As a VC, How Did I Miss the 100x Opportunity in Virtuals Protocol?

TechFlow Selected TechFlow Selected

As a VC, How Did I Miss the 100x Opportunity in Virtuals Protocol?

Luck is what happens when preparation meets opportunity.

Author: Marco Manoppo

Translation: TechFlow

During bull markets, our social media feeds are constantly flooded with success stories of 100x returns (like the Hyperliquid hype—please stop spamming). Yet, we rarely discuss the opportunities that were missed.

In this article, I want to reflect on the story of Virtuals Protocol, sharing how I engaged with the founding team early on and how, as a venture investor, I missed my first 100x opportunity.

Note: Strictly speaking, my first missed 1000x opportunity was participating in Solana’s seed round in 2019 through an angel friend—but at that time, I wasn’t yet a real investor.

Disclaimer: I am an investor in @primitivecrypto (PV). While PV isn't a traditional VC firm, we do make venture-style investments. The views expressed here are entirely my own.

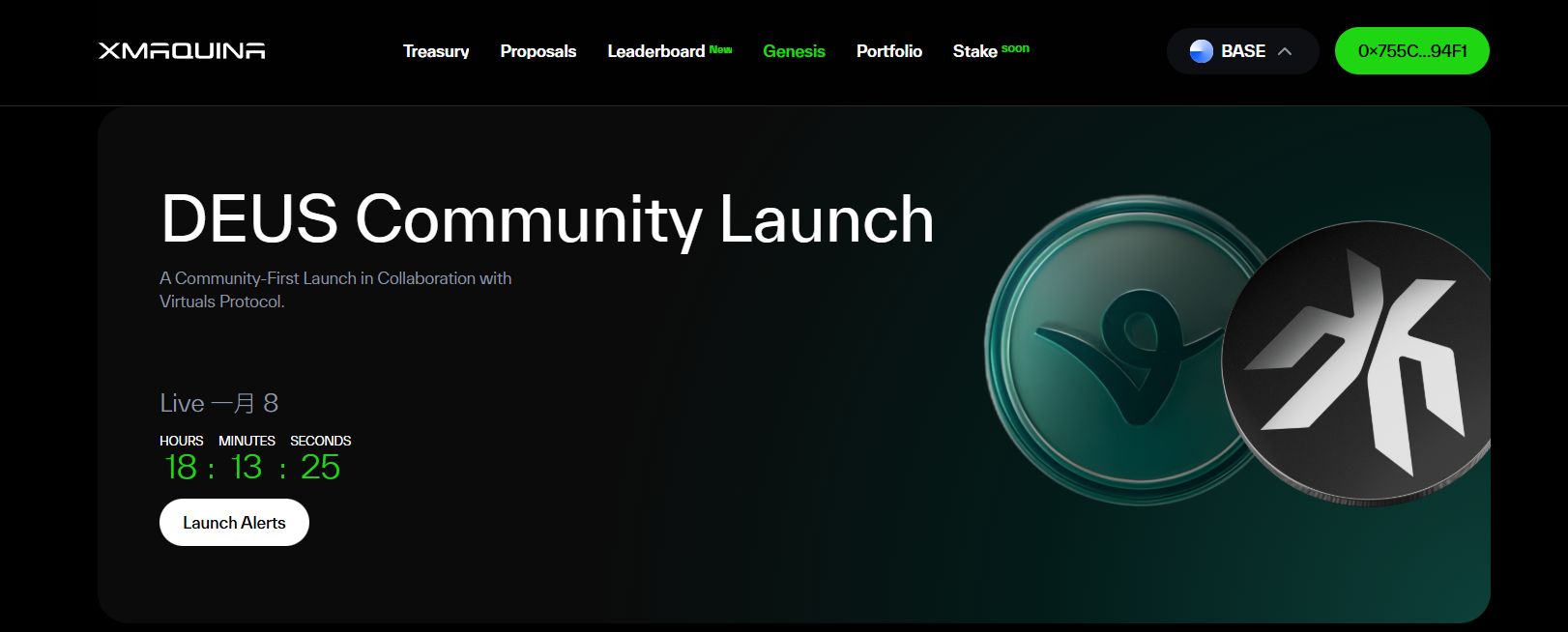

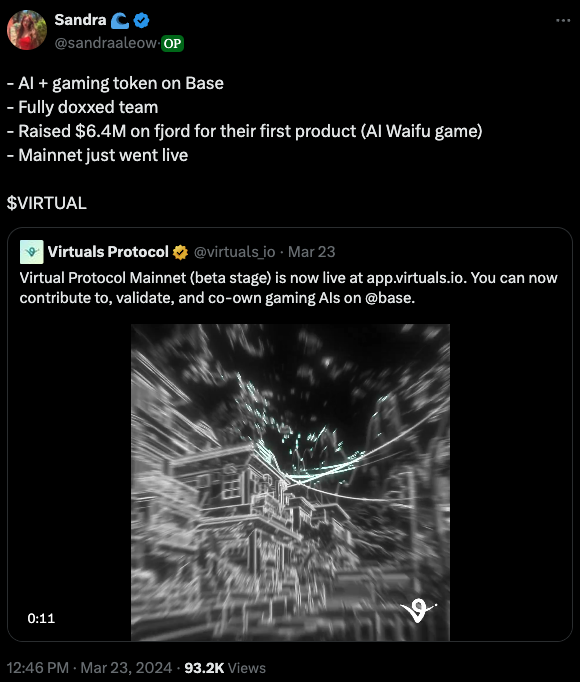

Virtuals was one of the biggest investment misses for me in this cycle. The founding team first reached out to me back in July (during ETHCC), when their fully diluted valuation (FDV) was just $50 million. Prior to that, I had actually heard about the project earlier in Q1 through mutual friends—when their valuation was even lower. Fast forward six months, and this AI agent tokenization platform has become one of the focal points of the current crypto cycle.

Virtuals co-founders Jansen and Wee Kee truly demonstrated extraordinary perseverance.

I clearly remember them tirelessly pitching Virtuals to investors and industry insiders. Based primarily in Southeast Asia (SEA), I heard from various crypto friends about their rebranding journey since the PathDAO days and their theories around tokenizing AI agents. To keep pushing forward through a bear market without a major centralized exchange (CEX) listing is admirable. Many other founders would have returned funds or given up altogether, but the Virtuals team persisted—and came back stronger.

Why Did I Make the Wrong Decision?

Earlier this year, we saw many projects attempting to merge crypto and AI, focusing on decentralized computing or inference. Frankly, a lot of these were just talk. Most lacked effective ways to engage regular users. Sure, you might earn some airdrops by joining a network and running computations, but it's nowhere near as compelling for mass retail participation as GameFi or DeFi’s pool2 models.

Initially, I thought these projects would gamify data collection and combine it with consumer-facing applications to create unique experiences—perhaps even incorporating some “Ponzi economics.” After all, data remains core to any AI model; incentivizing people to share unique data with "free internet money" seemed like a perfect fit.

Remember Westworld Season 3?

Yet, it turned out the crypto market took a different path. We skipped straight past what I described and jumped directly into asset issuance—the strongest product-market fit (PMF) in crypto to date.

The Virtuals team, thanks to all their prior groundwork, was perfectly positioned to seize this moment.

The Rise of GOAT

They say luck is what happens when preparation meets opportunity.

I won’t go into detail about what GOAT is—if you’re unfamiliar, check out this explanatory article. In short, GOAT sparked the AI agent token frenzy by making the market imagine what becomes possible when AI agents can interact with money. Despite limitations—such as requiring some human oversight—the key point was that it proved the concept: combining AI agents with crypto opens a whole new experimental frontier.

Recognizing this opportunity, the Virtuals team moved fast to demonstrate technical capability.

Their tokenized AI agent, LUNA, launched on October 16—just one week after GOAT. If you’ve been in crypto long enough, you know being merely the “beta version” of the main character isn’t good enough. At a breakfast meeting in Bangkok, Jansen told me the team went all-in to ensure LUNA became the first AI agent capable of executing autonomous on-chain trades.

Reflection: How to Catch Winning Bets in Crypto?

Reflections are inherently subjective, but here are my takeaways:

-

Resilience: The Virtuals team showed exceptional persistence through continuous product iteration. While founders vary based on background and motivation, investing in teams who don’t give up easily, maintain high ambition, and stay closely aligned with market trends is crucial.

-

Geographic Advantage & Rapid Experimentation: Projects aiming for rapid experimentation (e.g., platforms or launchpad models) often struggle in Western markets due to high costs. Being based in Southeast Asia allowed the Virtuals team to iterate quickly at low cost, while still serving dollar-denominated user bases and capital markets.

-

Resilience & Pragmatism: Founders from Southeast Asia often bring resilience and pragmatism. The regional business culture emphasizes “practicality first,” adapting successful Western or Chinese market models locally—whether in traditional businesses, Web2, or crypto. This pragmatic, business-oriented mindset was clearly evident in the Virtuals team.

What’s Next?

The AI agent craze has only lasted about two months, yet it feels like I’ve lived through two years. Although signs of fatigue are emerging, I believe we’ll see more waves of AI x crypto innovation by 2025. Crypto innovation typically starts in the most speculative corners before maturing into practical use cases.

One undeniable truth: without crypto,AI experimentation would be severely limited.

This is especially clear in AI agent experiments. Imagine trying to let a random AI agent handle real capital in traditional finance (TradFi)—you’d need reams of paperwork and legal support. Let alone handing cash directly to an AI agent. Crypto, as purely digital money, provides the ideal medium for these experiments.

Thus, AI agent experiments will evolve from simple functions (like a tweet-posting GPT wrapper valued at $100 million) toward more meaningful applications. Here are some directions I’m personally excited about:

-

More AI agent tokenization frameworks and platforms: While Virtuals continues launching new products rapidly, there’s still ample room for competition. Platforms like @ai16zdao, @MoemateAI, @Spectral_Labs, and @griffaindotcom are already emerging and capturing market share.

-

Niche AI agent experiments: Projects like @freysa_ai, @aiwdaddyissues, and @Big_Pharmai showcase more niche experiments and use cases. The key challenge is evolving from a fun experiment into a sustainable protocol with long-term commercial value.

-

Consumer-facing crypto x AI applications: How can we transform AI agents—while preserving their uniqueness and innovation—into practical consumer applications? These could integrate with other AI services like data collection, model training, or inference. The goal is to make AI agent interactions both novel and useful.

-

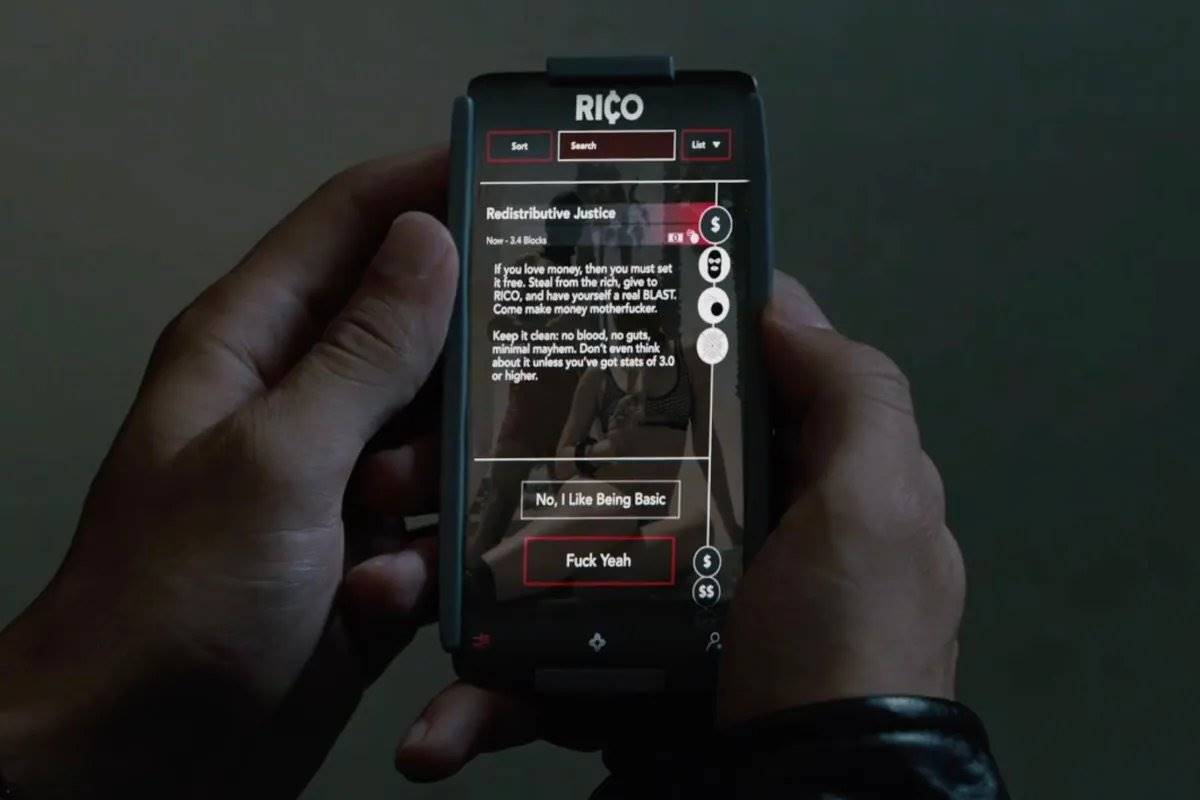

AI agents in “side hustle” domains: I hesitate to speculate too much here, but we can expect more AI agents generating real cash flow through participation in areas like gambling or adult entertainment—not relying solely on token emissions or crypto trading.

-

Integration of AI agents with payment systems: As agent-to-agent interaction improves, we can explore using AI agents to enable seamless on-chain and off-chain payments, optimizing the entire payment experience.

When facing community-driven innovation, traditional venture capital thinking can sometimes feel limiting. The key to learning is staying open-minded toward new experiments, unshackled from conventional wisdom, and being able to adapt quickly rather than chasing perfection. Primitive is always looking for bold founders. If you're working on any of the above, reach out!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News