2025 Crypto Market Outlook: BTC and Altcoin Trends Diverge, Agile Trading on Hotspots Becomes the New Market Normal

TechFlow Selected TechFlow Selected

2025 Crypto Market Outlook: BTC and Altcoin Trends Diverge, Agile Trading on Hotspots Becomes the New Market Normal

Go with the flow; don't go against it.

Author: Route 2 FI, Kyle

Translation: TechFlow

Introduction

Crypto KOLs Route 2 FI and Kyle have shared their insights on the current market state. Both believe that the crypto market is now in a unique phase—distinct from the bull run of 2021—with diverging price dynamics between Bitcoin and altcoins.

Route 2 FI focuses on the rapid rotation of market themes this cycle, contrasting today’s environment with 2021. Unlike in previous cycles where investors would spot a trend and simply buy on centralized exchanges (CEX), participants now go directly onchain to engage in PVP trading. He also explores how market "reflexivity" affects investment strategy. Meanwhile, Kyle emphasizes the decoupling of Bitcoin and altcoin cycles, noting that Bitcoin is driven by macroeconomic factors and capital flows, while altcoins are shaped by localized narratives and multiple "mini-cycles."

With fast-shifting trends and an explosion in token variety, identifying true gems has become increasingly difficult. Traditional HODLing strategies appear less effective in this new environment, placing higher demands on investors. The key to thriving lies in flexibility—moving with the market rather than against it. Success now depends on adapting strategies to market movements instead of clinging to past experiences.

TechFlow compiles and translates these two influential perspectives below.

1. Reflexivity in Crypto Markets: How the 2025 Crypto Market Differs From 2021

In this crypto cycle, we’ve seen several “mini-altseasons,” periods during which most tokens—including established ones from prior cycles—experienced significant rallies. Based on my observation, notable phases include:

January 2023 – March 2023

October 2023 – March 2024

September 2024 – December 2024

Beyond these, market narratives have rotated frequently—from gambling tokens and Telegram bots popular in summer 2023, to AI agents and DeFAI (decentralized artificial intelligence) gaining traction starting Q4 2024.

Yet many investors still anticipate a broad altcoin bull run akin to the two frenzied waves of 2021. However, the landscape has fundamentally changed. Compared to four years ago, nearly 1,000 new altcoins with defined roadmaps may have entered the market, vastly increasing complexity for investors.

The traditional playbook—buy altcoins expecting them to outperform BTC, then rotate profits into BTC or USD—now faces a critical question: Which altcoins should you actually buy? With such a fragmented market, it's easy to pick wrong—you might hold a stagnant token while your friend hits big gains elsewhere.

Another defining feature of this cycle is the surge in onchain activity. While onchain engagement existed in 2021, today’s level—especially within ecosystems like Solana, often described as active “trenches”—is far more intense and complex.

In earlier days, logging into Binance allowed easy access to major altcoins. The logic was simple: when influencers dropped certain “buzzwords,” you knew to go long $SOL, followed by $AVAX.

But everything shifted dramatically with the breakout of $PEPE in April 2023. Memecoins began capturing widespread attention—starting with $PEPE, then $BITCOIN, $WIF, $POPCAT, $GOAT, and many others (the list goes on). Their rise not only reflects changing market sentiment but also highlights the growing influence of social media in driving investment trends.

The crypto market has evolved significantly—from a synchronized rally across most tokens to one dominated by "meta cycles." Different categories of tokens (utility tokens, animal-themed memecoins, AI agent tokens, etc.) now take turns leading the market in successive waves. This shift confuses many investors, especially those accustomed to holding spot positions—a strategy dominant among veterans from 2017 and 2021. Is this approach still viable? Clearly, it no longer works universally.

Even experienced players who thrived in 2017 and 2021 may find little edge in 2024 if they haven't transitioned from CEX perpetuals to active onchain participation. In contrast, newer participants deeply engaged in Solana’s ecosystem—focusing on memecoins and AI-related tokens—are better positioned to adapt.

The explosion in token diversity has led to extreme fragmentation. The old “buy and hold” strategy now applies only to select assets—primarily Bitcoin (BTC) and Solana (SOL). Investors are thus forced to rotate positions more frequently to capture short-term opportunities.

If you're willing to operate across both centralized exchanges (CEX) and onchain environments, this new reality shouldn’t be daunting. As long as volatility persists, trading opportunities will exist. My advice: don’t limit yourself to going long. During uncertain times, consider hedging, earning funding rates, shorting, or even pairing trades.

Flexibility is the key to success in this environment.

Has the market topped out? For Bitcoin, probably not yet. But I’m confident that many altcoins have already reached all-time highs—and likely won’t return to those levels. That doesn’t mean altcoins won’t see multiple rallies in 2025; however, long-term demand is unlikely to absorb the selling pressure from unlocked tokens.

Market “reflexivity” operates in both directions. Just like a ball thrown into the air must eventually fall back down, price movements follow a similar gravitational pull.

2. Understanding the “Mixed Supercycle”

I believe we’re currently in what I call a “Mixed Supercycle.” Here are my thoughts.

Bitcoin (BTC) follows its own market logic, independent of other assets; BTC and altcoins move on completely different timelines.

While altcoins often use Bitcoin’s price action as a reference point, Bitcoin itself is primarily influenced by macroeconomic conditions and capital flows, operating under its own internal mechanics.

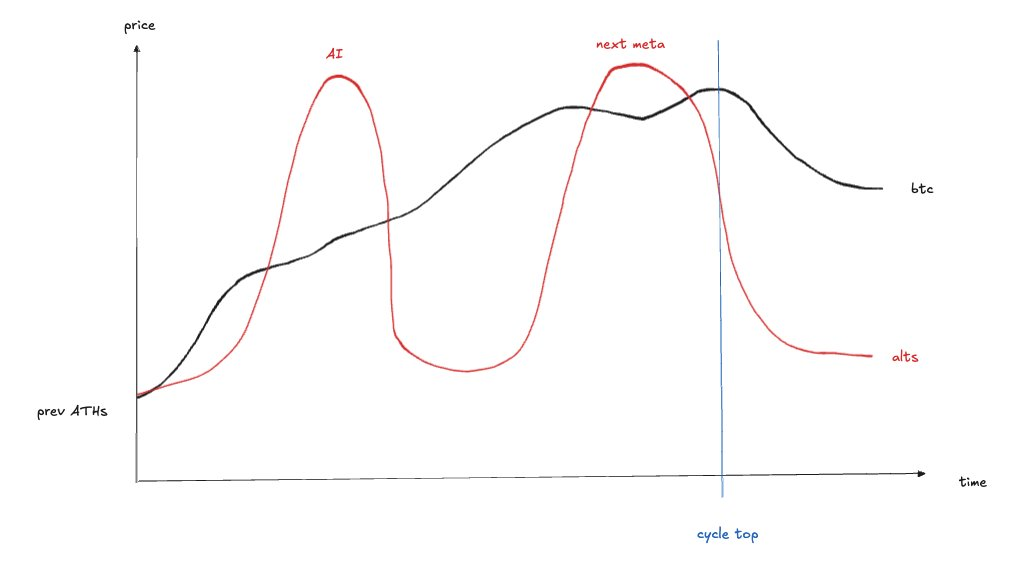

Traditional market cycles still apply—the market will eventually peak. But within that broader arc, we experience numerous “mini-altcoin cycles”—localized surges driven by specific narratives.

Judging whether the market has topped based solely on altcoin performance can be misleading. For example, even if altcoins surge dramatically over a weekend, it doesn’t necessarily signal the end of the cycle.

This pattern persisted throughout 2024—we saw distinct mini-altseasons in Q1 and Q4, while Bitcoin marched to its own rhythm.

This dynamic hasn’t fundamentally changed. The only difference is that Trump-era policies could provide additional catalysts for Bitcoin (such as SBR), potentially triggering more mini-altcoin cycles.

This marks a key distinction between 2024 and 2025: similar underlying mechanics, but 2025 may bring more positive catalysts that further fuel localized altcoin rallies.

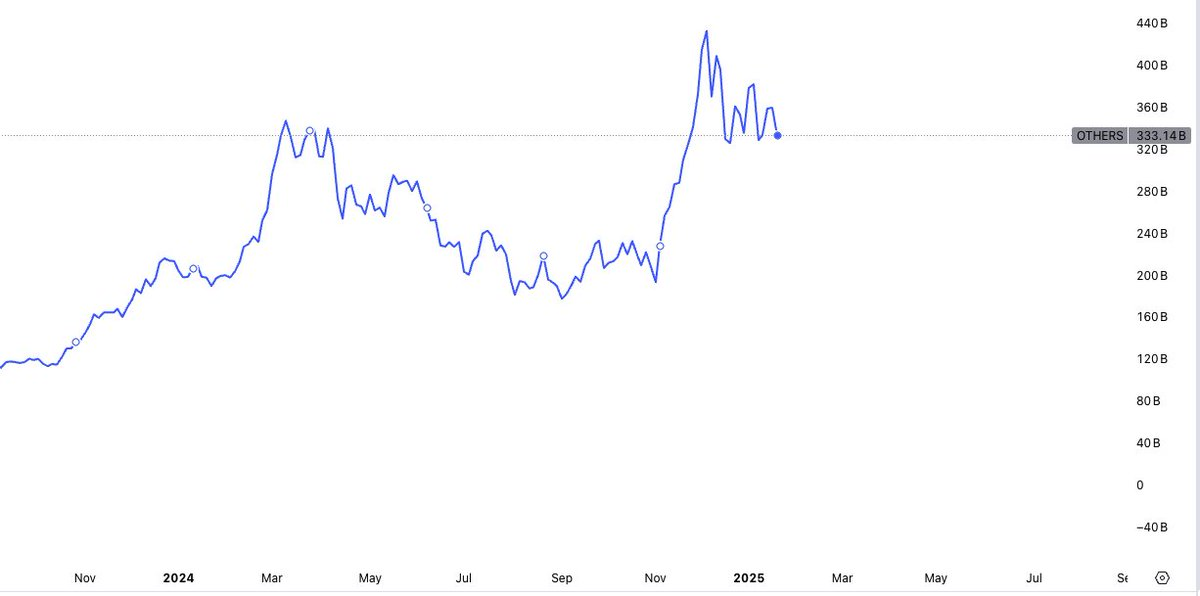

A common issue in Crypto Twitter (CT) is that many investors prefer holding altcoins over Bitcoin. If you examine charts of the “Others” basket (i.e., non-BTC, non-ETH altcoins), you’ll notice repeated “small cycles,” closely matching the model I’ve outlined.

Thus, even when Bitcoin remains flat, the weakness in “Others” can trigger extreme bearish sentiment across the board.

In my view, there is currently no clear market leader. Predicting where capital will flow next is extremely difficult. A simpler approach is to watch for emerging trends and quickly ride the momentum once it begins.

Alternatively, just buy Bitcoin.

At present, the total market cap of “Others” sits at a local bottom, signaling the end of the latest thematic wave. While buying the dip may seem rational, top-performing altcoins offer few clues about where money will rotate next. In this context, prioritizing risk management outweighs chasing returns.

After all, we’ve just come off three months of market euphoria.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News