Stablecoins and AI Convergence: A Three-Stage Revolution from Human-Machine Interaction to Machine Economy

TechFlow Selected TechFlow Selected

Stablecoins and AI Convergence: A Three-Stage Revolution from Human-Machine Interaction to Machine Economy

The integration of stablecoins and AI creates an efficient, intelligent new financial ecosystem.

Author: Peter Schroeder

Translation: Yuliya, PANews

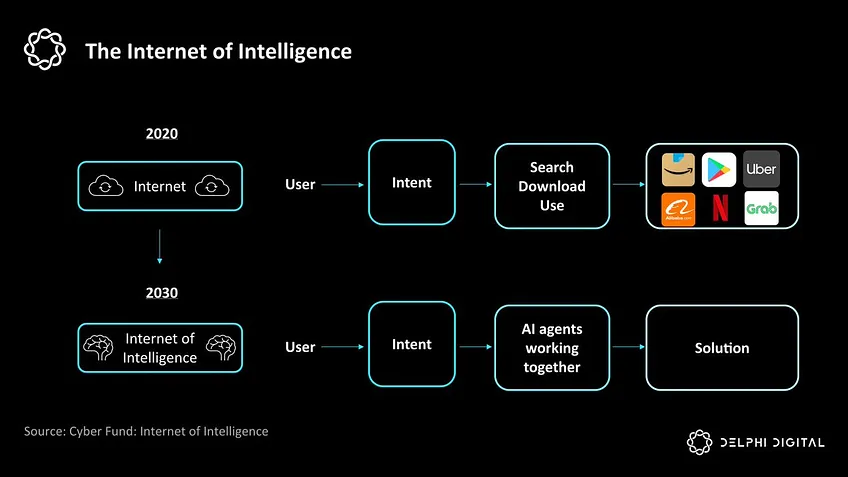

Before the internet emerged, personal computers had already demonstrated their revolutionary power. In the 1990s, the widespread adoption of PCs fundamentally transformed how people handled daily tasks, significantly boosting productivity and quality of life. Yet, despite their powerful capabilities, these computers remained isolated standalone systems, confined within closed environments.

The arrival of the internet completely changed this landscape. Computers suddenly gained the ability to connect to a vast world of information and a global network of users. These once-isolated machines became gateways to infinite possibilities, enabling instant communication, collaboration, and knowledge sharing across the globe. This breakthrough innovation ultimately shaped today’s technology-driven modern society.

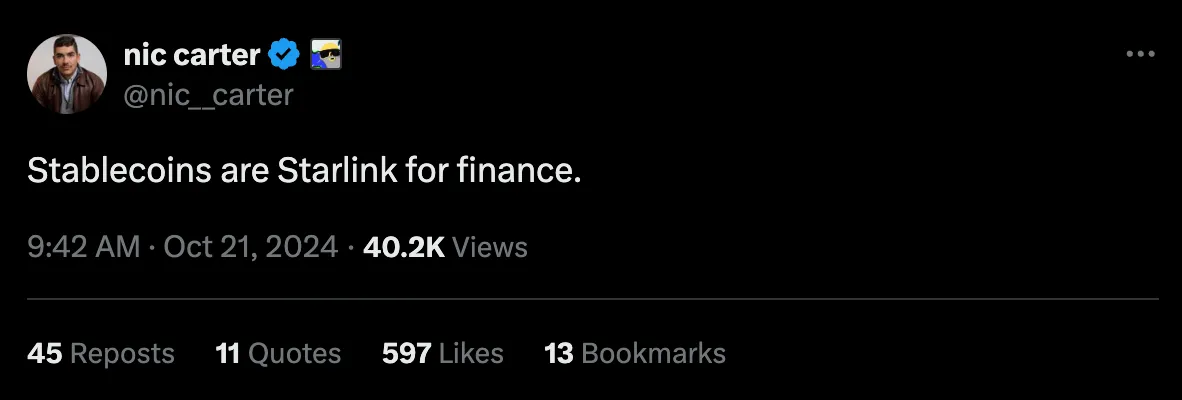

Today, money is undergoing a similar historical transformation. Traditionally, money has served three core functions: medium of exchange, store of value, and unit of account. With the emergence of stablecoins, money is now gaining all the advantages of the internet—and creating the foundation for the rise of AI agents. As industry expert Nic Carter put it: "Stablecoins are Starlink for finance."

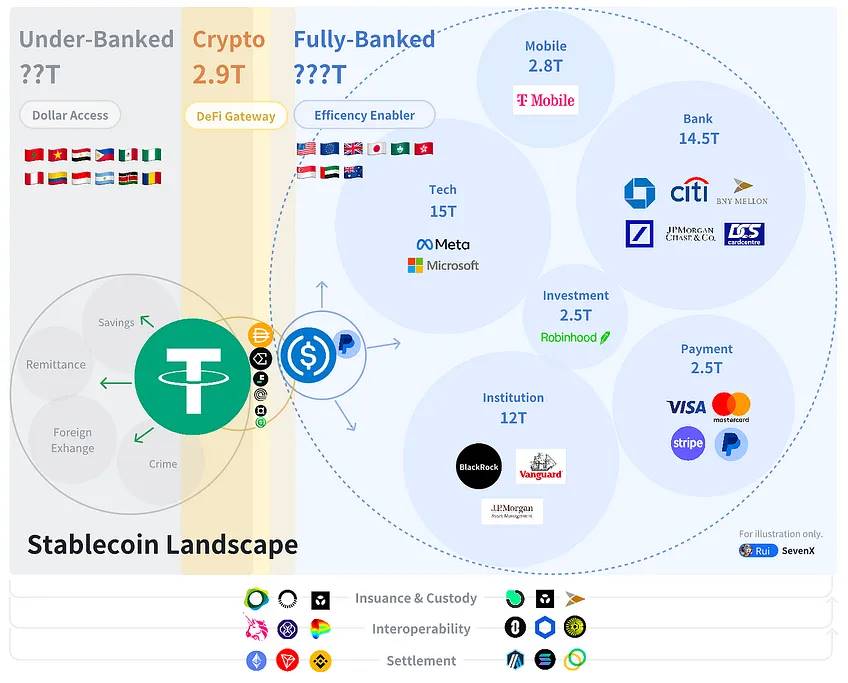

Stablecoin market capitalization has now reached $200 billion, processing trillions of dollars in transactions each month. By combining the stability of fiat currencies with the programmability of digital assets, stablecoins have become foundational infrastructure for internet-native money, unlocking new possibilities for a global decentralized financial system.

Artificial intelligence injects intelligence into this new monetary system. AI agents can:

-

Analyze massive datasets

-

Predict market movements

-

Automate operations at unprecedented scale

When this intelligence is combined with the seamless value transfer enabled by stablecoins, an entirely new realm of possibilities opens up. For example, investors can leverage AI to analyze global financial data in real time while using stablecoins to execute trades instantly and securely.

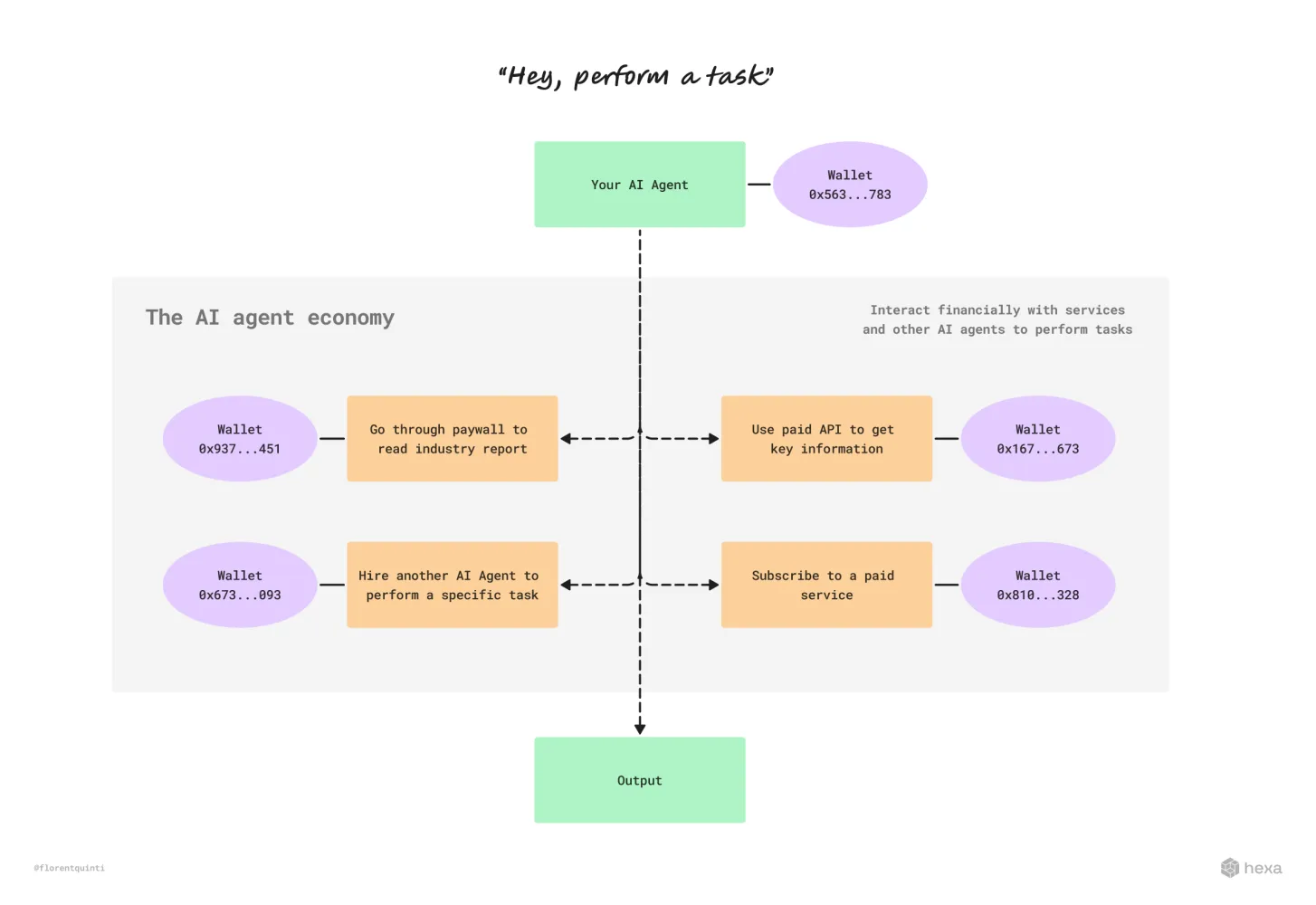

The convergence of stablecoins and AI creates a new, efficient, intelligent financial ecosystem. AI not only autonomously analyzes data and executes tasks but also interacts directly with blockchain protocols. This goes beyond simple automation of financial processes—it represents a fundamental transformation of the traditional financial system.

Three Stages of Stablecoin Evolution

Stablecoins provide the scalability and reliability AI agents need to operate independently.

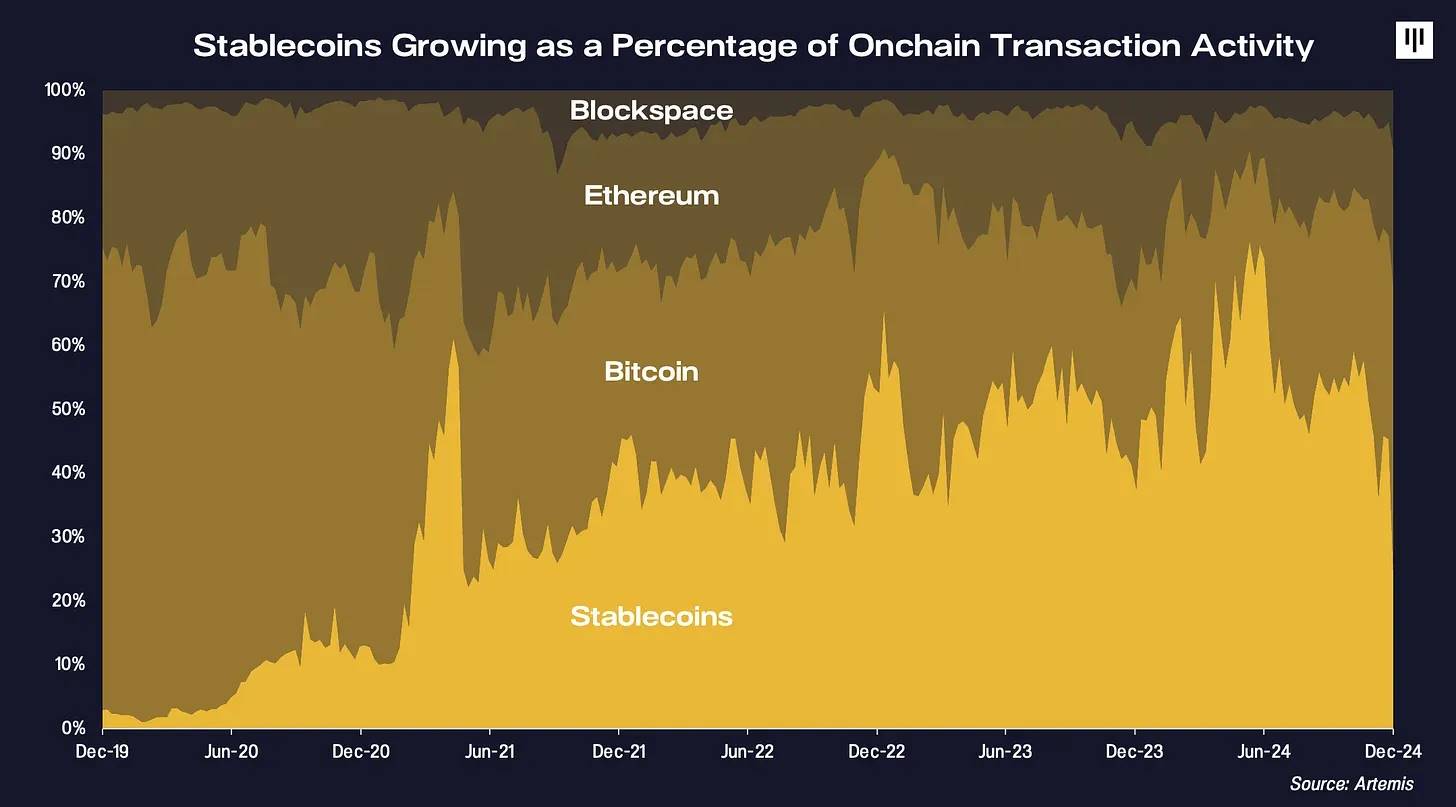

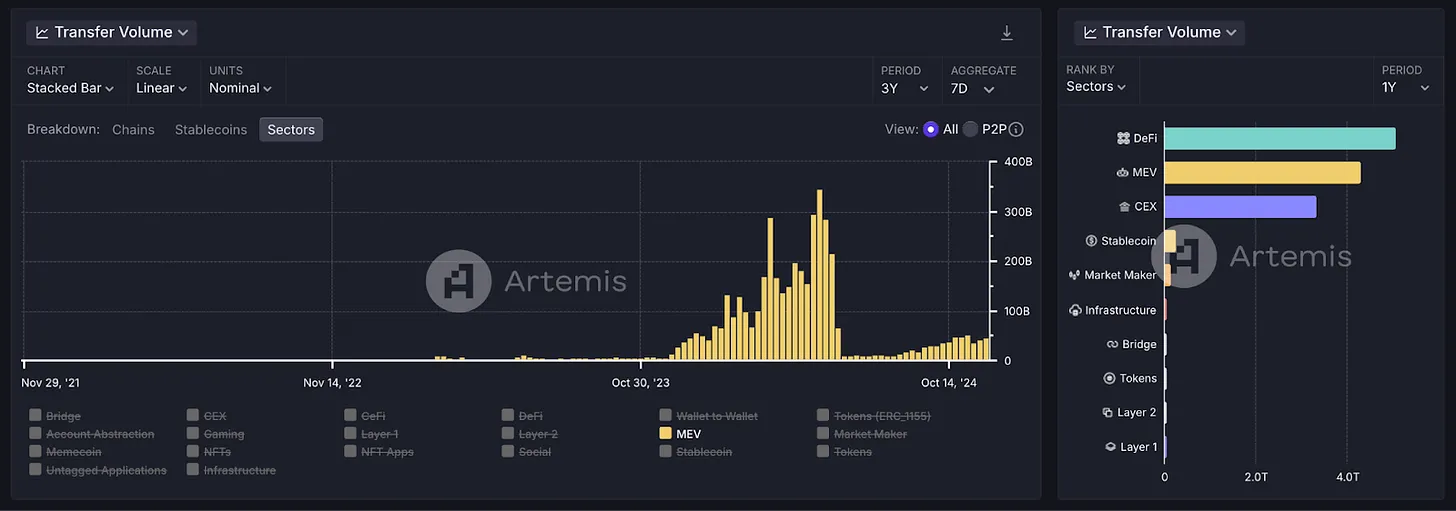

Since their inception in 2014, stablecoins have processed over $60 trillion in transaction volume and now account for about half of on-chain transaction volume.

While stablecoins have already achieved clear product-market fit and are ready for AI agent development, their applications will unfold gradually in stages. As Robbie Petersen outlines in his article “The Role of Cryptocurrency in the Agent Economy,” this evolution will progress through three distinct phases:

Phase One: Human-Machine Interaction (Now)

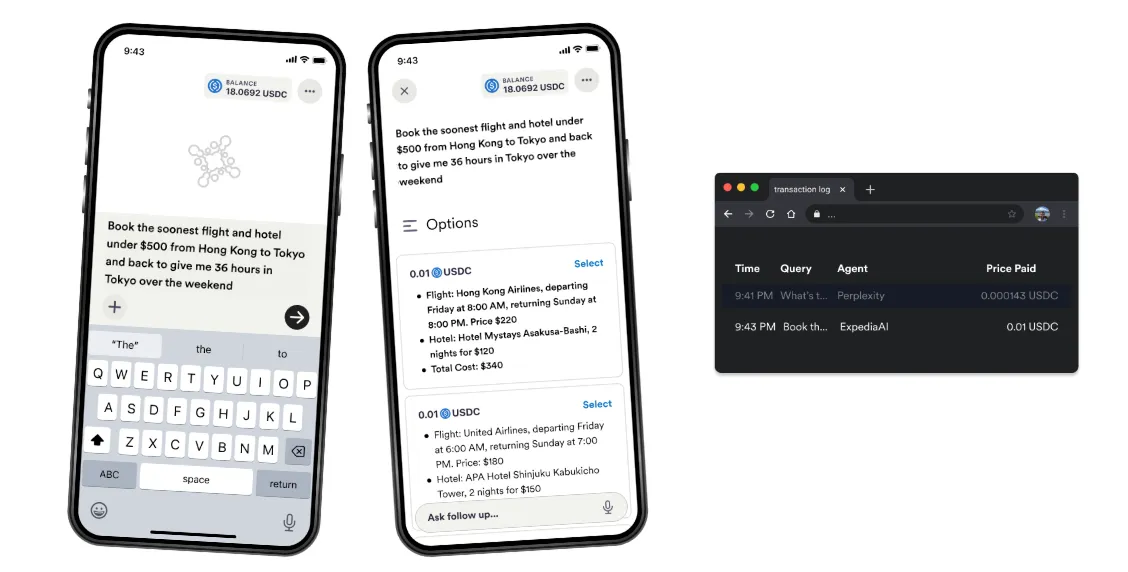

This phase is already well underway. For instance, Perplexity's recently launched shopping feature enables agents to make purchases on behalf of users. Although stablecoin integration isn’t live yet, the full rollout of such features is imminent.

As Chamath Palihapitiya, founder of Social Capital, said: "AI is ruthless because it has no emotions. It won't be swayed by a steak dinner, a basketball game, or a CEO's pitch. It's simply an agent that looks at API endpoints and writes code to get the job done." This means AI agents will choose the most accessible and efficient systems, unaffected by marketing or business development efforts. Crossmint is building tools to enable AI agents to use stablecoins like USDC.

Phase Two: Machine-Human Interaction (Emerging)

This phase is rapidly developing. According to Delphi Digital researcher Robbie, it is characterized by AI agents autonomously initiating transactions with humans. This trend is already visible in specific domains—such as AI trading systems executing trades, smart home systems purchasing electricity based on time-of-use pricing, and automated inventory systems restocking based on demand forecasts.

MEV (Maximal Extractable Value) bots are prime examples of this stage. Over the past three years, these bots have used stablecoins to process over $430 million in transaction volume, completing nearly 200 million transactions.

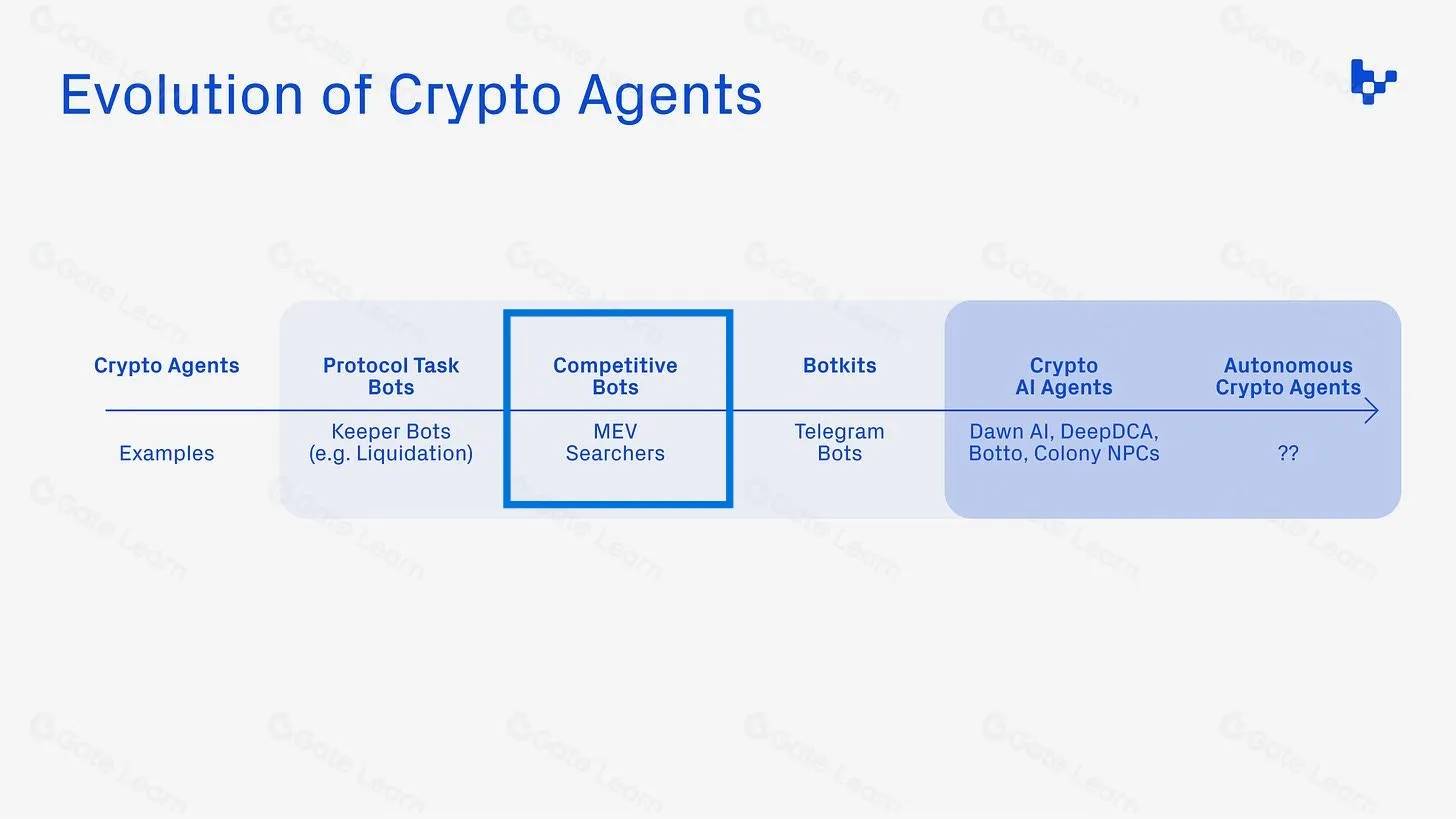

MEV bots are automated programs that identify and exploit arbitrage, liquidation, and front-running opportunities in blockchain transactions. Traditional MEV bots operate using rule-based algorithms, monitoring mempools, executing trades, and reordering transactions according to predefined strategies to generate profit.

These bots now employ machine learning techniques to predict market trends, optimize trade execution, and adapt to market changes in real time—showcasing technological advancement in crypto agents. In this process, stablecoins play a crucial role by providing the stability and liquidity needed for high-frequency, low-risk strategies.

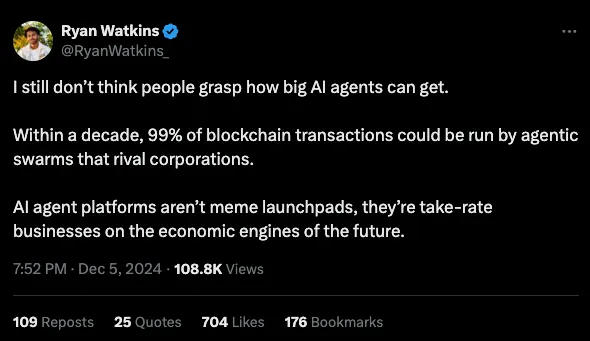

The increasing sophistication of these bots reflects a broader trend: AI agents, robots, and automated systems are becoming dominant forces within the blockchain ecosystem. The success of MEV bots is just one example of scalable stablecoin adoption, clearly demonstrating how AI agents and bots are beginning to widely influence market dynamics. This growing impact signals that the cryptocurrency market is entering a new era of greater automation and intelligence.

Phase Three: Machine-to-Machine Interaction (Future)

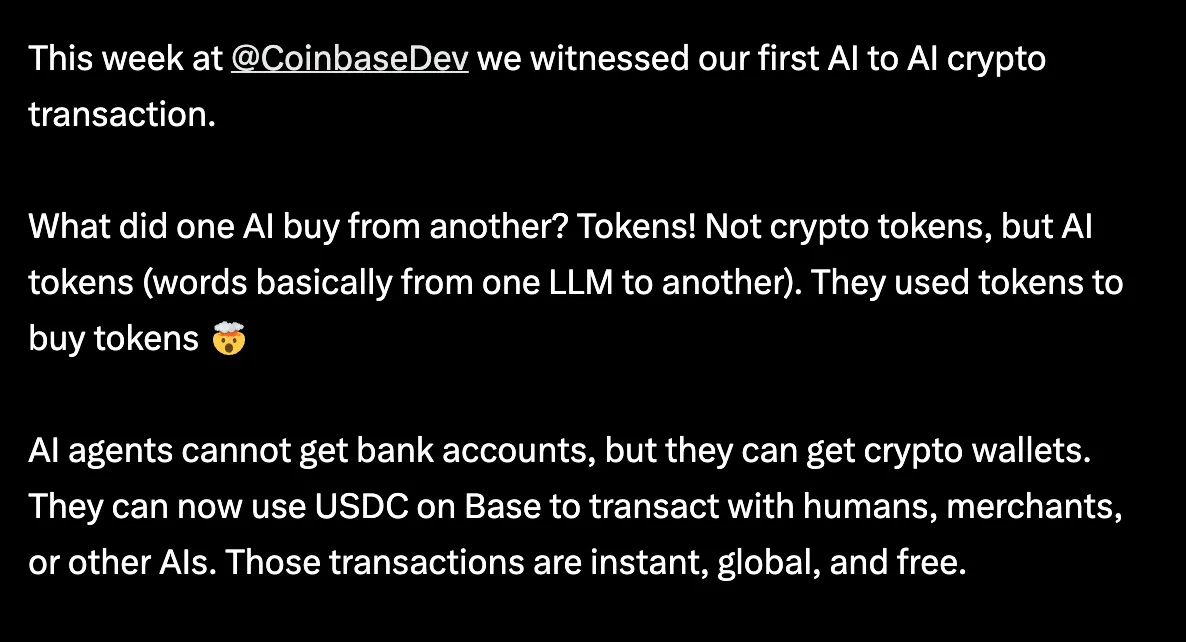

The early signs of this phase are already visible. In August this year, Coinbase incubated the first-ever AI-to-AI transaction using USDC.

As Coinbase CEO Brian Armstrong stated: "AI agents can't open bank accounts, but they can own cryptocurrency wallets. They can now use USDC on Base to transact instantly, globally, and freely with humans, merchants, or other AIs."

Stablecoins provide AI agents with an efficient, liquid, and permissionless medium of exchange, while AI brings intelligence to blockchain operations, enabling smarter, faster, and more efficient systems. The impact of AI-to-AI transactions will be profound and far-reaching—this space deserves ongoing attention.

Perfect Synergy: Use Cases Driven by Stablecoins and AI

Programmable Liquidity

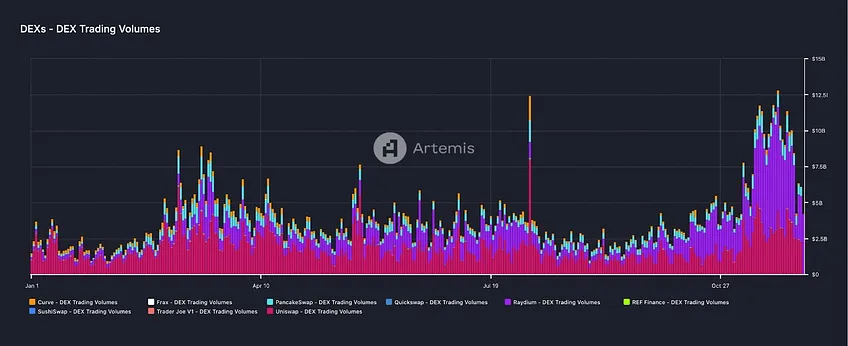

One of the most compelling current use cases for stablecoins is programmable liquidity, which allows AI agents to instantly access and deploy funds. To date in 2024, global DeFi markets have seen over $1.3 trillion in trading volume, with stablecoins representing a significant share of available liquidity.

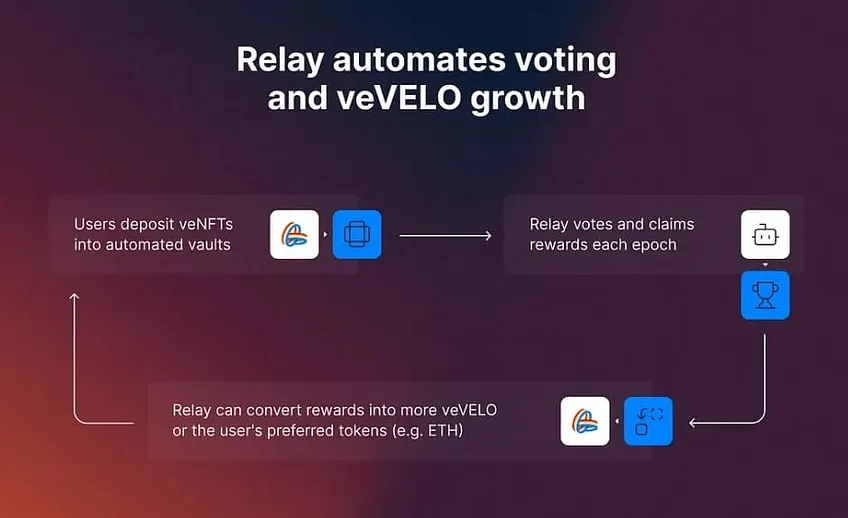

Companies like Velodrome and Aerodrome Finance are innovating Automated Market Maker (AMM) mechanisms by introducing vote-escrowed (ve) token models to promote community-driven liquidity distribution. By integrating Layer 2 networks such as Optimism and Base, this model ensures efficiency and scalability in fund deployment.

AI can enhance the efficiency and adaptability of stablecoin liquidity provision by enabling programmable liquidity—dynamically optimizing pool allocations, fee structures, and reward distributions based on market conditions and user behavior.

These developments are fueling continued growth in DeFi. According to VanEck, DeFi is poised to reach new highs by 2025, with DEX trading volume hitting $4 trillion and total value locked reaching $200 billion—driven largely by liquidity and adoption from AI-related tokens, consumer-facing dApps, and tokenized assets.

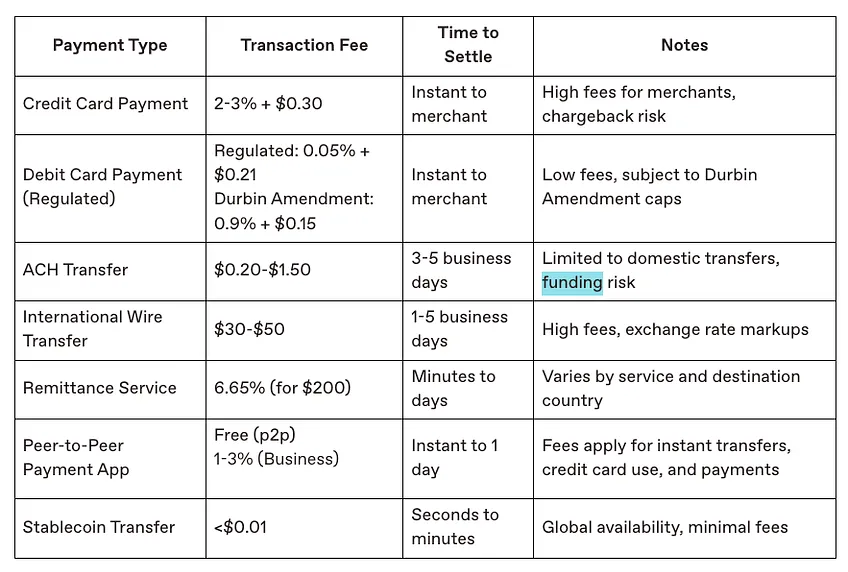

Cross-Border Payments

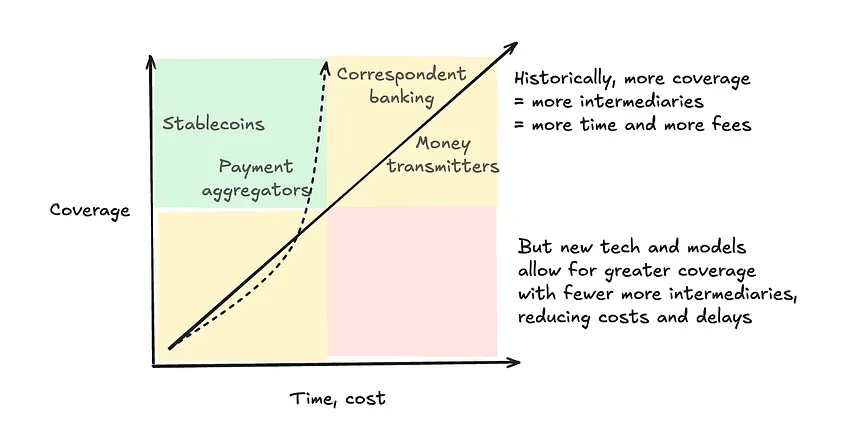

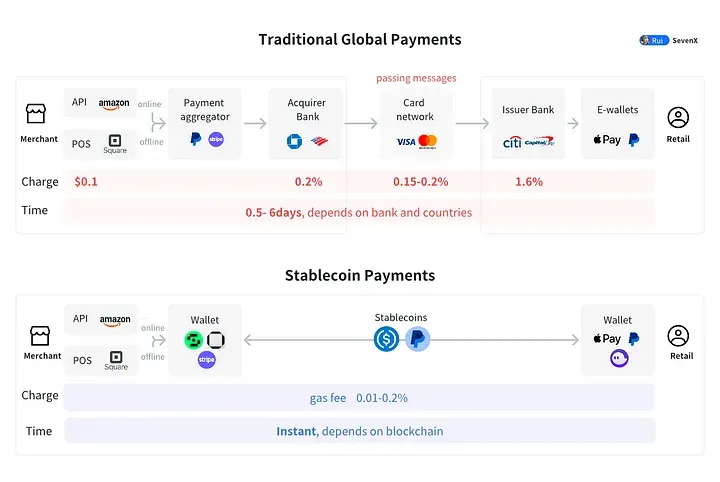

Cross-border payments represent another area of immense potential for stablecoins and AI agents. The global remittance market reached $883 billion in 2023 and is projected to grow to $913 billion by 2025. Traditional remittances suffer from high fees (averaging around 6% globally) and long processing times (sometimes taking days). Stablecoins, with their near-instant settlement and extremely low costs, are disrupting this space. When combined with AI agents, the process becomes even more seamless: AI agents can analyze exchange rates, identify the most cost-effective routes, and autonomously execute transfers.

As Circle co-founder Jeremy Allaire discussed at the Circle Forum in Hong Kong, stablecoins are the ideal tool for AI agents due to their focus on programmability, trust, and transparency. They provide immutable on-chain transaction records, ensuring that AI agent activities are auditable and verifiable. This programmable trust is essential for connecting human and machine economies.

AI agents powered by this stable, programmable liquidity are transforming these transactions into smarter, faster, and more cost-effective workflows. From optimizing DeFi strategies to automating global commerce, the synergy between stablecoins and AI agents is upgrading how value flows across systems.

Looking Ahead

As the share of AI-driven economic activity grows, stablecoins are becoming critical infrastructure for this transformation. Their stability, speed, and accessibility make them the ideal monetary vehicle for AI agents, driving the formation of smarter, more efficient, and inclusive financial systems.

Stablecoin-powered AI agents simplify complex financial tasks, enabling anyone with internet access to participate. Users can simply converse with an AI agent to create a wallet and conduct transactions using stablecoins—without needing to understand the intricacies of finance. For example, individuals without specialized financial knowledge can delegate portfolio management of any amount to an AI agent, earning stablecoin yields via DeFi. To the user, it appears as nothing more than a dollar-denominated savings account generating passive income.

These agents can automatically rebalance investments, optimize returns, and even obtain loans—lowering barriers to DeFi participation behind the scenes while presenting a simple user interface. This has profound implications for financial inclusion, especially in regions where traditional banking services are limited.

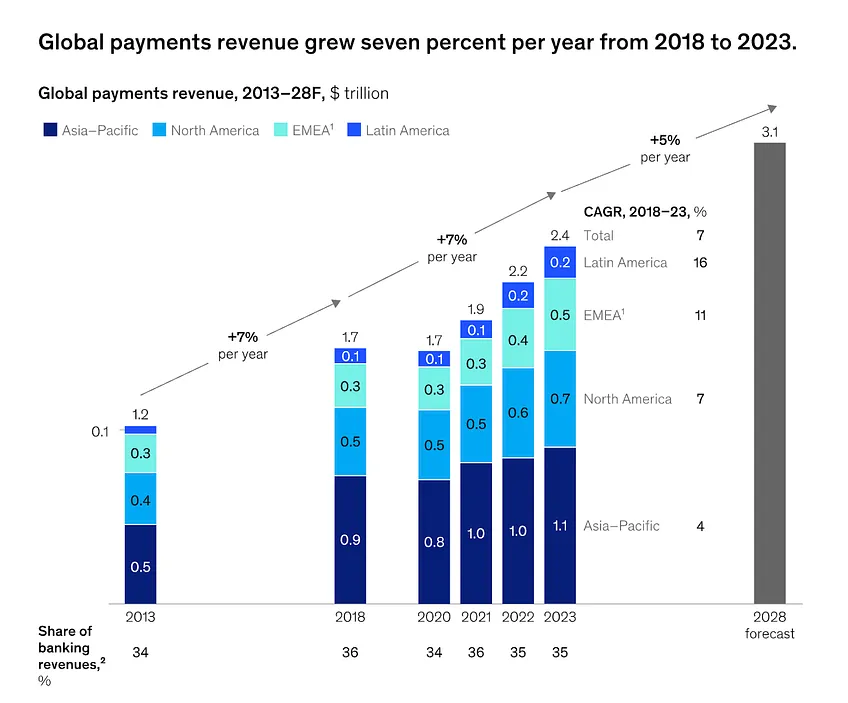

In payments, the benefits of enhanced efficiency are already emerging. In 2023, the global payments industry processed $18 quadrillion in transaction value and generated $2.4 trillion in revenue, primarily from fees.

AI agents reduce friction in financial workflows by automating transactions and decision-making. Combined with the near-zero transaction costs of stablecoins, AI agents can minimize this "payment tax," offering businesses and consumers faster, more economical transaction methods. Stablecoins and AI converge: a three-phase revolution from human-machine interaction to a machine economy.

Even more exciting is the creation of new economic models and markets. As AI agents use stablecoins to transact autonomously, entirely new industries and ecosystems are emerging. The machine-to-machine economy—where autonomous devices and systems directly exchange value—is becoming a reality. This has the potential to significantly boost global economic productivity, reduce inefficiencies, eliminate intermediaries, and free up resources for growth and innovation.

The convergence of stablecoins and AI agents is transforming how value flows, enabling autonomous economic systems of unprecedented speed, intelligence, and efficiency.

As the ecosystem evolves, stablecoins will continue to serve as the backbone of this revolution, providing the stability and liquidity necessary for AI agents to thrive. When programmable money meets intelligent automation, this is only the beginning—the future holds opportunities as vast as the digital economy itself.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News