Can Ethereum Survive Its Midlife Crisis Amid Severe Wealth Effect Erosion?

TechFlow Selected TechFlow Selected

Can Ethereum Survive Its Midlife Crisis Amid Severe Wealth Effect Erosion?

Vitalik faces backlash, officially descending from the pedestal to become ordinary.

Author: 1912212.eth, Foresight News

Recently, Vitalik has once again been thrust into the center of community criticism. This isn't the first time Ethereum has faced such a crisis—since 2018, it's weathered no fewer than four or five similar storms. The immediate trigger this time was Trump choosing to launch his meme coin TRUMP on the Solana blockchain. The explosive price surge of this meme coin made overnight legends and early retirees out of those who seized the opportunity.

The exaggerated wealth effect left many regretful investors lamenting missed chances, bringing both Solana and meme coins back into the spotlight. FOMO even caused SOL shortages, leading Binance to temporarily suspend withdrawals. As TRUMP surged forward, SOL’s price skyrocketed to $295, hitting an all-time high. While markets were euphoric and both Bitcoin and SOL rallied strongly, Ethereum—the second-largest cryptocurrency by market cap—remained stagnant, prompting widespread frustration. What exactly is wrong with ETH? How did it fall so far that it now faces universal scorn?

New and Old Money No Longer Favor Ethereum

There was a time when Ethereum's grand vision of becoming a global computing layer captivated tech elites, financial giants, and industry leaders alike. But those days seem long gone. Bitcoin's status as digital gold remains rock solid, reinforced by spot ETF approvals, MicroStrategy's aggressive accumulation, and growing acceptance from government institutions. Despite its massive market cap, BTC has delivered over 6x returns since bottoming around $15,000—making it still the preferred asset for legacy wealth and institutional investors.

In contrast, Ethereum, though positioned differently from Bitcoin, has hovered stubbornly around $3,000 since last March. Its performance during the much-anticipated altcoin season has been deeply disappointing.

As of January 16, net inflows into Ethereum spot ETFs reached $2.66 billion. Yet this capital influx appears to have had little impact on supporting or boosting the token price. Price in financial markets reflects consensus; prolonged sideways movement erodes confidence and drains market sentiment entirely.

Meanwhile, Solana, with its low gas fees and booming meme-driven wealth creation, continues attracting new users eager to chase speculative opportunities. According to recent data from Circle’s official website, USDC issuance on Ethereum’s mainnet stands at $31.53 billion, while the emerging chain Solana has rapidly grown to $7.72 billion.

L2 Fragmentation Sparks Criticism

The debate between L2 and L1 began in the previous cycle and has intensified this cycle with the arrival of the “Four Heavenly Kings” among L2s. However, market sentiment increasingly leans toward L1.

Despite being designed for scalability, L2 chains face significant challenges regarding cross-chain bridging security, transaction speed, and overall user experience. While technically distinct, most users don’t perceive meaningful differences across chains.

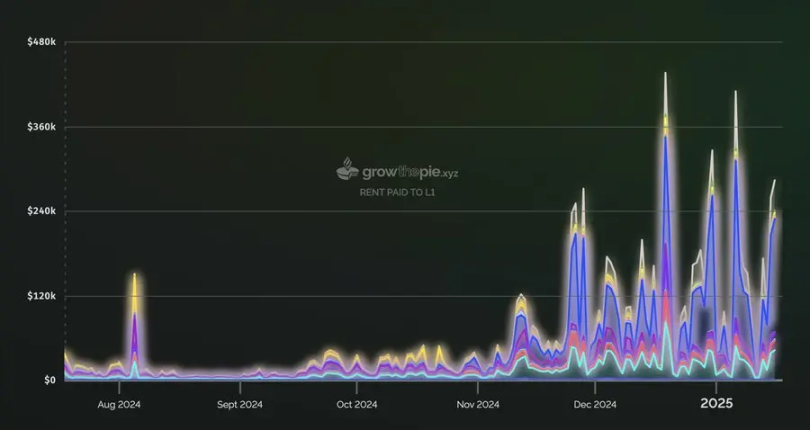

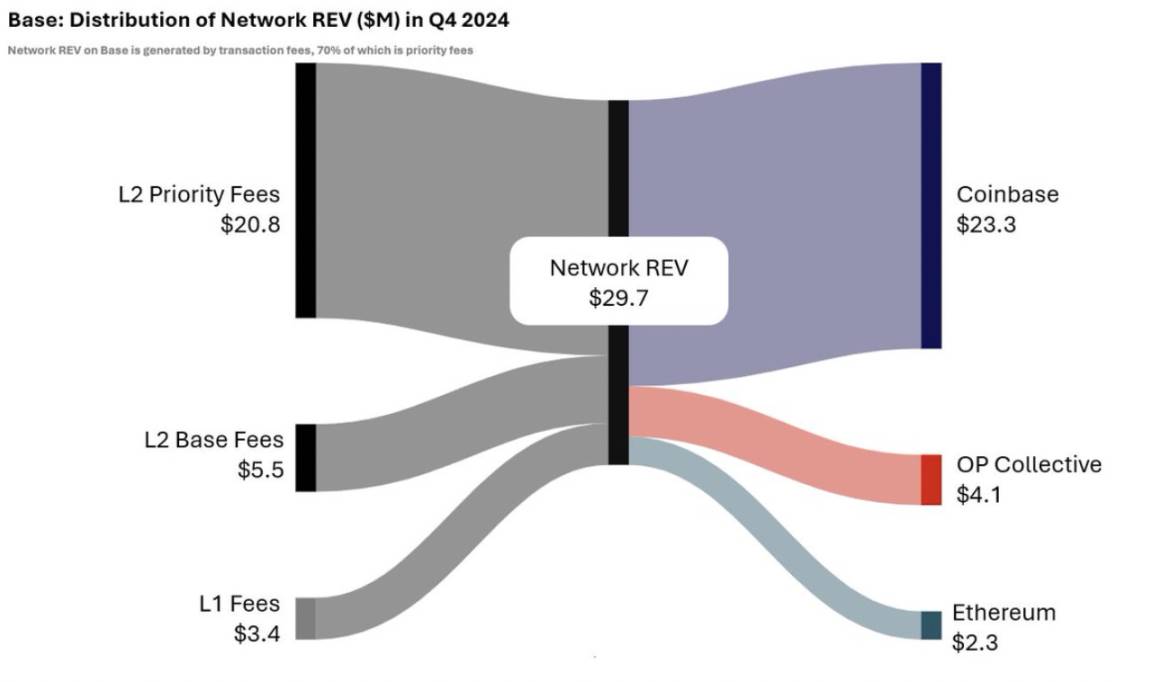

Some projects frequently shift between different L2s, further fragmenting liquidity and degrading user experience. Moreover, individual L2s have launched their own token economies without meaningfully feeding value back to Ethereum, weakening ETH’s appeal. Take Base, for example: most network fees go directly to Coinbase’s profits, with minimal funds flowing back to Ethereum’s mainnet. On an annualized basis, Coinbase earns nearly $100 million from Base alone.

Kain, founder of Synthetix and Infinex, stated: "If I were running the EF (Ethereum Foundation), I would absolutely pressure L2s to use sequencer revenue to burn ETH."

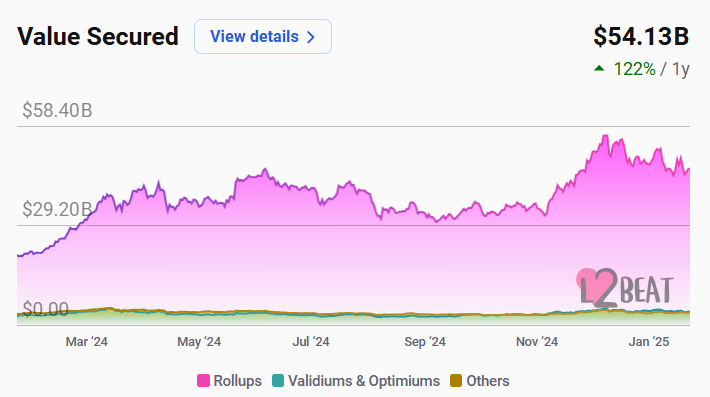

Since launching, most L2 tokens have underperformed. Although total TVL exceeds $54 billion, there has been no significant growth since March last year.

Now, L2 technology itself is hitting bottlenecks. With increasing numbers of L2s competing for limited blob storage space, costs are rising and user expenses are climbing. Even Pectra upgrades expanding blobs to six will only offer temporary relief—not a fundamental solution. Potential fixes include short-term Pectra upgrades, mid-term PeerDAS implementation, and long-term DA expansion.

Michael Egorov, Curve’s founder, commented: “It’s time to abandon the L2-centric roadmap and instead focus fully on scaling L1.” He bluntly added that L2s aren’t moats—they’re Band-Aids.

Ethereum’s current maximum TPS is about 90 transactions per second—nowhere near enough. As a financial settlement layer, Ethereum urgently needs to scale to handle vast volumes of high-frequency data processing. But doing so poses immense challenges: complex protocol-level adjustments like sharding and proof-of-stake must be implemented without compromising security or decentralization. Community consensus is also critical—any major upgrade requires broad support. Abruptly shifting focus from L2 to L1 could leave existing L2s in awkward positions, risking community fragmentation and conflict.

In the short term, whether Ethereum should scale via L2s or through mainnet upgrades remains unresolved.

DeFi and NFT Twin Engines Lose Steam

It’s well known that the last bull market was fueled by DeFi and NFTs, amplified by macroeconomic stimulus, creating an unprecedented crypto boom. As the base currency for DeFi applications, Ethereum benefited greatly from DeFi’s explosive growth, which boosted demand for ETH and elevated its profile, driving prices higher through positive flywheel effects.

NFTs also played a crucial role during the previous bull run. During the craze for pixelated NFT art, numerous platforms and branded NFTs were priced in ETH, requiring buyers to first acquire ETH. This significantly expanded ETH’s reach and influence, working alongside DeFi to paint a golden chapter for both the broader crypto market and Ethereum.

As a result, ETH delivered over 50x returns from its lows in the prior cycle.

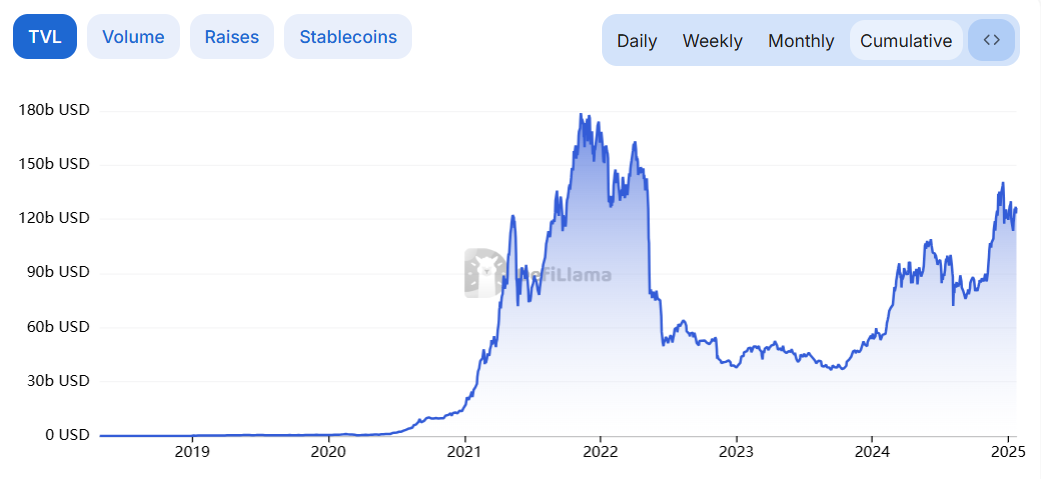

Fast-forward to this cycle, however, and new DeFi protocols in lending and derivatives lack compelling innovations to attract large capital flows. Instead, many opt to build their own chains, capturing value away from Ethereum. Numerous DeFi tokens suffer from redundant designs and peak immediately upon launch, dragging down already fragile market sentiment. Since 2023, DeFi’s brightest moment was confined to a brief peak in Q4 of last year before being quickly overshadowed by meme and AI trends. Current total DeFi TVL still falls short of the previous cycle’s record high of $180 billion.

In the last cycle, NFT mania was largely driven by profits people made trading other assets. Today, capital rotation revolves around just three themes: Bitcoin, on-chain memes, and AI tokens. Ordinary retail investors are priced out of the first, while the latter two require advanced PvP skills and deep research capabilities. The era of easy money is over.

Broad-based gains have disappeared. With increased difficulty in making profits, opportunities are shrinking. Many altcoin holders didn’t see an altseason come; instead, they experienced a wallet “paradigm shift.” Those who moved fast profited or minimized losses. Those who hesitated ended up severely trapped.

Market interest in DeFi and NFTs remains lukewarm. Without these twin engines, ETH’s price momentum stalls predictably.

Ethereum Loses Its Wealth Effect – Solana Takes Over

This market cycle differs markedly from past ones, with AI and meme coins driving the latest wave of wealth creation. In earlier cycles, Ethereum thrived due to early ICOs and successive waves of innovative DeFi protocols, generating strong wealth effects.

Ten years ago, Vitalik gave a code-filled presentation in Silicon Valley where every slide was pure code. Afterward, investors were electrified, declaring it the future. Ethereum subsequently raised $20 million through an ICO—a then-record—and each ETH traded around $0.30.

Today, ETH trades above $3,000. Anyone who participated in the public sale and held until now would have seen over 10,000x returns. The ICO era brought countless 100x and even 1,000x returns in 2017, mostly funded in ETH. After a period of dormancy, DeFi protocols like AAVE, COMP, SNX, and UNI in the 2021 cycle generated massive profits for investors.

Never underestimate the power of wealth effects. Project teams, exchanges, and launchpads all strive to create them. While markets can’t enrich everyone, enabling some to get rich is vital—it creates narratives worth imitating and spreading, drawing in countless newcomers.

In this cycle, the greatest wealth effects aren’t coming from traditional VC-backed tokens but from AI-themed coins and memecoins. Taking memes as an example, apart from classics like DOGE, SHIB, and PEPE, Ethereum hasn’t seen any major meme surges. Even on L2s, only BRETT and DEGEN on Base briefly shone. AIXBT and VIRTUAL became rare bright spots on Base.

On Solana, meme and AI projects sprout like bamboo shoots after rain. Just look at TRUMP: within four days of its launch, Circle minted 2.5 billion additional USDC on Solana. Some advanced Chinese-speaking on-chain traders reportedly earned tens of millions in profits within four hours—an achievement that sparked envy across Twitter.

Past successes like BONK, BOME, WIF, and PENGU injected vitality into Solana’s ecosystem. Advocates of the “meme supercycle” theory have amplified this narrative, drawing more users into Solana.

In the AI trend, Solana also outshines Ethereum, with hot tokens like AI16Z, FARTCOIN, and GOAT leading the charge.

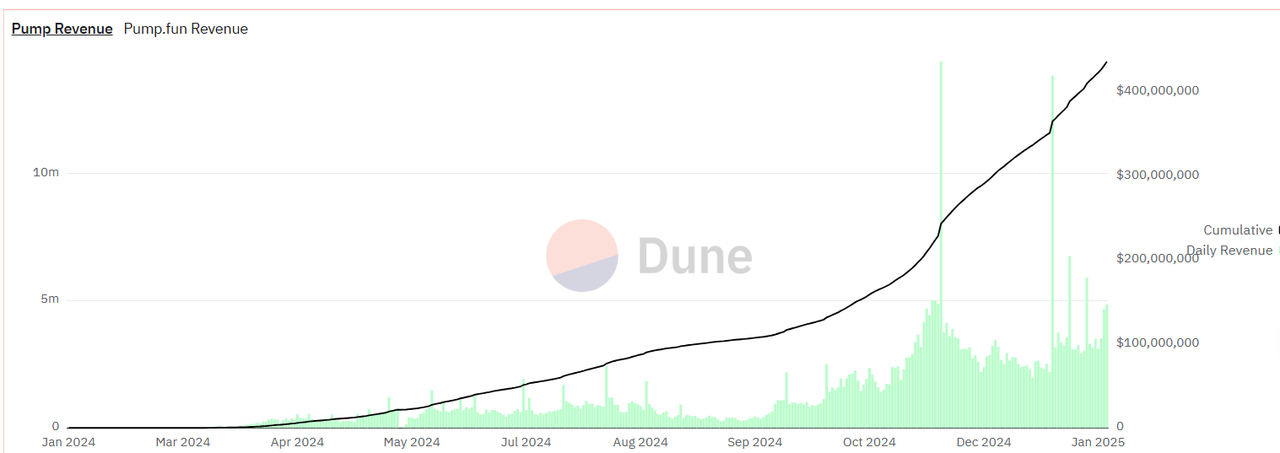

Solana firmly dominates the market in AI-themed and meme coins. Dune data shows Pump.fun, its primary launch platform, has generated cumulative revenue exceeding $400 million.

Raydium, serving as meme liquidity infrastructure, reports annualized revenue of $363 million and transaction fees surpassing $3 billion. Over the past three months, fees grew over 370% and revenue rose over 260%. Its market cap-to-fees ratio stands at 1.1x, and market cap-to-revenue ratio at 9.6x.

The reason so many meme and AI projects choose Solana over Ethereum or its L2s lies primarily in Ethereum’s high mainnet gas fees and slow transactions, compounded by fragmented liquidity across L2s—a vicious cycle. Ultimately, Solana expands its wealth effect through continuous flywheel dynamics.

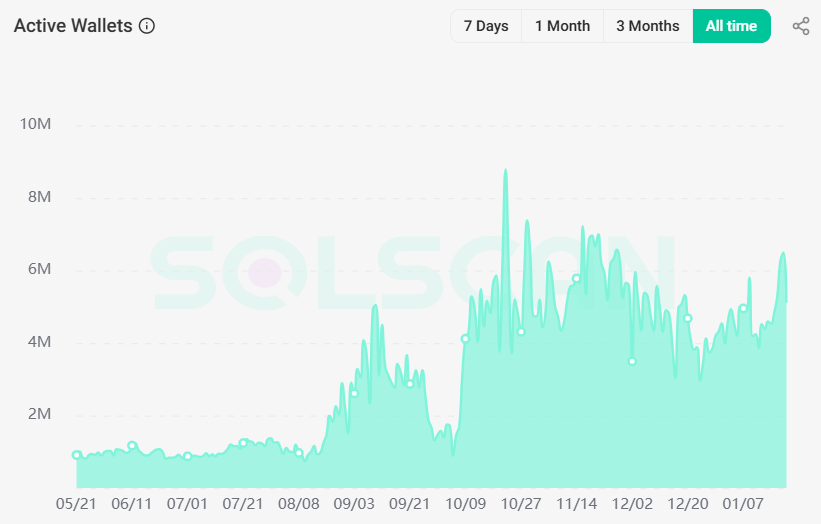

Currently, according to Solscam data, active wallets remain high at 6 million—nearly six times higher than in May 2024.

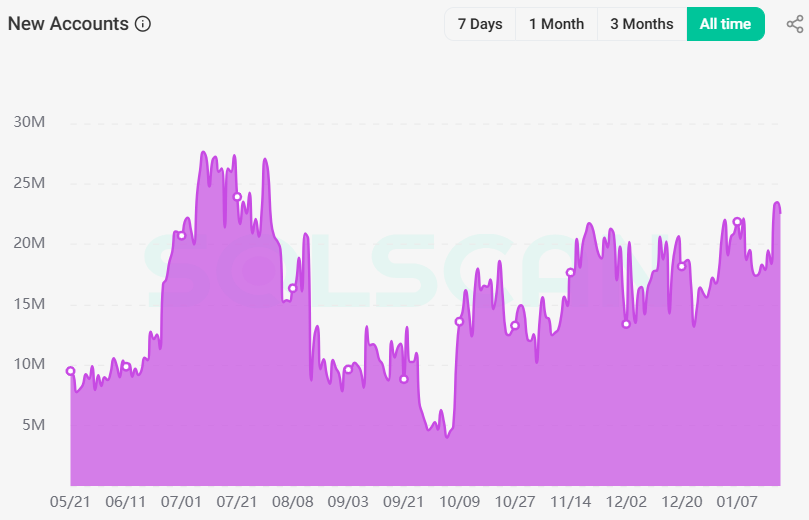

Daily new account creations (counting accounts holding multiple tokens) stay historically high at 20 million.

Beneath Solana’s explosive data growth, a small spark may already be turning into a prairie fire.

Ethereum Foundation Selling Tokens, Bloated Team

With L2s losing investor favor, DeFi and NFT engines stalled, and weak wealth generation, mounting contradictions have kept ETH’s price range-bound. The community now directs blame toward Vitalik. Once revered, he’s been pulled off his pedestal amid relentless accusations. Under his leadership, the Ethereum Foundation has become a prime target.

In the last cycle, the EF gained notoriety for perfectly timing market tops. This cycle, frequent token sales by EF have repeatedly triggered outrage once detected and reported by on-chain monitors. When prices rise, the community might overlook such actions—but when ETH stagnates, these sales become “sensitive sell-side pressure.” Vitalik explains the sales are meant to fund salaries and ecosystem grants, but the community isn’t convinced.

Aave’s founder shared his thoughts after reading the EF’s annual budget report, stating that EFEF faces spending and financial issues. Stani Kulechov proposed concrete measures: immediately slash burn rate from $130 million to $30 million, downsize staff, and form a new leadership team.

If token selling is one outlet for retail frustration, another stems from perceived lack of direction and leadership within EF.

Kyle Samani, co-founder of Multicoin Capital and early SOL investor, recently wrote that he entered crypto through Ethereum and was initially thrilled. But after Devcon 3 in November 2017, he lost faith. “I truly can’t understand how the Ethereum Foundation could be so clueless. No one inside the foundation had sufficient awareness to push forward a concrete scalability plan.”

Kyle added: “Over the past seven years, I’ve seen no change. Still lacking urgency, leadership disconnected from core users, and still no clear direction.”

Well-known Twitter KOL Eric Conner recently announced he’s leaving the Ethereum community altogether, criticizing the foundation for failing to report to stakeholders, sinking into inertia, and resisting reform. The current EF exhibits an “anti-victory and anti-competition mindset,” causing many community members to question whether they should stay.

Under intense scrutiny, Vitalik finally responded, revealing major changes underway in EF’s leadership structure—efforts ongoing for about a year. Some reforms have already been implemented and disclosed; others remain in progress. He expressed support for engaging with funds, institutions, and governments, and welcomed discussions treating ETH as an asset.

Regarding the flood of criticism, Vitalik said: “If you keep pressuring like this, you're creating an environment extremely toxic for top talent. Recently, some of Ethereum’s best developers privately messaged me, expressing dissatisfaction with the social media climate—one created precisely by people like you. You’re making my job harder. And you’re making me less interested in complying with your demands.”

Conclusion

Ethereum is facing a severe midlife crisis. What steps Vitalik will take to address it remain unclear. Fortunately, Joseph Lubin, Ethereum co-founder and Consensys CEO, has stepped forward: “One of Vitalik’s most admirable traits is his decision-making process. When problems arise, he listens to diverse opinions, gathers information, weighs pros and cons, and makes decisions after considering most necessary data. He has heard everyone out—progress is being made.”

Lubin added: “Based on what I’ve seen, many high-value initiatives will soon be announced—so impressive they’ll leave you breathless. For now, stay calm and avoid losing your head before the boom begins.”

After years of turbulence, whether this giant ship called Ethereum still has a chance to turn things around—only time will tell.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News