Is Using Whale Movements as a Trading Signal Reliable?

TechFlow Selected TechFlow Selected

Is Using Whale Movements as a Trading Signal Reliable?

The data indicates that whale deposits to exchanges lack sufficient predictive value.

Authors: Peter Chung, Jaehyun Ha, Presto Research

Translation: Golem, Odaily Planet Daily

Key Takeaways:

-

Whale alerts are popular because large on-chain transactions are often seen as precursors to token dumping and sell signals. To evaluate these claims, Presto Research analyzed price movements of BTC, ETH, and SOL following large deposits into Binance.

-

Regression analysis shows low R-squared values (ranging from 0.0017 to 0.0537) between large transaction deposits and subsequent price changes. Narrowing the data to deposits from VCs and market makers (MM) slightly improved R-squared values, but their practical utility as trading signals remains limited. The findings strongly suggest that whale deposits to exchanges lack predictive power as reliable trading indicators.

-

On-chain metrics are effective in other areas—such as analyzing blockchain fundamentals, tracking illicit fund flows, or explaining price volatility. They serve the industry better only when investors have more realistic expectations about their capabilities and limitations.

One key difference between crypto assets and traditional assets is the public availability of transaction records stored on distributed ledgers. This blockchain transparency has given rise to various tools leveraging this unique feature, collectively categorized as "on-chain data." One such tool is "whale alerts"—automated notifications of large on-chain crypto transactions. These are popular because large transactions are often interpreted as harbingers of impending sell-offs, making them perceived as "sell signals" by traders.

This report evaluates the validity of this widely accepted assumption. After briefly reviewing popular whale alert services in the market, we analyze the relationship between large transaction deposits and price movements for BTC, ETH, and SOL. We then present our findings along with key conclusions and recommendations.

Overview of Whale Alerts

Whale alerts refer to services that track and report large cryptocurrency transactions. These services emerged alongside the growth of the crypto ecosystem, reflecting market participants' recognition of blockchain transparency.

History

The term "whales" gained popularity as early Bitcoin adopters, miners, and investors (e.g., Satoshi Nakamoto, Winklevoss Twins, F2 Pool, Mt. Gox) accumulated significant amounts of Bitcoin. Initially, blockchain enthusiasts monitored large transactions via blockchain explorers like Blockchain.info and shared information on forums such as Bitcointalk or Reddit. Such data was frequently used to explain major Bitcoin price swings.

During the 2017 bull run, increasing whale activity and large transactions created demand for automated monitoring solutions. In 2018, a European developer team launched a tool called "Whale Alert," which tracked large crypto transactions across multiple blockchains in real time and sent alerts via X, Telegram, and web platforms. The tool quickly gained favor among market participants and became a go-to service for those seeking actionable trading signals.

Source: Whale Alert (@whale_alert)

Core Assumption

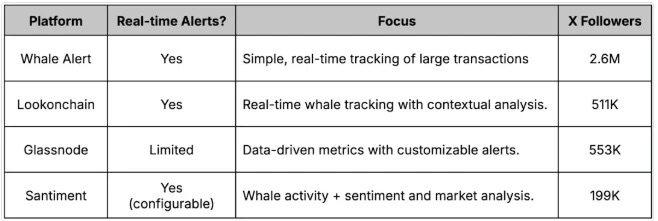

Following Whale Alert's success, many similar platforms have emerged over the years, as shown in the figure below. Although newer platforms add contextual features to enrich alerts, the original Whale Alert maintains focus on simple, real-time notifications and remains the most popular service—evident from its large following on X. A common thread across all these services is the underlying assumption: large on-chain transactions, especially deposits to exchanges, signal imminent selling activity.

Mainstream whale alert services, Source: Whale Alert, Lookonchain, Glassnode, Santiment, X, Presto Research

Evaluating Signal Effectiveness

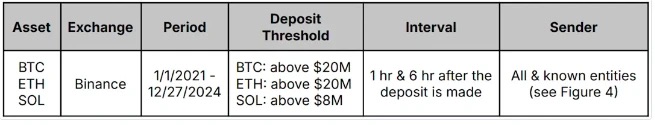

Proponents of whale alert services argue that on-chain asset transfers to exchanges often precede liquidation events and thus serve as valid sell signals. To test this hypothesis, we analyzed price changes of digital assets following large deposits into exchanges. The figure below outlines the key parameters of our analysis. The assumption is that if large transaction deposits were reliable trading signals, a clear relationship should exist between deposits and corresponding asset prices.

Key analysis parameters, Source: Presto Research

Assets, Exchange, Time Period, and Deposit Thresholds

Our analysis focuses on three major crypto assets—BTC, ETH, and SOL—and their USDT prices on Binance from January 1, 2021, to December 27, 2024. This period aligns with the operational lifespan of Binance’s current wallet addresses used for aggregating deposits.

Deposit thresholds were adjusted based on exchange-level data analysis. Specifically, using Whale Alert’s thresholds of $50 million for BTC, $50 million for ETH, and $20 million for SOL as benchmarks, we scaled them down proportionally to $20 million, $20 million, and $8 million respectively, reflecting Binance’s ~40% share of global spot trading volume.

Entity Types

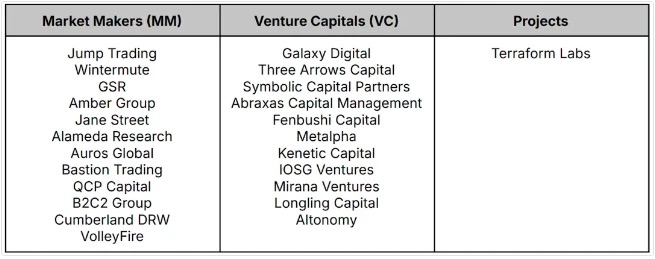

We also specifically analyzed deposits from known entities, conducting the same analysis on a narrower dataset to check whether deposits from specific entity types show stronger correlations with price movements. These entities were identified through Arkham Intelligence and supplemented with our own research, as shown in the figure below.

Entities with known addresses, Source: Arkham Intelligence, Presto Research

Measuring Market Impact

To assess potential selling pressure from whale deposits, we made the following assumptions:

-

After confirmation of a deposit exceeding the threshold on-chain, selling pressure would manifest within a defined time window. We examined two intervals: one hour and six hours.

-

The maximum drawdown (MDD) within the specified interval was used as a metric to measure any price impact from the deposit, effectively filtering out noise during that period.

Results

The results of the analysis are presented in the figures below:

-

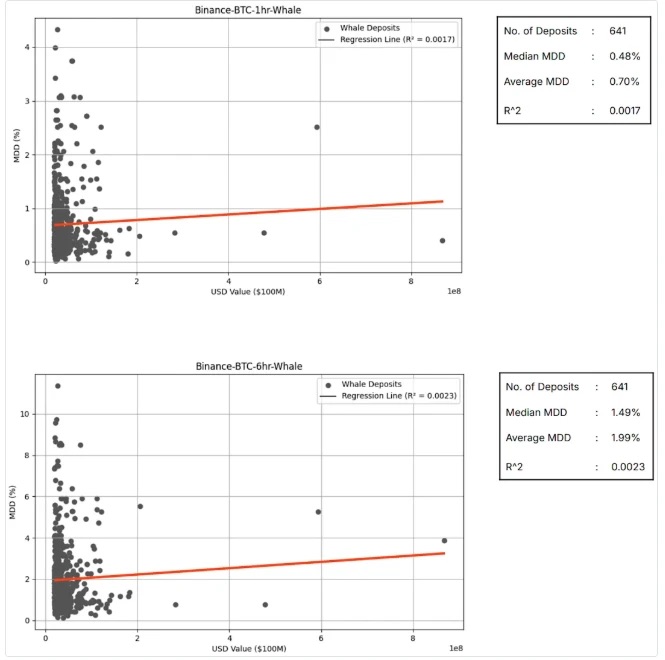

BTC Whale Deposit Impact (All):

Source: Binance, Dune Analytics, Presto Research

-

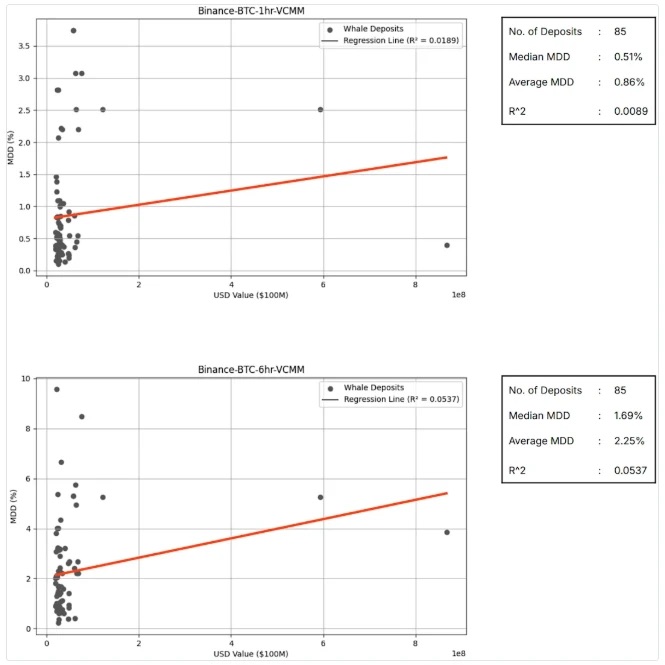

BTC Whale Deposit Impact (VC and MM Only):

Source: Binance, Dune Analytics, Presto Research

-

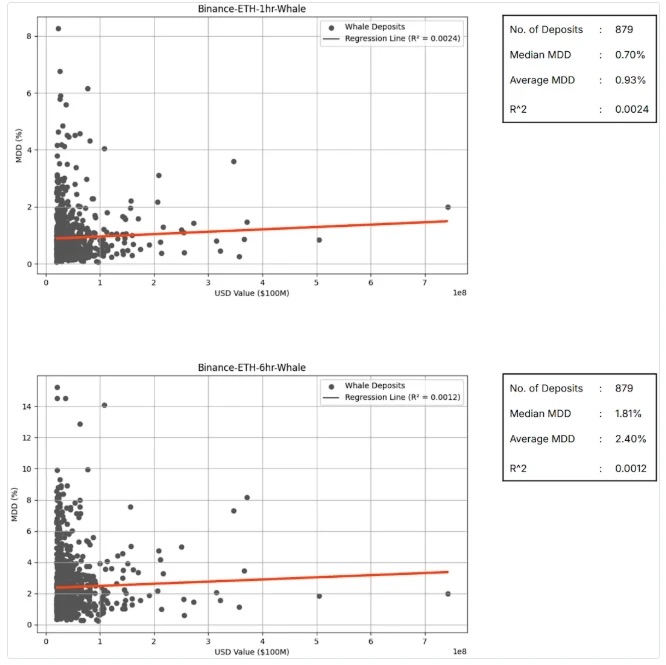

ETH Whale Deposit Impact (All):

Source: Binance, Dune Analytics, Presto Research

-

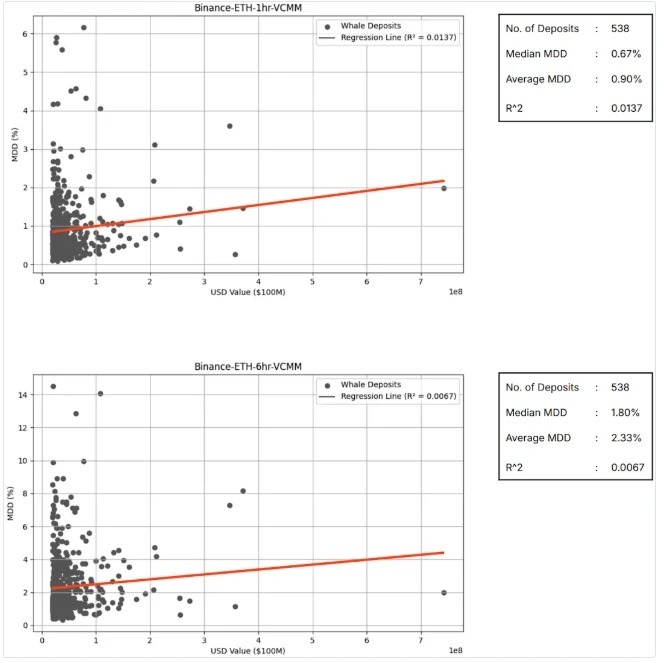

ETH Whale Deposit Impact (VC and MM Only):

Source: Binance, Dune Analytics, Presto Research

-

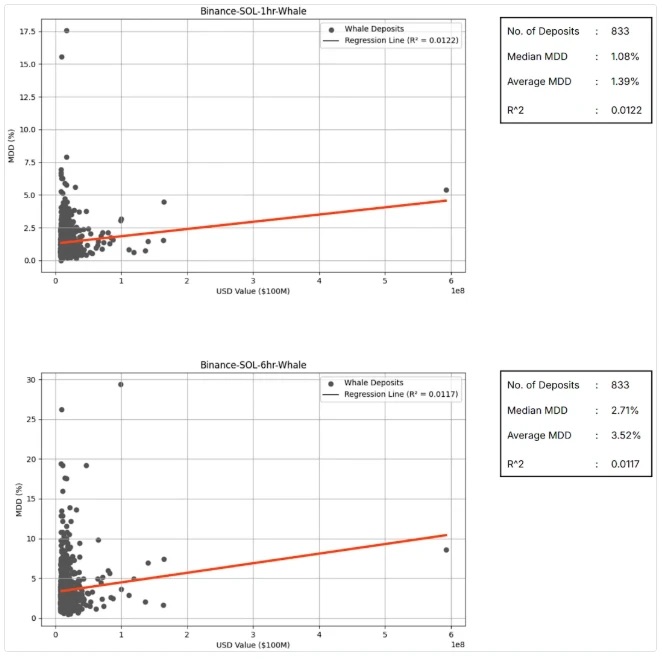

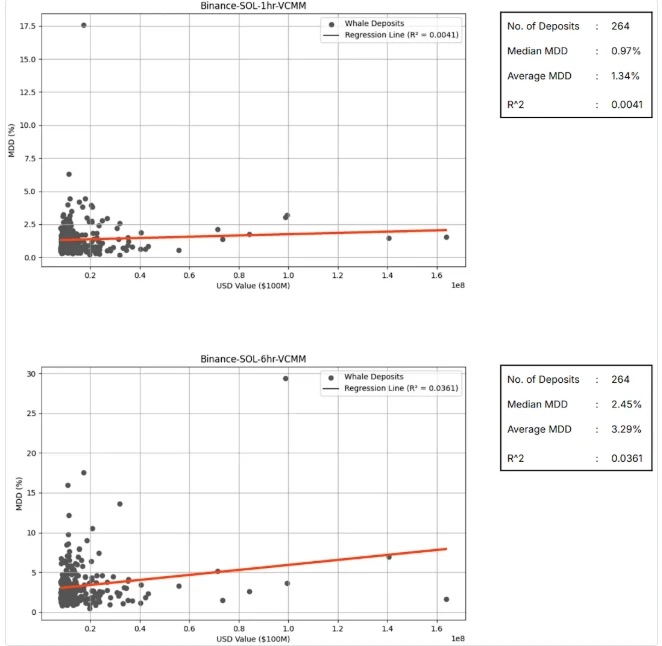

SOL Whale Deposit Impact (All):

Source: Binance, Dune Analytics, Presto Research

-

SOL Whale Deposit Impact (VC and MM Only):

Source: Binance, Dune Analytics, Presto Research

Key Insights

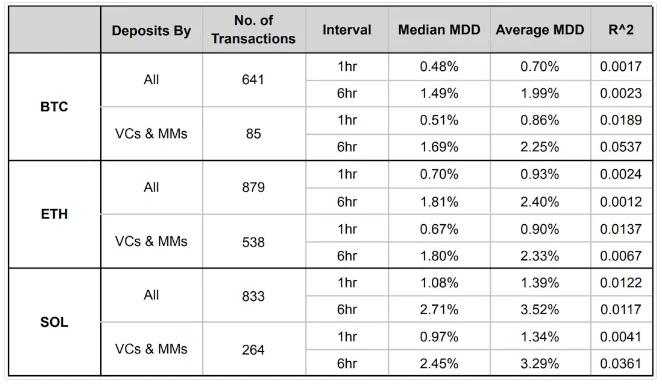

Source: Binance, Dune Analytics, Presto Research

The chart above summarizes the statistical results, leading to the following three conclusions:

-

Large exchange deposits show weak predictive power for price declines: R-squared values across all 12 scenarios indicate extremely weak predictive ability, ranging from 0.0017 to 0.0537.

-

Deposits from VCs and MMs may be marginally better predictors: R-squared values improved slightly in this subset, but this improvement may simply reflect reduced sample noise rather than a genuinely stronger correlation. Moreover, absolute values remain low, indicating limited practical effectiveness as trading signals.

-

ETH whale deposits primarily come from VCs and MMs: They account for 61% of ETH whale deposits (538 out of 879), compared to only 13% for BTC and 32% for SOL. This reflects differing asset characteristics: ETH, due to its diverse Web3 use cases (e.g., gas fees, staking, DeFi collateral, swap medium), exhibits higher turnover, whereas BTC, as a store-of-value asset, is more stable.

Conclusion

Certainly, our analytical approach has limitations, and regression analysis inherently carries constraints. Drawing definitive conclusions solely from R-squared values can sometimes be misleading.

That said, combining context and individual observations, the analysis strongly indicates that whale deposits to exchanges lack sufficient predictive power to serve as reliable trading signals. It also offers broader insights into the use of on-chain metrics.

On-chain metrics are undoubtedly valuable tools—for analyzing blockchain fundamentals, tracking illicit fund flows, or explaining price movements after the fact. However, using them to predict short-term price changes is an entirely different matter. Price is a function of supply and demand, and exchange deposits are just one of many factors influencing the supply side—even assuming they have any real effect at all. Price discovery is a complex process influenced by fundamentals, market structure, behavioral factors (such as sentiment and expectations), and random noise.

In the highly volatile cryptocurrency market, where participants constantly seek "foolproof" trading strategies, there will always be an audience drawn to the perceived "magic" of on-chain metrics. But only when investors maintain realistic expectations about the capabilities and limitations of these tools can on-chain metrics truly serve the industry well.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News