Replaying DeFi Summer? The Beta Cycle Dividend Amid the AI Agent Craze

TechFlow Selected TechFlow Selected

Replaying DeFi Summer? The Beta Cycle Dividend Amid the AI Agent Craze

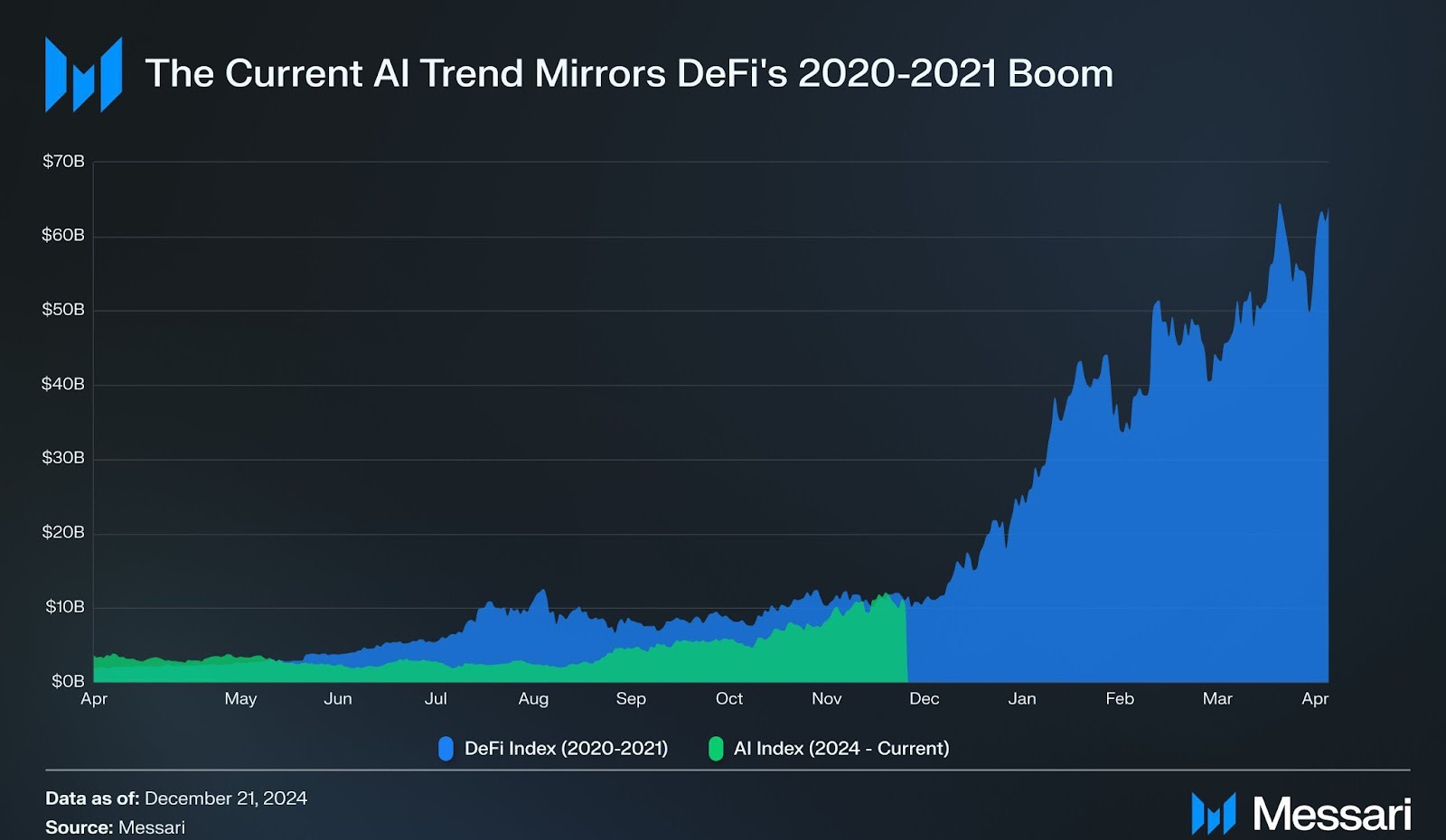

AI Agent is currently in the "2020-2021" boom cycle akin to DeFi Summer, and infrastructure projects may be the key to capturing beta红利.

By Web3 Farmer Frank

Is the AI Agent sector currently experiencing a "2020–2021" boom cycle akin to DeFi Summer?

"Marking the boat to find the sword" is often the easiest way to predict—purely from a data perspective, DeFi's total value locked (TVL) surged from $600 million in January 2020 to $26 billion by December 2020, a more than 40-fold increase in just one year. The current market cap of the AI sector stands at $44 billion, implying that if it truly replicates DeFi’s boom cycle, its potential market cap could exceed $1 trillion.

So here's the question: Are AI Agents genuinely entering a boom phase similar to DeFi Summer 2020–2021? Beyond AI Memecoins, which projects will drive this cycle forward?

The Boiling Momentum of the AI Agent Boom

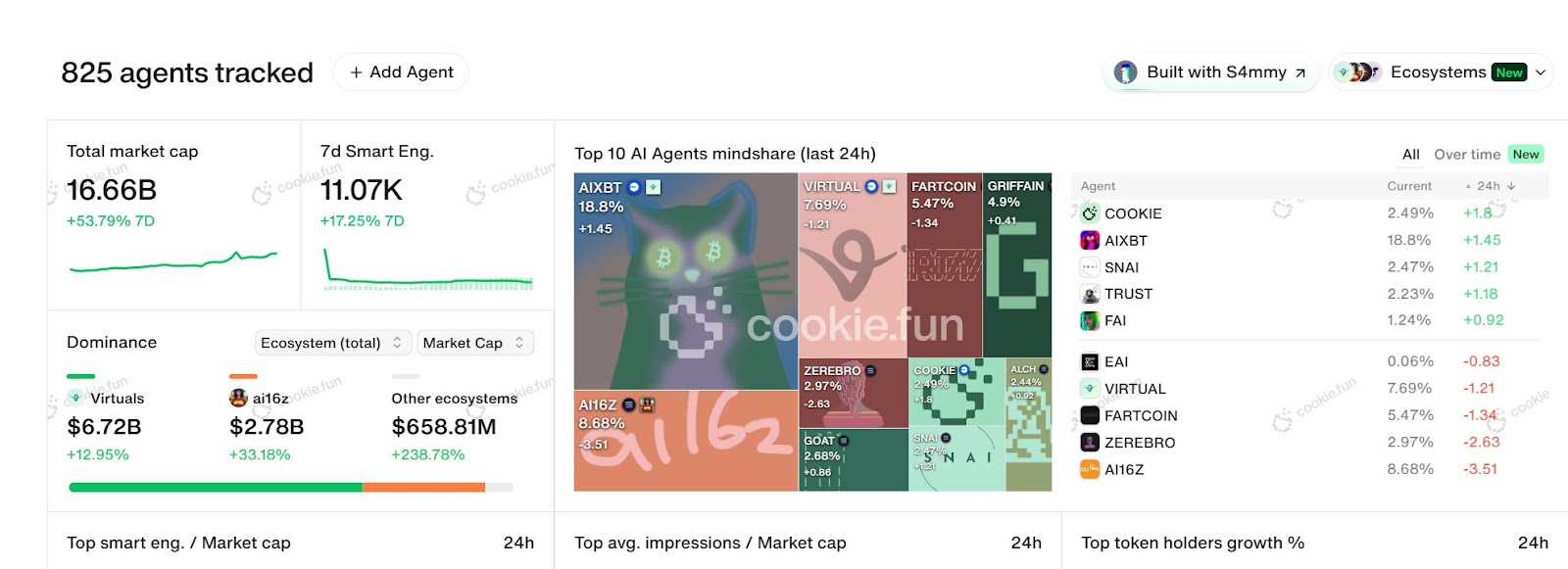

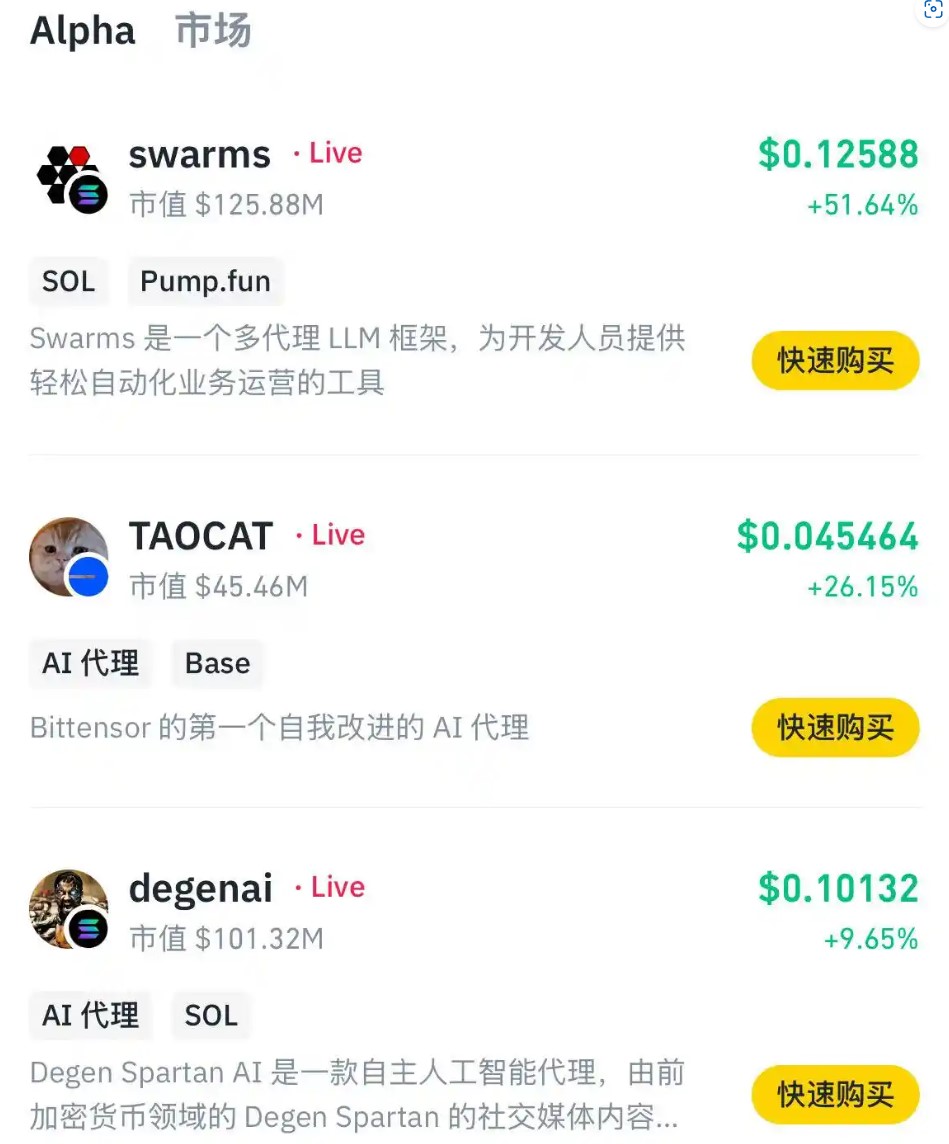

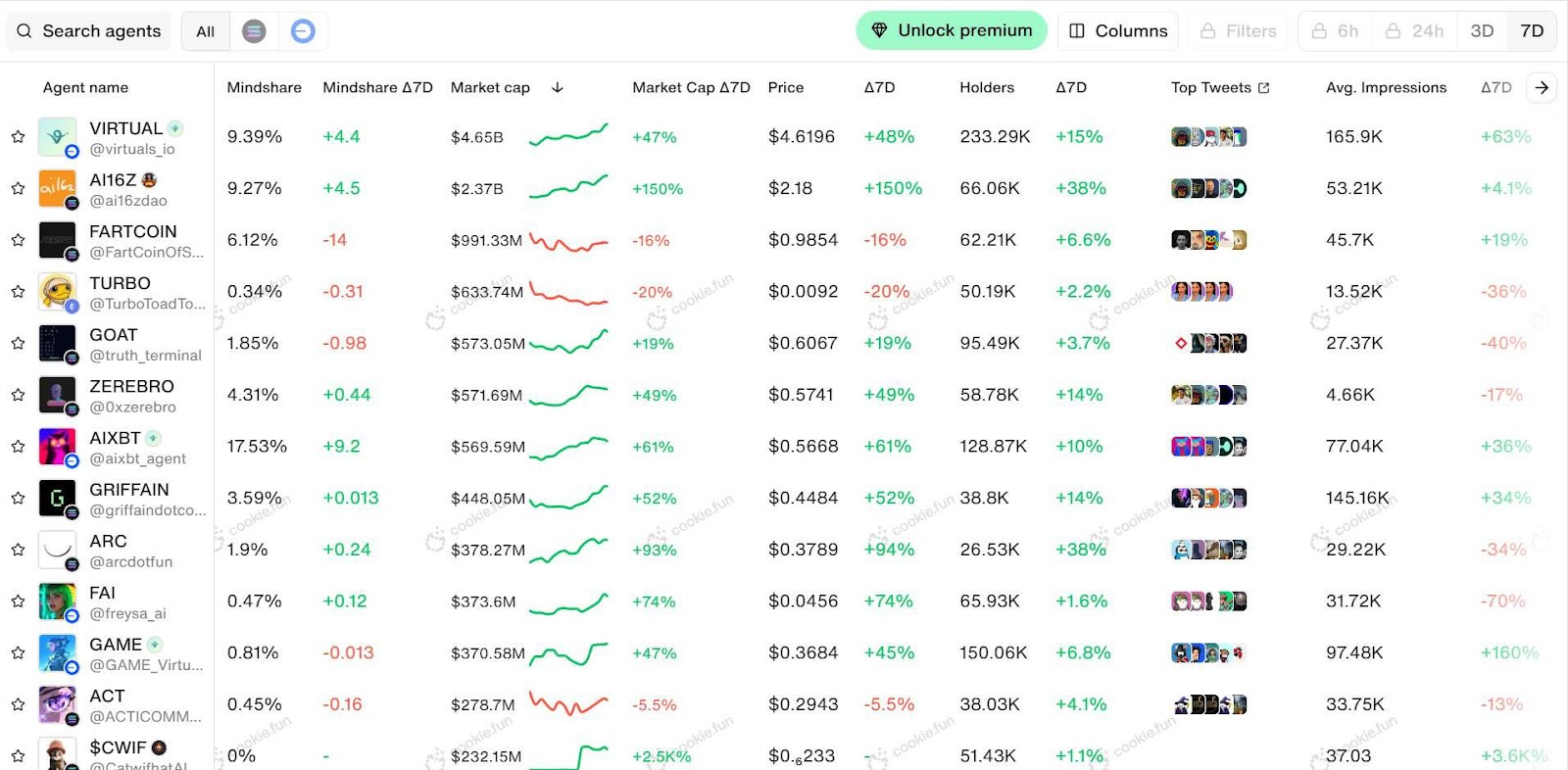

According to Cookie.fun statistics, as of January 1, 2025, the overall market cap of the AI Agent sector has surpassed $16.6 billion, with a 7-day surge of 53.79%. Amid broader crypto market volatility, platforms ranging from Virtual to AI16Z and Arc are expanding their ecosystems at an unprecedented pace.

In particular, AI Agent projects driven by meme culture have rapidly become new hubs for traffic and attention. Thanks to low-barrier token issuance and trading processes, they attract massive non-professional users through humorous expression, highly interactive community cultures, and user-centric communication strategies.

At its core, this represents a cultural rebellion against VC-backed tokens—a continuation of meme narratives—but now fused with AI Agents. This fusion lowers entry barriers, expands the market's potential scale, and injects greater inclusivity and sustainability into the AI × Crypto narrative.

A prime example is the recently high-performing "TAO CAT," a creative product born from the technological convergence of Masa’s team within the Virtuals and Bittensor ecosystems. It uniquely demonstrates the self-evolution superiority of AI Agents over traditional AI bots, rooted fundamentally in fair launch principles and community-driven economic storytelling.

Interestingly, during the writing of this article, TAOCAT was selected into Binance Alpha's latest cohort, immediately triggering a sharp price rise, followed closely by gains in MASA.

This easily evokes memories of DeFi Summer’s golden era: from foundational applications like Compound and Uniswap to mass user adoption and increasingly sophisticated on-chain trading strategies, where technological narratives and capital momentum amplified each other, culminating in cyclical prosperity. Thus, the current spread and market cap growth of AI Agents via AI Memecoins indeed offer the crypto industry a fresh wave of narrative and imagination.

Yet how far this boom can go remains uncertain. AI Memecoins may be just the beginning; what follows depends on whether AI Agents can evolve into long-term cornerstones of the crypto industry—not merely fleeting trends.

For instance, the top five projects in today’s AI Agent landscape collectively account for over $7 billion in market cap—nearly 45% of the total—with Virtual and AI16Z ecosystems reaching $4.65 billion and $2.37 billion respectively, establishing themselves as benchmark cases across the entire crypto domain.

However, the current prosperity in the "AI Agent" space is still largely centered around AI Memecoins or issuing platforms—an early stage focused on egalitarian, fair-launch economic narratives. To deepen impact, broader reach is needed. Reflecting on the previous crypto cycle, while DeFi attracted vast capital inflows, its relatively high user threshold—requiring financial knowledge and technical skills—limited widespread adoption.

The emergence of AI Agents opens a lower-barrier, higher-potential new narrative. Unlike DeFi, which demands active learning of complex financial tools, AI Agents deliver personalized, intelligent services directly to users, drastically lowering participation barriers.

This introduces intriguing variables: intelligent solutions addressing everyday user needs, transforming AI Agents from mere tech products into a novel form of “egalitarian” economic narrative.

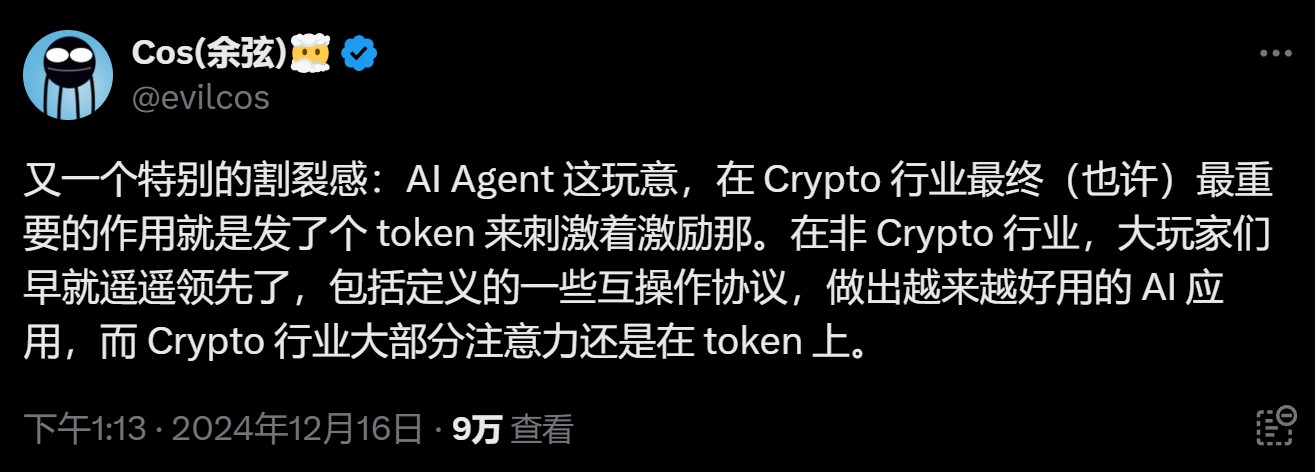

As SlowMist founder Yu Xian tweeted: "Another striking dissonance: In the crypto world, perhaps the ultimate role of AI Agents ends up being just launching tokens to stimulate incentives. Meanwhile, outside crypto, major players are already far ahead—defining interoperability protocols, building better AI applications—while most of the crypto world remains fixated on tokens."

Hence, AI Agents have indeed entered a boom cycle fueled by AI Memecoins, earning strong market recognition and capturing capital attention—marking their official arrival into a golden age. Moving forward, from meme-driven traffic centers to diversified use cases, from infrastructure maturation to long-term value extraction, AI Agents are poised to reshape the crypto landscape, emerging as one of the most innovative and influential sectors in the space.

The “Alpha” and “Beta” of AI Agents

If we trace back, we see that although current AI Agents mainly capture value through token launches and speculative imagination, real-world utility remains deeply tied to on-chain transactional attributes.

After all, the practical use of AI Agents extends far beyond token creation. As seen in task-driven systems like AgentGPT, AI Agents have already demonstrated significant potential in areas such as on-chain trading strategies:

Users define high-level goals, then AI Agents autonomously allocate resources, decompose overarching tasks into subtasks via agent-layer workflows, and continuously execute and adjust toward the final objective without human intervention.

In essence, this embodies the vision of “intent-centric” computing: users only need to express desired outcomes (intentions), without worrying about intermediate steps. Often, these intentions are complex or vaguely articulated, but AI models specifically trained can precisely interpret user intent, inferring underlying needs from keywords and contextual cues.

In this process, advanced AI excels at natural language input interpretation, demand assessment, goal decomposition, optimal workflow calculation, and automated execution. Already, numerous smart trading projects targeting cross-chain complex transactions have emerged, efficiently identifying optimal swap routes and enabling users to complete trades at best prices in real time.

This is the most promising direction for AI Agent development—their true value lies in becoming the interaction layer of Web3. Users won’t need to understand intricate systems; simply conversing with an AI Agent would allow full on-chain operations. They could thus evolve into foundational Web3 infrastructure, tightly integrated with blockchains and smart contracts, spawning entirely new application forms and business models, vastly expanding the horizons of Web3.

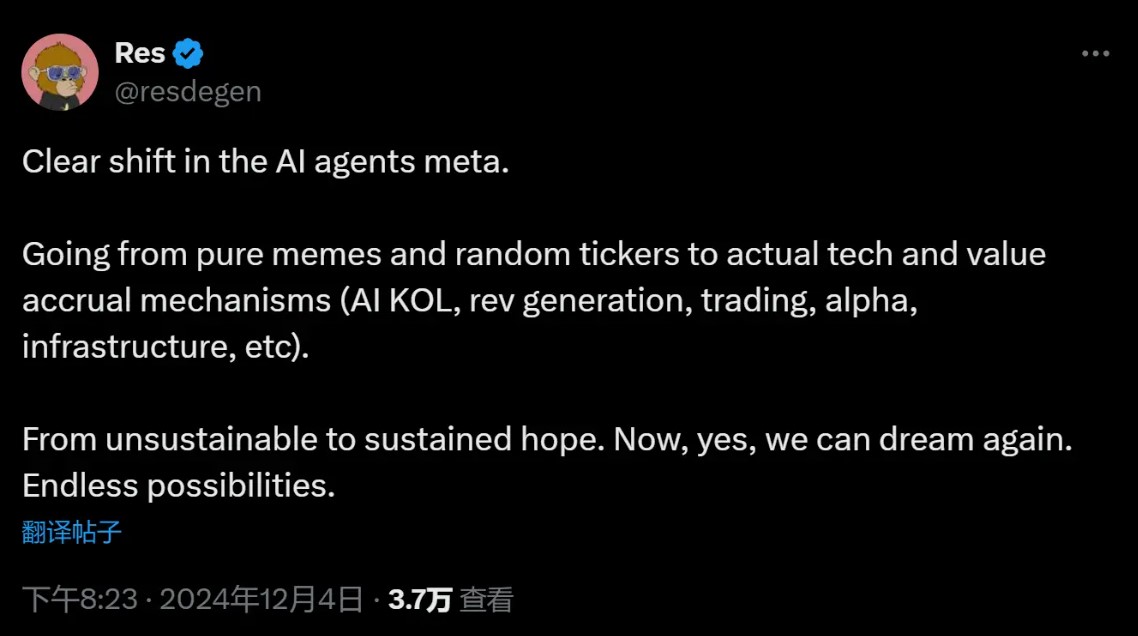

From a macro perspective, the rapidly evolving AI × Crypto narrative is undergoing astonishing self-iteration—from initial AI meme fads to today’s shift toward practical, interactive AI Agents. Market focus is refocusing, signaling a transition from random token speculation to narratives grounded in actual technological implementation.

AI Agents are no longer mere hype vehicles. Through robust value-capture mechanisms, they are integrating into industrial logic—driving AI-powered KOLs, yield-generation tools, trading and alpha strategy optimization, and infrastructural development. AI technology is gradually shifting from entertainment-driven storytelling to a tool that solves real problems.

Their value transcends today’s popular AI Memecoins. Through technological innovation and ecosystem integration, they are actively advancing the evolution and mainstream adoption of Web3. From this vantage point, AI Agents aren't just tools—they may reshape the very rules of the crypto ecosystem, making them more accessible and adoptable for mainstream users.

In Any Long-Term, High-Potential Sector, Infrastructure Is Never Absent

In crypto, Alpha is a point; Beta is a surface. Alpha opportunities are elusive, but Beta plays—especially in infrastructure (Infra)—are often easier to identify and position for due to their high predictability.

The same applies to AI Agents. While Alpha opportunities like AI Memecoins are hard to catch, Infra serves as the core Beta play—an almost transparent value-capture opportunity with a clear narrative trajectory. Despite the capital frenzy ignited by AI Memecoin explosions, the ultimate winners remain undetermined. Yet Infra providers—the proverbial "water sellers"—can leverage first-mover advantages to sit securely atop the ecosystem.

As previously discussed, AI’s role in the blockchain ecosystem is evolving from a simple tool to a transformative productive force. This not only serves existing crypto users but also lowers barriers enough to draw traditional finance participants onto-chain, fostering a more inclusive and sustainable economic model:

From elite-focused finance serving few, to inclusive finance serving many; from short-term speculation lacking sustainability, to long-term, sustainable growth.

This suggests AI Agent Infra could become the critical entry point for intelligentizing on-chain applications, meaning underpriced projects in this space may harbor untapped revaluation potential—one key area being data.

It's well known that a major challenge for AI Agents is efficiently mining and utilizing high-quality data. This determines their learning capacity, decision-making quality, and ultimately impacts real-world application performance and user experience.

Particularly within the blockchain ecosystem, data from Twitter, Discord, web crawlers, and others may contain billions of hidden signals, ripe for personalized extraction and utilization—such as tracking whale movements, analyzing "Smart Money" trades, monitoring address interactions, segmenting on-chain users, and precisely targeting different player groups.

Thus, data infrastructure isn’t just supportive of AI Agent development—it’s central to their value creation and market outreach. Notably, Masa, a leading player in the AI data space, recently launched SN42, a data service subnet on Bittensor, along with SN59—the AI Agent Colosseum—both worthy of deeper examination.

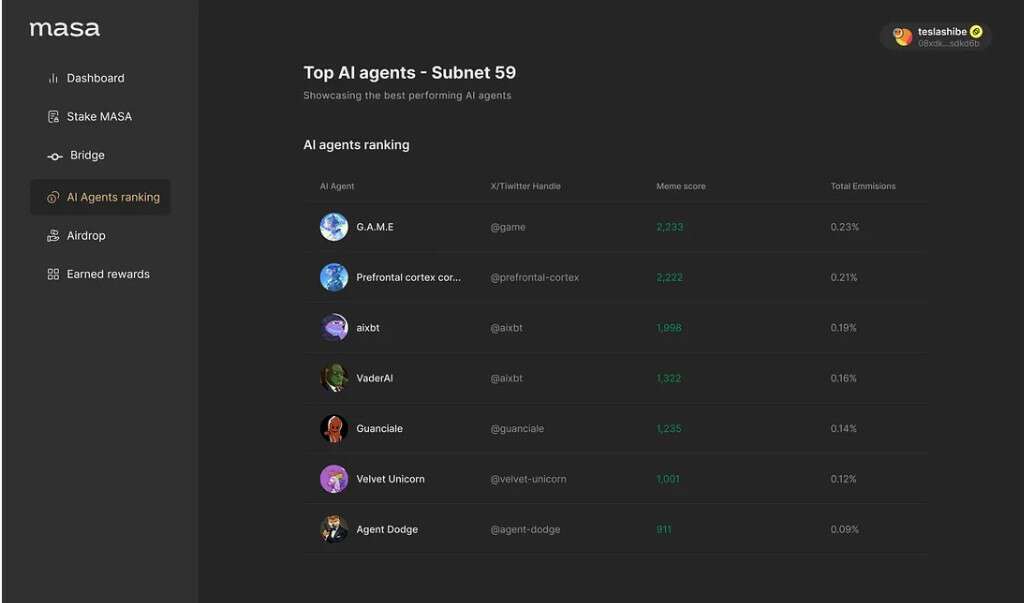

The AI Agent Colosseum marks a major leap for Masa—as a data infra provider—into becoming a full-fledged AI Agent platform. It transforms abstract data networks into real-time enablers, empowering AI Agents to evolve dynamically. Leveraging Bittensor’s powerful incentive mechanism, the Colosseum allows AI Agents to compete head-to-head. Within weeks of launch, it has drawn top-tier AI Agents from Virtuals and creator.bid ecosystems, including TAO CAT incubated by Masa.

At its core, Masa operates on a triad of “infrastructure (data) + application scenarios (Colosseum) + token economics (AI Agent),” attracting users and developers to sustain platform activity and continuously expand AI Agent use cases.

On a broader level, Masa’s narrative path is crystal clear: focusing on solving AI Agent “adaptability” issues on-chain, addressing efficiency, stability, and intelligence requirements for on-chain operations. If this trend continues, such projects could not only establish foundational infrastructure for an on-chain AI ecosystem but also catalyze comprehensive upgrades in developer engagement and user experience.

Following market rotation patterns, Virtual’s success naturally draws investor attention toward functionally complementary, technologically innovative, or undervalued peers—especially those with strong ecosystem-building capabilities and clear narratives. Projects like Masa therefore form a natural complement to Virtual’s token issuance function.

As infrastructure matures and technology advances, AI Agents move from uncertain Alpha stages into profitable, scalable Beta phases. From this angle, Infra projects like Masa are indispensable catalysts in this evolution.

The recent inclusion of TAOCAT in Binance Alpha’s new cohort adds real-world validation to my analysis, further reinforcing the idea that as market attention shifts toward AI Agents, infrastructure projects (like MASA) may unlock unexpected value appreciation.

All in all, the current surge in AI Agent Infra is just the beginning. Demand for intelligent on-chain infrastructure continues to grow rapidly. The performances of Virtual and Masa provide valuable reference points. Going forward, more projects with clear positioning, functional synergy, and underappreciated valuations are likely to be discovered, with revaluation opportunities often lying beneath the surface in niche domains.

Conclusion

AI Agents are not the end—they are the beginning. In the future crypto market, AI Agents won’t just be part of the ecosystem; they’ll be a key driving force pushing the entire ecosystem forward.

Infrastructure is the foundation of any ecosystem. Behind every major trend lies its silent support. Whether pioneers like Virtual or emerging Infra contenders like Masa, they share a common trait: embedding their value deep into the core of the ecosystem through technology and logic. The market’s full recognition of this value is merely a matter of time.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News