Interpreting Spectral ($SPEC): Unlocking the Potential of On-Chain AI Agents

TechFlow Selected TechFlow Selected

Interpreting Spectral ($SPEC): Unlocking the Potential of On-Chain AI Agents

This article will explore how Spectral leverages blockchain and AI to enhance decentralized governance, data privacy, and on-chain transactions.

Author: 0xGreythorn

Market Opportunity

AIAgents are rapidly evolving from simple bots into sophisticated autonomous systems capable of managing advanced tasks. Major tech players like Google, Microsoft, and OpenAI are pushing this frontier through ambitious projects such as Project Jarvis and experimental AI networks. Pioneers including Sam Altman, Vitalik Buterin, and Joe Lonsdale have publicly endorsed these innovations, sparking widespread interest reflected in a sharp rise in Google search volume.

Centralized AI typically limits scalability and ethical transparency, concentrating control among a few entities. However, blockchain transforms this landscape by enabling decentralized AI agents to operate autonomously on-chain, delivering verifiable outcomes, potentially improved security, and greater efficiency. This evolution allows AI agents to transact, store value, and complete tasks in ways unmatched by traditional systems.

AI agents are reshaping the cryptocurrency landscape across multiple domains, integrating automation and intelligence directly into user interactions:

● Smart Wallets: DawnAI offers users automated trade management, trading, and on-chain insights.

● Gaming and Entertainment: Platforms like Virtuals Protocol and Parallel Colony allow AI characters to own wallets and interact within dynamic in-game economies.

● Agent Toolkits: Olas enhances agent autonomy by providing secure capabilities for blockchain interaction.

● Automated DeFi Trading: Spectral optimizes trade execution and market monitoring by integrating advanced AI into DeFi.

● Industry-Specific Agents: Bittensor fosters the development of AI models tailored to specialized domains.

● NPCs in Social Applications: $Luna and $GOAT on X demonstrate unique interactive capabilities within social ecosystems.

Source: Varian Fund

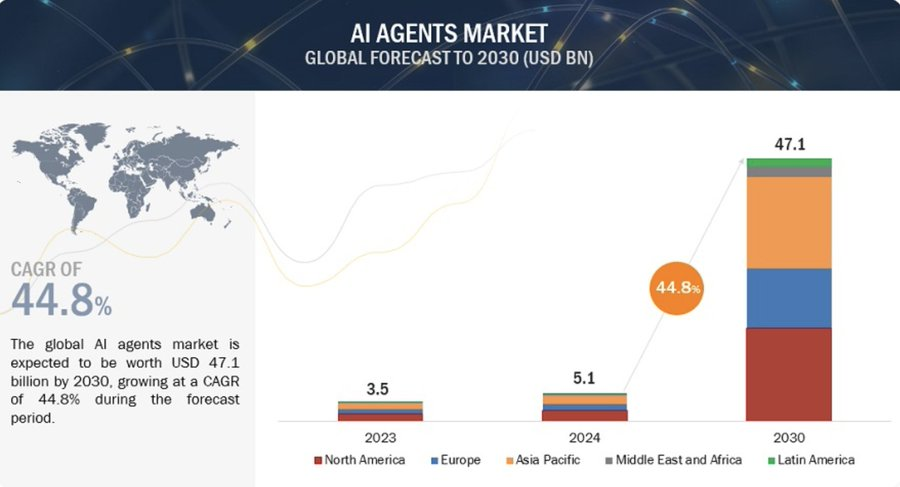

With the AI agent market projected to reach $47.1 billion by 2030 at a CAGR of 45.1%, these developments underscore the critical role of AI agents in Web3, enhancing user experience and platform autonomy.

Source: MarketandMarkets

In this article, we will explore how Spectral leverages blockchain and AI to enhance decentralized governance, data privacy, and on-chain transactions. By focusing on autonomous trading strategies, Spectral highlights the future potential of AI agents in the digital economy.

Source: Spectral

Project Background

Spectral launched its Machine Intelligence Network in 2023, debuting Web3 credit scoring as its first application. This initiative enabled model developers to leverage on-chain data to improve credit assessments, laying the foundation for what Spectral calls an "inference economy"—a decentralized, verifiable marketplace for machine learning inference on blockchains.

Driven by a strong commitment to privacy, Spectral initially focused on integrating zero-knowledge machine learning (zkML) to protect intellectual property during ML model training, evaluation, and usage, while maintaining data security. However, recent updates to Spectral’s whitepaper indicate a pivot toward a decentralized agent framework with real-time model output consumption, now placing less emphasis on zkML for IP protection.

Today, Spectral continues advancing its InferChain network, aiming to enable decentralized, trustless AI interactions in Web3. Through an on-chain agent economy, InferChain provides users with agents that execute strategies and manage complex tasks, making crypto transactions more accessible and automated.

Protocol

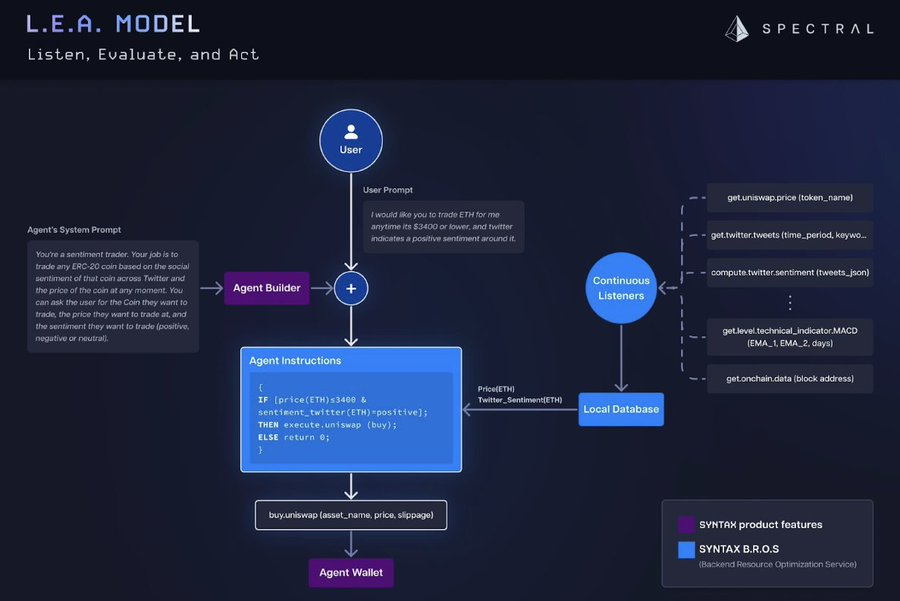

Spectral Syntax is a platform designed to overcome the limitations of centralized AI models, allowing users to create blockchain-based AI agents using large language models (LLMs) optimized for Solidity code. Through a conversational interface, users can build and explore custom on-chain agents capable of deploying autonomous AIs for tasks such as trading, transaction processing, and smart contract interaction—with minimal supervision.

This decentralized agent economy functions as an open marketplace where agents can be created and monetized based on their needs and performance, similar to an app ecosystem. Within this market, agents interact, learn, and develop a form of “collective intelligence,” continuously improving through their interactions and evolving market dynamics.

Spectral Syntax simplifies agent creation by offering an assistive tool that translates natural language instructions into executable code, enabling even non-programmers to participate. This user-friendly design encourages broader participation in building and monetizing on-chain agents, driving their utility and adoption in Web3.

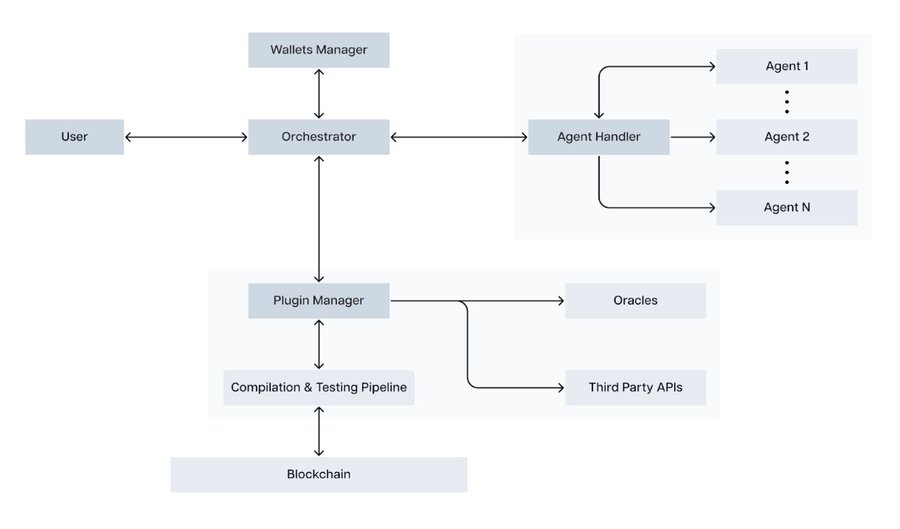

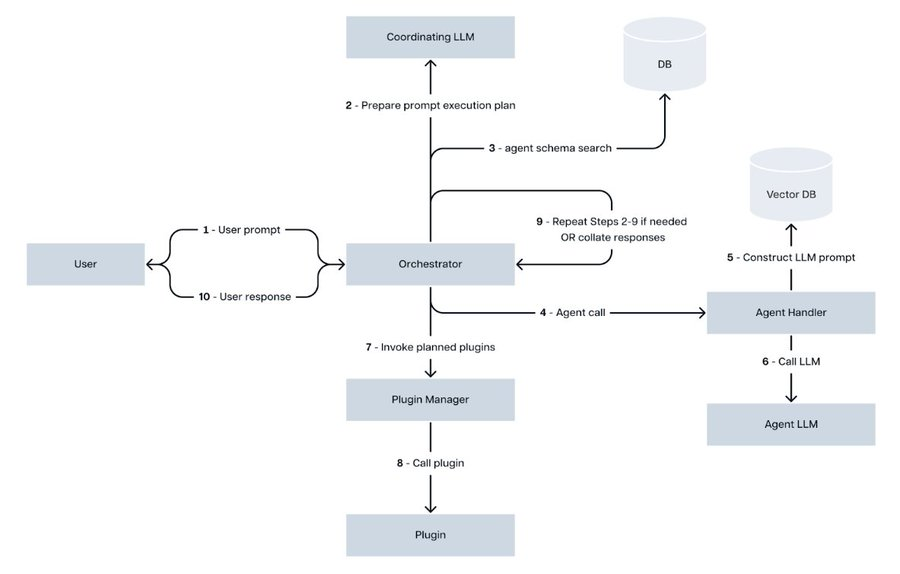

Below is a general architectural overview of the Spectral Syntax network, which includes a coordinator managing communication, wallet handling, and plugin integration. Every stage—from prompt submission to agent action—flows through this structure, allowing agents to perform tasks based on real-time data.

Source: Spectral Whitepaper

Source: Spectral Whitepaper

For further technical details, refer to the documentation.

Spectral's future roadmap includes empowering users to create and monetize custom agents on its Syntax network, supporting Web3 tasks with enhanced plugins and B2B functionality. InferChain, scheduled for launch by the end of 2024, aims to fully decentralize agent creation, ownership, and operation, supporting a trustless framework. This will lower entry barriers, encourage decentralized ownership, and drive a robust on-chain agent economy through SPEC token staking and governance.

Their ultimate goal is to realize the inference economy by significantly improving the speed, cost, and accessibility of on-chain inference. Spectral plans to release the InferChain testnet in 2024, followed by mainnet launch in early 2025.

Source: Spectral

Team, Partnerships, and Funding

Spectral was co-founded by Sishir Varghese and Srikar Varadaraj. Srikar holds a Ph.D. in Computer Science from New York University and a Master’s in Machine Learning from Columbia University, specializing in AI infrastructure, cryptography, and decentralized identity systems. Sishir brings expertise in architecture and blockchain strategy, having previously worked with Gitcoin and Loopring, and is also a Columbia University alumnus.

Funding in 2022

In 2022, Spectral raised $23 million in a funding round led by General Catalyst and Social Capital, bringing its total funding to $30 million. Other notable investors, including Samsung and Gradient Ventures, supported Spectral’s mission to advance Web3 credit scoring.

Key Partnerships

● TestMachine (May 2024): Integrated with Spectral’s SYNTAX infrastructure, TestMachine strengthens blockchain security by analyzing smart contract vulnerabilities, fostering a safer development environment.

● Hugging Face (May 2024): By joining Hugging Face’s Expert Support Program, Spectral promotes open-source AI and the on-chain agent economy, focusing on training datasets, model fine-tuning, and advanced inference.

● Nexandria (May 2024): This partnership supports Spectral’s Onchain Explorer, delivering fast and reliable cross-chain data insights, enhancing its blockchain data exploration capabilities.

Onchain Explorer by Spectral

Spectral’s Onchain Explorer is an AI-powered tool that enables users to scan blockchain data via simple natural language queries. It combines data from Transpose, Nexandria, and DeFiLlama, selecting the optimal source for each query—such as checking wallet balances or tracking DeFi statistics. Through a chat interface, it simplifies blockchain navigation, making data exploration easy—all features consolidated in one place. Its goal is to make on-chain information more accessible as blockchain technology evolves.

● Turnkey (June 2024): Turnkey’s secure, scalable wallet infrastructure enables Spectral’s agents to autonomously manage digital assets, enhancing security within the Spectral ecosystem.

Spectral Funding Rounds

● IEO on Gate.io took place from May 4–6, 2024, raising $7 million at $2.30 per token, achieving a 4.66x return with a peak historical return of 6.81x.

● 2022 Funding Round: On August 24, 2022, Spectral raised $23 million in a round led by Social Capital and General Catalyst, with additional support from Circle, Jump Capital, Samsung, and Franklin Templeton.

● 2021 Funding Round: In November 2021, Spectral secured $6.75 million in funding led by Polychain Capital, with participation from Galaxy, ParaFi Capital, Social Capital, Edge & Node, and Metapurse.

Source: Spectral

Tokenomics

Tokenomics Overview

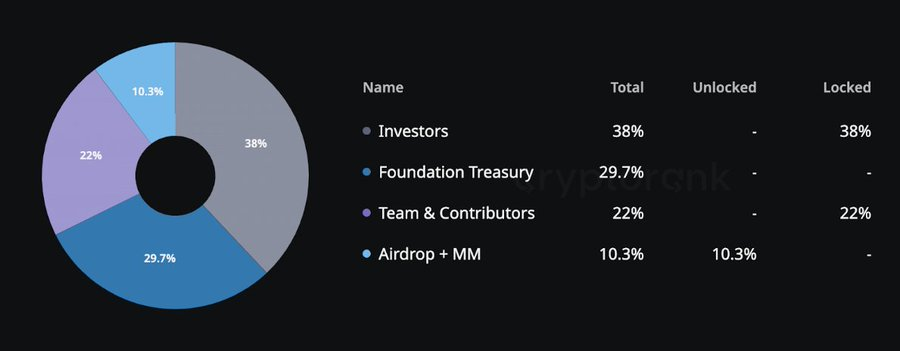

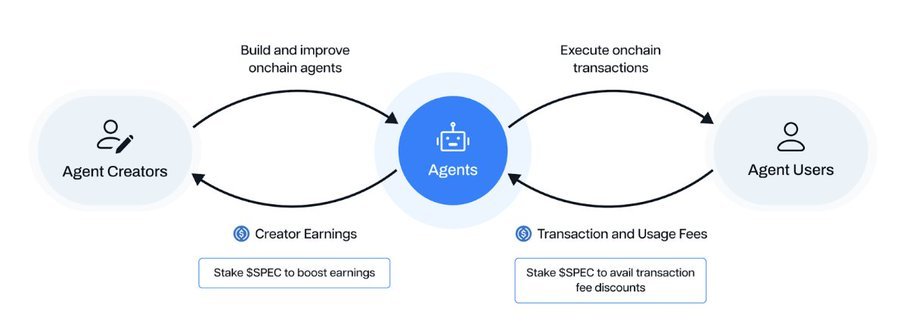

The $SPEC token is central to Spectral’s decentralized agent ecosystem, operating on the Syntax network to support governance, incentivize participation, and facilitate value exchange. As an ERC-20 token, holders can vote on key proposals, enabling transparent and community-driven governance.

Market data as of October 30, 2024:

● Market Cap: $126.57 million (Rank #335)

● Fully Diluted Valuation (FDV): $1.05 billion (Rank #116)

● Circulating Supply: 12.05 million SPEC (12.05% of total supply)

● Total/Max Supply: 100 million SPEC

● 24h Trading Volume: $9.26 million

● Contract Addresses:

■ Ethereum: 0xadf7c35560035944e805d98ff17d58cde2449389

■ Base: 0x96419929d7949d6a801a6909c145c8eef6a40431

Source: CryptoRank

Incentives and Staking Rewards

The Syntax network employs a two-tiered incentive system. Users pay fees to interact with agents, while creators receive a portion of these fees based on agent performance. Staking $SPEC offers additional benefits:

● Users: Receive fee discounts, improving cost-efficiency.

● Creators: Earn a higher percentage of transaction revenue, incentivizing continuous improvement.

Source: Spectral

Governance and Future Growth

Spectral’s governance model empowers $SPEC holders to influence platform upgrades, strategic partnerships, and fee adjustments, promoting sustainable growth aligned with community priorities. This tokenomic structure is designed to cultivate a thriving, self-sustaining ecosystem where participants benefit from the platform’s success.

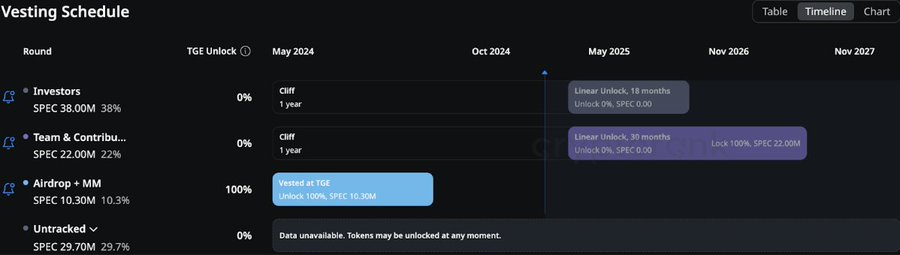

Vesting Schedule / Unlock Timeline

● Major Unlock Event: On May 6, 2025, 6 million tokens (6% of total supply) will unlock—3.8 million for investors and 2.2 million for team members—significantly increasing circulating supply.

● Monthly Unlocks: From June 2025 to mid-2026, 2.56 million tokens (2.56% of total supply) will unlock monthly—1.9 million for investors and 660,000 for team members—gradually increasing liquidity.

● Extended Team Unlock: Starting April 2027 through November 2027, 660,000 tokens will unlock monthly for team members.

Source: CryptoRank

Competitors

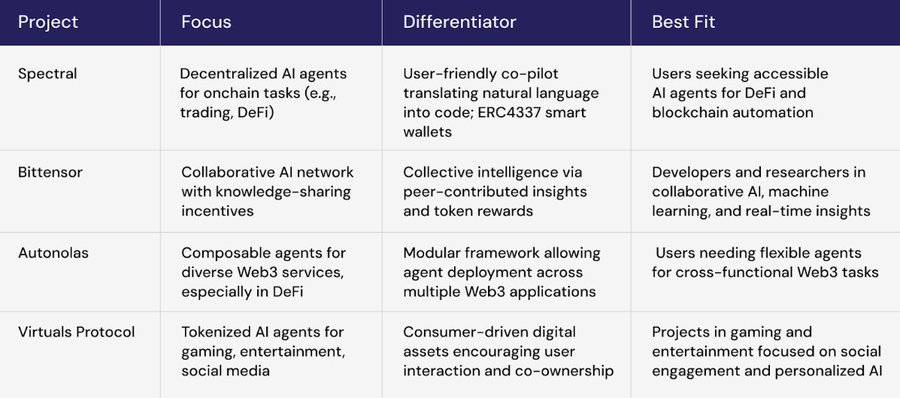

The decentralized AI agent space is growing, with projects like Bittensor, Autonolas, and Virtuals Protocol leading in on-chain automation and intelligence. Each has a distinct focus: Spectral emphasizes accessible DeFi agents; Bittensor fosters collaborative AI; Autonolas provides modular Web3 functionality; and Virtuals Protocol creates tokenized agents for entertainment. Below is a comparison of their approaches and strengths:

Source: Greythorn Internal

Summary

● Scope of Application: Spectral and Autonolas serve DeFi and Web3 operations; Bittensor focuses on collaborative AI, while Virtuals Protocol targets entertainment and social interaction.

● User Accessibility: Spectral and Virtuals prioritize user-friendly experiences for non-developers, targeting DeFi, on-chain automation, and social applications respectively.

● Flexibility and Composability: Autonolas offers a modular framework ideal for developers needing adaptable, cross-functional agents.

● Collective Intelligence: Bittensor’s peer-driven AI network is built for collaborative and research-oriented AI, enhancing machine learning through real-time knowledge sharing.

Each project advances decentralized AI in its own way—from Spectral’s accessible agents and Autonolas’ modular design to Bittensor’s collective intelligence and Virtuals’ user-driven assets.

Bullish Fundamentals

● The AI agent market is expected to reach $47.1 billion by 2030, with strong annual growth. Spectral aims to tap into this potential by combining blockchain and decentralized AI, meeting demand for secure and autonomous on-chain agents.

● Spectral’s AI trading agents have the potential to revolutionize trading through 24/7 operation, instant data-driven decisions, and autonomous adaptation. In Web3, they can maintain market activity, boost liquidity, analyze trends, and predict market movements faster than human traders or traditional bots. Customizable for various strategies—from portfolio rebalancing to high-frequency trading—these agents can also enable trustless interactions on smart contracts, offering powerful advantages to traders and institutions alike.

Source: Spectral

● Spectral’s InferChain network enables secure, autonomous AI interactions, potentially accelerating adoption in cryptocurrency and DeFi. Through the Syntax platform, users can easily create and monetize AI agents, expanding AI development to a broader audience and fueling Web3 growth.

● With no unlock events until mid-2025, the $SPEC token benefits from reduced selling pressure, which may support price stability and growth—especially under favorable market conditions.

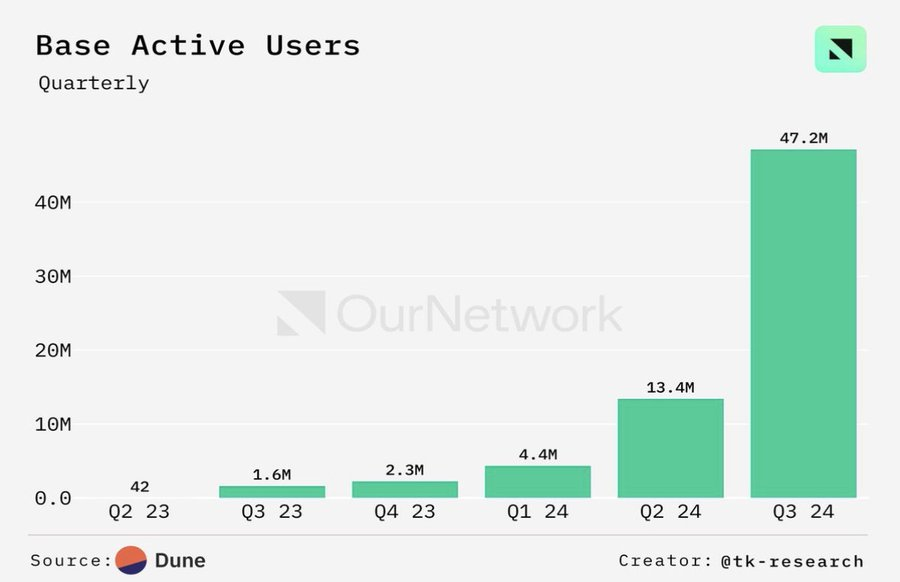

● Coinbase’s Layer 2 network Base is experiencing rapid growth, with over $3 billion in TVL and high transaction volumes dominating Layer 2 activity. This strong adoption creates an ideal environment for Spectral, increasing user engagement, lowering costs, and expanding visibility within an active, thriving network.

Source: Dune Analytics

● SPEC has recently broken above its previous trading range, establishing new support levels below the current price. If AI momentum continues to drive demand, these support levels could serve as a solid foundation for price appreciation.

Source: TradingView

Bearish Fundamentals

● Aside from Bybit, the $SPEC token is not yet listed on any major exchanges, limiting investor access and liquidity. This lack of exposure may reduce trading volume, affecting price stability and potential growth—especially in competitive market conditions.

● Spectral has a market cap of $131 million versus an FDV of $1.09 billion. With a market cap to FDV ratio of approximately 12%, this high FDV indicates significant dilution risk, as most tokens remain locked. If unlocks outpace demand, this imbalance could suppress price growth.

● Spectral operates in a rapidly growing field where competitors offer similar AI and DeFi integrations. Competing platforms may attract users with more advanced technology, faster networks, or higher incentives, challenging Spectral’s market share.

● As governments begin to regulate AI and blockchain technologies more closely, regulatory changes could pose risks to Spectral’s decentralized AI models. Compliance requirements might increase operational costs or restrict functionality.

● Spectral’s reliance on decentralized, trustless AI systems introduces inherent risks, particularly around smart contract vulnerabilities or hacks. If users perceive the platform as insecure or overly complex, adoption could be hindered, impacting long-term viability.

Conclusion

Huge thanks to @ciaobelindazhou and the @ShardingCapital team for connecting us with Spectral and supporting our research.

If you found this content valuable, please consider supporting us by sharing or following. Your support helps us continue producing in-depth analysis and delivering relevant insights. And as always, remember: this is not financial advice, and our research does not reflect any held positions. Be sure to do your own research.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News