Today's AI Agent market summary: Fartcoin dominates, while emerging projects Moby and Orbit continue to gain attention

TechFlow Selected TechFlow Selected

Today's AI Agent market summary: Fartcoin dominates, while emerging projects Moby and Orbit continue to gain attention

AI is consuming the user interface, and AI will also consume search.

Author: s4mmy

Translation: TechFlow

Quoted Perspectives:

-

"The market cap of AI agents will reach $100 billion. I have no doubt about this."

—— @osf_rekt, reposted by @punk9059

-

"Virtuals is the economic layer for AI agents."

-

"Search is the UI of the web, and AI is eating the UI—therefore, AI will eat search too."

—— @naval

-

"'I don't need AI agents.' Famous last words before getting left behind by competitors."

—— @dolion_ai

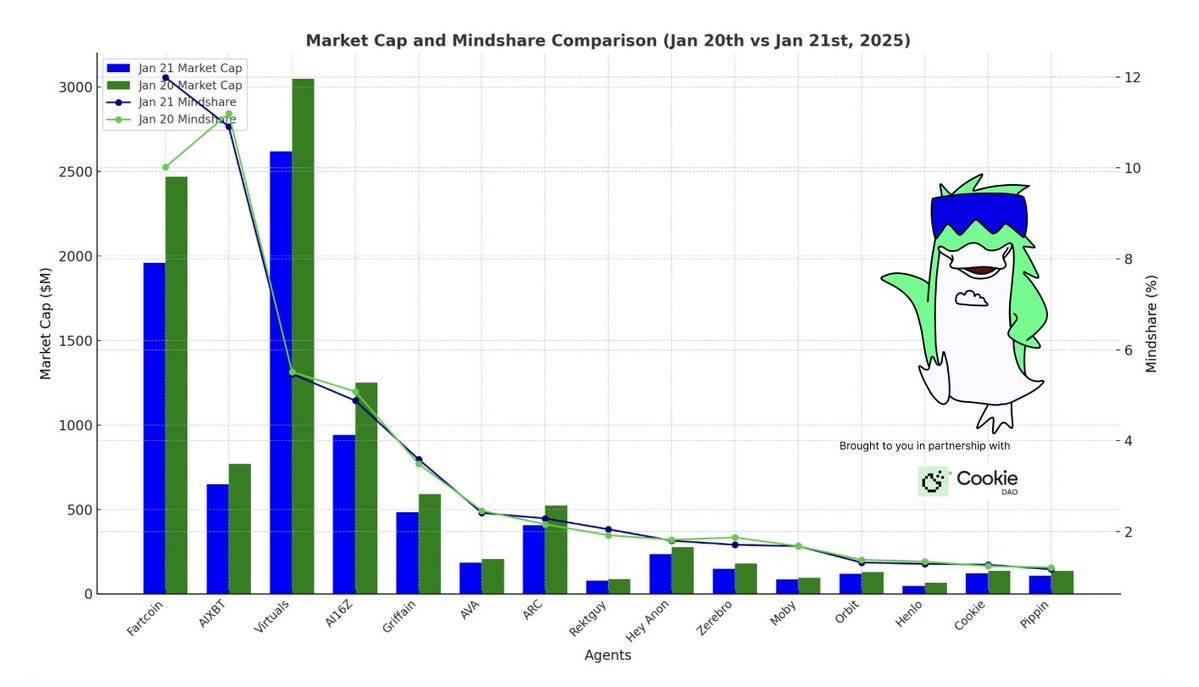

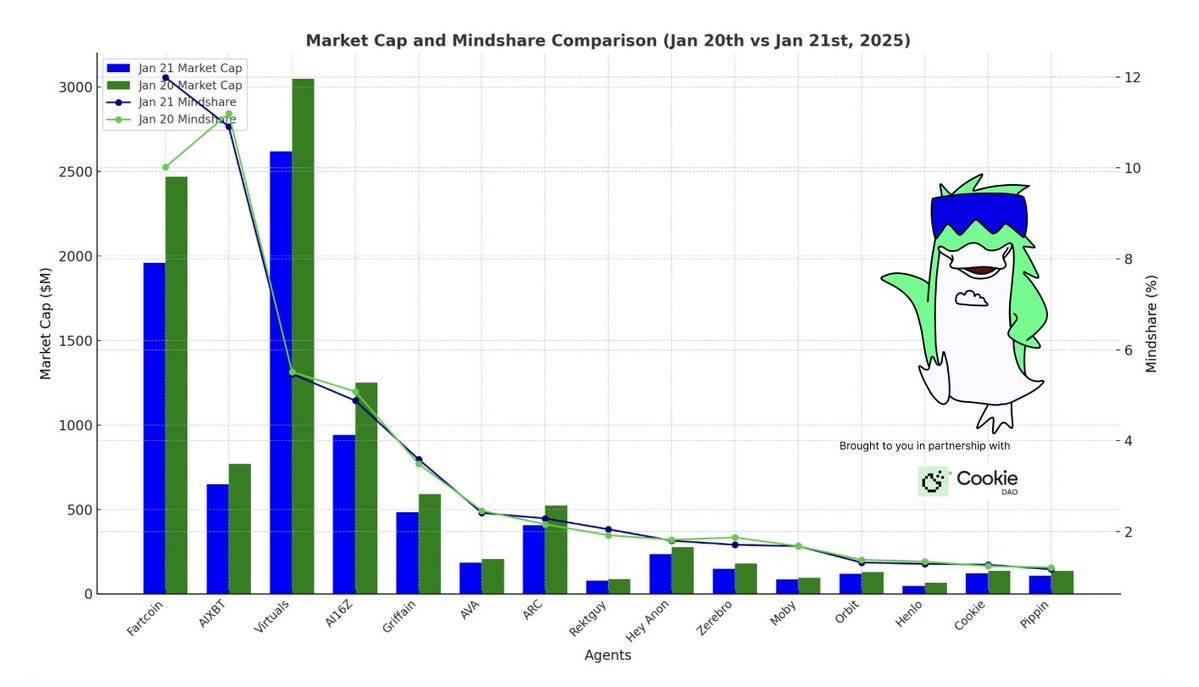

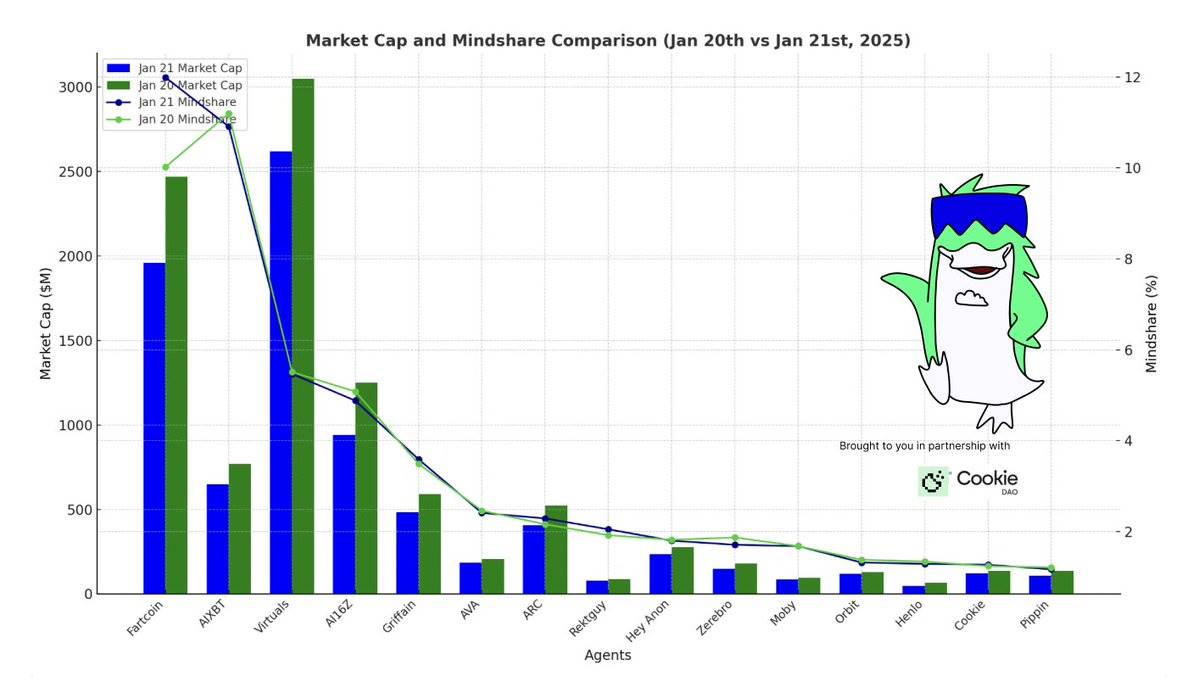

Market Highlights:

Currently, the AI agent market is experiencing a phase of profit-taking intertwined with rebounds.

Fartcoin dominates in both Mindshare and market capitalization, rising rapidly due to an influx of speculative retail traders and traditional finance (TradFi) investors.

Meanwhile, foundational projects like Virtuals, AIXBT, and AI16Z have maintained relative stability amid broader market corrections.

Newcomers such as Moby and Orbit continue to gain attention, while more mature DeFAI startups like HeyAnon and GriffAin are making steady progress against the backdrop of growing on-chain narratives.

Top Performing Projects Include:

-

Fartcoin: Despite a 20% price drop over the past 72 hours, it has surpassed several established agents in market cap, driven by memetic narratives, achieving over 100% returns in the short term.

-

AIXBT: Has consolidated its leadership in data analytics but faces pressure from declining Mindshare and slight market cap adjustments.

-

Virtuals: Maintains a key position in agentic infrastructure thanks to SDK integration and continuous ecosystem growth.

-

Moby: Reinforces its role as a whale-monitoring and infrastructure data agent, drawing increasing interest from developers.

-

ARC and GriffAin: As core players in emerging AI frameworks, both demonstrate strong developer engagement and market resilience.

Agent-by-Agent Analysis:

i) Fartcoin (@FartCoinOfSOL)

-

Mindshare: 11.99% (up 1.97%)

-

Market Cap: $1.96 billion, down 20.6%

Commentary: Fartcoin leverages speculative momentum to lead in Mindshare. Its meme-driven appeal continues to drive user engagement, with liquidity and trading volume hitting new highs. After surging from $1 billion to $2.5 billion in market cap, it underwent a healthy price correction.

"Market heat keeps rising." —— @TaikiMaeda2

ii) AIXBT (@aixbt_agent)

-

Mindshare: 10.91% (down 0.29%)

-

Market Cap: $650 million, down 15.5%

Commentary: Although both Mindshare and market cap declined slightly, AIXBT remains a leader in analytics infrastructure. Recent focus has been on optimizing tokenomics and expanding ecosystem integrations to strengthen competitiveness.

iii) Virtuals (@virtuals_io)

-

Mindshare: 5.47% (down 0.04%)

-

Market Cap: $2.62 billion, down 15.6%

Commentary: Despite a market cap pullback, Virtuals maintains its leading position in agentic infrastructure, consistent with broader market trends.

Through GAME SDK integration and partnerships with key ecosystems, Virtuals' tech stack is gaining adoption among developers. It enables any framework to use its technology, rapidly positioning itself as the future economic layer for agents:

"Build freely within any framework—freedom of framework choice is a core value of the Virtuals society." —— Virtuals

iv) AI16Z (@ai16zdao)

-

Mindshare: 4.88% (down 0.2%)

-

Market Cap: $941 million, down 6.3%

Commentary: Both Mindshare and market cap declined for AI16Z, yet it remains a popular choice among developers. Its robust multi-chain integration capabilities and real-world performance of the Eliza agent keep it in the spotlight.

Recent developments include integration with the Virtuals API (Issue #2552). As alternative infrastructure, this move promotes wider framework adoption and lays the foundation for collaborative agents.

v) Griffain (@griffaindotcom)

-

Mindshare: 3.59% (up 0.1%)

-

Market Cap: $484 million, down 4.7%

Commentary: Griffain’s modular tools are gaining increased attention. New partnerships and product updates further highlight their practical utility.

"A new era of labor is arriving... Agents will empower businesses and consumers with robot-powered task execution." —— @tonyplasencia3

vi) AVA (@AVA_holo)

-

Mindshare: 2.41% (down 0.05%)

-

Market Cap: $184 million, down 11.4%

Commentary: While market cap dipped, AVA's ongoing adoption in cross-chain applications demonstrates strong resilience. Integration based on Solana has particularly boosted user engagement. Currently, its staking rate is approaching 20%.

vii) ARC (@arcdotfun)

-

Mindshare: 2.29% (up 0.13%)

-

Market Cap: $408 million, up 3.3%

Commentary: Through active GitHub development and newly launched developer tools, ARC continues to enhance its framework offerings and solidify its position in the ecosystem.

At the same time, ARC is expanding partnerships, recently announcing an official collaboration with $listen:

"AI completes tasks not through mechanical repetition, but through emergent behavioral patterns that reflect—and extend—human capability." —— ARC

viii) Rektguy (@RektguyAI)

-

Mindshare: 2.05% (down 0.1%)

-

Market Cap: $78.55 million, down 9.9%

Commentary: Rektguy’s meme community remains highly engaged, though it was impacted by profit-taking, with market cap decline aligning with broader market corrections.

Notably, Rektguy now has the ability to create OSF-style artwork, and its thought process and decision logic can be verified via terminal:

"You can view the agent's thinking process and decision flow directly in our terminal." —— @osf_rekt

ix) Hey Anon (@HeyAnonai)

-

Mindshare: 1.8% (down 0.02%)

-

Market Cap: $236 million, up 1.7%

Commentary: Hey Anon has strengthened its leadership in DeFAI strategies through consistent community engagement.

Its backend technology continues to upgrade, optimizing DeFAI solutions via multiple data plugins provided by core vendors:

"We've integrated almost the entire DeFi tech stack because others are just forks—minor variations. Right now we have 45 workstreams, most of which are nearly complete." —— @danielesesta

With its beta version soon opening to a wider user base, this is a project worth watching closely.

x) Zerebro (@0xzerebro)

-

Mindshare: 1.71% (down 0.16%)

-

Market Cap: $148 million, down 17.4%

Commentary: Despite a sharp market cap drop, Zerebro remains highly relevant in developer communities, having launched new developer-focused updates alongside enhanced analytical features. Accelerated open-source development may lie ahead.

"If we open-source a 2-billion-parameter Zerebro model lightweight enough to run on an NVIDIA RTX 3060... @huggingface, here we come." —— @jyu_eth

The revenue-sharing NFT recently launched in collaboration with @dolion_ai sold out quickly:

"10,000 zerebully NFTs sold out in under 40 minutes." —— @khouuba

xi) Moby (@mobyagent)

-

Mindshare: 1.68% (down 0.02%)

-

Market Cap: $85.98 million, up 1.3%

Commentary: As a whale-watching data agent, Moby attracts developer attention with unique market insights.

"Winners of the 2025 cycle will be determined by attention and Mindshare. @assetdash and @whalewatchalert are building growing Mindshare among critical consumer groups." —— @mattdorta

"The Moby pattern" —— @frankdegods

xii) Orbit/Grift (@orbitcryptoai)

-

Mindshare: 1.32% (down 0.06%)

-

Market Cap: $120 million, up 3.1%

Commentary: Orbit, as a DeFAI abstraction layer, maintains high engagement amid growing developer interest. Meanwhile, Grift has successfully launched on @HTX_Global.

xiii) Henlo (@henlokart)

-

Mindshare: 1.29% (down 0.05%)

-

Market Cap: $46.81 million, down 28.9%

Commentary: Henlo maintains market relevance through its AI-NFT narrative, but after the initial hype, both market cap and user engagement saw minor declines.

"At this stage of the supercycle, I'm too lazy to tell anyone the price targets for BTC, ETH, HYPE, PENGU, and HENLO—because even if I did, you wouldn't believe me anyway." —— @ciniz

xiv) Cookie (@cookiedotfun)

-

Mindshare: 1.27% (down 0.09%)

-

Market Cap: $121 million, down 11.1%

Commentary: Cookie continues to upgrade its analytics dashboard product, but sentiment decline has affected both Mindshare and market cap. However, could a larger plan beyond the agent space be in the works?

"What if the Cookie ecosystem gains attention not just in the AI market, but broadly follows the flow of capital?" —— @fwielanier

xv) Pippin (@pippinlovesyou)

-

Mindshare: 1.17% (down 0.07%)

-

Market Cap: $107 million, down 12.3%

Commentary: Pippin's framework tools continue to attract developer interest, but market cap declined due to profit-taking. Additionally, slower update cadence in the GitHub repository has created some friction.

Meanwhile, a Discord moderation tool powered by large language models (LLM) is under development:

"Built an LLM-powered Discord mod tool (pippin-mod), and I’ll open-source it too." —— @yoheinakajima

Emerging Trends:

i) Memetic Resilience: Despite a 20% pullback, Fartcoin’s Mindshare continues to rise—further demonstrating the narrative power of meme-driven assets.

ii) DeFAI Expansion: Projects like Moby, Hey Anon, and Orbit indicate rapidly growing market interest in DeFAI automation and infrastructure.

iii) Infrastructure Leadership: Projects including Virtuals, AI16Z, Griffain, Pippin, and ARC are attracting significant developer attention by offering scalable AI solutions.

iv) Profit-Taking & Rotations: Broad market corrections suggest capital is rotating from meme-driven agents toward utility-driven agents, also reflecting reduced Trump-related liquidity.

Data Source: @cookiedotfun

Track your AI agents more efficiently with the Cookie Analytics platform. Join over 400,000 independent users and unlock premium features by staking 10,000 Cookie tokens.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News