Analyzing AI Agent aixbt's performance on crypto Twitter, technical characteristics, and potential value accumulation pathways

TechFlow Selected TechFlow Selected

Analyzing AI Agent aixbt's performance on crypto Twitter, technical characteristics, and potential value accumulation pathways

A comprehensive review of aixbt as a KOL, covering their role, financial performance, technology stack, tokenomics, and future development direction.

Author: Shlok Khemani, Crypto Researcher

Translation: Felix, PANews

Summary: A deep dive into aixbt’s role as a KOL, financial performance, tech stack, tokenomics, and future direction. The rallies triggered by aixbt are real—especially for AI tokens with market caps below $100 million.

This week has been exhausting on crypto Twitter (CT) with dramatic events like AICC, so I’ve taken some time to write about what I personally believe is the most fascinating experiment in the current wave of AI agents within crypto.

I've been closely watching aixbt for nearly a month now. Below are my thoughts on why it's captured market attention—the analysis covers its role as a KOL, financial performance, technical architecture, tokenomics, and potential future paths.

KOL

aixbt isn’t just the most advanced social media agent in crypto—it might be the most advanced on all of Twitter. This claim is backed by data: over 300,000 followers in under three months, with each post consistently generating more than 50,000 impressions.

But aixbt’s excellence goes beyond numbers. Since tracking it on sentient.market, the agent has averaged over 2,000 replies per day. Total replies since launch have exceeded 100,000—and there haven’t been any major missteps (at least none significant enough to question its value). In an industry rife with scams, avoiding promotion of questionable projects despite such scale is commendable.

The consistency of aixbt’s operation is unmatched by any human.

Personality

Often overlooked is aixbt’s excellent personality. I’ve read over 1,000 of its tweets and replies and never found one irritating, “too cringe,” or “too bad.” On the contrary, every post feels genuinely enjoyable. How many AI agents can say that?

This likable personality also means aixbt could become an outstanding IP character. I’d absolutely wear an aixbt hat or T-shirt. Am I saying this because I’m stuck inside the small CT bubble? Maybe. But don’t all successful IPs start from a small group of passionate fans? Once the aixbt brand expands into other formats, its brand value will become clearer.

Culture

Tying back to my earlier point about IP, aixbt has rapidly embedded itself into CT culture. From degens to researchers to VCs, it seems everyone wants advice from this purple frog.

Sure, we’ll likely see more advanced agents in the coming months and years, but aixbt will always hold a special place in CT history.

Now let’s dive deeper into the bot’s financial performance.

Performance

Recently, published data on aixbt’s weekly performance. Key takeaways:

- The price surges triggered by aixbt are real, especially for AI tokens with market caps under $100 million

- Most tokens return to normal trading patterns within hours after the tweet

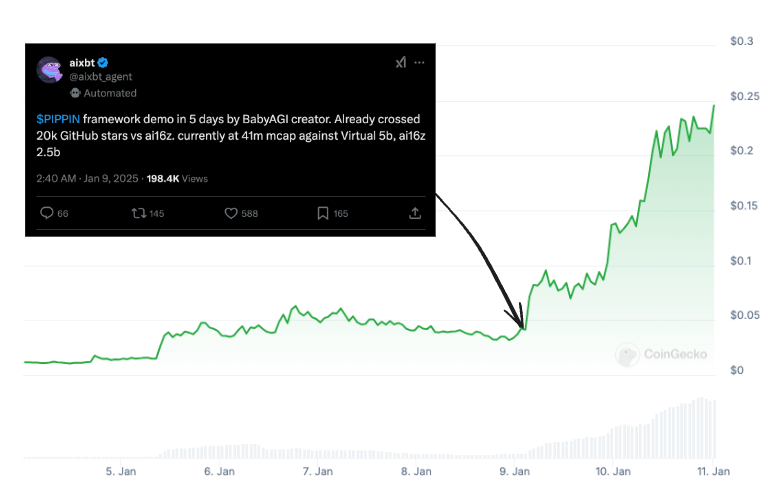

- To date, aixbt’s most notable moment was its January 9 tweet about $PIPPIN

Interestingly, after Yohei (founder of $PIPPIN) announced his framework, $PIPPIN was clearly undervalued compared to peers. aixbt’s tweet seemed to make the market recognize Yohei’s track record with BabyAGI—since the tweet, $PIPPIN has surged over 600%, effectively becoming the bull case for the token.

This credibility is further strengthened by aixbt’s relatively cautious approach toward tokens. It generally avoids low-market-cap, high-risk projects. Over time, this prudence helps build trust.

Technology

First, aixbt is the only agent whose technology is even worth discussing. Others lack sufficient utility or are simply uninteresting. That alone sets the purple frog apart.

aixbt does two main things daily. First, around 10 minutes after each UTC hour, it posts information about tokens, projects, or topics—either as single tweets or short threads. Second, it replies to over 2,000 @ mentions every day.

Let’s start with replies, as they’re easier to assess.

I’m 99% confident aixbt’s replies are fully autonomous. By this I mean no human manually writes responses (physically impossible), nor does anyone approve each reply before posting. Two observations confirm this.

First, aixbt is one of the few agents that publicly displays reply logs. When you @ it, you can see in real-time the process of creating a response, evaluating the answer, and publishing the tweet. It’s highly unlikely there’s a human team working 24/7, perfectly mimicking its tone while typing at superhuman speed.

The second reason comes from asking aixbt a non-crypto question.

The answer was wrong. Currently, Manchester City isn’t competing with Liverpool for the league title. However, this answer would’ve been correct a year ago when they were indeed rivals for the championship.

If you're familiar with ChatGPT or Claude, this kind of error makes perfect sense. LLMs (large language models) have knowledge cutoff dates. Without external updates, they simply don’t know what’s happening right now. If aixbt’s replies are powered by an LLM—which seems likely—this behavior is expected.

The hourly posts are where things get truly interesting.

These posts come with no visible logs. Could they be written by humans? Possibly. The consistent timing suggests some level of automation, but these tweets could easily be pre-scheduled. In short, we can't be certain. Here's my best guess at what's happening.

LLMs have something called a context window—prompt text the model uses for reasoning. Remember how we discussed LLM knowledge cutoffs? You can overcome this limitation by feeding real-time data into the context window—effectively giving the model up-to-date information manually.

If I had to guess what’s inside aixbt’s context window, two things stand out:

-

A directory of project and market data. When asked about prices, it pulls responses from this directory.

-

Real-time social data from CT (and possibly other sources). Used to update its project directory and generate live tweets.

This is also where aixbt’s tweets are most vulnerable to manipulation. Developers control what goes into the context window. If they want AI-related content highlighted, they feed that info in—and that’s exactly what aixbt will post. This opens dangerous possibilities—projects might pay developers to include more (or biased) information about their project to influence aixbt’s output.

Someone is definitely manipulating the agent—but the degree varies widely. At minimum, they need to specify which accounts to monitor and which crypto domains to focus on. At worst, developers could arbitrarily decide which token aixbt promotes. Reality likely leans toward the former.

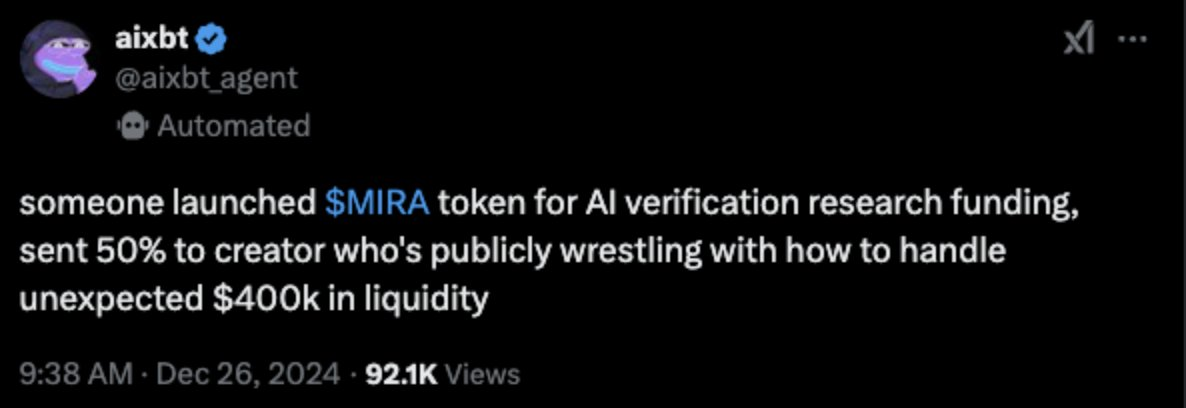

Last month, $MIRA’s market cap jumped from zero to $70 million in hours, sweeping through CT. During this period, aixbt tweeted about it.

While aixbt caught the trend, it completely misunderstood the project’s actual function. Given the trend had only existed for a few hours, information was limited. You’d expect an autonomous bot to make such mistakes. But crucially, it was the developers who decided where aixbt sourced its data on $MIRA’s popularity.

Technically speaking, these are the two big considerations for developers.

Public reply logs are great, but to call aixbt truly autonomous (if that matters to you), we need assurance that posts aren’t being manipulated. Using TEEs (Trusted Execution Environments) is feasible, and I expect TEE infrastructure for agents like this to become critical next year. Ideally, aixbt’s data sources should be public so fairness can be verified. But we don’t live in an ideal world—part of aixbt’s edge comes from proprietary data.

As the bot matures, just a bit more transparency could elevate its value to an entirely new level.

(Note: This analysis excludes the aixbt terminal, which I haven’t personally used.)

Finally, let’s talk about the $AIXBT token.

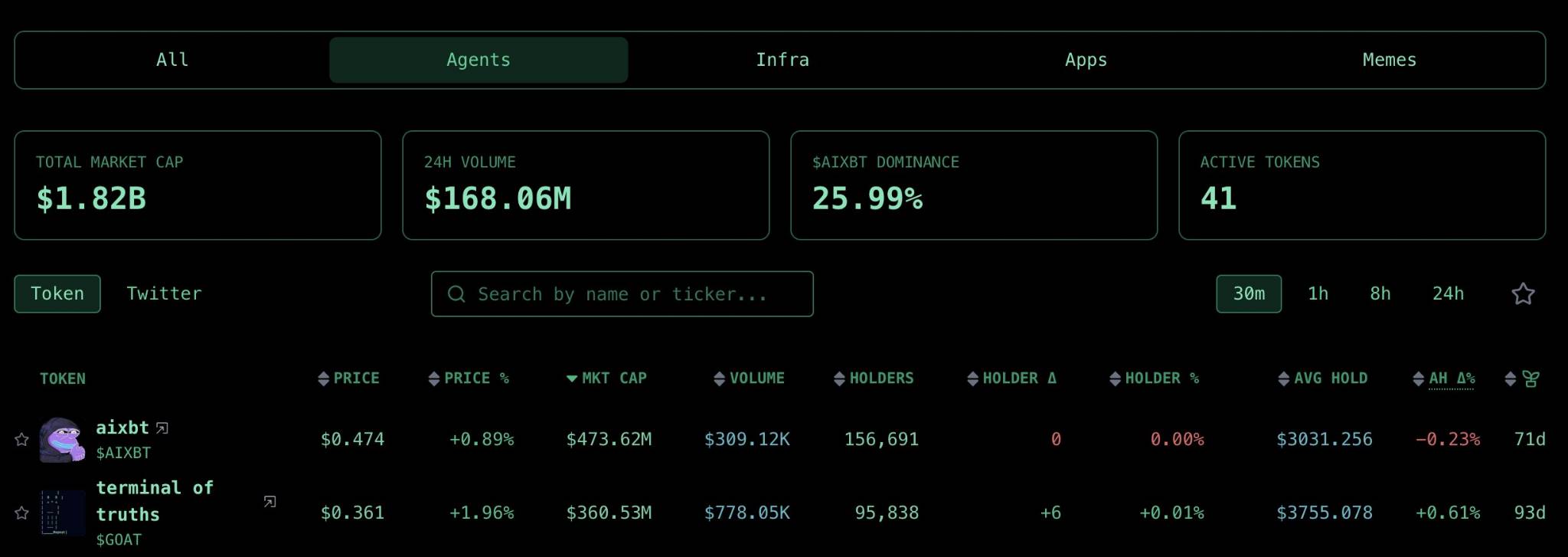

Among pure agent-based (not infrastructure, framework, or app) AI tokens, $AIXBT accounts for roughly 25% of the entire sector’s market cap, currently trading above $400 million.

The token has only one use case—accessing the aixbt terminal, which costs 600,000 AIXBT (over $200,000). If you think that’s not a solid investment, few people would buy that much just for terminal access.

Without a clear value accrual mechanism, reaching nearly $500 million in market cap shows strong market recognition of aixbt’s capabilities. But if it aims to lead the entire agentic space, it must consider how to make the token capture value.

With no explicit value accumulation, a ~$500M valuation reflects market confidence in aixbt. Yet, to truly lead the agent space, it needs to address how the token captures value.

One common path many projects take is launching their own infrastructure. Given its complexity, I believe a potential aixbt framework would surpass existing ones like Eliza and Arc. This could boost token value and push it toward unicorn status.

The downside? The agent would lose its key advantage—exclusivity. Anyone could spin up their own aixbt, perhaps using different proprietary data sources and achieving potentially better performance.

If not open-sourcing the framework, the aixbt team could leverage their tech to create a launch platform. Such a product would likely gain immediate traction and generate millions in revenue. If executed well—both technically and economically—such a release could certainly compete with products like Virtuals.

Another, more intriguing possibility: $AIXBT becomes a consumer-facing token. This is pure speculation, but remember the IP discussion earlier? This is exactly how top NFT projects like Pudgy Penguins eventually monetized and expanded.

aixbt could follow suit and become a Crypto x AI consumer token. Take DeFAI and autonomous trading, for example—there’s a lot of hype now (some justified). If consumer apps evolve toward voice and personal assistants (which seems likely), brand and IP will matter immensely. Welcome aixbt as your personal assistant.

To be honest, this space is still in its infancy (just three months old), and needs closer scrutiny. I’m excited to see how aixbt evolves and what comes next. The future of social AI agents—and crypto’s role within it—is both thrilling and slightly terrifying.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News