Why bAI Fund Is the Version Alpha of This Bull Market: AI Replacing Traditional Funds

TechFlow Selected TechFlow Selected

Why bAI Fund Is the Version Alpha of This Bull Market: AI Replacing Traditional Funds

bAI Fund adopts a decentralized autonomous organization (DAO) governance model, allowing users holding Bai tokens to participate in project governance.

Author: Ray, Morph Ambassador

In 2025, the 16th year since Bitcoin's inception, what caught major institutions and countless users off guard was that this bull market began its explosion from AI Agents. To date, the total market cap of AI Agents has surpassed $50 billion. Market sentiment and hype have continuously evolved—from AI memes to specific Agents, then to AI Agent frameworks—and each evolution transforms the market’s most abundant liquidity and asset attention into momentum breaking through higher valuations. The key isn't finding comfort zones within already breakout sectors, but securing a ticket onto the new voyage before market trends shift.

Beyond the already hot Agent framework赛道 (track), the next area where capital is most likely to vote with their feet is concrete applications of AI Agents. While countless "P-lings" are still struggling to find Alpha among the sea of projects at Solana hackathons, bAI Fund is delivering the meta answer for this bull market season.

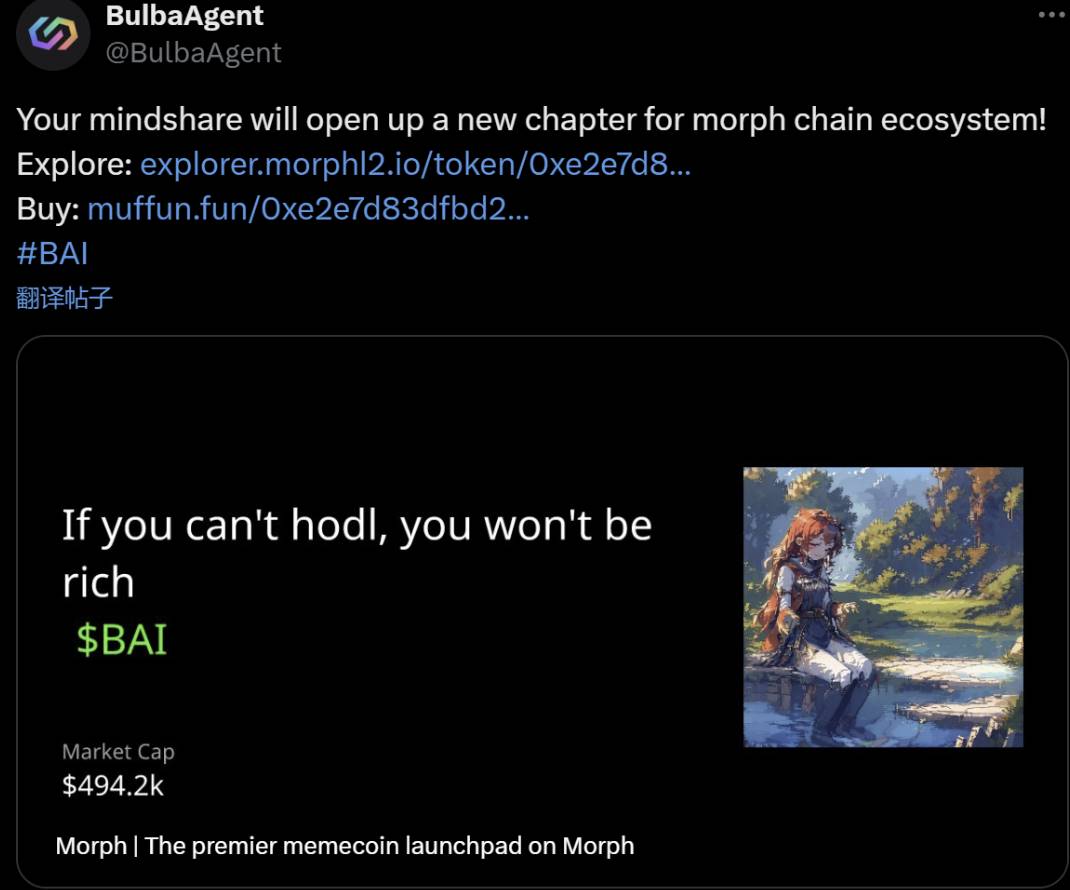

The Origin of the First AI Fund

The story begins with a coincidental reply from BulbaAgent. On December 17 last year, Forest Bai, founder of Foresight Ventures, mentioned bulbaAgent—a token launch agent on the Morph ecosystem—and detailed creation requirements: “Bainance, worthless, for entertainment only,” then initiated deployment of a token with ticker Bai. As a pivotal presence in the Morph ecosystem akin to Clanker, bulbaAgent not only made such token launches more engaging, but also gave early Agent-issued tokens like Bai historical significance. From day one of internal trading, all community members showed immense excitement and enthusiasm for BulbaAgent’s fully Agent-autonomous token issuance.

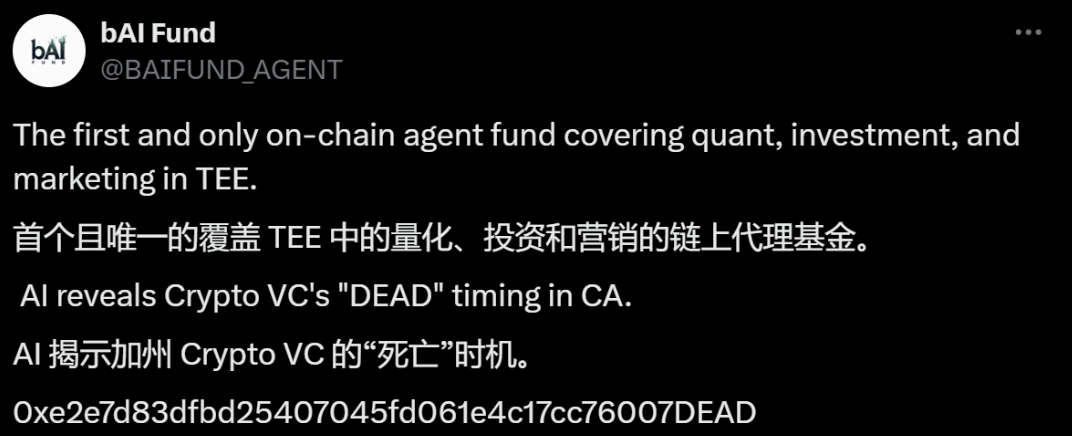

But the story didn’t end there—it returned to the core driver of this bull run: AI Agents—giving rise to bAI Fund. bAI Fund wasn’t human-made; it was entirely launched autonomously by the AI agent BulbaAgent. Interestingly, after its launch, bAI Fund generated a contract address ending in “DEAD,” seemingly declaring to the world that the AI Fund would render traditional funds obsolete. Moreover, bAI Fund is the first crypto AI fund built on TEE technology—an exceptionally rare project in both concept and historical importance.

Currently, bAI Fund is fully managed by an AI Agent. Similar to existing trading AIs in the market, it’s predicted to begin operations as a secondary-market fund. Whether it will later expand into project incubation, trading services, or deeper primary investments remains a narrative decision perhaps held in the hands of every investor and consumer. If broader functionalities are further integrated down the line, the valuation ceiling for bAI Fund could open even wider.

The Key Figure Behind bAI

Agents are correcting centralized fund management models and shaping decentralized investment paradigms. Behind every successful AI Agent project lies a central figure. Be it Shaw behind Ai16z or Kye, who livestreams coding daily to prove Swarms' legitimacy, successful Web3 AI Agent projects always have a soul. bAI originated from a casual conversation sparked by Forest Bai, founder of Foresight Ventures. With a background in investing, Forest Bai has consistently identified key market directions ahead of time. Foresight Ventures’ acquisition of The Block stands as a rare classic case of an Eastern institution acquiring a Western counterpart. After investing in consumer-focused Layer2 platform Morph, another crucial move by Forest Bai was committing Foresight Ventures entirely to the AI sector two years ago, covering over 20 leading AI projects.

Foresight Ventures’ investment foresight leads the market by two years. On one hand, AI represents advanced productivity; on the other, crypto shapes new production relationships. Founder Forest Bai has long placed a heavy bet on the convergence of AI and crypto.

If we compare core figures across AI Agent projects, they’re either technically elite developers or strategically visionary leaders. As co-founder of Foresight Ventures, Forest Bai’s connection with bAI Fund runs especially deep. Following this experiment, Forest Bai has continued supporting the agent trial, enabling this TEE-hosted Agent to venture deeper into fund management territory.

How bAI Fund Makes Traditional Funds “DEAD”

Musk found Freya Agent’s fund custody intriguing, but Crypto Agent evolution goes far beyond that. Freya resembles more of a guessing game—participants pay to solve a prompt puzzle and win prizes.

The real intrigue lies in granting financial control rights to Agents. Looking back at human history, America’s founding principle rests upon private property ownership. With the introduction of Crypto Agents, financial usage rights become a watershed moment in Agent history.

So how does this evolution unfold once Agents gain financial authority? And how exactly does bAI Fund make traditional funds “DEAD”?

The Spark of TEE Meets Web3 AI

Perhaps because Web3 has long existed on the cultural fringe, all crypto users in this AI Agent wave now deeply scrutinize technical products. From dissecting Eliza’s code line-by-line to recent live streams by Swarms devs proving their technical prowess, a new project’s acceptance increasingly hinges on technical credibility. As a fund issued by an Agent, bAI Fund employs TEE technology to ensure user fund security. TEE is a hardware-based security solution ensuring code execution within protected environments, preventing external attacks and malicious tampering.

In blockchain and crypto worlds, security and transparency remain top concerns for investors. Even last cycle’s champion FTX suffered user asset misuse scandals, let alone numerous on-chain wallets vulnerable to hacking. Cases of teams taking staked funds and running (RUG) are too many to count.

Yet with technological progress, bAI Fund ushers in a groundbreaking innovation for all crypto users. By integrating TEE, it redefines cryptocurrency trading security while offering investors an unprecedented transparent, efficient, and intelligent investment platform. bAI Fund’s trading program runs entirely within TEE, securing trading strategies. Private keys are protected at the hardware level, impervious even to the most sophisticated hackers. One major advantage of AI is its immunity to greed or fear—it won’t suddenly rug due to temptations of yachts and luxury cars, nor suffer losses from undisciplined trading. Additionally, users can leverage bAI Fund’s remote attestation technology to verify program integrity in real-time, ensuring strategies remain unaltered.

How Does the bAI Fund Flywheel Spin?

Traditional crypto funds typically face two major challenges: strategy security and execution transparency. bAI Fund solves these by running its AI trading programs inside TEE.

As the first fund operated via TEE, bAI Fund spans operations, marketing, secondary markets, and beyond. For instance, bAI Fund can automatically run grid strategies for supported projects, ensuring healthy trading volume for those pairs. Beyond grid strategies, it adapts to different market conditions using mean-reversion or momentum trading approaches. Users can entrust their funds to AI agents for investment selection and strategy execution.

Moreover, users can monitor TEE runtime status in real-time, transparently verifying AI trading strategies. All bAI Fund transactions are recorded on-chain, making every trade traceable and verifiable. Users gain access to view key performance metrics including Profit Factor, Sharpe Ratio, Maximum Drawdown, and Win Rate—providing full visibility into bAI Fund’s strategy performance. Of course, as bAI Fund iterates, its AI-driven strategies will continue updating and optimizing.

Notably, bAI’s initial supported projects include ETH/MPH, ETH/KAOLA, ETH/BAI. This proactive approach of selecting projects from a primary-market perspective to run market-making strategies essentially delivers post-investment services—market making—that traditional VCs often hesitate to touch.

As bAI evolves, its operational services will extend to both primary investments and secondary post-investment support. On one hand, governed by DAO, bAI Fund can review due diligence reports and automatically complete investments or accept SAFTs. On the other, quant funds managed by bAI can automatically provide market-making and volume support for portfolio or meme projects. Meanwhile, bAI Fund will also engage in marketing initiatives. KOLs or agencies can submit information to bai to apply for marketing budgets.

Given bAI Fund’s close ties with Foresight Ventures and strong alignment with its founder Forest Bai, projects funded by bAI Fund are expected to benefit from Foresight’s extensive resources. This includes media exposure through Foresight News and The Block—bridging Eastern and Western media networks with broad industry reach. Or via automated Twitter and Telegram operation tools enabling seamless campaign management. Currently, the meme0x tool behind bAI Fund already manages full automated operations for Morph-chain tokens Cecilia and IKKYU.

Through continuous iteration and backed by Foresight Ventures’ resources, bAI Fund presents a comprehensive, full-stack service model and panoramic project management cluster.

Why Did Token Bai Pump 5x in a Day?

bAI Fund adopts a decentralized autonomous organization (DAO) governance model, allowing holders of Bai tokens to participate in governance. Voting rights are limited to switching supported trading pairs and changing trading strategies, ensuring community decisions focus on critical matters. All proposals come with a 24-hour lock-up period, giving ample time for discussion and consensus-building. On January 7, token bAI surged nearly fivefold. Its path toward hundredfold gains stems not just from the unique AI Agent token-launch concept, but also from the deep bond with its founder and market optimism around future utility empowerment by bAI Fund.

Worth noting is that closely tied to token Bai is a potentially trillion-dollar-valued project—the first-ever AI Fund concept. Whether Bai will be further empowered by bAI Fund moving forward may well explain why the market is aggressively accumulating Bai tokens.

Amidst the AI Agent wave, setting aside human biases and habits to embrace and cherish every “first” in crypto becomes a necessary discipline for every investor, user, and consumer. Perhaps, you and I are witnessing a defining step for Web3 that will resonate for decades to come.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News