Crypto Market Outlook for December: AI Agents with Brand-New Output Formats Will Gain Greater Popularity

TechFlow Selected TechFlow Selected

Crypto Market Outlook for December: AI Agents with Brand-New Output Formats Will Gain Greater Popularity

The future trend is "Agents that can operate independently and collaborate with each other."

Author: Sleeping Heavily in the Rain

GM, here comes the December outlook.

Dino coins aren’t my area of expertise, and it's hard to gauge these ancient old memecoins. This outlook is mainly about sharing some directions I’m watching.

If you find this content helpful, feel free to like and share 🫡

1/ AI Agent

After a series of hype cycles around AI memecoins, AI agent applications, and infrastructure, it’s time to look further ahead.

Let me first share my personal observations ⬇️

1. It will be difficult for any new pure AI memes to emerge. After the dust settles, only $GOAT and $ACT—two AI memecoins listed on Binance—remain notable (I don’t have strong opinions on $TURBO). However, both $GOAT and $ACT are market-made by Wintermute, and those holding them—myself included—are probably suffering.

2. Market taste is evolving: from AI Memes → AI Agent applications → more sophisticated AI Agent apps & AI Agent infrastructure.

My thoughts on future developments ⬇️

1. AI Agents with novel output formats will gain more traction;

Currently, most popular AI Agents in the market are tweet bots competing primarily on "creative content," such as $AIXBT’s market analysis. If you deliver differentiated high-quality output, the market will reward it.

Differentiated quality output has two dimensions:

First, new content formats—where the key is “traffic,” meaning attracting sufficient audience reach. Right now it's text-based; we’re starting to see experiments with video content and podcasts (e.g., $ZEREBRO and $LUNA releasing music singles, or $POD working on podcast-related projects).

Second, new behavioral patterns—for example, launching an Agent that autonomously trades memecoins. We should expect more exploration into innovative behaviors (this was why I previously liked $FLOWER and $LOLA). If a new behavior leads to good outcomes, the market will respond positively.

2. Demand for AI-related infrastructure will become increasingly evident;

This is self-explanatory—the taller the building, the stronger the foundation must be. Tokens like $VIRTUAL, $AI16Z, and $VVWIFU represent this category. Beyond basic token issuance platforms, also pay attention to meta-infrastructure integrating these tools—such as Seraph on Virtuals.

3. The future trend is “independently operating yet collaborative Agents”;

We’re already seeing early signs—like what $UBC is currently doing (Agent-to-Agent interaction). In the future, AI Agents on Virtuals may follow this path too. $LUM marks the beginning of this conceptual meme coin category. It’s a cultural meme without utility (though there are teams building on $LUM now, I still don’t fully grasp their vision).

P.S. I'm currently at a loss on $LUM. Mentioning it doesn’t constitute financial advice.

2/ Ethereum

I personally believe Ethereum will experience a major upward wave (in terms of EB exchange rate), though I'm unsure exactly when. My view remains consistent with November’s outlook ⬇️

1. BTC ETFs will create spillover effects;

2. Major institutions like BlackRock are launching RWAs on Ethereum, which underscores that Ethereum’s underlying value cannot be ignored;

3. The rise of the Base AI Agent ecosystem;

From price performance alone, tokens such as $ONDO, $LINK, $UNI, and $ENS are showing strength. This suggests the market is shifting focus toward Ethereum-related beta plays—a bullish signal.

When choosing Ethereum beta exposure, there are essentially three directions:

1. ETH staking-related ($LDO, $EIGEN LRT);

2. DeFi & RWA ($AAVE, $UNI, $COW, $MKR, $ONDO, $LINK);

3. Meme coins ($MOG, $PEPE, $SHRUB). I personally prefer DeFi-related assets, and I indirectly hold $PENDLE and $EIGEN through $PNP and $EGP.

3/ Layer 1 Wars

In my previous article on Stacks, I mentioned that the Layer 1 battle is reigniting—in December you’ll see: 1) Fantom Sonic mainnet launch approaching; 2) Avalanche9000 mainnet launching on December 16; 3) Aptos seeing data growth, institutional adoption, and ETP developments; 4) Stacks introducing sBTC post-Satoshi upgrade to boost adoption.

Most surviving legacy chains are seizing the bull market to make moves. We should witness a new round of Layer 1 competition throughout December and Q1 next year. Don’t forget, there’s also a new player in this war: HyperLiquid. From my perspective, $HYPE isn’t as heavily positioned as we might think, with relatively fewer participants and holders in Chinese communities (especially compared to $ACT or $PNUT). There’s still potential for exchange listings ahead for $HYPE.

All the above projects seem solid to me—they share one trait: “willingness to release positive catalysts to drive price.” Among legacy chains, I favor Fantom the most. I’ll write separate pieces covering Fantom and Avalanche updates.

Beyond Layer 1s, within Ethereum Layer 2s, I’m watching $METIS and Base. You might want to check out @ScoreMilk on Metis—it’s the reason I’m paying attention to Metis.

One final note on Base: Base has a unique culture. When participating, don’t focus too much on whether the concept is good—instead, ask if it meets the needs of the Coinbase Cabal. Otherwise, even with a great concept, it’s likely just a flash-in-the-pan move.

4/ Chain Abstraction

A quick word on chain abstraction.

Chain abstraction / intent abstraction is a concept I’m quite bullish on—it can lower blockchain entry barriers and reduce on-chain complexity.

In this space, I only care about products, not token prices—if the product works well, that’s enough. Token price movements matter less right now. Moreover, I believe chain/intent abstraction still requires time to mature and evolve.

If you're interested in this sector, keep an eye on @ParticleNtwrk. Particle is a modular, chain-abstracted Layer 1 (which I’ve covered before), whose core function is “providing users with a unified account and frontend for cross-chain interactions via a single universal address.”

You might also check NEAR Protocol’s chain abstraction framework.

5/ What Else Matters in December?

1. This week, $IO will announce something (remember my AI trio? $IO, $GRASS, $TAO);

2. $ME TGE on Dec 10—we’re seeing early signs of NFT recovery, possibly tied to Opensea;

3. Coinbase delisting $WBTC;

4. Watch Solana’s AI infrastructure: $SHDW, $SNS;

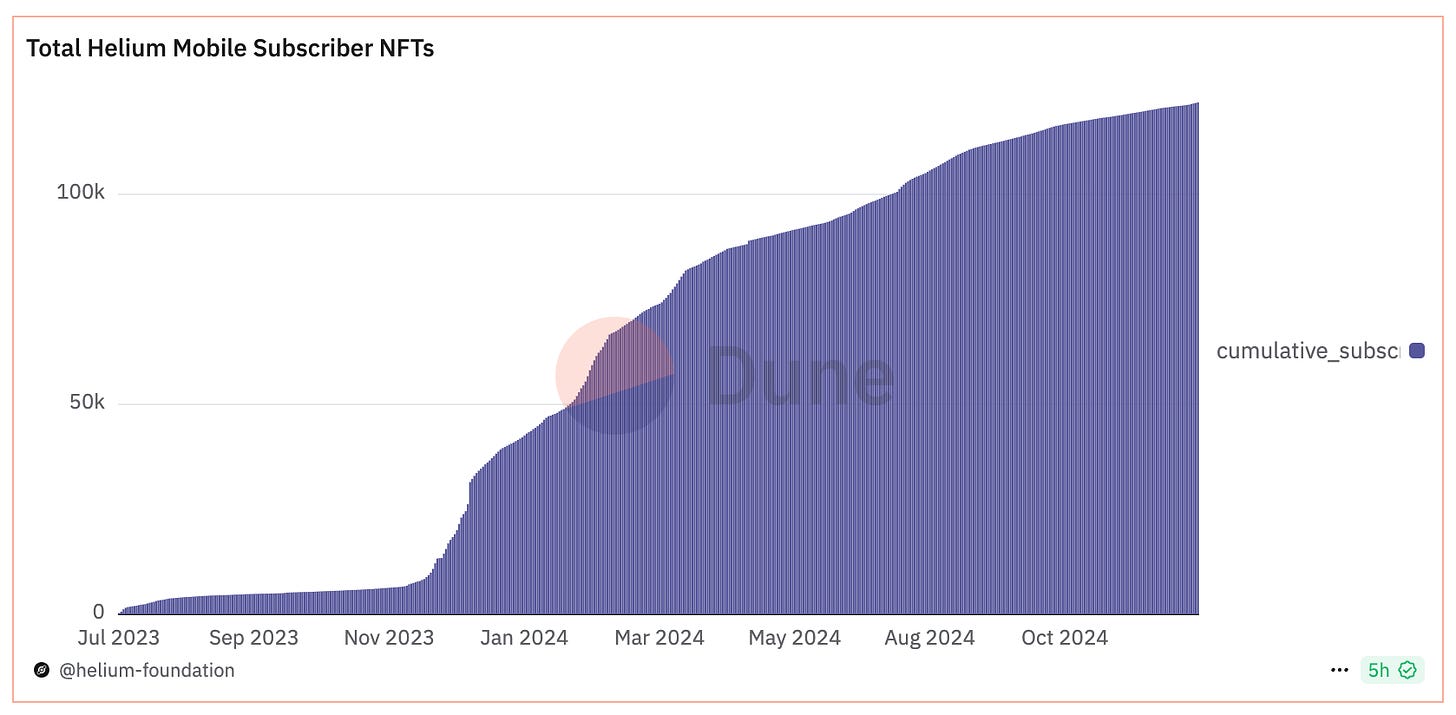

5. $HNT is a project I’m very bullish on—I believe $HNT will perform strongly this cycle (just look at Mobile’s data; though rarely discussed, Mobile user growth has been consistently solid) ⬇️

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News