced Trader

The key to success lies not in high intelligence, but in psychological factors such as patience, perseverance, discipline, and a healthy mental state.

Author: Route 2 FI

Translation: TechFlow

Trading psychology reveals the hidden mental games behind successful cryptocurrency trading. As a trader, your mind can be either your most powerful weapon or your biggest obstacle.

Personal biases such as confirmation bias and overconfidence often subtly influence your financial decisions without you even realizing it.

The most successful traders aren't necessarily the smartest people, but rather those who understand their own psychological patterns, manage their emotions, and make rational decisions under pressure.

By understanding the brain's natural response mechanisms, you can cultivate discipline, manage risk more effectively, and free your trading from emotional ups and downs—making it more rational and strategic.

Let’s dive in, friends!

How to Avoid Psychological Traps in Crypto Trading

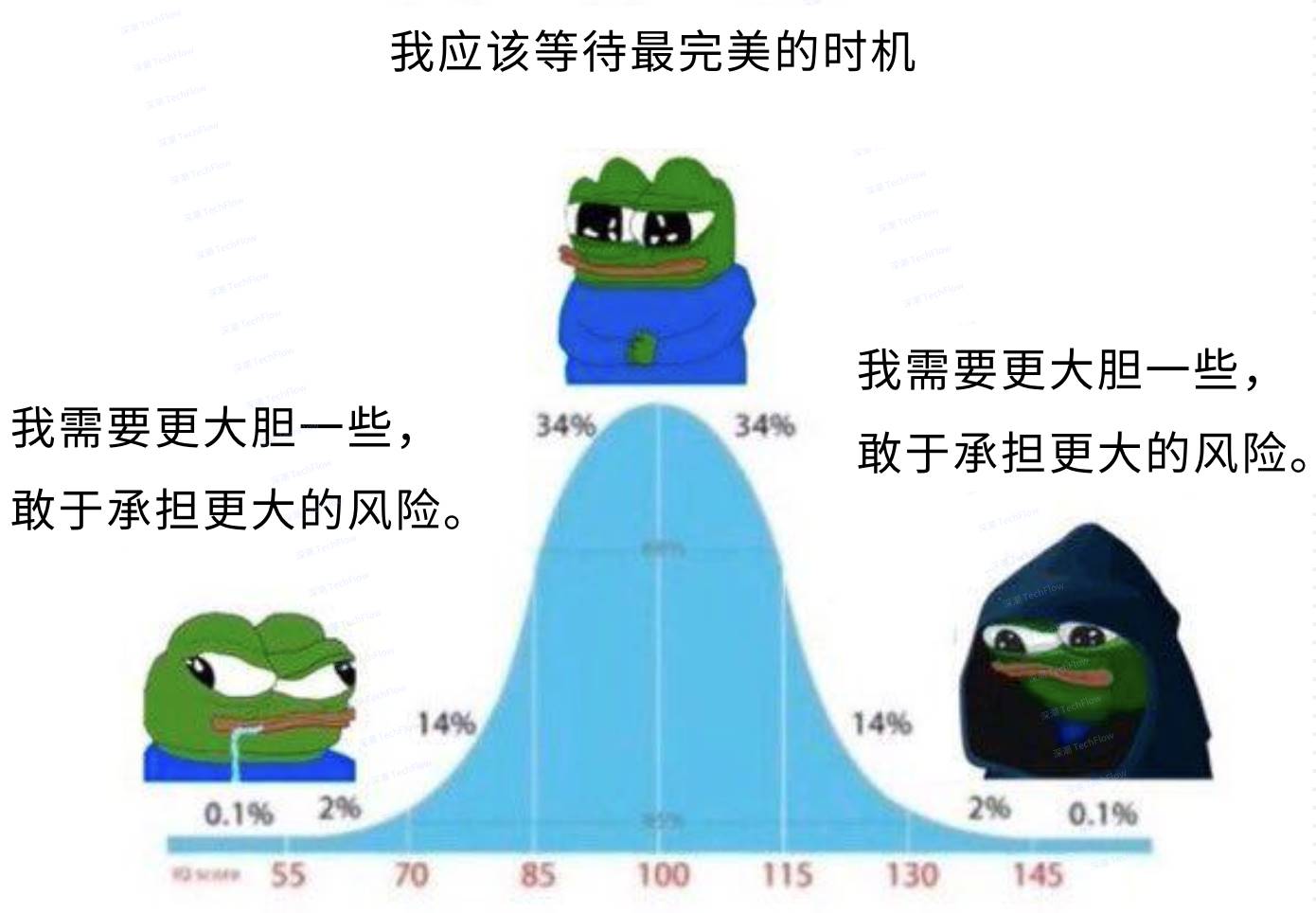

On the IQ bell curve, which Pepe do you think you are?

Trading psychology examines how traders collectively respond to market events and other influencing factors. A trader’s psychological state almost entirely determines their trading decisions and long-term career trajectory.

You may already know that success doesn’t hinge on high intelligence, but rather on psychological factors like patience, perseverance, discipline, and sound mental health.

Faced with the same market conditions, different traders may react completely differently. For example, when $BTC drops sharply, some panic-sell while others seize the opportunity to buy, confident prices will rebound. Based on these behavioral patterns, traders fall into several psychological types:

-

Impulsive Traders: These traders typically lack detailed plans and make rapid decisions, often ignoring consequences. They’re easily influenced by emotions, which can lead to significant losses.

-

Cautious Traders: Cautious traders conduct thorough analysis of market conditions and their financial capacity before acting. They usually have stable emotions and strong self-management skills. However, they can sometimes be overly conservative, missing profitable opportunities that require risk-taking.

-

Practical Traders: Practical traders represent a blend of risk-takers and cautious traders. They understand risk management and trade with confidence. This is the ideal trader type—neither over-analyzing nor impulsive, capable of scientifically assessing whether a trade has positive expected value (+EV, Expected Value).

You’ve likely already identified which type you belong to, and can reflect on how this psychological profile correlates with your trading outcomes.

Undoubtedly, trading psychology is a core component of trading success.

Trading Biases

Trading biases refer to cognitive errors that traders may exhibit during decision-making, significantly impacting their performance in financial markets.

Below is a detailed breakdown of common trading biases:

Confirmation Bias

Confirmation bias occurs when traders seek information that supports their existing positions or market views while disregarding contradictory evidence. This mindset can lead to poor decisions and even overtrading.

For example: Suppose you hold a large amount of $ETH. You might habitually browse Crypto Twitter (CT) looking for content confirming Ethereum as a solid long-term asset, rather than researching why ETH might not be the best choice. Instead, you're drawn to tweets that reinforce your current belief.

Availability Bias

Availability bias in crypto trading manifests when investors base decisions on easily accessible or recently encountered information instead of conducting comprehensive analysis.

A classic case is when a cryptocurrency gains popularity on social media due to celebrity endorsements or viral memes, leading traders to overestimate its potential and buy heavily—even if the coin lacks technical foundation or real-world use cases.

This bias can result in poor investment decisions, as readily available information often fails to accurately reflect an asset’s true value or long-term prospects.

Another example is traders overreacting to recent market events. If Bitcoin’s price suddenly surges, availability bias might lead investors to believe such rapid gains are normal, prompting overly optimistic trades. This behavior often results in chasing short-term trends while neglecting more stable, long-term strategies.

Anchoring Bias

Anchoring bias refers to traders becoming overly fixated on a specific price or number, preventing them from adapting to changing market conditions.

A typical example: An investor buys Bitcoin at its peak market price of $100,000. Even as the market price plummets, they remain emotionally attached to that "$100,000 anchor." This mindset leads to several problems:

-

They continue holding despite signals indicating they should sell, hoping the price returns to $100,000.

-

They ignore new market data or analyses that contradict their anchored price point.

This bias can cause severe financial losses, as traders fail to adjust strategies in time, missing both stop-loss opportunities and chances to buy low.

Another common form of anchoring bias is fixation on net worth. As a trader, you check your PnL daily. Suppose your total crypto holdings drop from $100,000 to $80,000—you may become anxious about the lost $20,000, feeling it's extremely difficult to recover. This mindset can make you overly conservative, causing you to avoid good investment opportunities out of fear of further losses.

Loss Aversion Bias

Loss aversion bias describes how the psychological pain of losing feels stronger than the joy of gaining. This tendency often causes traders to hold losing positions too long or exit winning trades prematurely.

In crypto trading, consider this scenario: A trader buys Bitcoin at $100,000, expecting prices to rise. When the price drops to $80,000, they refuse to sell and cut losses, hoping it rebounds to their entry point. This reluctance stems from avoiding the psychological pain of "realizing a loss," even though market indicators suggest further declines.

Another example: A trader sells a coin after a 10% gain out of fear of giving back profits, yet hesitates to sell another coin down 20%, hoping it recovers. This illustrates how sensitivity to loss far exceeds sensitivity to gain.

In the highly volatile crypto market, loss aversion bias can lead to:

-

Holding underperforming assets longer, increasing loss risk

-

Mising out on better profit opportunities elsewhere

-

Greater emotional stress, leading to irrational decisions

Personal Experience Sharing

To be honest, loss aversion is a classic psychological trap I encounter almost every day. For instance: Recently, I was shorting weak altcoins. Let’s say I initially made $10,000 in profit, but then the price slightly rebounded, reducing my gain to $5,000. At this point, I often fall into a mental trap—I refuse to close the trade at $5,000 unless I can regain $10,000 or more. Even though both outcomes are profitable, I still feel like I “lost” $5,000 because I once had $10,000. This makes it hard to accept reduced profits—a feeling I believe many can relate to.

Overconfidence Bias

Overconfidence bias occurs when traders overestimate their knowledge and abilities, believing they can accurately predict market movements. This mindset often leads to excessive risk-taking and frequent trading.

A classic example happened during Bitcoin’s 2021 bull run. Many traders, overly confident in their predictive abilities, used high leverage, convinced Bitcoin’s price would keep rising.

When Bitcoin broke $60,000 in early 2021, many investors got caught up in the upward momentum, certain prices would continue climbing. They ignored the possibility of a market correction.

Yet when the market eventually corrected and Bitcoin fell below $30,000 months later, these overconfident traders suffered major losses. This case shows how overconfidence leads traders to overlook risks and pay a heavy price.

Fear and Greed

Fear and greed are two dominant emotions in trading. Fear may cause traders to exit positions prematurely to avoid losses, while greed may lead them to hold too long chasing higher profits.

For example, when markets fluctuate, fear may prompt traders to close positions early, missing further upside. Conversely, greed may blind them to risks, ultimately resulting in losses.

These emotions are especially prevalent in crypto markets, where traders must remain vigilant to avoid emotional decision-making.

Recency Bias

Recency bias occurs when traders give disproportionate weight to recent events or information, overlooking long-term trends or historical data.

For example, when $ETH experiences a sharp drop, traders may assume the downtrend will persist and rush to sell—only to miss the subsequent market rebound.

This phenomenon is particularly visible on Crypto Twitter (CT). After several days of market decline, many CT users declare the bull run over and advise selling. Yet markets often recover shortly afterward, proving these short-term judgments wrong.

Herding Bias

Herding bias refers to traders following the crowd rather than making independent decisions based on their own analysis. This behavior is extremely common in crypto markets, especially under social media influence.

A notable example is Ethereum’s price movement between 2020 and 2021. During this period, ETH surged from around $130 in early 2020 to a record high of $4,859 in November 2021—an increase of 3,756%.

This surge was largely driven by herd mentality. As more investors poured in, prices rose further, creating a positive feedback loop. However, such herd behavior also contributed to a market bubble; once the trend reversed, investors faced massive losses.

This dramatic rise was fueled by several key factors illustrating herding dynamics:

-

FOMO (Fear of Missing Out): As Ethereum’s price climbed steadily in 2020–2021, growing numbers of investors rushed in fearing they’d miss out. This sentiment was amplified by social media and market chatter, driving more people to buy the rally.

-

Market Sentiment: The overall bullish sentiment in the crypto market played a major role. Bitcoin’s strong performance and increased institutional adoption boosted investor confidence, which spilled over into Ethereum.

-

Technological Progress: Ethereum’s planned transition to Ethereum 2.0 and the implementation of EIP-1559 in August 2021—which introduced fee burning to reduce ETH inflation—sparked new optimism. These upgrades were seen as critical milestones for Ethereum’s long-term growth, attracting more investors.

-

DeFi Boom: As the core platform for decentralized finance (DeFi) applications, demand for and usage of the Ethereum network grew significantly. DeFi’s expansion not only increased network activity but also solidified Ethereum’s leadership in the blockchain industry.

-

Institutional Interest: As institutions increasingly embraced cryptocurrencies, Ethereum gained greater attention. For example, the launch of Ethereum futures by the Chicago Mercantile Exchange (CME) in February 2021 added credibility and attracted participants from traditional finance.

Notably, after peaking at $4,859 in November 2021, Ethereum dropped sharply in 2022, falling to around $900 by June. This correction caught many off guard and serves as a reminder of the risks of herding behavior: Blindly following the crowd can lead to serious losses when market sentiment shifts.

Framing Effect

The framing effect refers to how the presentation of information influences decisions—even when the underlying facts are identical. For traders, positive or negative phrasing can trigger vastly different market reactions.

Take Solana as an example. Consider these two headlines describing the same 10% price increase:

-

"Solana rises 10% in the past 24 hours, showcasing strong ecosystem growth."

-

"Solana up 10%, but still far from previous all-time highs."

Both describe the same 10% gain. However, the first headline emphasizes growth and ecosystem strength, potentially inspiring investor optimism and encouraging buying or holding. The second focuses on failing to reach prior highs, possibly causing disappointment or caution, prompting some to sell.

This framing effect is especially powerful in crypto markets. Traders are often swayed by headlines and tone, neglecting objective analysis. Some investors may see the first headline as a bullish signal and increase exposure, while the same gain framed negatively might make them hesitate or exit—despite identical fundamentals.

Illusion of Control

The illusion of control is the mistaken belief that one can influence random or uncontrollable outcomes. In trading, this cognitive bias leads to overconfidence and unnecessary risk-taking.

For example, a trader might spend hours analyzing Fartcoin’s price patterns and believe they’ve discovered a reliable timing strategy. Confident in their analysis, they allocate a large portion of their portfolio to Fartcoin. Yet, actual market movements are typically driven by broader macroeconomic forces or random events—not individual analysis.

This illusion is especially common during bull markets. When the overall crypto market rises, most coins go up together. Traders often misattribute this broad rally to their own skill. They might think: "I knew this altcoin would jump 30% today thanks to my technical analysis," when in reality, the move was simply part of a general market uptrend.

The danger lies in ignoring market randomness and risk, placing undue faith in personal judgment—leading to substantial losses. Traders must remember: markets are complex and uncontrollable. Success depends more on risk management than on the illusion of control.

Clustering Illusion

The clustering illusion is the tendency to perceive meaningful patterns in random data. In crypto trading, this bias can lead to flawed investment decisions based on short-term fluctuations.

For example, a high-risk speculator notices a coin’s price rising for five consecutive days. Assuming a bullish trend is forming, they decide to go all-in. But those five green days could simply be random noise with no predictive value.

This clearly demonstrates the clustering illusion:

-

The trader identifies a supposed "pattern" in a small dataset (five days of price changes).

-

They assign excessive meaning to it, ignoring broader market context or long-term data.

-

They base investment decisions on the assumption that the short-term pattern will continue, overlooking the fact that volatility may be purely random.

In crypto markets, price movements are influenced by numerous factors—macroeconomic conditions, policy changes, sentiment—and mistaking random swings for real trends leads to irrational decisions. This bias is common among traders. While analysis requires data, overinterpreting short-term noise can backfire.

Negativity Bias

Negativity bias is the tendency to focus more on negative information while underweighting positive news. In trading, this can cause missed opportunities or excessive caution.

For instance, a trader has been consistently profitable for months but suffers a major loss due to a regulatory scare and market crash. Despite an overall strong track record, this single negative event dominates their mindset. As a result, they may:

-

Grow overly cautious, missing profitable opportunities even as conditions improve.

-

Stay hyper-vigilant about similar negative events, exiting positions too early or setting overly tight stop-losses.

-

Ignore positive signals or news, focusing only on risks and threats.

This bias not only affects short-term choices but can also make long-term investing overly conservative. For example, after selling a bullish asset, some traders develop FUD (fear, uncertainty, doubt), hoping it won’t keep rising—to avoid regret. Negativity bias reminds us that trading isn’t just about numbers and strategies; it’s a psychological battle. Traders must balance risk and opportunity assessments, avoiding the trap of overemphasizing negatives and missing potential gains.

Self-Attribution Bias

Self-attribution bias occurs when traders credit successes to their own skill and judgment but blame failures on external factors. This cognitive distortion hinders learning and improvement.

For example, a trader buys Bitcoin at $80,000 and sells at $105,000, booking a handsome profit. They attribute this win to superior market analysis and trading acumen. But when the same trader buys Ethereum at $3,500 and the price drops to $3,000, they blame market manipulation, unexpected regulations, or whale dumping—anything but their own mistake.

The danger here is that traders ignore the real causes of failure—market randomness or flawed decision-making—and selectively excuse themselves, preventing strategy refinement.

This phenomenon is widespread in crypto, especially on social media, where we see such examples daily.

Hindsight Bias

Hindsight bias is the tendency, after an event occurs, to believe it was predictable. This distorts perception and may lead to overconfidence in future predictions, ignoring market complexity and uncertainty.

For example, a trader buys Solana at $200 in early January 2025 and sells at $250 by mid-January. Looking back, they might say: "I knew Solana would go up 25%. Market sentiment was strong, and technical indicators were bullish—it was obvious."

But this ignores key realities:

-

The trader overestimates their ability to forecast Solana’s movement and underestimates market randomness.

-

Crypto markets—especially altcoins—are highly volatile; short-term moves depend on countless unpredictable factors.

-

The price rise may have resulted from overall market conditions or news events, not personal insight.

The danger of hindsight bias is that it breeds overconfidence. Traders may ignore risks or contrary signals, concentrate excessively on few assets, and fail to diversify properly.

Trading Issues I've Personally Experienced

Random Reinforcement

Random reinforcement is a psychological phenomenon where people strengthen behaviors or beliefs due to random wins or losses. In trading, this can distort self-perception and impair rational decision-making.

For example, novice traders may believe they’ve mastered the market after a few lucky wins, while experienced traders may doubt their skills after a string of losses—when both streaks may just be luck. Random reinforcement traps traders in cycles of overconfidence or self-doubt.

I frequently make this mistake: Suppose I start the day with a huge gain trading $TIA. It could be any asset, but if I begin with a big win, I often become overconfident and keep trading without clear logic.

My thinking goes: "Since I’ve already made so much, I can take bigger risks. Even if I lose, it doesn’t matter—I’m playing with 'free money' now."

But this mindset has clear flaws. It ignores market randomness and downplays risk management. Traders must recognize that overconfidence leads to reckless decisions, which often result in larger losses.

Fear of Missing Out (FOMO)

FOMO is an intense anxiety about missing out on opportunities. In trading, it’s often triggered by social media, news, or herd mentality, convincing people they must act immediately to capture big profits. But this emotion often leads to panic-driven trades, bypassing reason and discipline.

I feel this almost daily on Crypto Twitter (CT). There’s always some coin believed to be “going to the moon,” making it hard to stay calm.

One reader shared his experience:

“I haven’t taken a vacation since 2019 because I feel that if I leave for a week, the market will explode in my absence. I believe others feel the same, unable to fully enjoy life due to FOMO.”

This is sadly common. Even I feel similar anxiety—especially when I’m not fully invested or am sitting in cash during a bear market.

Note: FOMO often leads to buying high, selling low, or overtrading, harming investment returns. If you enter due to FOMO on a “green day” (a market rally), you may have no capital left when a real correction comes.

So if you must act on FOMO, consider doing so on a “red day” (during a dip)—at least you’ll buy cheaper. More importantly, learn to control emotions and avoid irrational decisions driven by short-term volatility.

Revenge Trading

Revenge trading is an extremely dangerous behavior that rarely recovers losses and often worsens financial damage.

Imagine you’ve had a smooth week, steadily building profits. Then, in one weekend trade, you lose all gains and even go into the red. In this situation, many traders develop a strong urge to “get back at the market” through quick trades.

Interestingly, this “revenge” is directed at the market itself. Traders may lose rationality, blindly jumping into shitcoin trades hoping to quickly recover—but end up making worse mistakes.

I define revenge trading as attempting to recoup losses through a series of impulsive, low-quality trades after a losing trade. This doesn’t solve anything—it often deepens losses.

Instead of rushing in, pause and reassess your strategy. High-quality setups take time, not impulse. After a loss, the best move is to stop trading and reflect. Analyze your trade history to identify what went wrong—this helps avoid repeating mistakes and improves your skills. Tools like CoinMarketMan and TradeStream offer detailed analytics to better understand your trading behavior.

If you find yourself stuck in a revenge-trading cycle, consider seeking professional help. An experienced mentor or coach can provide valuable guidance to build more rational and effective trading strategies.

Gambling Psychology

Gambling psychology is widespread in trading. Although trading should be a rational activity grounded in planning, discipline, and continuous learning, many treat it like gambling.

Traders with a gambling mindset often ignore the importance of systems and skip developing sound strategies. Instead, they rely on luck, driven by adrenaline and the fleeting thrill of winning. This is common among beginners and even some professionals chasing fast wealth.

The greatest danger of gambling psychology is that it traps traders in impulsive decisions. Without a thoughtful trading plan, inevitable losses follow. Over time, this can lead to emotional burnout, damaging both mental health and trading performance.

To overcome gambling tendencies, traders must recognize that trading is a long-term game. Success relies on systematic strategies, strict risk management, and continuous learning—not luck or impulse. Only by cultivating discipline and rational habits can sustainable profitability be achieved.

Herd Instinct

Herd instinct is a key psychological phenomenon, especially evident in trading. Driven by fear of failure, traders often follow the crowd instead of making independent decisions based on thorough analysis. This reliance on group behavior can trigger panic trades and irrational decisions, ultimately leading to losses.

Becoming a successful trader requires mastering your psychology. Staying calm, rational, and capable of independent thinking is essential throughout the trading process.

Here’s an example of herd instinct:

Suppose an influencer named Ansem tweets about a new coin. Upon release, the coin’s price spikes rapidly.

Soon, other influencers join the conversation, and market sentiment heats up. Feeling safe amid the crowd, you decide to follow suit. But if you’re not closely monitoring developments, you may get trapped at the top—because market sentiment can reverse quickly. This pattern repeats constantly in markets.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News