Interpreting The Graph: The data marketplace offers rare product-market fit—can GRT become the new alpha amid growing data demand?

TechFlow Selected TechFlow Selected

Interpreting The Graph: The data marketplace offers rare product-market fit—can GRT become the new alpha amid growing data demand?

You might not need the data yourself, but as long as new crypto projects emerge, there will be a demand for data querying and indexing.

By TechFlow

As we enter the new year and reflect on the second half of last year’s crypto market, sentiment and trends have felt like a rollercoaster ride.

In September, some Ethereum developers believed they had “chosen the wrong industry,” as most projects lacked novelty or real-world demand. At the same time, there was growing skepticism that investing in tokens from the previous cycle was a waste of time. The prevailing mindset: chase new launches, not old ones—older tokens were gradually losing value...

Yet, with the surge in AI Agent hype and a recent broad recovery among legacy tokens, both new and established projects have reignited market enthusiasm, prompting investors to find fresh justifications for price increases.

In this current market environment, which types of projects should we focus on to uncover greater opportunities?

Cycles turn and prices fluctuate—that’s the heartbeat of market volatility. But to survive bull and bear markets alike, product-market fit through genuine demand remains the ultimate determinant of a project's survival.

Having demand doesn’t guarantee skyrocketing prices, but lacking demand inevitably leads to low liquidity or eventual collapse.

With this framework in mind, what sectors remain under the radar yet continue to exhibit strong underlying demand?

A recently popular narrative is that AI Agents require more and better data to become truly intelligent. But in reality, every Web3 project constantly carries a persistent need for a certain type of data—one that often goes unnoticed by the average observer:

Data indexing.

Querying data from the chaotic, unstructured nature of blockchain data via indexing forms the foundational layer for any project team, developer, or even on-chain user to understand project fundamentals and conduct analysis.

Every time a new crypto project emerges, so does the need for data querying and indexing—and the more projects that exist, the greater the demand grows.

In this space, The Graph stands out as a veteran player, quietly maintaining strong momentum behind the scenes:

Since its launch in December last year—four years ago—it has built over 10,000 subgraphs, powered by 100 indexers, supported 170,000 delegators, and engaged over 800 curators, with a global community of users.

In the fast-paced world of crypto where trends vanish overnight, such longevity is rare.

If an infrastructure is genuinely needed, that becomes the floor for a project’s sustainability. But what defines The Graph’s ceiling? Can its token GRT break free from the "chase new, ignore old" curse?

If you’re unfamiliar with The Graph and the concept of data indexing, yet are seeking higher return potential in today’s market, consider diving into the deep sea of on-chain data to explore an overlooked yet high-demand underwater operation driven by The Graph.

Data Indexing Demand: The Perpetual Engine Beneath Shifting Hype

When analyzing a project, understanding its ecosystem positioning is critical.

Where does The Graph sit within the current crypto ecosystem? Think of the entire market as an ocean—what happens above water versus below couldn't be more different.

Due to limited human attention, you’re naturally drawn to the surface-level “noise”—projects launching and fading rapidly, where PMF (product-market fit) often exists merely as a slogan or exploited narrative.

But in my view, true product-market fit in crypto isn’t found above water.

Beneath the surface, regardless of whether the trend is AI or Memes, the real PMF lies in tools that the majority of projects actually use. Examples include Pump.fun, which clearly fits this description.

If trading is the continuous warm current beneath the crypto ocean, Pump.fun makes perfect sense. But on the opposite end lies another force—less visible, deeper, yet powerful enough to support nearly every project above: data indexing.

To put it simply, you personally may not need indexed data—but every time a new crypto project launches, the need for data querying and indexing arises.

For example, a decentralized exchange (DEX) needs to analyze its transaction history and liquidity—requiring data queries.

Or take a Meme coin: to check its token burn rate or whether fee buybacks are acquiring new tokens, it still needs to query data...

You might struggle to identify a universal “must-have” in crypto, but providing data services to projects is undeniably essential—crypto projects must deliver services (or at least appear to), and that always requires leveraging on-chain data for analytics, visualization, and real-time monitoring.

If a given demand cuts across nearly all project types without discrimination, that suggests a vast market.

Conversely, if everyone needs data indexing, instead of trying to judge who the “good” or “bad” actors are (including vaporware), it’s wiser to focus on those providing the tools—the “shovel sellers.” This is precisely the unique and realistic niche The Graph occupies in today’s market.

This position is hard to spot amid market noise—which is exactly why you should pay attention to projects like The Graph:

Providing data indexing for other projects represents a practical, widespread, and genuinely demanded PMF—one that gives the project itself a fighting chance to survive market cycles.

From a builder’s perspective, how would you think if you were launching a crypto project?

On-chain data is messy and fragmented. Trying to trace whether user A moved asset B into wallet C is extremely difficult. Doing this in-house is too costly—so you need a service provider to hand you a “shovel.”

Then comes the question: Where do I get this data? How can I query it faster?

The answer leads you to The Graph—let’s dive into the details.

Understanding The Graph and Subgraphs: The “Digital Catalog” of the On-Chain Library

Looking at Chinese-language research and articles, coverage of The Graph remains sparse.

Partly because data indexing targets B2B use cases, making it distant from retail users, and partly because underlying tech gets drowned out by speculative noise, becoming harder to grasp.

Therefore, we’ll use simple analogies to help you quickly understand The Graph. Once you recognize data indexing as a true necessity, your view of The Graph and its token may shift significantly.

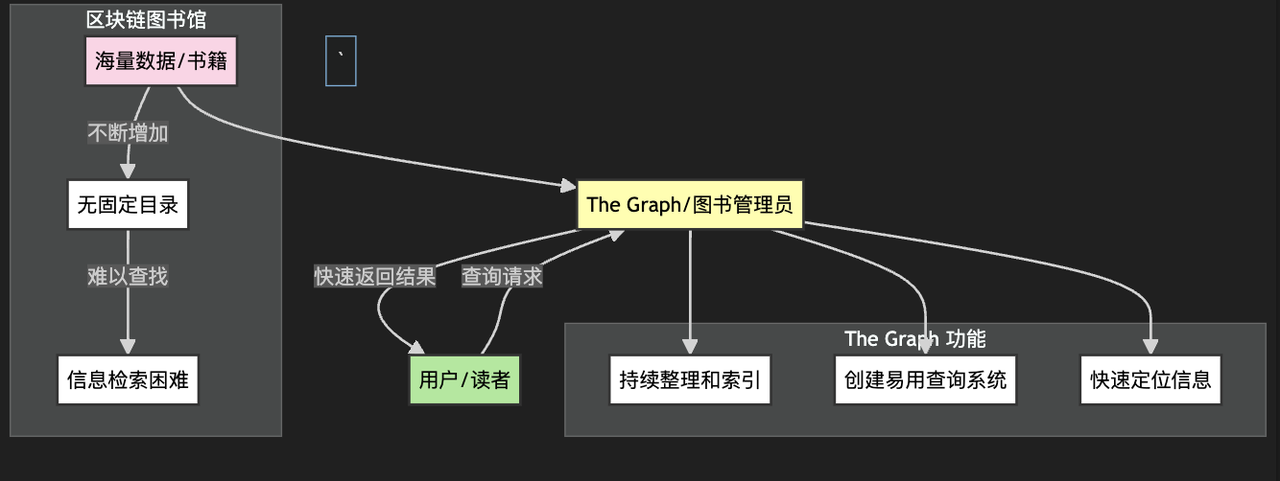

Strip away all technical complexity: imagine The Graph as alibrarian.

Different blockchains are like sections of a massive library storing vast amounts of information—transaction records, smart contract states, etc. But this library has peculiar traits:

-

Books (data) are constantly being added.

-

No fixed catalog or indexing system exists.

-

Finding specific information means potentially sifting through thousands of books.

Too many books, no guidance—finding anything feels like searching for a needle in a haystack.

Enter The Graph—the librarian:

-

It continuously organizes and indexes newly added books (blockchain data).

-

It builds an easy-to-use query system (like a digital library catalog).

-

When you need specific information, you simply tell The Graph what you want, and it quickly returns the relevant book and its "page number" (specific blockchain data).

So what The Graph does is essentially create a well-organized digital catalog for the entire crypto world’s on-chain data, making queries dramatically easier.

The benefits are clear:

Developers and projects don’t need to build complex indexing systems themselves. Users can access blockchain data faster. Building sophisticated decentralized applications (DApps) becomes far more feasible at the data layer.

Returning to our earlier discussion on project value and narratives, The Graph’s lasting power lies here: No matter why you enter the library (whether your app is legitimate or vaporware), if you need to look up a book, you’ll likely use The Graph. That’s why data indexing is a true necessity.

You might ask: What if I don’t want the whole library? What if I only care about certain books?

This brings us to a core feature of The Graph: subgraphs.

Say you're particularly interested in the “Decentralized Exchange (DEX)” section. You can create a dedicated subgraph for DEXs, which includes:

-

Which specific smart contracts to index

-

Which events to track (e.g., trades, liquidity additions)

-

How to structure and store the data

-

How to query the data

Thus, multiple specialized interests lead to multiple subgraphs, each serving different use cases across the crypto landscape.

More通俗ly, subgraphs function like classification codes in a library—each code grouping books under the same theme.

And these subgraphs keep growing.

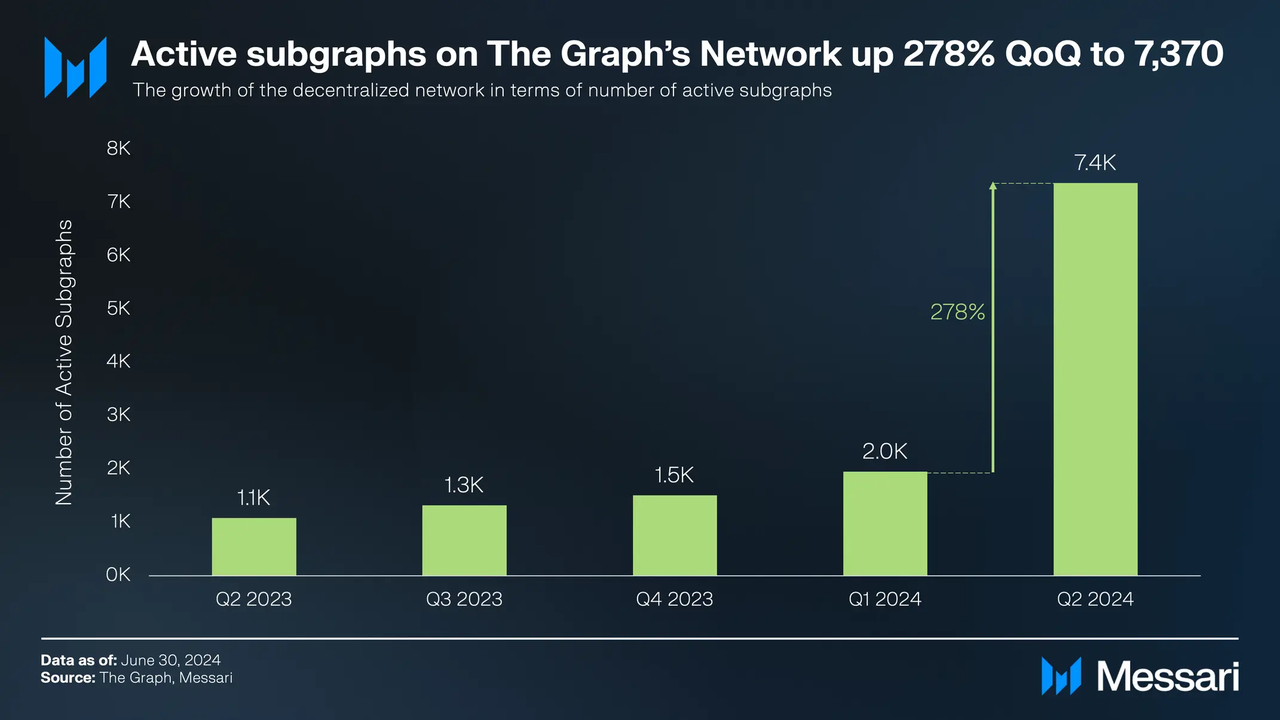

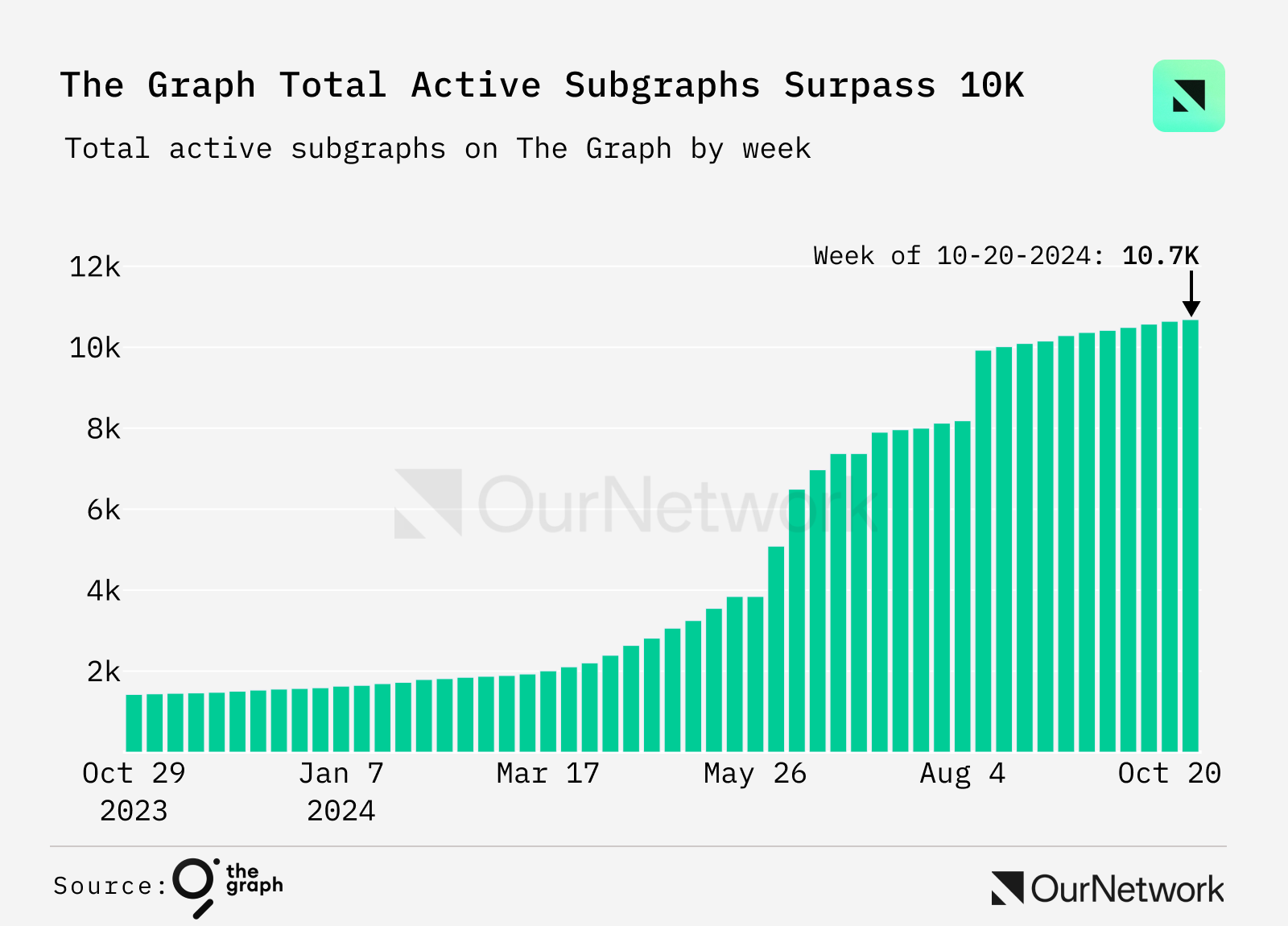

According to Messari, by the end of Q2 2024, 7,370 subgraphs had been deployed to the decentralized network—a 278% increase from 1,952 in Q1 2024.

In Q3, active subgraphs continued rising, surpassing 10,000 by January this year. This steady growth underscores The Graph’s increasingly vital role in supporting large-scale decentralized applications.

Once you grasp the concept, The Graph’s advantages become clearer.

Because specific topics can have dedicated catalogs meeting diverse application needs, it enables two key functions:

-

Transform raw blockchain data into subgraphs, creating thematic indexes

-

Allow different projects to use these indexes via Graph’s API to power data-driven services

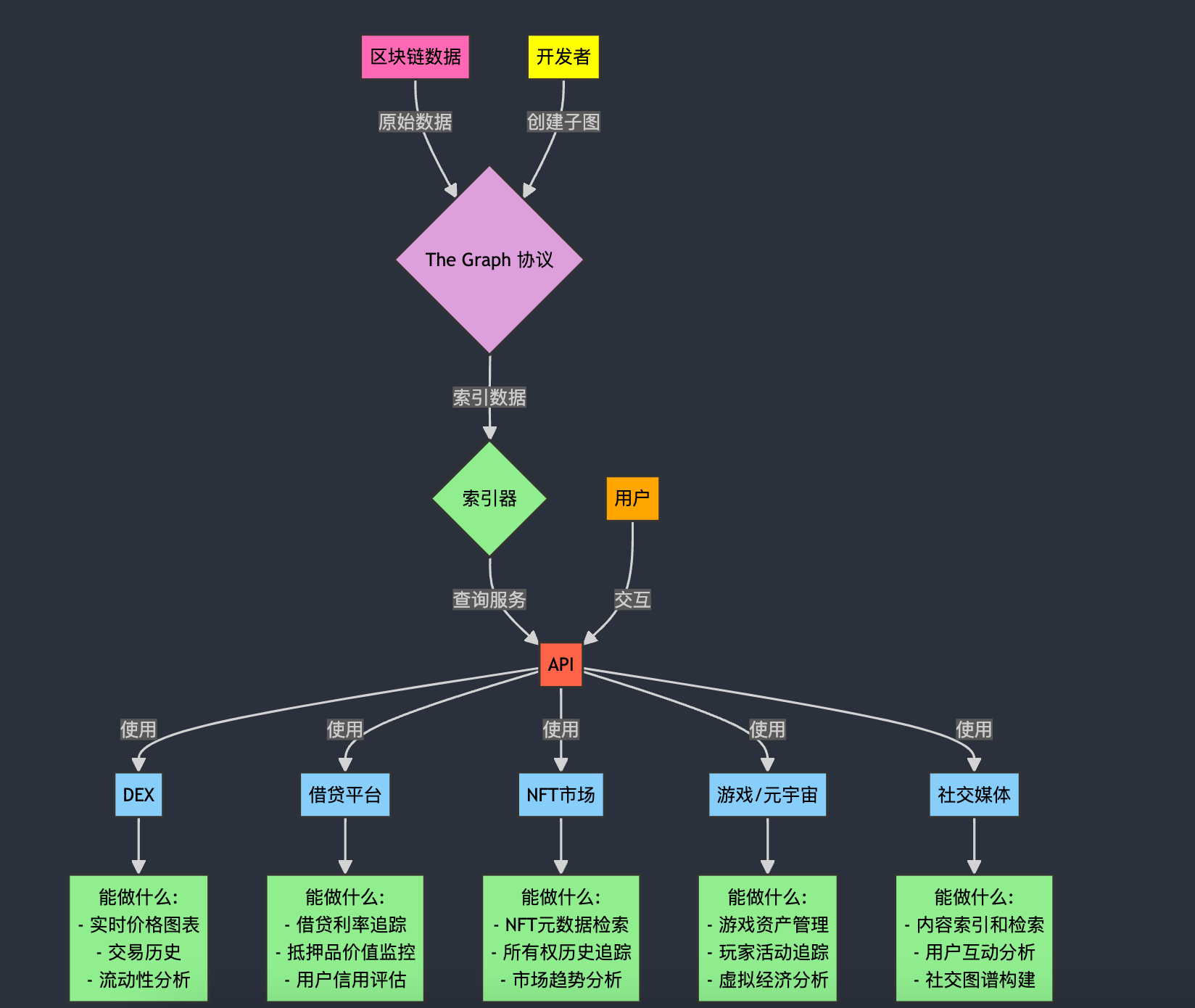

A Decentralized Data Indexing Market

Another question follows: If a single librarian controls access to all on-chain data indexing, why should we trust them?

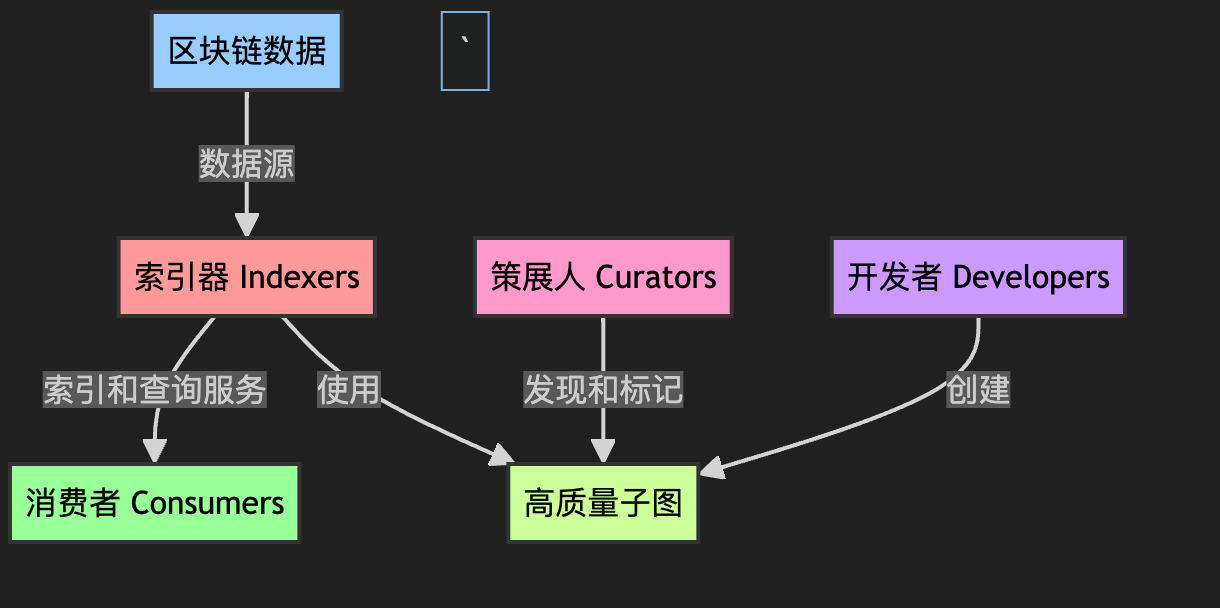

In The Graph’s design, different roles collectively perform the “librarianship” in a decentralized manner—no single entity holds control.

Specifically, indexers, delegators, curators, and developers form a decentralized data indexing marketplace.

First, the indexer: the foundational role. Indexers run nodes to process and index blockchain data. They are the primary data processors, responsible for the initial creation and maintenance of subgraph indexes.

Their incentive? They earn fees and rewards by staking GRT (the native token) and providing query services.

This resembles validators on Ethereum or other L1s—you need scale to run a node. But if you lack scale yet still want to participate, that’s where the delegator comes in.

Similar to liquid staking, delegators can stake their GRT to indexers, boosting network security and efficiency without running their own nodes.

Economically, delegators share in the indexer’s earnings.

Next, a crucial role: the curator.

With thousands of subgraphs created, which ones are best or most suitable for specific use cases? Curators identify high-quality subgraphs and signal their value.

Economically, when a curated subgraph sees heavy usage, the curator earns GRT rewards.

Beyond these, developers or independent researchers can leverage subgraph data to define desired data structures and build applications. They benefit from fast, efficient access to blockchain data, reducing development cost and complexity.

End users—DApps, analysts, or any entity needing blockchain data—gain reliable, rapid data access.

Overall, we see:

Some roles supply subgraphs and indexing; others consume them—forming a decentralized, multi-party data market not controlled by any single entity.

But I’m more interested in whether this market actually sees real usage.

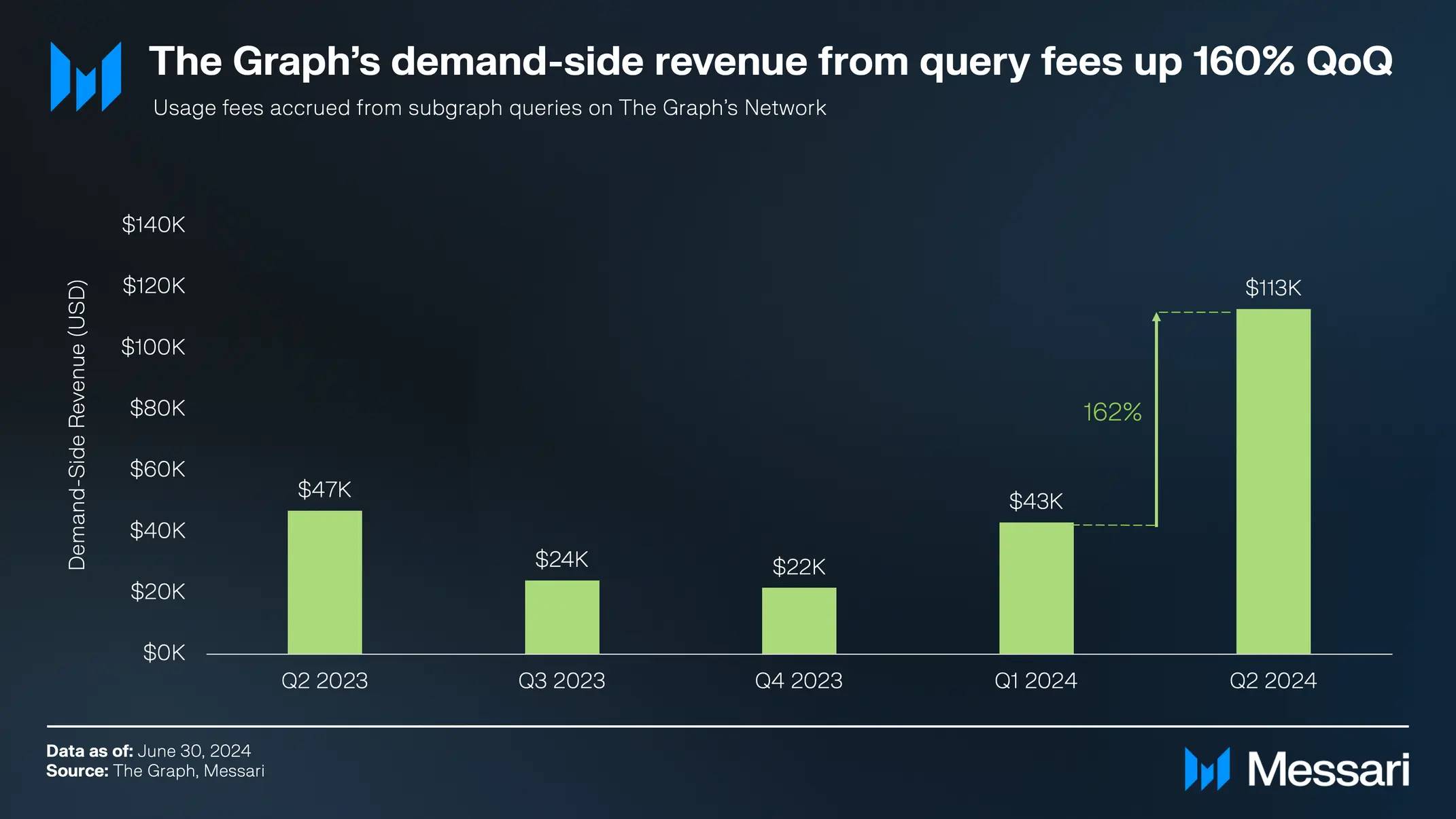

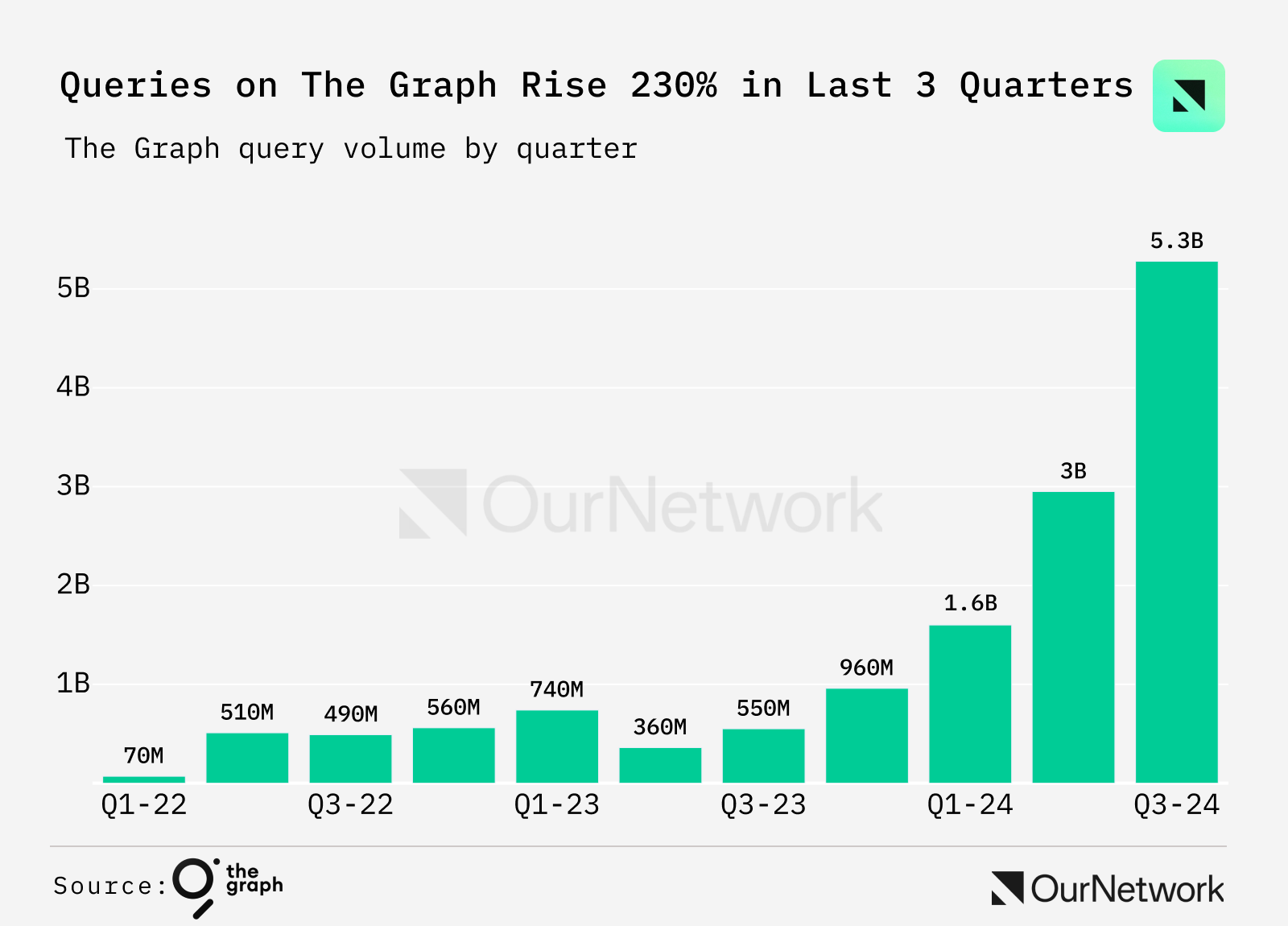

Messari reported that by Q2 last year, The Graph’s total query fee revenue surged 160% quarter-over-quarter in USD terms, hitting a record high of $113,000.

Meanwhile, data demand reached an all-time high of over 2.9 billion queries, up 84% from 1.6 billion in Q1 2024.

In Q3, that figure exceeded 5.3 billion queries, a 79% increase quarter-over-quarter.

Entering the new year, while I don’t have updated public figures, improved market conditions and more narratives will inevitably spawn more projects—and ecosystem activity will further fuel the data querying demand we’ve discussed.

Genuine, essential demand exists—even if it doesn’t come from retail-facing apps.

An under-discussed and under-recognized data market suggests that older projects can still emerge as alpha during cyclical rotations.

The Graph’s business metrics are solidly backed by data—but how has its token GRT performed? And what participation avenues exist for ordinary users?

GRT: A Play for Steady Yield

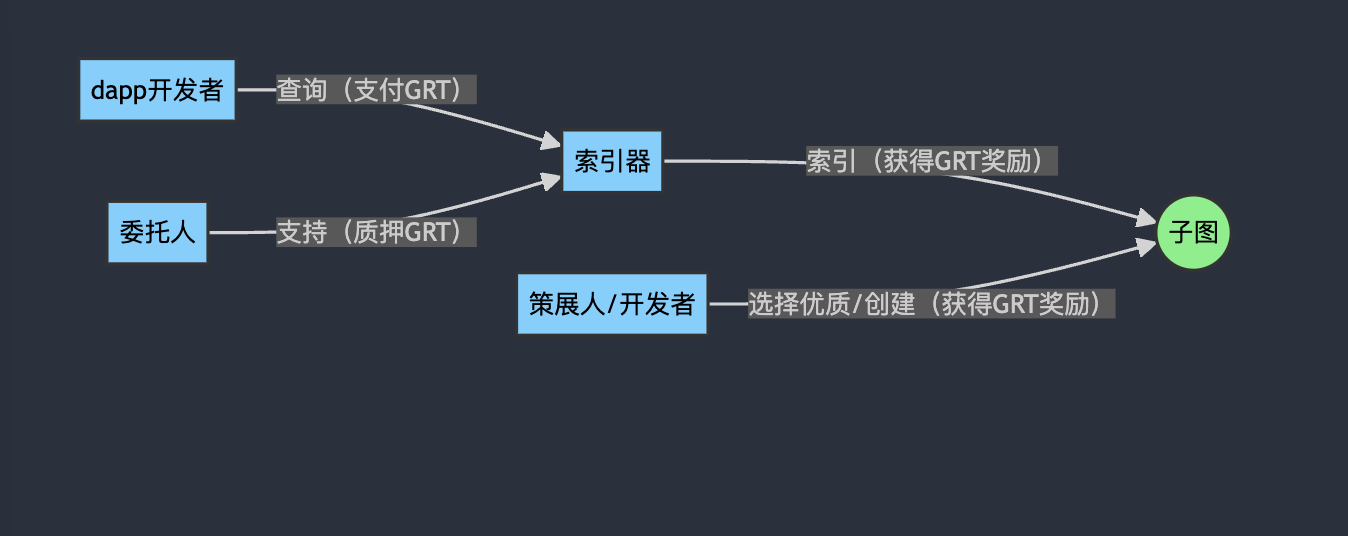

First, GRT plays a key role in incentivizing and regulating behavior within this data market:

-

Demand side: Data consumers and dApp developers pay GRT to query indexes, generating consistent consumption.

-

Supply side: Indexers earn GRT for providing indexing services; curators and developers earn GRT for discovering or creating high-quality subgraphs.

For regular participants, the most accessible path is becoming a delegator—staking GRT to indexers so they can provide more indexing services (similar to staking ETH to validators to secure the network).

But is staking GRT worthwhile? We can assess this from two angles: competitive landscape and project fundamentals.

First, competition.

Capital has opportunity costs—you could instead stake assets as LP in DeFi protocols.

Yet, DeFi is highly saturated. ROI is either already priced in or quickly discovered through marketing, and LP positions risk impermanent loss.

Staking into high-FDV, low-circulation VC coins may result in token depreciation due to unlock schedules—potentially outweighing staking yields.

In contrast, staking in a data indexing market is less crowded and offers relatively stable ROI.

Second, let’s examine staking yield within The Graph itself.

Rewards depend on the chosen indexer, amount of staked GRT, and overall network activity and revenue.

When developers or users query data on The Graph, they pay query fees. Indexers decide what percentage of these fees to retain. In the example below, the indexer keeps 13.96% as income.

The remainder (100% - 13.96% = 86.04%) is distributed to delegators.

Let’s take a concrete example: Suppose 1,000 GRT is staked to this indexer, and you contribute 100 GRT (10% of total stake):

-

A $100 query fee is paid

-

$86.04 is allocated to delegators

-

You receive 86.04 * 10% = 8.604 GRT

In other words, assuming stable indexing demand, the more GRT you stake, the more you earn proportionally.

The real question then becomes: Will the GRT token itself depreciate significantly?

We’re not professional trading analysts and can’t offer financial advice. But comparatively, GRT has one obvious advantage as an established project: fully circulating supply, no vesting unlocks or sell pressure.

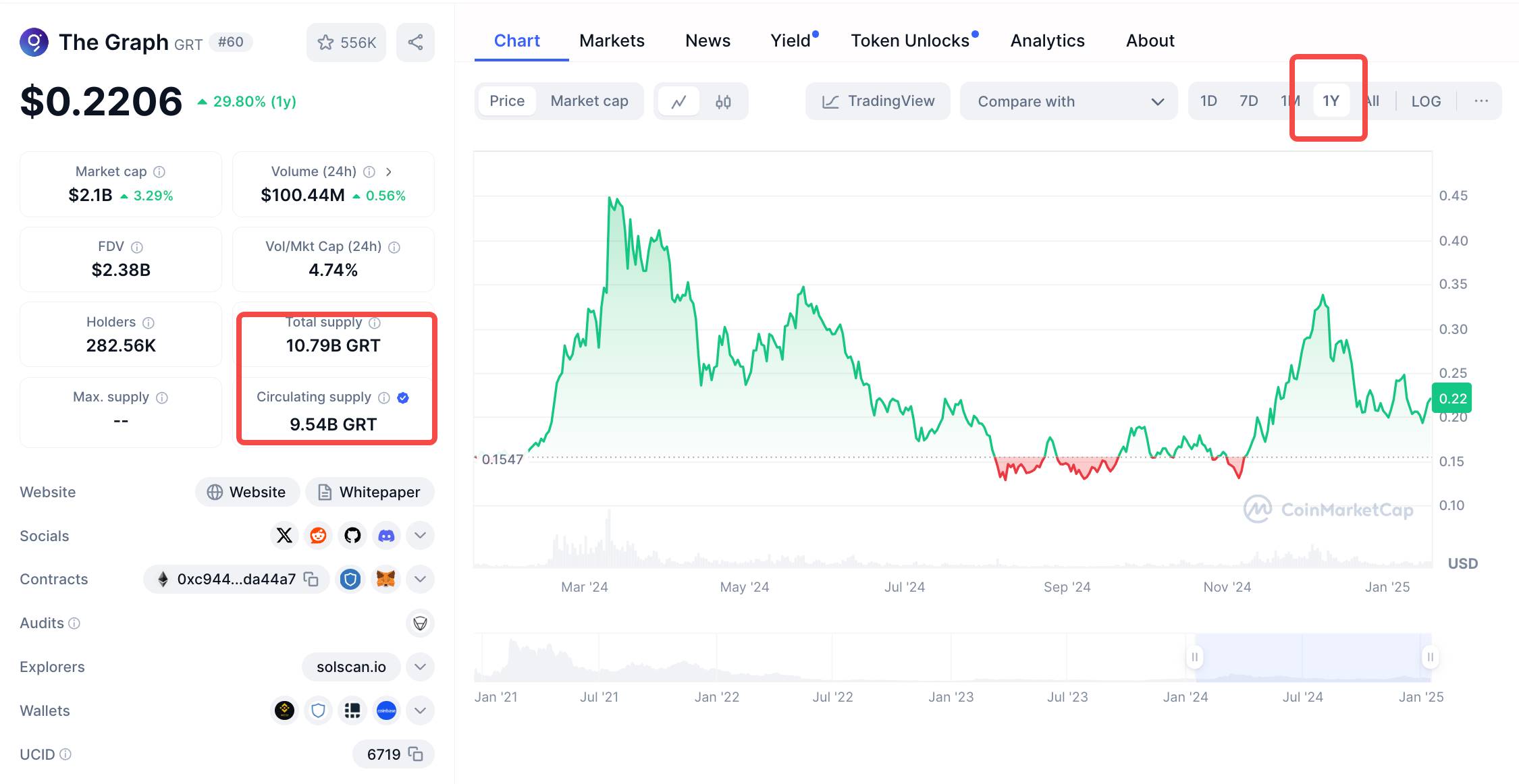

Of course, GRT’s price follows broader crypto cycles. Yet over the past year, it’s up over 30% compared to its level a year ago. On-chain data shows little evidence of active market manipulation or artificial pricing.

Therefore, for those seeking stable staking yields—with increasing token holdings and steady price appreciation—GRT remains an attractive option.

While it won’t match meme coin returns, it carries lower risk and consistent gains—without severe PVP (peak vs. purchase) issues.

The Future

Does The Graph have upcoming catalysts or developments that could capture market attention?

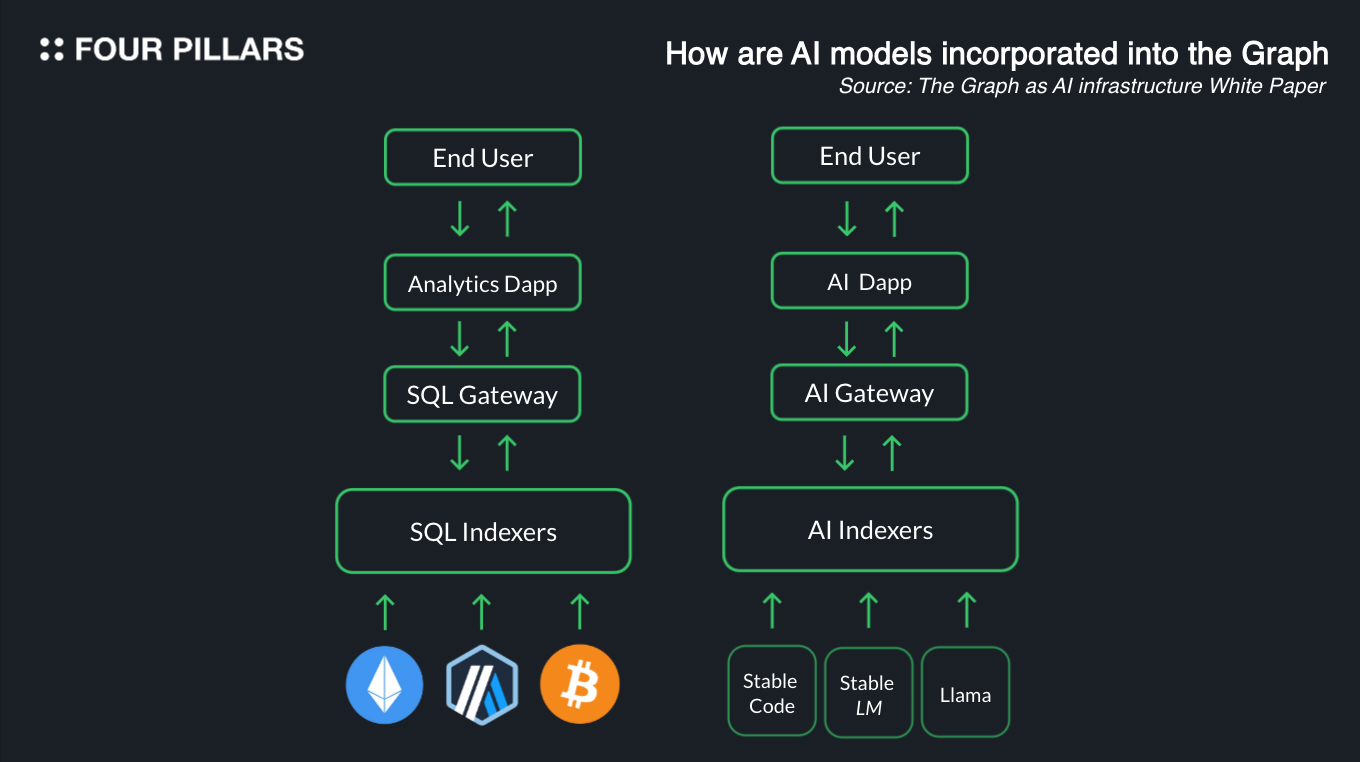

Currently, the project is expanding beyond its original indexer model, exploring deeper integration with AI.

For instance, the essence of indexing is making on-chain data easier to query—this closely resembles foundational infrastructure for AI services, offering backend support for the booming AI Agent trend.

Moreover, The Graph is experimenting with hosting AI models directly on its network. You could upload inference requests to selected indexers, execute them, and return results via gateway—all while The Graph collects service fees, establishing a sustainable business model.

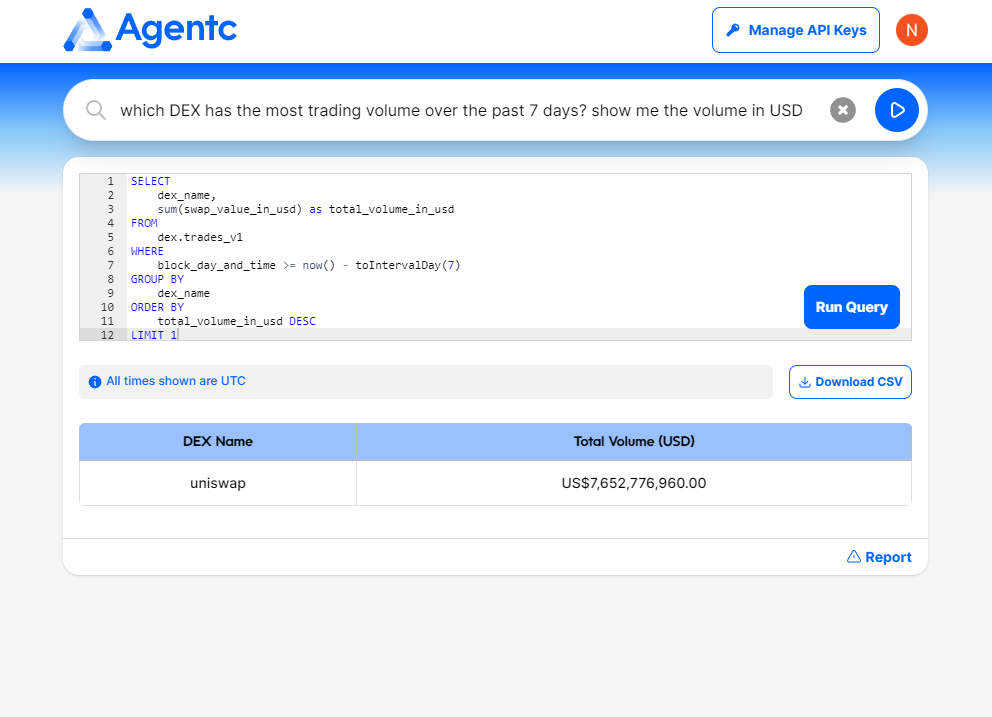

On the more user-facing side, the team is building AI agent tools akin to a crypto-native ChatGPT, powered by The Graph’s indexed DEX data. For example, you could directly ask, “Which DEX had the highest trading volume in the past seven days?” and get a response via indexed queries.

The key advantage here is that unlike newly launched AI Agent projects, The Graph follows a “indexing-first, AI-second” strategy.

It can ride the AI wave when favorable—or fall back on its robust data indexing foundation to maintain baseline operations.

This may represent one of the best current examples of PMF (product-market fit) in crypto.

Today’s PMF isn’t about going viral or grand idealism—it’s about pragmatically providing data indexing services to every crypto project, a durable and sustainable form of product-market fit.

Products with real demand deserve a place in the ecosystem. Tracking their development offers a solid path to reliable returns.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News