Turbulent and dynamic: Reviewing Ethereum's evolution and journey in 2024

TechFlow Selected TechFlow Selected

Turbulent and dynamic: Reviewing Ethereum's evolution and journey in 2024

Or perhaps "full of hidden dangers"...

By Tia, Techub News

Turbulent, dramatic, or perhaps even "full of hidden dangers"...

For Ethereum, this year has been anything but ordinary. It has seen exhilarating highs following the approval of spot ETFs in the U.S., as well as crises amid competition from Solana and various "anti-Ethereum" narratives. Personnel shifts have also marked the year—researchers first joining Eigenlayer as advisors, then stepping down to better focus on advancing Ethereum. At Devcon, key topics such as Beam Chain and liquidity fragmentation were raised. Each event underscores just how exceptional 2024 has been.

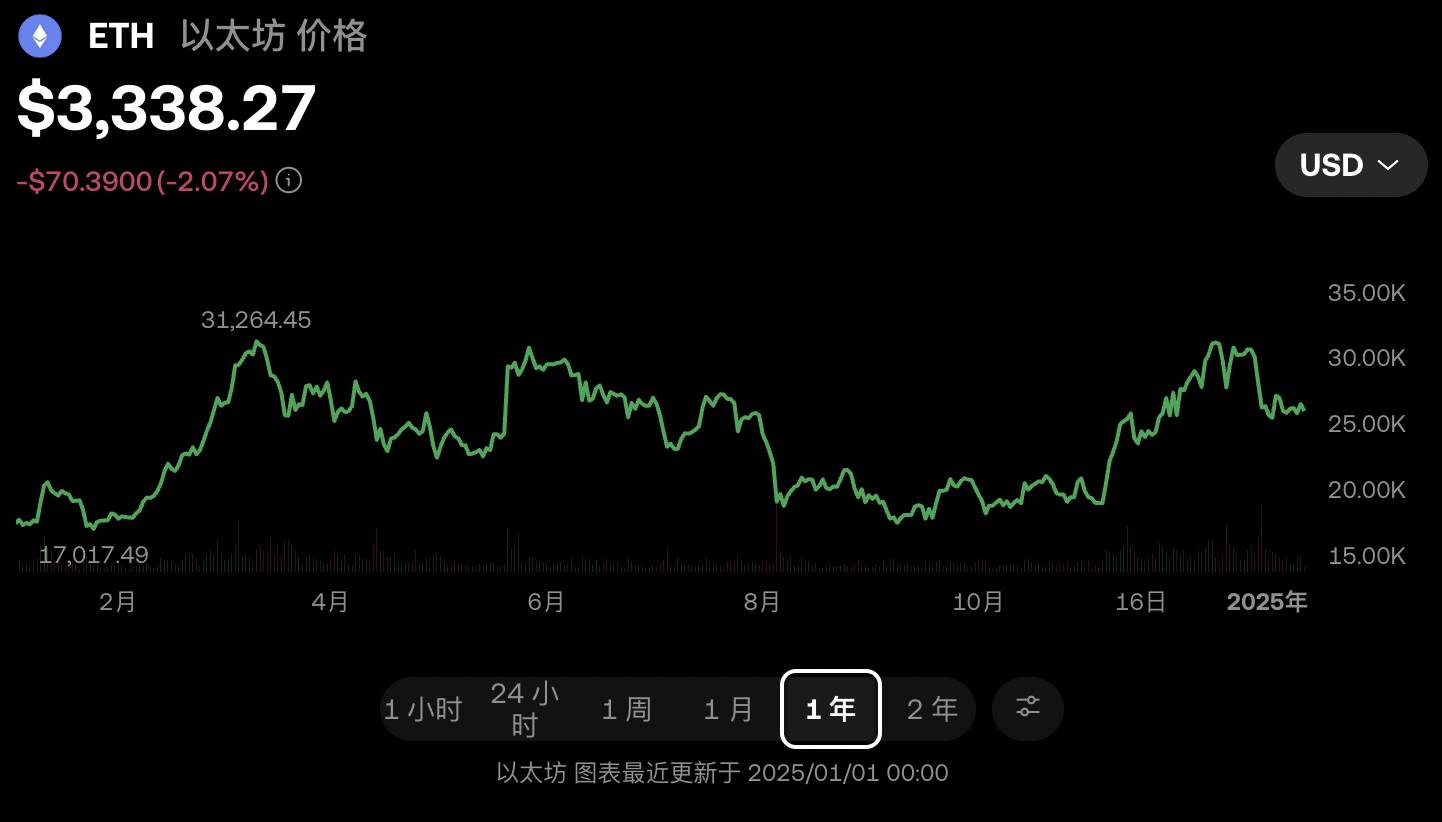

Turbulent Price Movements

The Ethereum price chart alone reveals its rollercoaster journey. From over $2,000 at the start of the year to more than $4,000 in March, back down into the low $2,000s, then climbing again past $4,000—its path has been full of drama and uncertainty.

On January 11, 2024, U.S. Securities and Exchange Commission (SEC) filings revealed approval for 11 spot Bitcoin ETFs. Riding the ETF wave and fueled by growing expectations for a spot Ethereum ETF, Ethereum surged—nearly doubling in value within just over a month.

On July 23, spot Ethereum ETFs officially launched. Although trading volume was strong—surpassing $200 million within 45 minutes—the price failed to see significant gains. This was largely because much of the anticipated rise had already been priced in during the first half of the year.

With no sustainable innovation to justify high valuations, Ethereum’s rally reversed sharply in August. Starting July 30, prices declined for seven consecutive days, falling from a peak of $3,366 to a low of $2,111. After that, the market entered a prolonged consolidation phase.

Then came Trump's victory in the presidential election, reigniting bullish momentum and pushing Ethereum from the low $2,000s to a new high of $4,170.

Streaks of seven-day drops followed by seven-day rallies, along with multi-fold swings, reflect the extreme volatility of crypto markets—and highlight how sentiment, expectations, and external events shape price action. (Yes, this is crypto 🕶️)

Beneath these price swings lie undeniable fundamental truths: the surge driven by anticipation of an Ethereum ETF after Bitcoin ETF approvals; the collapse back to baseline due to lack of real innovation and sustained demand despite ETF launches; and the explosive rally triggered by optimism around Trump’s pro-crypto stance...

Looking back, Ethereum’s price movements are not solely driven by macro forces—technical progress plays a crucial role. From the rollout of Ethereum 2.0, to Layer2 scalability solutions, to continuous network upgrades, each breakthrough captures market attention. Yet these advancements rarely translate into immediate price appreciation, often overshadowed by short-term sentiment.

Beam Chain, Dencun Upgrade, Pectra Upgrade, and Other EIPs

Beam Chain

Proposed by Ethereum researcher Justin Drake at Devcon in Thailand, Beam Chain is a reimagining of Ethereum’s consensus layer—a next-generation evolution of the Beacon Chain. Its main goals include addressing MEV, lowering staking barriers, achieving single-slot finality, and fully ZK-ifying the consensus layer. Leveraging recent advances in SNARK technology, Beam Chain effectively modernizes the five-year-old Beacon Chain design.

Dencun Upgrade

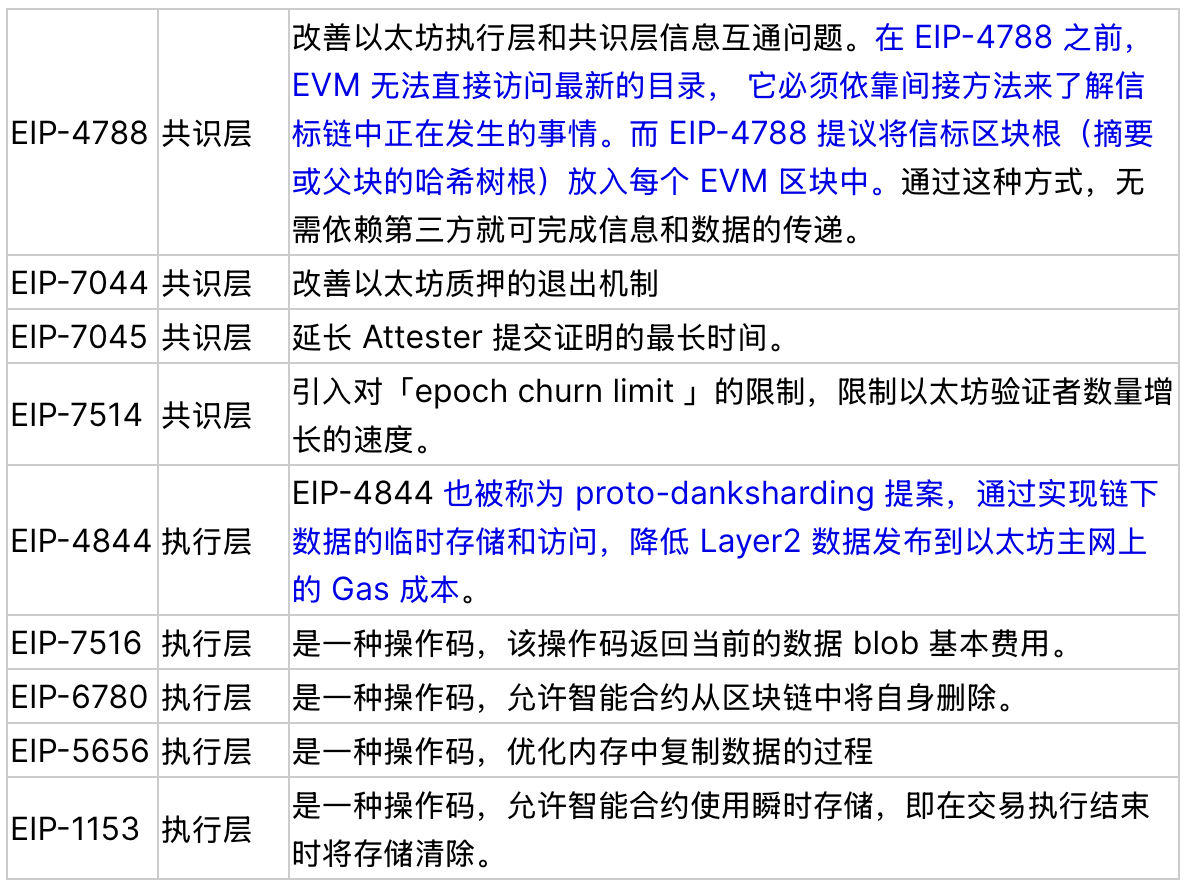

The Ethereum Dencun upgrade went live on March 13, 2024, combining two core updates: Deneb (consensus layer) and Cancun (execution layer). The centerpiece was EIP-4844 (Proto-Danksharding), enabling Rollups to send transaction data and proofs to Layer1 in the form of Blobs. Since Blobs serve as temporary off-chain storage, they significantly reduce Rollup costs compared to traditional calldata. However, this shift also led to a substantial drop in Ethereum’s revenue.

EIP-4844 remains controversial. In the short term, it has indeed caused a sharp decline in network income and drawn criticism. Yet others hail it as “a small step toward sharding, but a giant leap for Ethereum scaling.” Its long-term impact remains to be seen.

The Dencun upgrade also included several EIPs aimed at improving efficiency, such as EIP-7516, EIP-6780, EIP-5656, and EIP-1153. For a full list of EIPs included in the Dencun upgrade, see the table below:

Pectra Upgrade

The Pectra upgrade combines two separate enhancements: Prague (execution layer) and Electra (consensus layer). It serves as a precursor to the Fusaka upgrade, which will implement the Verkle Tree transition. Given developer consensus that no other major changes should accompany the Verkle migration, Pectra bundles other planned improvements before that pivotal shift.

The Verkle transition involves migrating Ethereum’s entire state data from Merkle Patricia Trees to Verkle Trees. This enables nodes to generate smaller proofs, facilitating easier state transfer between nodes and serving as a prerequisite for “stateless clients.”

Pectra is tentatively scheduled for mainnet activation in early 2025. Among its most significant components is EIP-7702, which extends smart account capabilities to externally owned accounts (EOAs).

EIP-7702 improves upon EIP-3074, first proposed in May 2024. EIP-3074 marked the community’s initial attempt to bring smart account features to EOAs. Unlike ERC-4337—which enables account abstraction via an EntryPoint contract without modifying the execution or consensus layers—EIP-3074 requires a hard fork. It introduces two opcodes, AUTH and AUTHCALL, to grant EOAs smart account functionality.

EIP-7702 takes this further. Instead of using opcodes, it allows an EOA to store a “delegate indicator”—an address pointing to a smart contract. When a transaction targets the EOA, it can execute code from the designated contract, similar to a delegatecall in smart contracts.

EIP-7702 brings smart account functionality to EOAs while resolving many concerns raised by EIP-3074. It ensures full compatibility with ERC-4337 and provides a clear upgrade path, making it a likely candidate for inclusion in the Pectra upgrade.

Since the focus post-Pectra will shift to Verkle Tree implementation, EIP-7702 may be the final account abstraction-related EIP for some time—there may not be another two-year window dedicated to such upgrades.

To date, other Pectra-related code changes primarily aim to improve user and developer experience. For a more detailed overview of the Pectra upgrade, refer to this article.

Other EIPs

Not all approved EIPs require a hard fork to take effect. In 2024, Ethereum adopted several important process and standard-type EIPs, such as cross-chain intent standard ERC-7683 and account abstraction standard ERC-4337 (ERCs being a subset of EIPs). These rely more on community adoption—whether users and developers choose to recognize and implement them. Even EIPs requiring a hard fork need time for broad acceptance among users and DApps before achieving widespread use.

Interoperability: Cross-chain / Rollup Standards

As Ethereum embraces a Rollup-centric roadmap and new Layer1 chains proliferate, liquidity across chains has become fragmented, eroding one of Ethereum’s greatest strengths: composability.

Interoperability faces two levels of challenges: first, enabling fast, low-cost, and secure cross-chain asset transfers; second, achieving synchronous composability.

Several protocols already address the first challenge. For example, Across has greatly improved cross-chain speed while keeping fees low. Thanks to its intent-based architecture, security risks are fully transferred to solvers. Current proposals in the cross-chain/Rollup space mainly focus on establishing foundational standards.

Synchronous composability is expected to be realized through Based Rollups. Key cross-chain/Rollup proposals include:

ERC-7683

Jointly proposed by Across and Uniswap, ERC-7683 is a standardized intent-based cross-chain protocol. It enables all intent-driven interoperability orders to share a common solver network.

When combined with ERC-3668 and ERC-3770, ERC-7683 delivers initial interoperability for L2s. ERC-7683 creates a unified framework for cross-chain intents accessible to all solvers; ERC-3770 adds chain-specific tags to addresses, preventing users from sending funds to wrong networks; ERC-3668 (CCIP Read) enables secure off-chain verification without additional trust assumptions, efficiently supporting lightweight clients on compatible L2s without extra wallet configuration.

RIP-7755 (L2 Invocation Standard)

RIP-7755, introduced on October 17 by Base’s research team, is a proof-of-concept standard designed to enable seamless interoperability between different Ethereum Layer2 networks—particularly mainstream ones like Optimism and Arbitrum. The current PoC supports blockchains compliant with EIP-4788 and has already demonstrated verification of OP Stack chains and Arbitrum states.

Summary

The above offers a comprehensive review of Ethereum’s major developments in 2024. Of course, the year encompasses far more: debates with Solana, criticisms over unclear positioning and centralization, large institutions beginning to hold spot Ethereum ETFs (e.g., Michigan pension fund disclosing over $10 million in holdings), major financial players launching tokenized products on Ethereum (such as UBS launching its uMINT tokenized money market fund in Singapore, and Wall Street giant Guggenheim tokenizing $20 million in commercial paper on Ethereum), and Vitalik Buterin publishing six consecutive articles outlining Ethereum’s roadmap amid crisis, alongside AMAs on the Ethereum Research subreddit, and more…

All of this leads to one unresolved question: Where does the road go from here?

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News