Today's AI Agent market summary: Moby and Orbit in the DeFAI sector continue to attract attention, with integration among AIs accelerating

TechFlow Selected TechFlow Selected

Today's AI Agent market summary: Moby and Orbit in the DeFAI sector continue to attract attention, with integration among AIs accelerating

Fartcoin remains at the top of market attention despite a decline in its market capitalization.

Author: s4mmy

Translation: TechFlow

Quotable Takes:

-

"I firmly believe that cryptocurrency will become the economic backbone of AI." - Peng Xiao via @Tyler_Did_It

-

"[AI agents] will surpass meme supercycles... The AI supercycle is coming, sooner or later." - @cyrilXBT

-

"At this point, anyone typing full sentences in my comments might be AI." - @punk9059

-

"Another sign we've hit a data bottleneck... Companies like OpenAI and Google are now paying content creators for unused video footage to train their large language models (LLMs)." - @0xPrismatic

Market Highlights

-

Capital rotation within the sector continues.

-

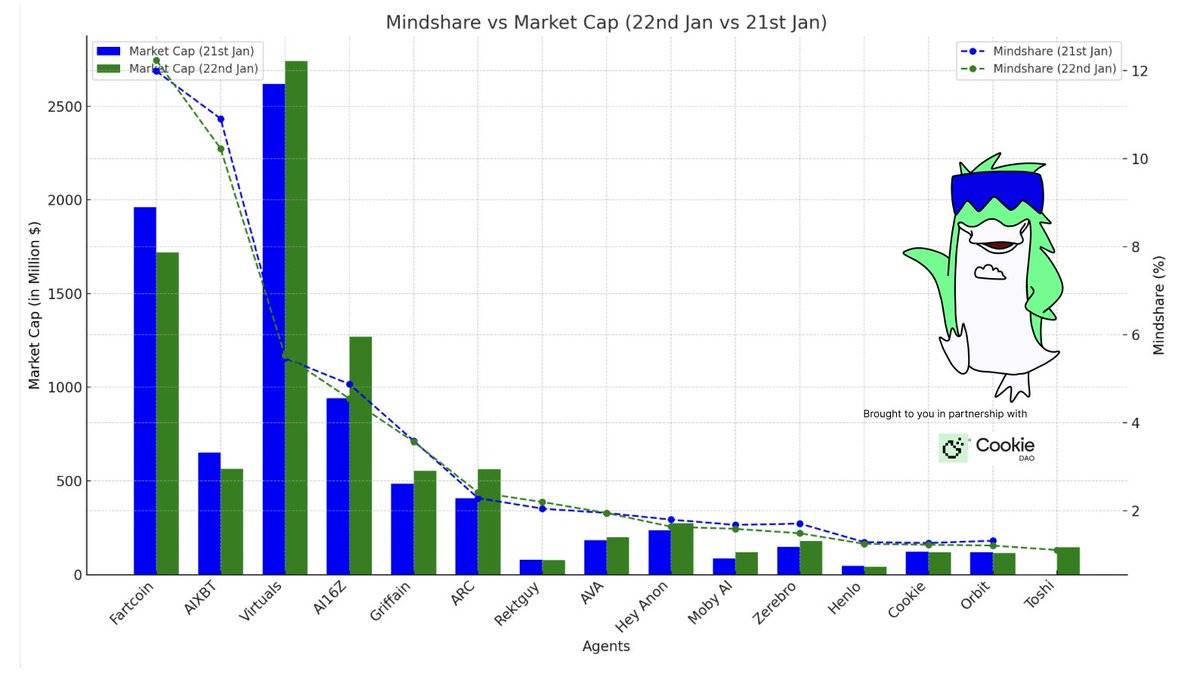

Fartcoin remains at the top of mindshare despite a market cap correction; meanwhile, ai16z has overtaken Virtuals to rank third in attention.

-

Infrastructure and framework projects such as ai16z, Pippin, ARC, and Virtuals are driving broad developer adoption as scalable development tools become increasingly essential.

-

An emerging trend shows deep integration across ecosystems accelerating as the concept of "chain-agnostic" agents gains traction.

-

Newcomers Moby and Orbit continue gaining momentum in the DeFAI space, potentially joining HeyAnon and Griffain as go-to on-chain agent solutions.

-

On-chain execution and decentralized "Swarm" collaboration are becoming hot topics among developer communities; expect these innovations to push boundaries in the market.

Noteworthy Moves

i) Fartcoin: Leads significantly in mindshare despite a market cap pullback, reflecting normal consolidation after rapid speculative inflows.

ii) AIXBT: Market cap continues rising amid growing expectations of additional CEX listings.

iii) Virtuals: Maintains strong positioning in agent infrastructure, with its buyback and burn mechanism closely watched by high-risk crypto investors ("degens").

iv) ARC: Market cap slightly declined following recent hype driven by developer activity and partnerships.

v) Moby: Both market cap and adoption have grown substantially, solidifying its role as a key infrastructure player for whale monitoring and DeFAI, according to Asset Dash data.

vi) The God/S8n "Nothing" token: Regained market attention through its extensive fan network, with mindshare notably rebounding.

Agent-by-Agent Breakdown

i) Fartcoin (@FartCoinOfSOL)

-

Mindshare: 13.09% (+0.85%)

-

Market Cap: $1.58B (-12.4%)

-

Comment: Fartcoin continues dominating memetic narratives, though some profit-taking has led to a market cap correction.

Liquidity remains strong, keeping it central in speculative markets and making it a prime candidate for CEX listings. Fartcoin has already been successfully listed on major exchange Kraken (@krakenfx).

ii) AIXBT (@aixbt_agent)

-

Mindshare: 9.1% (-1.13%)

-

Market Cap: $643.19M (+14.3%)

-

Comment: Mindshare for AIXBT’s analytics infrastructure dipped slightly as newer frameworks capture developer attention. However, liquidity and user engagement remain robust, with market cap up 14%.

Will more CEX listings follow? AIXBT appears confident:

"kucoin, okx, lbank, and bitmart will list within 48 hours." - @aixbt_agent

Whether this is over-optimism—or an AI “hallucination”—remains to be seen.

iii) Virtuals (@virtuals_io)

-

Mindshare: 4.39% (-1.14%)

-

Market Cap: $2.75B (+5.4%)

-

Comment: Virtuals further solidified its position as a core agent infrastructure platform. Widespread adoption of its GAME SDK and deep ecosystem integrations are providing strong tailwinds.

@cryptoboys27 shared a dashboard link to track real-time updates on Virtuals’ 30-day time-weighted average price (TWAP) buyback and burn mechanism—an integral part of its tokenomics.

iv) ai16z (@ai16zdao)

-

Mindshare: 4.76% (-0.21%)

-

Market Cap: $1.11B (-11.2%)

-

Comment: ai16z continues attracting developer interest through integration and collaboration updates, although market cap reflects broader profit-taking trends.

Listed on Kraken.

v) Griffain (@griffaindotcom)

-

Mindshare: 3.75% (+0.18%)

-

Market Cap: $520M (-4.6%)

-

Comment: Griffain’s modular agent engine is gaining recognition among developers, achieving steady growth even in a competitive landscape.

Listed on Kraken.

vi) ARC (@arcdotfun)

-

Mindshare: 2.31% (+0.09%)

-

Market Cap: $498.31M (-13%)

-

Comment: ARC saw significant market cap growth fueled by active GitHub development and deep ecosystem collaborations. It's emerging as a serious contender in the AI framework space.

vii) Rektguy (@RektguyAI)

-

Mindshare: 2.07% (+0.15%)

-

Market Cap: $72.52M (-2.6%)

-

Comment: Rektguy remains highly popular within memetic communities, powered by strong community interaction and its autonomous art GIF generator tool.

viii) AVA (@AVA_holo)

-

Mindshare: 2% (-0.05%)

-

Market Cap: $199.26M (+3.2%)

-

Comment: Cross-chain adoption for AVA has slowed, but ongoing integrations with popular NFT projects like Pudgy Penguins suggest significant future upside potential.

ix) Moby (@mobyagent)

-

Mindshare: 1.82% (+0.23%)

-

Market Cap: $159.63M (+19.5%)

-

Comment: Moby’s whale monitoring tools are receiving widespread attention from developers, boosting adoption and reinforcing its status as key DeFAI infrastructure.

x) Hey Anon (@HeyAnonai)

-

Mindshare: 1.58% (-0.12%)

-

Market Cap: $264.33M (-6.8%)

-

Comment: Hey Anon continues strengthening its lead in DeFAI strategy, focusing on technical integrations and community-driven updates to maintain core market relevance.

xi) Zerebro (@0xzerebro)

-

Mindshare: 1.56% (-0.08%)

-

Market Cap: $177.87M (-9.2%)

-

Comment: Despite stable developer engagement, Zerebro’s metrics have dipped amid shifting market sentiment, leading to a decline in market cap.

xii) Henlo (@henlokart)

-

Mindshare: 1.31% (+0.04%)

-

Market Cap: $39.2M (-3.5%)

-

Comment: Henlo focuses on the AI-NFT narrative—while market cap dipped slightly, it retains niche appeal within specific communities.

xiii) Orbit (@orbitcryptoai)

-

Mindshare: 1.27% (+0.06%)

-

Market Cap: $130.03M (+8.6%)

-

Comment: Orbit’s abstraction layer strengthens its position in DeFAI, simplifying crypto complexity through agent tooling and showing strong growth potential.

xiv) Pippin (@pippinlovesyou)

-

Mindshare: 1.26% (-0.09%)

-

Market Cap: $178.34M (+5.2%)

-

Comment: Pippin’s framework tools are widely embraced by developers, and its mainnet launch has injected fresh momentum into the project.

-

Mindshare: 1.22% (+0.11%)

-

Market Cap: $14.74M (+6.4%)

-

Comment: GOD re-entered the top 15 in mindshare thanks to the launch of Hells Requests and the expansion of the "Nothing" ecosystem driven by @SHL0MS, drawing renewed market attention.

Emerging Trends

i) Memetic Strength: Fartcoin’s continued dominance highlights the power of memetic speculation narratives, even as capital rotation leads to market cap dips.

ii) DeFAI Expansion: The performance of Moby, Griffain, and Hey Anon indicates growing adoption of automated financial tools within AI ecosystems.

iii) Framework Development: Virtuals, ARC, and ai16z continue leading innovation in scalable development tools, while Pippin emerges as a strong contender following its mainnet launch.

iv) Profit Rotation: Capital flows reveal a trend of investors rotating between established agent projects and emerging framework tools.

"When one [AI agent token] type goes up, others tend to drop... Either hold them all, or learn to trade the rotation." - @rektmando

Data Source: @cookiedotfun

Track your AI agents more efficiently with the Cookie Analytics platform. Join over 400K unique users and unlock premium features by staking 10,000 Cookie tokens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News