DWF 2024 Market Data Review: Total Market Cap Surpasses $3.7 Trillion, Stablecoin Supply Hits New Record of $187.5 Billion

TechFlow Selected TechFlow Selected

DWF 2024 Market Data Review: Total Market Cap Surpasses $3.7 Trillion, Stablecoin Supply Hits New Record of $187.5 Billion

Even amid market volatility, stablecoin trading volume remains at high levels.

Author: DWF Ventures

Translation: TechFlow

2024 has become a pivotal year for the development of cryptocurrency—marked by active participation from institutional investors and significant growth in on-chain activity, showcasing major industry advancements.

Below is a data review of this year:

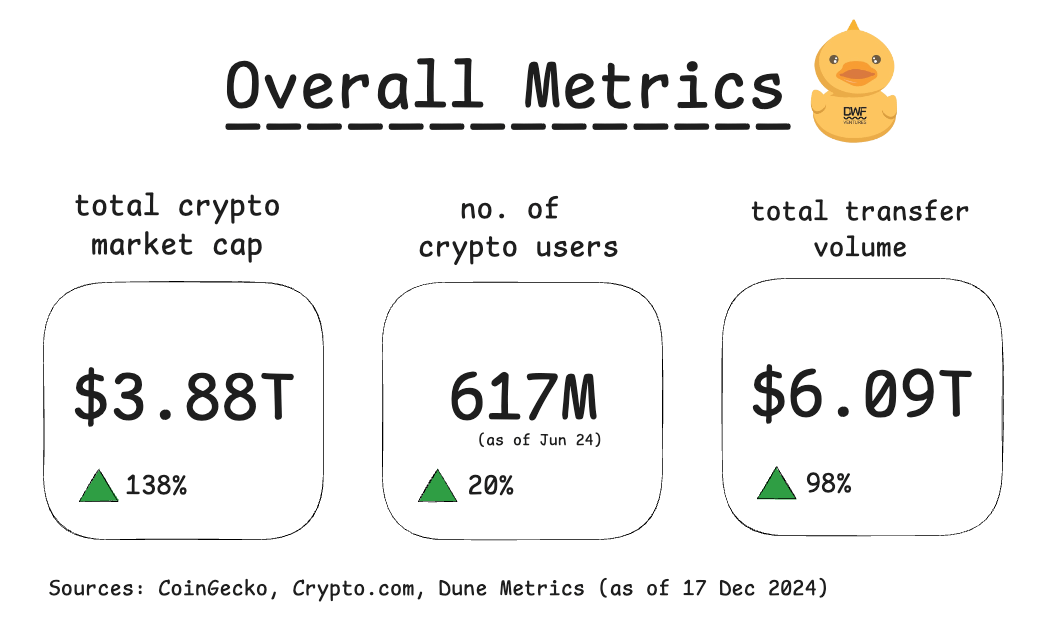

Continuation of 2023 Growth

The market rebounded strongly this year, with total market capitalization surpassing the previous all-time high (ATH) set in 2021, reaching $3.7 trillion.

In addition to significantly increased liquidity, user numbers and trading volumes also grew in tandem—indicating healthy market development and rising real-world usage.

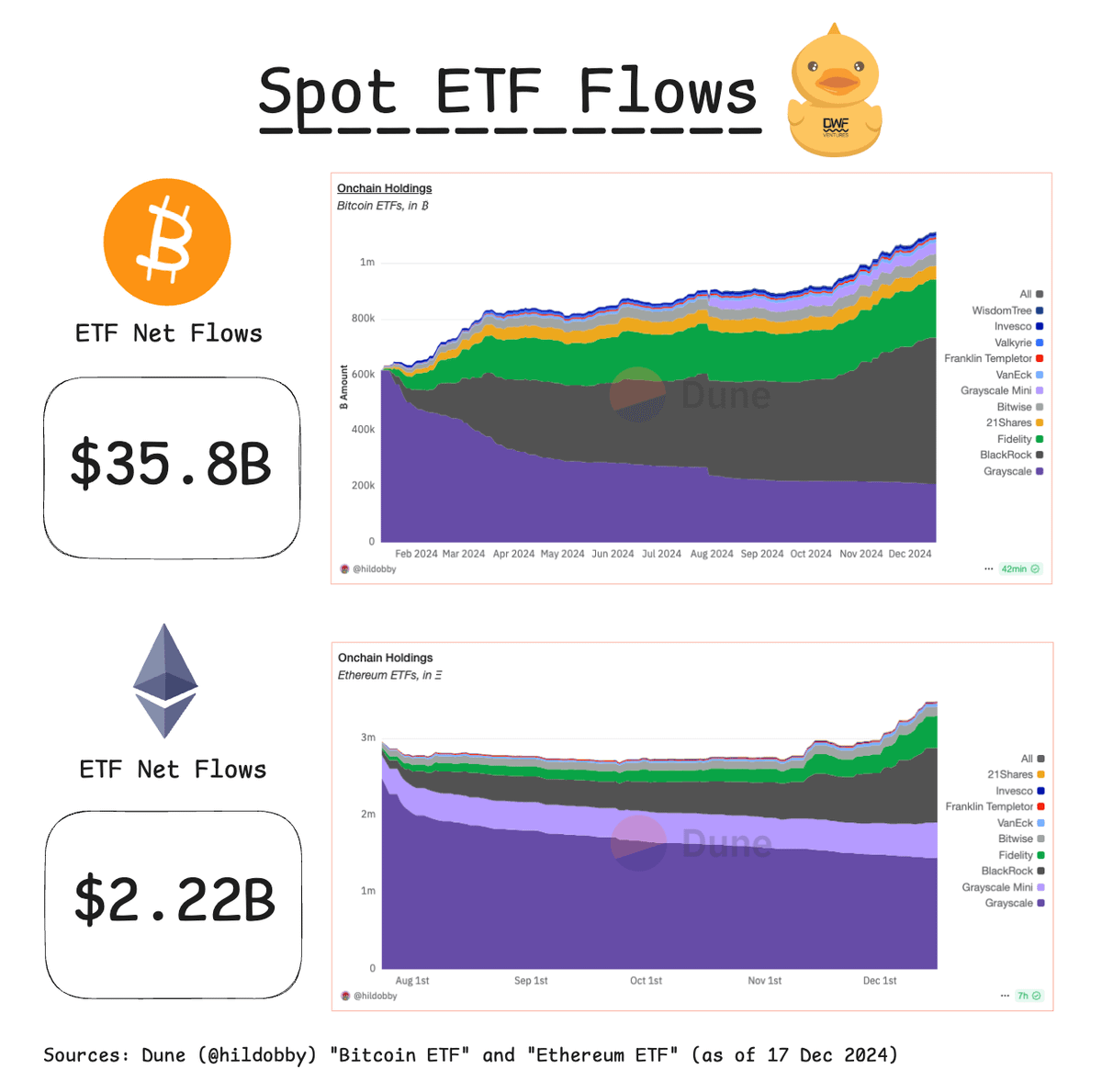

ETFs and Institutional Capital Inflows

One of the biggest market drivers in 2024 was the launch of Bitcoin ETFs in January and Ethereum ETFs in July. These financial products not only lowered the barrier to entry for investors into the crypto market but also reflected rapidly growing demand from traditional investors for crypto assets.

It's estimated that Bitcoin ETFs now hold a total of 1.1 million BTC on-chain—an increase of over 100% since the beginning of the year.

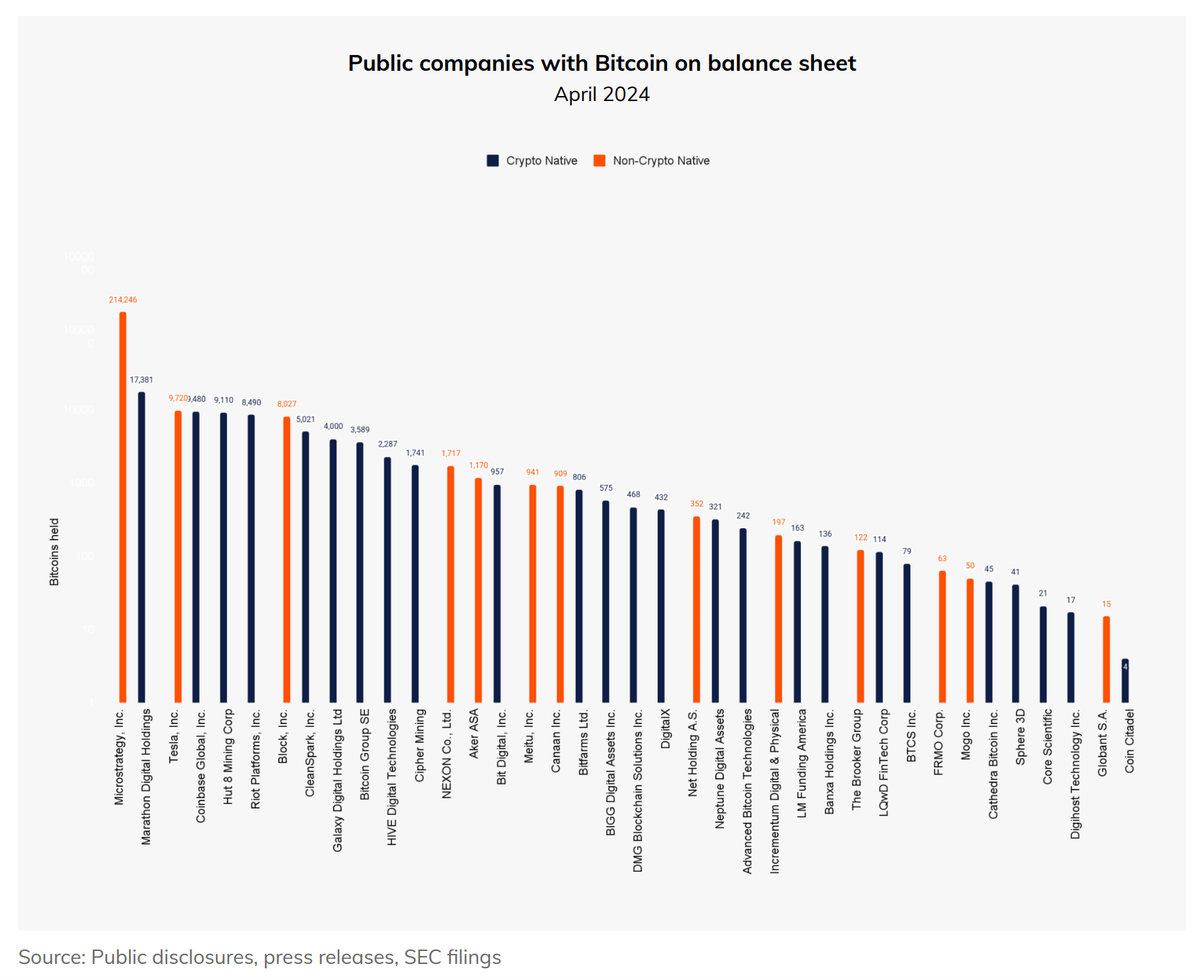

Not just crypto-native companies—many traditional enterprises have also been increasing their investments in Bitcoin and other crypto assets. For example, @MicroStrategy, led by Saylor, has continued accumulating Bitcoin and now holds 439,000 BTC.

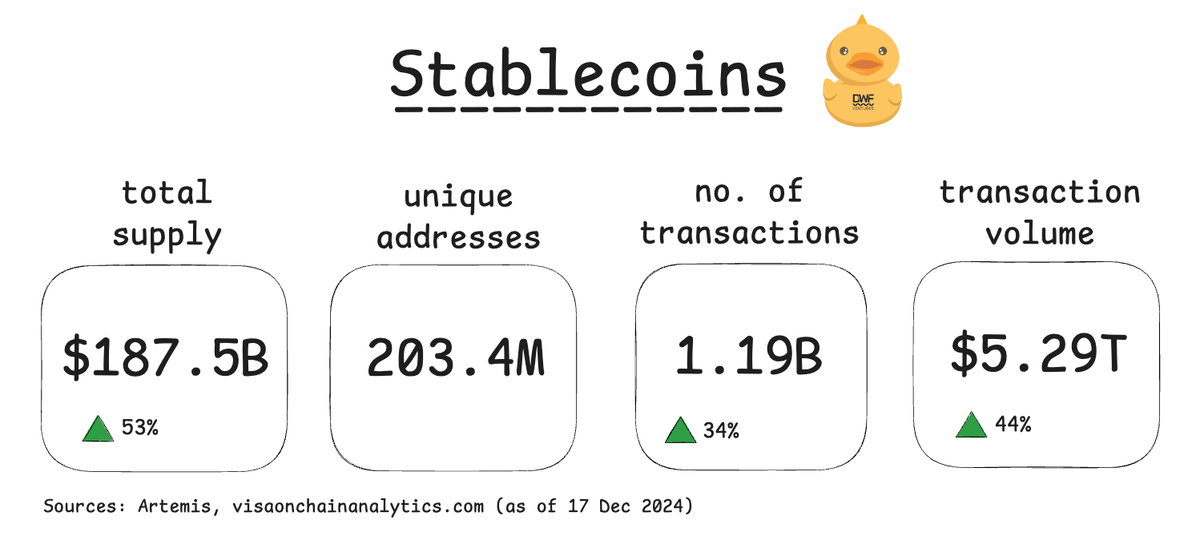

The Potential of Stablecoins

Stablecoins are core tools within the cryptocurrency ecosystem, enabling fast asset conversions and serving as key indicators of new capital inflows.

In 2024, the total supply of stablecoins reached $187.5 billion, setting a new record high. At the same time, stablecoin transaction counts and volumes increased by 30%-40% respectively.

Notably, even during periods of market volatility, stablecoin transaction volumes remained consistently high—suggesting significant real-world use cases beyond trading.

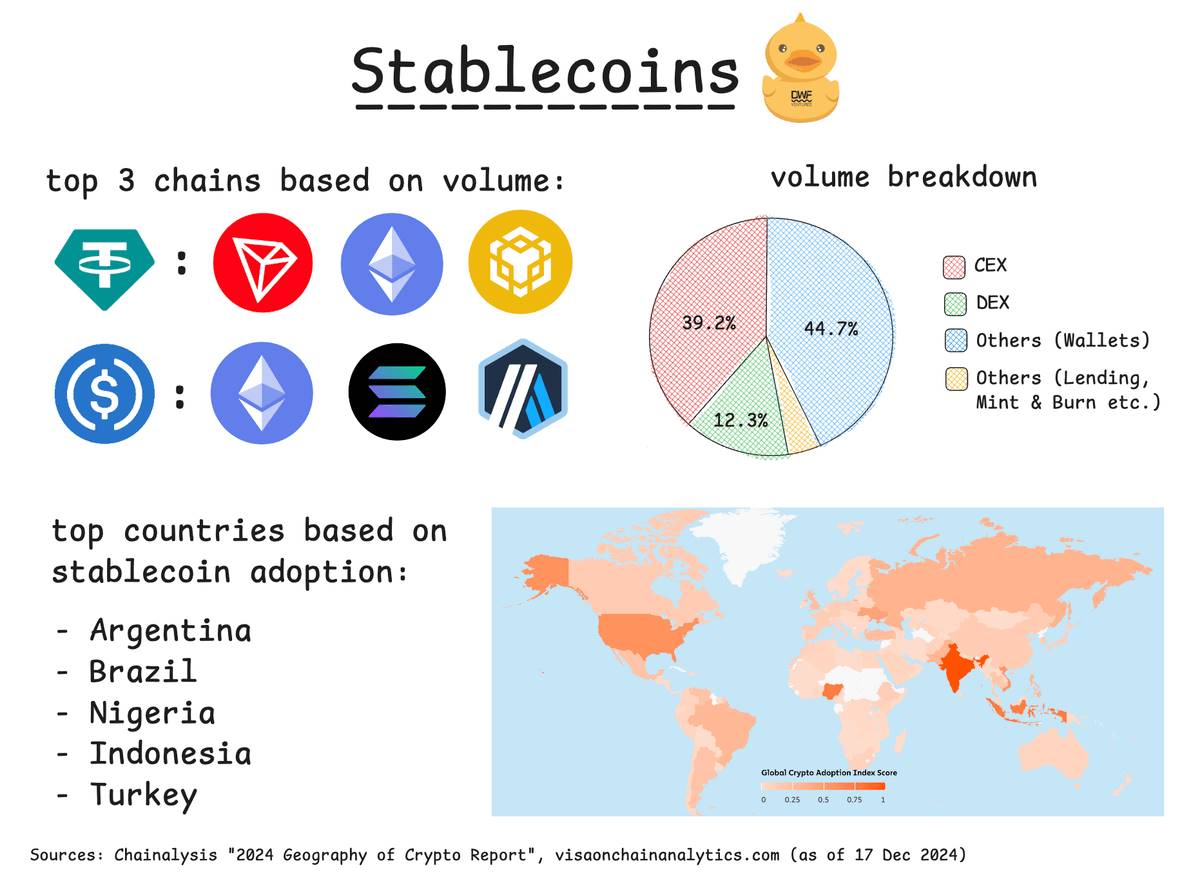

In terms of on-chain stablecoin transaction volume, @trondao, @ethereum, @BNBCHAIN, and @solana continue to dominate. Meanwhile, Layer-2 networks such as @arbitrum and @base are showing strong momentum in both USDC transaction volume and user growth.

Although centralized exchanges (CEX) still lead in trading activity compared to decentralized exchanges (DEX), this dynamic is beginning to shift.

New products like USDtb launched recently by @BlackRock and @ethena_labs provide secure and convenient pathways for traditional capital to enter DeFi. With the emergence of these regulated gateways, we may see more funds flowing into on-chain ecosystems in the future.

Rise of Stablecoin Markets in Latin America and Africa

Over the past year, stablecoin markets in Latin America and Africa have grown by 40%-50%. These regions have strong demand for trustless monetary hedging tools, fueling rapid expansion of stablecoin adoption.

Increasing resources are being directed toward these areas—for instance, educational initiatives launched by @Tether_to and @circle's plans to expand payment services across Latin America. As a result, we expect this sector to maintain robust growth momentum into 2025.

Trends in On-Chain Activity

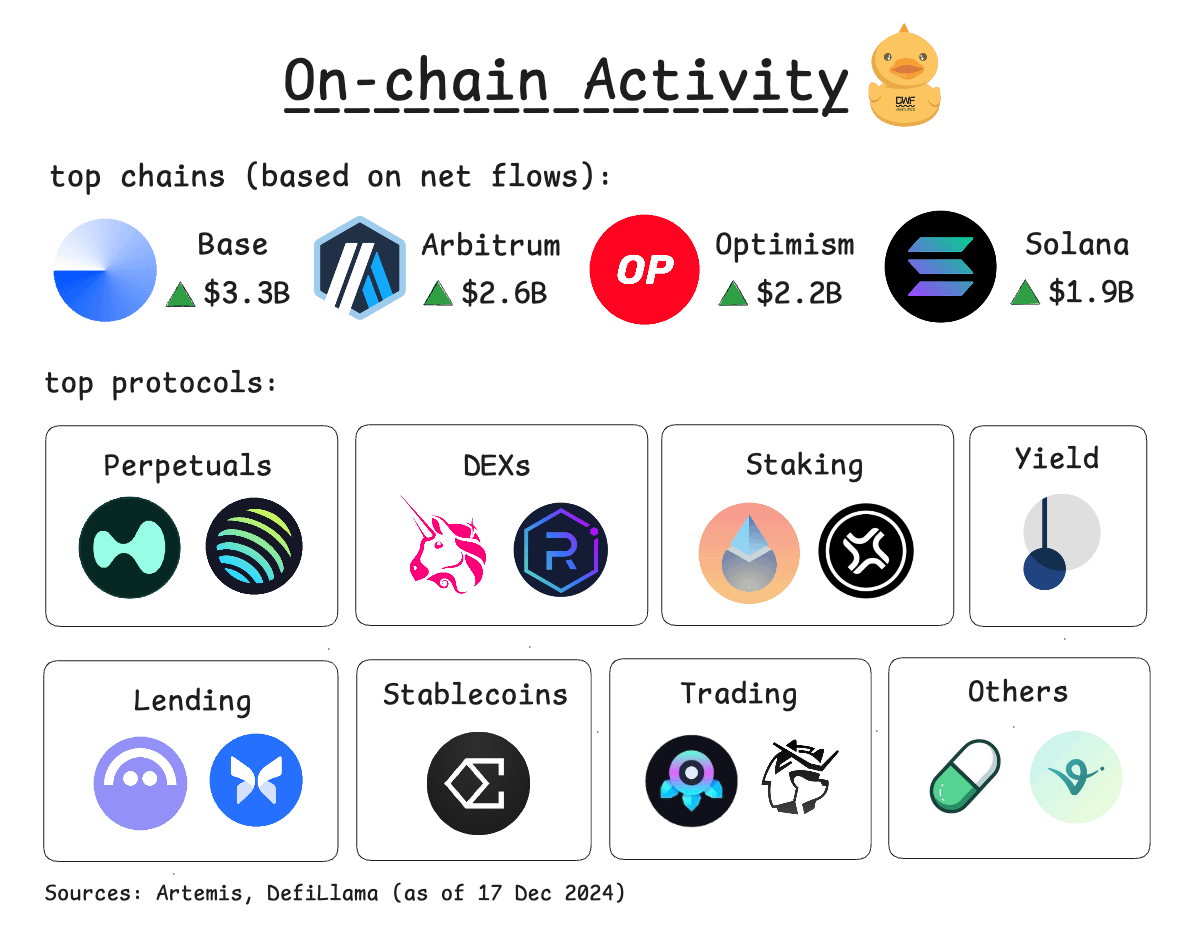

Layer-2 networks such as @base, @arbitrum, and @Optimism, along with non-EVM chains like @solana, saw notable net inflows this year. Users increasingly favor blockchain networks with lower fees and faster speeds, leading to greater user adoption on these platforms.

The fastest-growing sectors were perpetual contracts and decentralized exchanges (DEX). Trading volumes in these areas surged over 150%, while total value locked (TVL) doubled or tripled. The memecoin craze ignited by @pumpdotfun significantly boosted trading volume, with @RaydiumProtocol emerging as one of the main beneficiaries and helping drive growth across other ecosystems. This trend also led to widespread adoption of trading bots such as @tradewithPhoton and @bonkbot_io. These bots are not only heavily used but have become among the highest fee-generating protocols in the current crypto landscape.

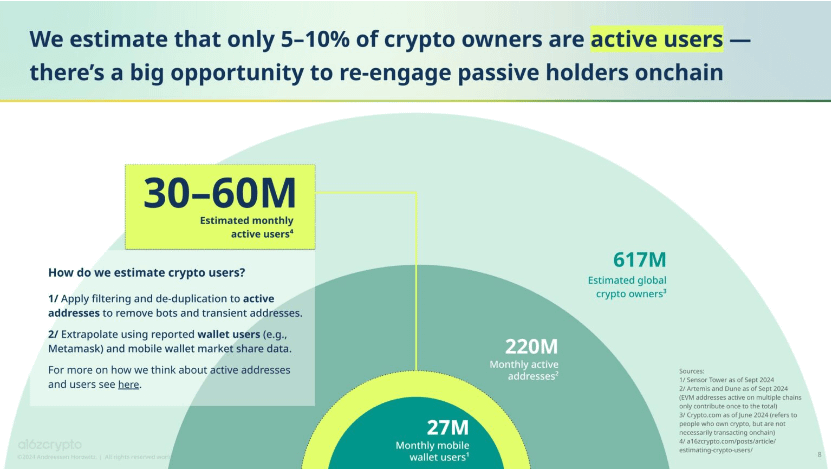

Nonetheless, on-chain activity still has enormous growth potential. Currently, only 5%-10% of cryptocurrency holders actively engage in on-chain operations, indicating a vast untapped user base.

Mobile-friendly interfaces, such as TON’s mini apps, have already achieved remarkable success in user acquisition. For example, @ton_blockchain's mini apps have successfully attracted over 50 million users. Therefore, future protocol development will increasingly depend on optimizing user experience (UX) and improving user retention mechanisms.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News