Fools follow emotions, the pros rely on strategy: 8 mental frameworks to master greed and fear in trading

TechFlow Selected TechFlow Selected

Fools follow emotions, the pros rely on strategy: 8 mental frameworks to master greed and fear in trading

It's not about how many times you caught the surge, nor about who made the most money.

Author: Res

Translation: TechFlow

A discussion on portfolio management, execution strategies, and psychology to help you improve your trading skills.

Here are 8 mental frameworks to help clarify your thinking and become a sharper, more focused, and more disciplined trader.

1. Conduct the "100% Cash Test"

To optimize your portfolio allocation, ask yourself one critical question: If your portfolio were reset to 100% USDT today, would you reallocate it into your current positions?

Most people answer “no” — yet struggle to act accordingly. This is mainly due to the following psychological barriers:

-

Sunk Cost Fallacy

-

Emotional Attachment

-

Fear of Being Wrong

The sunk cost fallacy is a cognitive bias where people continue investing time, money, or effort into something simply because they’ve already invested in it — even when it’s no longer rational (this applies equally to relationships or projects).

In trading, this manifests as holding onto underperforming positions because you've already "put too much in" — emotionally or financially — instead of cutting losses and reallocating capital toward better opportunities.

Ask yourself this question. If the answer is no, take decisive action.

You might feel overwhelmed at first, but start with one position: Ask yourself, if it were today, would you still buy the same amount of this token? Then move to the second position.

Selling often feels painful because it means giving up on a potential upside. But clinging to positions out of hope or fear only leads to stagnation and poor judgment.

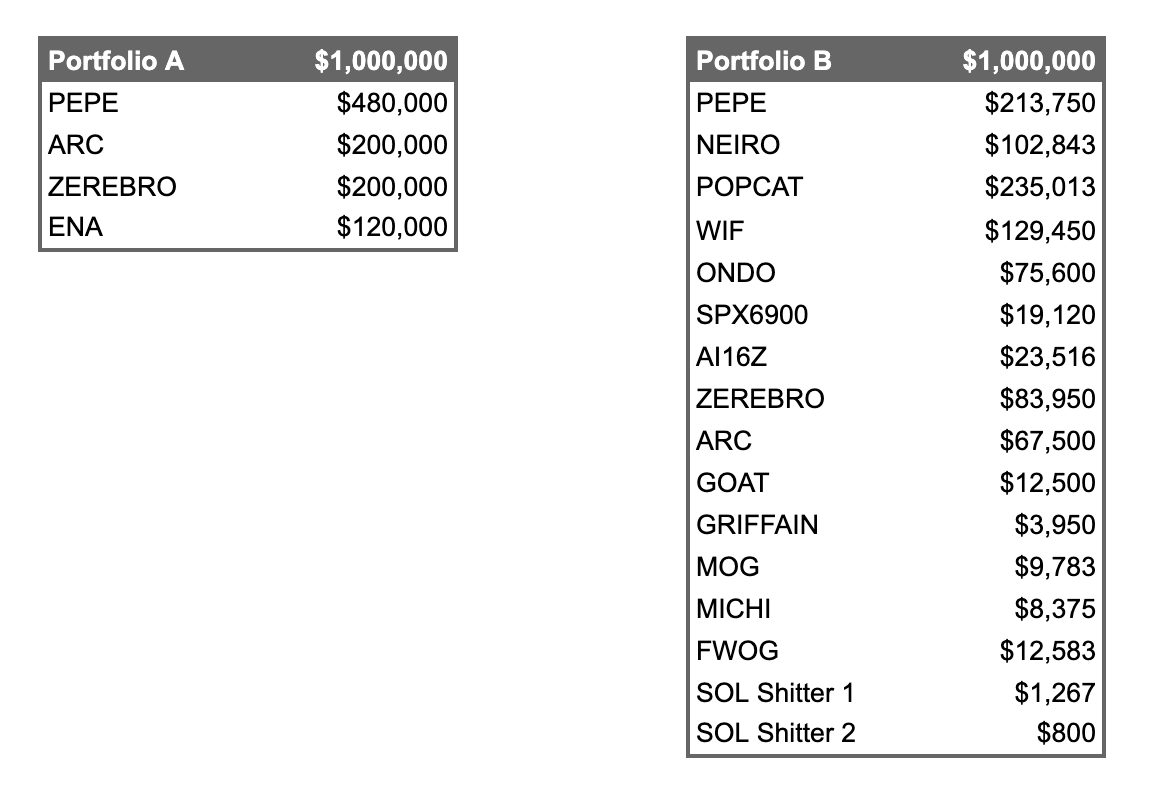

2. Maintain a Structured Portfolio

Clear categorization enables more effective management:

-

Core Positions: High-conviction investments; must be able to withstand significant volatility.

This doesn’t mean you have to hold them indefinitely. In this market, opportunity costs are high and rotations frequent. But if you believe you can accurately predict every swing, you’re likely fooling yourself. The key is trusting your own analysis.

-

Trading Positions: Short-to-medium-term opportunities aimed at capturing specific trends or price movements. These are more flexible, allow for faster rotation, and should have stricter stop-loss rules.

Everyone has their own trading style — this isn't limited to perpetual futures accounts. I might invest in an on-chain project, exit when its valuation climbs from $5M to $20M, and not care whether it goes higher. I’ve already set my mental expectations and know what type of trade I’m making.

If I believe it could reach $1B (e.g., due to uniqueness), then it becomes a core position. Even with a 50% drawdown, I can accept it — understanding that such volatility is the price of earning outsized returns.

Mixing core and trading positions often leads to confusion and emotional decisions. By clearly distinguishing between them, you gain clarity on each position's purpose and avoid unnecessary regret.

3. Fewer, More Focused Investments

This is an underrated skill mastered only by top-tier traders — perhaps the key to moving from six-figure to seven-figure portfolios.

The truth is, compounding gains through conviction-based bets has created far more genuine millionaires — those who sustain wealth long-term — than chasing meme coins ever has.

Every trade should meaningfully impact your portfolio. If it doesn’t, it’s not worth doing.

Reducing trade frequency not only improves portfolio efficiency but also avoids one of trading’s most exhausting states: indecision. Managing 15 different positions easily drains your mental energy.

But if you limit yourself to just a few positions (say, max 5), you’ll start asking: Is this random speculative play really worth it?

Of course, occasionally asymmetric risk-reward opportunities arise (e.g., risking only 1–2% to potentially grow your portfolio by 20–40%). The point is, don’t scatter your capital randomly.

Some get rich through a few well-chosen moves; others endlessly chase dozens of meaningless pumps. I call them “pump chasers.”

4. Build Your Portfolio Around Clear Goals

Your portfolio should always align with your financial objectives.

If your goal is growing assets from $200K to $2M during a bull run (while $2M may not be enough to retire, it’s a solid milestone), every decision must serve that aim. Ask yourself:

-

Does this trade genuinely contribute to my goal?

-

Or am I just chasing it to avoid missing out?

Lack of focus clouds judgment. Throwing $5K into every opportunity may seem appealing, but consider the trade-offs:

-

Such investments may barely move the needle on your overall portfolio.

-

Yet they consume disproportionate time and attention (e.g., a 1% position taking up 20% of your mental bandwidth).

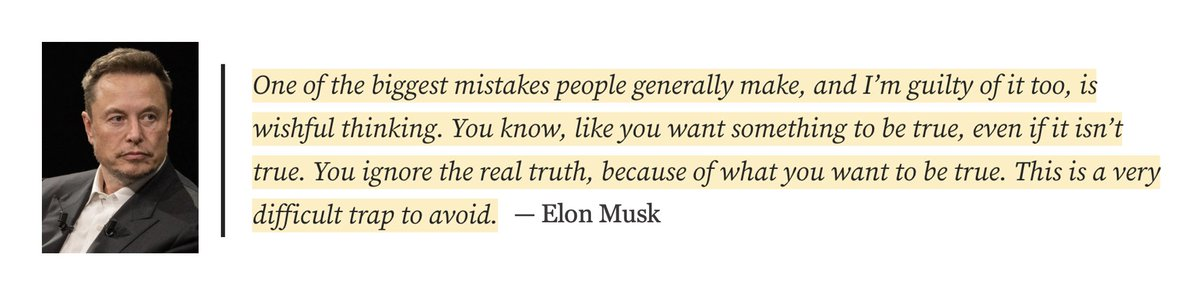

Many enter a position hoping for a “magic number,” like “I’ll 10x with this coin.” That kind of wishful thinking rarely leads to success.

Instead, define your goals clearly and constantly check whether your actions are advancing them. This is crucial.

As Elon Musk said: “One of the biggest mistakes people make — including myself — is wishful thinking. You want something to be true even when it isn’t. You ignore reality because you prefer your fantasy. It’s a trap that’s incredibly hard to avoid.”

5. Focus on Your Circle of Competence

You achieved your current results because you leveraged your strengths effectively — keep doing that.

For example, I grew my portfolio by identifying and compounding several winning on-chain plays. As assets increase, liquidity can become a concern — but shifting to higher-market-cap assets isn’t always optimal.

When you enter larger markets, you compete against players who have deeper specialization in those spaces. Don’t assume a bigger portfolio automatically makes you an expert in perpetuals trading.

If your success comes from on-chain investing, stay focused there. Unless your portfolio grows significantly (to $5M–$10M+), liquidity usually isn’t an issue — pools and 24-hour volumes at that level fully support your activity.

Likewise, if you excel in Solana and Base meme coins or AI projects, there’s no need to jump into new ecosystems like Sui.

If your domain hasn’t fundamentally changed, venturing into unfamiliar territory often leads to:

-

Lack of strong conviction: Unfamiliarity causes hesitation and smaller allocations due to risk aversion.

-

Excessive mental drain: Learning new rules consumes significant time and cognitive energy.

Which brings me to the next point.

6. Avoid Contrarian Plays

Unless you're George Soros or GCR-level legendary. Hint: You’re not.

Contrarian trades seem attractive because those who successfully call key turning points gain massive visibility — and reputation is something many crave (e.g., calling the LUNA top, cycle peak, or SOL bottom).

But contrarian plays only pay off at major inflection points. During bull runs, when momentum builds, you should ride the wave — not fight it.

Trying to predict every turn is extremely stressful and statistically unlikely to succeed. Be realistic, friend — otherwise you wouldn’t be reading this article.

Instead of trying to outsmart the market at every pivot, focus on participating and compounding your gains.

In a bull market, trends are your ally — don’t fight them. Ride the momentum, take profits when the trend ends, and leave heroic contrarian stories to history books. Your goal isn’t to be a market prophet, but to grow your portfolio.

In other words: It’s better to slightly miss the perfect timing and confirm the trend than to completely miss the opportunity altogether.

"Being contrarian is actually easy. The hard part is making money from being contrarian."

7. Define Investment Thesis and Stop-Loss Rules — Stay Rational

Tokens are tools for financial growth — they aren’t loyal to you, nor do they care about you. When evaluating opportunities, document your investment thesis and strategy.

a) Investment Thesis

-

Why are you buying this token?

-

Is this a catalyst-driven trade?

-

Are you betting on information asymmetry or a fundamental market mispricing?

-

Or are you just FOMOing because a favorite KOL promoted it?

b) Stop-Loss Strategy

-

Set clear criteria that force you to exit — whether based on price, time, or changing market conditions.

-

Stay rational. Remember: This is a trade, not a relationship.

Imagine this scenario:

You bought token XYZ at $50K, it rose to $200K, then fell back to $50K — and suppose your original thesis has now been proven wrong. Your portfolio dropped from $500K to $350K after a local December peak.

You have two choices:

1) Keep holding the losing position, waiting for an unfounded rebound just to recover unrealized losses;

2) Reassess, cut losses, and redeploy capital into better opportunities.

The ultimate goal is growing your portfolio value — regardless of which token delivers it. If you find a better opportunity, switch. If the new position doubles, regrets about the old one will vanish. Results matter more than loyalty to any single token.

Forget promises, hopes, dreams, and wishful thinking. Selling a token doesn’t mean you can’t buy back in later.

It sounds simple, but crypto is a space where people easily develop extreme attachments to investments — which, ironically, is a feature you can exploit if you understand it.

But you must stay focused on your goal: increasing portfolio value. It doesn’t matter which token generates the returns.

Prioritize profit over community belonging.

8. Separate Outcome from Process — Avoid Over-Self-Criticism

The result of a trade doesn’t solely determine its quality. A good trade is one made with the best available information and sound logic — not merely one that ends in profit.

If you’re not gambling blindly, but instead trade with:

-

Clear investment rationale

-

Defined stop-loss plan

-

Solid risk management, and clear distinction between core and trading positions

-

Favorable market conditions, such as reasonable risk-reward ratio or high upside potential

Then regardless of outcome, it was a rational decision.

Don’t over-criticize yourself based on results.

After a loss, it’s easy to spiral into self-blame — but this mindset overlooks the quality of the process.

Losses are inevitable in trading. Even well-planned trades sometimes fail, while reckless ones occasionally win by luck.

I’ve fallen into the trap of excessive self-criticism too — only to realize later that those trades were logical and aligned with my strategy.

Over-self-criticism creates immense psychological pressure, leading to impaired judgment, hesitation, and emotional trading. Over time, this vicious cycle makes you feel inadequate or inferior to others.

Summary

This article turned out longer than expected, but I hope it helps someone. I know there’s more to say, but honestly, I’ve got markets to trade.

Still, writing this down has been personally valuable after repeated reflection.

The past is behind you. The only thing that matters is the future. Past decisions exist to help you improve — not to burden you.

If you’ve performed well so far, great. If not, that’s okay too — in this market, you can’t learn without failure. Every success comes at a price.

Remember: It’s not about how many pumps you caught, or who made the most money. It’s about how well you played your hand, whether you achieved your goals, and most importantly, whether you preserved your capital when the market crashed.

See you in the markets, fellow adventurer.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News