DWF Labs November Market Insights: Trump's election victory drives broad crypto market rally, BTC nears $100K, DeFi and stablecoin markets steadily recover

TechFlow Selected TechFlow Selected

DWF Labs November Market Insights: Trump's election victory drives broad crypto market rally, BTC nears $100K, DeFi and stablecoin markets steadily recover

Market structure indicates that institutionalization is still progressing steadily, while also providing opportunities for retail investors to participate.

Author: DWF Labs

Translation: TechFlow

Introduction

The cryptocurrency market has just experienced one of the most anticipated events of 2024—the successful election of Trump. This event triggered significant market shifts, pushing Bitcoin (BTC) to new all-time highs and driving broad gains across most cryptocurrencies.

BTC is currently trading near $100,000—a price target that has been a subject of speculation since 2021.

This report focuses on key metrics and trends in BTC price movements, DeFi activity, stablecoin market capitalization, and altcoin performance.

These indicators offer valuable insights to help better capture opportunities in the current market cycle.

BTC Trend Analysis

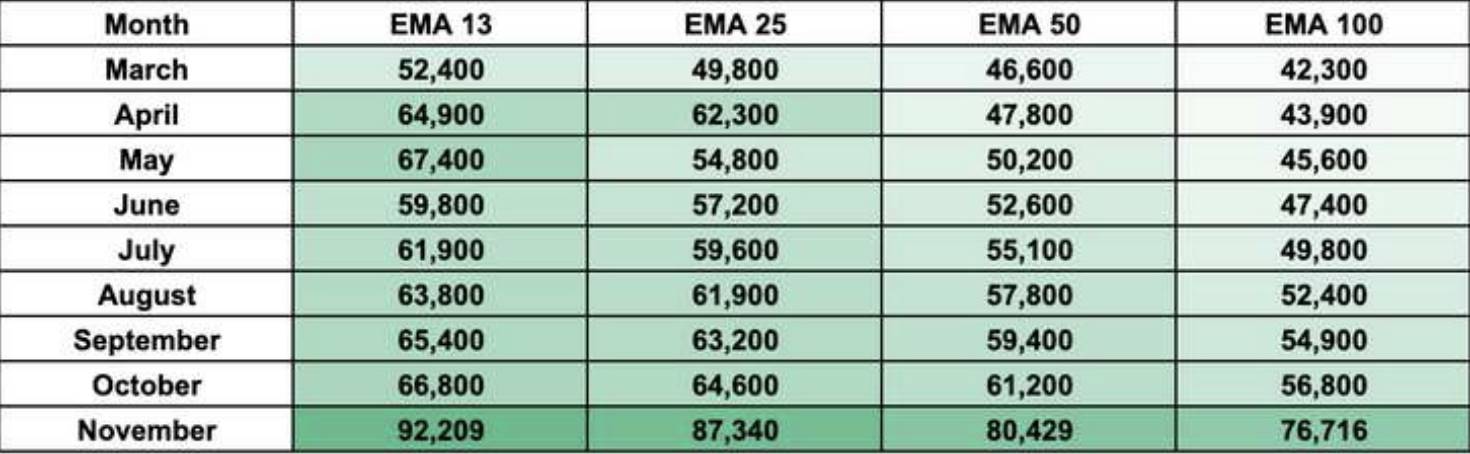

Since the launch of ETFs, Bitcoin (BTC) has maintained strong upward momentum. Overall, the Exponential Moving Average (EMA) shows a clear uptrend.

In the short term (EMA 13 and EMA 25), from August through November ahead of the election, the EMA sustained steady positive expansion. The medium-term trend (EMA 50) provided crucial support during pullbacks, with BTC consistently trading above the EMA 50 since September.

For the long-term trend, the 100-day EMA has shown increasing expansion since July, signaling a clear bullish market sentiment.

The overall trend remains positive: BTC’s price action indicates a confluence of bullish short-, medium-, and long-term trends, supported by healthy market structure.

Despite this optimistic outlook, it's important to remain vigilant about evolving market dynamics. Simple trend indicators like EMA can help identify potential risk signals:

-

Price breaking below short- or medium-term trend lines

-

Longer-term EMA crossing below shorter-term EMA

-

Contraction in EMA following an uptrend

BTC Spot Basis Analysis: Binance vs. Coinbase

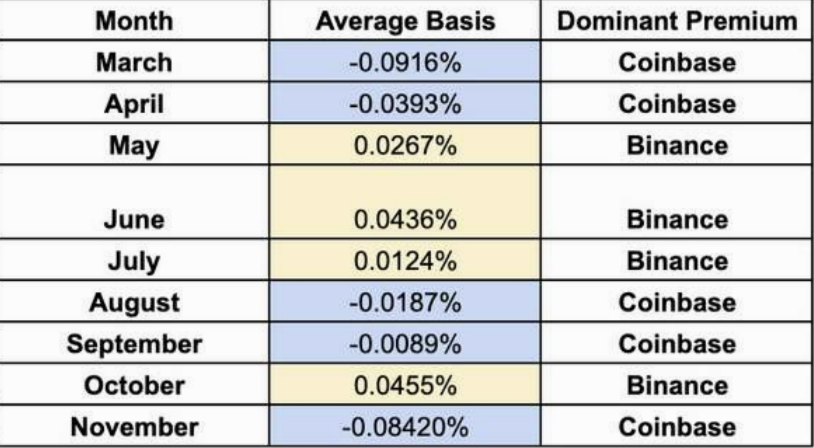

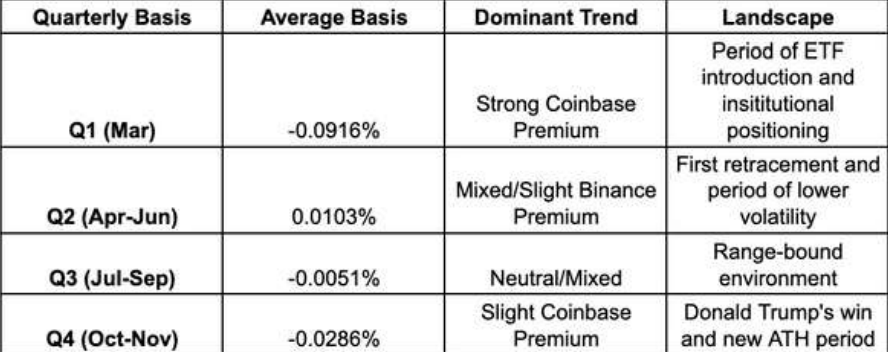

Recent BTC price increases are closely linked to the return of the Coinbase premium—the phenomenon where BTC's spot price on Coinbase exceeds that on Binance. This premium typically signals renewed institutional interest and capital inflows. Conversely, when the Coinbase premium disappears, markets often see price corrections. Therefore, monitoring the Coinbase premium is essential as a key market indicator.

Generally, a persistent Coinbase premium foreshadows directional market moves, while a Binance premium reflects broader market participation.

The table below summarizes how shifts in basis between Binance and Coinbase influence BTC price movements and market regime changes.

Stablecoins, DeFi, and Industry Trends

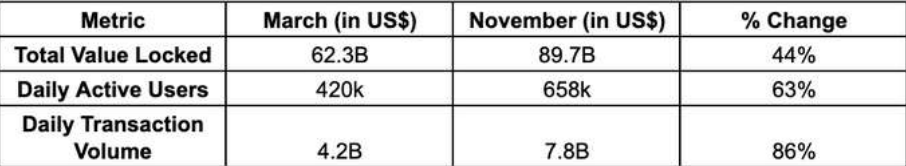

Trump’s victory raises the possibility of deregulation in the crypto space. Following the election, DeFi has performed exceptionally well—likely driven by expectations of a more favorable regulatory environment, as well as Trump’s own launch of the stablecoin project World Liberty Finance.

Trends in stablecoin adoption and DeFi growth indicate rising user engagement. Looking ahead, the continued expansion of USDT and USDC will further enhance overall liquidity in the crypto market. This trend aligns with anticipated regulatory easing post-Trump election, reinforcing the optimistic outlook for the cryptocurrency sector.

(Note: Data sourced from Coingecko and DefiLlama)

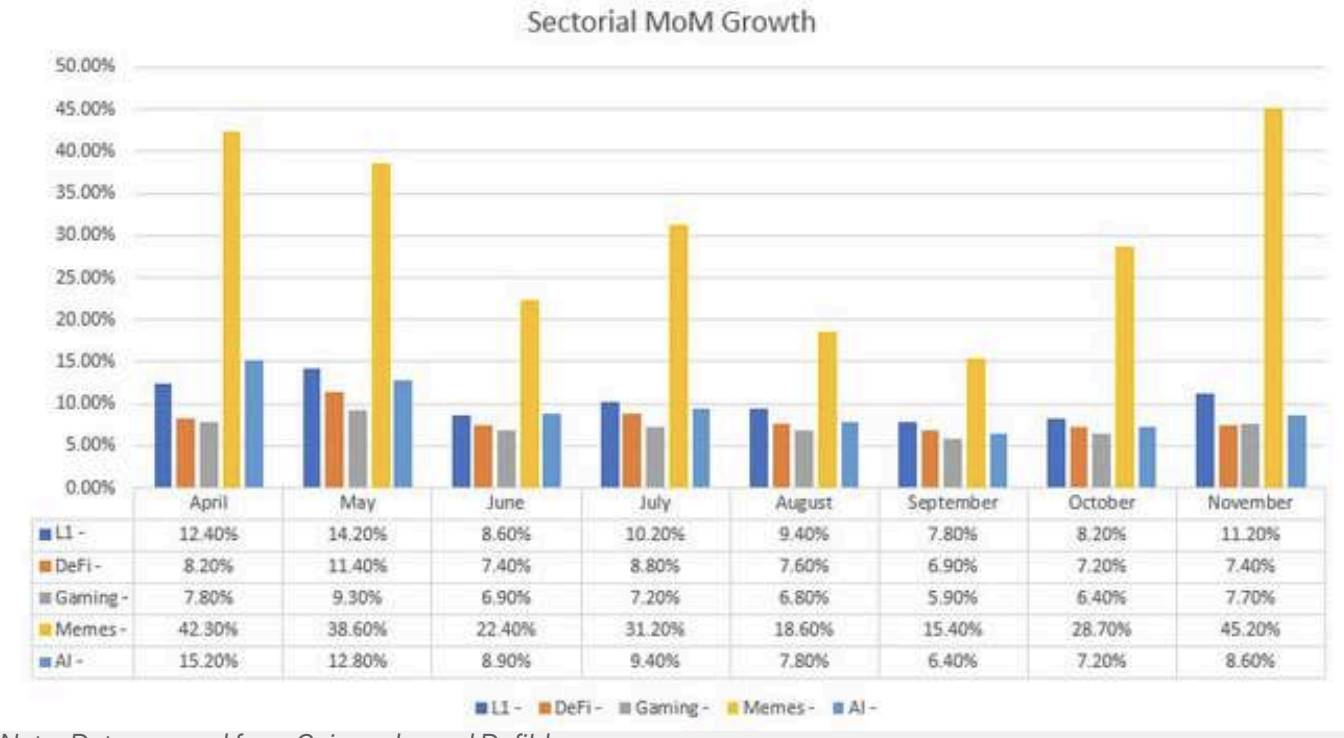

Notably, despite strong performance across the board, Meme tokens have significantly outperformed in terms of returns, likely due to retail investors’ preference for attention-driven assets. In contrast, declining volatility in other sectors may reflect their gradual maturation.

Investment themes and trends in the crypto market tend to be cyclical. Therefore, focusing on areas such as DeFi and Layer 1 blockchains may help identify early signs of institutional adoption. Additionally, integration with real-world assets (RWA) and infrastructure-focused projects or applications could serve as important industry indicators.

As crypto market narratives continue to diversify, data-driven approaches to tracking these shifts become increasingly critical.

Conclusion

In 2024, the cryptocurrency market has demonstrated clear signs of maturation. Different sectors show distinct performance characteristics, and behavioral differences between institutional and retail investors are becoming more pronounced. Bitcoin’s strong performance has catalyzed growth across multiple areas, with Meme tokens standing out particularly.

Market structure suggests ongoing institutionalization, while still offering opportunities for retail participation. At DWF, we continue to monitor core metrics such as total value locked (TVL) in DeFi and stablecoin growth. These data points not only illustrate the broader industry landscape but also provide foresight into future trends.

Additionally, tracking capital flows into major crypto assets is a vital measure of market momentum. These indicators enable investors to better manage risk and formulate investment strategies.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News