Magic Eden After Launching Its Token: Opportunities and Challenges for a Multi-chain NFT Marketplace

TechFlow Selected TechFlow Selected

Magic Eden After Launching Its Token: Opportunities and Challenges for a Multi-chain NFT Marketplace

Platforms need to overcome Ethereum's market bottlenecks, optimize their economic models, and drive ecosystem innovation to solidify their industry position and realize long-term growth potential.

Authors: Riffi / Mat / Darl, WolfDAO

Edited by: Nora

1. Project Overview

Magic Eden is a multi-chain non-fungible token (NFT) marketplace that has rapidly risen to become one of the leading platforms in 2024, thanks to its presence across multiple blockchain ecosystems including Solana, Ethereum, Polygon, and Bitcoin. Since its launch in September 2021, Magic Eden has expanded its market share through cross-chain capabilities and innovative features. Notably, after integrating Bitcoin Ordinals, it became a key player in this emerging sector. This report analyzes its economic model, market position, and future direction to assess its growth potential.

2. Market Performance & Competitive Analysis

1. Market Sentiment and Token Performance

Source: CoinMarketCap

The ME token was first announced in August 2024, with the Token Generation Event (TGE) planned for December. Initial market sentiment was positive, but current trends show underperformance—characterized by a high opening followed by a sustained decline. After dropping below $3, the price rebounded slightly to around $3.3, with a circulating market cap of $424 million and an FDV of $3.264 billion. One major factor behind this trend is the overall bearish market, especially weakness in the altcoin sector. However, the continued downward pressure on the token price also reflects investor caution regarding the platform’s long-term outlook. This indicates broader pessimism in the NFT and altcoin markets, with investors remaining cautious about future growth.

2. Market Share and Competition

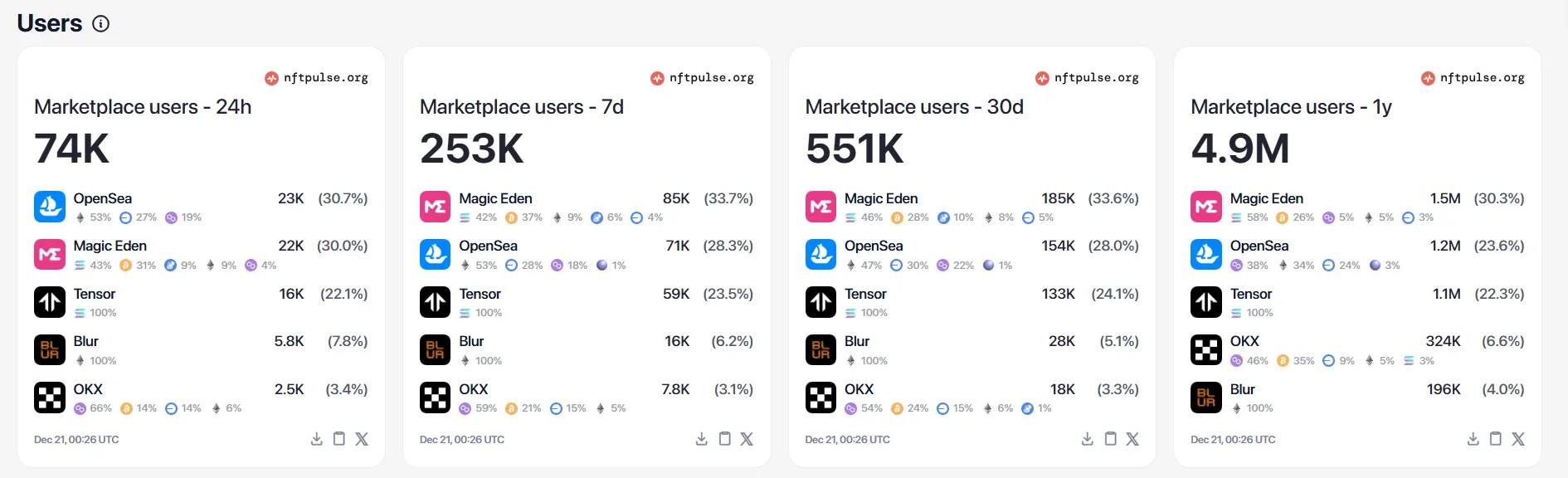

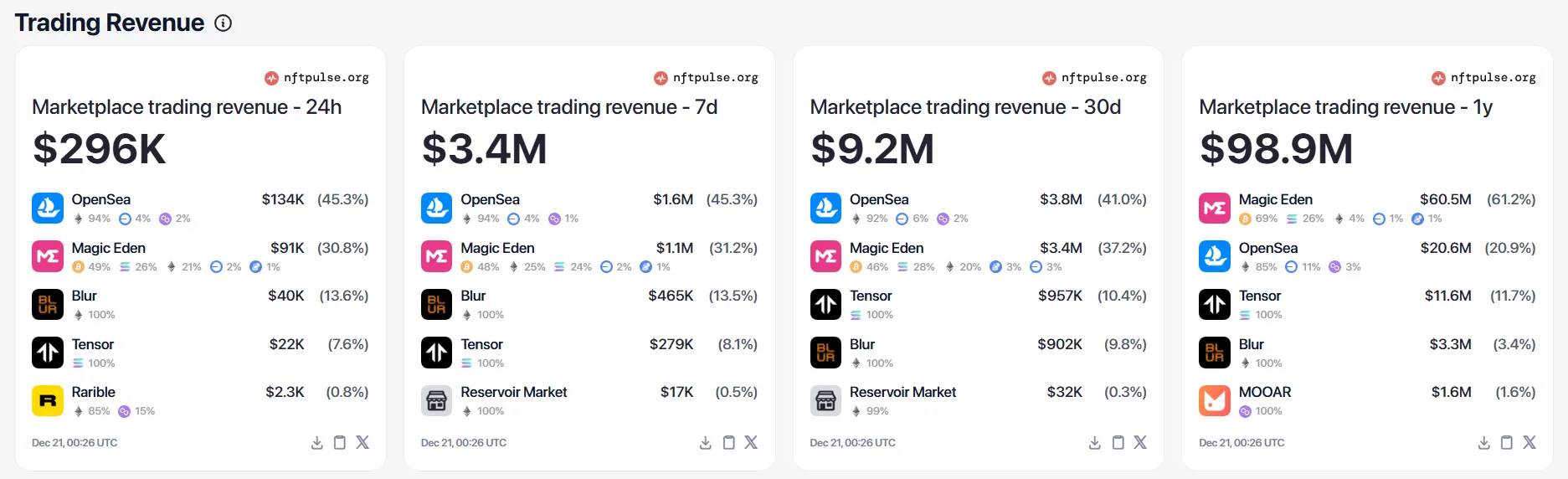

Source: NFTPluse

Magic Eden dominates the Solana and Bitcoin ecosystems, capturing over 80% market share in Bitcoin Ordinals and RuneScape NFTs. However, it faces intense competition from Ethereum-based giants OpenSea and Blur. OpenSea remains the leader on Ethereum, while Blur has gained an edge in the premium NFT trading segment through low fees and high-frequency trading incentives.

Competitor Analysis:

The primary competitors in the market are OpenSea, Magic Eden, and Tensor. In terms of user data, OpenSea and Magic Eden maintain strong positions within their respective core ecosystems. OpenSea leverages its first-mover advantage to dominate Ethereum and its Layer-2 networks, while Magic Eden controls the majority of activity on Solana and Bitcoin. The future competition between them will largely depend on each platform’s ability to grow users and expand within their ecosystems.

In the Solana market, Magic Eden's main rival is Tensor, though Tensor has clear shortcomings. First, its user quality is relatively low. Many transactions involve minimal royalties, attracting retail traders but resulting in lower user loyalty and significantly lower average transaction values compared to other platforms.

Source: NFTPluse

-

Main Competing Platforms:

-

OpenSea: Dominates the Ethereum ecosystem due to strong brand recognition and a large user base, maintaining its leadership position.

-

Blur: Focuses on low fees and high-frequency trading, attracting sophisticated NFT traders, particularly active in high-value asset transactions.

-

Tensor: Competes primarily in the Solana market. While it has captured some market share, it still lags behind Magic Eden in terms of user depth and market maturity.

-

In the short term, Magic Eden’s dominance in the Solana and Bitcoin markets is unlikely to be challenged. Post-TGE, increased funding and visibility may further strengthen its lead. However, Magic Eden’s biggest challenge remains breaking OpenSea and Blur’s monopoly on the Ethereum market. Although Bitcoin Ordinals and inscriptions experienced a surge in popularity, their market stability pales in comparison to Ethereum. Even during downturns in the Ethereum NFT space, OpenSea and Blur continue to control most blue-chip projects, boasting stronger community cohesion and market credibility. As the saying goes: “Blur owns the whales; OpenSea owns the retail.”

3. Market Analysis Summary

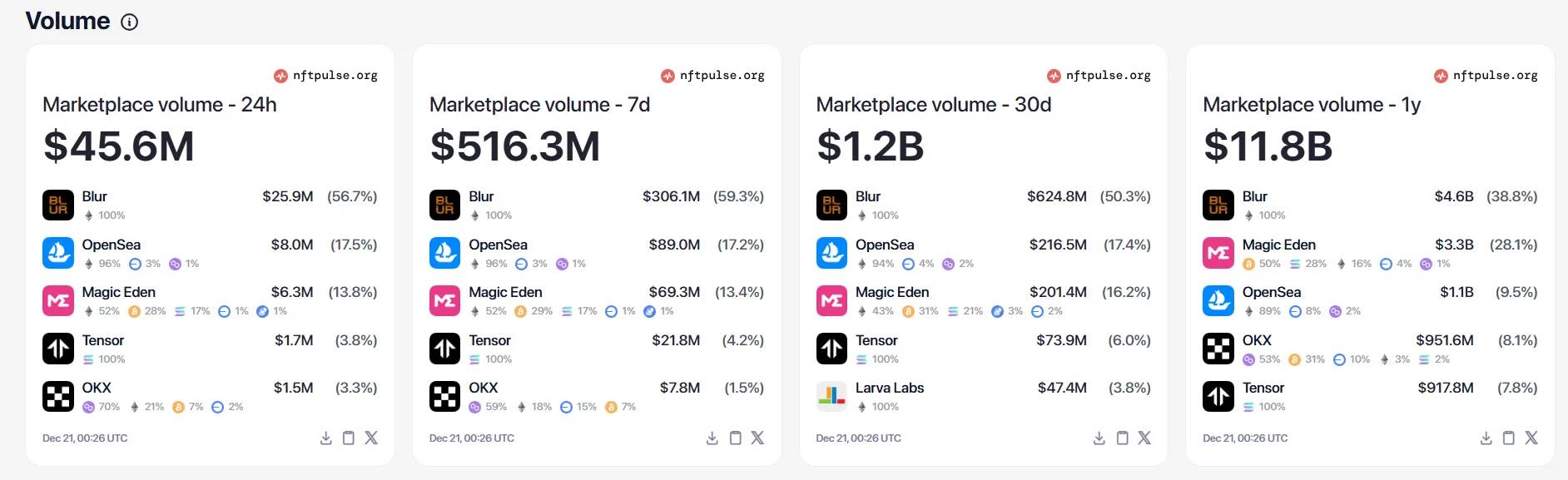

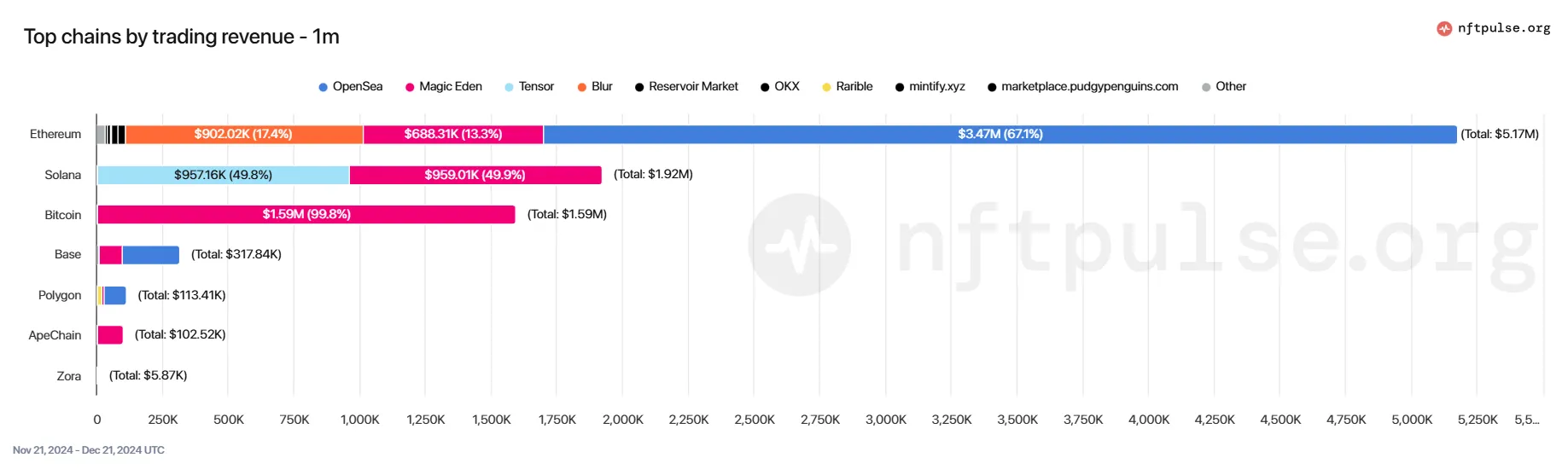

Source: NFTPluse

Despite the explosive growth of Bitcoin ordinals and inscriptions, their market stability cannot match that of the ETH ecosystem. Even when the Ethereum NFT market is sluggish, OpenSea and Blur still monopolize recognized blue-chip projects, far ahead in community strength and market validation. In contrast, although assets like Bitcoin Frogs briefly surpassed BAYC in price, these rallies were fleeting and quickly collapsed post-hype. If Magic Eden fails to cultivate enduring flagship projects, its long-term protocol profitability remains uncertain.

3. Economic Model & Tokenomics Analysis

1. Token Distribution

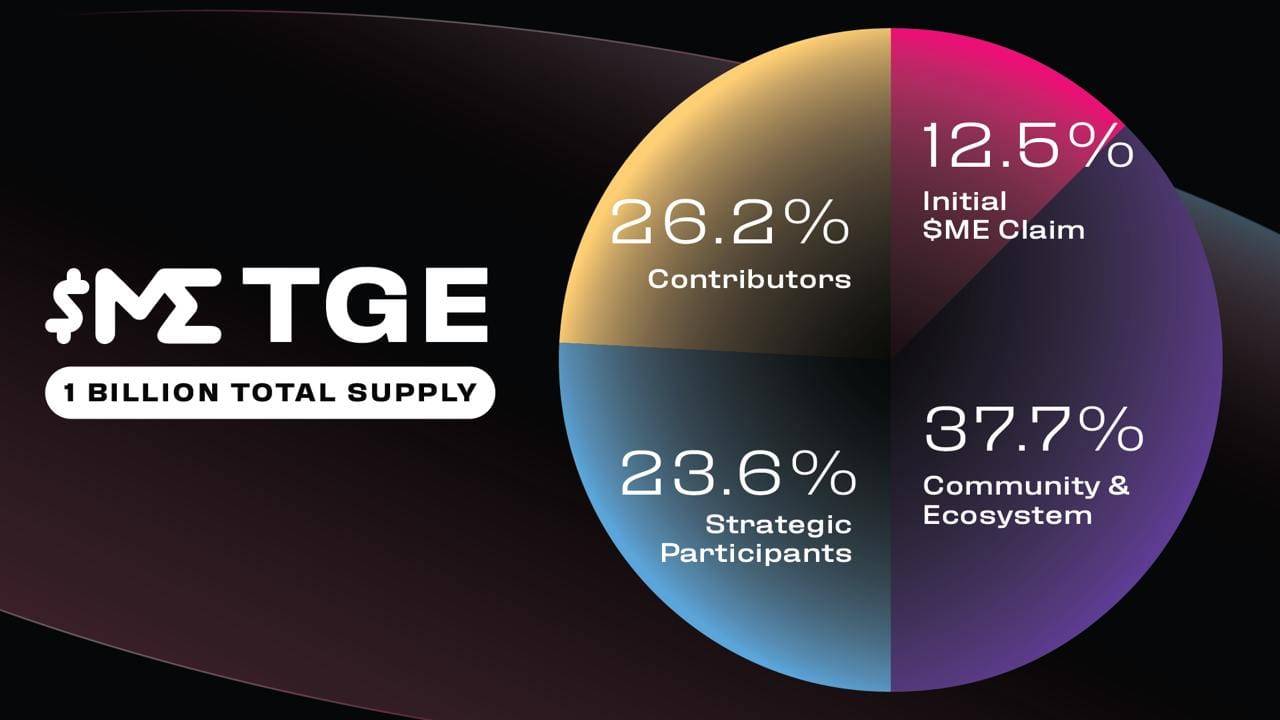

Magic Eden’s token ($ME) has a total supply of 1 billion, to be gradually released over four years. Over half of the tokens are allocated to the community, distributed as follows:

-

Initial Token Claim (12.5%)

This portion will be fully unlocked at TGE and distributed to active users from the Bitcoin, Solana, and Ethereum ecosystems. These users will become part of the Magic Eden DAO. Unclaimed tokens will return to the staking reward pool for future community incentives.

-

Community & Ecosystem (37.7%)

-

Active User Rewards (22.5%): Distributed via Magic Eden’s reward programs, primarily targeting active users and delivered through the platform’s mobile dApp.

-

Ecosystem Development (15.2%): Allocated for long-term investments supporting creators and advocates. Funds will be provided via long-term agreements to ensure stakeholder commitment. Additionally, 5% of this allocation will go to the Magic Eden Foundation treasury for protocol support and liquidity provision.

-

-

Contributors (26.2%)

Allocated to advisors, contractors, and employees who support the Magic Eden protocol and platform. To ensure long-term alignment, core contributors (over 60% of contributor tokens) will have an 18-month lock-up period post-TGE, followed by gradual unlocking.

-

Strategic Partners (23.6%)

Reserved for strategic partners who contributed significantly to the development of the Magic Eden Foundation protocol. All strategic participants will have at least a 12-month lock-up post-TGE, with unlocks following a predefined vesting schedule.

Overall, the structure lacks groundbreaking innovation, relying mainly on standard staking mechanisms and community governance to drive participation and ecosystem growth.

The initial release of 12.5% of the total supply could create selling pressure, but since unclaimed tokens revert to the staking rewards pool—and early investors typically adopt a wait-and-see approach—the immediate impact is expected to be manageable.

Mid-term unlocks for contributors and strategic partners will gradually increase market supply, potentially causing volatility. If demand does not keep pace, the token price may face downward pressure.

However, if Magic Eden can attract more users through ecosystem expansion and product innovation, this selling pressure could be offset by strong organic demand.

2. Sustainability of the Economic Model

Source: NFTPluse

Magic Eden currently generates revenue primarily from transaction fees and marketplace income. Its multi-chain strategy—especially deep integration with Solana and Bitcoin—enables it to capture trading volume across different chains. However, as competition intensifies, particularly on Ethereum and Layer-2 solutions, Magic Eden must diversify its revenue model through innovative products and ecosystem enhancements.

Prior to launching its token, Magic Eden generated $2.8 million in monthly trading revenue, capturing 45.4% market share—approximately $600,000 ahead of second-place OpenSea and nearly 9.3 times the revenue of the already-launched Blur platform ($301,000). Revenue has remained robust post-airdrop, with recent 24-hour and 7-day earnings at $91K and $1.1M respectively. Although OpenSea has recently regained market share due to a resurgence in Ethereum blue-chips, Magic Eden continues to demonstrate strong profitability. Nevertheless, based on its annual revenue of $60 million over the past year, Magic Eden’s price-to-earnings (P/E) ratio stands at 50. With recent signs of declining revenue, concerns arise regarding its long-term profitability and valuation. While Web3 project valuations are inherently more complex than traditional models, this metric remains an important reference point.

4. Challenges & Future Outlook

1. Market Bottlenecks

Although Magic Eden dominates the Solana and Bitcoin ecosystems, competition in the Ethereum space remains a significant hurdle. OpenSea and Blur’s entrenched positions make it difficult for Magic Eden to attract Ethereum-native users and gain meaningful traction.

2. Token Unlocking and Selling Pressure

The ME token distribution is relatively aggressive, with limited initial release but substantial later unlocks, which could flood the market and exert downward pressure on the token price. This unlock schedule risks increasing price volatility and undermining market stability.

3. Lack of Innovation and Ecosystem Expansion

Magic Eden’s investment in innovative products and ecosystem development remains insufficient. The platform needs to accelerate innovation, particularly in cross-chain functionality, differentiation in NFT marketplace features, and improvements in community governance.

Conclusion

Magic Eden demonstrates a solid industry position due to its market share and revenue performance on Solana and Bitcoin. However, since its token launch, $ME has faced challenges including weak market confidence, fierce competition, and looming token unlock pressures. Breaking through the Ethereum market bottleneck is critical in its rivalry with Blur and OpenSea. Going forward, the platform must strengthen its tokenomics design, enhance ecosystem development and user retention, and introduce innovative products to sustain and extend its leadership position.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News