Azuki is launching a token—another rug pull or a sign of NFT revival?

TechFlow Selected TechFlow Selected

Azuki is launching a token—another rug pull or a sign of NFT revival?

ANIME's relaunch, Azuki's final push.

By Pzai, Foresight News

As one of the key assets during the NFT bull market, Azuki has followed in Pudgy's footsteps by launching its own ANIME token and releasing a detailed tokenomics structure. With a total supply of 10 billion tokens, the initial circulating supply stands at 7.69 billion. Among these, 37.5% will be airdropped to Azuki NFT holders, while the remainder is allocated for community funds, ecosystem development, and team incentives.

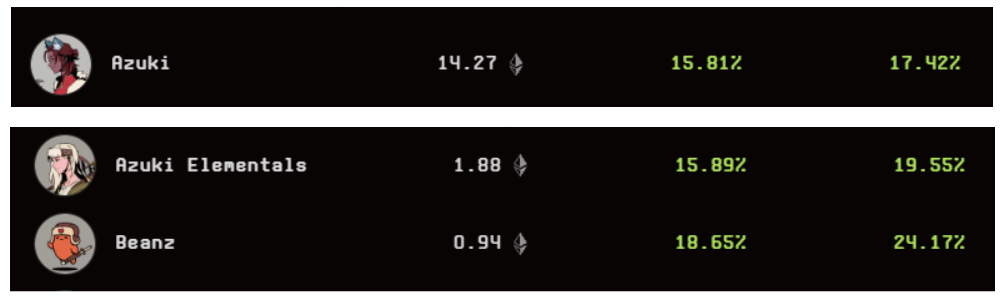

Boosted by the announcement of the ANIME token launch, NFT prices within the Azuki ecosystem reacted swiftly, signaling a clear recovery in market sentiment. At the time of writing, the floor price of the Azuki NFT collection had reached 14 ETH—marking a recent high—with a daily increase of as much as 17.42%. Meanwhile, other related NFTs within the Azuki ecosystem, such as Beanz and Elementals, also rose in tandem, reflecting optimistic market expectations for Azuki’s future.

From Takeoff to Fall from Grace

In Azuki’s development journey, founder ZAGABOND’s past actions and the launch of the Elementals series have undoubtedly cast a shadow over the project’s sustainability. As the central figure behind Azuki, ZAGABOND admitted in May 2022 to having initiated—and then abandoned—three NFT projects: Crypto Phunk, Tendies, and CryptoZunks. These were widely criticized by the community as “Rug Pull” incidents. Although ZAGABOND defended them as part of his “learning experience” and insisted he did not maliciously abscond with funds, the community remained unconvinced. This controversy directly caused the floor price of Azuki NFTs to plummet from around 20 ETH to 7.39 ETH, severely damaging market confidence.

On June 28, 2023, the release of Azuki’s new series "Elementals" pushed community dissatisfaction to its peak. The Elementals launch was highly anticipated, expected to breathe new life into Azuki. However, the delivered NFTs bore striking similarities to the original Azuki series, featuring numerous duplicate images and low-quality designs that significantly undermined the rarity framework of existing Azuki NFTs. Community members felt deceived—especially loyal supporters who had invested substantial capital. The Elementals floor price quickly dropped from 2 ETH to 1.32 ETH, dragging down the main Azuki series’ floor price to 9.87 ETH.

These events severely eroded community consensus and triggered panic selling among large holders. Several prominent Azuki collectors offloaded their collections, further depleting market liquidity. Worse still, the team’s post-event response was seen as insincere and ineffective in calming community tensions. While the team pledged to improve minting processes and fix technical issues, these measures failed to restore trust. Subsequently, AzukiDAO even filed a lawsuit against founder Zagabond, seeking the return of 20,000 ETH. The case eventually fizzled out, and in November 2023, AzukiDAO rebranded as "Bean" and pivoted into a memecoin project on the Blast chain.

Perhaps inspired by the market enthusiasm surrounding PUDGY’s token launch—or drawing lessons from prior meme-based operations—Azuki ultimately chose an alternative path to revival through the ANIME token.

The Paradigm Shift: From NFTs to 'Culture'

As early as January 6, the Azuki account followed and retweeted Weeb3 Foundation, whose profile describes itself as “building an open metaverse powered by ANIME.” This sparked speculation within the community about upcoming token issuance plans. As Azuki transitions from an NFT brand to an ANIME-driven movement, many are beginning to shift their perception.

Azuki defines ANIME as a “cultural token”—a movement aiming to transform 1 billion anime fans into a community-owned creative network. From the outset, Azuki’s distinct anime-inspired aesthetic laid a solid foundation for its long-term vision. Its unique art style blends the essence of Japanese animation with modern streetwear elements, successfully attracting global crypto art collectors. This identity not only set Azuki apart in the NFT space but also endowed it with strong cultural attributes. The introduction of the ANIME token further strengthens this cultural narrative, using token economics to incentivize community participation and extend cultural value to broader audiences.

Following shifts in the market, NFT holders’ mindsets and needs have evolved significantly—increasingly viewing digital assets as identity markers rather than mere tradable commodities. Especially within specific communities or cultural niches, the value of NFTs has surpassed their financial utility, becoming tools for self-expression and identity affirmation.

This transformation reflects a broader trend in the NFT market: a move away from early speculation-driven dynamics toward culture- and community-driven engagement. In today’s rising meme landscape, initiatives like Azuki’s airdrops to the Hyperliquid (HYPE stakers), Kaito Yappers, and Arbitrum communities demonstrate how projects are leveraging such opportunities to reward NFT holders, expand organic ecosystem circles, broaden influence, and create mutual benefits.

Growth Through Alternative Paths

The growth brought by token launches for NFT projects is evident. For example, Azuki saw a significant surge in trading volume and floor prices within a week before and after the token announcement, attracting more new users and capital inflows. The Pudgy Penguins team has already demonstrated this growth trajectory. Since its token launch, Pudgy’s floor price has consistently stayed above 23 ETH. Additionally, the anticipated airdrop from its upcoming Abstract Chain provides strong backing for Pudgy’s valuation. Token issuance not only enhances user engagement and sense of belonging but also creates new revenue streams and sustainable development pathways. Thus, the growth driven by tokens manifests not just in short-term market heat but also injects long-term momentum through robust token economies. Compared to NFTs, fungible tokens offer greater liquidity and composability.

Clearly, the trend of NFT “revival” brings significant benefits—not only to individual NFT projects but also to the broader crypto ecosystem. Key advantages include:

-

Enhancing Cultural Appeal and Brand Value: By building around a distinct cultural theme, projects attract like-minded users and strengthen community identity. Assigning clear cultural attributes to NFTs allows brands to quantify value via tokens, creating unique brand narratives through synergies between tokens and ecosystem initiatives—boosting market recognition and long-term worth.

-

Expanding User Base and Enabling Cross-Community Collaboration: Projects can reach wider audiences of culture enthusiasts, breaking beyond crypto-native circles and expanding mainstream influence. Through token airdrops and partnerships, they connect with other communities, generating powerful network effects. The shift from NFTs to fungible tokens enables access at higher liquidity levels—such as centralized exchanges—maximizing ecosystem accessibility.

-

Creating Sustainable Value and Iterating Incentive Models: Tokens help transition NFTs from short-term speculative assets into long-term cultural value carriers, enhancing project sustainability and resilience. Through tokenomic models, projects can incentivize community contributions and content creation, unlocking diverse cultural applications such as virtual events and IP licensing. For Azuki, the vast anime market represents a core area of ambition, with the token serving as a critical catalyst and lubricant—delivering enhanced income and experiences for users.

In summary, token launches provide NFT holders with expanded rights and incentives—such as governance power, airdrop rewards, and in-ecosystem use cases—thereby strengthening community stickiness and engagement. Moreover, token circulation opens new revenue channels for NFT projects, including transaction fees and potential staking yields, further driving sustainable ecosystem growth. However, such growth comes with challenges: token price volatility may impact NFT valuations, and balancing token economics with NFT scarcity remains complex. Going forward, NFT projects must strike the right balance between token distribution and community culture to achieve genuine long-term value appreciation.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News