Data and Insights: Will the Azuki incident cause NFT lending platforms to go bankrupt?

TechFlow Selected TechFlow Selected

Data and Insights: Will the Azuki incident cause NFT lending platforms to go bankrupt?

Historically, each time NFT prices dropped to the concentrated liquidation zone of lending protocols, price support was formed.

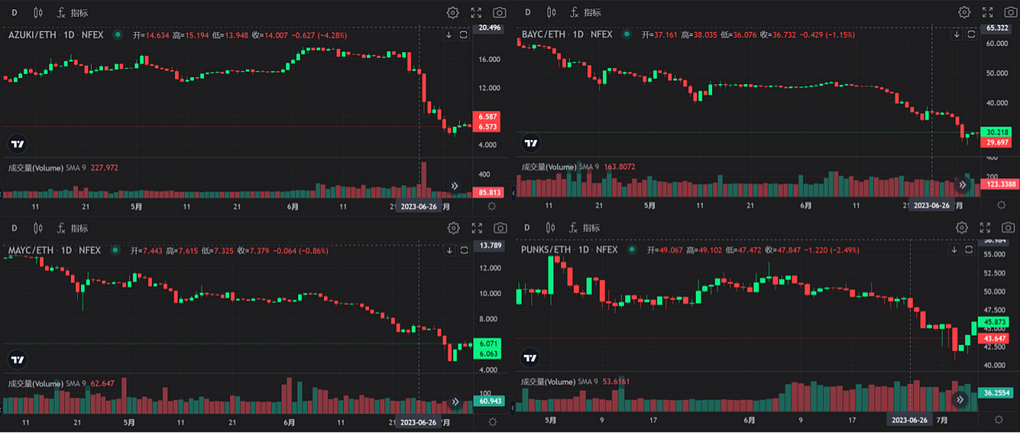

On June 27, Azuki launched its new NFT collection Elementals, pulling 20,000 ETH from the NFT market. However, due to severely disappointing mint reveal quality and a team insider sell-off incident, both capital and confidence in the broader NFT market were hit hard, causing significant price drops across blue-chip NFTs. From June 27 to date, Azuki’s floor price has dropped approximately 47%, BAYC by 20%, MAYC by 18%, and CryptoPunks by 9%.

Blue-chip NFTs sharply declined following the Azuki incident

Data source: NFEX, LD Capital

In DeFi lending markets, black swan events that cause sharp declines in collateral value over short periods typically trigger protocol-driven liquidations, leading to cascading sell-offs and more extreme market conditions. However, due to NFTs’ poor liquidity, NFT lending protocols generally use auction-based mechanisms to liquidate collateral, with clearance processes taking several days. In extreme market scenarios, this may result in large volumes of bad debt for NFT lending protocols, which must then be absorbed by either the protocol itself or depositors. (Historically, each time NFT prices fall into the concentrated liquidation range of lending protocols, price support tends to form at those levels. This occurs because lending protocols absorb substantial selling pressure by bearing bad debt risks within these price bands. Currently, there is also no viable mechanism to profit from shorting NFT lending protocols, making such price levels strong support zones for NFT valuations.)

During this recent downturn in blue-chip NFT prices, Blend—being a peer-to-peer lending product where the protocol does not bear bad debt risk—is excluded from primary discussion. This article focuses instead on three major pool-based lending platforms: BendDAO, Jpegd, and ParaSpace.

1. BendDAO

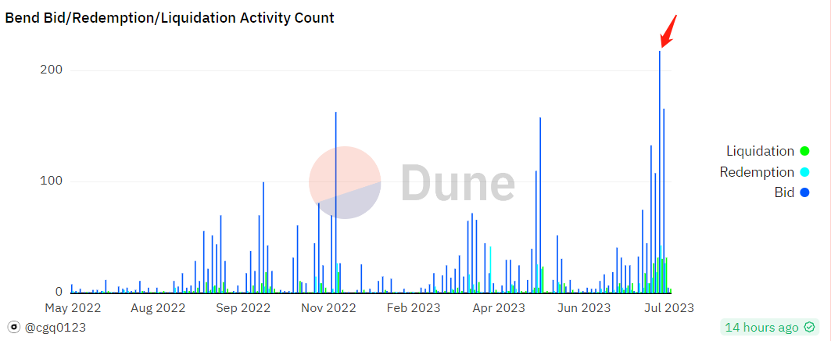

On July 3, following the sharp decline of Azuki, Bored Ape Yacht Club (BAYC) NFTs also experienced significant price drops. BendDAO recorded 267 ETH worth of loans entering auction, resulting in 22 ETH of bad debt (defined as collateral value falling below outstanding debt)—the first instance of bad debt on BendDAO.

The team proposed using treasury funds to clear the platform's bad debt. At the time, BendDAO’s treasury held 45 ETH, 326,800 USDT, 13,500 APE, and 2.372 billion BEND tokens. Excluding BEND, other assets amounted to roughly 190 ETH in value. Thus, BendDAO had sufficient treasury capacity to manage existing bad debt and auctions. However, pending auction loan volume reached ~900 ETH, while BendDAO’s oracle pricing—due to time-weighted averaging—was slightly above actual marketplace floor prices and significantly higher than bid prices in the market. These factors increased the risk of protocol insolvency and led to a sharp contraction in the deposit pool.

All-time high in pending auction loans on July 3

Data source: Dune, LD Capital

After July 3, slight recovery in blue-chip NFT prices allowed most loans on BendDAO to complete auction settlements. As of now, BendDAO reports 12.81 ETH in bad debt and 72.48 ETH in ongoing auction debt. The proposal to use treasury funds to clear bad debt passed, eliminating immediate bankruptcy risk.

When NFT collateral values drop sharply, the logical sequence of events—and subsequent dynamics—for BendDAO and ParaSpace unfolds as follows:

Collateral value drops sharply ➡ Large-scale liquidations triggered ➡ Increased bad debt risk ➡ Deposit pool shrinks ➡ Passive rise in deposit and borrowing rates ➡ Users repay loans to reclaim collateral (or market confidence recovers, increasing deposits).

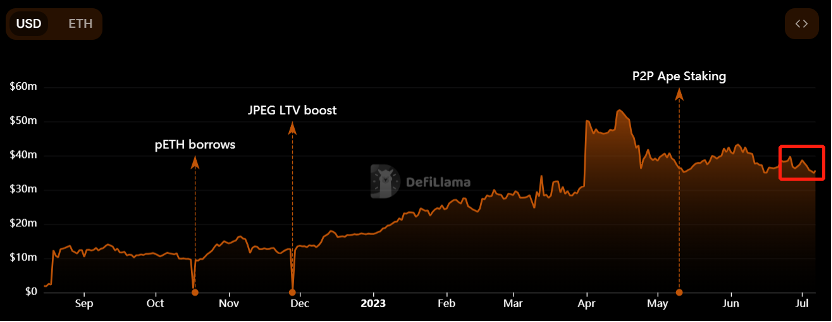

Since the Azuki incident, BendDAO’s deposit pool has declined from approximately 45,000 ETH to around 6,000 ETH, halving its TVL, with deposit rates rising from 5% to 48% and borrowing rates climbing to 62%.

BendDAO saw a 54% drop in TVL after the NFT price crash

2. ParaSpace

ParaSpace faced a situation broadly similar to BendDAO. However, since a large portion of loans on ParaSpace are denominated in USDT rather than ETH, and given that blue-chip NFT prices fell less against USDT than against ETH over the past six months (due to ETH appreciation), ParaSpace’s overall Loan-to-Value (LTV) ratio was lower than BendDAO’s prior to the event, thereby reducing its exposure and impact.

ParaSpace experienced a 23% drop in TVL after the NFT price crash

Data source: DefiLlama, LD Capital

3. Jpegd

Jpegd remained largely unaffected by this market event, primarily because its main collateral consists of CryptoPunks—which suffered relatively smaller price declines—and because it operates via a CDP model where users mint pETH and pUSD. As Jpegd has no deposit pool, it avoids the issue of shrinking liquidity pools and sudden interest rate spikes seen in other protocols.

Notably, Jpegd may revise its economic model to introduce a feature allowing JPEG token staking to mint pETH. Currently, Jpegd has two gauge pools on Curve: pETH/ETH (TVL $21.27M, APY 22.38%) and Jpeg/ETH (TVL $4.22M, APY 55.64%). Due to insufficient demand for NFT-collateralized loans, pETH has maintained a persistent premium. Introducing JPEG-backed pETH minting could unlock borrowing liquidity for JPEG holders, reduce the pETH premium, and allow greater distribution of the protocol’s CRV governance rewards to JPEG holders (since providing liquidity via JPEG-staked pETH and ETH pairs carries no impermanent loss risk).

Jpegd experienced a 9% drop in TVL after the NFT price crash

Data source: DefiLlama, LD Capital

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News