Market panic intensifies, focus shifts to DeFi and AI Agent sectors

TechFlow Selected TechFlow Selected

Market panic intensifies, focus shifts to DeFi and AI Agent sectors

With the Christmas holiday approaching, market liquidity is expected to decline, and investors are advised to adopt a defensive allocation strategy.

Author: Frontier Lab

Market Overview

Key Market Trends

Overall Market Summary

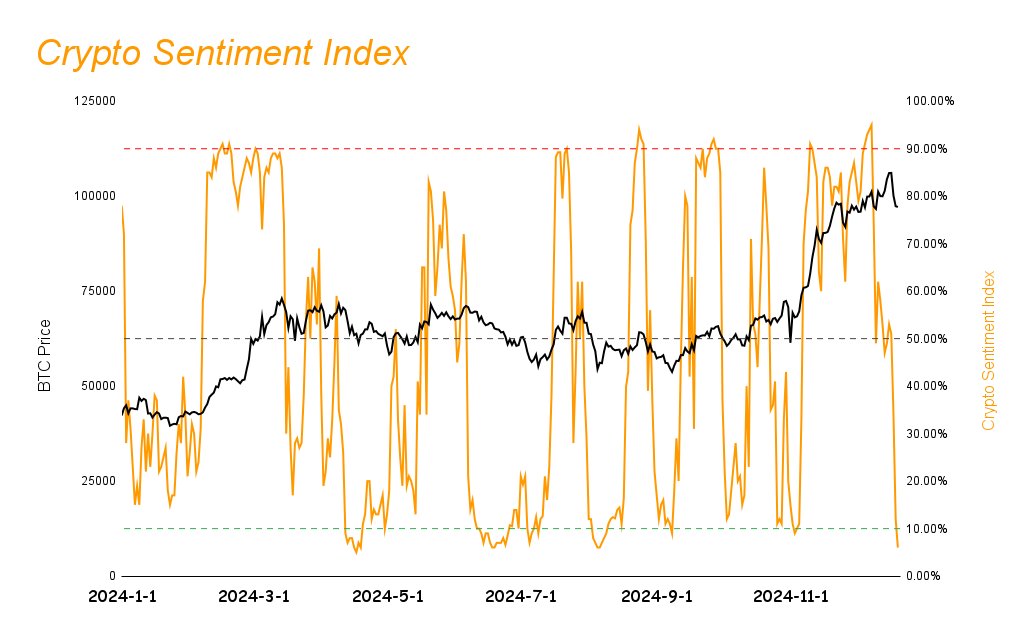

The market is currently in a state of extreme panic, with the sentiment index plunging from 53% to 7%. Combined with the Federal Reserve's hawkish stance (interest rate cut expectations reduced from four to two cuts), this triggered approximately $1 billion in forced liquidations, indicating a significant deleveraging process underway.

DeFi Ecosystem Development

The DeFi sector experienced its first negative TVL growth (-2.21%) in nearly two months. However, stablecoin market capitalization continues to grow (USDT +0.55%, USDC +1.44%), suggesting that despite market corrections, fundamental liquidity continues to flow in. Stable-yield strategies such as yield aggregators are gaining popularity.

AI Agent

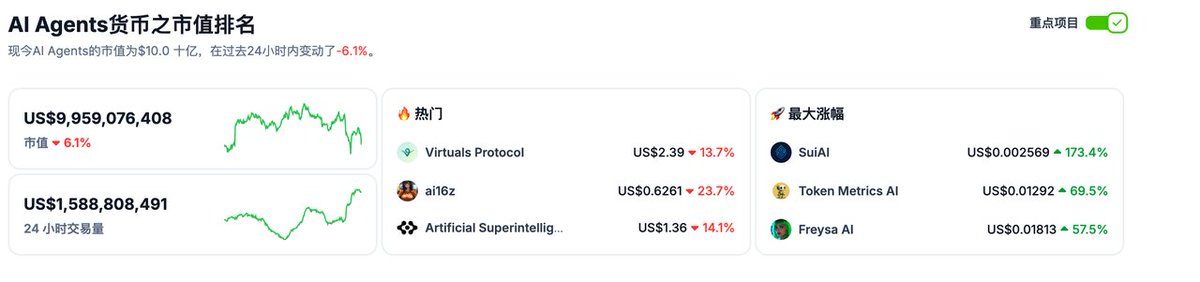

The AI Agent sector has reached a market size of $9.9 billion. Investment focus is shifting from speculative AI meme coins to infrastructure development, reflecting a maturing market with more rational and practical project directions.

Meme Coin Trends

Meme coin market热度 has significantly cooled, with capital large-scale exiting, indicating reduced speculative sentiment. Investors are increasingly favoring projects with real utility, potentially marking the end of the meme coin boom phase.

Public Chain Performance Analysis

During periods of high market volatility, public chains have demonstrated strong resilience and become investors' preferred safe-haven assets, reflecting continued confidence in foundational infrastructure.

Future Market Outlook

Approaching the Christmas holiday, market liquidity is expected to decline. Investors are advised to adopt a defensive portfolio strategy—focusing on BTC and ETH—while considering exposure to DeFi stable-yield and AI infrastructure projects. Caution is warranted due to potential increased volatility during the holiday period.

Market Sentiment Index Analysis

-

The market sentiment index dropped sharply from 53% last week to 7%, now in the "extreme fear" zone.

-

Altcoins underperformed the benchmark index this week, experiencing significant declines. Leveraged positions led to over $1 billion in forced liquidations, resulting in substantial de-leveraging among long holders. Given the current market structure, altcoins are likely to remain correlated with major indices in the short term, with low probability of independent rallies.

-

Historically, altcoin markets in extreme fear conditions often precede bullish reversals.

General Market Trend Summary

-

The cryptocurrency market declined this week, with sentiment entering extreme fear territory.

-

DeFi-related crypto projects performed strongly, reflecting sustained investor interest in enhancing base yields.

-

AI Agent projects generated high discussion volume this week, signaling growing investor interest in identifying the next breakout sector.

-

Meme coin projects broadly declined, with capital exiting the space, reflecting diminishing enthusiasm for meme-based speculation.

Hot Sectors

AI Agent

Despite the broader market downtrend and price declines across most AI Agent tokens, this sector dominated social discourse this week. Previously, attention centered on AI Agent-themed meme coins, but is now gradually shifting toward infrastructure development.

In this cycle, traditional VC-backed projects have struggled to gain traction, while meme coins fail to deliver sustainable growth. The AI Agent sector stands out as a promising candidate to lead the next market phase—not only because it includes AI memes, but also encompasses AI DePIN, AI platforms, AI rollups, AI infra, and other sub-sectors. Fundamentally, blockchain projects are expressions of smart contracts, and AI Agents are designed to enhance them. Thus, AI Agents and crypto represent a natural synergy.

Top 5 AI Agent Projects by Market Cap:

DeFi Sector

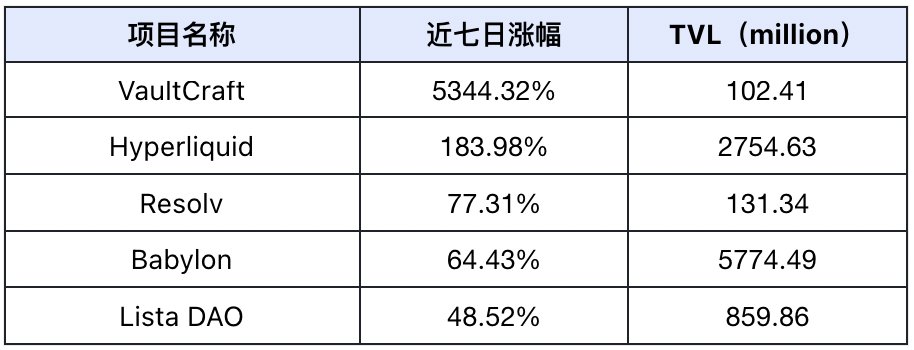

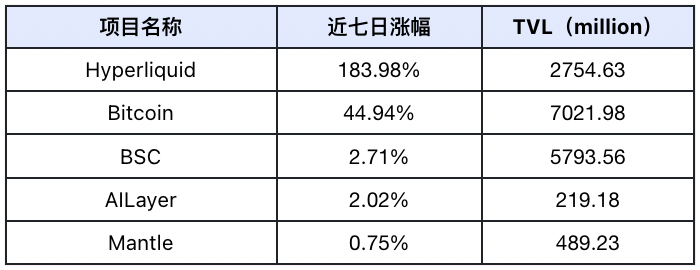

TVL Growth Ranking

Top 5 projects by TVL growth over the past week (excluding small projects with less than $30 million TVL). Data source: DefiLlama

VaultCraft (VCX): (Recommendation Rating: ⭐️⭐️)

-

Project Overview: VaultCraft is a blockchain project built on Algorand aimed at reducing participant costs in storage and network bootstrapping. It leverages Algorand’s Proof-of-Stake consensus mechanism.

-

Latest Developments: This week, VaultCraft launched a stETH 4X leveraged looper based on Lido Finance, supporting multi-chain deployment across Base, Arbitrum, Optimism, and Ethereum. Through Chainlink CCIP, it enables direct staking from L2s to mainnet, offering users over 7% APY. The project partnered with Matrixport and secured a 1,000 BTC custody deal, driving rapid TVL growth. Strategic collaborations were also established with Safe and CoWSwap.

Hyperliquid (HYPE): (Recommendation Rating: ⭐️⭐️⭐️⭐️⭐️)

-

Project Overview: Hyperliquid is a high-performance decentralized finance platform specializing in perpetual futures and spot trading. Built on its own Layer 1 blockchain using the HyperBFT consensus algorithm, it supports up to 200,000 orders per second.

-

Latest Developments: Amid intense market volatility—reaching new highs midweek before a sharp drop post-Fed meeting—the environment favored traders seeking high returns via derivatives. This attracted many on-chain users to Hyperliquid, pushing open interest beyond $4.3 billion. In response, the platform added leveraged trading (up to 5x) for trending pairs including VIRTUAL, USUAL, and PENGU, further boosting user engagement.

Resolv (No Token Yet): (Recommendation Rating: ⭐️⭐️)

-

Project Overview: Resolv is a delta-neutral stablecoin initiative focused on tokenizing market-neutral portfolios. Its architecture relies on economically viable, fiat-independent yield sources, enabling competitive returns for liquidity providers.

-

Latest Developments: This week, Resolv completed integration with Base, significantly lowering transaction costs and improving speed. It launched lending services for USR, USDC, and wstUSR via Euler Finance and introduced a USR-USDC liquidity pool on Aerodrome. The Spectra YT yield point system was adjusted to 15 points daily, optimizing reward distribution. The Grants Program was initiated with three confirmed recipients. Deepened partnerships with Base, Euler Finance, and Aerodrome strengthened its DeFi competitiveness.

Babylon (No Token Yet): (Recommendation Rating: ⭐️⭐️⭐️⭐️⭐️)

-

Project Overview: Babylon aims to leverage Bitcoin’s security to enhance PoS blockchains by enabling trustless staking of idle BTC. This resolves the conflict between Bitcoin holders’ desire for asset security and participation in high-yield opportunities.

-

Latest Developments: Despite volatile prices, BTC remained resilient at elevated levels. With strong conviction in BTC’s future, holders seek to unlock BTC’s liquidity through yield-bearing applications. This week, Babylon deepened ZK scalability integration via collaboration with Layeredge and formed a strategic partnership with Sui to advance modular ecosystem development.

Lista DAO (LISTA): (Recommendation Rating: ⭐️⭐️⭐️)

-

Project Overview: Lista DAO is a BSC-based liquid staking and decentralized stablecoin project offering staking yields and LISUSD lending services.

-

Latest Developments: This week, Lista DAO launched Gauge Voting and Bribe Market features, allowing veLISTA holders to influence LISTA emissions for liquidity pools. Strategic partnerships were announced with 48Club_Official and defidotapp, particularly expanding opportunities within the BNBChain ecosystem. Proposal #012 advances PumpBTC integration as collateral in the innovation zone. Weekly veLISTA rewards (~$230K) and high APR compounding incentives attract users, along with a competitive 5.25% borrowing rate. A $7,000 USDT winter campaign with FDLabsHQ was launched, offering slisBNB and clisBNB airdrops to BNBChain holders.

In summary, projects with the fastest-growing TVL this week were primarily concentrated in the stable-yield segment (yield aggregators).

Sector-Wide Performance

-

Stablecoin market cap steadily increased: USDT grew from $145.1B to $145.9B (+0.55%), and USDC rose from $41.5B to $42.1B (+1.44%). Despite this week’s market downturn, both USDT (dominant outside the U.S.) and USDC (U.S.-focused) saw inflows, indicating ongoing capital entry into the ecosystem.

-

Liquidity is gradually increasing: Traditional risk-free arbitrage rates continue declining due to rate cuts, while on-chain DeFi yields rise alongside crypto asset value appreciation. Returning to DeFi presents an attractive opportunity.

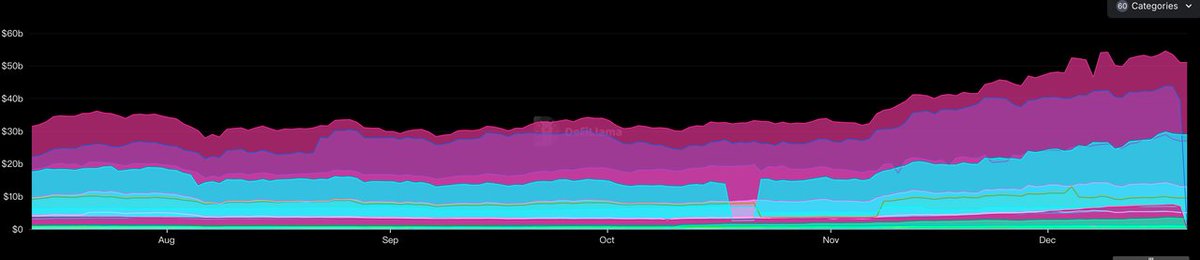

TVL Across DeFi Sub-Sectors (Data Source: https://defillama.com/categories)

-

Funding Status: DeFi TVL decreased from $54.1B to $52.9B, marking the first negative growth (-2.21%) in two months. This was primarily caused by large-scale liquidations due to the market’s sharp decline, breaking a two-month upward trend. The next two weeks will be critical to monitor whether this downward trend persists.

In-Depth Analysis

Upward Drivers: The core driver of this rally can be summarized as follows: Bull market dynamics increase liquidity demand, which pushes up base lending rates, thereby expanding yield opportunities for DeFi arbitrage looping strategies.

More specifically:

-

Market Environment: Bull cycles elevate overall liquidity demand

-

Interest Rates: Rising base lending rates reflect market pricing of capital

-

Returns: Looping arbitrage strategies see expanded yields, significantly improving protocol-level internal returns. This creates a self-reinforcing virtuous cycle that strengthens DeFi’s intrinsic value proposition.

Potential Risks: Recently, investors have heavily focused on yield and leverage, underestimating downside risks. This week, the Fed unexpectedly revised 2024 rate cut expectations from four to two cuts, triggering a swift market correction. Over $1 billion in contracts and loans were liquidated, causing investor losses. Such cascading liquidations could trigger further price declines and additional sell-offs.

Performance of Other Sectors

Public Chains

Top 5 public chains by TVL growth over the past week (excluding small chains). Data source: DefiLlama

Hyperliquid: Amid volatile market conditions—reaching new highs midweek before a sharp post-Fed decline—the environment favored derivative traders. Many on-chain users joined Hyperliquid, pushing open interest above $4.3 billion. The platform responded by adding leveraged trading (up to 5x) for popular pairs like VIRTUAL, USUAL, and PENGU, attracting active traders.

Bitcoin: While most assets fell sharply after Thursday, BTC exhibited relative strength. Risk-averse investors flocked to BTC, reinforcing confidence in its long-term upside. Additionally, users increasingly deposited BTC into BTCFi protocols to earn yield, contributing to rising Bitcoin TVL.

BSC: This week, BNB Chain welcomed new projects including Seraph_global, SpaceIDProtocol, and cococoinbsc, advancing AI and Web3 integration in gaming. The chain actively supported meme projects via the Meme Heroes LP program ($50K liquidity for CHEEMS and $HMC), launched a daily memecoin airdrop campaign (GOUT, MALOU, BUCK, $WHALE), and initiated a $200K Meme Innovation Contest.

AILayer: AILayer focused on community engagement and ecosystem collaboration: a giveaway with OrochiNetwork; a Mini App leaderboard; interactive events like “Would You Rather Challenge” and “Riddle of the Week”; and an EP31 AMA titled “How AILayer Uses AI to Revolutionize Bitcoin,” showcasing its vision for AI-blockchain convergence.

Mantle: Mantle achieved a key milestone by integrating Compound III, enabling $USDe lending with ETH and BTC as collateral. The Mantle Scouts Program expanded to 40 top industry scouts, and the Mantle Meetup initiative was launched. A major incentive campaign, Moe’s Rager, offered up to 1 million MNT, while Yield Lab attracted over 110K users and generated 2.5M transactions, boosting on-chain activity.

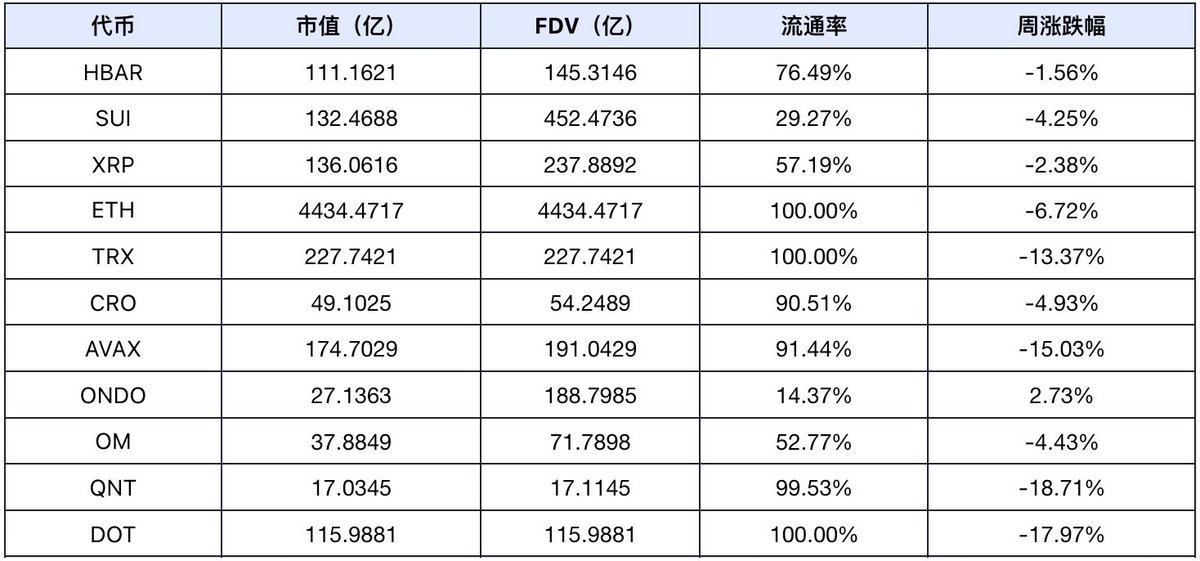

Top Gainers Overview

Top 5 token gainers over the past week (excluding low-volume and meme tokens). Data source: CoinMarketCap

This week’s top gainers showed sector concentration, with most winners coming from the public chain category.

UXLINK: UXLINK announced a strategic partnership with DuckChain and investment support from UFLY_Labs to co-develop a Social Growth Layer (SGL). LINE platform user count surpassed 2 million. UXLINK hit all-time highs on Upbit trading pairs. The project launched a $500K airdrop spanning 20+ Web3 projects and collaborated with exchanges like OKX to attract new users.

USUAL: Usual introduced an innovative USD0++ holder incentive vault and delta-neutral strategies, offering APYs of 76%-82%. It maintained strong yields on Curve’s USD0/USD0++ and USD0/USDC pools (averaging over 50%). Usual’s TVL surged from $750M to $800M. After its third reward round, TVL increased by 44% while minting rate dropped 28%, creating deflationary pressure on USUAL. The project emphasizes that 90% of tokens are allocated to the community, with 100% of revenue retained by the DAO.

MOCA: Moca launched version 3.0, introducing an “integrated account” concept and AIR Kit to address Web3 identity fragmentation. A key partnership with SK Planet integrates Moca into the OK Cashbag app, reaching 28 million South Korean users. MOCA is set to list on Upbit and Bithumb. Deep collaboration with Nifty Island and the introduction of Fixed Mode improved the MocaDrop mechanism, enhancing user experience and ecosystem engagement.

HYPE: Amid market volatility—new highs midweek, sharp drop post-Fed—the environment favored contract traders. Many users joined Hyperliquid, pushing open interest above $4.3 billion. The platform added leveraged trading for VIRTUAL, USUAL, and PENGU, attracting active participants.

VELO: Velodrome partnered with Sony Block Solutions Labs to expand onto Soneium, a new Optimism Superchain-based L2. Significant progress was made in liquidity building: inkonchain locked 2.5M veVELO and provided $1.4M in incentives, and Velodrome supplied liquidity for Mode Network’s proxy token.

Meme Token Gainers

Data Source: coinmarketcap.com

Meme projects were heavily impacted by the market downturn. They failed to rally with the broader market early in the week and then plunged sharply after Wednesday’s selloff, resulting in few meme coins posting gains. Clearly, current market attention and capital are not focused on the meme coin sector.

Social Media Hotspots

Based on LunarCrush’s top 5 daily gainers and Scopechat’s top 5 AI-scored tokens for the week (12/14–12/20):

The most frequently mentioned theme was L1s. Listed tokens (excluding low-volume and meme tokens) include:

Data Source: LunarCrush and Scopechat

Data analysis shows L1 projects received the highest social media attention this week. After the Fed cut 2024 rate cut expectations from four to two, the market plunged. While all sectors declined, L1s exhibited relative resilience. During broad market sell-offs, L1s typically outperform other sectors. Besides allocating to BTC and ETH for safety, investors often turn to public chains, which tend to rebound first when recovery begins.

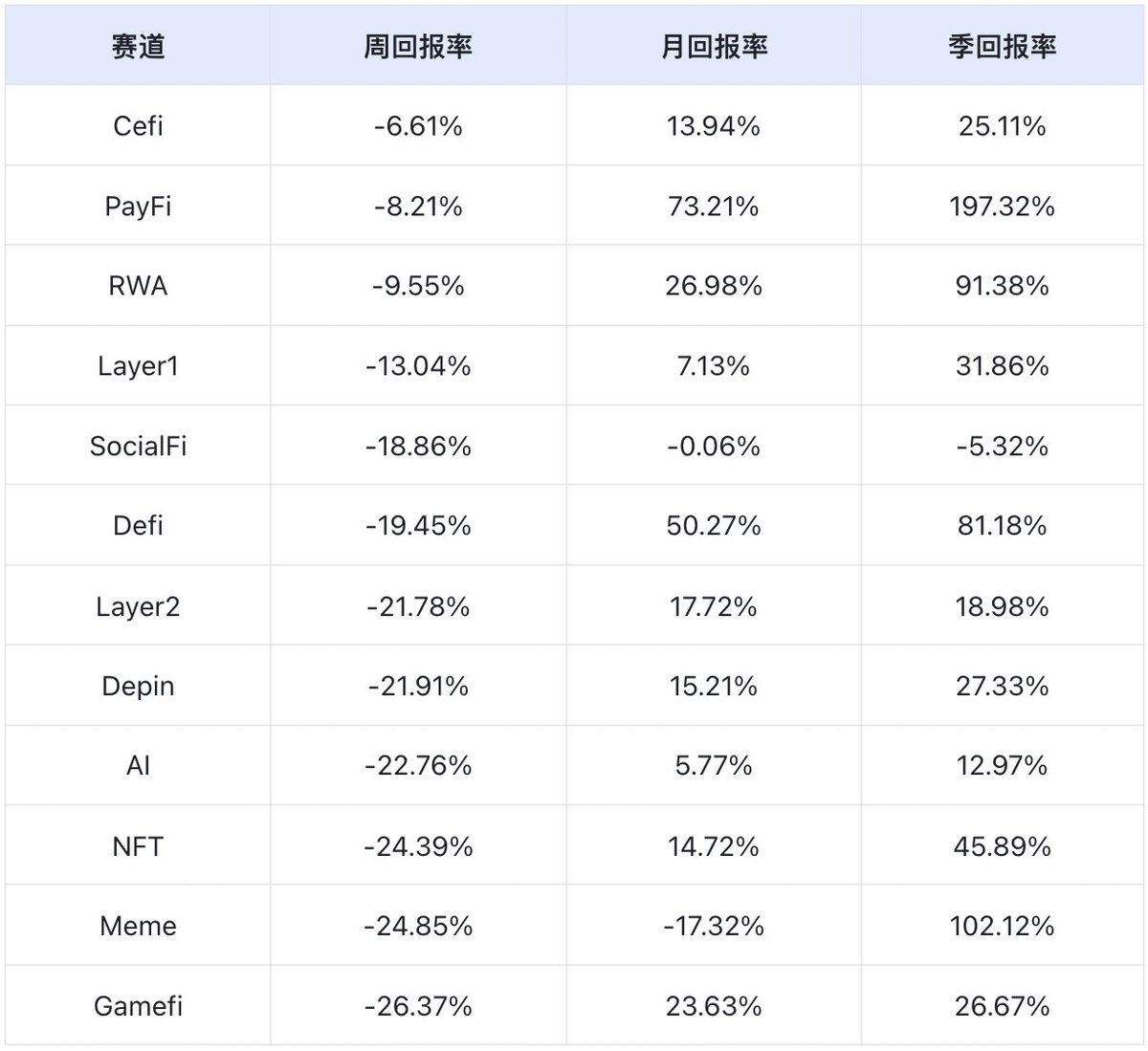

Overall Market Theme Overview

Data Source: SoSoValue

By weekly return, CeFi performed best while GameFi lagged.

-

CeFi Sector: Dominated by BNB (86.07%) and BGB (5.45%), totaling 91.52%. Binance consistently listed influential new tokens, driving traffic. BNB outperformed the market, down only 2.58% vs. BTC and ETH. Bitget also shined, launching multiple hot tokens, with BGB surging 37.93% this week, lifting the entire CeFi sector.

-

GameFi Sector: Largely ignored this cycle, suffering from lack of capital and traffic. Without the previous wealth-generation effect, interest has waned. Key tokens IMX, BEAM, GALA, SAND, and AXS collectively represent 82.14% of the sector and underperformed the broader market this week, dragging down GameFi performance.

Upcoming Crypto Events Next Week

-

Thursday (Dec 26): U.S. Weekly Initial Jobless Claims

Outlook for Next Week

-

Macroeconomic Assessment

Next week falls within the U.S. Christmas holiday period, with minimal macroeconomic data releases. Historically, holiday seasons see reduced buying power—especially from U.S. investors—and increased market volatility.

-

Sector Rotation Trends

Despite poor current market conditions, many investors anticipate a broad market rally in Q1 next year. As a result, most are reluctant to sell holdings. To boost yield, they are increasingly participating in yield aggregator projects. The AI Agent sector continues to draw strong market attention, now with a $9.9 billion market size. Web2 and Web3 ecosystems are converging faster, with data networks and functional AI Agents accelerating integration into existing crypto products.

-

Investment Strategy Recommendations: Maintain a defensive posture—increase allocation to leading assets BTC and ETH to enhance portfolio resilience. Hedge risk while participating in high-yield DeFi yield aggregators. Investors should remain cautious, strictly manage position sizes, and prioritize risk management.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News