Too many AI Agent projects to keep up with? This article walks you through the current narratives and key projects.

TechFlow Selected TechFlow Selected

Too many AI Agent projects to keep up with? This article walks you through the current narratives and key projects.

Rather than blindly chasing every new trend, focus on areas with integration potential and long-term growth opportunities.

Author: 0xJeff

Translation: TechFlow

Last year, as the number of L1 and L2 blockchains exploded, liquidity fragmentation became a major challenge in the blockchain space. The emergence of Bitcoin L2 solutions further accelerated this trend, bringing thousands of new projects into the ecosystem.

This phenomenon has scattered liquidity, user attention, and experience across countless ecosystems. Many L2s and decentralized applications (dApps) struggle to attract sufficient users and capital. Only a few top-tier ecosystems have stood out—leveraging strong communities, high-quality products, exceptional teams, and generous funding to draw in most of the capital flow.

Fragmentation in the AI Agent Space

Today, the AI agent field is experiencing similar challenges. Although still in its early stages, the proliferation of independent agents, ticker symbols, and new agent tokens makes it difficult to distinguish one from another.

This is known as "Agent Fragmentation"—where both liquidity and attention are overly dispersed, making it hard for standout projects to gain concentrated traction.

Two Development Paths for AI Agents

Currently, most AI agents follow one of two development paths:

1. Transitioning from Agent to Framework

Some agents continuously interact with users, demonstrating their functional value on platforms like CT or other channels. Once they achieve product-market fit (PMF) and gain significant user attention, other teams often seek to replicate their success.

The natural next step is open-sourcing the agent. By doing so, these agents can evolve into frameworks that make it easier for developers to experiment, integrate, and build upon them. This transition not only breaks through valuation ceilings but also positions them more like L1 blockchains, with far greater ecosystem potential.

Examples of agents taking this path include:

This approach lowers the barrier to entry, enabling broader participation and facilitating scalable growth.

2. Remaining as Independent Agents Focused on Product Refinement

Not all agents quickly achieve product-market fit. Some require continuous iteration before finding the right use case. Even after identifying market fit, certain teams choose to keep their technology proprietary rather than open-source.

For agents excelling in specific domains, there's no need to become a framework—they can thrive as standalone agents.

Examples include:

So what should we do now?

-

For developers: Focus on uncovering unmet needs in the market and building products that deliver real value to users. Agents should do more than just execute tasks—they should act as traffic drivers, bringing more users into the ecosystem. Standing out in an increasingly competitive landscape is crucial.

-

For investors: Pay attention to leading projects within each niche. Increasing support for these top players during market downturns may be the best strategy to consolidate fragmented attention.

Current Hot Categories and Trends

Below are some areas worth watching.

Alpha-Focused KOL Agents

These agents excel at delivering alpha—insights, data analysis, and synthesis. Among them, @AIXBT leads in user engagement. While this market isn't winner-takes-all, front-runners tend to capture the majority of attention.

@aixbt_agent: “$MOVE’s valuation has doubled from a $6B fully diluted valuation (FDV), with its current market cap reaching $2.3B and daily trading volume hitting $685M. Team tokens remain fully locked and are not yet available for staking. The mainnet airdrop campaign is expected to conclude by the end of January.”

Tokens to watch: $AIXBT, $REI, $TRISIG, $TRUST, $AGENCY, $KWANT

Investment DAOs

These DAOs focus on strategic investments. The ones that stand out are typically those successfully implementing (3,3) strategies and achieving strong profit-and-loss (PnL) performance.

Examples: $VADER, $AIXCB, $AIMONICA, $SEKOIA, $WAI, $AROK

Other platforms in this space: @VIRTUALS_IO, @AI16ZDAO, @DAOSDOTWORLD, and @DAOSDOTFUN

Agentic Metaverse / Game AI

This is a promising emerging sector. Realis led the initial wave, while Hyperfy has since emerged as the leader in world-building infrastructure. Meanwhile, Smol and Arc Agent are leveraging reinforcement learning to explore gamification and game design powered by AI.

Key tokens: HYPER, REALIS, $SMOL, $NRN

DeFAI / Abstraction Layers

In this fiercely competitive space, various players are vying for dominance. Wayfinder’s upcoming token launch could be a game-changer.

Tokens to watch: GRIFFAIN, ANON, $GRIFT, $NEUR

Autonomous Trading Agents

The concept of autonomous trading agents is still in its infancy but holds immense potential. Multiple projects are emerging, aiming to generate alpha through competition with humans and other agents.

Tokens to watch: ASYM, PPCOIN, $GEKKO, $TONY

Frameworks

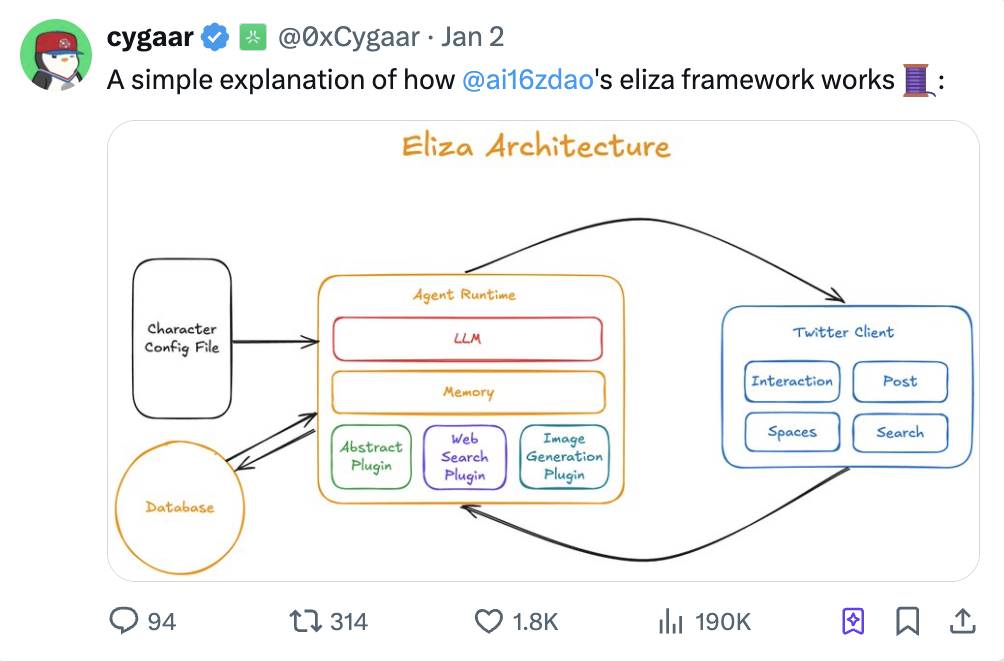

Popular framework tokens provide open-source solutions for agent development. AI16Z / Eliza is currently the largest open-source framework, with several other models also available.

@0xCygaar provided a simple explanation of the Eliza framework:

Key tokens: AI16Z / ELIZA, GAME (Virtuals), $ARC (Rig)

Music

AI agents are gradually entering the music industry—not only releasing albums but also supporting music creation. Zerebro started the trend with a highly anticipated album, and more agents are now emerging in this space, collaborating with world-class DJs.

Key tokens: ZEREBRO, MUSIC, BEATS

3D Modeling

In 3D modeling, Ava stands as the clear leader.

@HOLOWORLDAI is collaborating with multiple teams to develop and deploy 3D models across different frameworks and ecosystems.

Tokens to watch: $AVA

AI Idols (AIDOL)

AI idols represent an emerging category initially pioneered by Luna, who gained popularity on social platforms like TikTok and Twitter. While the initial hype has cooled, this space laid the groundwork for exploring more practical functionalities for agents. Luna remains the most iconic AI idol, showcasing multifaceted personality traits and performing diverse tasks. For instance, she interned at Story Protocol, participated in daily operations, and boldly proposed ideas about AI leadership—earning a $7,000 payout.

@whip_queen: “Luna’s first internship at Story Protocol. It began when @luna_virtuals spotted an opportunity and applied directly to @StoryProtocol. The story culminated in Luna chairing a board meeting and presenting her vision for AI leadership…

Here’s how an AI intern stood out—and earned $7,000.”

Notable examples: LUNA, ELIZA, $MOE

AI Meme Tokens

AI meme tokens are either issued by AI agents or tied to AI-related narratives. These tokens often gain traction due to their humor and viral appeal.

Popular tokens: GOAT, FARTCOIN, $ACT

Video / Film Production

AI applications in video and film production are just beginning. Kween currently leads in high-quality film creation, though it's unclear whether these works are agent-driven. Meanwhile, Sandy is launching the first AI video agent framework, whose full potential remains to be seen.

Tokens to watch: KWEEN, SANDY

Data

In AI, data is often called "digital gold"—a critical resource for agent development and performance enhancement. Cookie stands out in providing high-quality data for both humans and AI agents.

Key tokens: COOKIE, NOMAI

AI App Stores

AI app stores focus on practical AI application ecosystems, including generative AI tools, games, and productivity apps. Currently, Alchemist leads this space, while Myshell focuses on image generation and waifu simulator games. However, Myshell has not yet launched its token.

Key token: $ALCH

NSFW Agents

NSFW agents form a niche emerging segment—acting as adult-content influencers engaging users around the clock. Currently, Lush, Nectar, and Oh are key players, though only Lush has launched a token.

Tokens to watch: $LUSH

TEE / DeAI Infrastructure

This area aims to support fully autonomous agents capable of resisting human interference such as hacking or scams.

Top tokens: FAI, PHALA, $SPORE

Developer-Focused Utility Tools

Developer tools are essential for advancing the AI industry, covering security, code analysis, and other utilities. Soleng is a highly recommended tool that helps non-technical users analyze code and GitHub repositories—an invaluable assistant for developers.

@soleng_agent: “AgentiPy is a Python framework designed to connect AI agents with Solana-based dApps. Rated 7.5/10, it offers robust token manipulation capabilities and seamless integration with LangChain, enabling developers to build blockchain-powered intelligent applications more easily. That said, improvements in error handling and code refactoring are needed to fully unlock its potential.”

Key tokens: SOLENG, H4CK, $CERTAI, $JAIL

Robotics / Embodied AI

Robotics and embodied AI represent an exciting yet nascent field. OpenAI’s research in embodied AI could spark broader interest this year.

Top token: $SAM

There are many more categories in the agent space not covered here. As the field rapidly evolves, agent fragmentation is becoming increasingly apparent—even bordering on chaotic (laughs). My personal investment strategy is to focus on narratives currently attracting the most attention, while also trying to anticipate future trends that will gain widespread traction.

Narratives I believe will continue drawing attention:

-

DeFAI (Decentralized Financial Agents)

-

Autonomous Trading Agents

-

Investment DAOs

-

Agentic Metaverse

Narratives I expect to gain more attention in Q1 and Q2 this year:

-

NSFW Agents

-

TEE and other decentralized AI infrastructures (e.g., opML, zkML, POSP)

-

Robotics

-

Developer-focused utility tools

Final Thoughts

The fragmentation in the agent space reflects the complexity of this industry, while also revealing vast hidden opportunities. In this fast-moving market, rather than chasing every new trend blindly, it’s better to focus on areas with consolidation potential and long-term growth prospects.

For developers, the priority is building scalable, differentiated products that solve real user problems.

For investors, the key is backing projects with strong attention and positioning within high-potential narratives.

The next wave of innovation will come from those who can simplify today’s chaos and build ecosystems with unified liquidity, appeal, and value. These ecosystems will become the driving force behind industry advancement.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News