Base vs Solana: Who Can Become the Hitmaker for AI Agents?

TechFlow Selected TechFlow Selected

Base vs Solana: Who Can Become the Hitmaker for AI Agents?

AI Agent is a battleground for strategic dominance.

Author: Kevin, the Researcher at BlockBooster

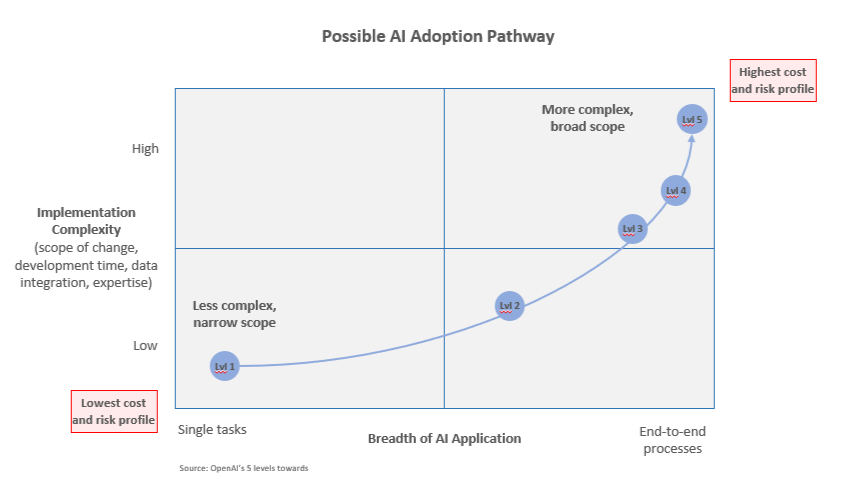

The term "AI Agents" originates from OpenAI's roadmap. Sam Altman divided the capabilities AI should possess into five stages, with the third stage—AI Agent—being what we will frequently encounter in the coming years.

AI Agents are capable of autonomous learning, decision-making, and task execution. Depending on their level of intelligence and capability, Stuart Russell and Peter Norvig classified AI Agents into five categories in their book *Artificial Intelligence: A Modern Approach*:

-

Simple Reflex Agents: React solely based on current state.

-

Model-Based Reflex Agents: Consider historical states during decision-making.

-

Goal-Based Agents: Focus on planning and finding optimal paths to achieve specific goals.

-

Utility-Based Agents: Weigh benefits against risks to maximize utility.

-

Learning Agents: Continuously learn and improve through experience.

At which level do current market or industry AI Agents stand? What type of agent are they?

OpenAI's o1 reaches Level 2 artificial intelligence. In my view, today’s industry AI Agents sit between Level 2 and Level 3—what I call Level 2.5. This does not mean these agents have surpassed OpenAI; in fact, Web3 Agents are still at the stage of GPT wrappers. So why Level 2.5? Because through human or programmatic intervention—let’s call it a mediator—the combination of a GPT wrapper and this mediator forms a fragile yet objectively proactive structure. It represents an extension of one direction of OpenAI models. In terms of functionality, most existing agents are fundamentally simple reflex-type agents. Some consider historical states, but only when explicitly fed data. Learning occurs passively via continuous input, far from meeting the criteria for Level 3. The latter three types—Goal-Based, Utility-Based, and Learning Agents—have yet to enter the market. Therefore, I believe current AI Agents remain in early stages: fine-tuned versions of Level 2 general-purpose LLMs, architecturally still within Level 2. Can crypto alone drive evolution to Level 3, or must we wait for companies like OpenAI to develop it?

Why discuss Base or Solana as potential centers for the AI Agent narrative?

Before discussing ecosystems that could foster the emergence of Level 3 Agents, we should first identify which ecosystem has the potential to become fertile ground for AI Agents. Is it Base? Or Solana?

To answer this, let’s revisit how AI has influenced Web3 over the past two years. When OpenAI first launched ChatGPT, protocols in the space followed惯性思维 (inertial thinking), rushing into infrastructure bubbles. Numerous compute/inference aggregation platforms emerged, alongside AI + DePIN infrastructure. Both shared grand visions—not inherently bad, since Agent-based projects can also build such narratives—but they were poorly grounded in actual user needs. The demand they aimed to serve remains unsaturated even in traditional internet industries, and both user and market education are inadequate. Under the冲击 (impact) of the Memecoin craze, these lofty AI infrastructure projects appear even more hollow.

If infrastructure is too heavy and bulky, perhaps we should lighten it. Agent systems evolved from GPT wrappers offer efficient deployment and rapid iteration. Lightweight Agents have strong potential to generate bubbles, and after the bubble bursts, fertile soil for new growth may emerge.

More specifically, in today’s market environment, launching projects using Agents combined with Memecoins allows products to go live extremely quickly, giving users direct hands-on experience. During this process, Agents can cleverly leverage the Memecoin playbook for community building, enabling fast product iteration—low-cost and rapid. Serious AI protocols no longer need to be constrained by heavy legacy consensus frameworks. They can break free, move lightly, and bombard users with lightweight, high-speed iterations. Once sufficient market education and dissemination occur, they can then lay the foundation for ambitious infrastructure. Lightweight Agents cloaked under ambiguous Memecoin facades allow community culture and fundamentals to coexist harmoniously. A new path for asset development is gradually emerging—one that future AI protocols might follow.

The above discussion highlights the potential of AI Agents becoming a core narrative. Assuming AI Agents continue growing rapidly, choosing the right ecosystem becomes critical. Base or Solana? Before answering, let’s examine the current state of serious Agent-focused protocols.

First, Arweave/AO: PermaDAO noted that AO adopts the Actor model, where each component is an independent autonomous agent capable of parallel computation—an architecture highly compatible with AI Agent-driven applications. AI relies on three elements: models, algorithms, and computing power. AO meets these high-resource demands by allocating dedicated computing resources to each Agent process, effectively eliminating performance bottlenecks.

In addition, Spectral is one of the few protocols built around Agents, focusing on text-to-code generation and model inference.

Looking at current Agent-related tokens in the market, we find that these Agents barely utilize blockchain infrastructure. This is true because all current models—including Agents—are off-chain. Data feeding happens off-chain, model training isn’t decentralized, and output information doesn’t go on-chain. EVM chains don’t support integration between AI and smart contracts—neither Base nor Solana currently do. Next year, we may see AO’s introduction testing whether models can run on-chain effectively. If AO fails, on-chain models might not arrive until Ethereum introduces them years later—likely not before 2030—or another chain achieves it. But if AO, with its architectural design and historical resource advantages, cannot succeed, the challenge for other public chains would be even greater.

Currently, AI Agent tokens lack substantial use cases. Indeed, it’s hard to distinguish between AI Agent coins on Base/Solana and AI Memecoins. Despite the limited utility of Agent tokens, why do I insist they shouldn’t be conflated with AI Memecoins? Because I believe we’re now in the phase of creating an AI Agent bubble.

Why is Base competing with Solana for dominance in the AI Agent narrative?

During the first half of this bull market, Base captured significant attention. In the battle for Memecoin market share, Base briefly shone—for example, with $BRETT and $DEGEN—but ultimately lost to Solana. I believe AI Agents represent Base’s next competitive frontier, and it already holds several advantages.

AI Agents accelerate bubble formation and create chaos—but ultimately leave behind users and applications:

Bubble formation and expansion attract market attention, which undergoes qualitative transformation over time. What characterizes this shift? As attention grows, a series of user pain points and market gaps are exposed. When major contradictions cannot be reconciled despite rising attention, a qualitative leap occurs. At that moment, accumulated users and applications can carry forward grand visions—a feat Memecoins neither aim for nor achieve. This is precisely why, despite the current blurriness between Agents and Memecoins, they must not be treated interchangeably.

Prior to this transformation, the bubble will produce clutter and drama: the number of Agents will grow exponentially, flooding users’视野 (field of vision). How? Agents can integrate with social media platforms like X and Farcaster, self-promoting their tokens using angles favored by degens and leveraging the unique information density of Agents to sell tokens.

Then, rapidly iterating Agents will execute on-chain transactions—entering the dark forest like Viking raiders. Current dashboard protocols, Telegram bots, and Dune dashboards will be invaded. Familiar metrics—volume, address count, chip distribution—will be manipulated. On-chain data may require professional cleaning to reveal real value; otherwise, it risks deception. Like Vikings plundering wealth, these Agents could strip users bare.

If the market reaches this stage, the AI Agent era will be halfway successful—because “attention is value” will elevate Agents into legitimacy. This potential stems from:

-

Strong distribution capability: Agents generate buzz (e.g., Goat), and stable distribution channels can be replicated.

-

Deployment simplicity: Platforms for deploying Agents will explode—Zerebro, vvaifu, Dolion, Griffain, Virtual—allowing users to create Agents without coding knowledge. UX will improve through competition.

-

Memecoin effect: In early stages, Agent tokens lack viable business models and meaningful use cases. Wearing a Memecoin mask enables rapid community accumulation and high launch success rates.

-

Extremely high ceiling: OpenAI’s Level 3 Agent is still under development. With giants unable to release such products quickly, the market opportunity must be enormous. An Agent’s floor is a Memecoin, but its ceiling is an autonomous advanced intelligent entity.

-

Low market resistance: Agents like Goat can reach mass audiences. Unlike AI infrastructure, users aren’t repelled by Agents. When users aren’t resistant, engagement becomes possible.

-

Potential incentives: While token utilities remain undeveloped, introducing point systems or stronger incentive mechanisms could attract large user bases.

-

Iteration potential: As previously stated, Agents are lightweight and enable rapid iteration. This objective capacity can produce increasingly engaging products and content.

Therefore, AI Agents can become a central narrative—a strategic battleground.

Why does Base have the potential to compete with Solana?

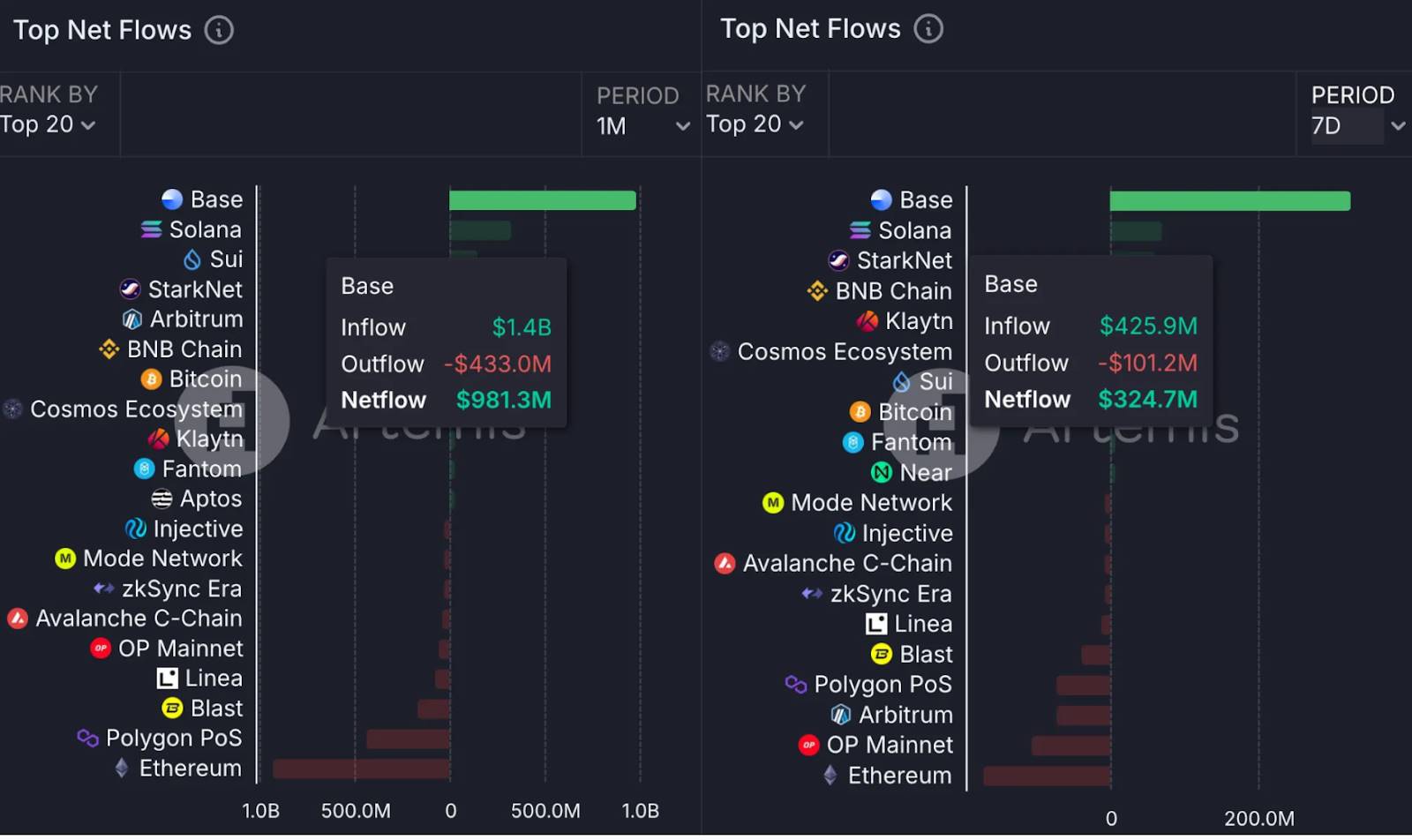

Backed strongly by Coinbase and North American capital, the Base ecosystem experienced explosive growth in 2024. In November, capital inflows surpassed Solana and have significantly outpaced it over the past seven days.

If ETH continues breaking the ETH/BTC ratio next year, the spillover effect of an “ETH season” will significantly benefit Base. Currently, 23% of outgoing ETH funds flow into Base—a figure still rising.

AI Agent Launchpad Mapping

Virtual

Phase V1 focused on model training, data contribution, and interaction features. In V2, Virtual launched a token incubation platform for AI Agents, highlighted by the October release of fun.virtuals.

LUNA has evolved into an independent entity with its own identity and financial capacity. This development aligns with Coinbase’s roadmap, which provides robust technical tools and support to facilitate AI Agent deployment on Base.

AI Agent technology excels in brand building, particularly in cultivating cultural brands. Through AI Agents, brands interact more efficiently with communities—simplifying interactions, flexibly distributing rewards, and enhancing user stickiness and brand recognition.

Notably, all AI Agent transactions exclusively accept the native Virtual token. The Virtual token captures value across the entire ecosystem, serving as a key pillar of its growth.

Virtual emphasizes product functionality and empowers users via AI tools, bridging Web2 and Web3. It prioritizes “utility value” over “hype cycles.” Although its tool-based products are frequently used, they lack the viral spread typical of crypto projects—this was V1’s weakness.

Clanker

“Post-to-mint” lowers the barrier to token issuance and attracts massive user experimentation. People rush to @Clanker—similar to asking an AI to summarize video content on social media—but here, content creation directly translates into asset creation.

How does Clanker work?

The TokenBot (i.e., Clanker) deploys Meme tokens on Base into single-sided liquidity pools (LP), locking the liquidity. Token issuers receive:

-

0.25% of all swap fees.

-

1% of total supply (unlocked over one month).

Users can visit clanker.world to check deployment counts or create their own tokens.

Unlike PumpFun, which issues tokens on Raydium via bonding curves charging 1% trading fees plus 2 SOL fixed fees, Clanker avoids bonding curves and instead earns 1% fees through Uni v3 trades.

AI Agent Layer

An AI Agent and launchpad platform focused on the Base ecosystem, officially launched on November 18. Prior to the platform launch, the AIFUN token debuted on November 14 and is now listed on exchanges including MEXC and Gate, priced at $0.09 with a market cap of approximately $25 million.

Creator.bid

Initially an AI platform focused on monetizing digital content and ownership, Creator.bid completed a new funding round this April.

On October 21, Creator.bid announced its official launch on Base mainnet, offering one-click creation and publishing of AI Agents, providing creators with new tools and revenue models.

Simulacrum

Built on Empyreal, Simulacrum transforms platforms like Twitter, Farcaster, Reddit, and TikTok into blockchain interaction layers. Users can perform on-chain actions—such as token trades or tipping—through simple social media posts.

Leveraging account abstraction, AI agents, intent-driven architecture, and language models, it simplifies complex backend blockchain operations, making DeFi more accessible to everyday users.

vvaifu.fun

Similar to Pump.fun, users can easily create AI Agents and associated tokens. These Agents seamlessly integrate with social platforms like Twitter, Telegram, and Discord, enabling automated user interactions.

Dasha, an AI Agent created via vvaifu.fun, operates its own Twitter account, Telegram channel, and Discord community—all managed entirely by AI.

Top Hat

Top Hat interacts with users via text and also understands and processes images. Upon receiving an image, the AI Agent can “understand” its content and respond accordingly.

Griffain

A platform featuring trainable AI Agents, Griffain has already released 1,000 such agents, showcasing the future potential of smart contracts and automated trading.

About BlockBooster: BlockBooster is an Asia-based Web3 venture studio supported by OKX Ventures and other top-tier institutions, committed to being a trusted partner for outstanding founders. Through strategic investments and deep incubation, we connect Web3 projects with the real world, empowering high-potential startups to grow.

Disclaimer: This article/blog is for informational purposes only and reflects the author’s personal views, not necessarily those of BlockBooster. It is not intended to provide: (i) investment advice or recommendations; (ii) offers or solicitations to buy, sell, or hold digital assets; or (iii) financial, accounting, legal, or tax advice. Holding digital assets—including stablecoins and NFTs—carries high risk, with significant price volatility and the potential for total loss. You should carefully consider whether trading or holding digital assets is suitable for your financial situation. For specific questions, please consult your legal, tax, or investment advisor. Information provided herein (including market data and statistics, if any) is for general reference only. Reasonable care has been taken in preparing such data and charts, but no responsibility is accepted for any factual errors or omissions.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News