Bitcoin Breaks $100,000: A Top-Level Strategic Move

TechFlow Selected TechFlow Selected

Bitcoin Breaks $100,000: A Top-Level Strategic Move

Bitcoin's scarcity premium will be pushed to an entirely new level.

By: Big Dog

At 18:15:05 on January 3, 2009, Satoshi Nakamoto embedded the headline of that day’s front page of *The Times* into Bitcoin’s genesis block: “The Times 03/Jan/2009 Chancellor on brink of second bailout for banks.”

Who could have imagined that this digital asset born in the shadow of a financial crisis would break through the historic milestone of $100,000 on December 5, 2024, becoming a financial behemoth with a market capitalization nearing $2 trillion?

From being utterly worthless at inception, to someone spending 10,000 BTC on two pizzas in 2010; from early adopters celebrating when Bitcoin neared $10 in 2011, to its first surge past $10,000 in 2017 causing global sensation, and now to the approval of spot Bitcoin ETFs in 2024 and their listing on U.S. stock exchanges—this once-ridiculed “internet bubble” has become the coveted “digital gold” pursued by Wall Street giants like BlackRock and Fidelity.

Each transformation of Bitcoin astonishes us, reshaping our understanding of money, value, and wealth.

So here's the question: Do you hold Bitcoin? Have you held onto your Bitcoin?

Recently, many traders and professionals in the crypto industry have received messages like “Congratulations! You must be rich now!” At such moments, they can only awkwardly reply, “Not really, not really,” while others assume they're being modest—when in reality, they’re silently shedding tears.

Here are two painful yet surprising truths: This is a bull market uniquely dominated by Bitcoin, and most retail investors no longer hold it.

Why has Bitcoin stood out so dramatically in this cycle?

Top-Level Strategic Play

This is a top-level strategic play—one whose script was written long in advance.

Let’s go back to 4 a.m. on January 11, 2024, when the U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs, including BlackRock’s IBIT.

As Wang Chuan put it: “Looking back, the significance of January 10, 2024, in the history of global money might one day be compared to August 13, 1971 (when Nixon announced the dollar’s decoupling from gold), or January 18, 1871 (when Germany unified and led Europe and the U.S. into the gold standard system over the following years).”

The approval of spot ETFs opened the floodgates for institutional capital. From this point forward, Bitcoin became Bitcoin—and all other cryptocurrencies were left behind.

By November 21, within just ten months, Bitcoin ETFs had attracted a cumulative inflow of $100 billion—already equivalent to 82% of the size of U.S. gold ETFs, with overtaking within reach.

Bitcoin is no longer a retail-driven speculative market. It is increasingly dominated by traditional financial institutions. A scramble for Bitcoin holdings is underway among Wall Street firms, publicly traded companies worldwide, and even certain sovereign governments.

The most emblematic player in this battle is MicroStrategy (MSTR), a Nasdaq-listed company.

MSTR originally specialized in enterprise analytics software. In August 2020, under CEO Michael Saylor, the company announced it would spend $250 million to buy 21,454 BTC—making it the first public company to adopt a Bitcoin treasury strategy.

MSTR’s approach involves raising capital through stock and bond issuance, borrowing at around 1% interest to purchase Bitcoin. According to disclosures, MSTR has issued approximately 40 Bitcoin purchase announcements over the past four years.

As of December 5, MSTR holds over 402,100 BTC—about 1.5% of Bitcoin’s total supply—making it the largest publicly traded corporate holder globally. The company has spent a total of $23.483 billion acquiring Bitcoin, at an average cost of $58,402 per coin, resulting in unrealized gains exceeding $16.7 billion.

On November 20, MSTR’s share price briefly surpassed $500, pushing its market cap above $100 billion. Its trading volume even exceeded that of Nvidia—the Nasdaq leader—on that day. Compared to its pre-Bitcoin accumulation share price of around $12 in August 2020, it has appreciated more than 40-fold, making it one of the biggest winners in the U.S. stock market.

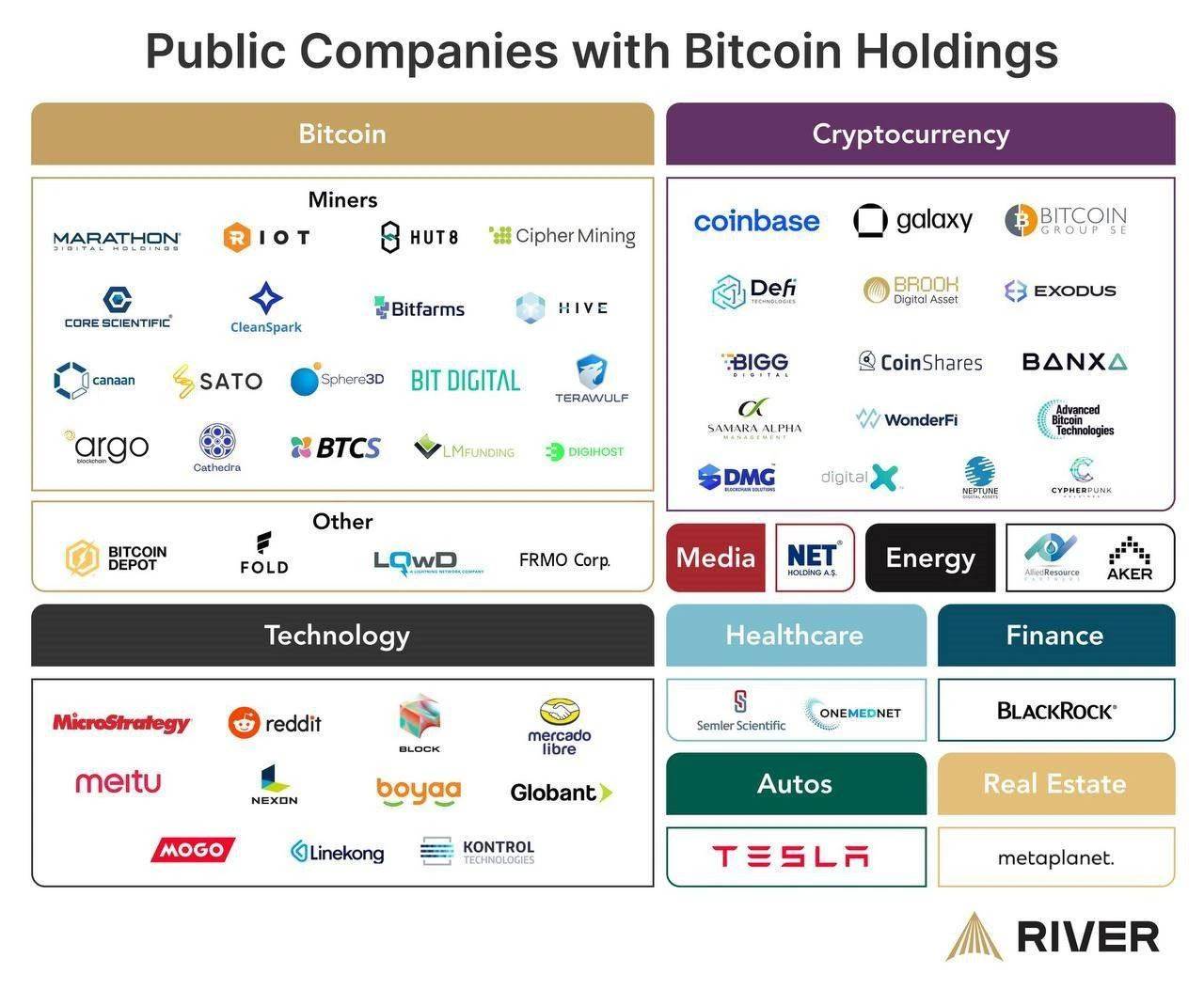

Buy Bitcoin, issue shares based on its rising valuation, use Bitcoin as collateral to issue bonds, reinvest proceeds into more Bitcoin—the higher Bitcoin goes, the higher the stock climbs, enabling further fundraising to buy more BTC… Inspired by MSTR’s success, companies worldwide have begun to follow suit. Japanese firm Metaplanet, U.S. healthcare company Semler Scientific, German-listed Samara Asset Group, Hong Kong-listed Meitu and Boyaa Interactive—all have launched Bitcoin accumulation programs.

Data shows over 60 public companies now hold Bitcoin, with thousands of private firms following similar strategies.

MSTR CEO Michael Saylor has become one of Bitcoin’s most influential evangelists, tirelessly promoting it across platforms.

Saylor reportedly had three minutes to pitch Bitcoin to Microsoft’s board, arguing that if Microsoft converted part of its cash reserves into Bitcoin each quarter, it could generate trillions in shareholder value over the next decade, adding hundreds of billions to its market cap.

While the Bitcoin ETF opened the channel and MSTR led by example, the key catalyst behind Bitcoin’s recent explosive rally is one man: Trump.

At the Bitcoin 2024 conference in July, Trump publicly pledged to make America the “crypto capital of the world” and establish a national Bitcoin reserve.

In late September, Trump and his three sons—Donald Jr., Eric, and Barron—launched their new venture, World Liberty Financial. Described as a decentralized finance (DeFi) money market platform, it introduced a proprietary cryptocurrency called $WLFI.

Trump himself has walked the talk, becoming the “first U.S. president to buy a burger with Bitcoin.”

His running mate, Vice President-elect J.D. Vance, is also deeply involved in crypto. According to disclosed financial records, as of 2022, he held between $100,000 and $250,000 worth of Bitcoin on Coinbase.

Moreover, Elon Musk—one of Trump’s biggest supporters in the election—is a well-known crypto enthusiast who added Bitcoin to Tesla’s balance sheet and has been especially vocal in supporting Dogecoin—even naming his newly formed Department of Government Efficiency “DOGE,” after the meme coin.

During Biden’s presidency, the SEC under Gary Gensler waged an unprecedented crackdown on the crypto industry: suing Ripple, launching major legal actions against Binance and its CEO Changpeng Zhao, classifying numerous tokens as unregistered securities, issuing massive fines, and sending warning letters to Coinbase. The entire U.S. crypto market remained under a regulatory cloud.

Trump’s victory marks a complete reversal in U.S. crypto policy—clearing away the regulatory fog and removing systemic barriers to crypto development in America.

To sum up, the elements of this grand strategic play have come together through a series of seemingly coincidental events:

As the U.S. enters a rate-cutting cycle, spot Bitcoin ETFs gain approval. Wall Street titans like BlackRock and Vanguard join the Bitcoin ecosystem, ushering in massive capital inflows.

MSTR’s Michael Saylor becomes Bitcoin’s chief advocate, continuously leveraging debt to accumulate more BTC, creating a virtuous cycle where rising prices boost both coin and stock valuations, inspiring countless public companies to replicate the model.

Trump wins the election, and the next U.S. president personally champions Bitcoin, eliminates regulatory obstacles, and plans to include BTC as a strategic national reserve asset.

All moves are transparent, everyone has a chance to participate, and every participant stands to benefit. This is the essence of a top-level strategic play: using Wall Street-financed ETF products, the U.S. is transforming Bitcoin—the once-decentralized rebel—into a controlled financial instrument.

Perfect Narrative

Now comes the real question: Why Bitcoin? Why only Bitcoin?

Bitcoin’s narrative power lies in its simplicity—it requires no technical explanation and cannot be disproven. Like a perfect closed loop, every crisis reinforces rather than undermines its core value proposition.

Born from the ruins of the 2009 financial crisis, it was designed to resist inflation and challenge the banking system. During the 2020 pandemic, as central banks printed money endlessly through quantitative easing, Bitcoin’s scarcity narrative shone brighter than ever. In 2022, amid the Russia-Ukraine war, Bitcoin emerged as a stealth financial weapon, demonstrating what a truly supranational currency looks like and reaffirming the importance of decentralized assets. In 2024, as the Fed cuts rates and geopolitical tensions escalate, Bitcoin perfectly assumes the role of a safe-haven asset.

From early labels like “digital gold,” to later concepts such as “supranational asset” and “Web3 cornerstone,” each narrative layer has been reinforced by real-world events.

In the crypto world, we’ve seen countless grand visions and complex technical solutions—but ultimately, the one that withstands the test of time is the simplest: Bitcoin. It needs no marketing, no roadmap, no promises of future upgrades. Its value proposition is as simple and undeniable as the law of gravity: a decentralized, scarce, immutable network for storing value.

That’s why it can only be Bitcoin. Because in an uncertain world, certainty is the most precious thing. And Bitcoin offers exactly that: fixed supply, predictable issuance rules, and transparent, tamper-proof mechanics.

Challenging Gold

Now that it has crossed the $100,000 threshold, Bitcoin’s next target is to challenge gold’s dominance.

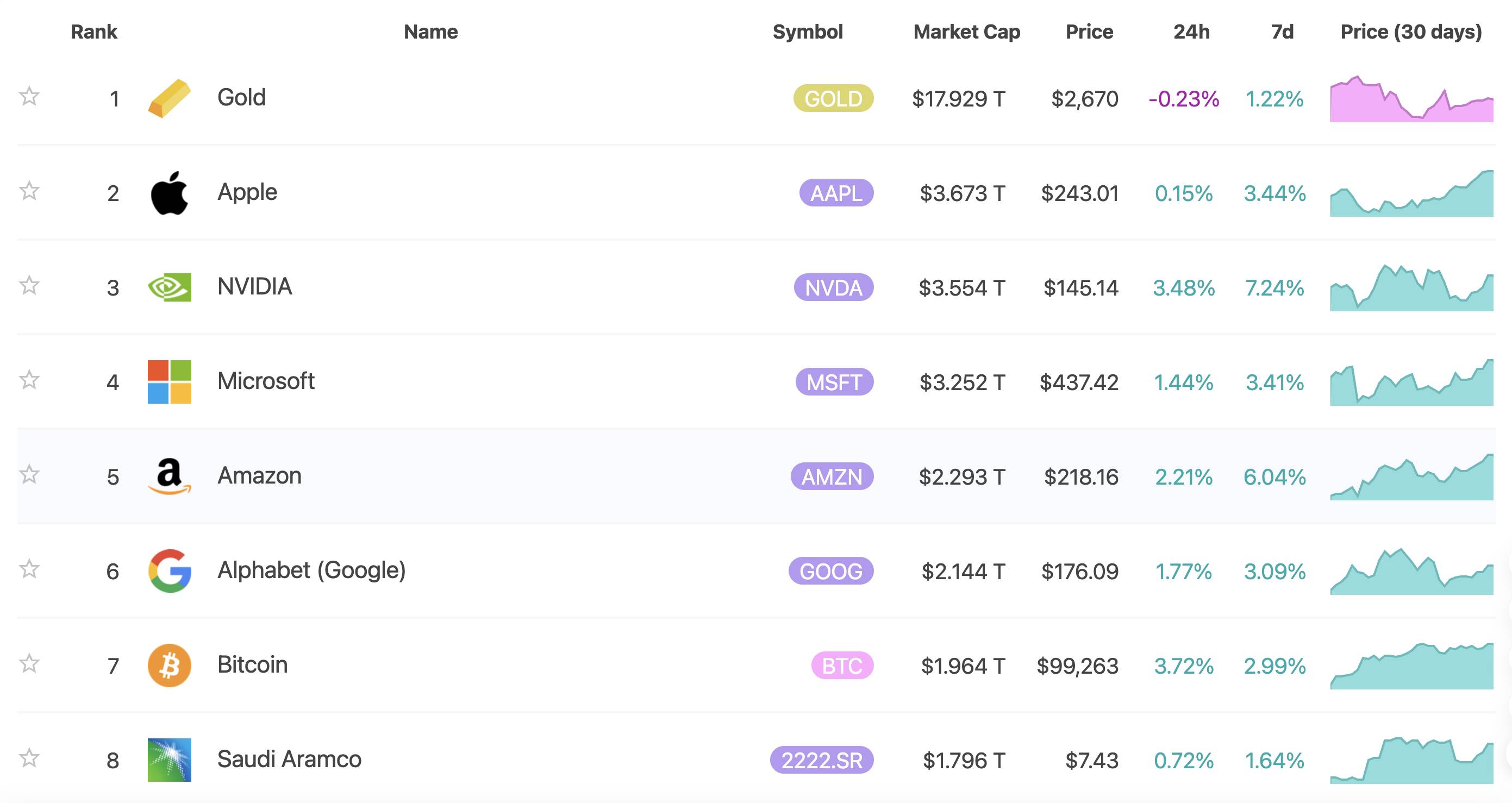

As of December 5, among the world’s top ten assets by market cap, gold ranks first at $18 trillion. Bitcoin, at $1.98 trillion, surpasses silver and Saudi Aramco to rank seventh.

Central banks are among gold’s most important buyers. Ongoing geopolitical black swan events and regional instability continue to drive demand. In 2022 and 2023, global central banks purchased over 1,100 tons of gold each year—making them the single largest force behind the recent rise in gold prices.

In detail, Western nations have been net sellers of gold, while emerging economies are net buyers. Central banks like China’s are increasing gold reserves and reducing U.S. Treasury holdings to lessen dependence on the dollar system.

Dedollarization is reshaping the landscape of global reserve assets.

Compared to gold, Bitcoin currently lags in cultural consensus and market size—but it possesses unique advantages.

Bitcoin’s supply is far more transparent and predictable, capped forever at 21 million coins. After the 2024 halving, daily new supply dropped to 450 BTC, with an annual inflation rate of just 0.8%. In contrast, annual gold production remains around 3,500 tons—equivalent to 2–3% inflation.

Bitcoin’s digital nature gives it a clear edge in cross-border transfer and storage. No need for vaults or complex logistics—a single cold wallet can securely store billions in value, a crucial advantage during times of geopolitical tension.

Bitcoin belongs to no nation and answers to no single government. It’s easily transferable and fully transparent—making it an ideal complement to traditional reserve assets.

In the week following Trump’s election win, BlackRock’s Bitcoin ETF-iShares (IBIT) reached $34.3 billion in assets under management—surpassing its own gold trust fund (IAU), despite gold ETFs having a 20-year head start.

If Trump fulfills his promise and establishes a national Bitcoin reserve, the symbolic impact would far outweigh the actual amount purchased. The financial order we know could be rewritten.

Just as the dollar’s link to gold once determined the fate of the Bretton Woods system, America’s stance on Bitcoin today could trigger a paradigm shift in global reserve assets.

We’re already seeing early signs: El Salvador made Bitcoin legal tender—tiny in scale but precedent-setting. Sovereign wealth funds are quietly investing too—Singapore’s Temasek, for instance, has backed multiple crypto-related ventures. Bhutan has actively mined Bitcoin since 2021.

If more countries begin allocating Bitcoin to their reserves—even at just 1–5%—the resulting demand surge would be transformative. Consider that global foreign exchange reserves exceed $12 trillion.

With institutions absorbing liquidity via ETFs, long-term holders increasing, exchange supplies dwindling, corporations accumulating, and now potential sovereign demand entering the picture, Bitcoin’s scarcity premium could soar to unprecedented levels.

If this unfolds, the mere 21 million Bitcoins will simply not be enough to go around.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News