AI Ignites Crypto's Third Major Leap: Four Key Sectors Positioning for the Next Trillion-Dollar Opportunity

TechFlow Selected TechFlow Selected

AI Ignites Crypto's Third Major Leap: Four Key Sectors Positioning for the Next Trillion-Dollar Opportunity

We are on the brink of the next "takeoff" in the crypto industry.

Author: Karthik Senthil

Translation: TechFlow

Introduction

As the narrative around smart contracts gradually loses its appeal, the strong emergence of AI has brought a breakthrough, driving unprecedented热度 and waves of innovation. From Bitcoin's consensus layer to the execution layer of smart contracts, and now to the AI-driven application layer—has the crypto industry entered its third major technological leap?

KOL @karsenthil shared his views on Crypto X AI at different times, arguing that we are standing on the brink of the next "takeoff" in the crypto space.

The original content is divided into two parts and somewhat fragmented in structure.

In the first thread, the author argues that AI will drive blockchain into its next major technological leap. In the second thread, he elaborates on concrete implementation paths for AI at both the application and infrastructure layers, outlining potential opportunities for investors and builders.

TechFlow has compiled and integrated these threads. Below is the full translated content.

Crypto X AI Thesis (Part One) — We Are Entering an Era of “Leapfrog” Development

AI is pushing blockchain toward its next major leap.

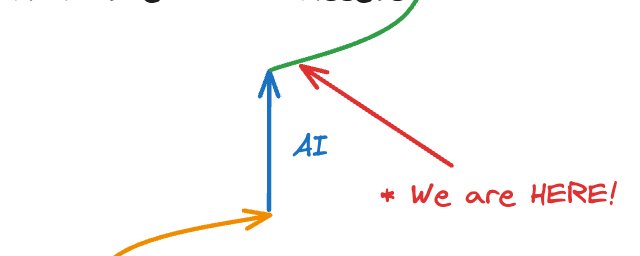

Each phase of blockchain development typically follows a similar trajectory:

-

A "leapfrog" technological advancement triggers a new wave of innovation;

-

As numerous imitators emerge, progress gradually stagnates;

-

Then, the next technological leap appears, propelling the industry forward once again.

Original image by @karsenthil, translated by TechFlow

The first major leap in cryptocurrency occurred at the consensus layer—the invention of Bitcoin and Proof-of-Work (PoW) marked the beginning of this era. Between 2009 and 2014, this wave drove the market cap of crypto from approximately $750,000 to about $7.5 billion—an increase of over 10,000x.

The second leap happened at the execution layer, with the advent of smart contracts enabling programmability on blockchains. Today, most blockchain infrastructure (e.g., L1s, L2s) and applications (e.g., tokens, stablecoins, DeFi) rely on this core innovation. Since 2014, this wave has increased the total crypto market cap roughly 500-fold to ~$3.5 trillion, with projects born during this period accounting for about 43% (~$1.5 trillion) of the total market value.

However, technological progress has once again stalled. Why? Here’s my view (potentially controversial):

-

The potential of smart contracts has largely been exhausted. Even today’s popular memecoins are merely re-combinations of existing technologies (such as tokens, bonding curves, NFT community hype), rather than truly novel inventions.

-

Smart contracts have become the main bottleneck for user experience (UX). Current crypto applications require direct interaction with smart contracts, meaning users must understand where contracts are deployed, what they do, how to interact with them, and must sign transactions while paying gas fees.

Luckily, the next technological leap has already arrived—it enhances usability and unlocks entirely new innovations at the application layer.

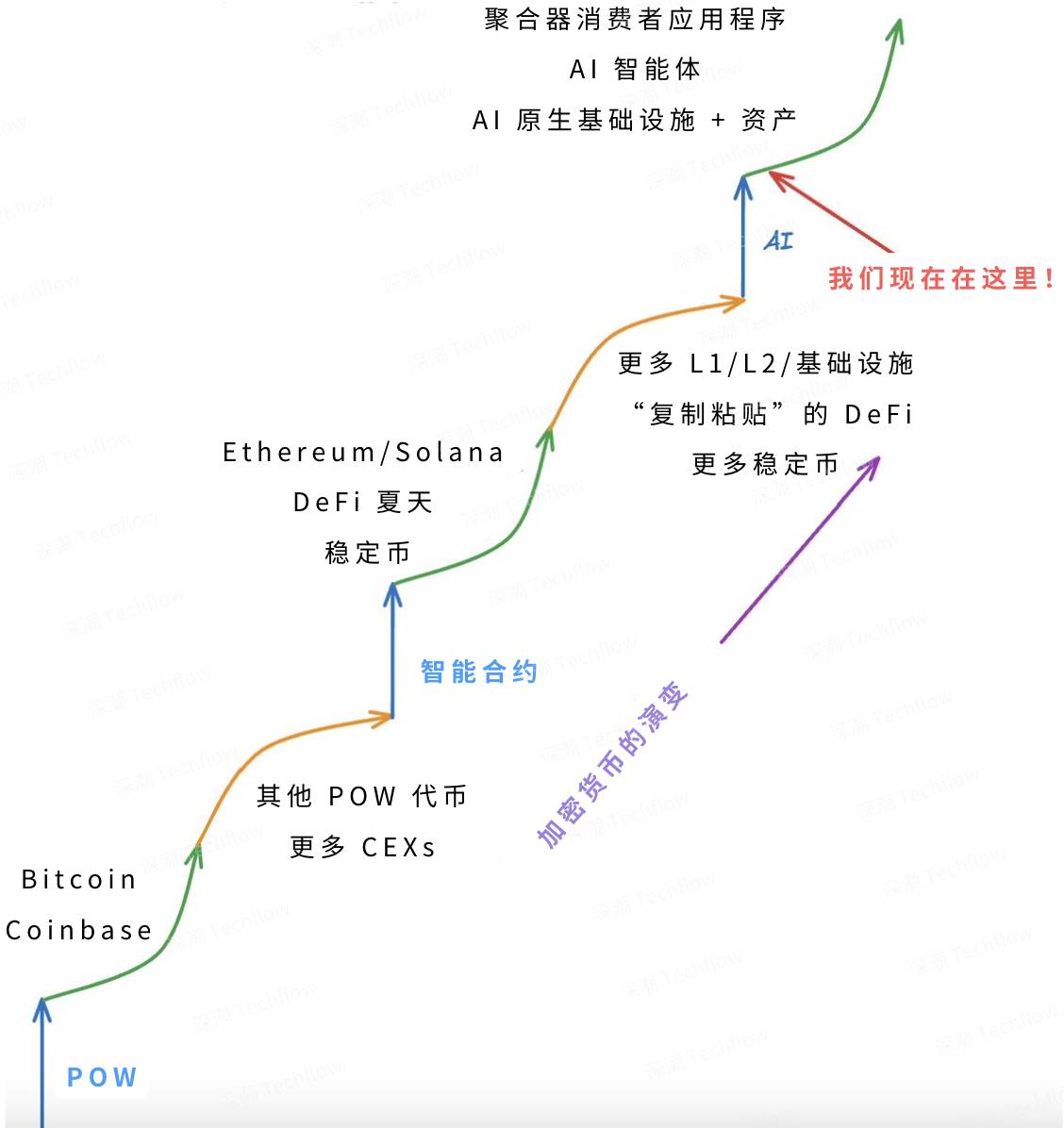

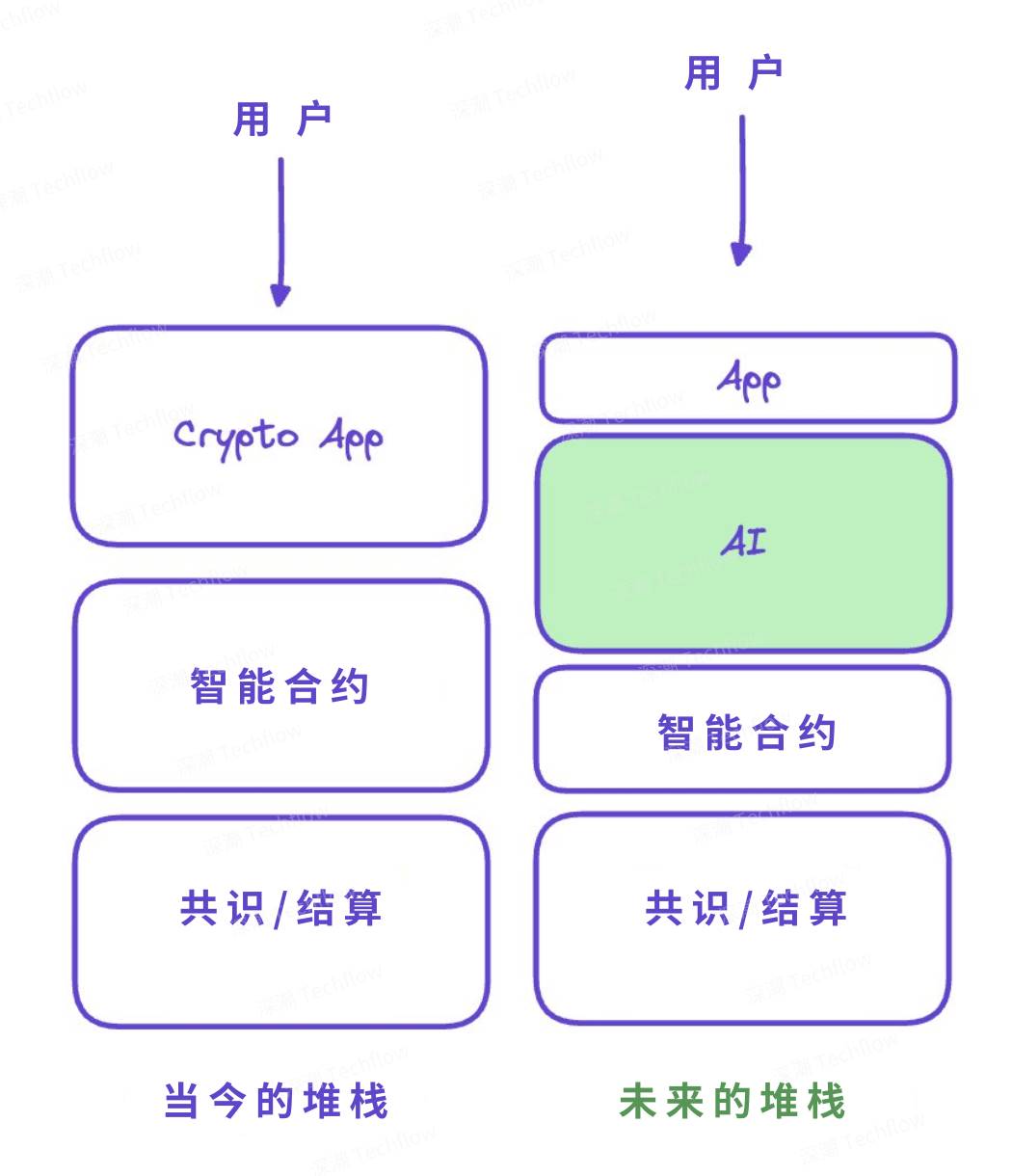

AI Will Become the User Experience Layer for Crypto Technology

The widespread adoption of any new technology requires a powerful "front-end" to simplify complexity and integrate functionality. Personal computers had GUIs and operating systems; the internet had web browsers and FAANG companies; mobile devices had native apps and app stores.

AI will serve as the user experience layer for blockchain technology, delivering orders-of-magnitude better UX and driving broader adoption. AI can address three key UX challenges in crypto: onboarding users, executing complex operations (often multi-step processes, which large language models [LLMs] excel at), and discovering functionalities. I predict that by 2030, 40% of the global population will have conducted an on-chain transaction, and over 95% of those transactions will be executed via AI. At that point, people will unconsciously use applications powered by blockchain technology.

Original image by @karsenthil, translated by TechFlow

To achieve this, AI will act as a bridge between the application layer and blockchain infrastructure, functioning both upward and downward within the tech stack. In the future, applications will interact directly with AI agents, which will aggregate and execute on-chain actions on behalf of users. Moreover, smart contracts will evolve into deeply integrated "intelligent tokens," offering generative and personalized experiences instead of today’s one-size-fits-all model.

From AI’s perspective, the future of blockchain applications becomes clearer. For example, the next-generation financial super-app might leverage AI to proactively recommend and execute on-chain DeFi operations based on a user’s intent and preferences (e.g., security, yield), combined with real-time data from prediction markets. Users won’t need to know the difference between L1s and L2s, or protocol and asset names, or even how cross-chain bridges work. Early signs of this trend are already emerging.

Crypto X AI Thesis (Part Two) — Opportunities for Builders and Investors

So, who will be the biggest winners?

As AI accelerates innovation at the application level, the answer is clear: applications remain central (though infrastructure still matters—this is still crypto, after all). As David noted below, we’re already witnessing a shift from an infrastructure cycle to an application cycle, and the integration of AI will further accelerate this trend.

@divine_economu: “In 2024, two important milestones emerged in crypto:

-

For the first time, popular projects were led by applications

-

And the trending protocols were those innovatively supporting application development

This marks the first time in crypto history that we’ve shifted from an infrastructure-led cycle to an application-centric one.”

I am particularly bullish on the following four categories of crypto products, all still in early stages and thus possessing massive growth potential:

-

Aggregators, aka SuperApps

I predict the rise of the “FAANG of crypto”: these superapps will integrate functions from AI agents that simplify on-chain UX and establish direct relationships with users. They will also vertically integrate the tech stack—not only enhancing their own application capabilities but also attracting developers by providing infrastructure (akin to Amazon or Google). Within their domains (e.g., search & advertising, finance, commerce, social), these apps will exhibit monopolistic characteristics. Just as FAANG companies today contribute about 20% of the S&P 500, I expect this category to capture a similar share of the crypto market by 2030. Conservatively, this represents a market opportunity worth hundreds of billions of dollars; optimistically, it could reach trillions.

In particular, in DeFi (or DeFAI), I see a killer use case: imagine a next-gen all-in-one financial superapp where users seamlessly access all on-chain financial assets, receive investment ideas or advice, analyze real-time market sentiment, and quickly execute decisions. Another exciting direction is a “crypto-native Google,” using algorithms akin to PageRank to solve discovery issues for crypto apps and assets, monetizing through ads or innovative revenue streams.

The winners in this category will create extraordinary outcomes, thanks to a key advantage unavailable to Web2 superapps: Tokens. Tokens are the only tool in crypto proven to achieve strong product-market fit (PMF), capable of attracting users, believers, and investors while capturing mindshare.

-

Agents as SaaS

I’m excited about AI agents that excel in specific domains. These agents can be used individually or combined via aggregators, much like today’s SaaS or financial products. For instance, imagine a fully autonomous agent that accepts funds from liquidity providers (LPs) and executes top-tier investments across crypto markets—performing among the top 1% of high-frequency traders while accessing the best-performing opportunities—all while charging lower management fees than ETFs or traditional funds. Or an agent generating high returns in prediction markets or sports betting. Another example is tools like @aix_bt, delivering high-quality market and investment research data. These agents will enable users to access previously inaccessible markets (like tokenized USD or real-world assets [RWAs]) and advanced strategies (e.g., quant trading, venture investing).

@Loopifyyy: “The first AI agent that actually works for me on-chain—I’ll put my entire net worth into it without hesitation. It solves UX. Now I just give simple prompts to use blockchain, no matter if it’s cross-chain or not.”

This isn’t limited to finance. I can envision a future with an AI doctor trained on a specific patient’s medical profile, capable of billing insurers via encrypted payment channels and issuing low-risk prescriptions. Or an AI insurance agent finding the cheapest home insurance for you. Of course, frankly speaking, we’re still far from realizing these scenarios (most current agents can’t even complete basic on-chain interactions).

Yet, as these agents innovate in customer acquisition, value capture, and pricing—through native tokens (e.g., requiring 100 AIXBT tokens to access premium features)—the opportunities here are nearly limitless. As this trend deepens, I believe platforms dedicated to trading and managing AI agents (similar to eBay or OpenSea for agent marketplaces) will also see massive growth potential.

-

AI-Native Infrastructure

The most significant infrastructure opportunities of the future (e.g., next-gen L1s) will no longer focus solely on speed or cost optimization, but instead attract users by dramatically improving UX. This improvement will come from architectures built around AI agents and AI-powered smart contracts, natively supporting features such as: efficient on-chain inference (see Section 4), verifiable off-chain inference via Trusted Execution Environments (TEEs), smart accounts enabling semi-autonomous agent operations (with built-in safeguards to act on users’ behalf), access to compute resources and model training capabilities, and bidirectional value flows between agents to foster collaboration and economic innovation.

Similar to today’s decentralized apps (dApps), many agents from Category 2 (especially long-tail agents) will choose to deploy on these new L1s rather than manage their own infrastructure, benefiting from proximity and composability-driven network effects. I’m also excited about the potential of these next-gen L1s to redefine value capture mechanisms, Maximum Extractable Value (MEV), and consensus models (e.g., could agents themselves become validators?).

This doesn’t mean I’m bearish on Ethereum, Solana, or other mainstream L1/L2 ecosystems. In fact, they’ll likely adopt similar capabilities over the coming years. But I believe new L1s born in this era will better meet the needs of contemporary developers and thus possess enormous growth potential. Projects like ai16z and Virtuals are already showing early signs of this trend, indicating massive opportunities for winners in this space.

L1 innovation will continue to thrive.

Intelligent Assets

Currently, some of crypto’s most popular applications—stablecoins, NFTs, ERC-20/SPL governance tokens—are deterministic and static. They perform well when fulfilling predefined objectives. But what if users could own dynamic, self-optimizing assets designed to autonomously achieve specific goals (e.g., increasing holders or boosting value)?

Imagine smart contracts dynamically invoking models during on-chain execution, enabling assets to adjust token supply, release schedules, burn or staking mechanisms—even modifying parameters currently requiring hard coding or social consensus. Each token could even be personalized according to holder preferences, delivering a whole new level of customization.

I expect early experimentation with intelligent assets to focus on NFTs and DAOs. For example, NFTs could be fully generative—not just media content—but behavior and utility as well. Or a governance token could automatically draft proposals or vote on behalf of users based on protocol history and individual preferences.

As the technology matures, the primary use cases may shift toward finance. Imagine Ethena’s USDE stablecoin dynamically adjusting its synthetic dollar strategy in response to macroeconomic conditions. That would be an exhilarating future!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News