AI Agent × Crypto: Is the Revolutionary Moment for the Cryptocurrency World Here?

TechFlow Selected TechFlow Selected

AI Agent × Crypto: Is the Revolutionary Moment for the Cryptocurrency World Here?

Current AI Agents have attracted capital attention, sustained broad narrative热度, prominent examples of wealth effects, and long-term practical value for continuous development.

Author: Icefrog

AI Agents have caught fire in the crypto world, and it's evident they're on the verge of exploding. Faced with massive wealth effects, they've been shaped into a revolutionary variable—red-hot and unmatched in popularity. Yet, "revolutionary" is a highly inflated term in crypto; scattered across countless whitepapers and social media posts, such rhetoric hardly sparks passion among seasoned veterans anymore. The rise and fall of numerous tokens in crypto history prove that only a handful of new narratives have truly driven major bull markets, while most were merely fleeting.

Thus, we must go further to explore a classic question in the crypto space: xxx, will this time be different? Everyone has their own answer, but if we look back at history, at least the fundamental conclusion to this question won't change much.

That is: the crypto world operates on attention economics. How far a new narrative goes depends entirely on how widely user attention and network effects can spread. Even Bitcoin isn't immune to this core rule.

Naturally, to dissect this issue, we must start from the source and seek answers there.

1. What Is an AI Agent?

An AI Agent refers to an Artificial Intelligence Agent. A relatively well-known and commonly used concept today is that an AI Agent is an intelligent entity capable of perceiving its environment, making decisions, and executing actions. It primarily relies on LLMs (Large Language Models)—in other words, it serves as the functional carrier for large language models. Interestingly, while intuitively it represents a concrete application of LLMs, the naming as "Agent" emphasizes autonomy—the delegation of independent decision-making, action, and corresponding capabilities.

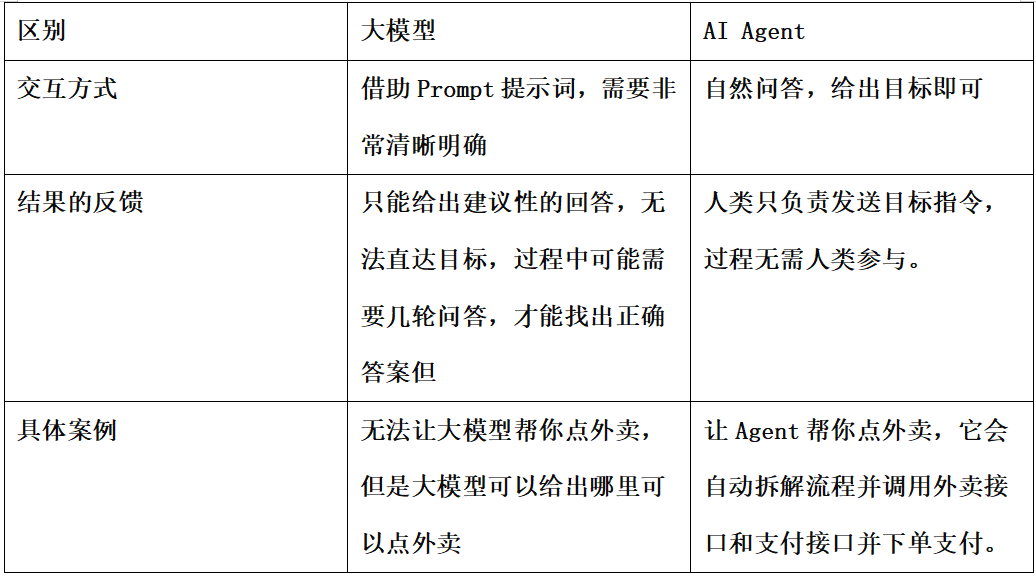

In terms of definitional distinction, although there’s a sequential relationship between AI Agents and large models, interaction between humans and large models requires specific tasks delivered via prompts before generating answers. An AI Agent, however, only needs a goal defined by a human; the Agent then autonomously breaks down execution steps, generates its own prompts, and achieves the objective.

In terms of human-AI collaboration, the Agent model represents a relatively advanced mode of cooperation—comparable to early Siri → Microsoft Copilot → AI Agent. From this progression, we can clearly see that fundamentally, an AI Agent is a digital representation of human thought and behavior patterns. Therefore, its architecture mainly consists of: a Q&A interface + fully automated workflows (perception, decision-making, action) + knowledge base (the human hippocampus). The AI handles the vast majority of the work, going beyond mere assistance.

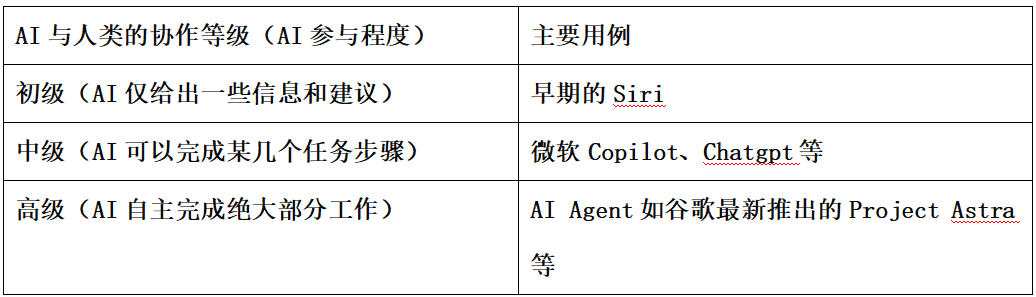

From a technical framework perspective, Lilian Weng, former Chief Safety Researcher at OpenAI, wrote a dedicated blog post in June 2023 titled “LLM Powered Autonomous Agents,” outlining the structure as follows:

In this article, Lilian Weng proposed the foundational AI Agent framework = LLM + Planning + Memory + Tool Use, where the large model functions like the human brain’s reasoning and planning center.

Overall, an AI Agent is an independent computational entity that leverages the LLM’s reasoning and planning abilities, combined with environmental perception, tool usage, and action execution, enabling AI to act as a human proxy and complete a series of relatively complex tasks.

2. How Is the AI Agent Industry Progressing?

Since 2023, AI Agents have entered the industry's spotlight, with discussions and advancements accelerating steadily. Most major tech companies regard 2025 as a pivotal year for commercial breakthroughs in AI Agents, signaling the industry is entering a phase of accelerated development.

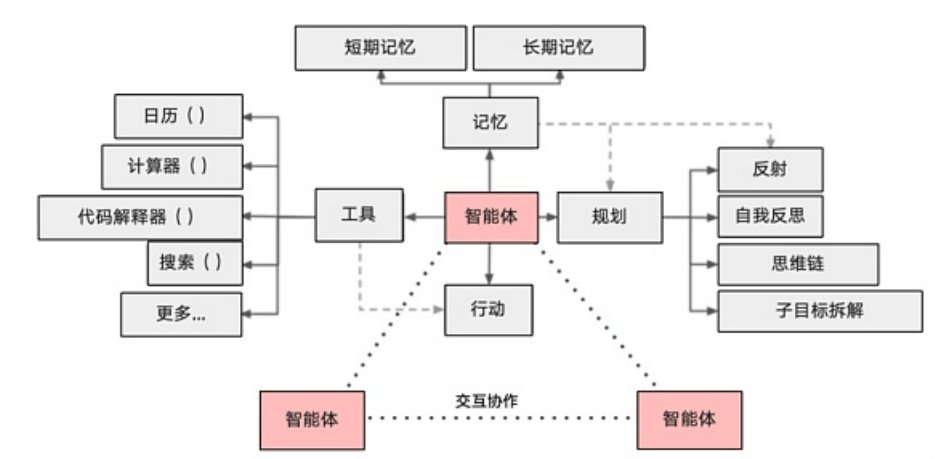

From a holistic industrial chain perspective, upstream remains dominated by computing power and hardware suppliers like NVIDIA, data providers, and foundational technology developers including algorithm and large model creators. Midstream focuses on AI Agent integrators, while downstream encompasses vertical applications across various industries or general-purpose Agents.

Currently, excluding existing upstream infrastructure, the AI Agent industry is primarily concentrated in mid- and downstream segments, especially downstream applications which are already showing a flourishing diversity.

Moreover, downstream development shows varying progress between consumer (C-end) and enterprise (B-end) adoption. C-end users benefit from significantly improved user experience through AI Agents, while B-end implementations achieve substantial cost reduction and efficiency gains.

Looking at moves by major players, AI Agent initiatives began accelerating in the second half of this year, with expectations for broader acceleration next year:

-

This month, Google launched Gemini 2.0, explicitly emphasizing the model's design for AI Agents, and also unveiled three AI Agent products: Project Astra (general-purpose), Project Mariner (browser automation), and Jules (programming).

-

In late October, Microsoft introduced 10 AI Agents on its Dynamics 365 platform.

-

Amazon announced this month it will open an AI lab in San Francisco focused on realizing AI Agents.

-

OpenAI kicked off a 12-day consecutive product rollout this month. Sam Altman himself declared next year will mark the mainstream arrival of AI Agents. Although OpenAI hasn’t released a standalone AI Agent product yet, it has rolled out a suite of tools supporting Agent development at the foundational level.

Whether judging by big tech moves or overall industry vitality, AI Agents are indeed entering an acceleration phase. Their integration into crypto is inevitable—it's just a matter of time—but everything is still very early.

3. Where Does AI Agent Meet Crypto? The Real Anchor Points

Fast forward a few months ago—Andy Ayrey, creator of the Truth of Terminal model, probably never imagined that an experimental AI Agent prototype would create a stunning wealth miracle in the crypto world. Its衍生 concept GOATSE became a crypto sensation, with the meme token GOAT surging to $20 million market cap within half a day, nearly $300 million in four days, and surpassing $1 billion within a month—a thousandfold gain reappearing once again. AI Agent entered the crypto realm in a distinctly *crypto* way, igniting a seismic wave of excitement.

Shortly after, Ai16Z—an AI Agent-driven venture fund—gained rapid popularity under the banner of an "AI-powered DAO," boosted by support from Marc Andreessen, co-founder of traditional powerhouse A16z, skyrocketing over tenfold in just days. Then another AI project, ACT, listed on Binance, pushed AI Agents to new heights—not only amplifying market noise to unprecedented levels but also deeply impressing the wider crypto community with the sector’s wealth-generating potential.

The first two sections of this article spent considerable space clarifying what exactly an AI Agent is and how the industry is developing. This is critically important because the origin of AI does not lie in the crypto world. More broadly speaking, crypto is not the primary battlefield for AI. If AI Agent fails to gain traction in the broader landscape, attention toward it will quickly fade, and its narrative will become just another flash in the pan, like so many before it.

Yet this time, visibly, things are different. Here’s why:

-

The broader AI ecosystem has not yet entered a phase of bubble deflation. Companies like NVIDIA, Microsoft, and Google all simultaneously increased capital expenditure forecasts for 2025 in their Q3 reports. The top four tech giants alone plan to invest over $170 billion next year—with one singular focus: AI.

-

While no breakout product akin to ChatGPT has emerged yet in the AI Agent space, both corporate initiatives and industrial momentum show clear upward trajectories in activity and funding. There's a real chance a market-defining AI Agent could emerge by 2025.

-

Given these two points, AI and AI Agents will remain among the top-tier topics commanding public attention from a broad technological standpoint. As mentioned earlier, in crypto, attention is everything.

-

From a technical architecture standpoint, the convergence of AI Agents and crypto could yield breakthroughs comparable to the birth of Ethereum smart contracts—not just technological enhancement, but potentially a paradigm-shifting economic transformation, as it may fundamentally alter the mechanics of attention economy creation.

One of blockchain’s biggest hurdles to mass adoption lies in its operational complexity and high entry barriers. Beyond compliance issues around fiat on/off ramps, activities like interacting with chains and managing wallets are several times more complicated than Web2 equivalents. With AI Agents using natural language interfaces, simple commands could manage wallets, identify optimal DeFi investments, perform cross-chain operations, and automatically execute trading strategies based on external market conditions. This wouldn’t just drastically simplify operations—it would reduce learning curves for new users by several orders of magnitude.

Beyond that, Agent participation could extend to creator economies, sentiment monitoring, smart contract audits, governance voting, AI-run DAOs, even meme token issuance. Under predefined conditions, they might operate more diligently and fairly than most humans, free from emotional bias.

From a narrative logic perspective, AI + Crypto creates a powerful synergy: AI makes trustworthy blockchains smarter, while blockchains make intelligent AI more trustworthy.

Blockchain’s hallmark is immutable data, whereas one of AI’s key weaknesses is poor data quality. If AI Agents can be trained on on-chain data and leverage decentralized compute resources, they could fundamentally reshape current incentive models.

In the longer term, perhaps not too far off, every crypto user might have a digital twin—an AI Agent managing their token assets, social interactions, and more. Every project team could deploy multiple AI Agents to handle operations ranging from asset issuance, marketing, code development, contract auditing, media management, even designing and distributing airdrops—all powered by AI.

These long-term transformations will shift the very mode of attention generation—from large communities of people to networks of AI Agents.

Of course, these ideas remain visionary projections. In reality, AI Agents in blockchain are still in an early, wild frontier stage. Beyond the explosive popularity of AI memes, the field remains more speculative than builder-focused. Currently, no true AI Agent framework exists that genuinely leverages blockchain-specific features. Even pioneers like ELIZA remain limited to conversational functionality, never penetrating the core of the blockchain ecosystem.

At each of the three AI Agent layers—perception, decision-making, and execution—we need to rebuild systematic, foundational infrastructure grounded in decentralization and smart contract capabilities. Not to mention the myriad tools, platforms, data privacy safeguards, and transaction security measures required. The good news is that top-tier investors like A16z are paying close attention to AI Agents, the broader global narrative around AI Agents continues to heat up, and the astonishing wealth effects demonstrated by AI memes provide solid ground for growth within crypto.

Within crypto’s attention economy, today’s AI Agent landscape enjoys investor interest, sustained narrative热度, proven wealth-effect case studies, and tangible long-term utility.

Perhaps, we can dare to say it this time—truly, it’s different!

Passion!

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News