Variant Fund Investment Partner: AI Agents Have Already Become "First-Class Citizens" of the On-Chain Economy

TechFlow Selected TechFlow Selected

Variant Fund Investment Partner: AI Agents Have Already Become "First-Class Citizens" of the On-Chain Economy

Whether for profit or面向普通用户, bots are gradually becoming priority users on the blockchain.

Author: Mason Nystrom

Translation: TechFlow

Bots are becoming core participants in the crypto economy.

Signs of this trend are everywhere. For instance, searchers deploy bots—such as Jaredfromsubway.eth—to exploit human users’ desire for convenience by frontrunning their decentralized exchange (DEX) trades. Tools like Banana Gun and Maestro allow users to conduct bot-powered trading via Telegram, consistently ranking among the top applications on Ethereum’s "gas consumption" leaderboard. Additionally, in emerging social applications such as FriendTech, bots quickly enter after initial adoption by humans and may inadvertently accelerate market speculation cycles, as seen here.

Overall, whether profit-driven (e.g., MEV bots, where MEV stands for "Maximal Extractable Value") or consumer-facing (e.g., Telegram-based bot toolkits), bots are increasingly becoming priority users on blockchains.

While today's crypto bots remain relatively simple, outside of crypto, bots have evolved into powerful AI agents powered by large language models (LLMs), aiming to autonomously handle complex tasks and make intelligent decisions.

Building these AI agents within crypto-native environments offers several key advantages:

-

Native Payments: AI agents can exist outside crypto, but enabling them to perform complex operations requires access to funds. Compared to traditional methods like bank accounts or Stripe, crypto payment systems offer greater efficiency in funding AI agents while avoiding common off-chain inefficiencies.

-

Wallet Ownership: By connecting wallets, AI agents can own digital assets such as NFTs or yield-bearing instruments, benefiting from crypto’s inherent digital property rights—crucial for asset transfers between agents.

-

Verifiable Deterministic Execution: Verifiability is essential when AI agents execute tasks. On-chain transactions are inherently deterministic—either completed or not—enabling AI agents to carry out tasks with high accuracy, a level of certainty difficult to achieve off-chain.

Of course, on-chain AI agents also face limitations.

A major constraint is that AI agents must execute logic off-chain to improve performance. This means computation and reasoning occur off-chain, while final decisions are executed on-chain to maintain verifiability. Additionally, AI agents can use zkML (zero-knowledge machine learning) providers like Modulus to verify the authenticity of their off-chain data inputs.

Another critical limitation is that an AI agent’s functionality depends on the richness of its toolset. For example, if you want an agent to summarize breaking news, it needs web crawling tools. If you want it to save results as PDFs, it needs file system access. To mimic your favorite Crypto Twitter influencer’s trades, it requires wallet access and key signing capabilities.

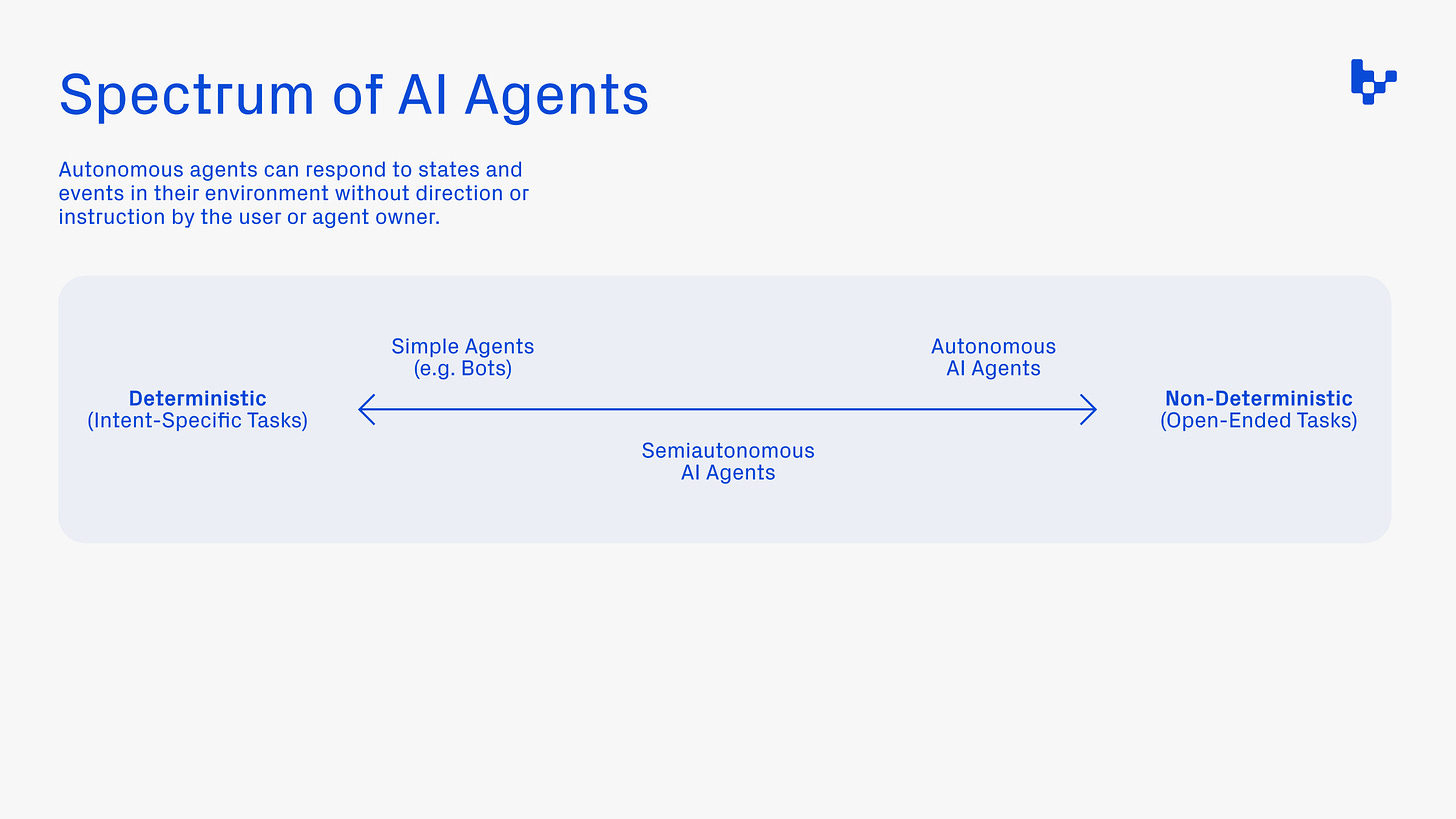

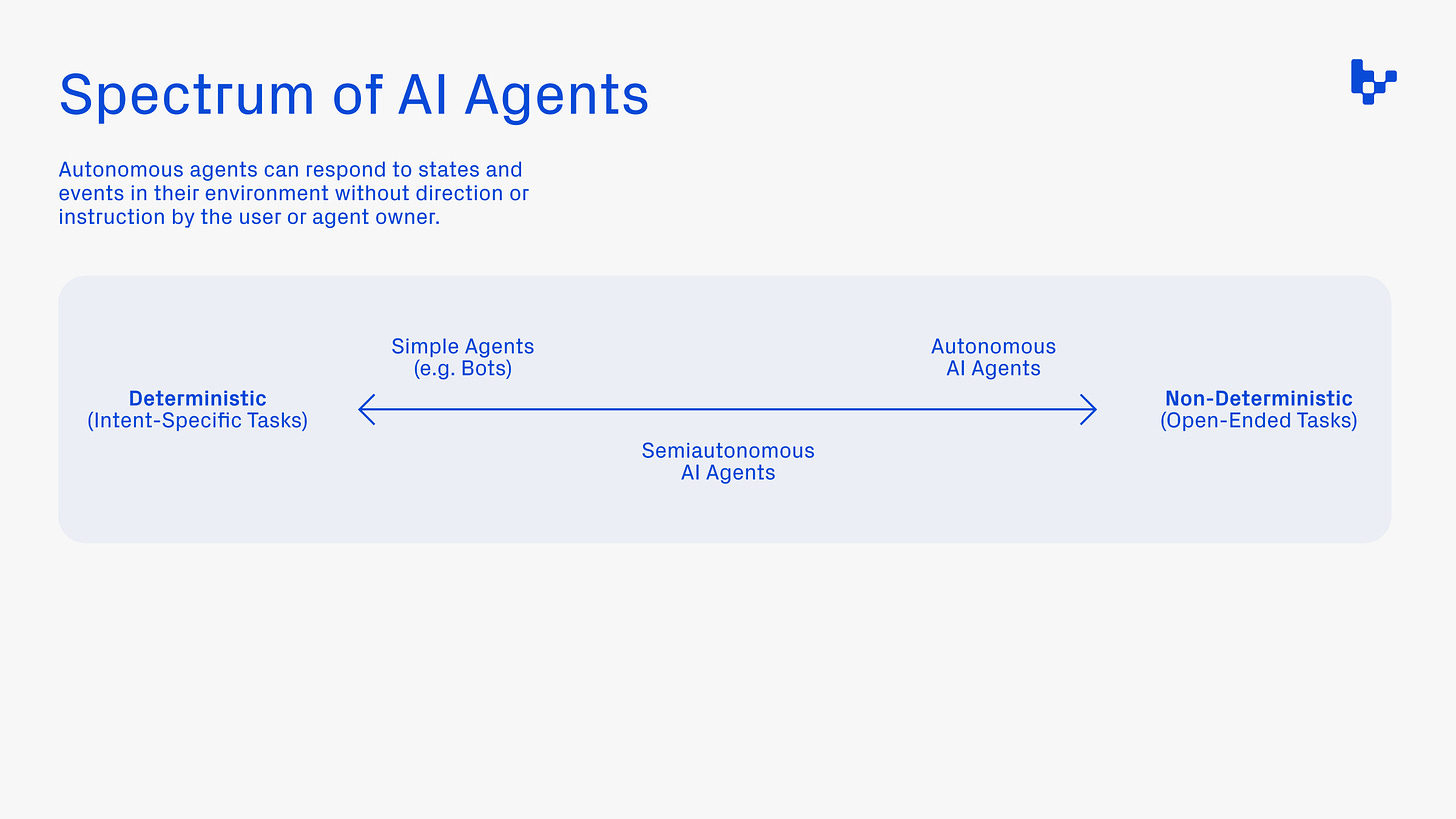

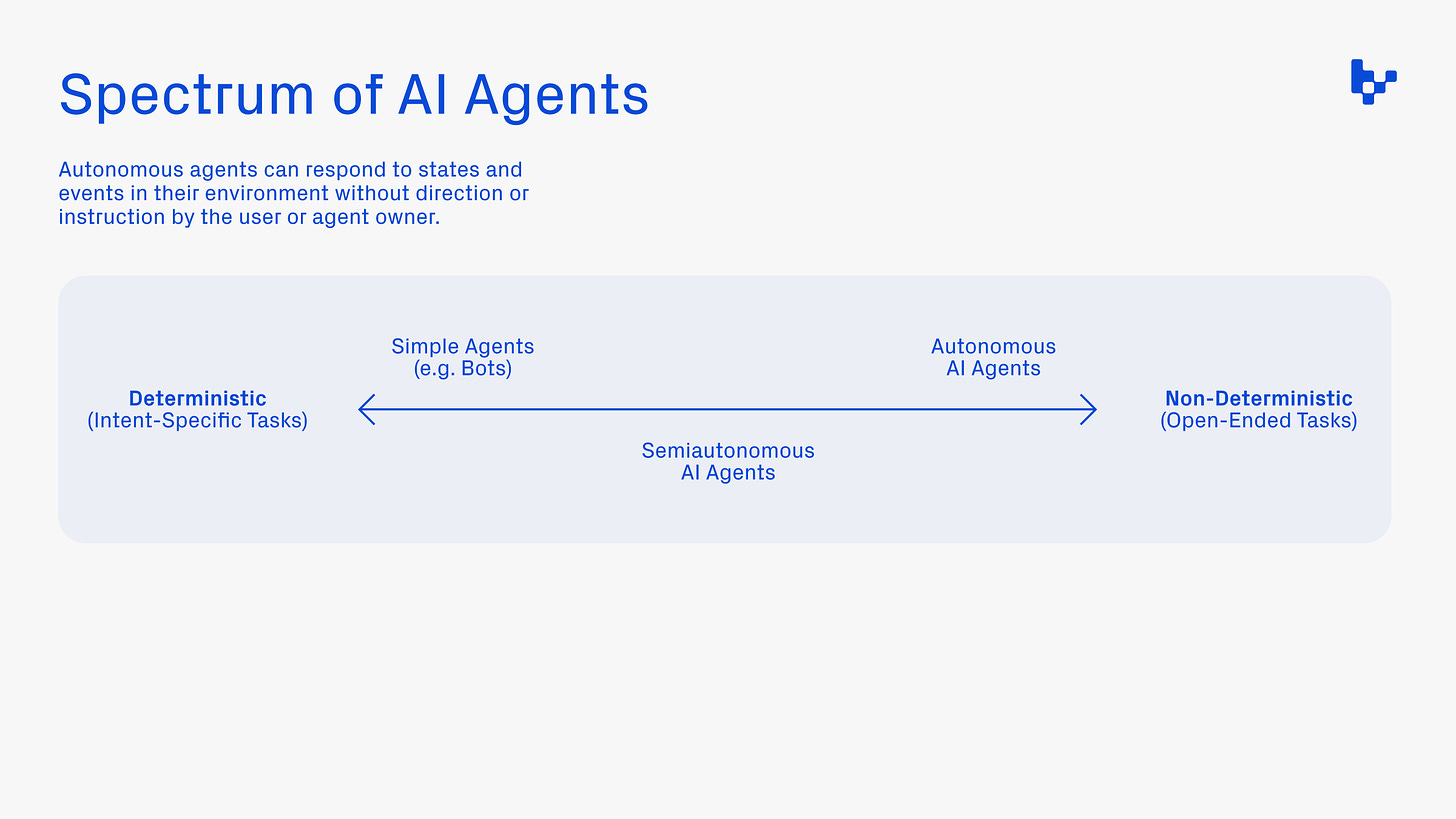

From a determinism perspective, most current crypto AI agents perform deterministic tasks—meaning humans have pre-defined both the task parameters and execution steps (e.g., specific token swap workflows).

Crypto AI agents evolved from early keeper bots, which are still widely used in DeFi and oracle services. Today, they’ve become far more sophisticated. They now leverage LLMs for autonomous creation (like Botto, a decentralized autonomous artist) and even provide financial services for themselves using platforms like Syndicate's trading cloud, as shown here. Early marketplaces for AI agents, such as Autonolas, are also beginning to emerge.

Currently, many cutting-edge applications demonstrate the potential of AI agents:

-

AI Assistants in Smart Wallets: Dawn’s DawnAI agent acts as a multi-functional assistant, helping users send transactions, complete on-chain actions, and deliver real-time insights such as trending analysis of popular NFTs.

-

AI Characters in Crypto Games: Parallel Alpha’s latest game, Colony, aims to create AI characters equipped with wallets capable of conducting on-chain transactions, adding deeper interactivity to gameplay.

-

Enhanced Capabilities for AI Agents: An AI agent’s power depends on its toolset, and blockchain interaction remains in early stages. Crypto AI agents need wallet functionality, fund management, permission controls, integrated AI models, and the ability to interact with other agents. Gnosis has demonstrated early infrastructure prototypes, such as their AI Mechs, which encapsulate AI scripts into smart contracts so anyone—including other bots—can call the contract to perform tasks (e.g., place bets in prediction markets) and compensate the agent accordingly.

-

Advanced AI Traders: DeFi super apps enable traders and speculators to operate more efficiently—for example: automatically dollar-cost averaging (DCA) when conditions are met; executing trades only when gas fees fall below a threshold; monitoring newly deployed meme token contracts; and intelligently selecting optimal routing paths without requiring manual user intervention.

-

Vertical-Specific AI Agents: While general-purpose models like ChatGPT work well for broad conversational use cases, AI agents require fine-tuning to meet industry-specific needs. Platforms like Bittensor incentivize developers to train specialized models focused on tasks such as image generation or predictive modeling, targeting industries including crypto, biotech, and academic research. Though Bittensor is still nascent, developers are already building applications and agents based on open-source LLMs.

-

AI NPCs in Consumer Apps: Non-player characters (NPCs) are common in MMORPGs but rare in consumer applications. However, due to the financial nature of crypto consumer apps, AI agents can serve as ideal participants in novel game mechanics. For example, Ritual, an open AI infrastructure company, recently launched Frenrug, an LLM-powered agent operating on the Friend.tech platform. It automatically executes trades (e.g., buying or selling keys) based on user messages. Users can try to persuade the agent to buy their key, sell someone else’s, or creatively influence how Frenrug uses its funds.

As more apps and protocols integrate AI agents, humans will increasingly rely on them as gateways into the crypto economy. Although today’s AI agents may seem like “toys,” they will soon significantly enhance everyday user experiences, become key stakeholders in blockchain protocols, and even form fully functional economic ecosystems among themselves.

AI agents are still in their infancy, but as core participants in the on-chain economy, they’ve only just begun to reveal their potential.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News