AI Meme: The Biggest Trend of 2024, A Historical Replay from DeFi Summer to AI Winter

TechFlow Selected TechFlow Selected

AI Meme: The Biggest Trend of 2024, A Historical Replay from DeFi Summer to AI Winter

Meme coin supercycle + AI supercycle = ultimate cycle of AI Meme coins.

Author: Taiki Maeda, Founder of HFAresearch

Translation: TechFlow

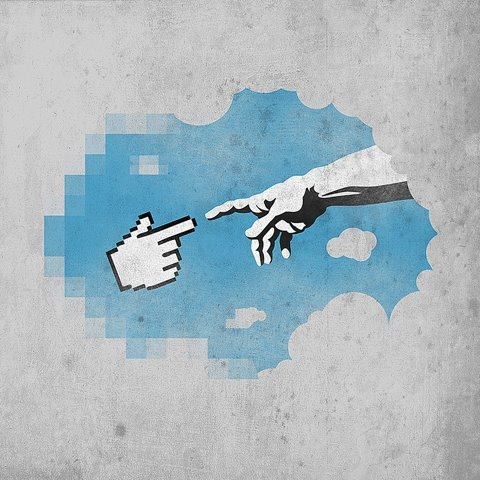

At the market peak in Q1 2024, the combined circulating market cap of the top 10 "AI tech tokens" reached $30.9 billion. In contrast, despite drawing significantly more attention, the top 10 AI Meme coins had a total market cap of only $2.54 billion.

I believe the emergence of $GOAT and @truth_terminal has opened up an entirely new frontier in AI—one that could see hundredfold growth in the future. This is a prime first-mover opportunity in a PvE (Player vs Environment) setting, much like the early days of DeFi Summer in 2020.

Market Opportunity

Meme Coin Super Cycle + AI Super Cycle = Ultimate AI Meme Coin Cycle

In Q1 2024, as NVIDIA (NVDA) stock surged wildly, many AI-related tokens also experienced parabolic growth, even though their fundamentals and tokenomics were questionable. We saw the top 10 "AI tech tokens" exceed a $30 billion valuation—excluding fully diluted valuations (FDV) and smaller-cap tokens. I view this as merely a speculative price test between crypto and AI. In 2025, we’re likely to witness a much larger parabolic move.

However, I believe most outsized returns will come from the AI Meme coin category. Currently, the total market cap of AI Meme coins is roughly equivalent to Ethereum Classic (ETC). AI Meme coins will gradually siphon capital from AI tech tokens, static memes, and VC-backed tokens through what I call “vampire attacks.”

The “DeFi Summer” Moment

Many compare $GOAT’s rise from $0 to a $1 billion valuation to the “YFI moment” of this new space. A key catalyst during DeFi Summer 2020 was the launch of $YFI. It launched with a “fair launch” in July and reached a $1 billion market cap within two months. This proved that a fairly launched DeFi token could go from zero to $1 billion, mobilizing massive on-chain capital into DeFi.

DeFi became a hot sector in the last cycle because it was novel, captivating, and full of futuristic promise. Against a backdrop of near-zero interest rates, its narrative centered on using “vampire attacks” to pull capital from traditional finance (TradFi) and build the financial system of the future. This sparked a wave of on-chain speculation, helping DeFi apps accumulate total value locked (TVL) and users while stress-testing the ecosystem. When $YFI launched, DeFi’s total market cap was around $5 billion; at its peak, it reached approximately $170 billion—a 34x increase. If we treat $GOAT as the $YFI of this cycle, we are clearly still very early, as the total market cap of AI Meme coins remains under $5 billion.

The rise of the DeFi cycle relied both on internal crypto catalysts (like liquidity mining, high-yield farming, and speculation) and external macro conditions (such as near-zero rates driving capital into crypto for yield). Together, these forces created a bubble.

The ultimate cycle of AI Meme coins follows a similar pattern. Within crypto, the dominant narrative today is the Meme coin super cycle. Meanwhile, in public markets, AI technology continues to drive sustained momentum. The convergence of these two trends creates ideal bull market conditions.

In crypto, parabolic growth opportunities often emerge in areas that spark boundless imagination.

Reflexivity in the New Paradigm

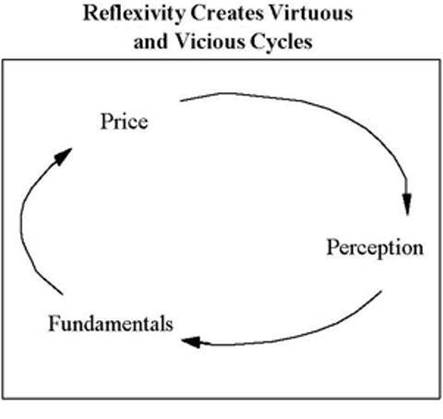

Reflexivity theory suggests investors don’t act based on objective reality, but rather on their perception of reality. These perceptions drive behavior that then alters reality (or fundamentals), which in turn reshapes perceptions and prices.

In this context:

-

Price refers to the overall market cap of the AI Meme coin sector.

-

Perception is how the market views the significance of these tokens.

-

Fundamentals are based on attention and the scale of dreams these tokens can inspire.

I believe these tokens aren't just "pure meme coins," but closer to "Tokenized AGI." They all launched via fair launches on pumpfun. Had they been VC-backed, they might have debuted with a $1 billion FDV and only 10% circulating supply, quickly dumped by insiders onto retail. Instead, these AI Meme coins started from zero, offering equal early access to everyone—an experience akin to reliving the ICO era in real time.

Here's how reflexivity unfolds:

-

The "AI Meme coin" category attracts speculators. Most dismiss it: “It’s just another PvP meme narrative.” (We are currently here)

-

Over time, AI agents improve functionally (e.g., Zerebro launching a record label, Truth Terminal releasing Infinite Backrooms v2), shifting investor perception from “just memes” to “a whole new frontier.”

-

This shift draws more capital and attention from inside and outside crypto, fueling further speculation. Failing AI startups may pivot to launching tokens as a last resort, while wealthy tech billionaires might begin allocating to select tokens.

-

Unlike “static memes,” these AI agents perform on-chain activities—launching NFTs, DeFi projects, and even creating real-world impact. They evolve continuously, generating sustained attention.

-

All of the above drives theoretically infinite valuation expansion, culminating in a bubble and eventual boom-bust cycle.

The fact that these tokens all launch on pumpfun is crucial. This model aligns perfectly with current trends: cult-like community formation, the overlap of Meme and AI super cycles, and strong anti-VC sentiment. If you believe in the four-year cycle theory, Elon Musk’s predicted arrival of AGI in 2025–2026 could coincide with the crypto market peak expected in Q4 2025.

My Investment Strategy

To be honest, I’m not sure how to allocate funds correctly. If this is purely a “meme” category, current winners may continue leading, making them worth betting on. On the other hand, if $GOAT behaves like YFI, it may surge initially—but eventually be overtaken by “better tech.” Personally, I know I can’t predict which tokens will ultimately win. So I’ve chosen to build a diversified portfolio of AI Meme coins to benefit from broad-based upside—the “rising tide lifts all boats” scenario.

Here’s my rough framework for allocating capital in this emerging space:

-

With Tokenized AGI, you're essentially betting on which AI agent can sustainably attract and grow attention. Here, “attention” functions like “revenue” in traditional markets—the core metric of value.

-

Large language models (LLMs) improve over time, so bet on founders or developers motivated to fine-tune models and create superior agents.

-

This space is in a long-term bull market. Focus on AI agents capable of gaining traction beyond crypto Twitter/X, as they have the potential to break out of the crypto echo chamber and capture wider attention.

-

As the market matures, tokenomics will become increasingly important. Ask: What is the token used for? What does it represent? If the token price rises, does that help the AI agent advance its mission? The interplay between price, perception, and fundamentals—i.e., reflexivity—is critical for each token.

In the last cycle, DeFi reached a $170 billion total market cap. If this sector achieves a similar valuation, that would mean roughly 40x growth from current levels. Given that today’s overall crypto market cap is much higher, surpassing those levels is entirely possible. The key is conviction, patience, and adaptability—adjusting your strategy as markets rotate—to maximize your “sleep-friendly returns”—gains substantial enough to deliver results without disrupting your peace of mind.

Please take me seriously when I say: I truly don’t know what I’m doing. In fact, I believe no one really knows. Things could change at any moment. But as of now, my AI Meme coin portfolio includes:

-

$GOAT: The current leader, strongest market performance.

-

#ZEREBRO: Led by native crypto founders who deeply understand cultural trends and move at lightning speed.

-

#Fartcoin: Caters to “left, center, and right curve” demand—designed to appeal across investor types. After all, everyone farts.

-

#Ai16z: Highly controversial, yet maintains a devoted, almost cult-like developer community. If they survive this phase, they’ll emerge more antifragile.

-

$FOREST: An AI monkey project aiming to save rainforests, with real-world impact.

Join TechFlow official community to stay tuned

Telegram:https://t.me/TechFlowDaily

X (Twitter):https://x.com/TechFlowPost

X (Twitter) EN:https://x.com/BlockFlow_News