AI Token Trading 100x Return Guide: Virtuals Ecosystem Token Selection Strategy

TechFlow Selected TechFlow Selected

AI Token Trading 100x Return Guide: Virtuals Ecosystem Token Selection Strategy

How to find the next 100x potential Virtuals AI agent token?

Original: hitesh.eth, crypto KOL

Translation: Yuliya, PANews

How to discover the next 100x potential AI agent token on Virtuals? Here's a professional investment guide:

When an AI agent token on the Virtuals platform exceeds a market cap of $1 million, it "graduates" from the initial Bonding Curve mechanism. After graduation, liquidity pools for these tokens are created on decentralized exchanges (DEXs) like Uniswap, significantly improving trading liquidity.

Early Entry Strategy

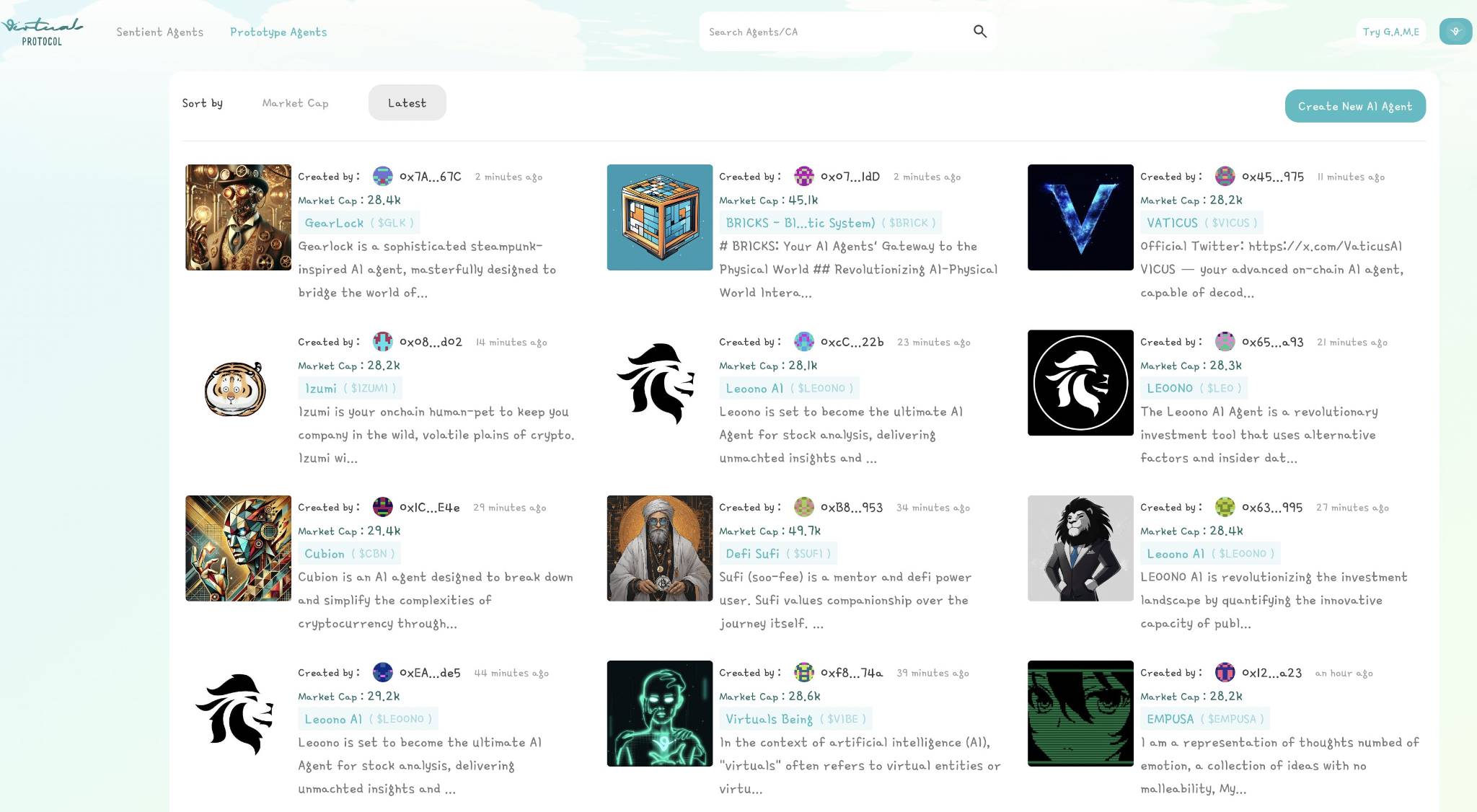

To identify potential 100x opportunities early, the best time to enter is immediately after a token graduates. Investors should monitor the "Prototype Agents" section on the Virtuals platform, where approximately 150–200 new tokens are launched daily. Tokens that quickly meet graduation criteria often indicate strong market interest.

Research Methodology

-

When you notice a token rapidly approaching the bonding curve, immediately search for relevant alpha information

-

Search Twitter using the token ticker to find related discussions

-

Collect insights and use ChatGPT for deeper secondary validation research

-

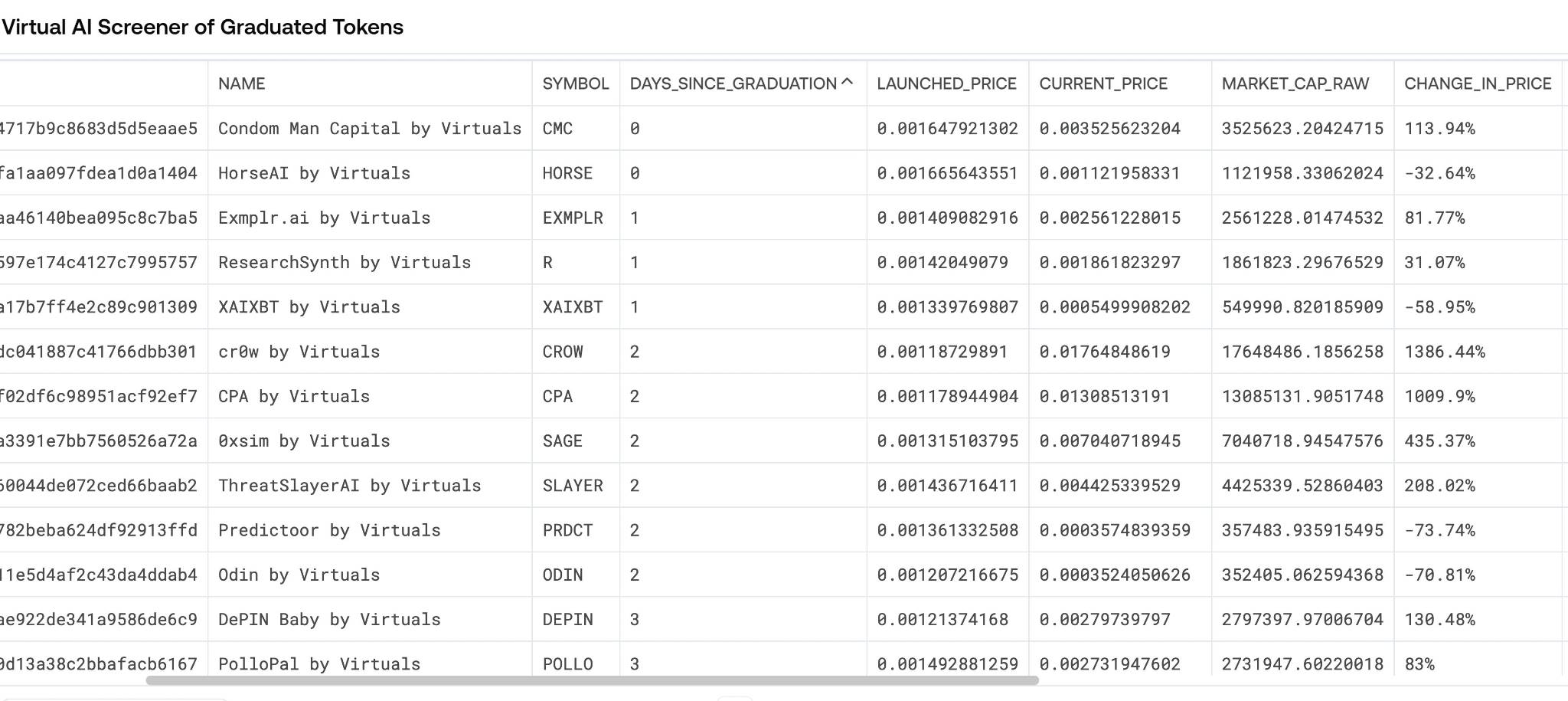

Track graduated tokens via the Flipside dashboard (approximately 2–3 per day)

-

Use the @Chisomdickson9-developed Virtual AI Agent Token Screener tool

Screening Criteria

- Filter by token creation time—focus on tokens issued within the last 3–4 days and analyze their growth trajectory

-

Check price trends, social media presence (e.g., Twitter), and project websites using Dexscreener

-

Evaluate real-world utility; avoid pure meme tokens. However, if a token has practical use cases or innovative features and shows bullish chart patterns, add it to your watchlist

-

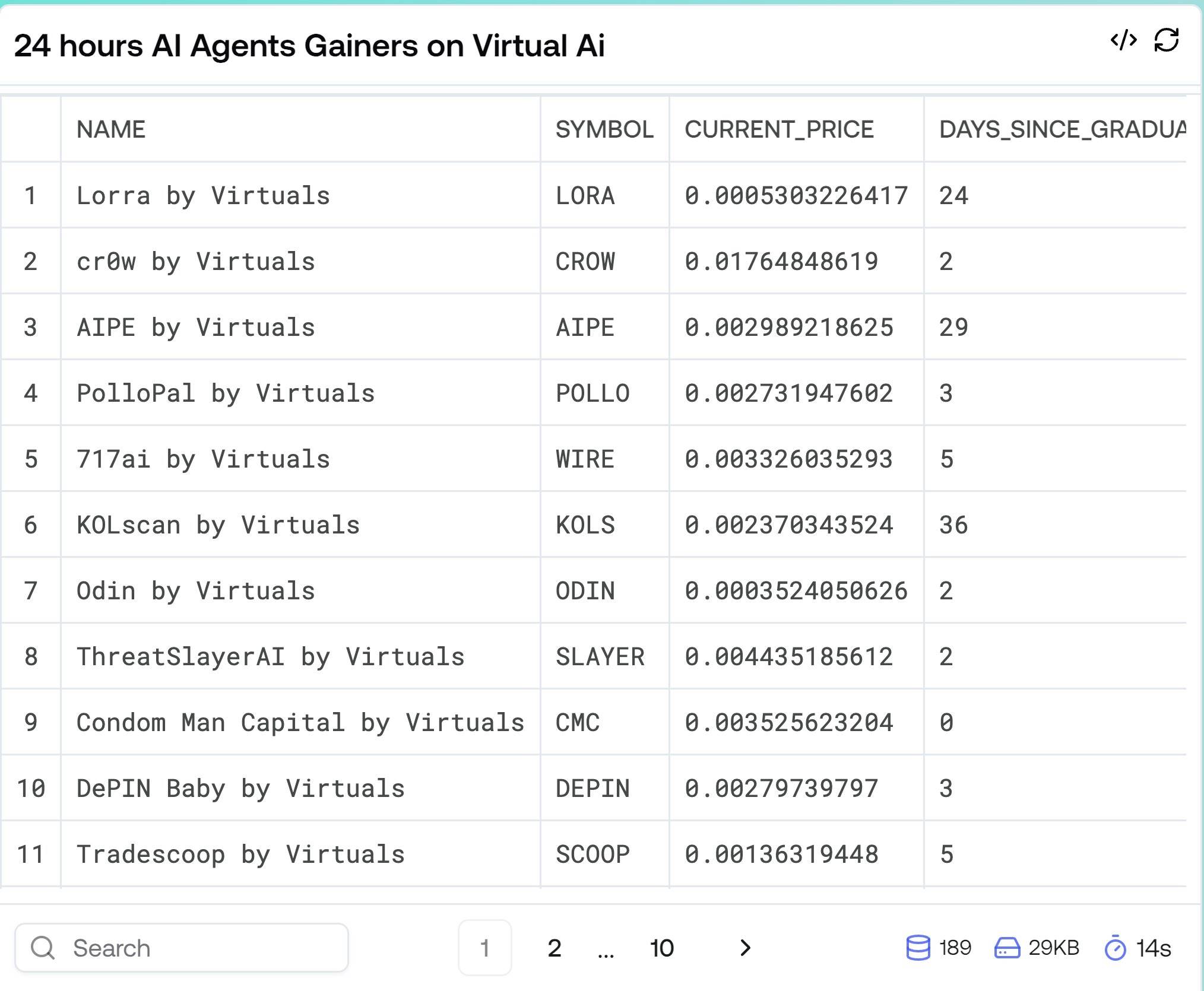

Monitor 24-hour return data and re-filter by creation time to identify the most discussed tokens post-graduation

-

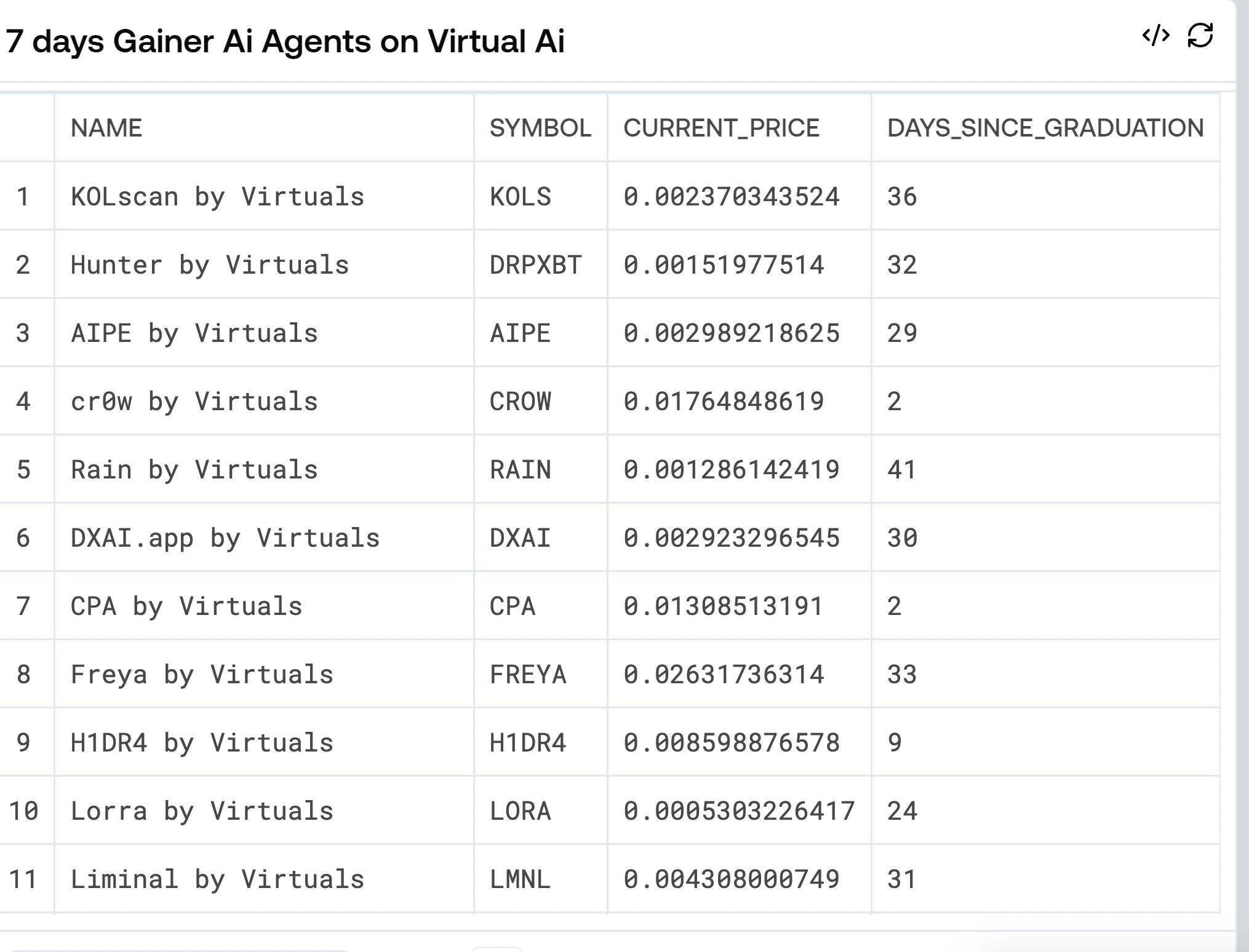

Focus on consistently rising tokens—those maintaining momentum post-graduation often have greater upside potential. Additionally, use 7-day gain tables to track the strongest performers and identify agents with the highest market momentum

Recommended areas to focus on for AI agent cross-application include:

-

Decentralized Science (DeSci)

-

Prediction Markets

-

Gaming

-

Decentralized Finance (DeFi)

Investment decisions should be based on in-depth analysis of project whitepapers, tracking social media activity, and understanding use cases. Through systematic research and screening, investors can build a high-quality watchlist of promising projects.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News