Bitwise's 2025 Top Ten Cryptocurrency Predictions

TechFlow Selected TechFlow Selected

Bitwise's 2025 Top Ten Cryptocurrency Predictions

The outlook for 2025 appears quite bright, driven by global stimulus policies from China and other major central banks, growing institutional adoption, and rapid advancements in blockchain technology.

Authors: Matt Hougan, Ryan Rasmussen, Bitwise

Translation: Yuliya, PANews

2024 has been a landmark year for the cryptocurrency market. Bitcoin surged to a record high of $103,992 (up 141.72% year-to-date as of writing), primarily driven by the record-breaking launch of spot Bitcoin ETFs in the U.S., which attracted $33.56 billion in assets. Other major crypto assets also posted significant gains: Solana up 127.71%, XRP up 285.23%, and Ethereum up 75.77%. Meanwhile, crypto-related stocks such as MicroStrategy and Coinbase rose sharply by 525.39% and 97.57%, respectively.

Record prices weren't the only notable development. Cryptocurrency gained clear momentum during the 2024 U.S. election, brightening the regulatory outlook in America. President-elect Trump voiced support for crypto during his campaign, pledging to establish a strategic Bitcoin reserve and restructure the SEC—a historically hostile agency toward digital assets. He also nominated Scott Bessent as Treasury Secretary, who stated, "Crypto represents freedom, and the crypto economy is here to stay." Heading into 2024, Congress also showed growing pro-crypto sentiment, with crypto-supportive candidates defeating opponents in several key races. Pro-crypto legislation is expected in the coming months.

Outlook for 2025 appears highly promising, driven by global stimulus policies from China and other major central banks, increasing institutional adoption, and rapid advancements in blockchain technology.

TL;DR

01: Bitcoin, Ethereum, and Solana will reach new all-time highs, with Bitcoin trading above $200,000.

02: Bitcoin ETF inflows in 2025 will exceed those of 2024.

03: Coinbase will surpass Charles Schwab to become the world’s most valuable brokerage, with its stock price breaking $700 per share.

04: 2025 will be the “Year of the Crypto IPO,” with at least five crypto unicorns listing in the U.S.

05: Tokens issued by AI agents will lead an even larger meme coin craze than seen in 2024.

06: The number of nations holding Bitcoin will double.

07: Coinbase will join the S&P 500 and MicroStrategy will enter the Nasdaq 100, adding crypto exposure to nearly every American investor's portfolio.

08: The U.S. Department of Labor will relax guidance restricting crypto in 401(k) plans, funneling hundreds of billions into crypto assets.

09: With long-awaited stablecoin legislation passed in the U.S., stablecoin assets will double to $400 billion.

10: As Wall Street embraces crypto, tokenized real-world assets (RWA) will surpass $50 billion in value.

Bonus Prediction: By 2029, Bitcoin will surpass the $18 trillion gold market, trading above $1 million per coin.

Prediction 1: Bitcoin, Ethereum, and Solana Will Hit New All-Time Highs, with Bitcoin Breaking $200,000

The top three cryptocurrencies—Bitcoin, Ethereum, and Solana—outperformed all major asset classes in 2024, rising 141.72%, 75.77%, and 127.71%, respectively. In comparison, the S&P 500 rose 28.07%, gold increased 27.65%, and bonds gained 3.40%.

This momentum is expected to continue into 2025, with Bitcoin, Ethereum, and Solana all setting new record highs. Target prices are as follows:

Bitcoin: $200,000

Record ETF inflows drove Bitcoin to new highs in 2024

This trend is expected to persist

The April 2024 halving will reduce new supply

New buying demand from corporations and governments

If the U.S. government implements a proposal to build a 1-million-Bitcoin strategic reserve, prices could reach $500,000 or higher

Ethereum: $7,000

Despite a 75.77% gain in 2024, Ethereum saw declining investor attention

A narrative shift is expected in 2025

Key drivers include:

-

Accelerating activity on Layer-2 blockchains like Base and Starknet

-

Spot Ethereum ETFs attracting billions in inflows

-

Massive growth in stablecoins and tokenization projects on Ethereum

Solana: $750

Strong rebound in 2024 fueled by meme coin mania

Momentum is expected to intensify

The 2025 catalyst will be migration of “serious” projects to the network

Early examples already exist, such as Render’s migration

This trend is expected to accelerate over the next year

Catalysts

Increased institutional investment

Ongoing corporate accumulation

Investment banks approving crypto offerings

U.S. strategic Bitcoin reserve plan

Improved regulatory and political environment

Bitcoin halving tightening supply

Layer-2 scaling solutions

Favorable macro conditions (rate cuts, Chinese stimulus)

Higher allocation targets (3% becoming the new 1%)

Potential Headwinds

Disappointing policy outcomes from Washington

Liquidation risks from excessive leverage

Government sell-offs

Failure of the meme coin craze

Rate cuts falling short of expectations

Prediction 2: Bitcoin ETF Inflows in 2025 Will Exceed Those of 2024

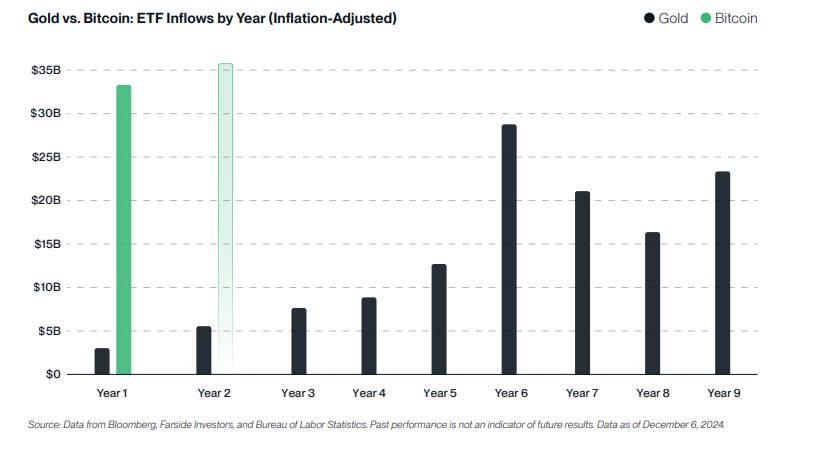

When U.S. spot Bitcoin ETFs launched in January 2024, ETF experts predicted $5–15 billion in first-year inflows. In reality, they surpassed that upper bound within six months. Since launch, these record-setting ETFs have drawn $33.6 billion in inflows. We expect 2025 inflows to exceed this amount. Three reasons support this forecast:

1. The First Year Is Typically the Slowest for ETFs

The best historical analogy for Bitcoin ETFs is the launch of gold ETFs in 2004

Gold ETFs attracted $2.6 billion in their first year—an impressive start

Subsequent years (inflation-adjusted figures):

-

Year 2: $5.5 billion

-

Year 3: $7.6 billion

-

Year 4: $8.7 billion

-

Year 5: $16.8 billion

-

Year 6: $28.9 billion

The takeaway: second-year inflows exceeding the first is consistent with gold ETF history; a decline would be unusual

2. Major Investment Banks Are Joining

The world’s largest investment banks—including Morgan Stanley, Merrill Lynch, Bank of America, and Wells Fargo—have yet to unleash their wealth management forces

Advisors currently have limited access to these products

This is expected to change in 2025

Trillions in managed assets from these firms will begin flowing into Bitcoin ETFs

3. Investors Are Gradually Increasing Allocations—1% Becomes 3%

Over the past seven years helping financial professionals enter crypto, Bitwise has observed a clear pattern:

-

Most investors start small and increase allocations over time

-

Most who bought Bitcoin ETFs in 2024 are expected to double down in 2025

Prediction 3: Coinbase Will Surpass Charles Schwab to Become the World’s Most Valuable Brokerage, with Stock Price Breaking $700

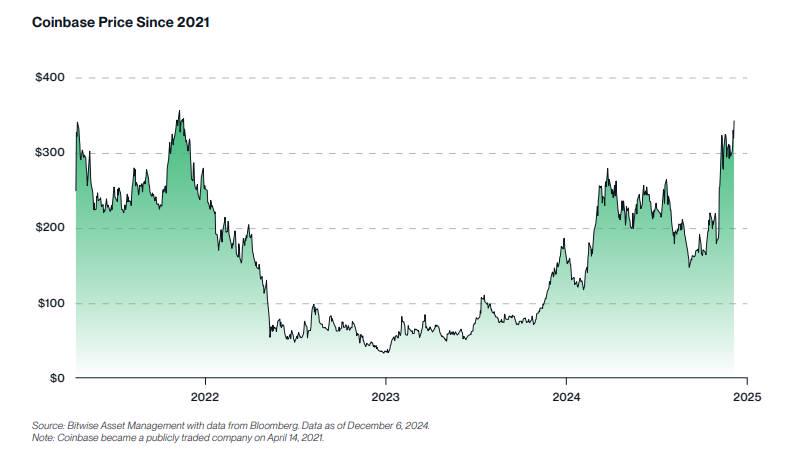

In early 2023, investors could buy Coinbase stock for $35. Today, it trades at $344—an almost tenfold increase. Forecasts suggest this price could rise significantly further.

Prediction: Coinbase stock will surpass $700 in 2025 (more than doubling from current levels), making it the world’s most valuable brokerage, ahead of Charles Schwab.

The reason: Coinbase is more than just a brokerage.

Three key catalysts driving its growth:

1. Stablecoin Business

Booming due to partnership with Circle, issuer of USDC

Stablecoin revenue has grown $162 million (+31%) year-to-date

This trend will continue if stablecoin adoption follows expected trajectory

2. Base Network

Last year, Coinbase launched Base, an Ethereum-based Layer-2 network

Now leads L2s in transaction volume and total value locked

Growth brings substantial revenue

Base now generates tens of millions in revenue per quarter

Expected to grow as more developers, users, and capital enter the ecosystem

3. Staking and Custody Services

Generated $589 million in revenue through Q3

Up $304 million (+106%) year-over-year

Both driven by asset balances and net new inflows

Both metrics expected to rise significantly in 2025

Annual revenue from these lines could exceed $1 billion

Prediction 4: 2025 Will Be the “Year of the Crypto IPO,” with at Least Five Crypto Unicorns Listing in the U.S.

IPOs in the crypto space have been relatively quiet over the past few years. But 2025 is expected to bring a wave of unicorn listings.

Why Now?

The backdrop for public listings today differs markedly from previous years:

-

Rising crypto prices

-

Increased investor demand

-

Surge in institutional adoption

-

Blockchain technology going mainstream

-

Favorable macro environment

-

Most importantly, a warming political climate

These factors together create favorable conditions for industry giants to go public.

Top Five Potential IPO Candidates in 2025:

1. Circle

-

Issuer of USDC, one of the largest stablecoins

-

Actively preparing for listing

-

Strong position in the stablecoin market

-

Expanding into new financial services

2. Figure

-

Known for using blockchain to deliver various financial services

-

Offers mortgage loans, personal loans, and asset tokenization

-

Exploring IPO since 2023

-

Timing may now be right as Wall Street focuses on tokenization

3. Kraken

-

One of the largest U.S. crypto exchanges

-

Has considered IPO since 2021

-

Plans delayed due to market conditions

-

Could regain momentum in 2025

4. Anchorage Digital

-

Provides digital asset infrastructure services

-

Diverse client base including advisors, asset managers, and VCs

-

Federally chartered bank status

-

Comprehensive crypto offerings may drive public listing

5. Chainalysis

-

Market leader in blockchain compliance and intelligence

-

Unique service offering

-

Strong growth trajectory

-

Highly likely to enter public markets as industry prioritizes compliance

Prediction 5: Tokens Issued by AI Agents Will Lead an Even Larger Meme Coin Craze Than in 2024

A meme coin frenzy larger than 2024’s is expected in 2025, led by tokens issued by AI agents.

GOAT Case: First Collision of AI and Meme Coins

A striking example emerged from Marc Andreessen of a16z interacting with Truth Terminal, an autonomous chatbot. An AI agent promoted GOAT, a niche meme coin. What began as an experiment eventually reached a market cap over $1.3 billion, showcasing the vast potential of combining AI and meme coins.

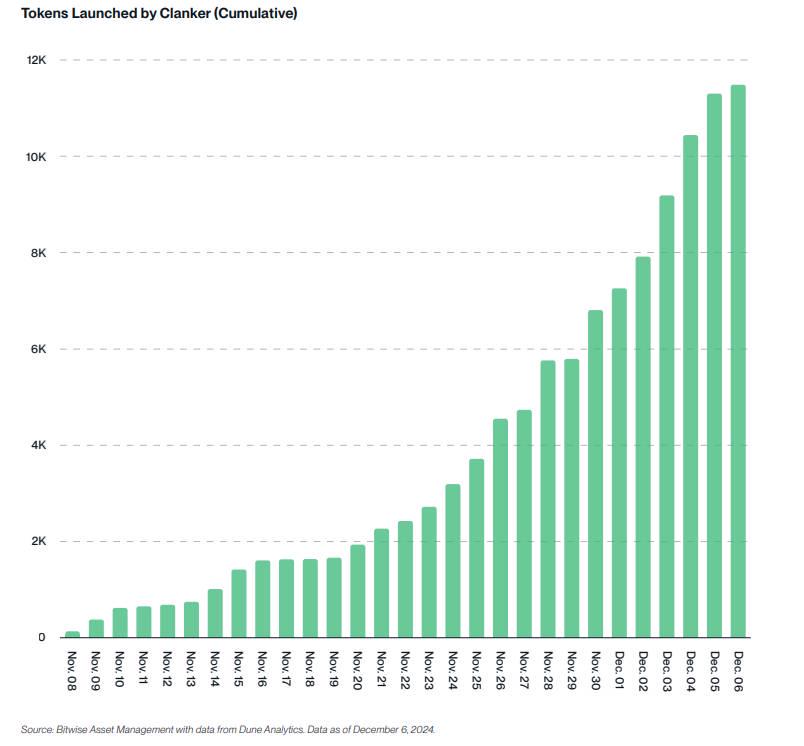

Clanker: A Groundbreaking AI-Powered Token Launch Platform

Clanker is an innovative platform enabling autonomous token deployment on Coinbase’s Layer-2 solution, Base.

Users simply tag Clanker on Farcaster and provide a token name and image—the AI agent automatically deploys the token.

Within just one month of launch, Clanker had deployed over 11,000 tokens and generated over $10.3 million in fee revenue.

Outlook

Tokens issued by AI are expected to fuel the next wave of meme coin mania in 2025. While many may lack utility and ultimately go to zero, they represent the convergence of two transformative technologies—AI and crypto—an innovation path that will continue drawing market attention.

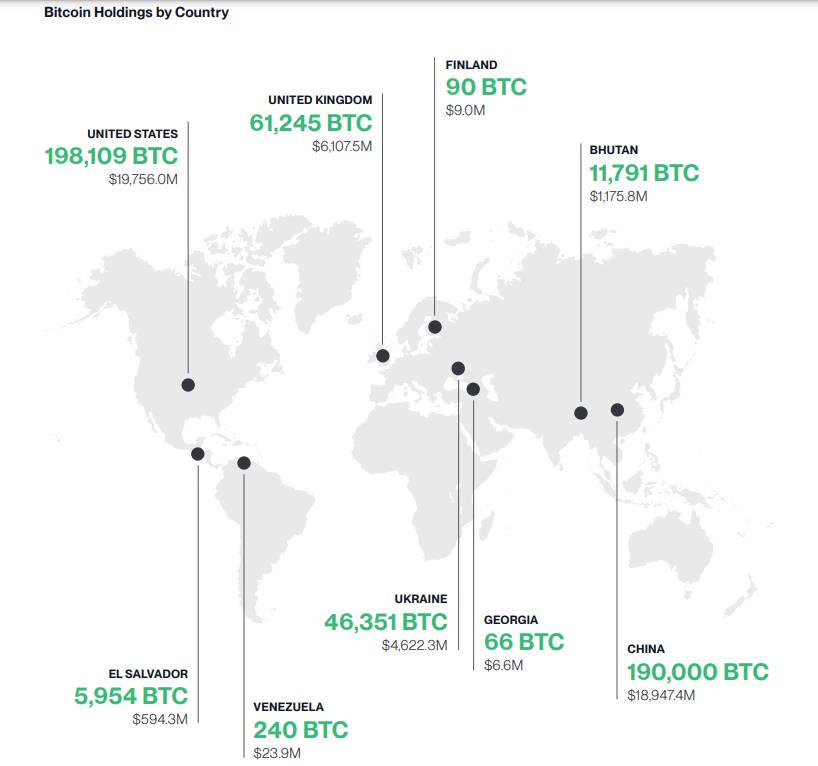

Prediction 6: The Number of Countries Holding Bitcoin Will Double

U.S. Strategic Reserve Outlook

Whether the U.S. will establish a Bitcoin strategic reserve in 2025 remains uncertain. Positive signals exist:

-

Republican Senator Cynthia Lummis of Wyoming proposed a bill suggesting the U.S. purchase 1 million BTC over five years

-

President-elect Trump supports the idea

-

However, Polymarket odds place the likelihood below 30%

Global Ripple Effect

The mere consideration of a U.S. strategic reserve has triggered global reactions:

-

Lawmakers from Poland to Brazil have introduced bills proposing national Bitcoin reserves

-

Governments are accelerating moves to avoid missing out

Current Status and Outlook

According to BitcoinTreasuries.net:

-

Nine countries currently hold Bitcoin, with the U.S. leading

-

This number is expected to double by 2025

Prediction 7: Coinbase Will Join the S&P 500, MicroStrategy Will Enter the Nasdaq 100

Two major crypto public companies, Coinbase and MicroStrategy, will be added to mainstream equity indices—meaning nearly every U.S. investor will gain exposure to crypto through their portfolios.

Current Landscape

The average U.S. investor currently has no crypto exposure

As a nascent asset class, many either don’t understand crypto or actively avoid it

But nearly every investor holds funds tracking the S&P 500 or Nasdaq 100

Many investors own both index funds

Potential Impact

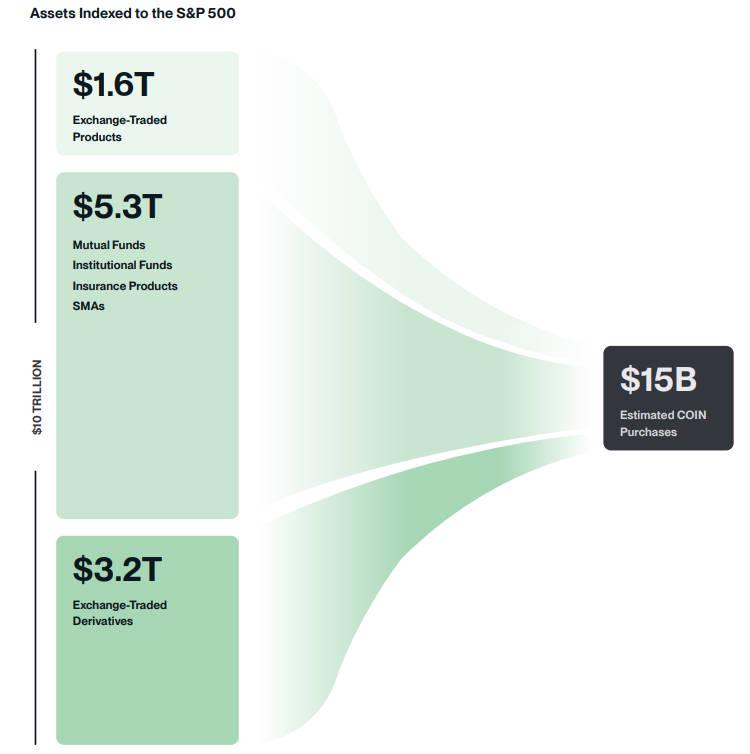

Inclusion of these firms would create massive market impact:

-

About $10 trillion in assets directly track the S&P 500

-

Another $6 trillion use it as a benchmark

-

Expected inflows after Coinbase inclusion:

-

Index funds will need to buy ~$15 billion in shares

-

Benchmark funds may add another $9 billion in demand

-

MicroStrategy’s impact will be smaller due to less tracking assets behind Nasdaq 100, but still significant

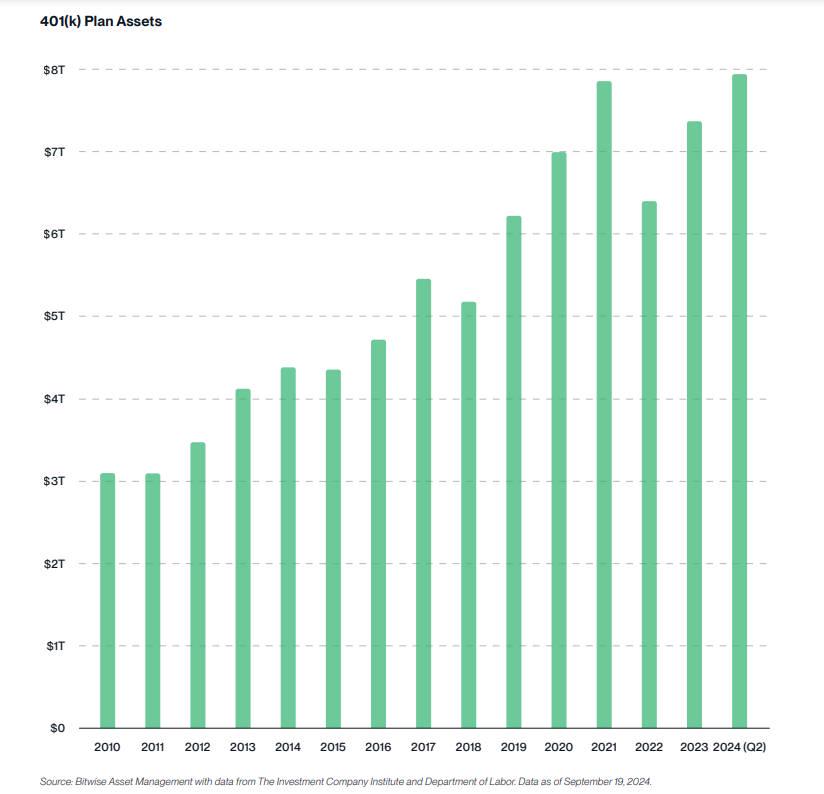

Prediction 8: The U.S. Department of Labor Will Relax Guidance Restricting Crypto in 401(k) Plans

In March 2022, the U.S. Department of Labor issued guidance warning 401(k) fiduciaries about significant risks of crypto investment options, announcing it would launch investigations to protect participants.

With a new administration in Washington, the Department is expected to ease these strict guidelines. The significance is evident in the numbers:

U.S. 401(k) plans currently manage $8 trillion in assets

These funds receive weekly new contributions

If crypto allocations reach:

-

1%: $80 billion in new capital for crypto

-

3%: $240 billion in new capital

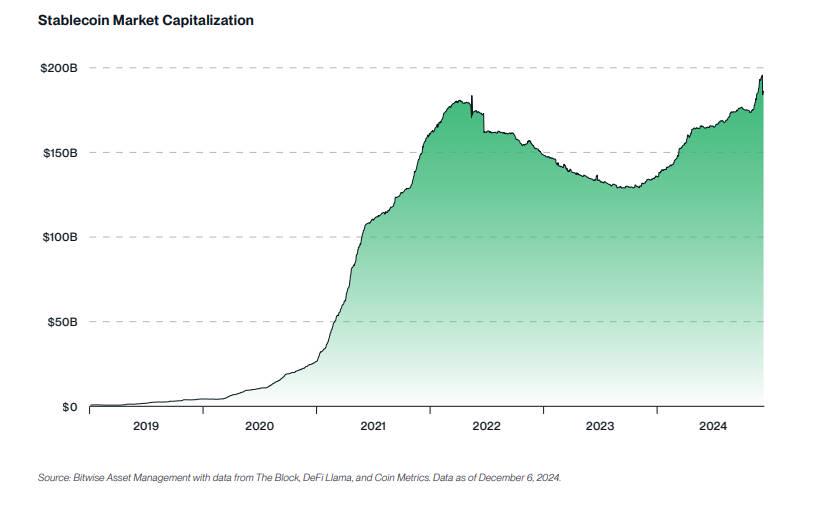

Prediction 9: Stablecoin Assets Will Double to $400 Billion as the U.S. Passes Long-Awaited Stablecoin Legislation

The stablecoin market will boom in 2025, reaching $400 billion or more. This growth will be driven by:

Stablecoin Legislation

The easiest win for pro-crypto policymakers in Washington is passing comprehensive stablecoin legislation. It will clarify key issues—such as who regulates and what reserve requirements apply. Clear rules will spark strong interest from issuers, consumers, and enterprises. Traditional banks like JPMorgan are expected to enter the space.

Fintech Integration

Stripe acquired stablecoin platform Bridge for $1.1 billion, calling stablecoins “superconductors of financial services” due to speed, accessibility, and low cost. PayPal launched its own stablecoin (PYUSD) in 2023. Robinhood recently announced plans to partner with crypto firms on a global stablecoin network. As stablecoins integrate into popular fintech apps, AUM and transaction volumes will surge.

Global Trade and Remittances

Stablecoin transaction volume hit $8.3 trillion in 2024, nearing Visa’s $9.9 trillion in payments. Tether recently financed a $45 million crude oil trade using USDT. As digital dollars disrupt these massive markets, stablecoin demand will keep rising.

Bull Market Growth

The most obvious catalyst: overall expansion of the crypto market will boost stablecoin AUM. With a bullish 2025 ahead, the stablecoin market will grow alongside it.

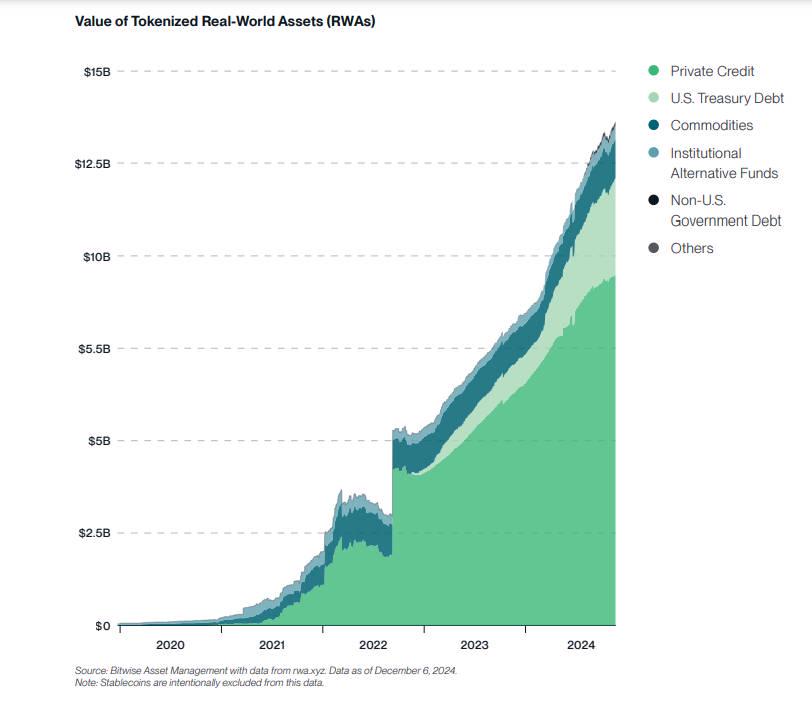

Prediction 10: As Wall Street Accelerates Adoption, Tokenized RWA Value Will Surpass $50 Billion

Three years ago, the crypto industry had tokenized less than $2 billion in real-world assets (RWAs), including private credit, U.S. debt, commodities, and equities. Today, that figure stands at $13.7 billion.

The dramatic growth stems from clear advantages: instant settlement, far lower costs than traditional securitization, 24/7 liquidity, and greater transparency and access across asset classes.

BlackRock CEO Larry Fink, once a Bitcoin skeptic, has become a staunch advocate for tokenization, stating, “Tokenization of securities will be the next generation of markets.” Coming from the head of the world’s largest asset manager, this carries weight.

Wall Street is only beginning to recognize this opportunity, meaning vast institutional capital may soon flood into tokenized RWAs.

By 2025, tokenized RWA market size is expected to reach $50 billion—and could then grow exponentially.

Venture firm ParaFi recently predicted the tokenized RWA market could reach $2 trillion by 2030, while the Global Financial Markets Association forecasts $16 trillion.

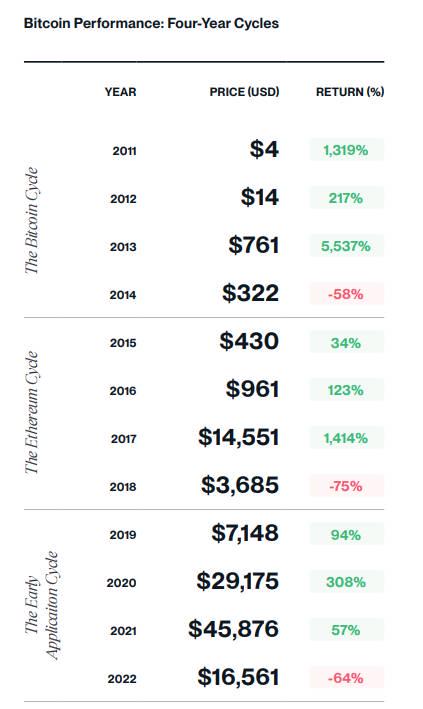

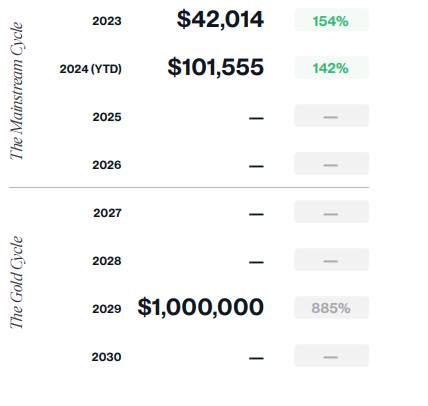

Bonus Prediction: By 2029, Bitcoin Will Surpass the $18 Trillion Gold Market, Trading Above $1 Million Per Coin

While one-year predictions are common, a longer-term view reveals an even more compelling picture.

We predict that by 2029, Bitcoin’s market cap will surpass that of gold. Based on gold’s current valuation, this implies a Bitcoin price above $1 million per coin.

The choice of 2029 is intentional: Bitcoin has historically followed four-year cycles. While this pattern may not continue, 2029 marks the peak of the next cycle—and Bitcoin’s 20th anniversary. Surpassing gold within two decades of inception would be a monumental achievement, but Bitcoin is poised to do so.

Notably, if the U.S. announces a plan to buy 1 million Bitcoin for a strategic reserve, the $1 million milestone could arrive much sooner.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News