Understanding The LP: A Social Experiment Tackling NFT Liquidity and Royalty Challenges

TechFlow Selected TechFlow Selected

Understanding The LP: A Social Experiment Tackling NFT Liquidity and Royalty Challenges

The LP is a 100% on-chain and CC0 experiment aiming to set a standard for revenue streams for creators who do not rely on secondary royalties.

Author: kezfourtwez

Translation: TechFlow

Last week was hellish. Whether you're new or seasoned, the shock of seeing a top-three exchange vanish in a single day is indescribable.

It didn't just affect ordinary retail investors—FTX's collapse severely impacted the entire ecosystem, not only on a monetary level or for JPEGs, but also by triggering a deep crisis of trust.

We don’t know how long recovery will take, but we need to pick up the pieces and move forward.

There’s little worth writing about in the crypto markets this week, so I’ve picked a project from the NFT space that suddenly caught my eye.

The LP

Since the launch of Sudoswap, debates around royalties have been a long and drawn-out discussion.

This is a solution that has been talked about since day one, but as far as I know, this is the first time someone has actually implemented it.

The LP is a 100% on-chain and CC0 experiment aiming to set a standard for creator revenue streams that do not rely on secondary royalties. The project issues NFTs through a Dutch auction, with the next phase only triggered once all 8,000 NFTs are minted. The LP aims to demonstrate and popularize a liquidity model that returns power to creators by enabling them to own their own liquidity. Auction prices start at 1.11 ETH and can drop as low as 0.011 ETH. There are only two possible outcomes: complete sellout or failure—and the mechanism operates through four simple rules:

-

Trustless Escrow—All mint proceeds are held in a smart contract. Once minted, NFTs are locked in the minter’s wallet. If not all NFTs are sold within 11 days, all bids are refunded and the NFTs are burned.

-

Instant Liquidity—If all 8,000 NFTs are minted, half of the mint revenue plus an additional 1,000 NFTs will be deposited into a two-sided liquidity pool to ensure deep and immediate liquidity.

-

Team Mint—If all 8,000 NFTs are minted, the contract immediately mints an extra 1,000 NFTs owned by the team as project revenue.

-

Fees—If the mint cap is reached, another 1,000 NFTs (totaling 10,000) will be minted and deposited into the liquidity pool, earning fees on every trade. For each NFT transaction, half of the fee goes into the pool for LP token holders to claim, while the other half is reinvested into the liquidity pool for further trading. The team not only owns 10% of the supply to use freely but also earns 10% of total trading fees.

Beyond its innovative LP mechanism, the project also showcases impressive on-chain pixel art.

Using SSTORE2, sprite sheets are stored directly on-chain. Each time an NFT is generated, the smart contract randomly selects traits and references the sprite sheet.

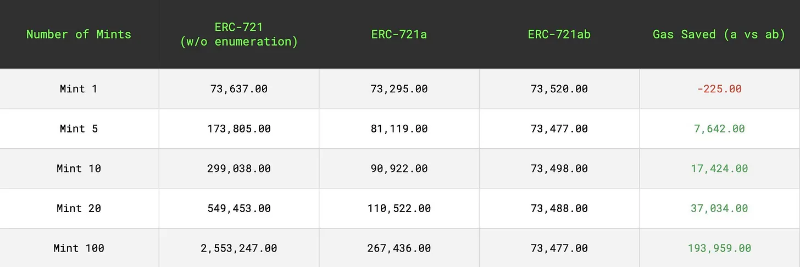

The LP’s developer, 0xDeployer, created his own NFT standard leveraging ERC-2309 to maintain a constant gas price—whether minting 1 or 1 million NFTs, the cost remains stable. In fact, minting the 100th NFT uses less gas than the first.

At the time of writing, the Dutch auction has been running for 7 days, with 8 NFTs minted so far and the current mint price at 0.4605 ETH.

I expect we won’t see significant minting activity until the price drops below 0.1 ETH. Moreover, the current market is highly volatile, which could strike this project at any moment.

The team’s goal is to further promote this model as a potential solution to the industry’s royalty dilemma. They plan to offer community rewards to support further system development and create a listing aggregator to assist other projects adopting this model.

I believe The LP is a remarkably cool innovation, featuring excellent on-chain art and clear objectives whose values align with true decentralization—a principle we need now more than ever. Wishing the team the best of luck.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News