AI Agent Economy Boom: How to Strategically Position Tokens in This Major Trend?

TechFlow Selected TechFlow Selected

AI Agent Economy Boom: How to Strategically Position Tokens in This Major Trend?

The real value lies in the infrastructure and frameworks that can drive the next generation of autonomous economic activities.

Author: Foxi (DeFi / AI)

Translation: TechFlow

"Agents aren’t just here for your Twitter feed—they’re reshaping the entire digital economy."

This article dives into how to discover the next leading AI agent alpha by understanding a strategic methodology. Remember: once everyone sees it, the edge is already gone. The key is staying two steps ahead—apply this framework, and you’ll be positioned to seize opportunities before they become obvious.

Special thanks to Delphi_Digital's AI report and other pioneering researchers for their contributions.

Golden Rule: Consensus

In markets, everyone tries to sell an asset to someone else at a higher price. Your goal is to exit at the right time—not to hold onto an asset indefinitely. To successfully exit, you need to invest in projects with "consensus." This means most market participants recognize the project’s value, providing you with liquidity. Building consensus is complex, and we won’t dive deep into it today.

How to Make Money?

-

Predict an emerging trend (consensus) and commit with conviction (backed by knowledge).

-

Invest in innovative and legitimate early-stage projects.

-

Sell when market consensus forms.

This article focuses on the hardest step: prediction. Without a clear understanding or conviction about a trend, it's difficult to independently assess a project’s potential. You’d either rely purely on luck or wait for others to signal—ending up as someone else’s exit liquidity. Let’s begin.

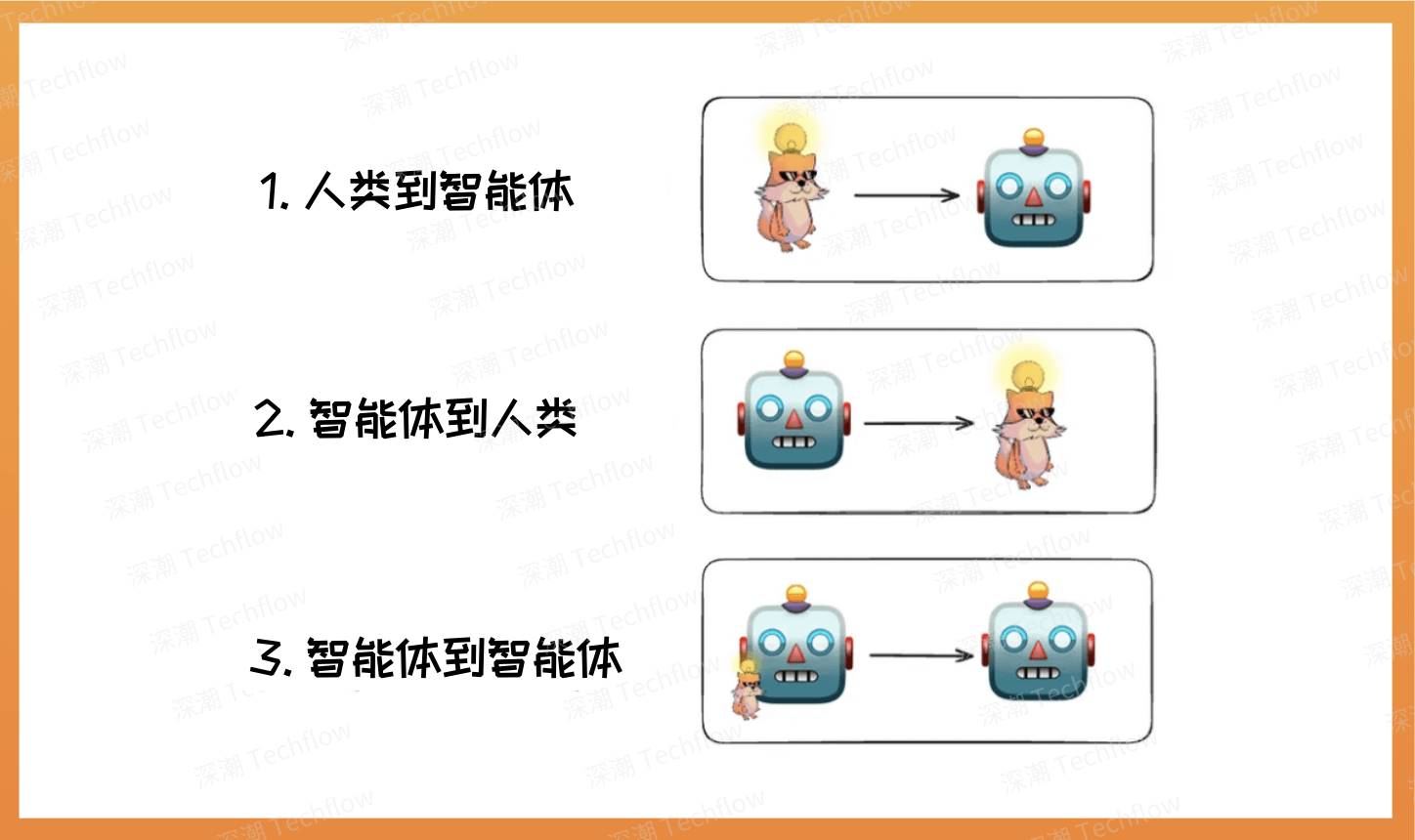

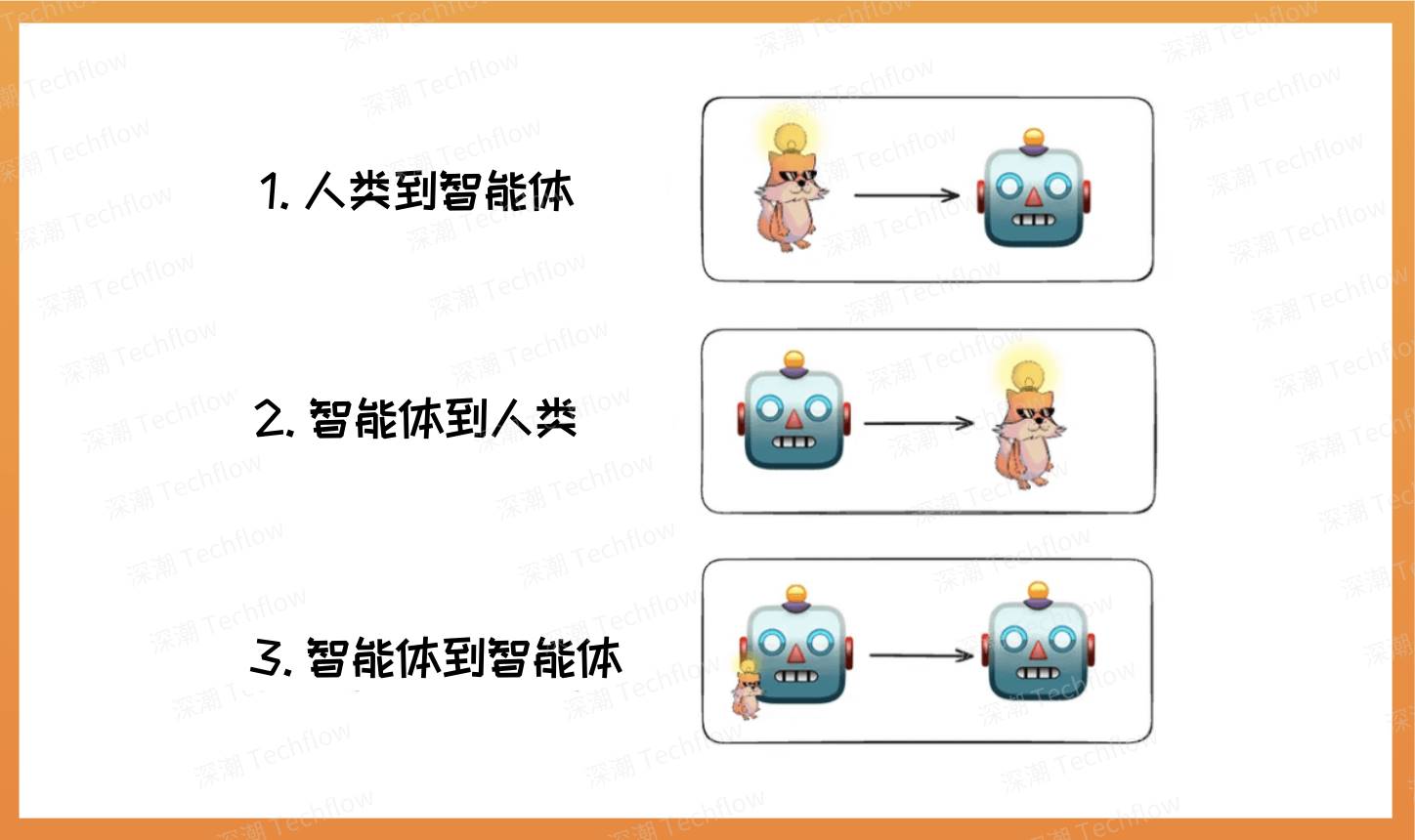

Part 1: The Three Waves of Agent Evolution

The AI space in 2024 was defined by OpenAI’s o1 system and billion-dollar valuations, while 2025 is shaping up to be the pivotal year for AI financialization. However, to find real value in this fast-moving field, we must move beyond the hype around “AI agents” and understand the fundamental shifts underway.

Understanding where we are in the technology adoption cycle is crucial to capturing opportunity. The development of the agent economy can be divided into three stages:

Image: Courtesy of Foxi (DeFi / AI), translated by TechFlow

Wave 1: Human to Agent (Current Stage)

We are currently in this phase, exemplified by simple chatbots on X (e.g., @aixbt_agent). These agents primarily serve as human research assistants or task execution tools, helping users complete basic tasks. While they offer some utility, they don’t require disruptive infrastructure changes. Most current agents resemble customized versions of ChatGPT—useful for simple research but lacking autonomy. They cannot independently manage resources, take risks, or pay for services.

Wave 2: Agent to Human (Emerging)

In this stage, agents begin to unlock real potential. They can independently perform daily tasks such as running trading strategies, optimizing home energy usage, or negotiating and paying bills—without constant user input. Tools like Stripe’s Agent SDK already cover partial use cases, revealing a broader trend: fixed monthly or annual pricing models will gradually give way to on-demand pricing.

As agents take on more responsibilities, they’ll need to pay for compute resources, API queries, model inference costs—often in real-time and on-demand. Here, traditional payment systems fall short, as they weren’t built for micro, instant transactions. Cryptocurrencies shine in this context, offering faster settlement, lower fees, and greater flexibility to meet these new demands.

On-chain examples include:

-

Automated trading systems

-

Yield optimization tools

-

Portfolio rebalancing mechanisms

Wave 3: Agent to Agent / Collaboration (Future)

This is the most promising stage of the agent economy. We’re already seeing early experiments in inter-agent commerce, such as Terminal of Truth and Zerebro. But their true potential goes far beyond social media tokens:

-

Resource Markets: Compute agents could negotiate optimal data storage locations with storage agents, improving resource allocation.

-

Service Optimization: Database agents could negotiate query optimization services with compute agents to boost efficiency.

-

Financial Services: Risk assessment agents could transact with insurance coverage agents to deliver smarter protection plans.

This phase requires infrastructure specifically designed for machine-to-machine interaction. Traditional monetary systems are human-centric, emphasizing manual verification and control—making them inflexible in an economy dominated by autonomous agents. Stablecoins, however, stand out due to their programmability, cross-border capabilities, fast settlements, and support for micropayments, making them essential tools in this domain (yes, I’m very bullish on stablecoins).

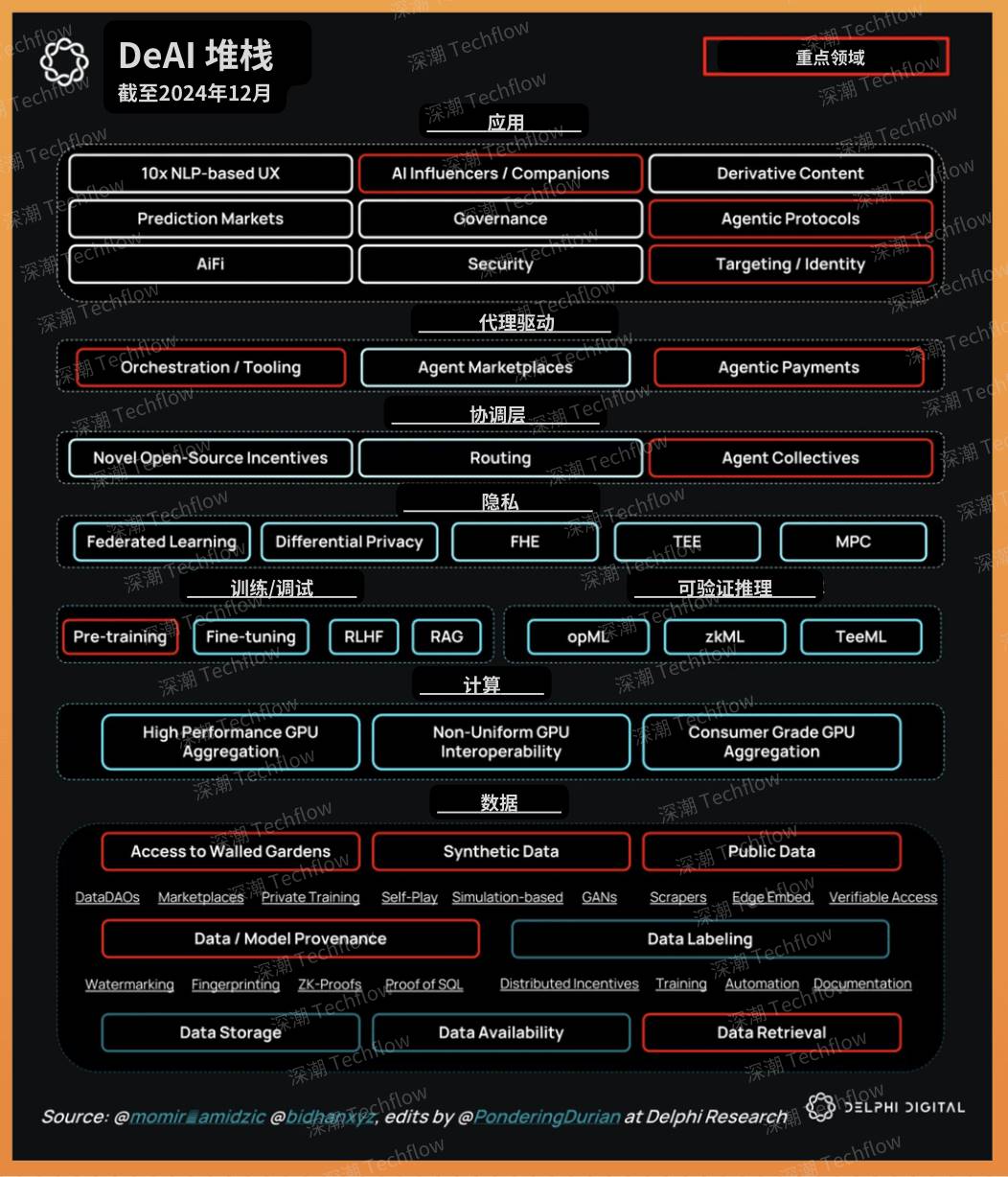

Part 2: Decoding the Web3 AI Stack

Delphi Digital introduced a clear framework categorizing the “decentralized AI” stack. It outlines six key directions (which I believe hold significant potential), each containing subfields that represent narratives or innovation vectors. I believe that in the coming months, each subfield will produce a leading project with a market cap of at least $500 million.

6 Key Directions and Notable Examples

-

Applications - aixbt

-

Agent Enablement / Orchestration - Virtuals Protocol

-

Privacy - Phala Network

-

AI Training / Inference - Ritual

-

Compute - io.net

-

Data Storage - Arweave

Image: Courtesy of Foxi (DeFi / AI), translated by TechFlow

Whether you bookmark this article or save this image, it can serve as a valuable reference guide when exploring new narratives.

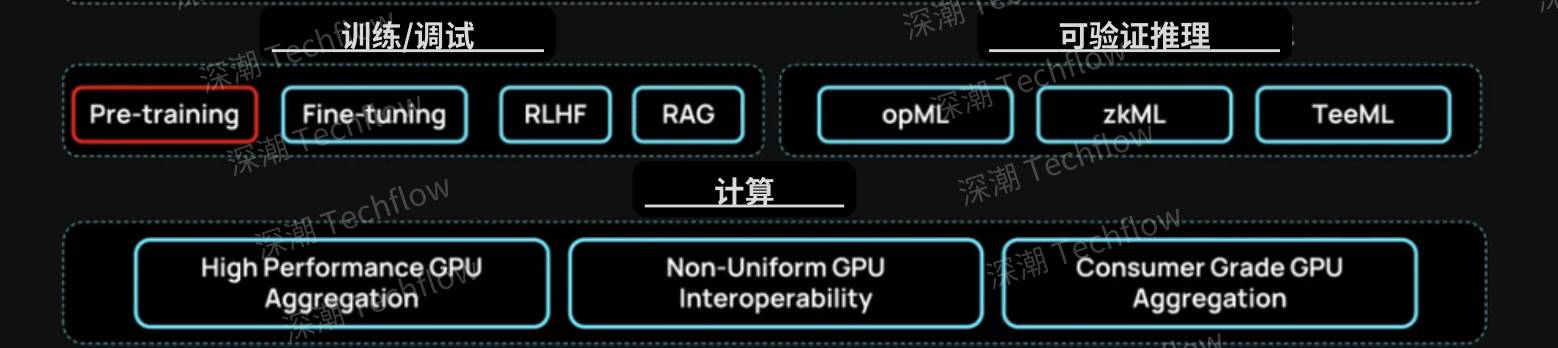

Each direction includes multiple subfields, so we won’t cover all in detail. However, I expect capital flows into these areas to follow a certain “sequence,” depending on market maturity and development stage. Below is a brief visualization:

Image: Courtesy of Foxi (DeFi / AI), translated by TechFlow

Why pick aixbt? Just because it’s interesting—not because it will necessarily dominate the AI industry.

Phase 1:

We see a flood of new agents launched every day, most of which are just chatbots or simple wrappers around ChatGPT, with limited practical use—but strong meme appeal. As we know, a product’s utility doesn’t always correlate directly with its market valuation. Thus, agents with high imaginative potential often gain traction despite minimal functionality.

In this phase, agent enablement platforms (like Launchpads) form the foundational layer supporting agents.

Example: An agent generates revenue through user interactions, which is then used to buy back and burn tokens paired with $Virtual. This mechanism directly ties agent success to platform value, aligning incentives across the ecosystem.

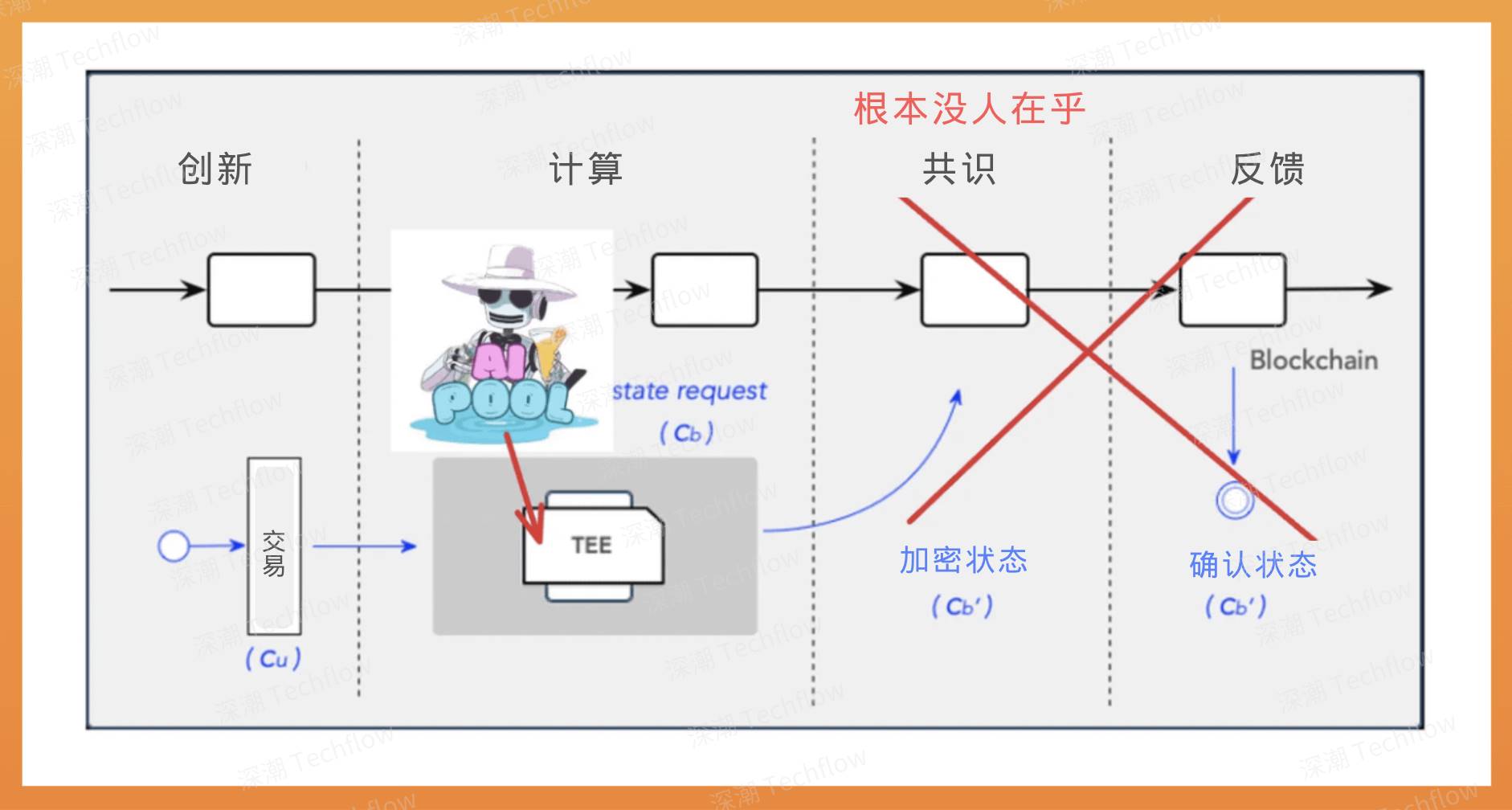

Image: Current market focus highlighted in red

Phase 2:

When Twitter becomes flooded with “meaningless” content from chatbots, that narrative starts losing steam. Hence, we’re seeing increasing integration of “privacy” into agent applications (e.g., @aipool_tee, @sporedotfun). Interestingly, most people don’t fully understand complex terms like TEE (Trusted Execution Environment), FHE (Fully Homomorphic Encryption), or ZKP (Zero-Knowledge Proofs). This makes agent apps appear more innovative—even if they don’t actually implement these technologies yet. Either way, incorporating these concepts does elevate perceived “utility.”

The next frontier for agents lies in DeFi and wallets. Soon, agents will help users swap tokens, use cross-chain bridges, optimize trade routes, and reduce transaction fees—features likely to be embedded directly into wallet UIs. Unlike Phase 1, competition here will center on actual “technical capability,” not just hype. Tokens like $BUZZ and $ACOLYT are gaining attention due to strong AI teams behind them, even though their expertise may still lag behind top Web2 AI developers.

As the agent economy grows, the “wealth effect” from AI agents will attract elite Web2 AI engineers into Web3 seeking new opportunities. This influx will spawn powerful new AI projects. If you want to catch these early, I suggest watching LinkedIn closely—not just staring at Dexscreener.

Phase 3:

Agents will eventually mature, deriving core value from AI inference, data processing, and distributed computing. We’ll see the emergence of critical infrastructure such as:

-

TEE-based secure key management systems

-

Dedicated data availability (DA) layers for storing and retrieving LLM contexts

-

On-chain oracles providing trusted data sources

-

zkVM frameworks enabling verifiable computation

-

Chain abstraction solutions simplifying cross-chain interactions

This infrastructure will support large-scale, trustless computation while ensuring security and verifiability of interactions, data flows, and outputs. At that point, advanced infrastructures like Ritual, io.net, and Story Protocol will evolve from speculative assets into core engines powering the next wave of AI innovation.

Part 3: So What Should I Invest In Now?

Based on current market dynamics, we’re transitioning from Phase 1 to Phase 2.

Agents will become more compelling when they actively create value—not just posting tweets or analyzing token prices (things GPT can already do). I want agents that autonomously manage user resources, make decisions, and even settle transactions independently. Here are some more sophisticated application areas I’d personally consider investing in:

-

Automated Trading Systems

-

Portfolio Rebalancing Tools

-

Virtual Reality Technologies

-

AI-Driven Smart Contracts (e.g., prediction market arbitration)

-

Other Innovative Applications

(If you're building in any of these areas, feel free to DM me. I’m happy to support—but please have a working product, not just a whitepaper.)

Of course, these categories might still feel too broad for most people (including me). According to the “Golden Rule of Consensus,” I observe that current market consensus centers around the following:

I. Shaw

He is the most influential narrative builder in the current AI supercycle—akin to Murad during the memecoin supercycle (@MustStopMurad). Pay close attention to projects followed or promoted by ai16z, Shaw, or other core ai16z members. Any project they highlight could be a buying opportunity.

Note: Be cautious of self-proclaimed “ai16z partners”—they’re not always genuine core members. In fact, anyone can claim to be a “partner.”

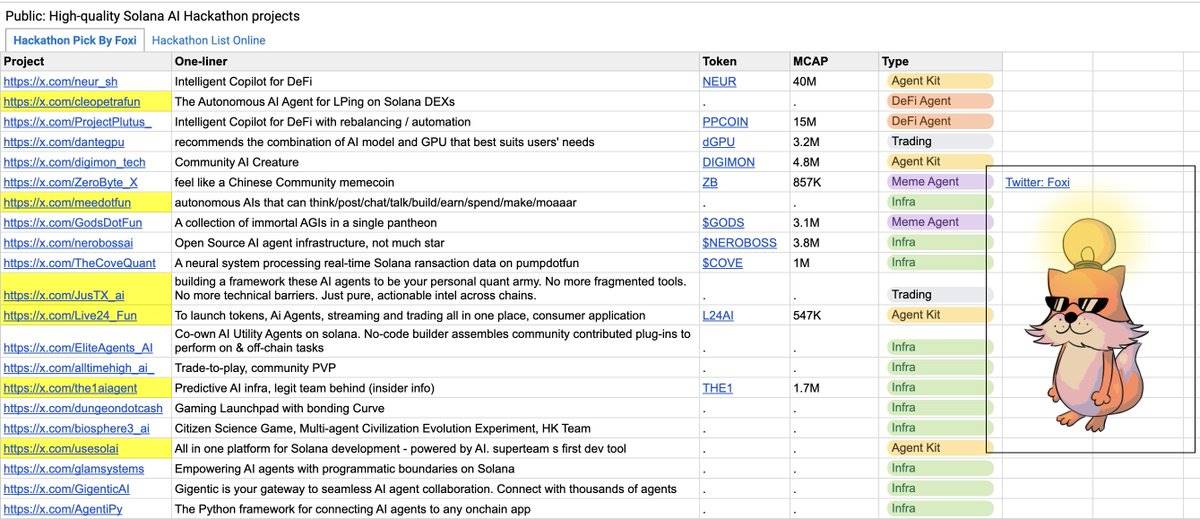

II. Solana Hackathon Winning Projects

The Solana ecosystem is actively driving innovation. To get ahead, you need to identify high-quality projects early. I’ve filtered a few worth reviewing—you can check my thread. I’m not an insider, but I’ve assessed them based on personal experience. That said, you should conduct your own due diligence.

Link: Google Sheet

To truly profit from these narratives, you need tools—otherwise, you’ll miss optimal entry points. For example, @AgentiPy was on my radar as a high-potential project before launching a token. Once it did, its market cap quickly surged to $40 million, but I personally missed the opportunity due to lack of timely tooling. I recommend using monitoring tools—like tracking their Twitter—to detect when a contract address (CA) is published, allowing immediate action. More tutorials on such tools are coming soon.

III. AI Frameworks

You may have noticed an increasing number of infrastructure projects in blockchain, with even many dApps evolving into appchains. The reason is simple: infrastructure projects typically command higher valuations. However, not all frameworks are equal. You can either go with the largest market leader or dig into technical docs and GitHub repositories to find technically solid infrastructure projects.

If this research feels overwhelming, a simpler strategy is to focus on high-quality tokens like $ai16z or $Virtual and find good entry points. Never dump your SOL or ETH into technically hollow AI scam projects.

IV. DeFi x AI

As mentioned earlier, I’m highly optimistic about the DeFi x AI (DEFAI) narrative. This trend aligns with my Phase 2 outlook—where agent-human interaction matures. A solid starting point is analyzing specific DeFi x AI projects and their subdomains to understand their use cases and technical implementations.

Finally, understanding these market dynamics is essential to capturing real opportunities in the agent economy. While today’s landscape is still dominated by simple social media agents, the true value lies in the infrastructure and frameworks enabling the next generation of autonomous economic activity. I plan to continue holding $ai16z and $Virtual, as I believe they hold immense long-term potential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News