FMG Founder: 10 Insights from 10 Years in the Crypto Secondary Markets

TechFlow Selected TechFlow Selected

FMG Founder: 10 Insights from 10 Years in the Crypto Secondary Markets

In the midst of a frenzied bull market, mastering your mindset at critical moments becomes especially important.

Author: EO Hao, Founder of FMG

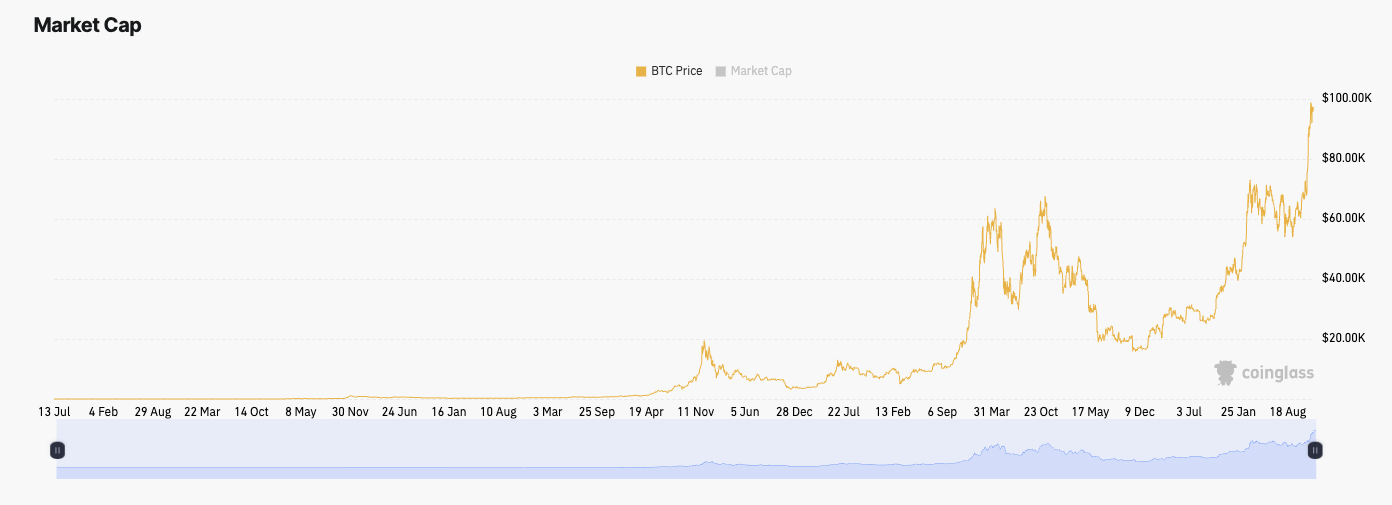

Hello everyone, I'm the founder of FMG. Today Bitcoin has broken through the $100,000 mark, and I'd like to share with you some core bull market principles distilled from experiencing multiple cycles.

1. Emotional Value

In the market, the most important asset is the emotional value you give yourself. Keep your energy high and your mindset strong—sleep well, exercise regularly, stay in good spirits, measure only against your past self, and ride the bull.

2. Recognize What Really Matters

The market has already risen sixfold from its 2023 bottom. If you're still fixated on fundamentals, unlock schedules, or FDV metrics instead of diving into the market and embracing risk, you'll completely miss this opportunity.

3. The Sad Truth: Reduced Volatility

With algorithmic trading and crowded gamma scalping strategies, BTC's price swings have been significantly dampened this cycle. Everyone knows how to accumulate and short. Profit protection should be removed and re-entered when opportunities arise. In such an environment, it's simply not as profitable as before.

This is precisely why memes are rising—the market craves more volatility. We believe a reversal in odds will come, where various sectors will explode. Then, eventually, the cycle will end and rest.

4. Use of Leverage

Leverage (via futures or margin) should be used for short durations. Off-exchange leverage, however, can be held long-term—MSTR is exactly this kind of player.

5. Navigating the Boom and Bust Within a Bull Market

We need a combination of strategy and disciplined risk management. Here’s how we structure our portfolio: Core Assets + Growth Assets + Cash Position + Speculative Assets.

Hold the first two firmly—don’t touch them. Only adjust the smallest portion—the speculative assets—if you really must act.

6. Understand Risk-Reward Ratio, Reduce Anxiety

Core assets offer stable returns, growth assets provide moderately high risk-reward, while speculative assets carry extremely high risk-reward.

If your friend says, "I bought a project that went up 5x," don't feel anxious—he merely invested in a low-quality speculative asset. Let me explain why.

7. Core Assets: Limited Downside, ~2x Upside

Core assets are those recognized by national treasuries, public companies, and financial institutions. Even non-experts instinctively know these are valuable—there’s only one name that fits. Your goal is to accumulate more and more core assets over time.

Don’t expect too much from core assets—don’t obsess over whether BTC will hit $200K or $500K. Just hold until market sentiment turns euphoric, then sell at whatever price prevails. Accept it calmly.

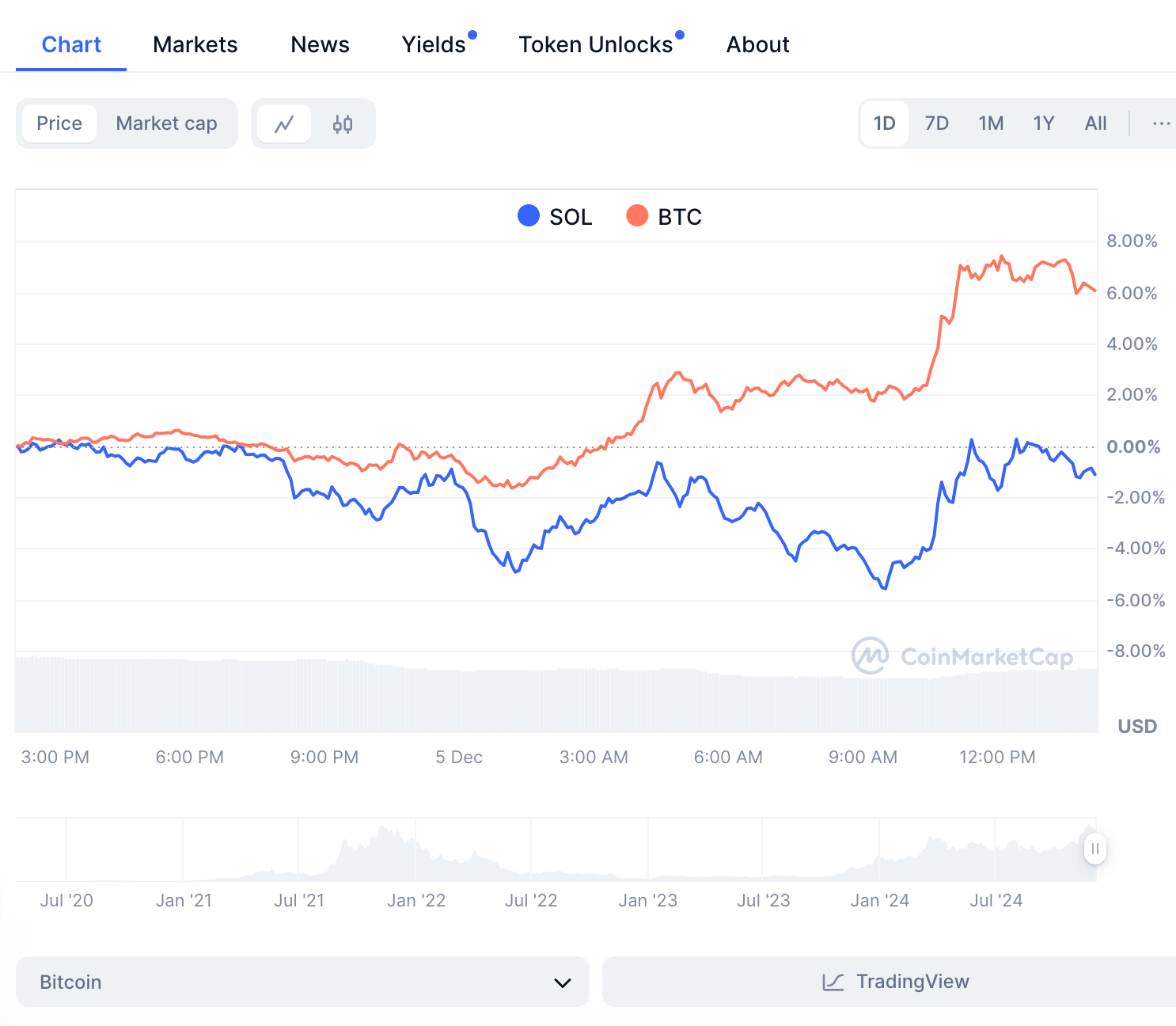

8. Growth Assets: 4–6x Returns, the Yao Ming Among Crowds

Growth assets aren’t officially endorsed by governments, but they’re supported by hedge funds, CEXs, and DeFi protocols, offering strong liquidity.

As Duan Yongping once described: How do you spot Yao Ming in a crowd? Most people might mistake someone who’s just 6'3" for him. But when Yao Ming walks in, the whole restaurant notices.

Growth assets typically fall within common understanding—not requiring technical expertise. They’re the names outsiders beyond crypto circles can recognize: Ethereum, Solana, Doge, BNB—all are “Yaos” among the crowd. If a novel project offers only slightly higher potential upside but far worse liquidity, it's better to skip it and stick with proven growth assets.

In a manic market, growth assets often deliver steady 4–6x or even higher returns.

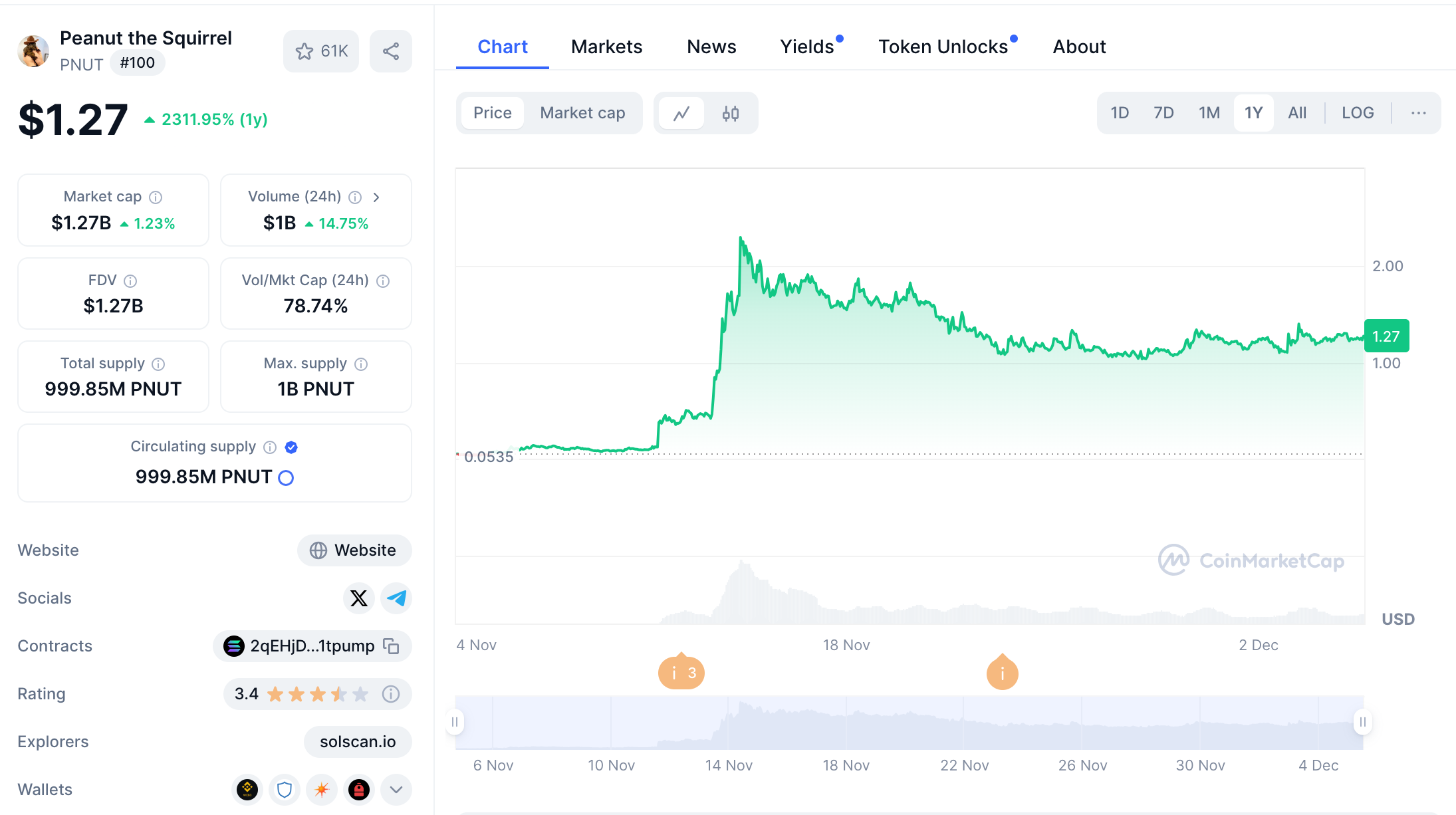

9. Speculative Assets: Must Aim for 10x or More

Speculative assets are for professional players only.

YC’s startup bible says: Deliver a 10x better user experience. Likewise, speculative assets must generate 10x returns to justify the risk taken.

So when your friend brags about his gains, ask yourself: Was this truly a quality speculation?

PNUT surged over 10x in 30 days

10. What Defines Successful Speculation?

Let me outline three key characteristics of speculative assets that can achieve 10x or even 100x returns:

First: The Strong Get Stronger – Dark Horses

Top 50 market cap projects have survived multiple cycles—achieving that status isn’t easy. A fast horse rarely surges overnight, but once it breaks into the top 50, hold tight. Network effects drive momentum—winner takes all.

Second: New Species

New species are things we’ve never seen before. Last cycle, AXS enabled Filipinos to earn money playing games. This cycle, AI Memes—an AI chatbot becomes a digital asset? We need scout-like capital to deploy early and learn through action. Get on board first, then figure it out.

Third: Obscure Gems and Undervaluation

The colder and more undervalued an asset, the lower it squats—and the higher it jumps.

Underrated niches are often as rare as pearls.

While everyone chases hot narratives, these overlooked gems get forgotten. One by one, positive news triggers rally the entire niche sector—low-cap tokens easily take off. Examples include POL, CRV, HNT, and others.

Conclusion

To sum up, speculative assets are extremely difficult. We invest in them using profits we've protected, hold patiently, and leave the rest to fate and time. Anyone obsessing over monthly absolute returns will fail here.

I believe investors who consistently allocate profits from BTC and growth assets into speculation—while maintaining discipline—are responsible, systematic alpha-seekers who truly understand capital management. That’s exactly what FMG stands for.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News