2024 On-Chain User Report: Monthly New Users Peak at 19.4 Million, Base Chain Contributes Nearly 70% of Growth

TechFlow Selected TechFlow Selected

2024 On-Chain User Report: Monthly New Users Peak at 19.4 Million, Base Chain Contributes Nearly 70% of Growth

Most blockchains are still in the early stages of converting ordinary users into high-value contributors.

Author: flipside

Translation: TechFlow

1. Introduction

Trends in On-Chain Users Heading into 2025

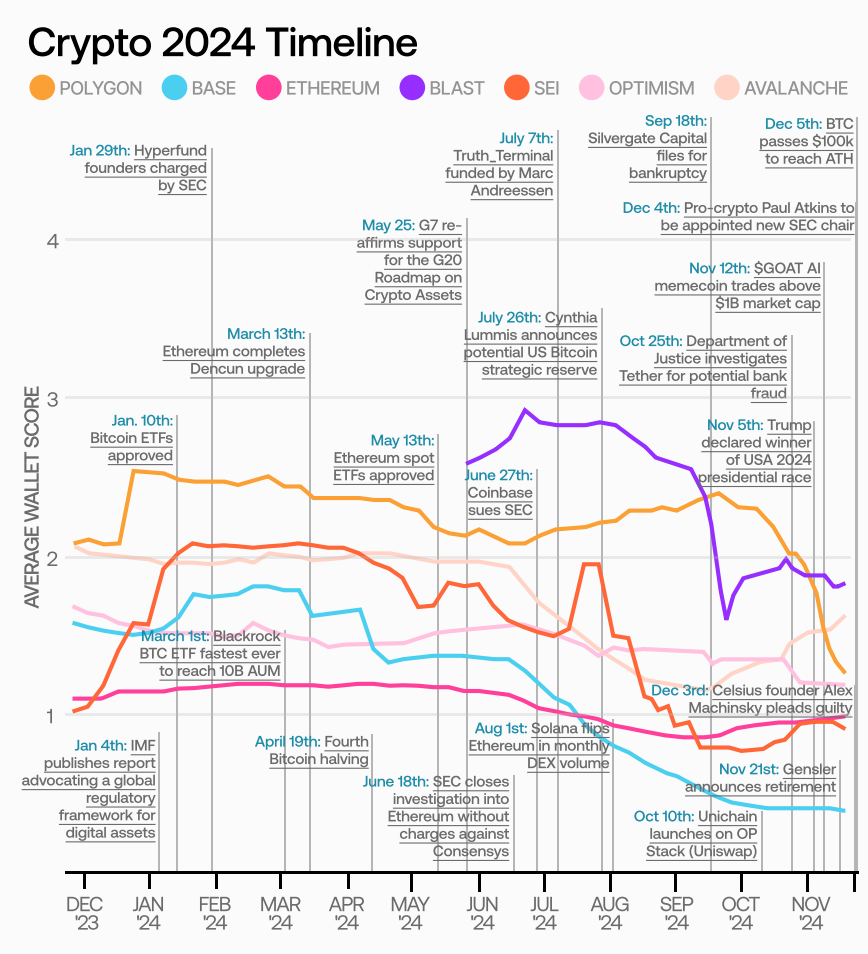

2024 marked a turning point for Web3 user growth, with record-breaking numbers of new and super users across major blockchains. Chains like Base redefined what exponential growth looks like, while Ethereum and its L2 solutions demonstrated how deeply entrenched ecosystems adapt to evolving user demands.

However, deeper analysis of the data reveals that not all growth is equally valuable—highlighting the importance of assessing on-chain activity by quality, not just quantity.

To address this, this report leverages Flipside's real-time 2024 on-chain crypto user data, introducing more actionable, multi-variable metrics beyond traditional performance indicators to evaluate crypto activity this year and offering a new framework for assessing on-chain user health in 2025.

Key Takeaways

-

Beneath the headlines of user growth lies a deeper challenge: building ecosystems that foster meaningful, lasting engagement—not just short-term speculation.

-

In short, most blockchains are still in early stages when it comes to converting casual users into high-value contributors.

New User Acquisition:

-

Base: Set a record in October 2024 with 19.4 million newly acquired users, contributing 13.7 million—nearly eight times more than second-place Polygon.

-

BTC: Despite BTC price reaching an all-time high above $100,000, monthly new user acquisition averaged only 935,900, indicating prevalent speculative activity among existing users rather than significant new user inflow.

-

ETH: Averaged 1.56 million new users per month, surpassing Arbitrum and Optimism, with a 33.4% month-over-month growth in March. Notably, Arbitrum reached a standout peak of 3.3 million new users in May.

Super Users:

-

Base: Attracted 15.1 million wallets executing 100+ DeFi transactions—38.4% more than Ethereum’s 10.7 million super users, the next closest chain.

-

ETH: With 10.9 million DeFi-related super users, Ethereum surpassed the combined total of Arbitrum (6.2 million) and Optimism (1.8 million), underscoring its advantages in liquidity and accessibility.

-

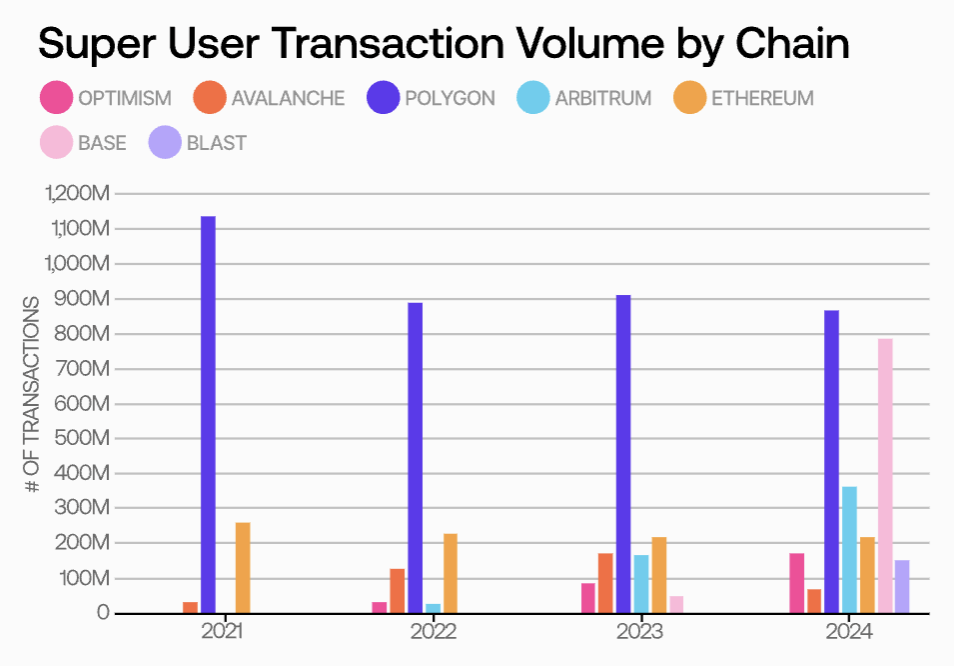

Polygon: Added 1.5 million new super users in 2024 and recorded 867.7 million super user transactions this year, highlighting success beyond DeFi applications.

DEX Usage:

-

Uniswap: Expanded dominance across major blockchains, capturing 91.3% of new user DEX activity on Base and increasing its market share on Ethereum by 27.72% compared to 2023.

-

Despite Uniswap’s gains, Trader Joe maintained leadership on Avalanche with a 61.1% market share—an increase of 6.1% from 2023.

-

Unlike in 2023, the top three DEXs for both new and super users are now aligned across all observed chains in 2024.

2. New User Acquisition

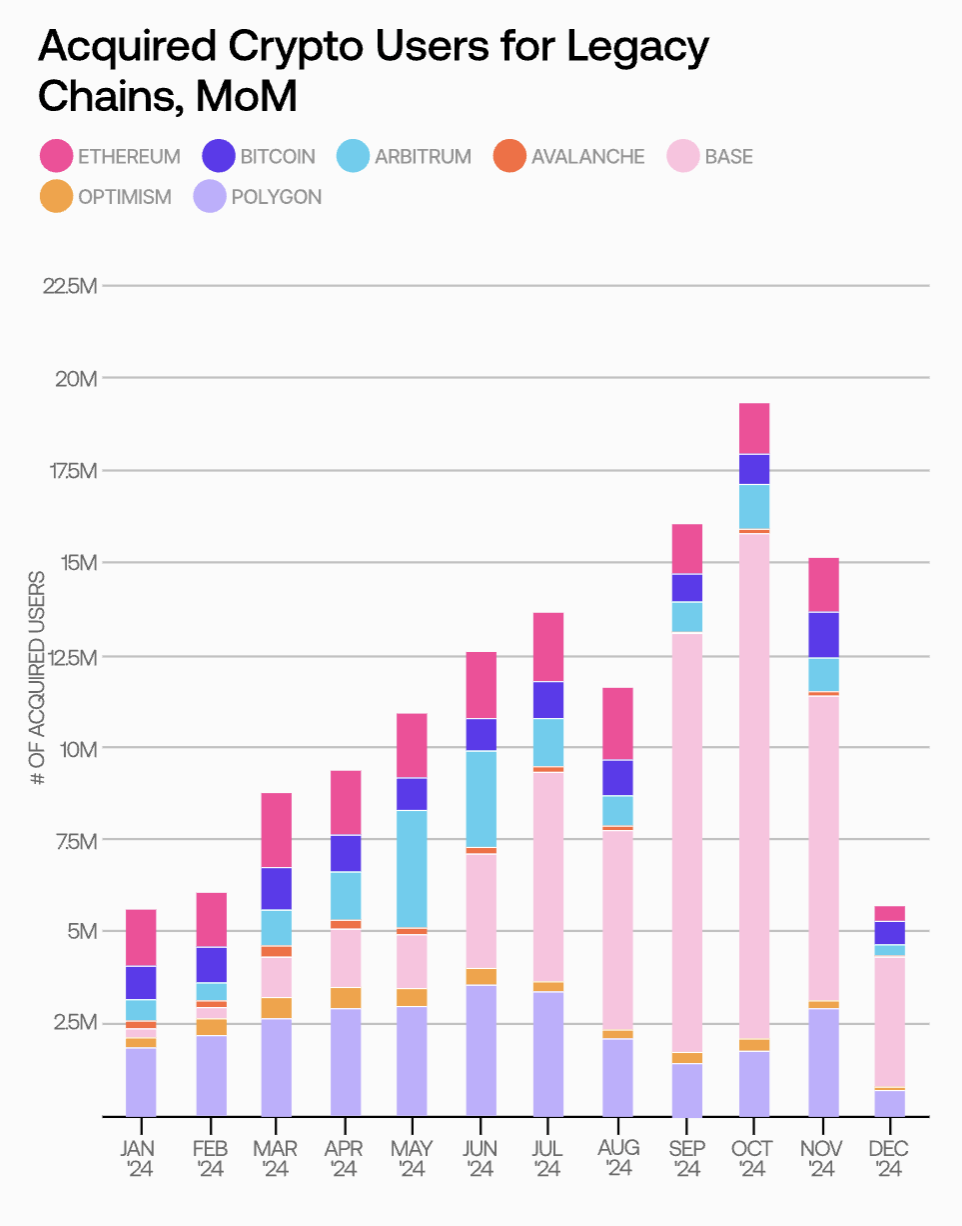

New user acquisition peaked at 19.4 million in October 2024.

On-chain user growth was led by Base, which contributed 13.7 million new users that month—nearly eight times more than second-place Polygon. Overall, it has been an impressive year for the industry. New user counts showed a sustained upward trend throughout 2024, with only a minor pullback in August.

Note: "Newly Acquired Users" are defined as users who conducted at least two transactions on a given chain, with the second transaction occurring in 2024.

This consistent growth may have been influenced by rising institutional adoption of crypto, reflected in the approval of a series of BTC and ETH ETFs earlier this year.

Other exciting developments in the first half of 2024 may also have boosted optimism, such as Grayscale adding several new cryptocurrencies to its “under consideration” list, and the Federal Open Market Committee (FOMC) cutting U.S. interest rates by 50 basis points in September 2024—the first rate cut in four years.

Base’s Remarkable Growth

Base started slowly in 2024 but saw a 56-fold surge in monthly new user acquisition since January.

With only 244,700 new users in January, Base experienced steady and significant growth throughout the year. By November, its monthly new user count had increased 56-fold compared to January, averaging 4.7 million new users per month in 2024.

The chain greatly benefited from Coinbase’s massive user base, collectively managing around $130 billion in assets. Popular DeFi protocols like Aerodrome may have drawn users from other EVM chains, while Base successfully drove user interest through trending areas such as memecoin trading and on-chain AI (e.g., initiatives like Based Agents).

Bitcoin Performance

Despite hitting all-time highs in BTC price, Bitcoin did not attract large numbers of new users in 2024.

Bitcoin’s new user acquisition remained relatively flat throughout the year, despite significant appreciation in BTC value. Overall, Bitcoin averaged 935,900 new users per month in 2024, ranking third-lowest among the seven legacy blockchains analyzed in this report.

This suggests that the rise in BTC price was primarily driven by enthusiasm and speculation among existing users, with limited effectiveness in attracting new entrants.

In March 2024, BTC’s first major price spike coincided with a 19.2% month-over-month increase in new user acquisition. However, in November—during sustained price increases as BTC hit the long-awaited $100,000 milestone—new user acquisition actually declined by 28.5% month-over-month.

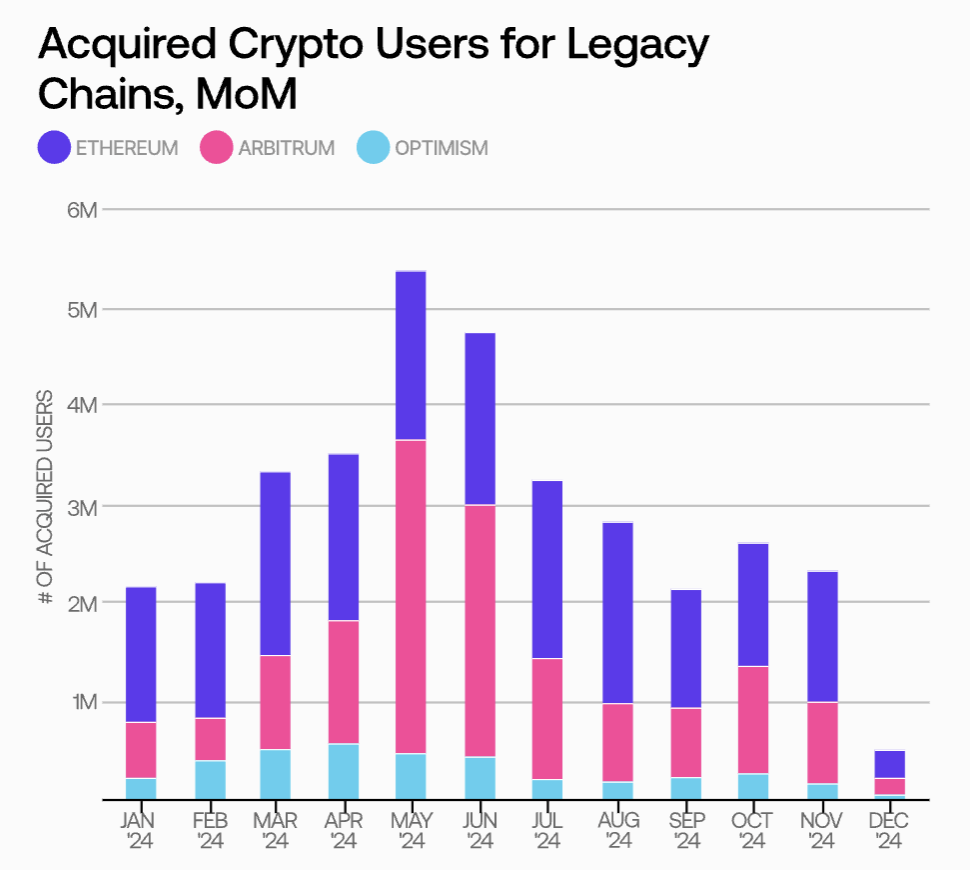

Ethereum and L2 Performance

Ethereum outpaced its traditional L2s in overall user acquisition, though Arbitrum saw impressive single-month spikes.

Ethereum surpassed its two leading L2 chains in 2024, averaging 1.56 million new users per month, compared to 1.2 million for Arbitrum and 348,800 for Optimism. Excluding December, Ethereum saw MoM declines in only four months and reached a monthly peak of 1.9 million new users in March—a 33.4% increase.

Both Arbitrum and Optimism started the year strong, reaching their 2024 peaks in user growth in April and May respectively, followed by a decline in growth for the remainder of the year.

Notably, Arbitrum’s 3.3 million new users in May exceeded any single-month peak achieved by Ethereum in 2024. In this context, Arbitrum’s user acquisition consistently outperformed Optimism throughout the year, driven by the success of its Arbitrum One initiative and expanding integrations in GameFi and SocialFi. After approving 169 builder grants in the first half of 2024, along with numerous behind-the-scenes developments, whether the chain can reclaim its position as the leading EVM L2 remains to be seen.

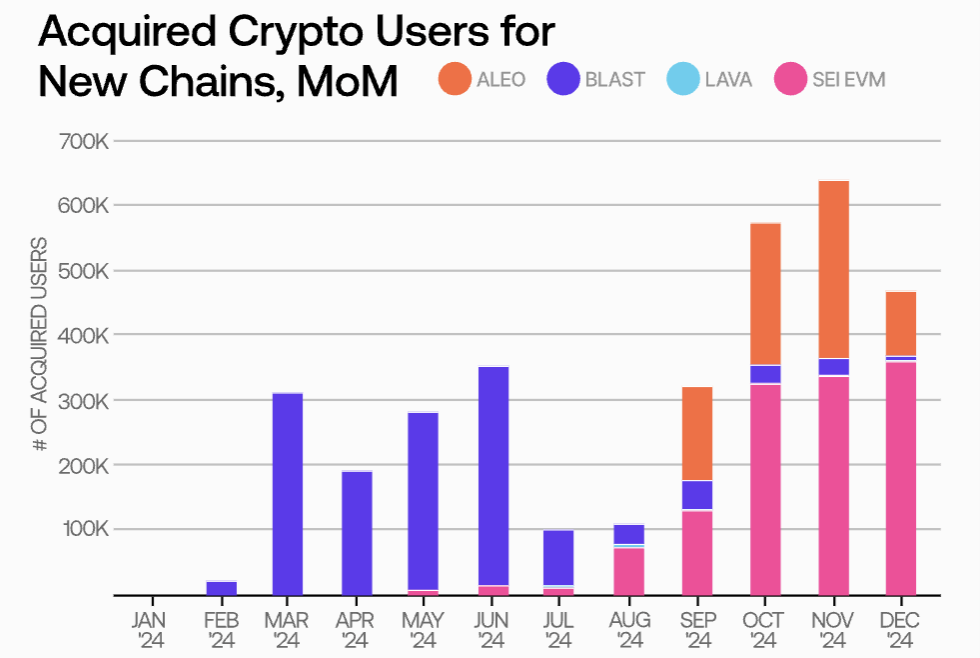

Performance of New Blockchains in 2024

Among blockchains launched in 2024, Aleo achieved the highest average new user growth, while Blast set a monthly record before gradually tapering off.

In terms of newly launched chains, Aleo saw the highest new user growth in its launch month, averaging 175,200 users per month, compared to 134,900 for Blast and 90,700 for Sei. This can be attributed to a sharp decline in Blast’s user acquisition starting in July, and Sei’s slow start—despite launching its mainnet months earlier, it didn’t reach a monthly peak of 324,500 users until October.

It remains unclear whether these chains will regain momentum in 2025—especially considering Base also experienced a similar post-launch cooling period before its 2024 surge. Among the four new chains tracked, Lava has so far been overshadowed by competitors, while Blast, despite setting the highest monthly new user growth for a newly launched chain in June, still has much ground to cover.

3. Super Users

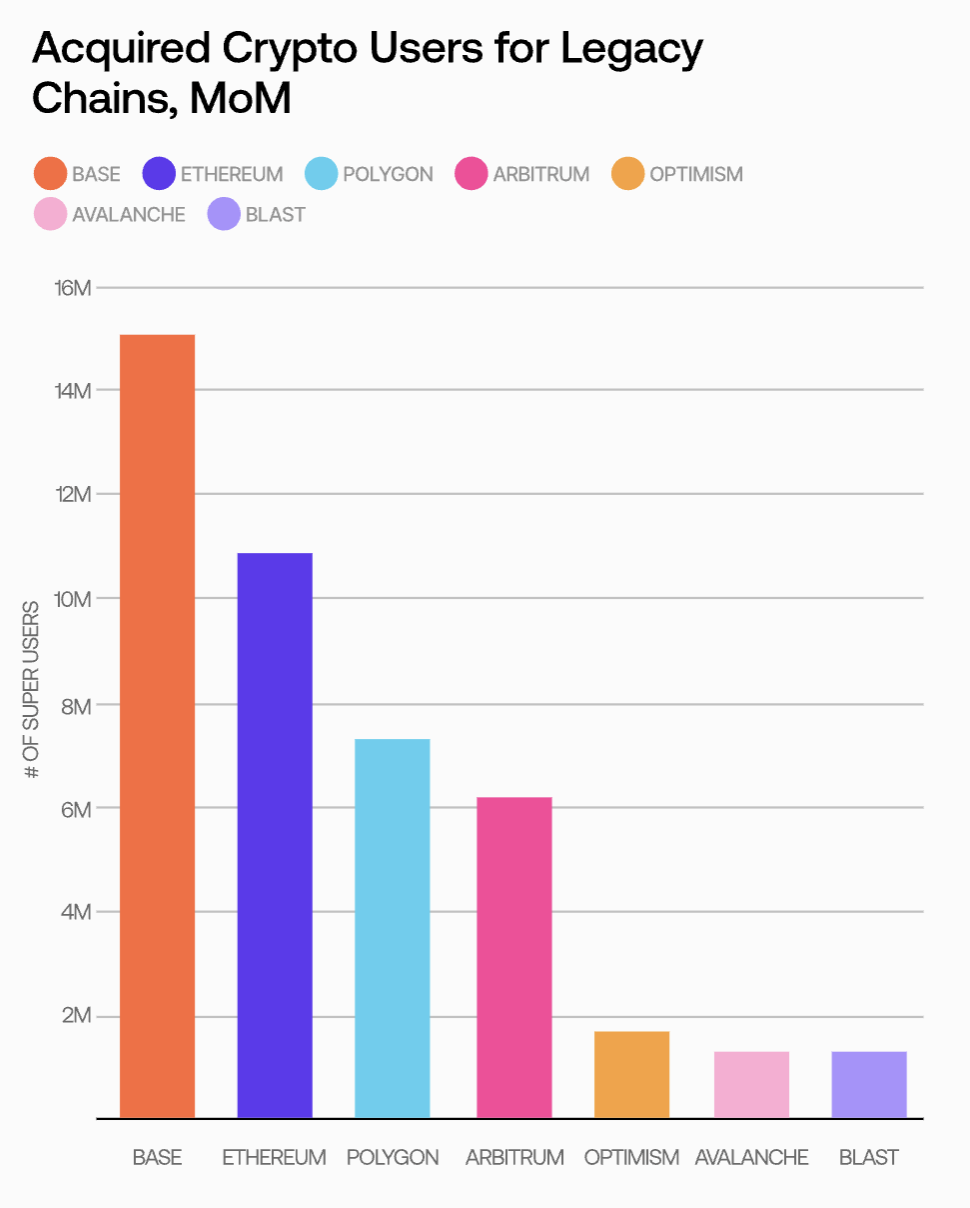

As of December 2024, Base had the largest number of DeFi-related super users, with 15.1 million wallets executing 100 or more transactions.

In addition to acquiring the most new users, Base attracted the highest number of DeFi-related super users—38.4% more than second-place Ethereum, which had 10.7 million. Ethereum was followed by Polygon with 7 million.

Note: "Super Users" are defined as users who executed at least 100 transactions on a given chain, regardless of wallet creation date or last transaction time.

Given Base’s explosive growth this year, its impressive super user numbers may not come as a surprise. This success likely stems from Base outperforming many legacy chains in multiple trending areas in 2024, including memecoin and NFT trading.

On the other end, Avalanche and Blast had similar super user counts this year, averaging around 1.3 million each, while Optimism performed slightly better with 1.7 million wallets completing at least 100 DeFi transactions.

Polygon’s Standout Performance

Polygon added the most new super users in 2024 and continued to excel in non-DeFi super user activity.

-

Polygon attracted 1.5 million new super users in 2024—nearly double that of second-place Base.

-

Polygon also led all observed chains in super user activity, averaging 867.7 million super user transactions per month this year. Aside from Base’s impressive 786.3 million super user transactions, Arbitrum also performed strongly with 365.3 million super user transactions in 2024.

Polygon’s strong performance continues its long-standing leadership in super user activity since 2021. That year, Polygon recorded 1.14 billion transactions—the highest level of super user activity ever recorded across all blockchains—and it still holds that record today.

However, despite having the highest volume of super user activity among all blockchains, Polygon ranks only third in the number of DeFi-related super user wallets. This indicates that Polygon successfully attracted a large number of high-frequency traders through GameFi and other use cases, not just DeFi applications.

Ethereum’s DeFi super users outnumber those of Arbitrum and Optimism combined.

By 2024, Ethereum had reached 10.9 million DeFi super users—second only to Base. This figure far exceeds the combined total of Arbitrum (6.2 million) and Optimism (1.8 million).

Although EVM L2s typically offer faster speeds and lower transaction costs, many users may still find cross-chain bridging too complex or risky, or simply prefer Ethereum’s mainnet due to its deeper liquidity and more established market position.

Nevertheless, Ethereum’s layer-2 networks need to further explore ways to attract users beyond relying solely on performance advantages over Ethereum’s mainnet to drive on-chain activity.

4. DEX Users

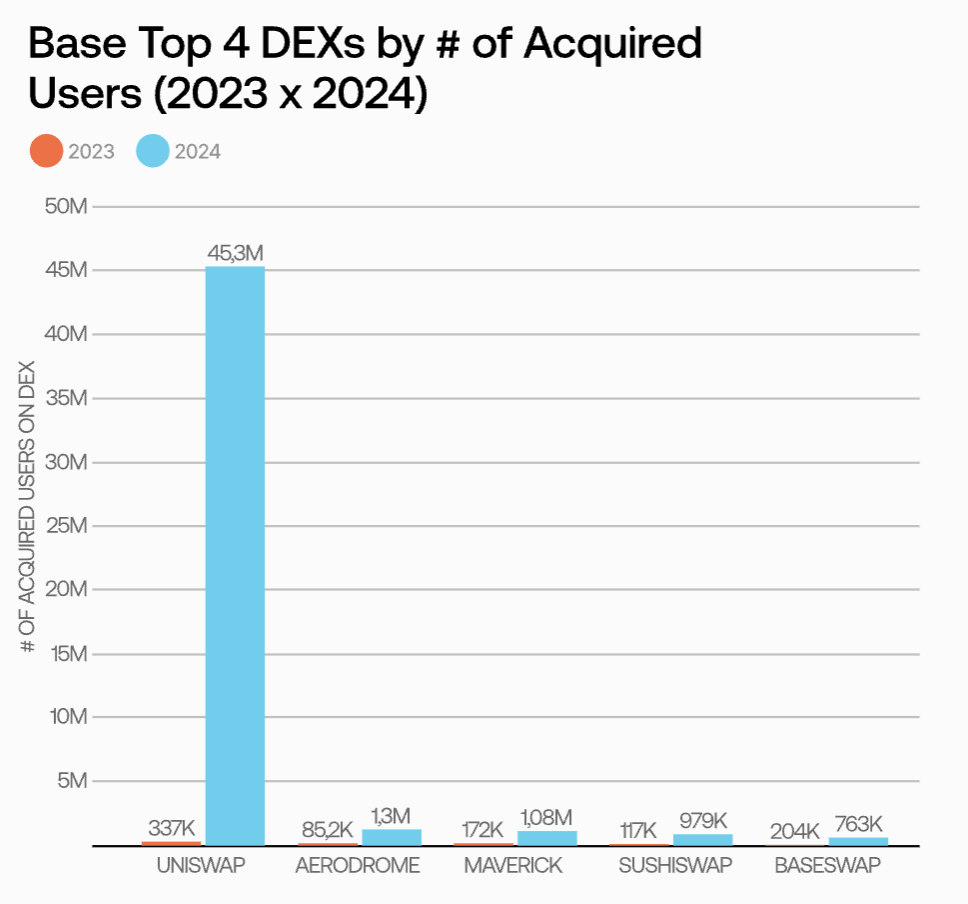

Uniswap continues to expand its market share across major blockchains, further cementing its position as the leader in decentralized exchanges (DEXs).

Across all observed chains, Uniswap remains the undisputed leader, except on Avalanche and Blast. On Base, Uniswap’s user share surged from 36.8% to 91.3%. Given the exponential growth of Base’s user base this year, this achievement is particularly notable.

Similarly, Uniswap improved its performance on other major chains. Compared to 2023, its share of DEX activity increased by 27.72% on Ethereum and 12.57% on Polygon. It’s worth noting that DEX activity on Polygon has historically been more fragmented, reflecting a more diverse range of trading behaviors among its user base compared to other leading chains.

Even without factoring in protocol upgrades, this phenomenon may reflect a “winner-takes-all” trend in DeFi, where larger platforms capture greater market share due to deep liquidity and brand recognition.

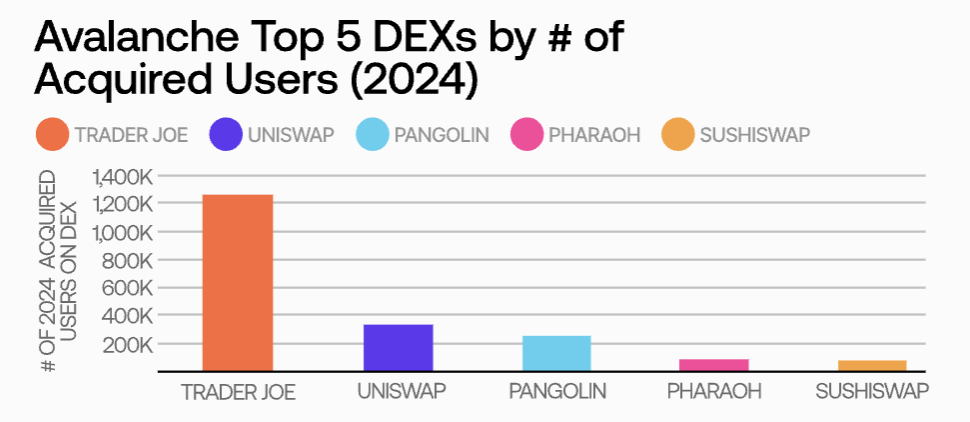

On Avalanche, Trader Joe further solidified its leadership, while Uniswap also rose in rank.

Uniswap is now the second most popular DEX on Avalanche, whereas in 2023 it didn’t even make the top five. However, Trader Joe remains the most popular DEX on Avalanche, holding 61.1% market share—an increase of about 6% since 2023.

As the first native-built major DEX on Avalanche, Trader Joe has consistently worked to maintain and expand its market lead. The launch of its Auto-Pools feature in April made it easier for liquidity providers (LPs) to automatically rebalance positions and compound yields. Additionally, the platform supports liquid staking for various Avalanche assets and has expanded to new chains like Arbitrum and BNB Chain, validating the feasibility of its unique Liquidity Book (LB) model.

The results show that Trader Joe’s efforts provide a replicable success case for other platforms aiming to establish themselves in a competitive DEX landscape.

Preferences among super users and new users are converging, but super users’ trading activity remains more diversified.

Unlike in 2023, the top three DEXs used by both super users and new users are now identical across every observed chain. This suggests that new users are becoming more adept at mimicking the behavior of experienced traders—or that leading DEXs have found more effective ways to optimize trading paths.

Nonetheless, super users still distribute their trading activity across a broader set of DEXs. Compared to new users, they are more familiar with a wider range of DeFi protocols and are willing to explore opportunities beyond mainstream platforms like Uniswap in pursuit of higher yields or unique trading conditions.

Looking Ahead: Opportunities and Challenges for Web3 in 2025

On-chain data shows continued growth in Web3 user numbers in 2024, while both legacy blockchains and emerging competitors face challenges in differentiating themselves and offering compelling use cases for new and existing users. Moreover, rising prices of native tokens have not significantly driven diversified on-chain activity, and emerging DeFi protocols continue to face strong resistance when challenging established giants.

Here are key trends shaping 2025:

-

Base Sets the Benchmark for Ecosystem Expansion

In 2024, Base emerged as a model for attracting and retaining new users through explosive growth, providing a blueprint for other aspiring blockchains. Base’s success in memecoin trading and on-chain AI applications suggests that innovation around trending use cases will continue to drive user growth in 2025. However, translating this high-frequency trading activity into more sustained and diverse user engagement remains a critical challenge.

-

Ethereum’s User Growth Opens New Opportunities for L2s

Despite the performance advantages of Ethereum’s layer-2s (L2s), Ethereum itself remains central to the Web3 economy due to its massive user base and liquidity. L2 chains like Optimism may refine their strategies to attract Ethereum’s growing base of casual users and onboard them into their own ecosystems.

-

Differentiation or Economies of Scale Will Determine Success

Uniswap’s growing market dominance signals a “winner-takes-all” trend in DeFi. Yet chains like Avalanche and Polygon demonstrate that targeted innovation can secure strong positions in specific markets. For example, Trader Joe’s Auto-Pools simplify operations for LPs, while Polygon’s GameFi projects attract large numbers of gamers. Looking ahead to 2025, protocols that deliver differentiated on-chain services beyond traditional DeFi functions will be better positioned to capture attention and market share.

-

Shift from User Quantity to User Quality

As new users flood in, ecosystem builders must find ways to incentivize broader participation—such as governance voting and staking—beyond mere trading. With wallet counts growing rapidly, chains that prioritize user quality and diverse engagement will gain long-term advantages in ecosystem health and sustainability.

5. Data-Driven Insights into User Quality

What Are Flipside Scores?

As we approach 2025, the Web3 industry faces a critical challenge: distinguishing between short-term activity spikes and truly sustainable growth. While the surge in new users and transaction volume in 2024 brought optimism, the key question remains: will these users stay, and contribute meaningfully to the long-term development of blockchain ecosystems? Flipside Scores were designed to answer exactly that.

Flipside Scores quantify the quality of on-chain user activity by integrating 15 performance metrics across five categories. Unlike simple volume-based metrics, this method offers a comprehensive view of the breadth and depth of user engagement, revealing which ecosystems are thriving and where improvements are needed.

User Quality Trends Across Chains

Overall, user quality declined across chains in 2024 amid surges in wallet counts and on-chain transaction volumes. This reflects an influx of new users with currently low engagement levels—but who may gradually explore the diverse use cases Web3 offers in the future.

Key findings include:

-

Base: A textbook case of successful user acquisition in 2024. While its user quality score is low, this does not indicate poor overall performance. Rather, it suggests that its large cohort of new users is currently focused on limited on-chain activities. With proper guidance toward more diverse ecosystem participation, Base has substantial room for improvement.

-

ETH: Saw a notable drop in user quality ahead of multiple SEC-approved ETH ETF launches. This suggests that while institutional inflows can rapidly grow wallet counts, without sufficient incentives and accessible participation mechanisms (e.g., protocol governance), the depth of on-chain activity may remain shallow.

-

Blast: Successfully engaged users in diverse on-chain activities during its early phase, showcasing strong capabilities in gamified incentives. Although user growth slowed in Q4 2024, remaining users stayed active across multiple domains—indicating potential for long-term sustainability beyond initial hype.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News